0001158449false00011584492024-11-012024-11-0100011584492024-09-132024-09-13

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): November 1, 2024

ADVANCE AUTO PARTS, INC.

(Exact name of registrant as specified in its charter)

| | | | | | | | |

| Delaware | 001-16797 | 54-2049910 |

| (State or other jurisdiction of incorporation) | (Commission File Number) | (I.R.S. Employer Identification No.) |

4200 Six Forks Road, Raleigh, North Carolina 27609

(Address of principal executive offices) (Zip Code)

(540) 362-4911

(Registrant's telephone number, including area code)

Not Applicable

(Former name or former address, if changed since last report)

Securities Registered Pursuant to Section 12(b) of the Act: | | | | | | | | | | | | | | |

| Title of each class | | Trading symbol | | Name of each exchange on which registered |

| Common Stock, $0.0001 par value | | AAP | | New York Stock Exchange |

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

INFORMATION TO BE INCLUDED IN THE REPORT

Item 2.01 Completion of Acquisition or Disposition of Assets.

As previously announced on August 22, 2024, Advance Auto Parts, Inc., a Delaware Corporation (the “Company”), and an affiliate of the Carlyle Group (NASDAQ: CG) (the “Buyer”) entered into a Sale and Purchase Agreement (the “Agreement”) to sell the Company’s Worldpac Inc. business (“Worldpac”). On November 1, 2024, the Company completed the sale of Worldpac to the Buyer pursuant to the terms of the Agreement for aggregate cash consideration of approximately $1.5 billion, as adjusted for working capital and other items.

In connection with the transaction, the historical results of Worldpac will be reflected as discontinued operations beginning in the third quarter of 2024.

The Company expects to use the proceeds from the transaction for general corporate purposes, which may include the provision of additional working capital, funding internal operational improvement initiatives and repayment or refinancing of outstanding indebtedness. As previously disclosed, the Company has agreed to provide a letter of credit of up to $200 million, under its unsecured revolving credit facility, for up to 12 months after closing of the transaction as credit support for Worldpac’s new supply chain financing program, which letter of credit will reduce to zero no later than 24 months after closing.

The foregoing description of the transaction terms is qualified in its entirety by reference to the Agreement, a copy of which was filed as Exhibit 10.1 to the Company’s Current Report on Form 8-K filed on August 22, 2024, and is incorporated into this Item 2.01 by reference.

The Company issued a press release on November 4, 2024 announcing the closing of the transaction, a copy of which is filed as Exhibit 99.1 to this Report on Form 8-K.

Item 7.01 Regulation FD Disclosure.

The information included in Item 9.01 of this Current Report on Form 8-K, including unaudited pro forma condensed consolidated financial statements as of and for the twenty-eight weeks ended July 13, 2024, do not reflect adjustments for certain historical intercompany sales, margins and overhead costs related to the Worldpac business. For an understanding of the forward-looking plans of the Company on a post-Worldpac basis, excluding intercompany adjustments, the information included in this Form 8-K should be read in conjunction with information expected to be filed in the Company's upcoming press release announcing third quarter financial results, including expected revised annual financial guidance, and the Company's upcoming update on strategic priorities, each of which is currently planned for November 14, 2024.

Item 9.01 Financial Statements and Exhibits.

(b) Pro forma financial information.

The following unaudited pro forma financial information of the Company is filed as Exhibit 99.2 to this Report on Form 8-K and is incorporated herein by reference:

•Unaudited Pro Forma Condensed Consolidated Balance Sheet as of July 13, 2024

•Unaudited Pro Forma Condensed Consolidated Statement of Operations for the twenty-eight weeks ended July 13, 2024

•Unaudited Pro Forma Condensed Consolidated Statements of Operations for each of the fiscal years ended December 30, 2023, December 31, 2022 and January 1, 2022

•Notes to the Unaudited Pro Forma Condensed Consolidated Financial Statements

(d) Exhibits.

| | | | | |

| Exhibit No. | Exhibit Description |

| |

| 99.1 | |

| 99.2 | |

| 104 | Cover Page Interactive Data File (embedded within the Inline XBRL document) |

