UNITED-GUARDIAN REPORTS FY-2019 FINANCIAL RESULTS

19 März 2020 - 2:00PM

United-Guardian, Inc. (NASDAQ:UG) reported today that sales and

earnings for FY-2019 were up slightly from 2018, with sales

increasing from $13,445,565 to $13,599,084, and net income

increasing from $4,352,331 ($0.95 per share) to $4,761,711 ($1.04

per share), an increase in earnings of 9.4%.

“Although we were one of many companies that

were negatively impacted by the trade war between the U.S. and

China in 2019, our sales into China were still considerable, and we

expect China to remain an important market for us, especially as

the impact of the coronavirus diminishes,” said Ken Globus,

President of United-Guardian. “Our sales in China, as well as in

Korea, were also impacted by increased competition from

lower-priced Asian competitors, but we are optimistic that our

appointment of a new marketing partner in Korea will enable us to

recover some of the business we lost there.”

“Offsetting the lower sales of our cosmetic

ingredients was a 33% increase in sales of our medical lubricants,

which have become an increasingly important revenue source for us,”

continued Mr. Globus. “We also experienced a 19% increase in sales

of Renacidin® Irrigation, our most important pharmaceutical

product, the sales of which have been increasing since we began our

internet marketing campaign. We are continuing to work closely with

all our marketing partners to develop new and innovative

ingredients for the cosmetic market, especially “natural”

ingredients, and plan to have several new products in the hands of

our marketing partners this year. We are hopeful that we will be

able to increase the sales of not only our cosmetic ingredients,

but our medical and pharmaceutical products as well, and that

despite the global economic impact of the coronavirus, 2020 can be

another profitable year for us.”

United-Guardian is a manufacturer of cosmetic

ingredients, personal and health care products, pharmaceuticals,

and specialty industrial products.

Contact:Robert S. Rubinger(631) 273-0900

NOTE: This press release contains both

historical and "forward-looking statements” within the meaning of

the Private Securities Litigation Reform Act of 1995. These

statements about the company’s expectations or beliefs concerning

future events, such as financial performance, business prospects,

and similar matters, are being made in reliance upon the “safe

harbor” provisions of that Act. Such statements are subject to a

variety of factors that could cause the company’s actual results or

performance to differ materially from the anticipated results or

performance expressed or implied by such forward-looking

statements. For further information about the risks and

uncertainties that may affect the company’s business please refer

to the company's reports and filings with the Securities and

Exchange Commission.

| |

|

FINANCIAL RESULTS FOR THE YEARS

ENDEDDECEMBER 31, 2019 AND DECEMBER 31,

2018 |

| |

|

STATEMENTS OF INCOME |

| |

|

|

|

| |

|

Years ended December 31, |

|

|

|

|

2019 |

|

|

2018 |

|

| |

|

|

|

|

|

|

| Net sales |

$ |

13,599,084 |

|

$ |

13,445,565 |

|

| |

|

|

|

|

|

|

| Costs and expenses: |

|

|

|

|

|

|

|

Cost of sales |

|

5,657,353 |

|

|

5,343,459 |

|

|

Operating expenses |

|

2,148,375 |

|

|

2,122,746 |

|

|

Research and development |

|

397,391 |

|

|

399,517 |

|

|

Total costs and expenses |

|

8,203,119 |

|

|

7,865,722 |

|

|

Income from operations |

|

5,395,965 |

|

|

5,579,843 |

|

| Other income (expense): |

|

|

|

|

|

|

| Investment income |

|

203,329 |

|

|

231,986 |

|

| Net gain (loss) on marketable

securities |

|

431,076 |

|

|

(333,138 |

) |

| Loss on trade-in of

equipment |

|

--- |

|

|

(12,837 |

) |

|

Total other income (expense) |

|

634,405 |

|

|

(113,989 |

) |

| |

|

|

|

|

|

|

|

Income before provision for income taxes |

|

6,030,370 |

|

|

5,465,854 |

|

| |

|

|

|

|

|

|

| Provision for income

taxes |

|

1,268,659 |

|

|

1,113,523 |

|

|

Net income |

$ |

4,761,711 |

|

$ |

4,352,331 |

|

| |

|

|

|

|

|

|

| Earnings per common share

(basic and diluted) |

$ |

1.04 |

|

$ |

0.95 |

|

| |

|

|

|

|

|

|

| Weighted average shares (basic

and diluted) |

|

4,594,319 |

|

|

4,594,319 |

|

| |

|

|

|

|

|

|

| |

|

BALANCE SHEET DATA(condensed) |

| |

|

|

| |

|

December 31, |

|

|

|

2019 |

|

|

2018 |

|

| |

|

|

|

|

|

|

| Current assets |

$ |

11,567,281 |

|

$ |

11,687,100 |

|

| Property, plant, and equipment

(net of depreciation) |

|

780,707 |

|

|

827,925 |

|

| Other assets (net) |

|

14,824 |

|

|

29,647 |

|

|

Total assets |

|

12,362,812 |

|

|

12,544,672 |

|

|

|

|

|

|

|

|

|

|

Current liabilities |

|

1,343,059 |

|

|

1,366,151 |

|

| Deferred income

taxes (net) |

|

386,855 |

|

|

253,583 |

|

|

Total Liabilities |

|

1,729,914 |

|

|

1,619,734 |

|

| |

|

|

|

|

|

|

| Stockholders’ equity |

|

10,632,898 |

|

|

10,924,938 |

|

|

Total liabilities and stockholders’ equity |

$ |

12,362,812 |

|

$ |

12,544,672 |

|

| |

|

|

|

|

|

|

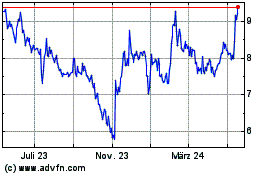

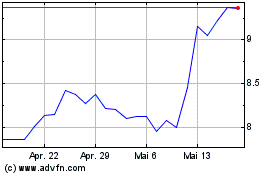

United Guardian (NASDAQ:UG)

Historical Stock Chart

Von Jun 2024 bis Jul 2024

United Guardian (NASDAQ:UG)

Historical Stock Chart

Von Jul 2023 bis Jul 2024