0000845877falseX100008458772024-05-062024-05-060000845877us-gaap:CommonClassAMember2024-05-062024-05-060000845877us-gaap:CommonClassCMember2024-05-062024-05-060000845877us-gaap:SeriesCPreferredStockMember2024-05-062024-05-060000845877us-gaap:SeriesDPreferredStockMember2024-05-062024-05-060000845877us-gaap:SeriesEPreferredStockMember2024-05-062024-05-060000845877us-gaap:SeriesFPreferredStockMember2024-05-062024-05-060000845877us-gaap:SeriesGPreferredStockMember2024-05-062024-05-06

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

________________

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): May 6, 2024

FEDERAL AGRICULTURAL MORTGAGE CORPORATION

(Exact name of registrant as specified in its charter) | | | | | | | | | | | | | | |

Federally chartered instrumentality of the United States | | 001-14951 | | 52-1578738 |

(State or Other Jurisdiction of Incorporation) | | (Commission File Number) | | (IRS Employer Identification No.) |

| | | | |

| 1999 K Street, N.W., 4th Floor, | | 20006 |

| Washington, | DC | | |

| (Address of Principal Executive Offices) | | (Zip Code) |

Registrant’s telephone number, including area code (202) 872-7700

No change

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act: | | | | | | | | | | | | | | |

| Title of each class | | Trading symbol | | Exchange on which registered |

| Class A voting common stock | | AGM.A | | New York Stock Exchange |

| Class C non-voting common stock | | AGM | | New York Stock Exchange |

| 6.000% Fixed-to-Floating Rate Non-Cumulative Preferred Stock, Series C | | AGM.PRC | | New York Stock Exchange |

| 5.700% Non-Cumulative Preferred Stock, Series D | | AGM.PRD | | New York Stock Exchange |

| 5.750% Non-Cumulative Preferred Stock, Series E | | AGM.PRE | | New York Stock Exchange |

| 5.250% Non-Cumulative Preferred Stock, Series F | | AGM.PRF | | New York Stock Exchange |

| 4.875% Non-Cumulative Preferred Stock, Series G | | AGM.PRG | | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405) or Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR §240.12b-2). Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02 Results of Operations and Financial Condition.

On May 6, 2024, the Federal Agricultural Mortgage Corporation (“Farmer Mac”) issued a press release to announce (1) its financial results for the fiscal quarter ended March 31, 2024 and (2) a conference call to discuss those results and Farmer Mac’s Quarterly Report on Form 10-Q for the fiscal quarter ended March 31, 2024. A copy of the press release is attached as Exhibit 99.1 and is incorporated by reference into this report. All references to www.farmermac.com in Exhibit 99.1 are inactive textual references only, and the information contained on that website is not incorporated by reference into this report.

The information furnished in this Item 2.02, including Exhibit 99.1, shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (“Exchange Act”), or otherwise subject to the liabilities of that Section, nor will any of such information or Exhibit be deemed incorporated by reference into any filing under the Exchange Act or the Securities Act of 1933, as amended (“Securities Act”), except as shall be expressly set forth by specific reference in such filing.

Item 7.01 Regulation FD Disclosure.

On May 6, 2024, Farmer Mac posted an investor slide presentation for equity investors to its website at www.farmermac.com under the tab “Investors — Events and Presentations.” Farmer Mac expects to use the slide presentation in connection with future investor presentations to analysts and investors. The slide presentation is attached as Exhibit 99.2 and is incorporated by reference into this report. All references to www.farmermac.com in Exhibit 99.2 are inactive textual references only, and the information contained on that website is not incorporated by reference into this report.

The information furnished in this Item 7.01, including Exhibit 99.2, shall not be deemed “filed” for purposes of Section 18 of the Exchange Act, or otherwise subject to the liabilities of that Section, nor will any of such information or Exhibit be deemed incorporated by reference into any filing under the Exchange Act or the Securities Act, except as shall be expressly set forth by specific reference in such filing.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits

104 Cover Page Inline Interactive Data File - the cover page interactive data file does not appear in the Interactive Data File because its XBRL tags are embedded within the Inline XBRL document included as Exhibit 101

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

FEDERAL AGRICULTURAL MORTGAGE CORPORATION

By: /s/ Stephen P. Mullery

Name: Stephen P. Mullery

Title: Executive Vice President – General Counsel

Dated: May 6, 2024

Farmer Mac Reports First Quarter 2024 Results

- Outstanding Business Volume of $28.8 Billion -

WASHINGTON, D.C., May 6, 2024 — The Federal Agricultural Mortgage Corporation (Farmer Mac; NYSE: AGM and AGM.A), the nation's secondary market provider that increases the accessibility of financing for American agriculture and rural infrastructure, today announced its results for the fiscal quarter ended March 31, 2024.

"Farmer Mac delivered another quarter of strong earnings resulting from our well-disciplined asset-liability management, development of new markets, and investments to modernize our infrastructure," said President & Chief Executive Officer, Brad Nordholm. "With a strong capital position, a talented team, and a clear strategic vision, we are confident in our ability to continue delivering value to our stockholders and accelerating rural opportunities for American agriculture and rural infrastructure."

First Quarter 2024 Highlights

•Provided $1.4 billion in liquidity and lending capacity to lenders serving rural America

•Net interest income grew 9% year-over-year to $86.4 million

•Net effective spread1 increased 8% from the prior-year period to $83.0 million

•Net income attributable to common stockholders grew 17% year-over-year to $47.0 million

•Core earnings1 of $43.4 million, or $3.96 per diluted common share, reflecting 12% growth year-over-year

•Maintained strong capital position with total core capital of $1.5 billion, exceeding statutory requirement by 70% and a Tier 1 Capital Ratio of 15.5% as of March 31, 2024

•As of March 31, 2024, Farmer Mac had 295 days of liquidity

| | | | | | | | | | | | | | | | | |

| $ in thousands, except per share amounts | Quarter Ended |

| March 31, 2024 | Dec. 31, 2023 | March 31, 2023 | Sequential % Change | YOY % Change |

Net Change in

Business Volume | $376,206 | $819,013 | $562,036 | N/A | N/A |

| Net Interest Income (GAAP) | $86,368 | $82,169 | $79,058 | 5% | 9% |

Net Effective Spread

(Non-GAAP) | $83,044 | $84,551 | $77,173 | (2)% | 8% |

| Diluted EPS (GAAP) | $4.28 | $3.73 | $3.69 | 15% | 16% |

| Core EPS (Non-GAAP) | $3.96 | $4.10 | $3.56 | (3)% | 11% |

1 Non-GAAP Measure

Earnings Conference Call Information

The conference call to discuss Farmer Mac's first quarter 2024 financial results will be held beginning at 8:30 a.m. eastern time on Monday, May 6, 2024, and can be accessed by telephone or live webcast as follows:

Telephone (Domestic): (800) 836-8184

Telephone (International): (646) 357-8785

Webcast: https://www.farmermac.com/investors/events-presentations/

When dialing in to the call, please ask for the "Farmer Mac Earnings Conference Call." The call can be heard live and will also be available for replay on Farmer Mac’s website for two weeks following the conclusion of the call.

More complete information about Farmer Mac's performance for first quarter 2024 is in Farmer Mac's

Quarterly Report on Form 10-Q for the quarter ended March 31, 2024, filed today with the SEC.

Use of Non-GAAP Measures

In the accompanying analysis of its financial information, Farmer Mac uses "non-GAAP measures," which are measures of financial performance that are not presented in accordance with GAAP. Specifically, Farmer Mac uses the following non-GAAP measures: "core earnings," "core earnings per share," and "net effective spread." Farmer Mac uses these non-GAAP measures to measure corporate economic performance and develop financial plans because, in management's view, they are useful alternative measures in understanding Farmer Mac's economic performance, transaction economics, and business trends. The non-GAAP financial measures that Farmer Mac uses may not be comparable to similarly labeled non-GAAP financial measures disclosed by other companies. Farmer Mac's disclosure of these non-GAAP measures is intended to be supplemental in nature and is not meant to be considered in isolation from, as a substitute for, or as more important than, the related financial information prepared in accordance with GAAP.

Core Earnings and Core Earnings Per Share

The main difference between core earnings and core earnings per share (non-GAAP measures) and net income attributable to common stockholders and earnings per common share (GAAP measures) is that those non-GAAP measures exclude the effects of fair value fluctuations. These fluctuations are not expected to have a cumulative net impact on Farmer Mac's financial condition or results of operations reported in accordance with GAAP if the related financial instruments are held to maturity, as is expected. Another difference is that these two non-GAAP measures exclude specified infrequent or unusual transactions that we believe are not indicative of future operating results and that may not reflect the trends and economic financial performance of Farmer Mac's core business.

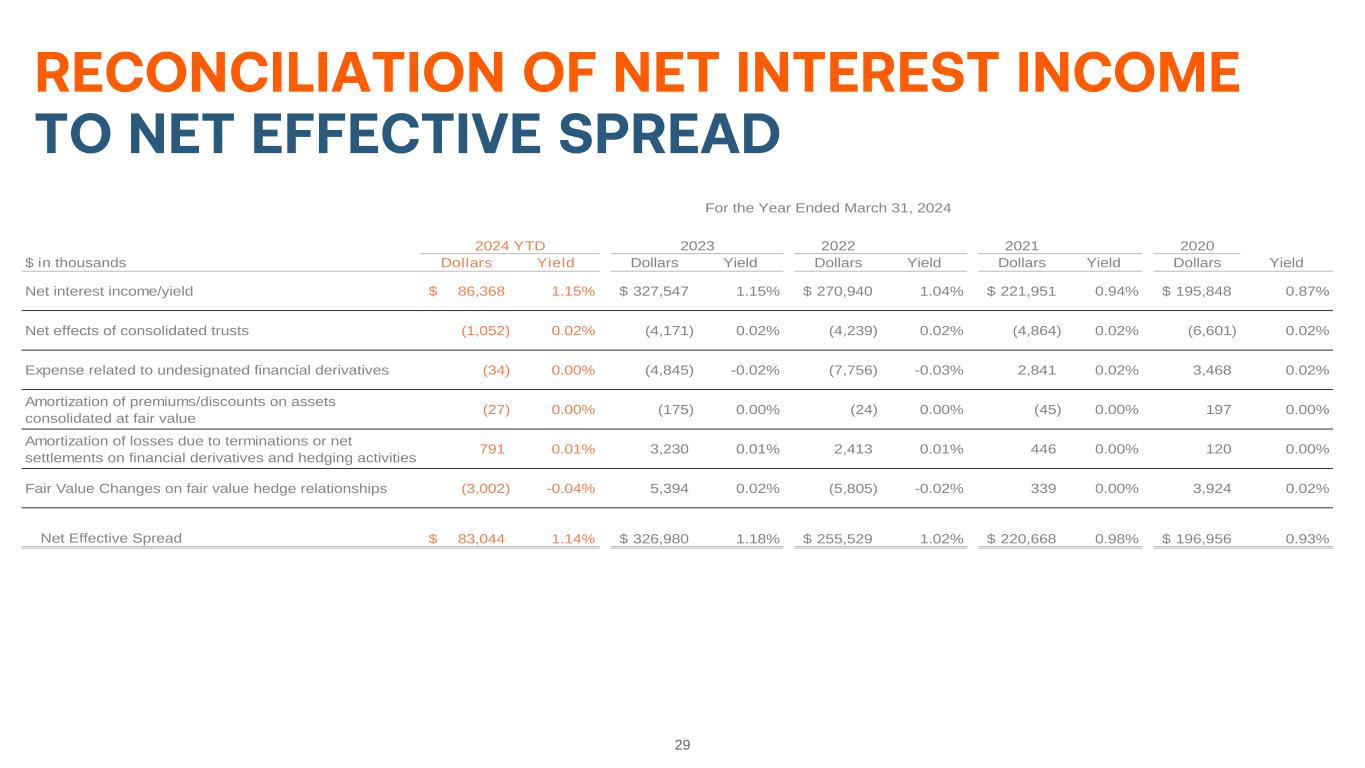

Net Effective Spread

Farmer Mac uses net effective spread to measure the net spread Farmer Mac earns between its interest-earning assets and the related net funding costs of these assets. As further explained below, net effective spread differs from net interest income and net interest yield by excluding certain items from net interest income and net interest yield and including certain other items that net interest income and net interest yield do not contain.

Farmer Mac excludes from net effective spread the interest income and interest expense associated with the consolidated trusts and the average balance of the loans underlying these trusts to reflect management's view that the net interest income Farmer Mac earns on the related Farmer Mac Guaranteed Securities owned by third parties is effectively a guarantee fee. Accordingly, the excluded interest income and interest expense associated with consolidated trusts is reclassified to guarantee and commitment fees in determining Farmer Mac's core earnings. Farmer Mac also excludes from net effective spread the fair value changes of financial derivatives and the corresponding assets or liabilities designated in fair value hedge accounting relationships because they are not expected to have an economic effect on Farmer Mac's financial performance, as we expect to hold the financial derivatives and corresponding hedged items to maturity.

Net effective spread also differs from net interest income and net interest yield because it includes the accrual of income and expense related to the contractual amounts due on financial derivatives that are not designated in hedge accounting relationships ("undesignated financial derivatives"). Farmer Mac uses interest rate swaps to manage its interest rate risk exposure by synthetically modifying the interest rate reset or maturity characteristics of certain assets and liabilities. The accrual of the contractual amounts due on interest rate swaps designated in hedge accounting relationships is included as an adjustment to the yield or cost of the hedged item and is included in net interest income. For undesignated financial derivatives, Farmer Mac records the income or expense related to the accrual of the contractual amounts due in "Gains on financial derivatives" on the consolidated statements of operations. However, the accrual of the contractual amounts due for undesignated financial derivatives are included in Farmer Mac's calculation of net effective spread.

Net effective spread also differs from net interest income and net interest yield because it includes the net effects of terminations or net settlements on financial derivatives, which consist of: (1) the net effects of cash settlements on agency forward contracts on the debt of other GSEs and U.S. Treasury security futures that we use as short-term economic hedges on the issuance of debt; and (2) the net effects of initial cash payments that Farmer Mac receives upon the inception of certain swaps. The inclusion of these items in net effective spread is intended to reflect our view of the complete net spread between an asset and all of its related funding, including any associated derivatives, whether or not they are designated in a hedge accounting relationship.

More information about Farmer Mac’s use of non-GAAP measures is available in "Management's Discussion and Analysis of Financial Condition and Results of Operations—Results of Operations" in Farmer Mac's Annual Report on Form 10-K for the year ended December 31, 2023, filed February 23, 2024 with the SEC. For a reconciliation of Farmer Mac's net income attributable to common stockholders to core earnings and of earnings per common share to core earnings per share, and net interest income and net interest yield to net effective spread, see "Reconciliations" below.

Forward-Looking Statements

Management's expectations for Farmer Mac's future necessarily involve assumptions and estimates and the evaluation of risks and uncertainties. Various factors or events, both known and unknown, could cause Farmer Mac's actual results to differ materially from the expectations as expressed or implied by the forward-looking statements in this release, including uncertainties about:

•the availability to Farmer Mac of debt and equity financing and, if available, the reasonableness of rates and terms;

•legislative or regulatory developments that could affect Farmer Mac, its sources of business, or agricultural or rural infrastructure industries;

•fluctuations in the fair value of assets held by Farmer Mac and its subsidiaries;

•the level of lender interest in Farmer Mac's products and the secondary market provided by Farmer Mac;

•the general rate of growth in agricultural mortgage and rural infrastructure indebtedness;

•the effect of economic conditions stemming from disruptive global events or otherwise on agricultural mortgage or rural infrastructure lending, borrower repayment capacity, or collateral values, including inflation, fluctuations in interest rates, changes in U.S. trade policies, fluctuations in export demand for U.S. agricultural products and foreign currency exchange rates, supply chain disruptions, increases in input costs, labor availability, and volatility in commodity prices;

•the degree to which Farmer Mac is exposed to interest rate risk resulting from fluctuations in Farmer Mac's borrowing costs relative to market indexes;

•developments in the financial markets, including possible investor, analyst, and rating agency reactions to events involving government-sponsored enterprises, including Farmer Mac;

•the effects of the Federal Reserve’s efforts to achieve monetary policy normalization to respond to inflation and employment levels; and

•other factors that could hinder agricultural mortgage lending or borrower repayment capacity, including the effects of severe weather, flooding and drought, climate change, or fluctuations in agricultural real estate values.

Other risk factors are discussed in "Risk Factors" in Part I, Item 1A in Farmer Mac's Annual Report on Form 10-K for the year ended December 31, 2023, as filed with the SEC on February 23, 2024. Considering these potential risks and uncertainties, no undue reliance should be placed on any forward-looking statements expressed in this release. The forward-looking statements contained in this release represent management's expectations as of the date of this release. Farmer Mac undertakes no obligation to release publicly the results of revisions to any forward-looking statements included in this release to reflect new information or any future events or circumstances, except as otherwise required by applicable law. The information in this release is not necessarily indicative of future results.

About Farmer Mac

Farmer Mac is driven by its mission to increase the accessibility of financing for American agriculture and rural infrastructure. As the nation’s premier secondary market for agricultural credit, we provide financial solutions to a broad spectrum of customers supporting rural America, including agricultural lenders, agribusinesses, and rural electric cooperatives. We are uniquely positioned to facilitate competitive access to financing that fuels growth, innovation, and prosperity in America’s rural and agricultural communities. Additional information about Farmer Mac (including the Annual Report on Form 10-K referenced above) is available on our website at www.farmermac.com.

