D. Boral Capital Served as Co-manager to U.S. Energy Corp. (Nasdaq: USEG) in connection with its up to $12.1 Million Public Offering

27 Januar 2025 - 7:29PM

U.S. Energy Corp. (NASDAQ: USEG, “U.S. Energy” or the “Company”)

announced today the closing of its previously announced

underwritten public offering of 4,871,400 shares of its common

stock, which includes 635,400 shares sold pursuant to the exercise

in full by the underwriters of their over-allotment option, par

value $0.01 per share, at a public offering price of $2.65 per

share, for total net proceeds, after underwriting commissions, of

approximately $12.1 million.

U.S. Energy plans to use the net proceeds of the offering to

fund growth capital for its industrial gas development project,

including new industrial gas wells and processing plant and

equipment, and to support upcoming operations. The proceeds

received by the Company from the exercise of the over-allotment

option may be utilized to purchase shares of common stock from Sage

Road Capital, LLC, a related party, or its affiliates at a price

equal to the net offering price received by the Company.

Roth Capital Partners acted as sole book-running manager for the

offering. Johnson Rice & Company and D. Boral Capital acted as

co-managers for the offering. The Loev Law Firm, PC represented the

Company and K&L Gates LLP represented the underwriters in the

offering.

The offering is being made pursuant to a shelf registration

statement on Form S-3, including a base prospectus, which was filed

with the U.S. Securities and Exchange Commission (the “SEC”) and

became effective on September 15, 2022. The prospectus supplement

and accompanying base prospectus relating to the offering are

available on the SEC’s website at www.sec.gov. Copies of the

prospectus supplement and accompanying base prospectus relating to

the offering may be obtained by sending a request to: Roth Capital

Partners, LLC, 888 San Clemente Drive, Suite 400, Newport Beach, CA

92660, (800) 678-9147, email at rothecm@roth.com.

This press release shall not constitute an offer to sell or the

solicitation of an offer to buy the shares of common stock or any

other securities, nor shall there be any sale of such shares of

common stock or any other securities in any state or other

jurisdiction in which such offer, solicitation or sale would be

unlawful prior to registration or qualification under the

securities laws of any such state or other jurisdiction.

ABOUT U.S. ENERGY CORP.

We are a growth company focused on consolidating high-quality

assets in the United States with the potential to optimize

production and generate free cash flow through low-risk development

while maintaining an attractive shareholder returns program. We are

committed to being a leader in reducing our carbon footprint in the

areas in which we operate. More information about U.S. Energy Corp.

can be found at www.usnrg.com.

Contact Us:

D. Boral Capital 590 Madison Avenue, 39th FloorNew York, NY

10022Main Phone: +1 (212)

970-5150www.dboralcapital.cominfo@dboralcapital.com

FORWARD-LOOKING STATEMENTS

Certain of the matters discussed in this communication which are

not statements of historical fact constitute forward-looking

statements within the meaning of the federal securities laws,

including the Private Securities Litigation Reform Act of 1995,

that involve a number of risks and uncertainties. Words such as

“strategy,” “expects,” “continues,” “plans,” “anticipates,”

“believes,” “would,” “will,” “estimates,” “intends,” “projects,”

“goals,” “targets” and other words of similar meaning are intended

to identify forward-looking statements but are not the exclusive

means of identifying these statements. Important factors that may

cause actual results and outcomes to differ materially from those

contained in such forward-looking statements include, without

limitation: (1) the expected use of proceeds, including, but not

limited to the repurchase of certain shares of common stock; (2)

the ability of the Company to grow and manage growth profitably and

retain its key employees; (3) risks associated with the integration

of recently acquired assets; (4) the Company’s ability to comply

with the terms of its senior credit facilities; (5) the ability of

the Company to retain and hire key personnel; (6) the business,

economic and political conditions in the markets in which the

Company operates; (7) the volatility of oil and natural gas prices;

(8) the Company’s success in discovering, estimating, developing

and replacing oil, natural gas and helium reserves; (9) risks of

the Company’s operations not being profitable or generating

sufficient cash flow to meet its obligations; (10) risks relating

to the future price of oil, natural gas, NGLs and helium; (11)

risks related to the status and availability of oil, natural gas

and helium gathering, transportation, and storage facilities; (12)

risks related to changes in the legal and regulatory environment

governing the oil, gas and helium industry, and new or amended

environmental legislation and regulatory initiatives; (13) risks

relating to crude oil production quotas or other actions that might

be imposed by the Organization of Petroleum Exporting Countries and

other producing countries; (14) technological advancements; (15)

changing economic, regulatory and political environments in the

markets in which the Company operates; (16) general domestic and

international economic, market and political conditions, including

the military conflict between Russia and Ukraine and the global

response to such conflict; (17) actions of competitors or

regulators; (18) the potential disruption or interruption of the

Company’s operations due to war, accidents, political events,

severe weather, cyber threats, terrorist acts, or other natural or

human causes beyond the Company’s control; (19) pandemics,

governmental responses thereto, economic downturns and possible

recessions caused thereby; (20) inflationary risks and recent

changes in inflation and interest rates, and the risks of

recessions and economic downturns caused thereby or by efforts to

reduce inflation; (21) risks related to military conflicts in oil

producing countries; (22) changes in economic conditions;

limitations in the availability of, and costs of, supplies,

materials, contractors and services that may delay the drilling or

completion of wells or make such wells more expensive; (23) the

amount and timing of future development costs; (24) the

availability and demand for alternative energy sources; (25)

regulatory changes, including those related to carbon dioxide and

greenhouse gas emissions; (26) uncertainties inherent in estimating

quantities of oil, natural gas and helium reserves and projecting

future rates of production and timing of development activities;

(27) risks relating to the lack of capital available on acceptable

terms to finance the Company’s continued growth, potential future

sales of debt or equity and dilution caused thereby; (28) the

review and evaluation of potential strategic transactions and their

impact on stockholder value and the process by which the Company

engages in evaluation of strategic transactions; and (29) other

risk factors included from time to time in documents U.S. Energy

files with the Securities and Exchange Commission, including, but

not limited to, its Form 10-Ks, Form 10-Qs and Form 8-Ks. Other

important factors that may cause actual results and outcomes to

differ materially from those contained in the forward-looking

statements included in this communication are described in the

Company’s publicly filed reports, including, but not limited to,

the Company’s Annual Report on Form 10-K for the year ended

December 31, 2023 and Quarterly Report on Form 10-Q for the quarter

ended September 30, 2024, and future annual reports and quarterly

reports. These reports and filings are available at www.sec.gov.

Unknown or unpredictable factors also could have material adverse

effects on the Company’s future results.

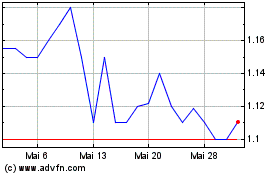

US Energy (NASDAQ:USEG)

Historical Stock Chart

Von Dez 2024 bis Jan 2025

US Energy (NASDAQ:USEG)

Historical Stock Chart

Von Jan 2024 bis Jan 2025