Forward Looking Statements

Certain statements herein are “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. Forward-looking statements are usually identifiable by words such as “anticipate,” “believe,” “could,” “estimate,” “expect,” “forecast, “guidance,” “intend,” “likely,” “may,” “plan,” “position,” “possible,” “potential,” “probable,” “project,” “should,” “strategy,” “will,” or similar language. All statements other than statements of historical fact are forward-looking statements, including, but not limited to, statements about the sale of Worldpac, including statements regarding the expected impact of transaction costs and expected use of proceeds and expectations for economic conditions, future business and financial performance, as well as statements regarding underlying assumptions related thereto. Forward-looking statements reflect the Company’s views based on historical results, current information and assumptions related to future developments. Forward-looking statements are subject to a number of risks and uncertainties that could cause actual results to differ materially from those projected or implied by the forward-looking statements. They include, among others, the Company’s use of proceeds and ability to maintain credit ratings, complexities in the Company’s inventory and supply chain and challenges with transforming and growing its business. Except as may be required by law, the Company undertakes no obligation to update any forward-looking statements made herein. Please refer to “Item 1A. Risk Factors” of the Company’s most recent Annual Report on Form 10-K filed with the Securities and Exchange Commission (“SEC”), as updated by the Company’s subsequent filings with the SEC, for a description of these and other risks and uncertainties that could cause actual results to differ materially from those projected or implied by the forward-looking statements.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | |

| | ADVANCE AUTO PARTS, INC. |

| | (Registrant) |

| | |

| Date: November 7, 2024 | | /s/ Ryan P. Grimsland |

| | Ryan P. Grimsland |

| | Executive Vice President, Chief Financial Officer |

Exhibit 99.1

Advance Auto Parts Announces Closing of Sale of Worldpac to Carlyle

•Transaction strengthens balance sheet and liquidity with $1.5 billion of cash proceeds.

•Advance to provide an update on strategic priorities and financial objectives on November 14, 2024, in conjunction with third quarter 2024 results.

RALEIGH, N.C., November 4, 2024 – Advance Auto Parts, Inc. (NYSE: AAP), a leading automotive aftermarket parts provider in North America that serves both professional installers and do-it-yourself customers, today announced the close of the sale of Worldpac, Inc. to global investment firm Carlyle (NASDAQ: CG). The sale agreement was announced on Aug. 22, 2024 with a transaction value of $1.5 billion. The company estimates net proceeds of approximately $1.2 billion after taxes and transaction costs.

“The completion of the Worldpac transaction is a pivotal moment in the simplification of our business model,” said Shane O’Kelly, president and chief executive officer. “The sale enables us to focus on actions to strengthen our blended-box business, which will elevate the performance of our core operations, and support our goal of delivering consistent profitable operating results. We look forward to providing an update at our next earnings call on November 14.”

Advance Blended-Box Strategic Priorities and Financial Objectives

On Thursday, November 14, 2024, in conjunction with reporting third quarter 2024 results, the company expects to report adjusted financials for the Advance RemainCo continuing operations. In addition, the company plans to provide an update on strategic priorities to elevate the performance of the Advance blended box. The company expects that the disclosure of adjusted financials along with a strategic road map for expanding adjusted operating margin will provide a better understanding of the company’s future potential.

The company has scheduled a conference call and webcast to begin at 8 a.m. ET on November 14, 2024. The live webcast and related presentation materials will be available on the company’s Investor Relations website (ir.AdvanceAutoParts.com). To join by phone, please pre-register online for dial-in and passcode information. Upon registering, participants will receive confirmation with call details and a registrant ID. A replay of the conference call and webcast will be available on the company’s Investor Relations website for one year.

About Advance Auto Parts

Advance Auto Parts, Inc. is a leading automotive aftermarket parts provider that serves both professional installers and do-it-yourself customers. As of July 13, 2024, Advance operated 4,776 stores and 320 Worldpac branches primarily within the United States, with additional locations in Canada, Puerto Rico and the U.S. Virgin Islands. The company also served 1,138 independently owned Carquest branded stores across these locations in addition to Mexico and various Caribbean islands. Additional information about Advance, including employment opportunities, customer services, and online shopping for parts, accessories and other offerings can be found at www.AdvanceAutoParts.com.