CONTACT: Jalpa Nazareth, Investor Relations

Lisa Meyer, Media Inquiries

(202) 872-7700

* * * *

FEDERAL AGRICULTURAL MORTGAGE CORPORATION AND SUBSIDIARIES

CONSOLIDATED BALANCE SHEETS

(unaudited) | | | | | | | | | | | |

| As of |

| | March 31, 2024 | | December 31, 2023 |

| | (in thousands) |

| Assets: | | | |

| Cash and cash equivalents | $ | 745,105 | | | $ | 888,707 | |

| Investment securities: | | | |

| Available-for-sale, at fair value (amortized cost of $5,165,562 and $5,060,135, respectively) | 5,007,787 | | | 4,918,931 | |

| Held-to-maturity, at amortized cost | 53,756 | | | 53,756 | |

| Other investments | 6,900 | | | 6,817 | |

| Total Investment Securities | 5,068,443 | | | 4,979,504 | |

| Farmer Mac Guaranteed Securities: | | | |

| Available-for-sale, at fair value (amortized cost of $5,811,302 and $5,825,433, respectively) | 5,466,688 | | | 5,532,479 | |

| Held-to-maturity, at amortized cost | 4,454,932 | | | 4,213,069 | |

| Total Farmer Mac Guaranteed Securities | 9,921,620 | | | 9,745,548 | |

| USDA Securities: | | | |

| Trading, at fair value | 1,066 | | | 1,241 | |

| Held-to-maturity, at amortized cost | 2,333,027 | | | 2,354,171 | |

| Total USDA Securities | 2,334,093 | | | 2,355,412 | |

| Loans: | | | |

| | | |

| Loans held for investment, at amortized cost | 9,837,962 | | | 9,623,119 | |

| Loans held for investment in consolidated trusts, at amortized cost | 1,409,397 | | | 1,432,261 | |

| Allowance for losses | (14,288) | | | (16,031) | |

| Total loans, net of allowance | 11,233,071 | | | 11,039,349 | |

| | | |

| Financial derivatives, at fair value | 31,433 | | | 37,478 | |

| Accrued interest receivable (includes $9,963 and $16,764, respectively, related to consolidated trusts) | 245,202 | | | 287,128 | |

| Guarantee and commitment fees receivable | 48,130 | | | 49,832 | |

| Deferred tax asset, net | — | | | 8,470 | |

| Prepaid expenses and other assets | 145,094 | | | 132,954 | |

| Total Assets | $ | 29,772,191 | | | $ | 29,524,382 | |

| | | |

| Liabilities and Equity: | | | |

| Liabilities: | | | |

| | | |

| | | |

| Notes payable | $ | 26,509,011 | | | $ | 26,336,542 | |

| Debt securities of consolidated trusts held by third parties | 1,325,289 | | | 1,351,069 | |

| Financial derivatives, at fair value | 128,530 | | | 117,131 | |

| Accrued interest payable (includes $6,338 and $9,407, respectively, related to consolidated trusts) | 202,894 | | | 181,841 | |

| Guarantee and commitment obligation | 45,866 | | | 47,563 | |

| Accounts payable and accrued expenses | 74,821 | | | 76,662 | |

| Deferred tax liability, net | 3,795 | | | — | |

| Reserve for losses | 1,642 | | | 1,711 | |

| Total Liabilities | 28,291,848 | | | 28,112,519 | |

| Commitments and Contingencies | | | |

| Equity: | | | |

| Preferred stock: | | | |

| Series C, par value $25 per share, 3,000,000 shares authorized, issued and outstanding | 73,382 | | | 73,382 | |

| Series D, par value $25 per share, 4,000,000 shares authorized, issued and outstanding | 96,659 | | | 96,659 | |

Series E, par value $25 per share, 3,180,000 shares authorized, issued and outstanding | 77,003 | | | 77,003 | |

| Series F, par value $25 per share, 4,800,000 shares authorized, issued and outstanding | 116,160 | | | 116,160 | |

| Series G, par value $25 per share, 5,000,000 shares authorized, issued and outstanding | 121,327 | | | 121,327 | |

| Common stock: | | | |

| Class A Voting, $1 par value, no maximum authorization, 1,030,780 shares outstanding | 1,031 | | | 1,031 | |

| Class B Voting, $1 par value, no maximum authorization, 500,301 shares outstanding | 500 | | | 500 | |

| Class C Non-Voting, $1 par value, no maximum authorization, 9,337,894 shares and 9,310,872 shares outstanding, respectively | 9,338 | | | 9,311 | |

| Additional paid-in capital | 133,576 | | | 132,919 | |

| Accumulated other comprehensive loss, net of tax | (4,118) | | | (40,145) | |

| Retained earnings | 855,485 | | | 823,716 | |

| Total Equity | 1,480,343 | | | 1,411,863 | |

| Total Liabilities and Equity | $ | 29,772,191 | | | $ | 29,524,382 | |

FEDERAL AGRICULTURAL MORTGAGE CORPORATION AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF OPERATIONS

(unaudited) | | | | | | | | | | | | | | | |

| For the Three Months Ended | | |

| | March 31, 2024 | | March 31, 2023 | | | | |

| | (in thousands, except per share amounts) |

| Interest income: | | | | | | | |

| Investments and cash equivalents | $ | 84,924 | | | $ | 59,703 | | | | | |

| Farmer Mac Guaranteed Securities and USDA Securities | 166,813 | | | 136,537 | | | | | |

| Loans | 144,580 | | | 119,032 | | | | | |

| Total interest income | 396,317 | | | 315,272 | | | | | |

| Total interest expense | 309,949 | | | 236,214 | | | | | |

| Net interest income | 86,368 | | | 79,058 | | | | | |

| Release of/(provision for) losses | 1,801 | | | (547) | | | | | |

| Net interest income after release of/(provision for) losses | 88,169 | | | 78,511 | | | | | |

| Non-interest income/(expense): | | | | | | | |

| Guarantee and commitment fees | 3,917 | | | 3,933 | | | | | |

| Gains on financial derivatives | 2,079 | | | 399 | | | | | |

| Release of/(provision for) reserve for losses | 69 | | | (203) | | | | | |

| Other income | 1,249 | | | 1,226 | | | | | |

| Non-interest income | 7,314 | | | 5,355 | | | | | |

| Operating expenses: | | | | | | | |

| Compensation and employee benefits | 18,257 | | | 15,351 | | | | | |

| General and administrative | 8,255 | | | 7,527 | | | | | |

| Regulatory fees | 725 | | | 835 | | | | | |

| | | | | | | |

| Operating expenses | 27,237 | | | 23,713 | | | | | |

| Income before income taxes | 68,246 | | | 60,153 | | | | | |

| Income tax expense | 14,500 | | | 13,118 | | | | | |

| | | | | | | |

| | | | | | | |

| Net income | 53,746 | | | 47,035 | | | | | |

| Preferred stock dividends | (6,791) | | | (6,791) | | | | | |

| | | | | | | |

| Net income attributable to common stockholders | $ | 46,955 | | | $ | 40,244 | | | | | |

| | | | | | | |

| Earnings per common share: | | | | | | | |

| Basic earnings per common share | $ | 4.33 | | | $ | 3.73 | | | | | |

| Diluted earnings per common share | $ | 4.28 | | | $ | 3.69 | | | | | |

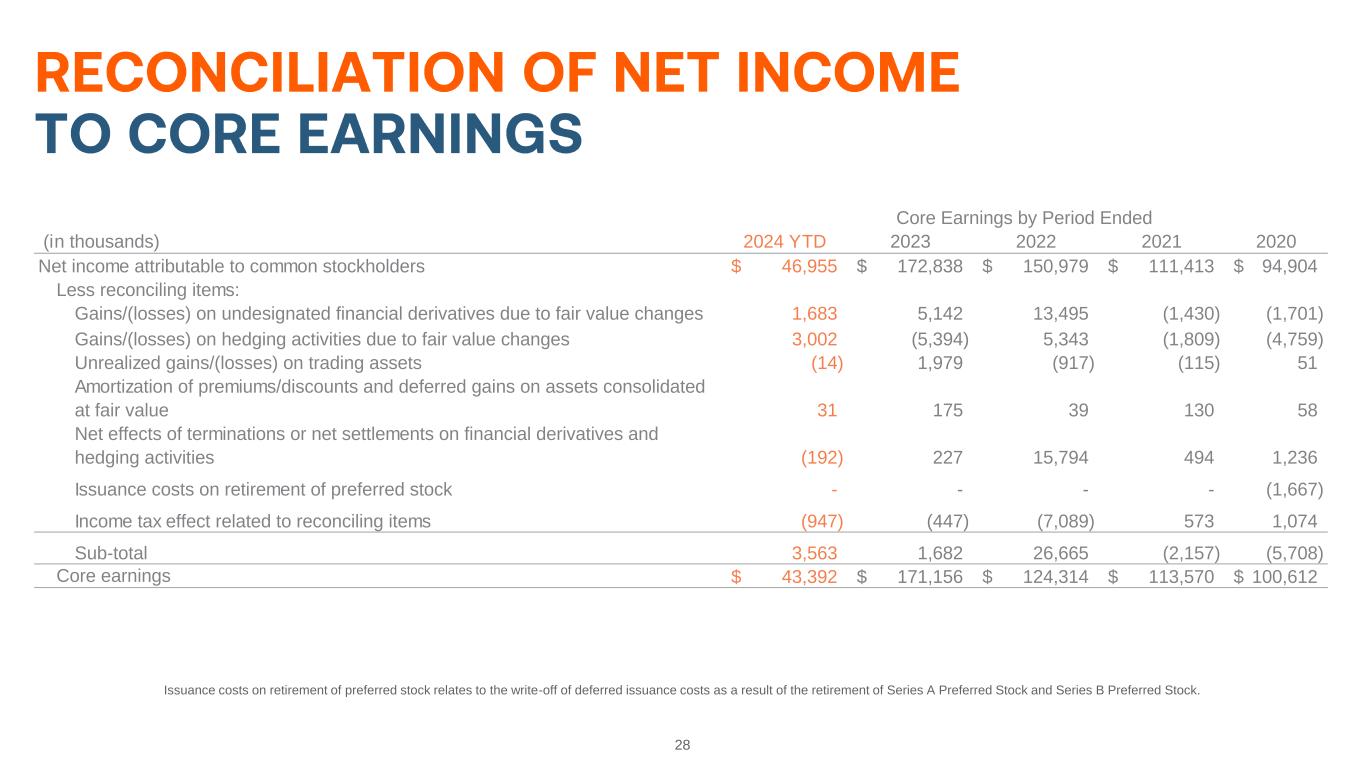

Reconciliations

Reconciliations of Farmer Mac's net income attributable to common stockholders to core earnings and core earnings per share are presented in the following tables along with information about the composition of core earnings for the periods indicated: | | | | | | | | | | | | | | | | | |

| Reconciliation of Net Income Attributable to Common Stockholders to Core Earnings |

| | For the Three Months Ended |

| | March 31, 2024 | | December 31, 2023 | | March 31, 2023 |

| | (in thousands, except per share amounts) |

| Net income attributable to common stockholders | $ | 46,955 | | | $ | 40,828 | | | $ | 40,244 | |

| Less reconciling items: | | | | | |

| Gains/(losses) on undesignated financial derivatives due to fair value changes | 1,683 | | | (836) | | | 916 | |

| Gains/(losses) on hedging activities due to fair value changes | 3,002 | | | (3,598) | | | (105) | |

| Unrealized (losses)/gains on trading assets | (14) | | | (37) | | | 359 | |

| Net effects of amortization of premiums/discounts and deferred gains on assets consolidated at fair value | 31 | | | 88 | | | 29 | |

| Net effects of terminations or net settlements on financial derivatives | (192) | | | (800) | | | 523 | |

| | | | | |

| Income tax effect related to reconciling items | (947) | | | 1,089 | | | (362) | |

| Sub-total | 3,563 | | | (4,094) | | | 1,360 | |

| Core earnings | $ | 43,392 | | | $ | 44,922 | | | $ | 38,884 | |

| | | | | |

| Composition of Core Earnings: | | | | | |

| Revenues: | | | | | |

Net effective spread(1) | $ | 83,044 | | | $ | 84,551 | | | $ | 77,173 | |

Guarantee and commitment fees(2) | 4,982 | | | 4,865 | | | 4,654 | |

Other(3) | 1,077 | | | 767 | | | 1,067 | |

| Total revenues | 89,103 | | | 90,183 | | | 82,894 | |

| | | | | |

| Credit related expense (GAAP): | | | | | |

| (Release of)/provision for losses | (1,870) | | | (575) | | | 750 | |

| | | | | |

| | | | | |

| Total credit related expense | (1,870) | | | (575) | | | 750 | |

| | | | | |

| Operating expenses (GAAP): | | | | | |

| Compensation and employee benefits | 18,257 | | | 15,523 | | | 15,351 | |

| General and administrative | 8,255 | | | 8,916 | | | 7,527 | |

| Regulatory fees | 725 | | | 725 | | | 835 | |

| Total operating expenses | 27,237 | | | 25,164 | | | 23,713 | |

| | | | | |

| Net earnings | 63,736 | | | 65,594 | | | 58,431 | |

Income tax expense(4) | 13,553 | | | 13,881 | | | 12,756 | |

| Preferred stock dividends (GAAP) | 6,791 | | | 6,791 | | | 6,791 | |

| Core earnings | $ | 43,392 | | | $ | 44,922 | | | $ | 38,884 | |

| | | | | |

| Core earnings per share: | | | | | |

| Basic | $ | 4.00 | | | $ | 4.14 | | | $ | 3.60 | |

| Diluted | $ | 3.96 | | | $ | 4.10 | | | $ | 3.56 | |

(1)Net effective spread is a non-GAAP measure. See "Use of Non-GAAP Measures" above for an explanation of net effective spread. See below for a reconciliation of net interest income to net effective spread.

(2)Includes interest income and interest expense related to consolidated trusts owned by third parties reclassified from net interest income to guarantee and commitment fees to reflect management's view that the net interest income Farmer Mac earns is effectively a guarantee fee on the consolidated Farmer Mac Guaranteed Securities.

(3)Reflects reconciling adjustments for the reclassification to exclude expenses related to interest rate swaps not designated as hedges and terminations or net settlements on financial derivatives, and reconciling adjustments to exclude fair value adjustments on financial derivatives and trading assets and the recognition of deferred gains over the estimated lives of certain Farmer Mac Guaranteed Securities and USDA Securities.

(4)Includes the tax impact of non-GAAP reconciling items between net income attributable to common stockholders and core earnings.

| | | | | | | | | | | | | | | | | | | | | |

| Reconciliation of GAAP Basic Earnings Per Share to Core Earnings Basic Earnings Per Share |

| | For the Three Months Ended | | |

| | March 31, 2024 | | December 31, 2023 | | March 31, 2023 | | | | |

| (in thousands, except per share amounts) |

| GAAP - Basic EPS | $ | 4.33 | | | $ | 3.77 | | | $ | 3.73 | | | | | |

| Less reconciling items: | | | | | | | | | |

| Gains/(losses) on undesignated financial derivatives due to fair value changes | 0.16 | | | (0.08) | | | 0.09 | | | | | |

| Gains/(losses) on hedging activities due to fair value changes | 0.28 | | | (0.33) | | | (0.01) | | | | | |

| Unrealized (losses)/gains on trading securities | — | | | — | | | 0.03 | | | | | |

| Net effects of amortization of premiums/discounts and deferred gains on assets consolidated at fair value | — | | | 0.01 | | | — | | | | | |

| Net effects of terminations or net settlements on financial derivatives | (0.02) | | | (0.07) | | | 0.05 | | | | | |

| | | | | | | | | |

| Income tax effect related to reconciling items | (0.09) | | | 0.10 | | | (0.03) | | | | | |

| Sub-total | 0.33 | | | (0.37) | | | 0.13 | | | | | |

| Core Earnings - Basic EPS | $ | 4.00 | | | $ | 4.14 | | | $ | 3.60 | | | | | |

| | | | | | | | | |

| Shares used in per share calculation (GAAP and Core Earnings) | 10,847 | | | 10,841 | | | 10,802 | | | | | |

| | | | | | | | | | | | | | | | | | | | | |

| Reconciliation of GAAP Diluted Earnings Per Share to Core Earnings Diluted Earnings Per Share |

| | For the Three Months Ended | | |

| | March 31, 2024 | | December 31, 2023 | | March 31, 2023 | | | | |

| (in thousands, except per share amounts) |

| GAAP - Diluted EPS | $ | 4.28 | | | $ | 3.73 | | | $ | 3.69 | | | | | |

| Less reconciling items: | | | | | | | | | |

| Gains/(losses) on undesignated financial derivatives due to fair value changes | 0.15 | | | (0.08) | | | 0.09 | | | | | |

| Gains/(losses) on hedging activities due to fair value changes | 0.28 | | | (0.33) | | | (0.01) | | | | | |

| Unrealized (losses)/gains on trading securities | — | | | — | | | 0.03 | | | | | |

| Net effects of amortization of premiums/discounts and deferred gains on assets consolidated at fair value | — | | | 0.01 | | | — | | | | | |

| Net effects of terminations or net settlements on financial derivatives | (0.02) | | | (0.07) | | | 0.05 | | | | | |

| | | | | | | | | |

| Income tax effect related to reconciling items | (0.09) | | | 0.10 | | | (0.03) | | | | | |

| Sub-total | 0.32 | | | (0.37) | | | 0.13 | | | | | |

| Core Earnings - Diluted EPS | $ | 3.96 | | | $ | 4.10 | | | $ | 3.56 | | | | | |

| | | | | | | | | |

| Shares used in per share calculation (GAAP and Core Earnings) | 10,969 | | | 10,952 | | | 10,918 | | | | | |

The following table presents a reconciliation of net interest income and net yield to net effective spread for the periods indicated:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Reconciliation of GAAP Net Interest Income/Yield to Net Effective Spread |

| | For the Three Months Ended | | |

| | March 31, 2024 | | December 31, 2023 | | March 31, 2023 | | | | |

| | Dollars | | Yield | | Dollars | | Yield | | Dollars | | Yield | | | | | | | | |

| | (dollars in thousands) |

| Net interest income/yield | $ | 86,368 | | | 1.15 | % | | $ | 82,169 | | | 1.12 | % | | $ | 79,058 | | | 1.14 | % | | | | | | | | |

| Net effects of consolidated trusts | (1,052) | | | 0.02 | % | | (1,048) | | | 0.02 | % | | (1,055) | | | 0.02 | % | | | | | | | | |

| Expense related to undesignated financial derivatives | (34) | | | — | % | | (846) | | | (0.01) | % | | (1,626) | | | (0.02) | % | | | | | | | | |

| Amortization of premiums/discounts on assets consolidated at fair value | (27) | | | — | % | | (104) | | | — | % | | (23) | | | — | % | | | | | | | | |

| Amortization of losses due to terminations or net settlements on financial derivatives | 791 | | | 0.01 | % | | 782 | | | 0.01 | % | | 714 | | | 0.01 | % | | | | | | | | |

| Fair value changes on fair value hedge relationships | (3,002) | | | (0.04) | % | | 3,598 | | | 0.05 | % | | 105 | | | — | % | | | | | | | | |

| Net effective spread | $ | 83,044 | | | 1.14 | % | | $ | 84,551 | | | 1.19 | % | | $ | 77,173 | | | 1.15 | % | | | | | | | | |

The following table presents core earnings for Farmer Mac's reportable operating segments and a reconciliation to consolidated net income for the three months ended March 31, 2024:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Core Earnings by Business Segment |

For the Three Months Ended March 31, 2024 |

| Agricultural Finance | | Rural Infrastructure | | Treasury | | Corporate | | | | |

| Farm & Ranch | | Corporate AgFinance | | Rural Utilities | | Renewable Energy | | Funding | | Investments | | | Reconciling

Adjustments | | Consolidated Net Income |

| | (in thousands) |

| Net interest income | $ | 33,889 | | | $ | 7,971 | | | $ | 7,265 | | | $ | 2,049 | | | $ | 34,719 | | | $ | 475 | | | $ | — | | | $ | — | | | $ | 86,368 | |

