Current Report Filing (8-k)

11 August 2015 - 3:01PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 OR 15(d) of

The Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): August 11, 2015

United-Guardian, Inc.

(Exact name of registrant as specified in its charter)

Delaware |

001-10526 |

11-1719724 |

(State or other jurisdiction

of incorporation) |

(Commission File Number) |

(IRS Employer

Identification No.) |

230 Marcus Boulevard, Hauppauge, New York 11788 |

| (Address of principal executive offices) |

Registrant's telephone number, including area code: (631) 273-0900

Not Applicable

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

| |

[ ] |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

[ ] |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

[ ] |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

[ ] |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Item 2.02. Results of Operations and Financial Condition.

On August 11, 2015 the Registrant issued a press release, a copy of which is attached hereto as Exhibit 99.1 and is incorporated herein by reference.

Item 9.01. Financial Statements and Exhibits.

Exhibit 99.1. Press release dated August 11, 2015

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, as amended, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

United-Guardian, Inc.

|

| Date: August 11, 2015 |

By: |

/s/ KEN GLOBUS

Ken Globus

President |

EXHIBIT 99.1

United-Guardian Reports Record Six Month Financial Results

HAUPPAUGE, N.Y., Aug. 11, 2015 (GLOBE NEWSWIRE) -- United-Guardian, Inc. (NASDAQ:UG) reported today that sales for the second quarter of 2015 increased by 38% over the same period last year, resulting in a 68% increase in net income compared with the second quarter of 2014. Sales for the quarter increased from $2,980,136 in 2014 to $4,124,091 this year, and net income increased from $901,273 ($0.20 per share) in 2014 to $1,510,511 ($0.33 per share) this year, resulting in the strongest second quarter in the company's history. For the first six months of 2015 sales increased 22% from $6,939,628 in 2014 to $8,496,484 this year, and net income increased 33% from $2,237,026 ($0.49 per share) to $2,971,021 ($0.65 per share), both new company records.

Ken Globus, President of United-Guardian, stated, "We are very pleased to report that our sales and earnings for the first half of 2015 have both reached new highs, due primarily to the significant increase in sales of our products in China. After having lost a significant customer for one of our products last year, we have now more than made up for the loss of that business with the increased demand for our products in China, which is coming from multiple customers. The current projection of our marketing partner is for sales of our products in China to remain strong for the third quarter, and we are optimistic that these sales will continue to grow. To supplement the significant inroads we have made into the personal care market in China we are continuing our efforts to develop new products for both the personal care and medical markets, and we are looking forward to the continued expansion of our global sales of these products."

United-Guardian is a manufacturer of cosmetic ingredients, personal and health care products, pharmaceuticals, and specialty industrial products.

NOTE: This press release contains both historical and "forward-looking statements" within the meaning of the Private Securities Litigation Reform Act of 1995. These statements about the company's expectations or beliefs concerning future events, such as financial performance, business prospects, and similar matters, are being made in reliance upon the "safe harbor" provisions of that Act. Such statements are subject to a variety of factors that could cause our actual results or performance to differ materially from the anticipated results or performance expressed or implied by such forward-looking statements. For further information about the risks and uncertainties that may affect the company's business please refer to the company's reports and filings with the Securities and Exchange Commission.

|

RESULTS FOR THE THREE AND SIX MONTHS ENDED |

|

JUNE 30, 2015 and 2014 |

|

|

|

|

|

|

|

STATEMENTS OF INCOME |

|

(UNAUDITED) |

|

|

|

|

|

|

|

|

THREE MONTHS ENDED |

SIX MONTHS ENDED |

|

|

JUNE 30, |

JUNE 30, |

|

|

2015 |

2014 |

2015 |

2014 |

|

|

|

|

|

|

|

Net sales |

$4,124,091 |

$2,980,136 |

$8,496,484 |

$6,939,628 |

|

|

|

|

|

|

|

Costs and expenses: |

|

|

|

|

|

Cost of sales |

1,403,942 |

1,104,254 |

3,083,144 |

2,537,172 |

|

Operating expenses |

600,532 |

623,942 |

1,227,767 |

1,239,584 |

|

Total costs and expenses |

2,004,474 |

1,728,196 |

4,310,911 |

3,776,756 |

|

Income from operations |

2,119,617 |

1,251,940 |

4,185,573 |

3,162,872 |

|

|

|

|

|

|

|

Other income: |

|

|

|

|

|

Investment income |

72,894 |

53,933 |

126,348 |

87,752 |

|

Income from damage settlement |

-- |

-- |

-- |

24,402 |

|

Total other income |

72,894 |

53,933 |

126,348 |

112,154 |

|

Income before income taxes |

2,192,511 |

1,305,873 |

4,311,921 |

3,275,026 |

|

|

|

|

|

|

|

Provision for income taxes |

682,000 |

404,600 |

1,340,900 |

1,038,000 |

|

|

|

|

|

|

|

Net Income |

$1,510,511 |

$901,273 |

$2,971,021 |

$2,237,026 |

|

|

|

|

|

|

|

Earnings per common share |

|

|

|

|

|

(Basic and Diluted) |

$0.33 |

$0.20 |

$0.65 |

$0.49 |

|

|

|

|

|

|

|

Weighted average shares – basic and diluted |

4,596,439 |

4,596,439 |

4,596,439 |

4,596,439 |

••• Additional financial information can be found at the company's web site at www.u-g.com. •••

CONTACT: Robert S. Rubinger

Public Relations

(631) 273-0900

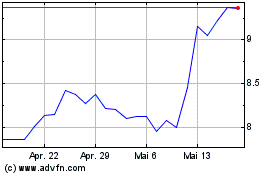

United Guardian (NASDAQ:UG)

Historical Stock Chart

Von Jun 2024 bis Jul 2024

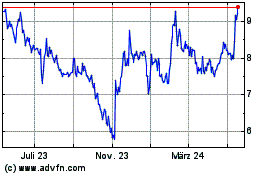

United Guardian (NASDAQ:UG)

Historical Stock Chart

Von Jul 2023 bis Jul 2024