Forward-Looking Statements

Certain statements herein are “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. Forward-looking statements are usually identifiable by words such as “anticipate,” “believe,” “could,” “estimate,” “expect,” “forecast, “guidance,” “intend,” “likely,” “may,” “plan,” “position,” “possible,” “potential,” “probable,” “project,” “should,” “strategy,” “will,” or similar language. All statements other than statements of historical fact are forward-looking statements, including, but not limited to, statements about the sale of Worldpac, including statements regarding the benefits of the sale, the expected use of proceeds and expectations for economic conditions, future business and financial performance of the company’s core blended box business, as well as statements regarding underlying assumptions related thereto. Forward-looking statements reflect the company’s views based on historical results, current information and assumptions related to future developments. Except as may be required by law, the company undertakes no obligation to update any forward-looking statements made herein. Forward-looking statements are subject to a number of risks and uncertainties that could cause actual results to differ materially from those projected or implied by the forward-looking statements. They include, among others, the company’s ability to hire, train and retain qualified employees, the timing and implementation of strategic and other initiatives, deterioration of general macroeconomic conditions, geopolitical conflicts, the highly competitive nature of the industry, demand for the company’s products and services, the company’s use of proceeds and ability to maintain credit ratings, access to financing on favorable terms, complexities in the company’s inventory and supply chain and challenges with transforming and growing its business. Please refer to “Item 1A. Risk Factors” of the company's most recent Annual Report on Form 10-K filed with the Securities and Exchange Commission (“SEC”), as updated by the company's subsequent filings with the SEC, for a description of these and other risks and uncertainties that could cause actual results to differ materially from those projected or implied by the forward-looking statements.

Investor Relations Contact: Media Contact:

Lavesh Hemnani Darryl Carr

T: (919) 227-5466 T: (984) 389-7207

E: invrelations@advance-auto.com E: AAPCommunications@advance-auto.com

Exhibit 99.2

UNAUDITED PRO FORMA CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

On August 22, 2024, Advance Auto Parts, Inc (the “Company”, “AAP”, “we”, “our” and “us”) entered into a Sale and Purchase Agreement (the “Agreement”) to sell and transfer all issued and outstanding shares of the Worldpac, Inc. business (the “Business” or “Worldpac”) to an affiliate of the Carlyle Group (“Buyer”). Worldpac is an automotive aftermarket parts provider who primarily serves professional installers in North America. The sale was completed on November 1, 2024 (the "Transaction Date"). Pursuant to the Agreement, and subject to the terms and conditions thereof, the Company contributed all shares of Worldpac to the Buyer for an aggregate cash consideration of approximately $1.5 billion (the “Transaction”).

The following unaudited pro forma condensed consolidated financial statements as of and for the twenty-eight weeks ended July 13, 2024 have been derived from the unaudited consolidated financial statements of the Company. The unaudited pro forma condensed consolidated financial statements for the years ended December 30, 2023, December 31, 2022 and January 2, 2022 have been derived from the audited consolidated financial statements of the Company for the years then ended. The unaudited pro forma condensed consolidated statements of operations are presented to illustrate the Company’s results as if the Transaction occurred on January 3, 2021, the beginning of the earliest period presented and reflect the reclassification of Worldpac as Discontinued Operations for all periods presented. The following unaudited Pro Forma Condensed Consolidated Balance Sheet as of July 13, 2024 reflects the Company’s financial position as if the Transaction had occurred on July 13, 2024. The adjustments in the “Additional Transaction Accounting Adjustments” column in the unaudited Pro Forma Condensed Consolidated Statements of Operations for the year ended December 30, 2023 and unaudited Pro Forma Condensed Consolidated Balance Sheet as of July 13, 2024 give effect to the Transaction as if it had occurred as of January 1, 2023 and July 13, 2024.