Less: reconciling adjustments(1)(2)(3) | (1,046) | | | — | | | (33) | | | — | | | (2,245) | | | — | | | — | | | 3,324 | | | — | |

| Net effective spread | 32,843 | | | 7,971 | | | 7,232 | | | 2,049 | | | 32,474 | | | 475 | | | — | | | 3,324 | | | — | |

| Guarantee and commitment fees | 4,484 | | | 87 | | | 349 | | | 62 | | | — | | | — | | | — | | | (1,065) | | | 3,917 | |

| | | | | | | | | | | | | | | | | |

Other income/(expense)(3) | 995 | | | 12 | | | — | | | — | | | — | | | 4 | | | 66 | | | 2,251 | | | 3,328 | |

| Total revenues | 38,322 | | | 8,070 | | | 7,581 | | | 2,111 | | | 32,474 | | | 479 | | | 66 | | | 4,510 | | | 93,613 | |

| | | | | | | | | | | | | | | | | |

| (Provision for)/release of losses | (561) | | | 378 | | | 3,017 | | | (1,034) | | | — | | | 1 | | | — | | | — | | | 1,801 | |

| | | | | | | | | | | | | | | | | |

| Release of reserve for losses | 64 | | | — | | | 5 | | | — | | | — | | | — | | | — | | | — | | | 69 | |

| Operating expenses | — | | | — | | | — | | | — | | | — | | | — | | | (27,237) | | | — | | | (27,237) | |

| Total non-interest expense | 64 | | | — | | | 5 | | | — | | | — | | | — | | | (27,237) | | | — | | | (27,168) | |

| Core earnings before income taxes | 37,825 | | | 8,448 | | | 10,603 | | | 1,077 | | | 32,474 | | | 480 | | | (27,171) | | | 4,510 | | (4) | 68,246 | |

| Income tax (expense)/benefit | (7,943) | | | (1,774) | | | (2,227) | | | (226) | | | (6,819) | | | (101) | | | 5,537 | | | (947) | | | (14,500) | |

| Core earnings before preferred stock dividends | 29,882 | | | 6,674 | | | 8,376 | | | 851 | | | 25,655 | | | 379 | | | (21,634) | | | 3,563 | | (4) | 53,746 | |

| Preferred stock dividends | — | | | — | | | — | | | — | | | — | | | — | | | (6,791) | | | — | | | (6,791) | |

| | | | | | | | | | | | | | | | | |

| Segment core earnings/(losses) | $ | 29,882 | | | $ | 6,674 | | | $ | 8,376 | | | $ | 851 | | | $ | 25,655 | | | $ | 379 | | | $ | (28,425) | | | $ | 3,563 | | (4) | $ | 46,955 | |

| | | | | | | | | | | | | | | | | |

| Total Assets | $ | 15,240,436 | | | $ | 1,637,460 | | | $ | 7,003,165 | | | $ | 578,709 | | | $ | — | | | $ | 5,190,082 | | | $ | 122,339 | | | $ | — | | | $ | 29,772,191 | |

| Total on- and off-balance sheet program assets at principal balance | $ | 18,900,906 | | | $ | 1,766,294 | | | $ | 7,437,723 | | | $ | 742,307 | | | $ | — | | | $ | — | | | $ | — | | | $ | — | | | $ | 28,847,230 | |

(1)Includes the amortization of premiums and discounts on assets consolidated at fair value, originally included in interest income, to reflect core earnings amounts.

(2)Includes the reclassification of interest income and interest expense from consolidated trusts owned by third parties to guarantee and commitment fees, to reflect management's view that the net interest income Farmer Mac earns is effectively a guarantee fee.

(3)Includes the reclassification of interest expense related to interest rate swaps not designated as hedges, which are included in "Gains on financial derivatives" on the consolidated financial statements, to determine the effective funding cost for each operating segment.

(4)Net adjustments to reconcile to the corresponding income measures: core earnings before income taxes reconciled to income before income taxes; core earnings before preferred stock dividends reconciled to net income; and segment core earnings reconciled to net income attributable to common stockholders.

Supplemental Information

The following table sets forth information about outstanding volume in each of Farmer Mac's lines of business as of the dates indicated:

| | | | | | | | | | | | | | | | | | | | | | |

| Outstanding Business Volume | | |

| | | | | | |

| | On or Off

Balance Sheet | | As of March 31, 2024 | | As of December 31, 2023 | | |

| | | | (in thousands) | | |

| Agricultural Finance: | | | | | | | | |

| Farm & Ranch: | | | | | | | | |

| Loans | | On-balance sheet | | $ | 5,247,543 | | | $ | 5,133,450 | | | |

| Loans held in consolidated trusts: | | | | | | | | |

Beneficial interests owned by third-party investors (single-class)(1) | | On-balance sheet | | 857,156 | | | 870,912 | | | |

Beneficial interests owned by third-party investors (structured)(1) | | On-balance sheet | | 552,241 | | | 561,349 | | | |

IO-FMGS(2) | | On-balance sheet | | 9,232 | | | 9,409 | | | |

| USDA Securities | | On-balance sheet | | 2,354,894 | | | 2,368,872 | | | |

AgVantage Securities(1) | | On-balance sheet | | 5,995,000 | | | 5,835,000 | | | |

| LTSPCs and unfunded loan commitments | | Off-balance sheet | | 2,884,375 | | | 2,999,943 | | | |

Other Farmer Mac Guaranteed Securities(3) | | Off-balance sheet | | 443,843 | | | 452,602 | | | |

| Loans serviced for others | | Off-balance sheet | | 556,622 | | | 577,264 | | | |

| Total Farm & Ranch | | | | $ | 18,900,906 | | | $ | 18,808,801 | | | |

| Corporate AgFinance: | | | | | | | | |

| Loans | | On-balance sheet | | $ | 1,258,506 | | | $ | 1,259,723 | | | |

AgVantage Securities(1) | | On-balance sheet | | 369,365 | | | 288,879 | | | |

| Unfunded loan commitments | | Off-balance sheet | | 138,423 | | | 145,377 | | | |

| Total Corporate AgFinance | | | | $ | 1,766,294 | | | $ | 1,693,979 | | | |

| Total Agricultural Finance | | | | $ | 20,667,200 | | | $ | 20,502,780 | | | |

| Rural Infrastructure Finance: | | | | | | | | |

| Rural Utilities: | | | | | | | | |

| Loans | | On-balance sheet | | $ | 3,108,495 | | | $ | 3,094,477 | | | |

AgVantage Securities(1) | | On-balance sheet | | 3,879,293 | | | 3,898,468 | | | |

| LTSPCs and unfunded loan commitments | | Off-balance sheet | | 449,935 | | | 487,778 | | | |

| | | | | | | | |

| Total Rural Utilities | | | | $ | 7,437,723 | | | $ | 7,480,723 | | | |

| Renewable Energy: | | | | | | | | |

| Loans | | On-balance sheet | | $ | 578,258 | | | $ | 440,286 | | | |

| Unfunded loan commitments | | Off-balance sheet | | 164,049 | | | 47,235 | | | |

| Total Renewable Energy | | | | $ | 742,307 | | | $ | 487,521 | | | |

| Total Rural Infrastructure Finance | | | | $ | 8,180,030 | | | $ | 7,968,244 | | | |

| Total | | | | $ | 28,847,230 | | | $ | 28,471,024 | | | |

(1)A type of Farmer Mac Guaranteed Security.

(2)An interest-only Farmer Mac Guaranteed Security retained as part of a structured securitization.

(3)Other categories of Farmer Mac Guaranteed Securities that were sold by Farmer Mac to third parties

The following table presents the quarterly net effective spread (a non-GAAP measure) by segment:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Net Effective Spread(1) |

| Agricultural Finance | | Rural Infrastructure Finance | | Treasury | | | | |

| Farm & Ranch | | Corporate AgFinance | | Rural Utilities | | Renewable Energy | | Funding | | Investments | | Net Effective Spread |

| Dollars | | Yield | | Dollars | | Yield | | Dollars | | Yield | | Dollars | | Yield | | Dollars | | Yield | | Dollars | | Yield | | Dollars | | Yield |

| (dollars in thousands) |

| For the quarter ended: | | | | | | | | | | | | | | | | | | | | | | | | | | | |

March 31, 2024(2) | $ | 32,843 | | | 0.95 | % | | $ | 7,971 | | | 2.05 | % | | $ | 7,232 | | | 0.42 | % | | $ | 2,049 | | | 1.75 | % | | $ | 32,474 | | | 0.45 | % | | $ | 475 | | | 0.03 | % | | $ | 83,044 | | | 1.14 | % |

| December 31, 2023 | 33,329 | | | 0.98 | % | | 8,382 | | | 2.06 | % | | 7,342 | | | 0.43 | % | | 1,540 | | | 1.69 | % | | 33,361 | | | 0.47 | % | | 597 | | | 0.04 | % | | 84,551 | | | 1.19 | % |

| September 30, 2023 | 32,718 | | | 0.97 | % | | 8,250 | | | 2.05 | % | | 6,362 | | | 0.39 | % | | 1,150 | | | 1.46 | % | | 34,412 | | | 0.49 | % | | 532 | | | 0.04 | % | | 83,424 | | | 1.20 | % |

| June 30, 2023 | 34,388 | | | 1.03 | % | | 7,444 | | | 1.92 | % | | 5,808 | | | 0.38 | % | | 1,100 | | | 1.47 | % | | 32,498 | | | 0.48 | % | | 594 | | | 0.04 | % | | 81,832 | | | 1.20 | % |

| March 31, 2023 | 32,465 | | | 0.97 | % | | 7,148 | | | 1.94 | % | | 5,507 | | | 0.36 | % | | 858 | | | 1.53 | % | | 31,738 | | | 0.47 | % | | (543) | | | (0.04) | % | | 77,173 | | | 1.15 | % |

| December 31, 2022 | 32,770 | | | 0.98 | % | | 7,471 | | | 1.94 | % | | 4,960 | | | 0.34 | % | | 935 | | | 1.76 | % | | 27,656 | | | 0.42 | % | | (2,689) | | | (0.19) | % | | 71,103 | | | 1.07 | % |

| September 30, 2022 | 33,343 | | | 1.04 | % | | 7,600 | | | 1.99 | % | | 4,220 | | | 0.30 | % | | 705 | | | 1.97 | % | | 22,564 | | | 0.36 | % | | (2,791) | | | (0.21) | % | | 65,641 | | | 1.03 | % |

| June 30, 2022 | 32,590 | | | 1.05 | % | | 6,929 | | | 1.87 | % | | 3,733 | | | 0.27 | % | | 468 | | | 1.78 | % | | 18,508 | | | 0.30 | % | | (1,282) | | | (0.10) | % | | 60,946 | | | 0.99 | % |

| March 31, 2022 | 30,354 | | | 1.02 | % | | 7,209 | | | 1.96 | % | | 3,159 | | | 0.23 | % | | 375 | | | 1.69 | % | | 16,738 | | | 0.28 | % | | 4 | | | — | % | | 57,839 | | | 0.97 | % |

(1)Farmer Mac excludes the Corporate segment in the presentation above because the segment does not have any interest-earning assets.

(2)See above for a reconciliation of GAAP net interest income by line of business to net effective spread by line of business for the three months ended March 31, 2024.

The following table presents quarterly core earnings reconciled to net income attributable to common stockholders:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Core Earnings by Quarter Ended |

| March 2024 | | December 2023 | | September 2023 | | June 2023 | | March 2023 | | December 2022 | | September 2022 | | June 2022 | | March 2022 |

| (in thousands) |

| Revenues: | | | | | | | | | | | | | | | | | |

| Net effective spread | $ | 83,044 | | | $ | 84,551 | | | $ | 83,424 | | | $ | 81,832 | | | $ | 77,173 | | | $ | 71,103 | | | $ | 65,641 | | | $ | 60,946 | | | $ | 57,839 | |

| Guarantee and commitment fees | 4,982 | | | 4,865 | | | 4,828 | | | 4,581 | | | 4,654 | | | 4,677 | | | 4,201 | | | 4,709 | | | 4,557 | |

| | | | | | | | | | | | | | | | | |

| Other | 1,077 | | | 767 | | | 1,056 | | | 409 | | | 1,067 | | | 390 | | | 473 | | | 307 | | | 514 | |

| Total revenues | 89,103 | | | 90,183 | | | 89,308 | | | 86,822 | | | 82,894 | | | 76,170 | | | 70,315 | | | 65,962 | | | 62,910 | |

| | | | | | | | | | | | | | | | | |

| Credit related expense/(income): | | | | | | | | | | | | | | | | | |

| (Release of)/provision for losses | (1,870) | | | (575) | | | (181) | | | 1,142 | | | 750 | | | 1,945 | | | 450 | | | (1,535) | | | (54) | |

| REO operating expenses | — | | | — | | | — | | | — | | | — | | | 819 | | | — | | | — | | | — | |

| | | | | | | | | | | | | | | | | |

| Total credit related expense/(income) | (1,870) | | | (575) | | | (181) | | | 1,142 | | | 750 | | | 2,764 | | | 450 | | | (1,535) | | | (54) | |

| | | | | | | | | | | | | | | | | |

| Operating expenses: | | | | | | | | | | | | | | | | | |

| Compensation and employee benefits | 18,257 | | | 15,523 | | | 14,103 | | | 13,937 | | | 15,351 | | | 12,105 | | | 11,648 | | | 11,715 | | | 13,298 | |

| General and administrative | 8,255 | | | 8,916 | | | 9,100 | | | 9,420 | | | 7,527 | | | 8,055 | | | 6,919 | | | 7,520 | | | 7,278 | |

| Regulatory fees | 725 | | | 725 | | | 831 | | | 831 | | | 835 | | | 832 | | | 812 | | | 813 | | | 812 | |

| Total operating expenses | 27,237 | | | 25,164 | | | 24,034 | | | 24,188 | | | 23,713 | | | 20,992 | | | 19,379 | | | 20,048 | | | 21,388 | |

| | | | | | | | | | | | | | | | | |

| Net earnings | 63,736 | | | 65,594 | | | 65,455 | | | 61,492 | | | 58,431 | | | 52,414 | | | 50,486 | | | 47,449 | | | 41,576 | |

| Income tax expense | 13,553 | | | 13,881 | | | 13,475 | | | 12,539 | | | 12,756 | | | 11,210 | | | 10,303 | | | 9,909 | | | 9,024 | |

| | | | | | | | | | | | | | | | | |

| Preferred stock dividends | 6,791 | | | 6,791 | | | 6,792 | | | 6,791 | | | 6,791 | | | 6,791 | | | 6,791 | | | 6,792 | | | 6,791 | |

| Core earnings | $ | 43,392 | | | $ | 44,922 | | | $ | 45,188 | | | $ | 42,162 | | | $ | 38,884 | | | $ | 34,413 | | | $ | 33,392 | | | $ | 30,748 | | | $ | 25,761 | |

| | | | | | | | | | | | | | | | | |

| Reconciling items: | | | | | | | | | | | | | | | | | |

| Gains/(losses) on undesignated financial derivatives due to fair value changes | $ | 1,683 | | | $ | (836) | | | $ | 2,921 | | | $ | 2,141 | | | $ | 916 | | | $ | 1,596 | | | $ | 6,441 | | | $ | 2,846 | | | $ | 2,612 | |

| Gains/(losses) on hedging activities due to fair value changes | 3,002 | | | (3,598) | | | 3,210 | | | (4,901) | | | (105) | | | (148) | | | (624) | | | 428 | | | 5,687 | |

| Unrealized (losses)/gains on trading assets | (14) | | | (37) | | | 1,714 | | | (57) | | | 359 | | | 31 | | | (757) | | | (285) | | | 94 | |

| Net effects of amortization of premiums/discounts and deferred gains on assets consolidated at fair value | 31 | | | 88 | | | 29 | | | 29 | | | 29 | | | 57 | | | 24 | | | (62) | | | 20 | |

| Net effects of terminations or net settlements on financial derivatives | (192) | | | (800) | | | (79) | | | 583 | | | 523 | | | 1,268 | | | (3,522) | | | 2,536 | | | 15,512 | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| Income tax effect related to reconciling items | (947) | | | 1,089 | | | (1,638) | | | 464 | | | (362) | | | (590) | | | (327) | | | (1,148) | | | (5,024) | |

| Net income attributable to common stockholders | $ | 46,955 | | | $ | 40,828 | | | $ | 51,345 | | | $ | 40,421 | | | $ | 40,244 | | | $ | 36,627 | | | $ | 34,627 | | | $ | 35,063 | | | $ | 44,662 | |

Equity Investor Presentation First Quarter 2024

Forward-Looking Statements 2 In addition to historical information, this presentation includes forward-looking statements that reflect management’s current expectations for Farmer Mac’s future financial results, business prospects, and business developments. Forward-looking statements include, without limitation, any statement that may predict, forecast, indicate, or imply future results, performance, or achievements. Management’s expectations for Farmer Mac’s future necessarily involve assumptions, estimates, and the evaluation of risks and uncertainties. Various factors or events, both known and unknown, could cause Farmer Mac’s actual results to differ materially from the expectations as expressed or implied by the forward- looking statements. Some of these factors are identified and discussed in Farmer Mac’s Quarterly Report on Form 10-Q for the quarter ended March 31, 2024, filed with the SEC on May 6, 2024. These reports are also available on Farmer Mac’s website (www.farmermac.com). Considering these potential risks and uncertainties, no undue reliance should be placed on any forward-looking statements expressed in this presentation. Any forward-looking statements made in this presentation are current only as of March 31, 2024, except as otherwise indicated. Farmer Mac undertakes no obligation to release publicly the results of revisions to any such forward-looking statements that may be made to reflect new information or any future events or circumstances, except as otherwise mandated by the SEC. The information in this presentation is not necessarily indicative of future results. NO OFFER OR SOLICITATION OF SECURITIES This presentation does not constitute an offer to sell or a solicitation of an offer to buy any Farmer Mac security. Farmer Mac securities are offered only in jurisdictions where permissible by offering documents available through qualified securities dealers. Any investor who is considering purchasing a Farmer Mac security should consult the applicable offering documents for the security and their own financial and legal advisors for information about and analysis of the security, the risks associated with the security, and the suitability of the investment for the investor’s particular circumstances. Copyright © 2024 by Farmer Mac. No part of this document may be duplicated, reproduced, distributed, or displayed in public in any manner or by any means without the written permission of Farmer Mac.

