Adams Diversified Equity Fund Announces Tender Offer Results

05 August 2024 - 6:10PM

Adams Diversified Equity Fund, Inc. (NYSE: ADX) announced today the

final results of its offer to purchase up to 12,405,174 of its

common shares at $22.47, 98% of the $22.93 net asset value per

share (“NAV”) at the close of regular trading on the New York Stock

Exchange on August 2, 2024, the expiration date.

Based on the final count by Equiniti Trust Company, LLC (“EQ”),

the depositary for the tender offer, a total of 41,882,825 common

shares of ADX were validly tendered and not withdrawn. The

total amount of shares tendered exceeded the offer amount, and the

Fund will purchase tendered shares on a pro rata basis,

disregarding fractions. The proration factor for shares purchased

pursuant to the offer is 29.61876%.

In accordance with the terms and conditions of the tender offer,

ADX has accepted for payment all 12,405,174 common shares subject

to the tender offer.

Payment for the shares accepted for purchase under the tender

offer and return of all other shares tendered and not purchased

will occur promptly.

EQ Fund Solutions, LLC is the information agent for the Offer.

Shareholders with questions may call EQ Fund Solutions, LLC at

(888) 886-4425.

About Adams Funds

Since 1929, Adams Funds has consistently helped generations of

investors reach their investment goals. Adams Funds is comprised of

two closed-end funds, Adams Diversified Equity Fund, Inc. (NYSE:

ADX) and Adams Natural Resources Fund, Inc. (NYSE: PEO). The Funds

are actively managed by an experienced team with a disciplined

approach and have paid dividends for more than 85 years across many

market cycles. The Funds are committed to paying a minimum annual

distribution rate of 8% of NAV or more, providing reliable income

to long-term investors. Shares can be purchased through our

transfer agent or through a broker. For more information about

Adams Funds, please visit: adamsfunds.com.

For further information please contact:

adamsfunds.com/about/contact or 800.638.2479

Statements in this press release that are not historical facts

are “forward-looking statements” as defined by the U.S. securities

laws. You should exercise caution in interpreting and relying on

forward-looking statements because they are subject to

uncertainties and other factors which are, in some cases, beyond

the Fund’s control and could cause actual results to differ

materially from those set forth in the forward-looking statements.

All forward-looking statements are as of the date of this release

only; the Fund undertakes no obligation to update or review any

forward-looking statements.

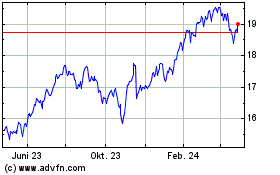

Adams Diversified Equity (NYSE:ADX)

Historical Stock Chart

Von Nov 2024 bis Dez 2024

Adams Diversified Equity (NYSE:ADX)

Historical Stock Chart

Von Dez 2023 bis Dez 2024