The unaudited Pro Forma Condensed Consolidated Financial Statements have been prepared in accordance with Article 11 of Regulation S-X, as amended, and are based upon management’s estimates utilizing the best available information and are subject to the assumptions and adjustments described below and in the accompanying notes to the unaudited Pro Forma Condensed Consolidated Financial Statements. They are not intended to be a complete representation of the Company’s financial position or results of operations had the Transaction occurred as of the periods indicated. In addition, the unaudited Pro Forma Condensed Consolidated Financial Statements are provided for illustrative and informational purposes only and are not necessarily indicative of the Company’s future results of operations or financial condition had the Transaction been completed on the date assumed. The unaudited Pro Forma Condensed Consolidated Financial Statements should be read in conjunction with the Company’s historical consolidated financial statements and accompanying notes included in the Company's Annual Report on Form 10-K for the year ended December 30, 2023 and the Company's Quarterly Report on Form 10-Q for the twenty-eight weeks ended July 13, 2024, as well as the "Management's Discussion and Analysis of Financial Condition and Results of Operations" sections of such reports. The adjustments included within the “Worldpac Disposal” column of the unaudited Pro Forma Condensed Consolidated Financial Statements are consistent with the guidance for discontinued operations in accordance with accounting principles generally accepted in the United States of America. The Company's current estimates on a discontinued operations basis are preliminary and could change as the Company finalizes discontinued operations accounting to be reported in the Company's Quarterly Report on Form 10-Q for the forty weeks ended October 5, 2024.

Advance Auto Parts, Inc. and Subsidiaries

Unaudited Pro Forma Condensed Consolidated Balance Sheets

As of July 13, 2024

(in thousands)

| | | | | | | | | | | | | | | | | | |

| | Transaction Accounting Adjustments | | |

| AAP

Historical Consolidated | Worldpac Disposal (1) | | Additional Transaction Accounting Adjustments | Notes |

AAP Pro Forma |

| Assets: | | | | | | |

| Current assets: | | | | | | |

| Cash and cash equivalents | $ | 479,418 | | $ | 60,268 | | | $ | 1,500,000 | | (a) | $ | 1,919,150 | |

| Receivables, net | 847,609 | | 198,567 | | | — | | 649,042 | |

| Inventories, net | 4,903,490 | | 958,173 | | | — | | 3,945,317 | |

| Other current assets | 229,623 | | 35,392 | | | — | | 194,231 | |

| Total current assets | 6,460,140 | | 1,252,400 | | | 1,500,000 | | | 6,707,740 | |

| Property and equipment, net | 1,579,886 | | 82,134 | | | — | | | 1,497,752 | |

| Operating right-of-use assets | 2,596,201 | | 228,993 | | | — | | | 2,367,208 | |

| Goodwill | 990,266 | | 390,213 | | | — | | | 600,053 | |

| Other intangible assets, net | 577,275 | | 165,114 | | | — | | | 412,161 | |

| Other assets | 86,038 | | 1,088 | | | — | | | 84,950 | |

| Total assets | $ | 12,289,806 | | $ | 2,119,942 | | | $ | 1,500,000 | | | $ | 11,669,864 | |

| | | | | | |

| Liabilities and Stockholders’ Equity: | | | | | | |

| Current liabilities: | | | | | | |

| Accounts payable | $ | 4,048,321 | | $ | 642,126 | | | $ | — | | | $ | 3,406,195 | |

| Accrued expenses | 694,970 | | 52,212 | | | 242,783 | | (b) (c) | 885,541 | |

| Other current liabilities | 513,483 | | 69,360 | | | — | | | 444,123 | |

| Total current liabilities | 5,256,774 | | 763,698 | | | 242,783 | | | 4,735,859 | |

| Long-term debt | 1,787,867 | | — | | | — | | | 1,787,867 | |

| Noncurrent operating lease liabilities | 2,177,074 | | 168,342 | | | — | | | 2,008,732 | |

| Deferred income taxes | 375,658 | | 6,698 | | | (53,898) | | (c) | 315,062 | |

| Other long-term liabilities | 85,681 | | — | | | — | | | 85,681 | |

| Total liabilities | 9,683,054 | | 938,738 | | | 188,885 | | | 8,933,201 | |

| | | | | | |

| Stockholders’ Equity: | | | | | | |

| Preferred stock | — | | — | | | — | | | — | |

| Common stock | 8 | — | | | — | | | 8 | |

| Additional paid-in capital | 975,540 | | — | | | — | | | 975,540 | |

| Treasury stock | (2,937,903) | | — | | | — | | | (2,937,903) | |

| Accumulated other comprehensive income | (44,531) | | (12,162) | | | — | | | (32,369) | |

| Retained earnings | 4,613,638 | | 1,193,366 | | | 1,311,115 | | (a) (b) (c) (d) | 4,731,387 | |

| Total stockholders’ equity | 2,606,752 | | 1,181,204 | | | 1,311,115 | | | 2,736,663 | |

| Total liabilities and stockholders’ equity | $ | 12,289,806 | | $ | 2,119,942 | | | $ | 1,500,000 | | | $ | 11,669,864 | |