Use of Non-GAAP Financial Measures 3 This presentation is for general informational purposes only, is current only as of March 31, 2024 and should be read in conjunction with Farmer Mac’s Quarterly Report on Form 10-Q filed with the SEC on May 6, 2024. In the accompanying analysis of its financial information, Farmer Mac uses the following non-GAAP financial measures: core earnings, core earnings per share, and net effective spread. Farmer Mac uses these non-GAAP measures to measure corporate economic performance and develop financial plans because, in management's view, they are useful alternative measures in understanding Farmer Mac's economic performance, transaction economics, and business trends. The non-GAAP financial measures that Farmer Mac uses may not be comparable to similarly labeled non-GAAP financial measures disclosed by other companies. Farmer Mac's disclosure of these non-GAAP financial measures is intended to be supplemental in nature and is not meant to be considered in isolation from, as a substitute for, or as more important than, the related financial information prepared in accordance with GAAP. Core earnings and core earnings per share principally differ from net income attributable to common stockholders and earnings per common share, respectively, by excluding the effects of fair value fluctuations. These fluctuations are not expected to have a cumulative net impact on Farmer Mac's financial condition or results of operations reported in accordance with GAAP if the related financial instruments are held to maturity, as is expected. Core earnings and core earnings per share also differ from net income attributable to common stockholders and earnings per common share, respectively, by excluding specified infrequent or unusual transactions that Farmer Mac believes are not indicative of future operating results and that may not reflect the trends and economic financial performance of Farmer Mac's core business. Farmer Mac uses net effective spread to measure the net spread Farmer Mac earns between its interest-earning assets and the related net funding costs of these assets. Net effective spread differs from net interest income and net interest yield because it excludes: (1) the interest income and interest expense associated with the consolidated trusts and the average balance of the loans underlying these trusts; and (2) the fair value changes of financial derivatives and the corresponding assets or liabilities designated in fair value hedge accounting relationships. Net effective spread also principally differs from net interest income and net interest yield because it includes the accrual of income and expense related to the contractual amounts due on financial derivatives that are not designated in hedge accounting relationships ("undesignated financial derivatives") and the net effects of terminations or net settlements on financial derivatives, which consist of: (1) the net effects of cash settlements on agency forward contracts on the debt of other GSEs and U.S. Treasury security futures that we use as short-term economic hedges on the issuance of debt; and (2) the net effects of initial cash payments that Farmer Mac receives upon the inception of certain swaps.

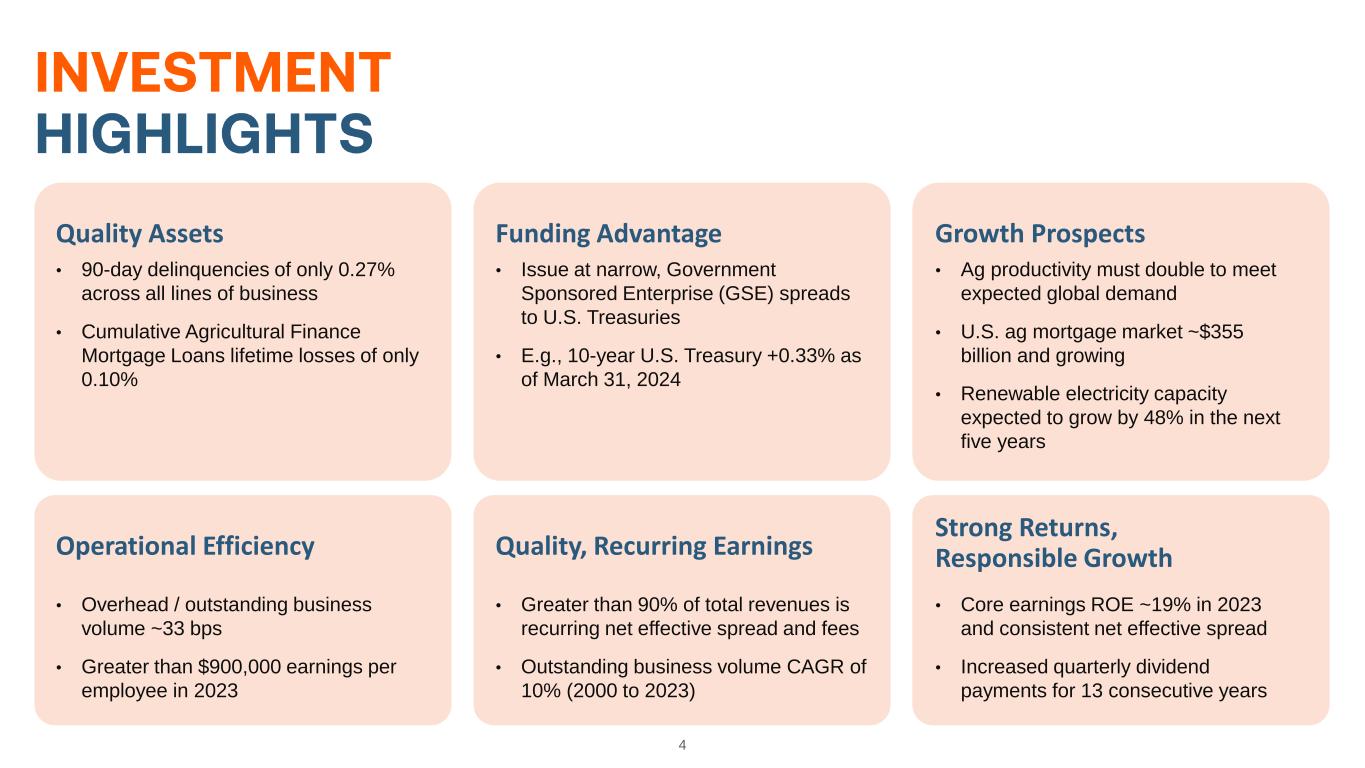

4 • 90-day delinquencies of only 0.27% across all lines of business • Cumulative Agricultural Finance Mortgage Loans lifetime losses of only 0.10% Quality Assets • Issue at narrow, Government Sponsored Enterprise (GSE) spreads to U.S. Treasuries • E.g., 10-year U.S. Treasury +0.33% as of March 31, 2024 Funding Advantage • Ag productivity must double to meet expected global demand • U.S. ag mortgage market ~$355 billion and growing • Renewable electricity capacity expected to grow by 48% in the next five years Growth Prospects • Overhead / outstanding business volume ~33 bps • Greater than $900,000 earnings per employee in 2023 Operational Efficiency • Greater than 90% of total revenues is recurring net effective spread and fees • Outstanding business volume CAGR of 10% (2000 to 2023) Quality, Recurring Earnings • Core earnings ROE ~19% in 2023 and consistent net effective spread • Increased quarterly dividend payments for 13 consecutive years Strong Returns, Responsible Growth

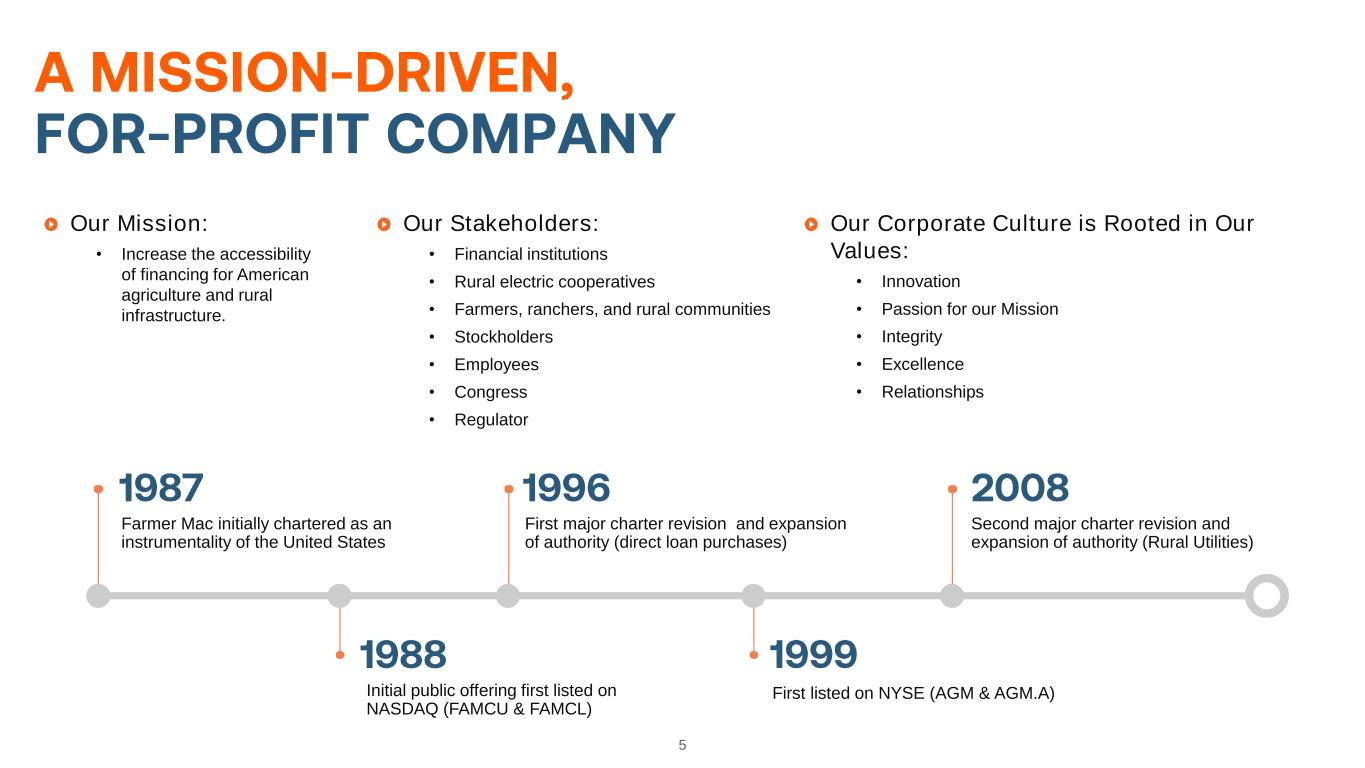

5 First listed on NYSE (AGM & AGM.A)Initial public offering first listed on NASDAQ (FAMCU & FAMCL) Farmer Mac initially chartered as an instrumentality of the United States First major charter revision and expansion of authority (direct loan purchases) Second major charter revision and expansion of authority (Rural Utilities) Our Mission: • Increase the accessibility of financing for American agriculture and rural infrastructure. Our Stakeholders: • Financial institutions • Rural electric cooperatives • Farmers, ranchers, and rural communities • Stockholders • Employees • Congress • Regulator Our Corporate Culture is Rooted in Our Values: • Innovation • Passion for our Mission • Integrity • Excellence • Relationships

6 Bradford T. Nordholm President & Chief Executive Officer • 40+ years of agricultural and energy finance experience. • Joined Farmer Mac in October 2018 from Starwood Energy Group, a leading private investment firm where he served as CEO and later as Vice Chairman. • Prior experience includes CEO of US Central and management positions at National Cooperative and within the Farm Credit System. Zachary N. Carpenter Executive Vice President – Chief Business Officer • 15+ years of experience in agribusiness banking, capital markets, finance, and corporate strategy. • Joined Farmer Mac in 2019 from CoBank, where he previously served as Managing Director and Sector Vice President of its Corporate Agribusiness Banking Group. • Prior experience includes Executive Director in CoBank’s Capital Markets division and Vice President in Finance and Corporate Strategy at Goldman Sachs. Aparna Ramesh Executive Vice President – Chief Financial Officer & Treasurer • 20+ years of experience in mission-oriented finance roles. • Joined Farmer Mac in 2020 from Federal Reserve Bank of Boston, where she previously served as Senior Vice President and Chief Financial Officer. • Prior experience includes roles spanning product management, asset-liability management and profitability within Cambridge Savings Bank and M&T Bank.

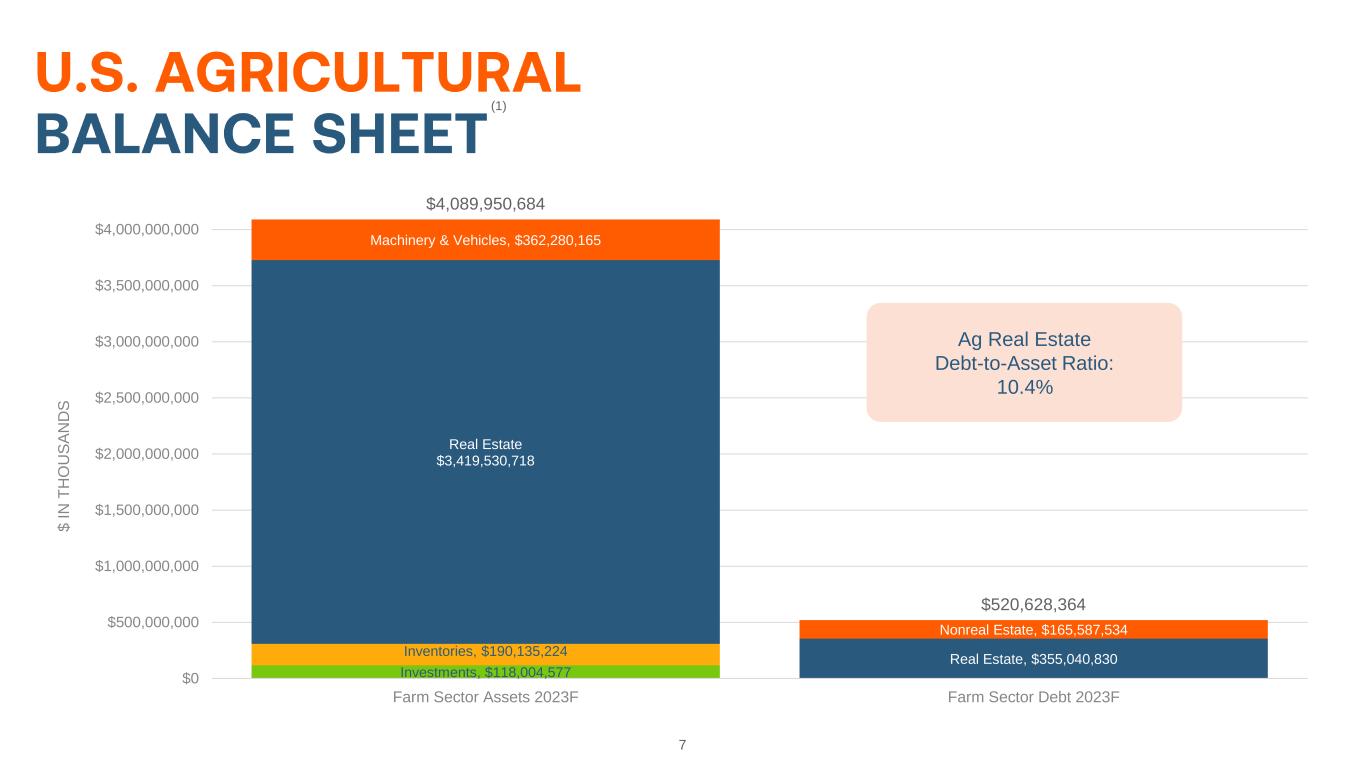

7 Investments, $118,004,577 Inventories, $190,135,224 Real Estate $3,419,530,718 Machinery & Vehicles, $362,280,165 $4,089,950,684 Real Estate, $355,040,830 Nonreal Estate, $165,587,534 $520,628,364 $0 $500,000,000 $1,000,000,000 $1,500,000,000 $2,000,000,000 $2,500,000,000 $3,000,000,000 $3,500,000,000 $4,000,000,000 Farm Sector Assets 2023F Farm Sector Debt 2023F $ I N T H O U S A N D S Ag Real Estate Debt-to-Asset Ratio: 10.4% (1)

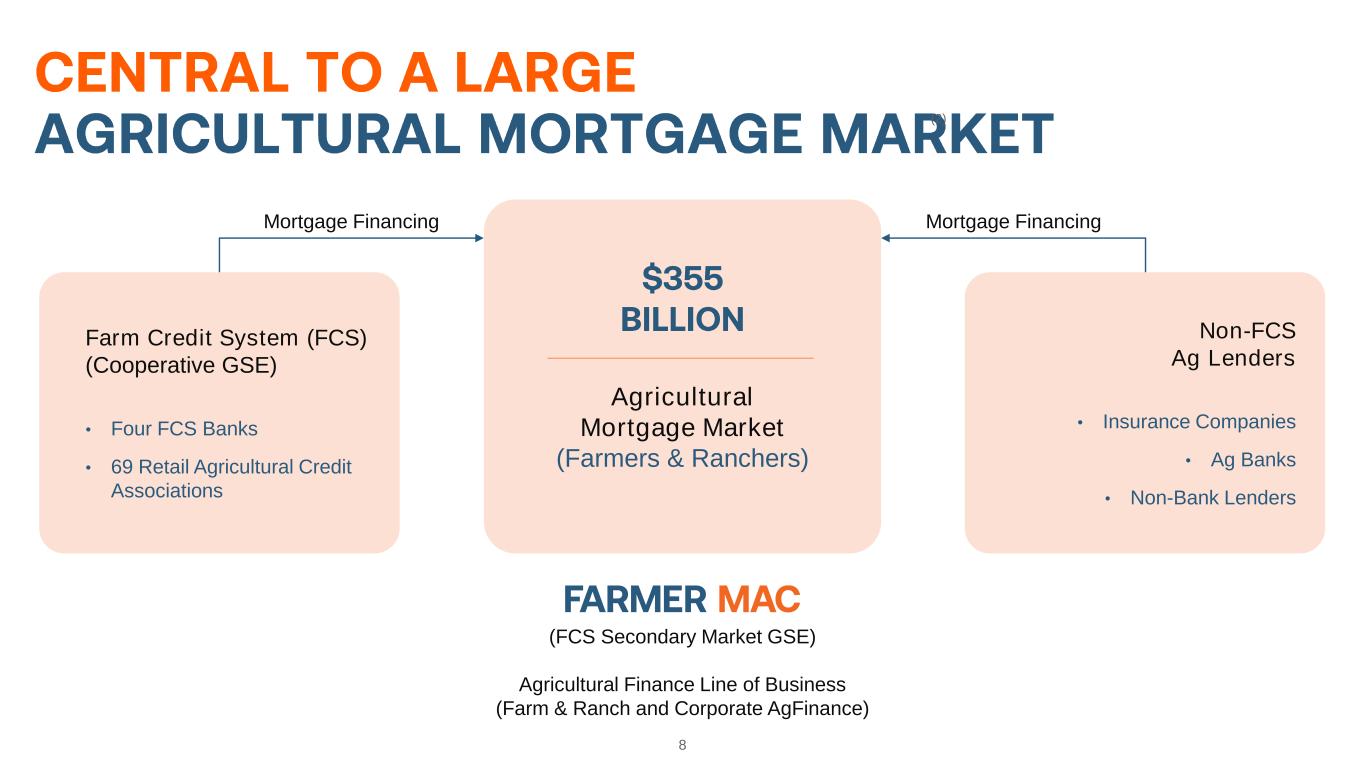

8 Farm Credit System (FCS) (Cooperative GSE) • Four FCS Banks • 69 Retail Agricultural Credit Associations Agricultural Mortgage Market (Farmers & Ranchers) (FCS Secondary Market GSE) Agricultural Finance Line of Business (Farm & Ranch and Corporate AgFinance) Non-FCS Ag Lenders • Insurance Companies • Ag Banks • Non-Bank Lenders Mortgage FinancingMortgage Financing (2)

