The PSA Group Benefits from the Strong Growth of the European Market, Focused on Its Pricing Power Strategy

27 April 2016 - 8:36AM

Business Wire

- The Group’s revenue amounted to

€13.0 billion, of which €8.8 billion for the Automotive division,

an increase of 1.5% at constant exchange rates.

- The operating environment is

mixed: strong European market growth but unfavourable exchange

rates.

- Global sales volumes (excluding

China) were up 3.9%. They were driven by Europe, where they grew by

5.9%.

Regulatory News:

The PSA Group’s (Paris:UG) first quarter 2016 revenue

amounted to €12,998 million, of which €8,796 million for the

Automotive division and €4,656 million for Faurecia. At constant

exchange rates, the Group’s revenue grew by 1.5% compared with Q1

2015. For the Automotive division, new vehicle revenue fell

by 1.1%. The 3.9% increase in sales volumes excluding China only

partially offset the negative impact of exchange rates (-4.4%).

In Europe, the increase in sales volumes (+5.9%) was

driven by growth in all three brands, Peugeot, Citroën and DS. In

China, deliveries to end customers were stable (-0.9%), while

invoices were down 17.9%. In Africa and Middle East, the Group’s

sales fell by 22.2%, mainly in the Algerian market.

At the end of March 2016, inventories were stable at

372,000 vehicles1.

The Group continues to pursue its strategy of profitable growth,

aimed at improving the pricing power of its three brands, Peugeot,

Citroën and DS, across all regions.

Jean-Baptiste de Chatillon, Chief Financial Officer of the PSA

Group and member of the Management Board, said: “Mobilised around

the ambitious objectives of our Push to Pass profitable growth

plan, our three brands benefited fully from the success of the Back

in the Race plan and the strong growth of the European market.

Despite the volatile environment, we are confident in our

performance and the achievement of our goals.”

Market outlook – The Group expects the automotive market

to grow by approximately 4% in Europe and 5% in China, and to

contract by approximately 10% in Latin America and 15% in Russia in

2016.

Operating outlook – The Push to Pass plan sets the

following operational targets:

- Reach an average 4% automotive

recurring operating margin in 2016-2018, and target 6% in

2021;

- Deliver 10% Group revenue growth by

20182 vs 2015, and target additional 15% by 20212.

About PSA Group

With its three world-renowned brands, Peugeot, Citroën and DS,

PSA Peugeot Citroën sold 3 million vehicles worldwide in 2014. The

second largest carmaker in Europe, PSA Peugeot Citroën recorded

sales and revenue of €54 billion in 2014. The Group confirms its

position of European leader in terms of CO2 emissions, with an

average of 104.4 grams of CO2/km in 2015. It is now the leader in

connected vehicles with a fleet of 1.8 million such vehicles

worldwide. It is also involved in financing activities (Banque PSA

Finance) and automotive equipment (Faurecia).

For more information, please visit groupe-psa.com/fr

Appendix

Consolidated World Sales Mar-15

2015 Mar-16 2016 Δ 16/15 Δ 16/15 (in thousands) YTD

Mar. YTD Mar. March YTD Mar.

China - South East

Asia Peugeot 35.7 107.9 28.3 85.1 -20.7% -21.1% Citroën 29.3

73.8 22.3 62.5 -23.8% -15.3% DS 1.1 4.3 1.4 5.0 19.9% 17.2%

PSA 66.1 186.0 52.0 152.7

### ###

Eurasia Peugeot 0.3 1.2 0.7 1.2

101.2% 0.0% Citroën 0.3 0.9 0.5 1.0 84.7% 1.8% DS 0.0 0.0 0.0 0.0

0.0% 41.2%

PSA 0.6 2.1 1.2

2.2 ### 1.1%

Europe Peugeot

103.1 245.8 109.9 264.1 6.6% 7.5% Citroën 68.5 174.3 71.1 181.8

3.7% 4.3% DS 7.7 18.9 8.0 19.1 3.7% 0.7%

PSA

179.4 439.0 189.0 464.9 5.4%

5.9%

India - Pacific Peugeot 2.1 5.2 1.9 4.2 -12.5%

-18.5% Citroën 0.5 1.0 0.3 0.7 -31.0% -27.7% DS 0.1 0.3 0.2 0.4

63.8% 20.6%

PSA 2.7 6.5 2.4

5.3 ### ###

Latin America Peugeot 7.3

22.4 11.7 27.2 59.8% 21.3% Citroën 4.2 13.2 5.6 14.0 31.4% 6.4% DS

0.1 0.3 0.1 0.3 -27.0% -12.2%

PSA 11.7

35.9 17.4 41.5 ### ###

Middle East - Africa Peugeot 11.5 26.8 8.6 21.3 -24.5%

-20.6% Citroën 7.0 15.6 5.2 11.6 -25.5% -25.4% DS 0.1 0.4 0.2 0.3

43.7% -2.8%

PSA 18.6 42.7 14.0

33.2 ### ###

Total Assembled

Vehicles Peugeot 160.0 409.2 161.1

403.1 0.7% -1.5% Citroën 109.9

278.8 105.1 271.7 ### ###

DS 9.3 24.2 9.9 25.1 6.5%

3.7% PSA 279.2 712.2

276.1 699.8 -1.1% -1.7%

1 Excluding China, including independent dealers.

2 At constant exchange rates (2015).

View source

version on businesswire.com: http://www.businesswire.com/news/home/20160426007039/en/

For The PSA Group:Communications Division, +33 1 40 66 42

00www.groupe-psa.com@GroupePSAorMedia+33 (0)1 40 66 42 00

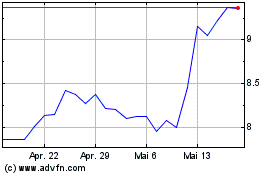

United Guardian (NASDAQ:UG)

Historical Stock Chart

Von Jun 2024 bis Jul 2024

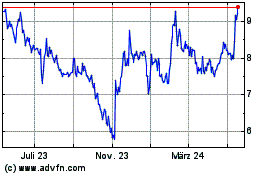

United Guardian (NASDAQ:UG)

Historical Stock Chart

Von Jul 2023 bis Jul 2024