Advance Auto Parts, Inc. and Subsidiaries Unaudited Pro Forma

Condensed Consolidated Statements of Operations

For the twenty-eight weeks ended July 13, 2024

(in thousands, except per share data)

| | | | | | | | | | | | | | | | | | |

| | Transaction Accounting Adjustments | | |

| AAP Historical Consolidated | Worldpac Disposal (1) | | Additional Transaction Accounting Adjustments | Notes | AAP Pro Forma |

| Net sales | $ | 6,089,307 | | $ | 1,138,996 | | | $ | — | | | $ | 4,950,311 | |

Cost of sales, including purchasing and warehousing costs | 3,545,924 | 749,119 | | — | | | 2,796,805 |

| Gross profit | 2,543,383 | | 389,877 | | | — | | | 2,153,506 | |

| Selling, general and administrative expenses | 2,385,610 | 338,398 | | — | | | 2,047,212 |

| Operating income | 157,773 | | 51,479 | | | — | | | 106,294 | |

| Other, net: | | | | | | |

| Interest expense | (43,543) | (221) | | — | | | (43,322) |

| Other income (expense), net | 7,720 | (2,656) | | — | | | 10,376 |

| Total other, net | (35,823) | | (2,877) | | | — | | | (32,946) | |

| Income before provision for income taxes | 121,950 | 48,602 | | — | | | 73,348 |

| Provision for income taxes | 36,947 | 11,538 | | | — | | | 25,409 | |

| Net income | $ | 85,003 | | $ | 37,064 | | | $ | — | | | $ | 47,939 | |

| | | | | | |

| Basic earnings per common share | $ | 1.43 | | | | | | $ | 0.80 | |

| Weighted-average common shares outstanding | 59,590 | | | | | 59,590 |

| Diluted earnings per common share | $ | 1.42 | | | | | | $ | 0.80 | |

| Weighted-average common shares outstanding | 59,868 | | | | | 59,868 |

Advance Auto Parts, Inc. and Subsidiaries Unaudited Pro Forma

Condensed Consolidated Statements of Operations

For the Year Ended December 30, 2023

(in thousands,except per share data)

| | | | | | | | | | | | | | | | | | |

| | Transaction Accounting Adjustments | | |

| AAP

Historical Consolidated | Worldpac Disposal (1) | | Additional Transaction Accounting Adjustments | Notes | AAP Pro

Forma |

| Net sales | $ | 11,287,607 | | $ | 2,078,532 | | | $ | — | | | $ | 9,209,075 | |

Cost of sales, including purchasing and warehousing costs | 6,764,105 | 1,415,139 | | — | | | 5,348,966 |

| Gross profit | 4,523,502 | | 663,393 | | | — | | | 3,860,109 | |

| | | | | | |

| Selling, general and administrative expenses | 4,409,125 | 587,903 | | — | | | 3,821,222 |

| Operating income | 114,377 | | 75,490 | | | — | | | 38,887 | |

| Other, net: | | | | | | |

| Interest expense | (88,055) | (66) | | — | | | (87,989) |

| Other income, net | 5,525 | 3,601 | | — | | | 1,924 |

| Total other, net | (82,530) | | 3,535 | | | — | | | (86,065) | |

| Income before provision for income taxes | 31,847 | 79,025 | | — | | | (47,178) |

| Provision for income taxes | 2,112 | 19,266 | | — | | | (17,154) |

| Net income (loss) | $ | 29,735 | | $ | 59,759 | | | $ | — | | | $ | (30,024) | |

| | | | | | |

| Basic earnings (loss) per common share | 0.50 | | | | | (0.51) |

| Weighted-average common shares outstanding | 59,432 | | | | | 59,432 |

| Diluted earnings (loss) per common share | 0.50 | | | | | (0.50) |

| Weighted-average common shares outstanding | 59,608 | | | | | 59,608 |

Advance Auto Parts, Inc. and Subsidiaries Unaudited Pro Forma

Condensed Consolidated Statements of Operations

For the Year Ended December 31, 2022

(in thousands, except per share data)

| | | | | | | | | | | | | | | | | | |

| | Transaction Accounting Adjustments | | |

| AAP

Historical

Consolidated | Worldpac Disposal (1) | | Additional Transaction Accounting Adjustments | Notes |