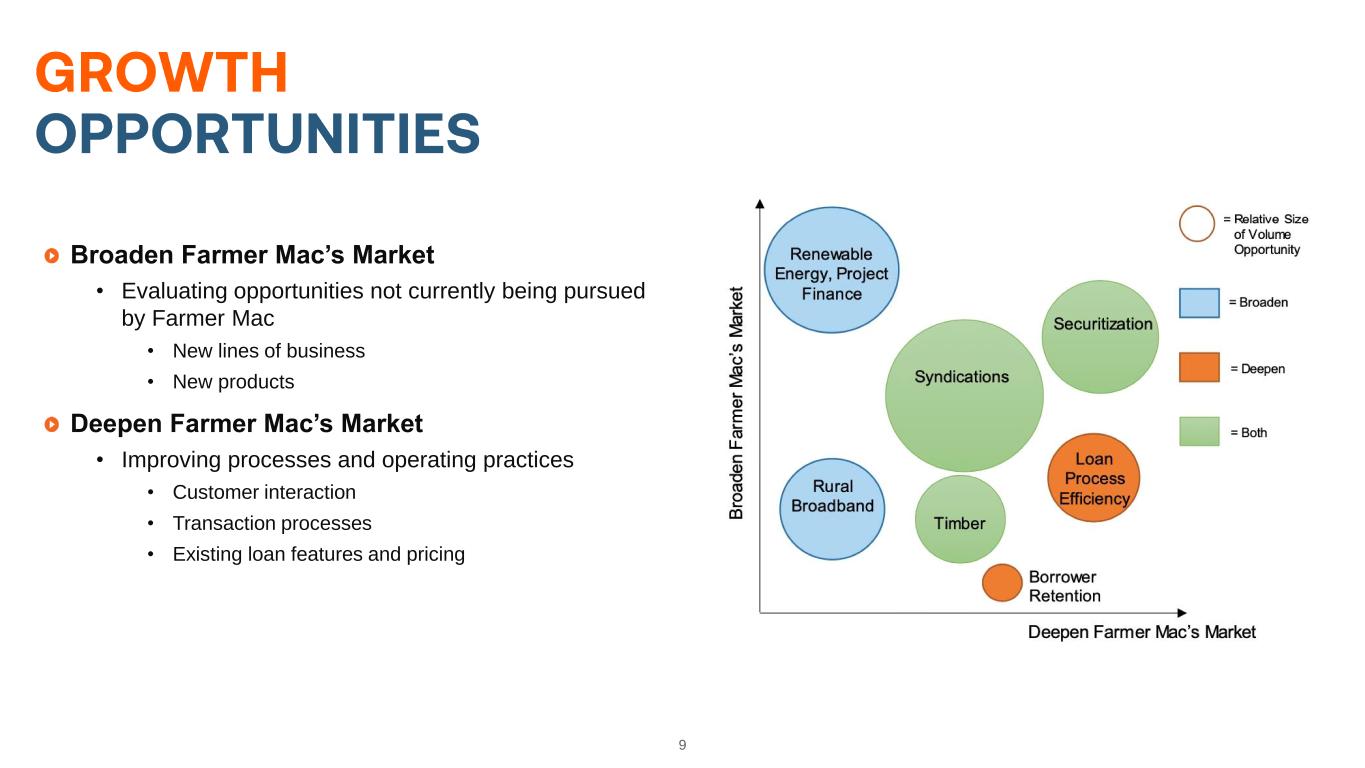

9 Broaden Farmer Mac’s Market • Evaluating opportunities not currently being pursued by Farmer Mac • New lines of business • New products Deepen Farmer Mac’s Market • Improving processes and operating practices • Customer interaction • Transaction processes • Existing loan features and pricing

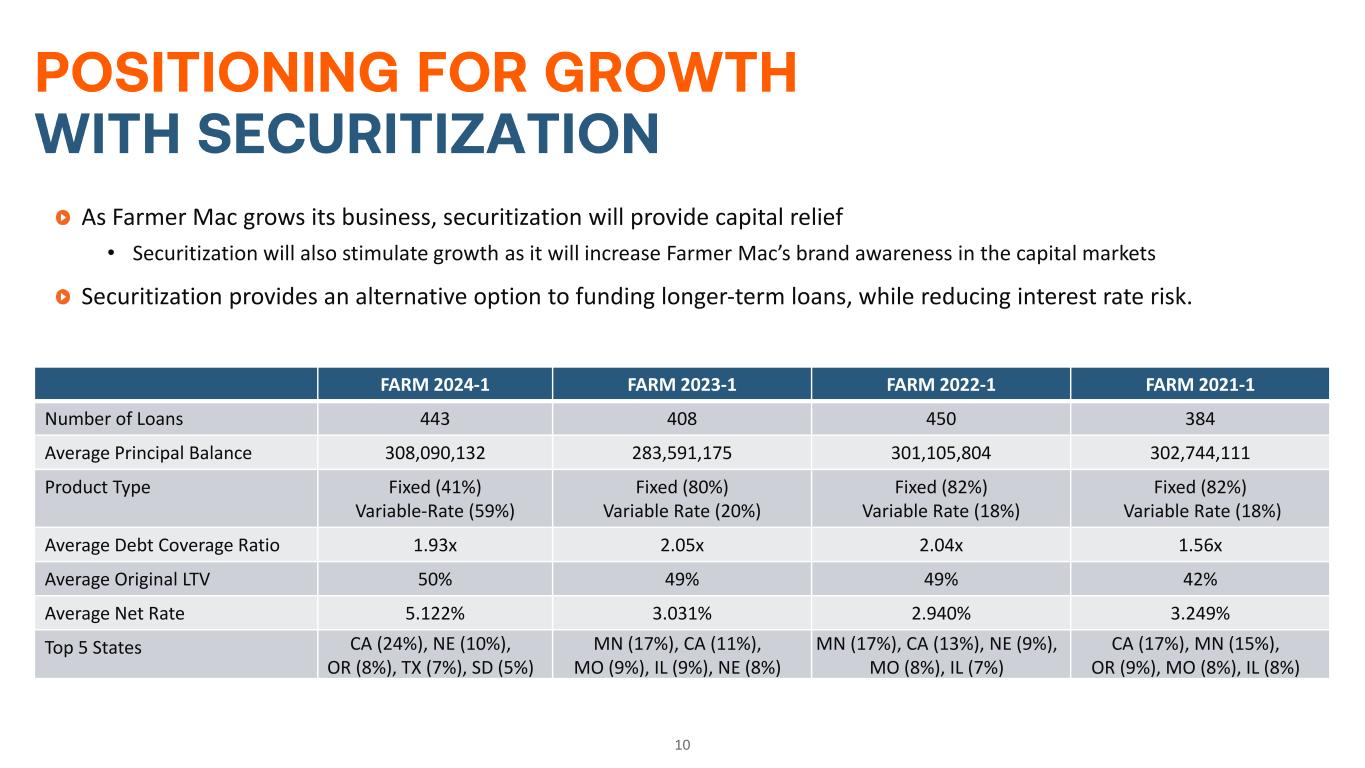

10 FARM 2024-1 FARM 2023-1 FARM 2022-1 FARM 2021-1 Number of Loans 443 408 450 384 Average Principal Balance 308,090,132 283,591,175 301,105,804 302,744,111 Product Type Fixed (41%) Variable-Rate (59%) Fixed (80%) Variable Rate (20%) Fixed (82%) Variable Rate (18%) Fixed (82%) Variable Rate (18%) Average Debt Coverage Ratio 1.93x 2.05x 2.04x 1.56x Average Original LTV 50% 49% 49% 42% Average Net Rate 5.122% 3.031% 2.940% 3.249% Top 5 States CA (24%), NE (10%), OR (8%), TX (7%), SD (5%) MN (17%), CA (11%), MO (9%), IL (9%), NE (8%) MN (17%), CA (13%), NE (9%), MO (8%), IL (7%) CA (17%), MN (15%), OR (9%), MO (8%), IL (8%) As Farmer Mac grows its business, securitization will provide capital relief • Securitization will also stimulate growth as it will increase Farmer Mac’s brand awareness in the capital markets Securitization provides an alternative option to funding longer-term loans, while reducing interest rate risk.

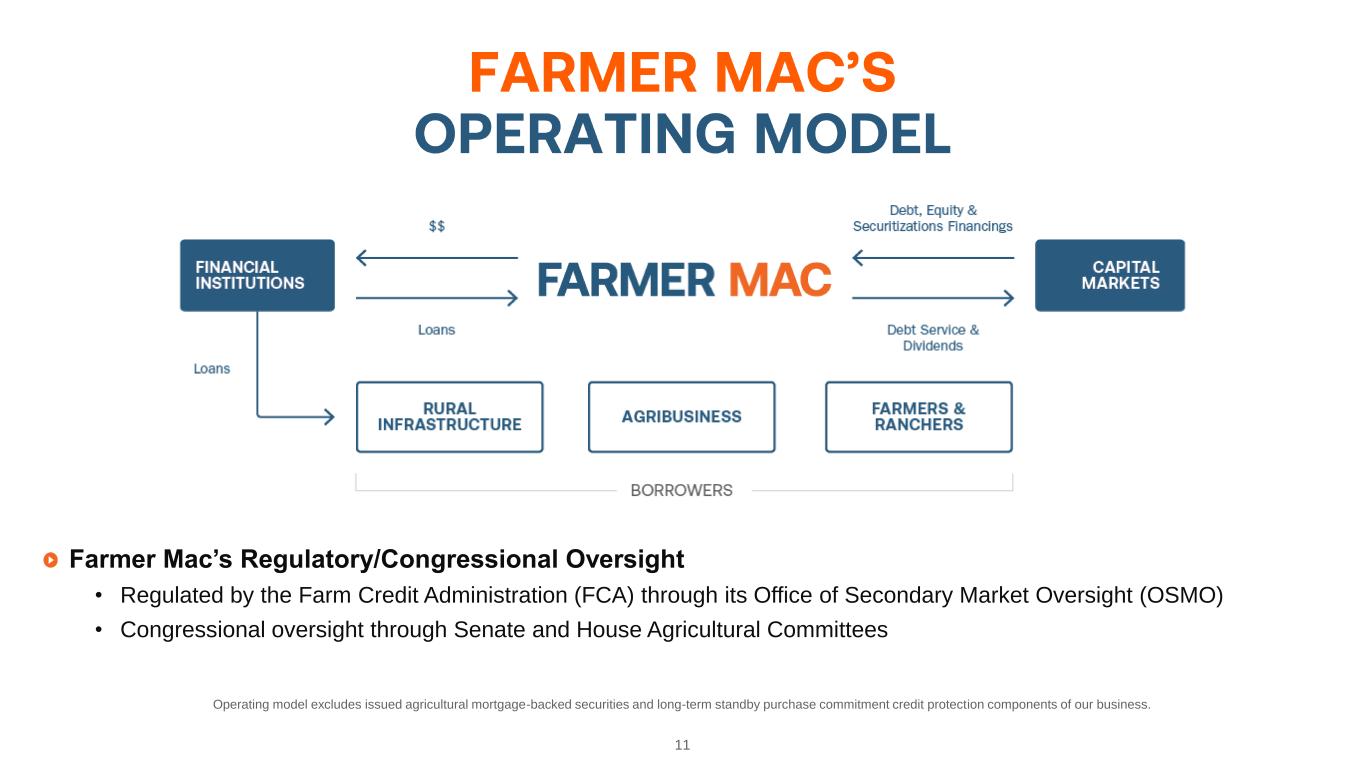

11 Operating model excludes issued agricultural mortgage-backed securities and long-term standby purchase commitment credit protection components of our business. Farmer Mac’s Regulatory/Congressional Oversight • Regulated by the Farm Credit Administration (FCA) through its Office of Secondary Market Oversight (OSMO) • Congressional oversight through Senate and House Agricultural Committees

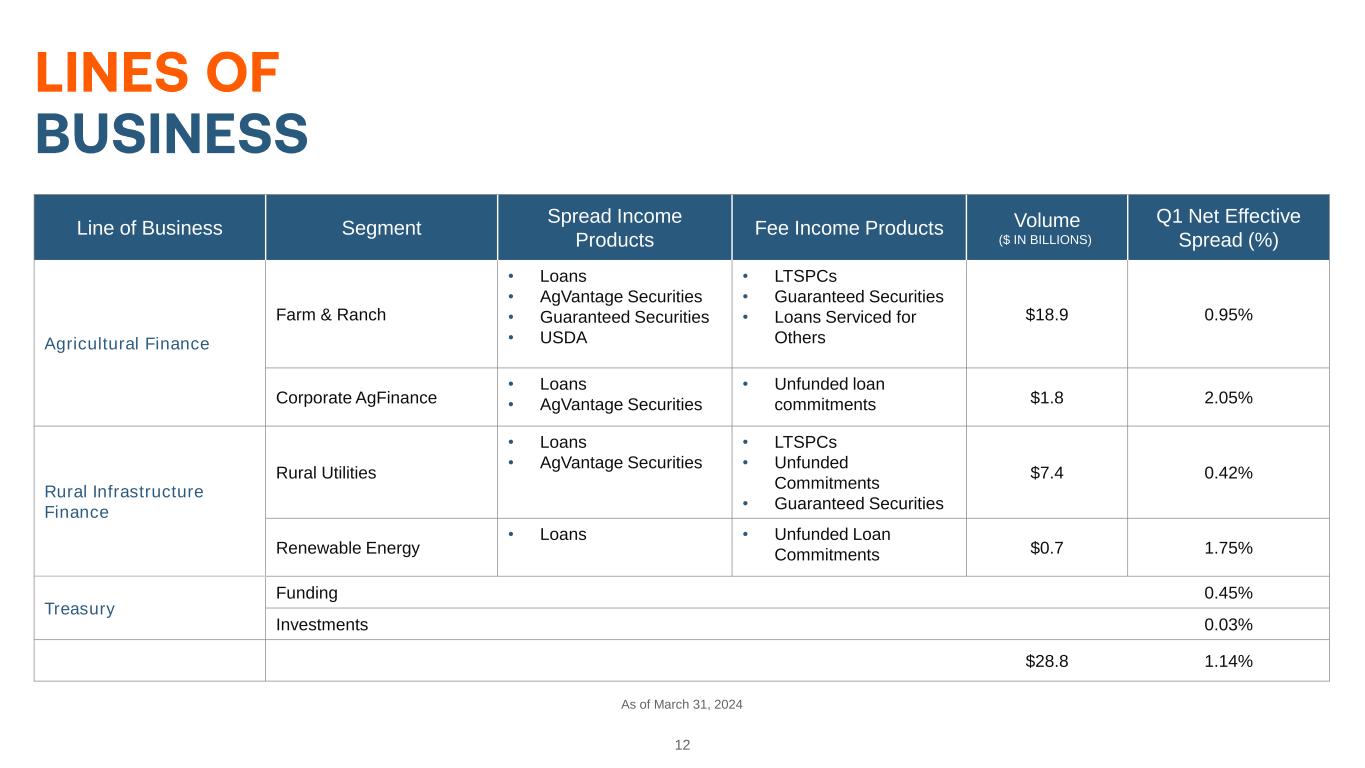

12 Line of Business Segment Spread Income Products Fee Income Products Volume ($ IN BILLIONS) Q1 Net Effective Spread (%) Agricultural Finance Farm & Ranch • Loans • AgVantage Securities • Guaranteed Securities • USDA • LTSPCs • Guaranteed Securities • Loans Serviced for Others $18.9 0.95% Corporate AgFinance • Loans • AgVantage Securities • Unfunded loan commitments $1.8 2.05% Rural Infrastructure Finance Rural Utilities • Loans • AgVantage Securities • LTSPCs • Unfunded Commitments • Guaranteed Securities $7.4 0.42% Renewable Energy • Loans • Unfunded Loan Commitments $0.7 1.75% Treasury Funding 0.45% Investments 0.03% $28.8 1.14% As of March 31, 2024

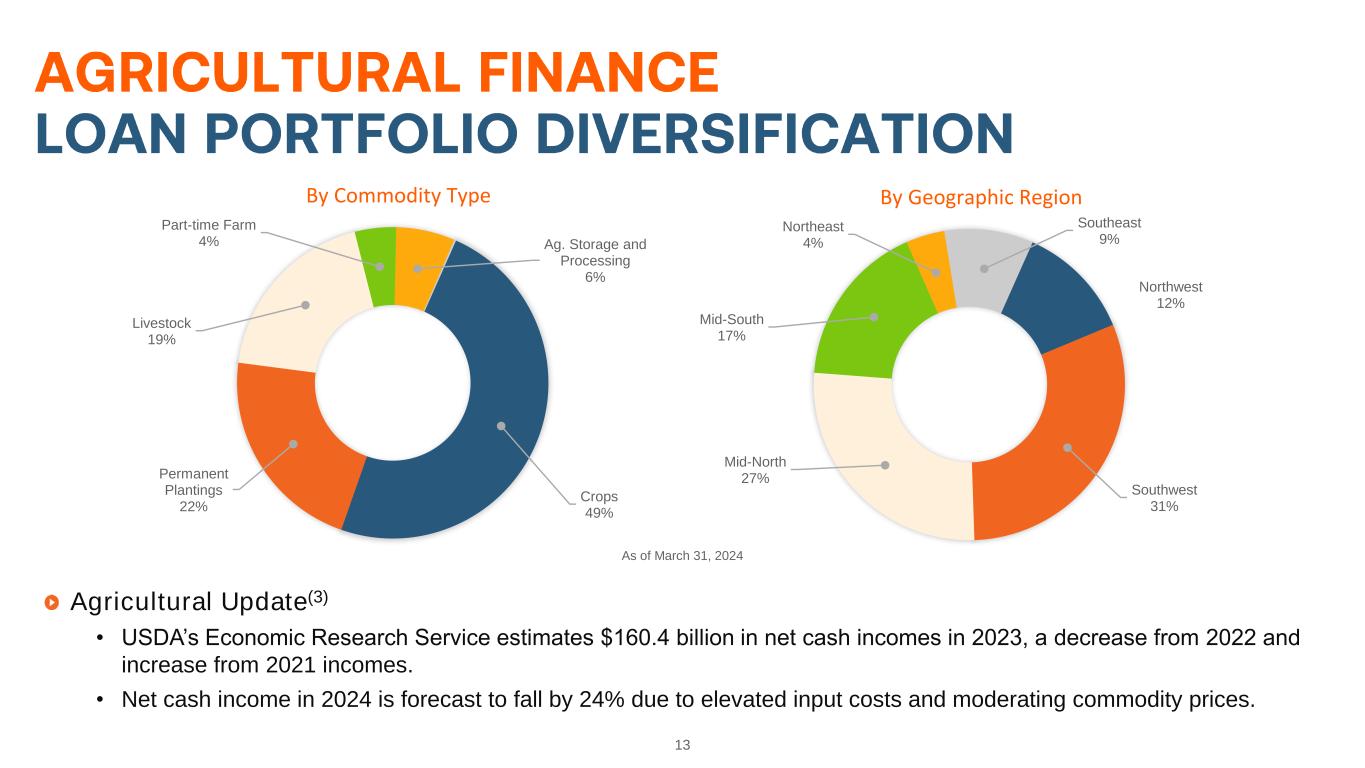

13 Northwest 12% Southwest 31% Mid-North 27% Mid-South 17% Northeast 4% Southeast 9% By Geographic Region Crops 49% Permanent Plantings 22% Livestock 19% Part-time Farm 4% Ag. Storage and Processing 6% By Commodity Type Agricultural Update(3) • USDA’s Economic Research Service estimates $160.4 billion in net cash incomes in 2023, a decrease from 2022 and increase from 2021 incomes. • Net cash income in 2024 is forecast to fall by 24% due to elevated input costs and moderating commodity prices. As of March 31, 2024

