- 6.8% of recurring operating margin1 for

the Automotive division and 5.1% for Faurecia

- Net income, Group share, doubled

to €1.2 billion

- €1.8 billion in Free Cash Flow2

- Roll out has started for the "Push to

Pass" plan; the product blitz and international development have

been launched. The PSA Group has greater agility than ever before

for continuing its profitable growth.

Regulatory News:

PSA Group (Paris:UG)

Group revenue amounted to €27,779 million in the first

half of 2016, compared to

€28,036 million in the first half of 2015 (after restatement in

accordance with IFRS 5, detailed in the appendices), growth of 2.4%

at constant exchange rates. Net of the unfavourable changes in

exchange rates, it is down by 0.9%.

Automotive division revenue amounted to €19,190 million,

also up 2.5% compared to the first half of 2015 at constant

exchange rates, attributable to the success of the models and the

pricing power strategy. Net of the unfavourable changes in exchange

rates, it is down by 1.1%.

Group Recurring Operating Income amounted to

€1,830 million, up 32% compared to the first half of 2015. With

Recurring Operating Income of €1,303 million, the Automotive

division grew by 34% compared to the first half of 2015. This

growth is buoyed particularly by increased volumes3, as well as the

continued reduction of fixed costs and production costs.

Non-recurring operating income and expenses amounted to

-€207 million, compared to -€343 million in the first half of

2015.

Group net financial expenses fell by half to -€150

million, compared to -€334 million in the first half of 2015.

Group consolidated net profit amounted to €1,383 million,

up by €663 million. Net income, Group share, is €1,212 million,

compared to €571 million in the first half of 2015.

Banque PSA Finance reported Recurring Operating Income of

€297 million4, a rise of 1% compared to the first half of 2015.

Faurecia's Recurring Operating Income amounted to €490

million, an increase of

€106 million compared to the first half of 2015.

Free Cash Flow of Manufacturing and sales companies

amounted to €1,846 million, driven by improved funds from

operations.

Total inventory, including independent dealers, stood at 399,000

vehicles at 30 June 2016, up 8,000 units from end June 2015.

The Manufacturing and sales companies' net financial

position at 30 June 2016 was a positive €5,972 million, up

€1,412 million on 31 December 2015.

Market outlook

For 2016, the Group expects the automotive market to grow by

about 4% in Europe and 8% in China, and to shrink by around 12% in

Latin America and 15% in Russia.

Operational targets

The Push to Pass plan, unveiled on 5 April 2016, sets the

following targets:

- Reach an average 4% automotive

recurring operating margin in 2016-2018, and target 6% by

2021;

- Deliver 10% Group revenue growth by

20181 vs 2015, and target additional 15% by 20211.

Carlos Tavares, Chairman of the Managing Board of the PSA

Group, said: "Our continued performance reflects the success of the

company's structural transformation, its efficiency, and the

profound change of spirit within the Group. In a changing

environment, all our teams are focused on operational excellence

and continue to demonstrate their agility in deploying our Push to

Pass strategic plan."

Financial Calendar - 26 October 2016: 3rd Quarter 2016

Revenue

The PSA Group's consolidated financial statements at 30 June

2016 were approved by the Managing Board on 22 July 2016 and

reviewed by the Supervisory Board on 26 July 2016. The Group's

Statutory Auditors have completed their audit and are currently

issuing their report on the consolidated financial statements.

The interim results report and interim financial results

presentation for 2016 are available at www.groupe-psa.com, in the

“Analysts and Investors” section.

About PSA Group

With its three world-renowned brands, Peugeot, Citroën and DS,

the PSA Group sold 3 million vehicles worldwide in 2015. Second

largest carmaker in Europe, the PSA Group recorded sales and

revenue of €54 billion in 2015. The Group confirms its

position of European leader in terms of CO2 emissions, with an

average of 104.4 grams of CO2/km in 2015. With a fleet of

1.8 million connected vehicles on the road worldwide, the

Group is on the cutting edge of innovation in this field, and is

expanding its services as a mobility provider. It is also involved

in financing activities (Banque PSA Finance) and automotive

equipment (Faurecia).For more information, please visit

groupe-psa.com/en

1 At constant (2015) exchange rates

Appendices

The Group’s interim 2015 financial statements have been restated

in accordance with IFRS 5.