AAP Pro Forma |

| Net sales | $ | 11,154,722 | | $ | 2,005,848 | | | $ | — | | | $ | 9,148,874 | |

Cost of sales, including purchasing and warehousing costs | 6,222,487 | 1,306,483 | | — | | | 4,916,004 |

| Gross profit | 4,932,235 | | 699,365 | | | — | | | 4,232,870 | |

| Selling, general and administrative expenses | 4,261,982 | 553,730 | | — | | | 3,708,252 |

| Operating income | 670,253 | | 145,635 | | | — | | | 524,618 | |

| Other, net: | | | | | | |

| Interest expense | (51,060) | (219) | | — | | | (50,841) |

| Loss on early redemptions of senior unsecured notes | (7,408) | - | | — | | | (7,408) |

| Other expense, net | (7,423) | (1,247) | | — | | | (6,176) |

| Total other, net | (65,891) | | (1,466) | | | — | | | (64,425) | |

| Income before provision for income taxes | 604,362 | 144,169 | | — | | | 460,193 |

| Provision for income taxes | 139,960 | 40,303 | | — | | | 99,657 |

| Net income | $ | 464,402 | | $ | 103,866 | | | — | | | $ | 360,536 | |

| | | | | | |

| Basic earnings per common share | $ | 7.70 | | | | | | $ | 5.97 | |

| Weighted-average common shares outstanding | 60,351 | | | | | 60,351 |

| Diluted earnings per common share | $ | 7.65 | | | | | | $ | 5.94 | |

| Weighted-average common shares outstanding | 60,717 | | | | | 60,717 |

Advance Auto Parts, Inc. and Subsidiaries Unaudited Pro Forma

Condensed Consolidated Statements of Operations

For the Year Ended January 1, 2022

(in thousands, except per share data)

| | | | | | | | | | | | | | | | | | |

| | Transaction Accounting Adjustments | | |

| AAP Historical

Consolidated | Worldpac Disposal (1) | | Additional Transaction Accounting Adjustments | Notes |

AAP Pro Forma |

| Net sales | $ | 10,997,989 | | $ | 1,858,576 | | | $ | — | | | $ | 9,139,413 | |

Cost of sales, including purchasing and warehousing costs | 6,074,039 | 1,210,549 | | — | | | 4,863,490 |

| Gross profit | 4,923,950 | | 648,027 | | | — | | | 4,275,923 | |

| Selling, general and administrative expenses | 4,101,585 | 521,434 | | — | | | 3,580,151 |

| Operating income | 822,365 | | 126,593 | | | — | | | 695,772 | |

| Other, net: | | | | | | |

| Interest expense | (37,791) | (79) | | — | | | (37,712) |

| Other (expense) income, net | (2,081) | 2,461 | | — | | | (4,542) |

| Total other, net | (39,872) | | 2,382 | | | — | | | (42,254) | |

| Income before provision for income taxes | 782,493 | 128,975 | | — | | | 653,518 |

| Provision for income taxes | 185,878 | 35,388 | | — | | | 150,490 |

| Net income | $ | 596,615 | | $ | 93,587 | | | $ | — | | | $ | 503,028 | |

| | | | | | |

| Basic earnings per common share | $ | 9.32 | | | | | | $ | 7.86 | |

| Weighted-average common shares outstanding | 64,028 | | | | | 64,028 |

| Diluted earnings per common share | $ | 9.25 | | | | | | $ | 7.80 | |

| Weighted-average common shares outstanding | 64,509 | | | | | 64,509 |

NOTES TO UNAUDITED PRO FORMA CONDENSED COMBINED FINANCIAL STATEMENTS

The unaudited proforma condensed financial statements include the following pro forma adjustments:

Worldpac Disposal Transaction Accounting Adjustments:

(1) These adjustments reflect the elimination of assets, liabilities and operations attributable to the Worldpac business. The disposal will meet the criteria to be presented as discontinued operations in accordance with ASC 205-20, Presentation of Financial Statements – Discontinued Operations.

Additional Transaction Accounting Adjustments:

(a)Reflects $1.5 billion of estimated cash consideration received from the Buyer from the disposal of the Worldpac business. No adjustment has been made to the sale proceeds to give effect to any potential post-closing adjustments under the terms of the Agreement.