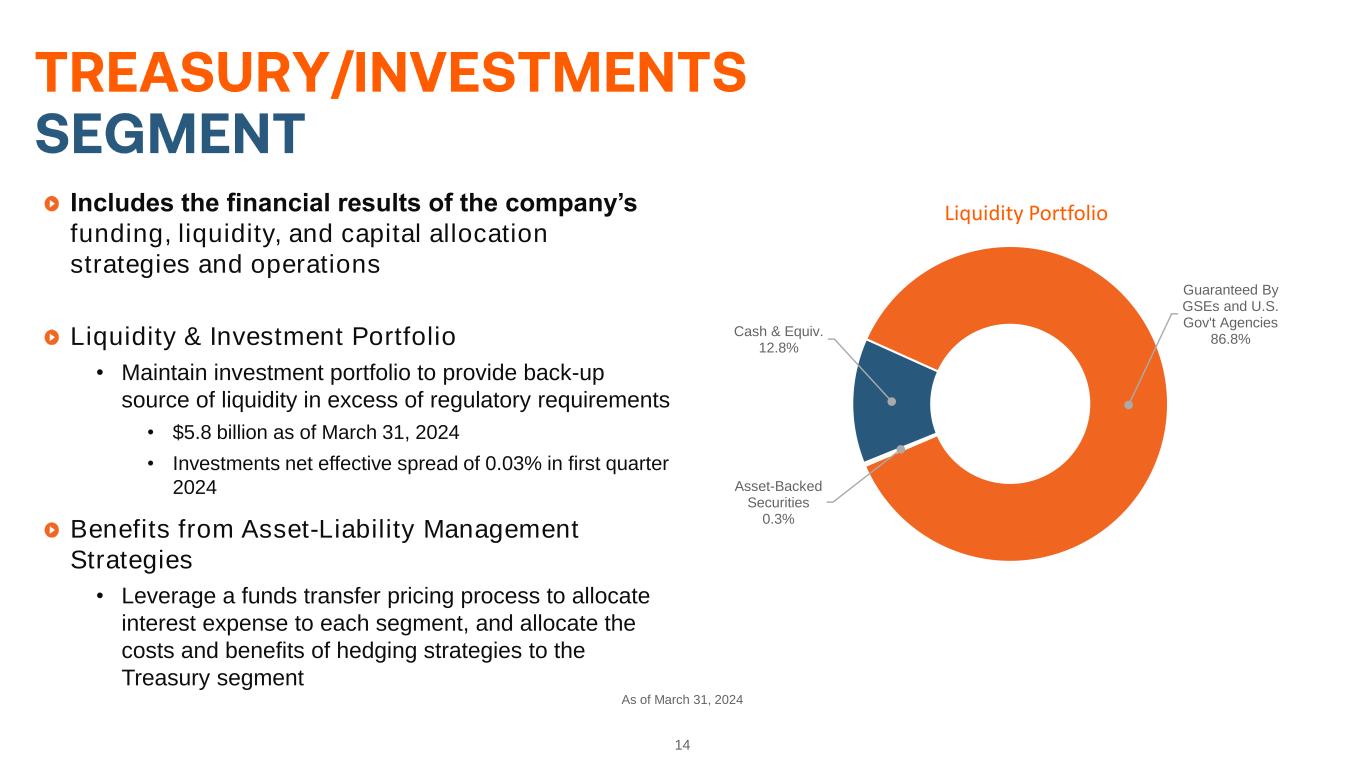

14 As of March 31, 2024 Includes the financial results of the company’s funding, liquidity, and capital allocation strategies and operations Liquidity & Investment Portfolio • Maintain investment portfolio to provide back-up source of liquidity in excess of regulatory requirements • $5.8 billion as of March 31, 2024 • Investments net effective spread of 0.03% in first quarter 2024 Benefits from Asset-Liability Management Strategies • Leverage a funds transfer pricing process to allocate interest expense to each segment, and allocate the costs and benefits of hedging strategies to the Treasury segment Cash & Equiv. 12.8% Guaranteed By GSEs and U.S. Gov't Agencies 86.8% Asset-Backed Securities 0.3% Liquidity Portfolio

15 $21.9 $23.6 $25.9 $28.5 $28.8 $0.0 $5.0 $10.0 $15.0 $20.0 $25.0 $30.0 $35.0 2020 2021 2022 2023 Q1 2024 $ I N B IL L IO N S Outstanding Business Volume $197.0 $220.7 $255.5 $327.0 $83.0$100.6 $113.6 $124.3 $171.2 $43.4 $0.0 $50.0 $100.0 $150.0 $200.0 $0.0 $100.0 $200.0 $300.0 2020 2021 2022 2023 Q1 2024 C O R E E A R N IN G S $ IN M IL L IO N S N E T E F F E C T IV E S P R E A D $ I N M IL L IO N S Net Effective Spread & Core Earnings Net Effective Spread Core Earnings CAGR is defined as Compound Annual Growth Rate. Core earnings and net effective spread are non-GAAP measures. For more information on the use of these non-GAAP measures, please see page 3. For a reconciliation of core earnings to GAAP net income attributable to common stockholders and a reconciliation of net effective spread to GAAP net interest income, please refer to pages 28-29 of the Appendix. 18% CAGR (2020-2023) 16% CAGR (2020-2023) 9% CAGR (2020-2023)

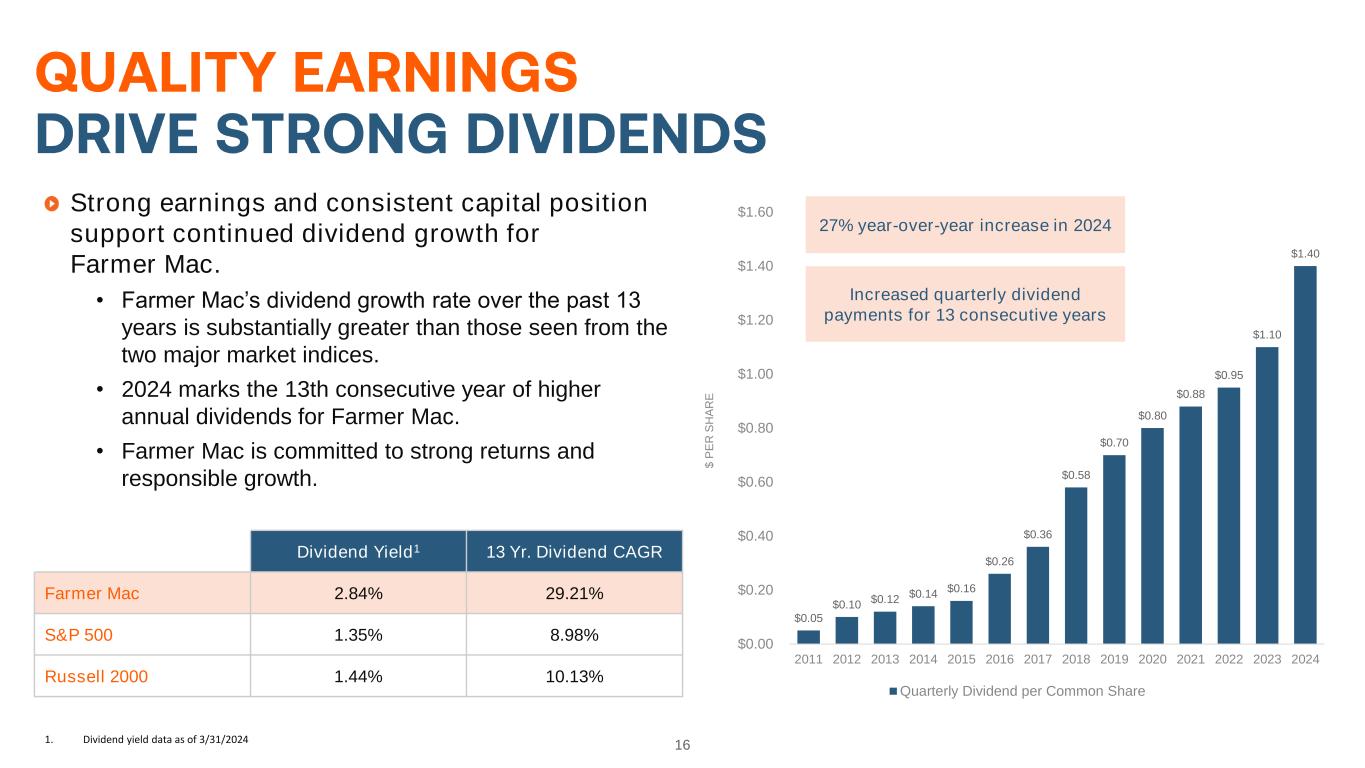

16 Strong earnings and consistent capital position support continued dividend growth for Farmer Mac. • Farmer Mac’s dividend growth rate over the past 13 years is substantially greater than those seen from the two major market indices. • 2024 marks the 13th consecutive year of higher annual dividends for Farmer Mac. • Farmer Mac is committed to strong returns and responsible growth. Dividend Yield1 13 Yr. Dividend CAGR Farmer Mac 2.84% 29.21% S&P 500 1.35% 8.98% Russell 2000 1.44% 10.13% $0.05 $0.10 $0.12 $0.14 $0.16 $0.26 $0.36 $0.58 $0.70 $0.80 $0.88 $0.95 $1.10 $1.40 $0.00 $0.20 $0.40 $0.60 $0.80 $1.00 $1.20 $1.40 $1.60 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 2021 2022 2023 2024 $ P E R S H A R E Quarterly Dividend per Common Share 27% year-over-year increase in 2024 Increased quarterly dividend payments for 13 consecutive years 1. Dividend yield data as of 3/31/2024

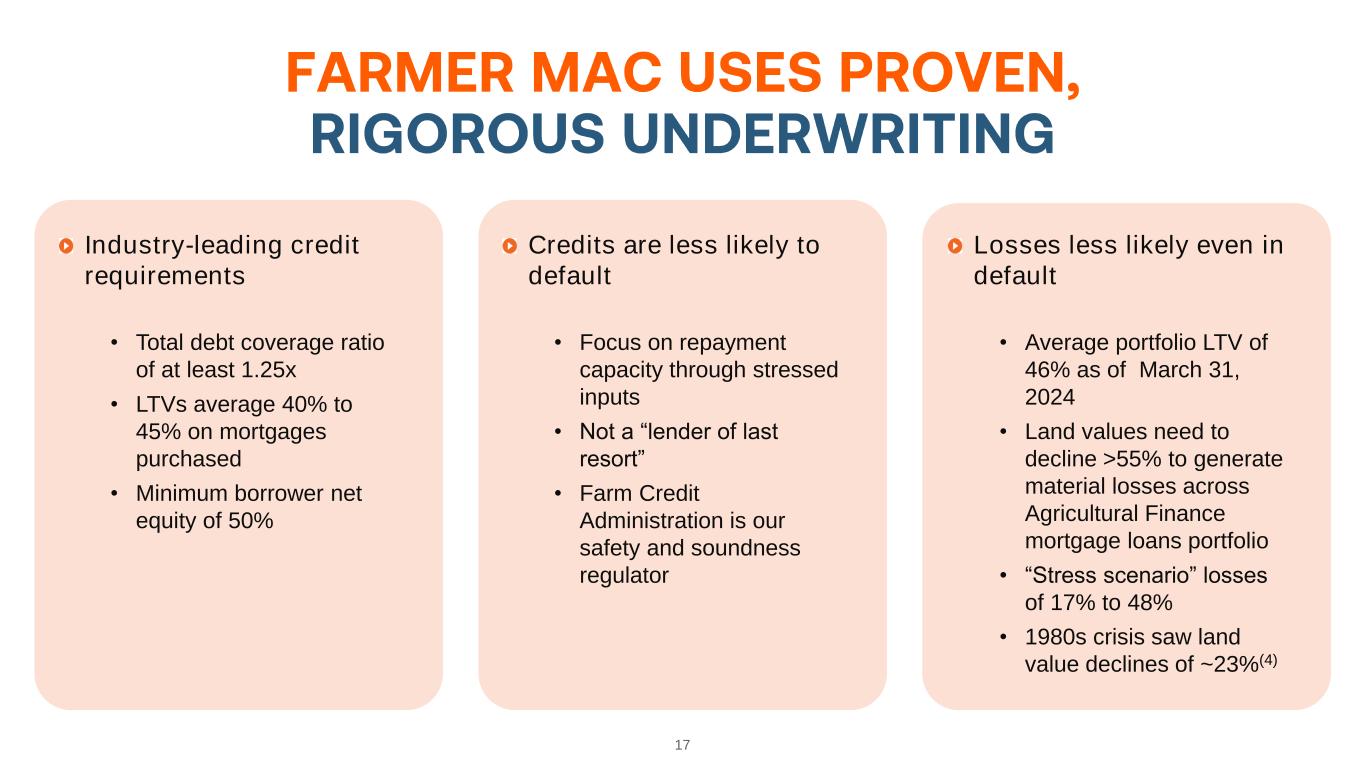

17 Industry-leading credit requirements • Total debt coverage ratio of at least 1.25x • LTVs average 40% to 45% on mortgages purchased • Minimum borrower net equity of 50% Credits are less likely to default • Focus on repayment capacity through stressed inputs • Not a “lender of last resort” • Farm Credit Administration is our safety and soundness regulator Losses less likely even in default • Average portfolio LTV of 46% as of March 31, 2024 • Land values need to decline >55% to generate material losses across Agricultural Finance mortgage loans portfolio • “Stress scenario” losses of 17% to 48% • 1980s crisis saw land value declines of ~23%(4)

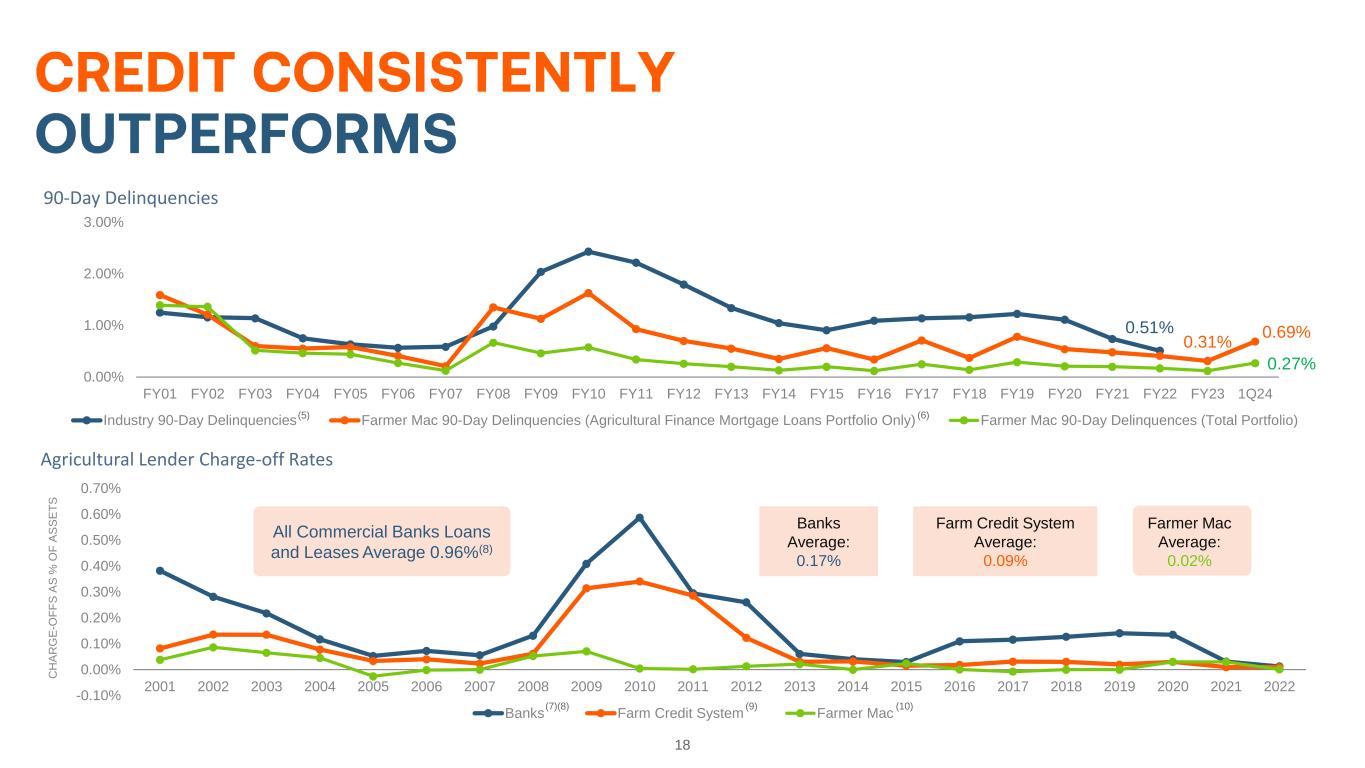

-0.10% 0.00% 0.10% 0.20% 0.30% 0.40% 0.50% 0.60% 0.70% 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 2021 2022 C H A R G E -O F F S A S % O F A S S E T S Agricultural Lender Charge-off Rates Banks Farm Credit System Farmer Mac 18 0.51% 0.31% 0.69% 0.27% 0.00% 1.00% 2.00% 3.00% FY01 FY02 FY03 FY04 FY05 FY06 FY07 FY08 FY09 FY10 FY11 FY12 FY13 FY14 FY15 FY16 FY17 FY18 FY19 FY20 FY21 FY22 FY23 1Q24 90-Day Delinquencies Industry 90-Day Delinquencies Farmer Mac 90-Day Delinquencies (Agricultural Finance Mortgage Loans Portfolio Only) Farmer Mac 90-Day Delinquences (Total Portfolio) All Commercial Banks Loans and Leases Average 0.96%(8) Banks Average: 0.17% Farm Credit System Average: 0.09% Farmer Mac Average: 0.02% (5) (6) (7)(8) (9) (10)