Impact of the plan to sell Faurecia's Automotive Exteriors

business on the Group's financial statements comparatives (30 June

2015)

(in million euros)

First half 2015 as reported in

July 2015

Automotive Exteriors

IFRS5 impacts

First half 2015 as reported in

July 2016

Group Revenue 28,904 (868) 28,036 Group

Recurring operating income (loss) 1,424 (40)

1,384 Free Cash Flow* 2,792 (74) 2,718

* Manufacturing and sales companies: Automotive Division and

Faurecia

Consolidated Income Statement

First-half 2015* First-half 2016

(in million euros)

Manufacturing and sales

companies

Finance companies

Eliminations

TOTAL

Manufacturing and sales

companies

Finance companies

Eliminations

TOTAL Revenue 27,904

140 (8)

28,036 27,684 102

(7)

27,779 Recurring operating income (loss)

1,365 19 -

1,384 1,823

7 -

1,830 Operating income (loss)

1,022 19 -

1,041 1,616

7 -

1,623 Net financial income

(expense) (339) 5 -

(334)

(154) 4 -

(150) Income taxes

(307) (13) -

(320) (299)

(11) -

(310) Share in net earnings of

companies at equity 174 59 -

233

62 87 -

149 Profit (loss) from

operations held for sale or to be continued in partnership

40 60 -

100 47 24

-

71 Consolidated profit (loss) for the period

590 130 -

720 1,272 111

-

1,383 Attributable to equity holders of the

parent 448 123 -

571

1,102 110 -

1,212 Attributable to

minority interests 142 7 -

149

170 1 -

171 Basic earnings per

€1 par value share attributable to equity holders of the parent

0.73

1.51

* Restated according to IFRS 5

Consolidated balance sheet

ASSETS

31 December 2015 30 June 2016

(in million euros)

Manufacturing and sales companies

Finance companies Eliminations

TOTAL Manufacturing and sales companies

Finance companies Eliminations

TOTAL

Total non-current assets 20,926 1,131 (2)

22,055 21,853 1,248 (1)

23,100 Total current assets 18,839 1,193

(608)

19,424 20,617 925

(647)

20,895 Total assets of operations held for sale

or to be continued in partnership 616 7,048

(33)

7,631 777 3,826 (20)

4,583 TOTAL ASSETS

40,381 9,372

(643) 49,110 43,247

5,999 (668) 48,578

EQUITY AND LIABILITIES

31 December 2015 30 June 2016 (in million euros)

Manufacturing and sales companies Finance companies

Eliminations

TOTAL Manufacturing

and sales companies

Finance companies Eliminations

TOTAL Total equity

12,219

13,347 Total non-current liabilities 9,984 17

10,001 11,535 15 -

11,550 Total current liabilities

20,104 3,405 (551)

22,958 19,964 1,188 (604)

20,548

Transferred liabilities of operations held for sale or to be

continued in partnership 401 3,623 (92)

3,932 420 2,777 (64)

3,133 TOTAL EQUITY & LIABILITIES

49,110 48,578

Consolidated Statement of Cash Flows

First half of 2015* First half of

2016 (in million euros)

Manufacturing and sales

companies Finance companies Eliminations

TOTAL Manufacturing

and sales companies

Finance companies Eliminations

TOTAL Consolidated profit (loss) from continuing operations

550 (11) - 539 1,225 76

- 1,301 Funds from operations 2,566

(24) 1 2,543 2,798 69 -

2,867

Net cash from (used in) operating activities of continuing

operations 3,453 6,161

54 9,668 3,187 907

(74) 4,020 Net cash from (used in)

investing activities of continuing operations

(1,305) (25) 136

(1,194) (1,560) 21

14 (1,525) Net cash from (used in)

financing activities of continuing operations

(358) (496) 343

(511) (903) (173)

(104) (1,180) Net cash related to the

non-transferred debt of finance companies to be continued in

partnership - (6,829)

(360) (7,189) -

(2,258) 175 (2,083) Net cash

from the transferred assets and liabilities of operations held for

sale or to be continued in partnership 34

(375) (254) (595)

(78) 1,201 (11)

1,112 Effect of changes in exchange rates 146

- - 146 (95) 10 - (85)

Increase (decrease) in cash from continuing operations and from

operations held for sale or to be continued in partnership

1,970 (1,564) (81)

325 551 (292) -

259 Net cash and cash equivalents at beginning of

period 8,429 2,601 (129) 10,901

10,453 893 (54) 11,292

Net cash and cash

equivalents of continuing operations at end of period

10,399 1,037 (210)

11,226 11,004 601

(54) 11,551

* Restated according to IFRS 5

1 Recurring operating income to revenue

2 In the first half of 2016, for Manufacturing and sales

companies

3 Excluding China

4 100% of the results of Banque PSA Finance. In the financial

statements of the PSA Group, the joint ventures are accounted for

at equity, and the other businesses covered by the Santander

agreement are reclassified under "Operations held for sale or to be

continued in partnership".

View source

version on businesswire.com: http://www.businesswire.com/news/home/20160726006681/en/

Media:(+33) 1 40 66 42 00

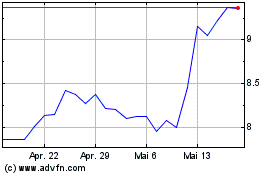

United Guardian (NASDAQ:UG)

Historical Stock Chart

Von Jun 2024 bis Jul 2024

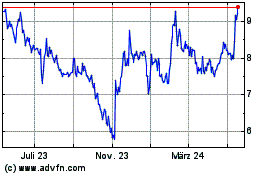

United Guardian (NASDAQ:UG)

Historical Stock Chart

Von Jul 2023 bis Jul 2024