(b)Reflects an estimated $26 million of additional Transaction advisory and professional fees to be incurred subsequent to July 13, 2024. A total estimate of $33 million of Transaction advisory and professional fees is expected to be incurred through Transaction close.

(c)Reflects approximately $217 million of estimated current income tax payable associated with the taxable gain from the Transaction and a $54 million reduction of deferred tax liability related to the Transaction. The tax effect of the pro forma adjustments was calculated using the historical statutory rates in effect for the period presented.

(d)Reflects an estimated gain of $319 million related to its sale of Worldpac business based on the estimate of $1.5 billion of consideration less Worldpac net assets as of July 13, 2024. The actual gain recorded upon close may be subject to change and will be based on amounts as of the close date. Since the unaudited pro forma consolidated statements of operations only include continuing operations, the estimated gain on sale is not included in any period presented.

In connection with the Transaction, the Company and Worldpac entered into supply agreements that are expected to result in sales and purchases between the two parties. The amount of such sales and purchases following the Transaction date are dependent on future events and not reasonably estimated at this time and not reflected within these unaudited Pro Forma Condensed Consolidated Financial Statements. The supply transactions, which represent products sold by Worldpac to the Company, are expected to continue subsequent to the Transaction and will be recorded as third-party expenses in the consolidated statement of operations of Advance Auto Parts, Inc.

As part of the supply chain financing agreement, the Company has agreed to provide a letter of credit of up to $200 million for up to 12 months after the Transaction Date as credit support. This letter of credit will reduce to zero no later than 24 months after Transaction Date. The impacts of such letter of credit following the Transaction date are not expected to have a material impact and are not reflected within these unaudited Pro Forma Condensed Consolidated Financial Statements.

Additionally, in connection with the Transaction, the Company and Worldpac entered into a transition services agreement and reverse transition services agreement whereby the Company and Worldpac will each provide certain post-closing services to each other on a transitional basis. Such agreements are not expected to have a material impact on the periods presented in these unaudited Pro Forma Condensed Consolidated Financial Statements.

v3.24.3

Cover

|

Nov. 01, 2024 |

Sep. 13, 2024 |

| Cover Page [Abstract] |

|

|

| Document Type |

8-K

|

|

| Document Period End Date |

Nov. 01, 2024

|

|

| Entity Registrant Name |

ADVANCE AUTO PARTS, INC.

|

|

| Entity Address, Address Line One |

4200 Six Forks Road

|

|

| Entity Address, City or Town |

Raleigh

|

|

| Entity Address, State or Province |

NC

|

|

| Entity Address, Postal Zip Code |

27609

|

|

| City Area Code |

540

|

|

| Local Phone Number |

362-4911

|

|

| Written Communications |

false

|

|

| Soliciting Material |

false

|

|

| Pre-commencement Tender Offer |

false

|

|

| Pre-commencement Issuer Tender Offer |

false

|

|

| Entity Emerging Growth Company |

false

|

|

| Entity Central Index Key |

0001158449

|

|

| Amendment Flag |

false

|

|

| Title of 12(b) Security |

|

Common Stock, $0.0001 par value

|

| Security Exchange Name |

|

NYSE

|

| Entity Incorporation, State or Country Code |

DE

|

|

| Entity File Number |

001-16797

|

|

| Entity Tax Identification Number |

54-2049910

|

|

| Trading Symbol |

|

AAP

|

| X |

- Definition

+ References

+ Details

| Name: |

aap_CoverPageAbstract |

| Namespace Prefix: |

aap_ |

| Data Type: |

xbrli:stringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

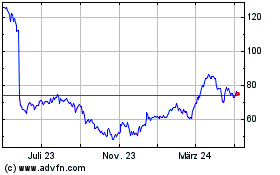

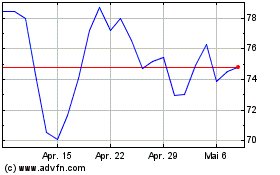

Advance Auto Parts (NYSE:AAP)

Historical Stock Chart

Von Nov 2024 bis Dez 2024

Advance Auto Parts (NYSE:AAP)

Historical Stock Chart

Von Dez 2023 bis Dez 2024