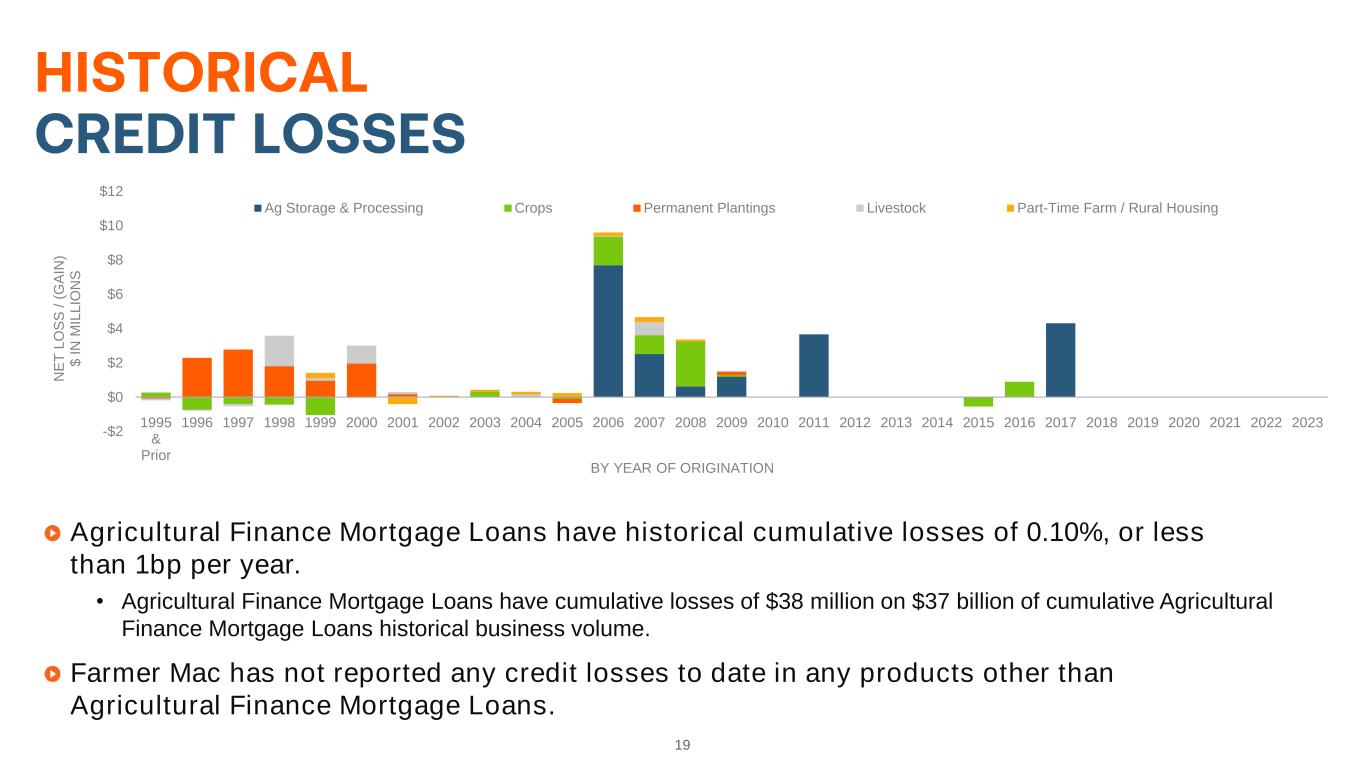

19 -$2 $0 $2 $4 $6 $8 $10 $12 1995 & Prior 1996 1997 1998 1999 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 2021 2022 2023 N E T L O S S / ( G A IN ) $ I N M IL L IO N S BY YEAR OF ORIGINATION Ag Storage & Processing Crops Permanent Plantings Livestock Part-Time Farm / Rural Housing Agricultural Finance Mortgage Loans have historical cumulative losses of 0.10%, or less than 1bp per year. • Agricultural Finance Mortgage Loans have cumulative losses of $38 million on $37 billion of cumulative Agricultural Finance Mortgage Loans historical business volume. Farmer Mac has not reported any credit losses to date in any products other than Agricultural Finance Mortgage Loans.

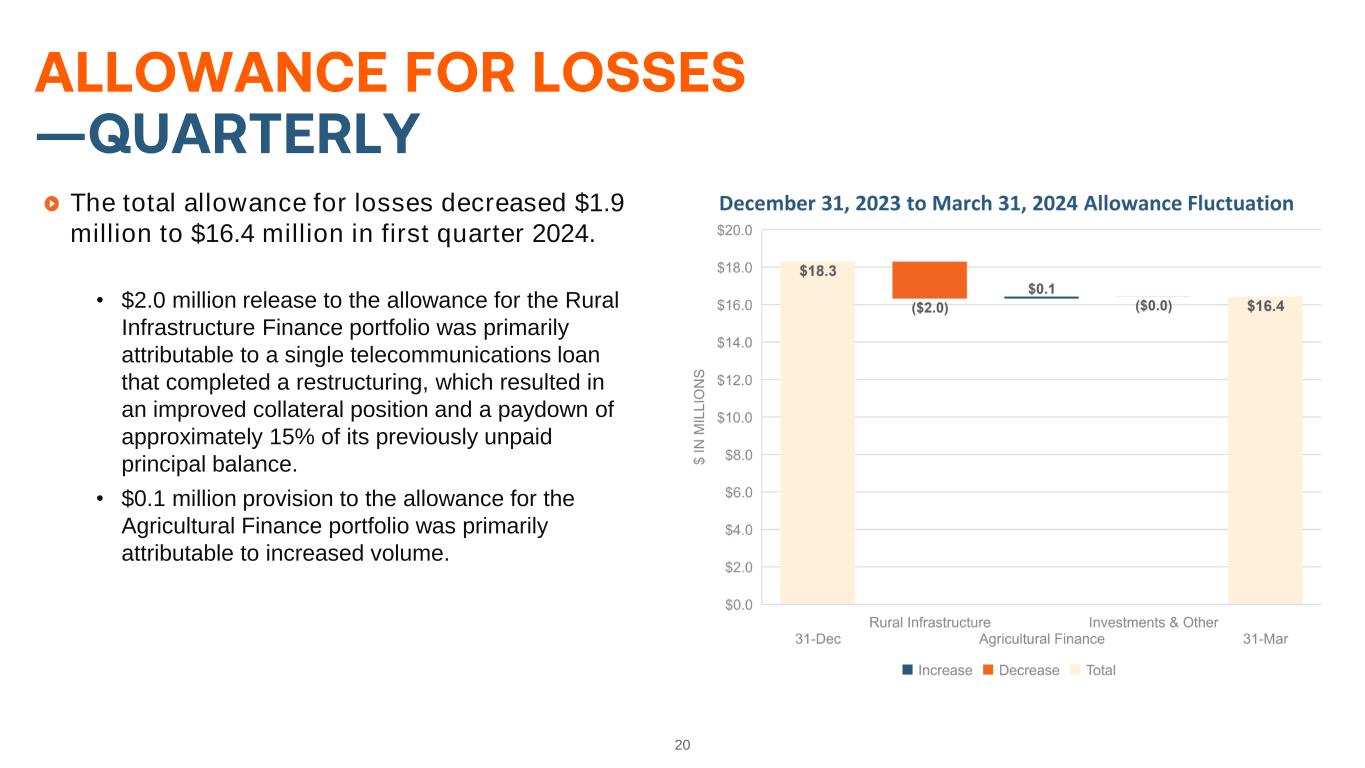

20 The total allowance for losses decreased $1.9 million to $16.4 million in first quarter 2024. • $2.0 million release to the allowance for the Rural Infrastructure Finance portfolio was primarily attributable to a single telecommunications loan that completed a restructuring, which resulted in an improved collateral position and a paydown of approximately 15% of its previously unpaid principal balance. • $0.1 million provision to the allowance for the Agricultural Finance portfolio was primarily attributable to increased volume.

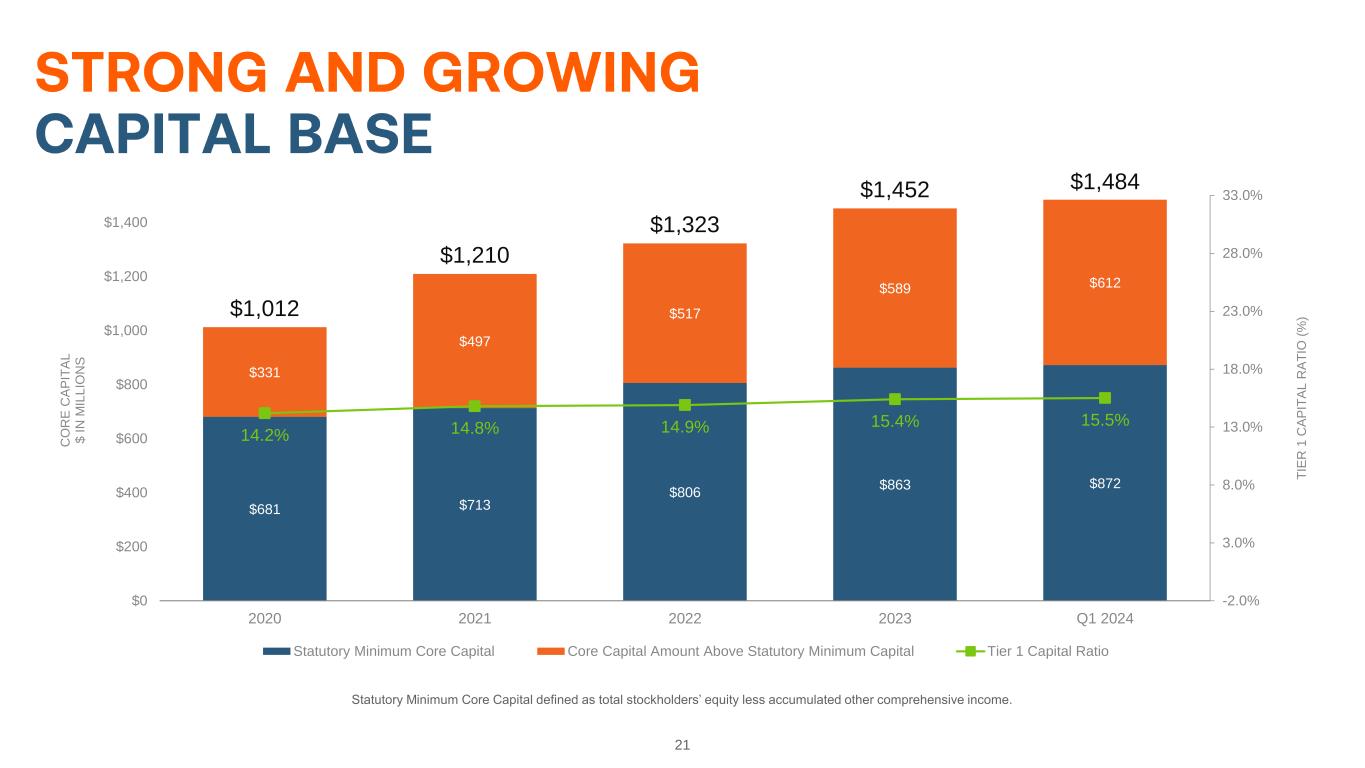

21 Statutory Minimum Core Capital defined as total stockholders’ equity less accumulated other comprehensive income. $681 $713 $806 $863 $872 $331 $497 $517 $589 $612 $1,012 $1,210 $1,323 $1,452 $1,484 14.2% 14.8% 14.9% 15.4% 15.5% -2.0% 3.0% 8.0% 13.0% 18.0% 23.0% 28.0% 33.0% $0 $200 $400 $600 $800 $1,000 $1,200 $1,400 2020 2021 2022 2023 Q1 2024 T IE R 1 C A P IT A L R A T IO ( % ) C O R E C A P IT A L $ I N M IL L IO N S Statutory Minimum Core Capital Core Capital Amount Above Statutory Minimum Capital Tier 1 Capital Ratio

22 • 90-day delinquencies of only 0.27% across all lines of business • Cumulative Agricultural Finance Mortgage Loans lifetime losses of only 0.10% Quality Assets • Issue at narrow, Government Sponsored Enterprise (GSE) spreads to U.S. Treasuries • E.g., 10-year U.S. Treasury +0.33% as of March 31, 2024 Funding Advantage • Ag productivity must double to meet expected global demand • U.S. ag mortgage market ~$355 billion and growing • Renewable electricity capacity expected to grow by 48% in the next five years Growth Prospects • Overhead / outstanding business volume ~33 bps • Greater than $900,000 earnings per employee in 2023 Operational Efficiency • Greater than 90% of total revenues is recurring net effective spread and fees • Outstanding business volume CAGR of 10% (2000 to 2023) Quality, Recurring Earnings • Core earnings ROE ~19% in 2023 and consistent net effective spread • Increased quarterly dividend payments for 13 consecutive years Strong Returns, Responsible Growth

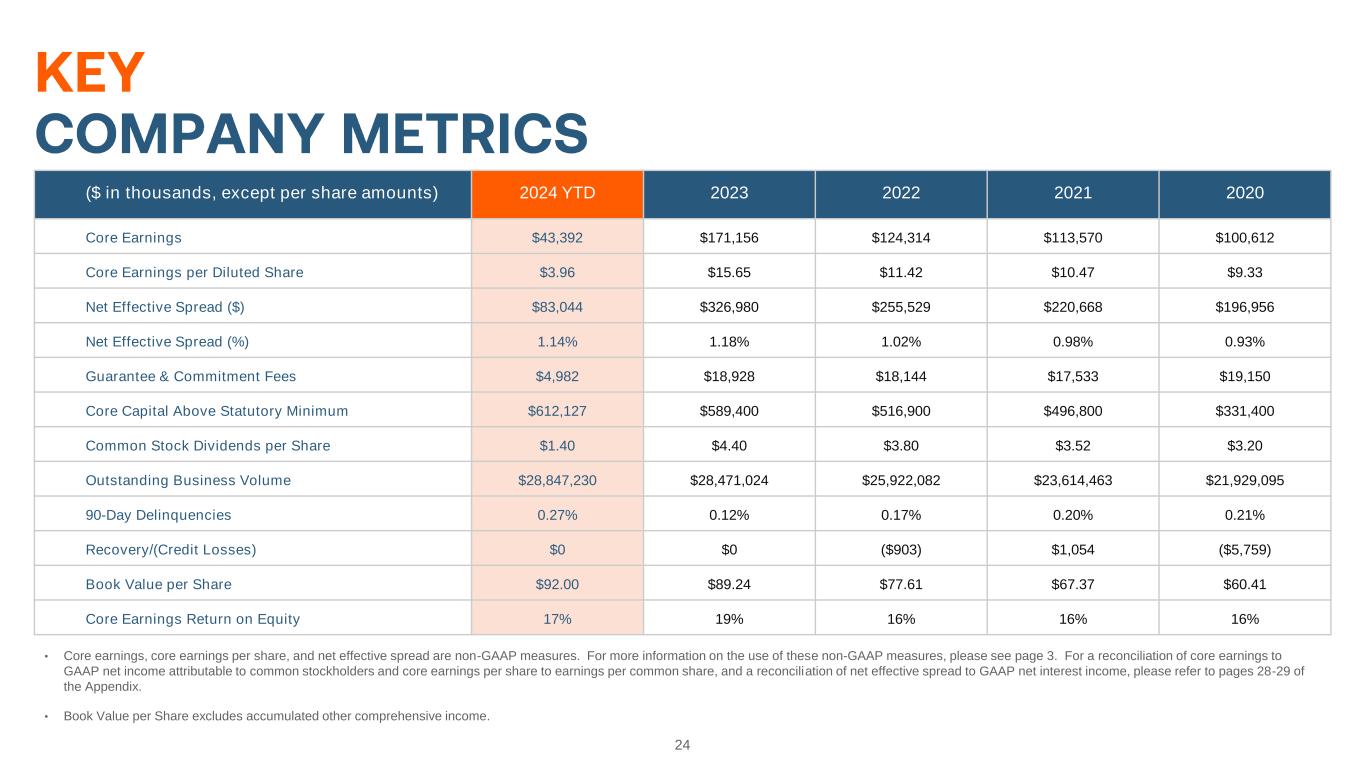

24 ($ in thousands, except per share amounts) 2024 YTD 2023 2022 2021 2020 Core Earnings $43,392 $171,156 $124,314 $113,570 $100,612 Core Earnings per Diluted Share $3.96 $15.65 $11.42 $10.47 $9.33 Net Effective Spread ($) $83,044 $326,980 $255,529 $220,668 $196,956 Net Effective Spread (%) 1.14% 1.18% 1.02% 0.98% 0.93% Guarantee & Commitment Fees $4,982 $18,928 $18,144 $17,533 $19,150 Core Capital Above Statutory Minimum $612,127 $589,400 $516,900 $496,800 $331,400 Common Stock Dividends per Share $1.40 $4.40 $3.80 $3.52 $3.20 Outstanding Business Volume $28,847,230 $28,471,024 $25,922,082 $23,614,463 $21,929,095 90-Day Delinquencies 0.27% 0.12% 0.17% 0.20% 0.21% Recovery/(Credit Losses) $0 $0 ($903) $1,054 ($5,759) Book Value per Share $92.00 $89.24 $77.61 $67.37 $60.41 Core Earnings Return on Equity 17% 19% 16% 16% 16% • Core earnings, core earnings per share, and net effective spread are non-GAAP measures. For more information on the use of these non-GAAP measures, please see page 3. For a reconciliation of core earnings to GAAP net income attributable to common stockholders and core earnings per share to earnings per common share, and a reconciliation of net effective spread to GAAP net interest income, please refer to pages 28-29 of the Appendix. • Book Value per Share excludes accumulated other comprehensive income.

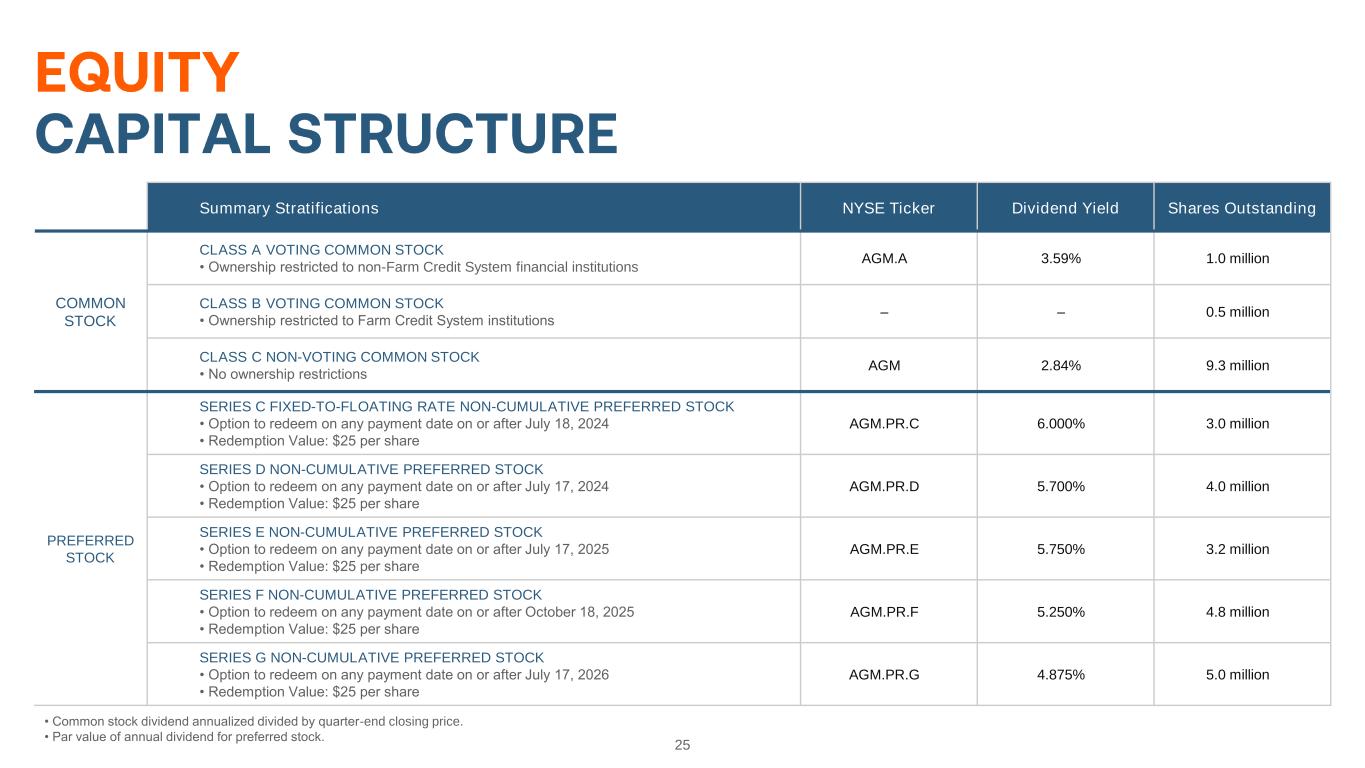

25 • Common stock dividend annualized divided by quarter-end closing price. • Par value of annual dividend for preferred stock. Summary Stratifications NYSE Ticker Dividend Yield Shares Outstanding COMMON STOCK CLASS A VOTING COMMON STOCK • Ownership restricted to non-Farm Credit System financial institutions AGM.A 3.59% 1.0 million CLASS B VOTING COMMON STOCK • Ownership restricted to Farm Credit System institutions – – 0.5 million CLASS C NON-VOTING COMMON STOCK • No ownership restrictions AGM 2.84% 9.3 million PREFERRED STOCK SERIES C FIXED-TO-FLOATING RATE NON-CUMULATIVE PREFERRED STOCK • Option to redeem on any payment date on or after July 18, 2024 • Redemption Value: $25 per share AGM.PR.C 6.000% 3.0 million SERIES D NON-CUMULATIVE PREFERRED STOCK • Option to redeem on any payment date on or after July 17, 2024 • Redemption Value: $25 per share AGM.PR.D 5.700% 4.0 million SERIES E NON-CUMULATIVE PREFERRED STOCK • Option to redeem on any payment date on or after July 17, 2025 • Redemption Value: $25 per share AGM.PR.E 5.750% 3.2 million SERIES F NON-CUMULATIVE PREFERRED STOCK • Option to redeem on any payment date on or after October 18, 2025 • Redemption Value: $25 per share AGM.PR.F 5.250% 4.8 million SERIES G NON-CUMULATIVE PREFERRED STOCK • Option to redeem on any payment date on or after July 17, 2026 • Redemption Value: $25 per share AGM.PR.G 4.875% 5.0 million

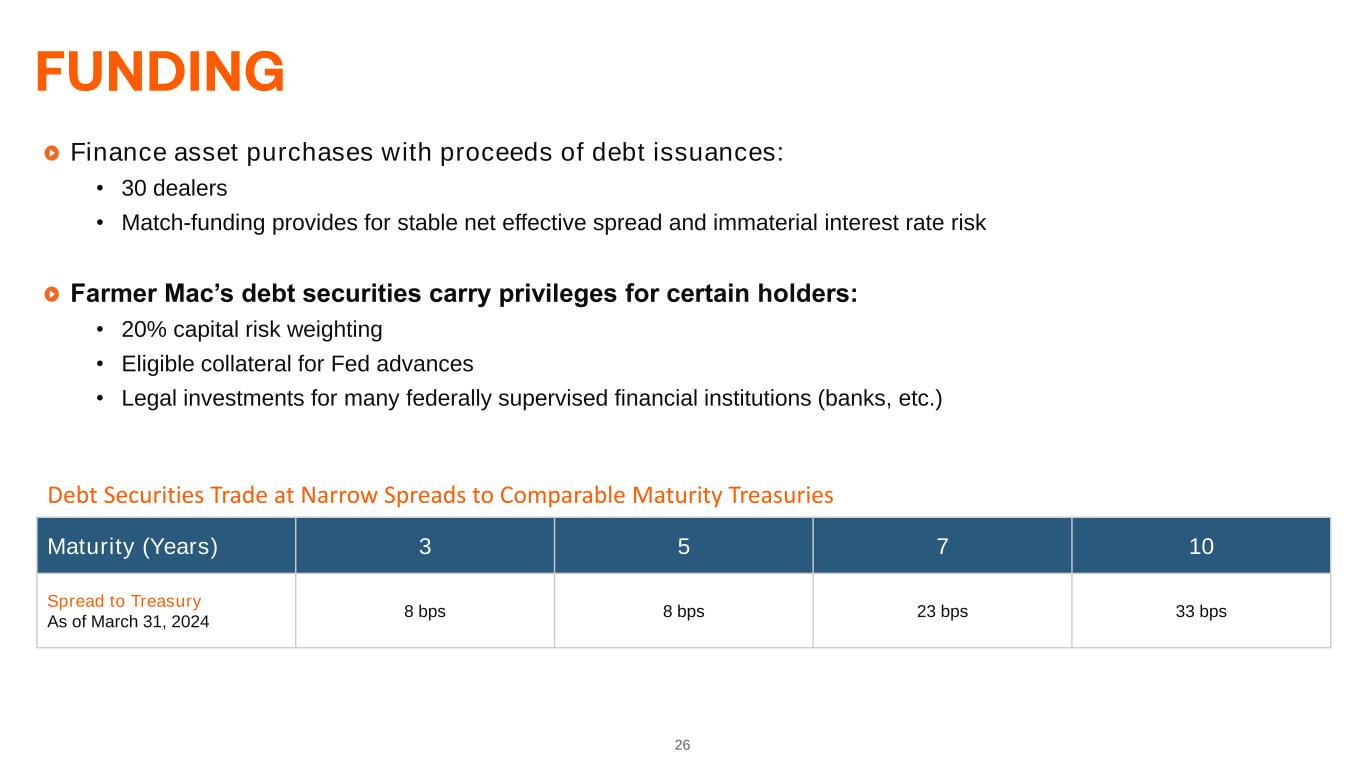

26 Finance asset purchases with proceeds of debt issuances: • 30 dealers • Match-funding provides for stable net effective spread and immaterial interest rate risk Farmer Mac’s debt securities carry privileges for certain holders: • 20% capital risk weighting • Eligible collateral for Fed advances • Legal investments for many federally supervised financial institutions (banks, etc.) Debt Securities Trade at Narrow Spreads to Comparable Maturity Treasuries Maturity (Years) 3 5 7 10 Spread to Treasury As of March 31, 2024 8 bps 8 bps 23 bps 33 bps

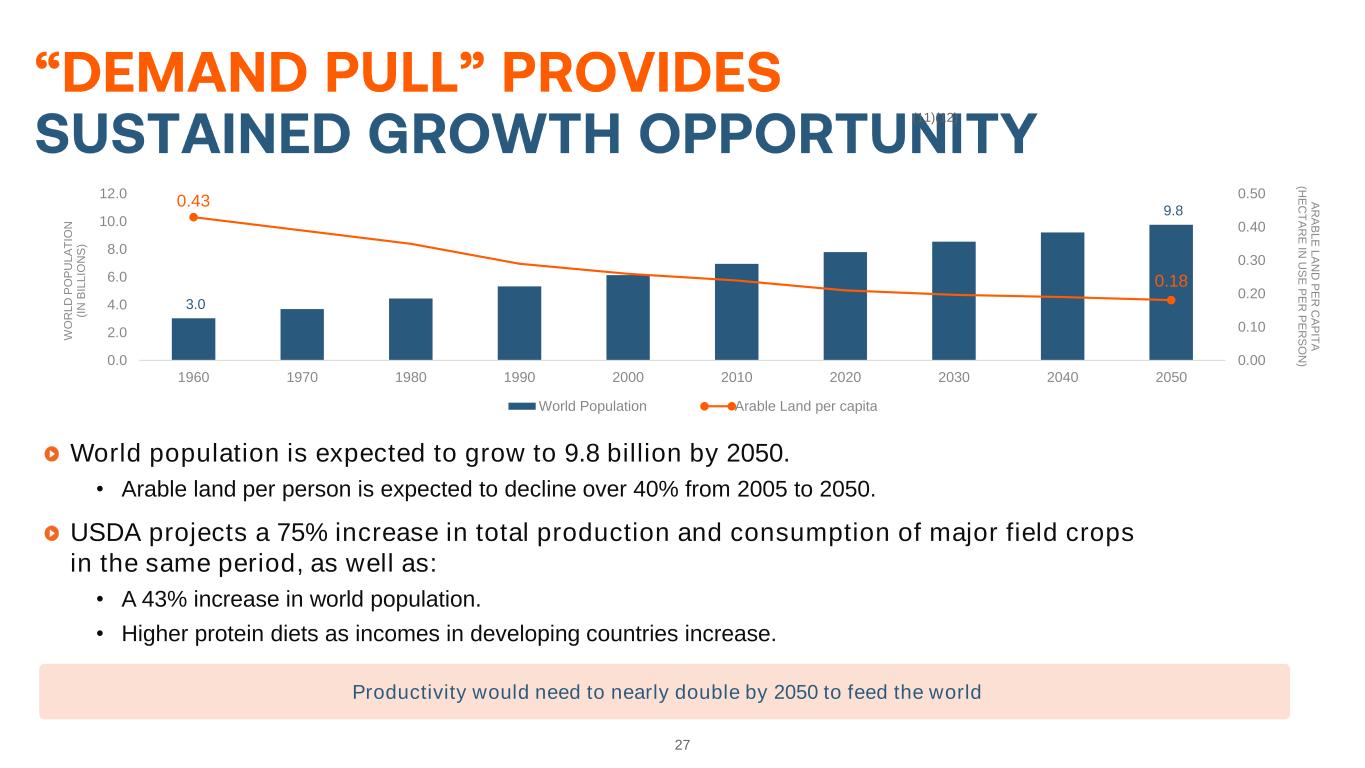

27 (11)(12) World population is expected to grow to 9.8 billion by 2050. • Arable land per person is expected to decline over 40% from 2005 to 2050. USDA projects a 75% increase in total production and consumption of major field crops in the same period, as well as: • A 43% increase in world population. • Higher protein diets as incomes in developing countries increase. Productivity would need to nearly double by 2050 to feed the world 3.0 9.8 0.43 0.18 0.00 0.10 0.20 0.30 0.40 0.50 0.0 2.0 4.0 6.0 8.0 10.0 12.0 1960 1970 1980 1990 2000 2010 2020 2030 2040 2050 A R A B L E L A N D P E R C A P IT A (H E C T A R E IN U S E P E R P E R S O N ) W O R L D P O P U L A T IO N (I N B IL L IO N S ) World Population Arable Land per capita

28 (in thousands) 2024 YTD 2023 2022 2021 2020 Net income attributable to common stockholders 46,955$ 172,838$ 150,979$ 111,413$ 94,904$ Less reconciling items: Gains/(losses) on undesignated financial derivatives due to fair value changes 1,683 5,142 13,495 (1,430) (1,701) Gains/(losses) on hedging activities due to fair value changes 3,002 (5,394) 5,343 (1,809) (4,759) Unrealized gains/(losses) on trading assets (14) 1,979 (917) (115) 51 Amortization of premiums/discounts and deferred gains on assets consolidated at fair value 31 175 39 130 58 Net effects of terminations or net settlements on financial derivatives and hedging activities (192) 227 15,794 494 1,236 Issuance costs on retirement of preferred stock - - - - (1,667) Income tax effect related to reconciling items (947) (447) (7,089) 573 1,074 Sub-total 3,563 1,682 26,665 (2,157) (5,708) Core earnings 43,392$ 171,156$ 124,314$ 113,570$ 100,612$ Core Earnings by Period Ended Issuance costs on retirement of preferred stock relates to the write-off of deferred issuance costs as a result of the retirement of Series A Preferred Stock and Series B Preferred Stock.

29 2022 2021 2020 $ in thousands Dollars Yield Dollars Yield Dollars Yield Dollars Yield Dollars Yield Net interest income/yield 86,368$ 1.15% 327,547$ 1.15% 270,940$ 1.04% 221,951$ 0.94% 195,848$ 0.87% Net effects of consolidated trusts (1,052) 0.02% (4,171) 0.02% (4,239) 0.02% (4,864) 0.02% (6,601) 0.02% Expense related to undesignated financial derivatives (34) 0.00% (4,845) -0.02% (7,756) -0.03% 2,841 0.02% 3,468 0.02% Amortization of premiums/discounts on assets consolidated at fair value (27) 0.00% (175) 0.00% (24) 0.00% (45) 0.00% 197 0.00% Amortization of losses due to terminations or net settlements on financial derivatives and hedging activities 791 0.01% 3,230 0.01% 2,413 0.01% 446 0.00% 120 0.00% Fair Value Changes on fair value hedge relationships (3,002) -0.04% 5,394 0.02% (5,805) -0.02% 339 0.00% 3,924 0.02% Net Effective Spread 83,044$ 1.14% 326,980$ 1.18% 255,529$ 1.02% 220,668$ 0.98% 196,956$ 0.93% 2024 YTD For the Year Ended March 31, 2024 2023

30 Footnote 1: USDA Economic Research Service year end 2023 balance sheet (https://data.ers.usda.gov/reports.aspx?ID=17835). Farm Sector Assets and Farm Sector Debt values are values for 2023 from USDA Economic Research Service. Footnote 2: Eligible ag real estate mortgage market structure shown includes the forecast for outstanding unpaid principal balance of first lien ag mortgage assets for December 31, 2023. Footnote 3: USDA, Economic Research Service U.S. and State-Level Farm Income and Wealth Statistic (https://www.ers.usda.gov/data-products/farm-income-and- wealth-statistics/data-files-us-and-state-level-farm-income-and-wealth-statistics/). Footnote 4: USDA, National Agricultural Statistics Service (as of August 2015). Historic values are not necessarily predictive of future results or outcomes. Footnote 5: FDIC Call Report Data & Farm Credit Funding Corp Annual Information Statements – Non-accrual real estate loans and accruing loans that are 90 days or more past due made by commercial and Farm Credit System banks (as of December 2022). Footnote 6: Delinquencies reflect Farmer Mac’s Agricultural Finance mortgage loan portfolio that are 90 days or more past due, in foreclosure, or in bankruptcy with at least one missed payment, excluding loans performing under either their original loan terms or a court -approved bankruptcy plan. Footnote 7: Kansas City Federal Reserve Agriculture Finance Databook (https://www.kansascityfed.org/agriculture/agfinance -updates/). Footnote 8: Banks’ charge-off rate is a percentage of agricultural loan assets. Footnote 9: Farm Credit Banks Funding Corporation Annual Information Statements; Farm Credit System’s charge-off rate is the percentage of total loans and guarantees. Footnote 10: Farmer Mac’s charge-off rate is the percentage of total loans and guarantees. Footnote 11: USDA, Economic Research Service Global Drivers of Agricultural Demand and Supply, September 2014. Footnote 12: Food and Agriculture Organization of the United Nations, “World Agriculture Towards 2030/2050,” June 2012.

31

v3.24.1.u1

Cover Page

|

May 06, 2024 |

| Entity Information [Line Items] |

|

| Document Type |

8-K

|

| Document Period End Date |

May 06, 2024

|

| Entity Registrant Name |

FEDERAL AGRICULTURAL MORTGAGE CORPORATION

|

| City Area Code |

202

|

| Local Phone Number |

872-7700

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity File Number |

001-14951

|

| Entity Central Index Key |

0000845877

|

| Entity Tax Identification Number |

52-1578738

|

| Entity Address, Address Line One |

1999 K Street, N.W., 4th Floor,

|

| Entity Address, Postal Zip Code |

20006

|

| Amendment Flag |

false

|

| Entity Incorporation, State or Country Code |

X1

|

| Entity Address, City or Town |

Washington,

|

| Entity Address, State or Province |

DC

|

| Entity Emerging Growth Company |

false

|

| Common Class A [Member] |

|

| Entity Information [Line Items] |

|

| Title of 12(b) Security |

Class A voting common stock

|

| Trading Symbol |

AGM.A

|

| Security Exchange Name |

NYSE

|

| Common Class C [Member] |

|

| Entity Information [Line Items] |

|

| Title of 12(b) Security |

Class C non-voting common stock

|

| Trading Symbol |

AGM

|

| Security Exchange Name |

NYSE

|

| Series C Preferred Stock [Member] |

|

| Entity Information [Line Items] |

|

| Title of 12(b) Security |

6.000% Fixed-to-Floating Rate Non-Cumulative Preferred Stock, Series C

|

| Trading Symbol |

AGM.PRC

|

| Security Exchange Name |

NYSE

|

| Series D Preferred Stock [Member] |

|

| Entity Information [Line Items] |

|

| Title of 12(b) Security |

5.700% Non-Cumulative Preferred Stock, Series D

|

| Trading Symbol |

AGM.PRD

|

| Security Exchange Name |

NYSE

|

| Series E Preferred Stock |

|

| Entity Information [Line Items] |

|

| Title of 12(b) Security |

5.750% Non-Cumulative Preferred Stock, Series E

|

| Trading Symbol |

AGM.PRE

|

| Security Exchange Name |

NYSE

|

| Series F Preferred Stock |

|

| Entity Information [Line Items] |

|