€2.2 billion of operating Free Cash Flow in

2014, the Group is net debt free

Regulatory News:

PSA Peugeot Citroën (Paris:UG):

- €53.6 billion in revenue for the

year1

- Recurring Operating Income of €905

million, up €1.3 billion, from a loss of €-364 million in

2013

- Favourable swing attributable to the

Automotive division, which ended the year with recurring operating

income at €63 million, up €1.1 billion from a loss of -€1,039

million in 2013

"Our 2014 results show evidence that the process of rebuilding

the Group's financial fundamentals is underway," said Carlos

Tavares, Chairman of the PSA Peugeot Citroën Managing Board. “By

generating €2.2 billion in operating Free Cash Flow2 during the

year, and becoming net debt free, we are ahead of our

reconstruction plan. I would like to thank all of our teams for

their achievements in a sometimes difficult environment. More than

ever, we remain focused on fully meeting our objectives and

achieving a 2% operating margin for the Automotive division."

Consolidated net revenue came to €53,607 million in 2014,

up 1% over 2013. Automotive division revenue dipped 0.9% to

€36,085 million, with favourable changes in the product mix and in

prices offsetting a very negative currency effect.

The Group ended the year with a Recurring Operating

Income ok €905 million, representing a positive swing of €1,269

million from a loss of -€364 million in 2013. The Automotive

division reported Recurring Operating Income of €63

million in 2014, up €1,102 million from a loss of €1,039 million

the year before. The return to profit was attributable to the

positive product and price mix resulting from the success of recent

launches by the brands and from the pricing power policy. It was

also supported by further reductions in fixed costs.

Including its pro forma share of the 2014 income of the DPCA and

CAPSA joint ventures, the Division's recurring operating income

came to €366 million, an improvement of €1,246 million over the

previous year.

Non-recurring operating income and expenses represented a

net expense of -€682 million, primarily due to restructuring costs

incurred by the Automotive division.

Financial income and expenses represented a net

financial expense of -€763 million compared with- €664 million

in 2013, with the year-on-year change corresponding mainly to the

non-recurring gain realised in 2013 on the sale of BNP Paribas

shares.

The Group's net loss eased to -€555 million in 2014 up

€1,672 million from -€2,227 million the year before.

Banque PSA Finance's recurring operating income came to

€337 million, a decline of -€31 million year-on-year that was due

to changes in the Bank's refinancing situation. In February 2015,

the first two joint ventures with Santander Consumer Finance were

launched, one in France and the other in the United Kingdom. These

new entities will enable Banque PSA Finance to offer competitive

interest rates to customers of the Peugeot, Citroën and DS brands

while at the same time improving its margins. The start-up of

operations by these new ventures also enabled Banque PSA Finance to

announce that it would no longer be using the French State's

guarantee for its future bond issues.

1 Income statement figures for 2013 and 2014 have been restated

to exclude the impact of applying IFRS 5,10 and 11 and IFRIC

21.

2 Free cash flow of manufacturing and sales companies

Faurecia's recurring operating income amounted to

€673 million, up 25% on 2013.

Free cash flow of manufacturing and sales companies for

the year amounted to €1,792 million, lifted by the improvement in

funds from operations and working capital requirement (up €1,752

million over the period) thanks mainly to the inventory reduction

action plans and supply chain optimisation. Excluding restructuring

costs of €583 million and net non-recurring income of €193 million

(mainly corresponding to gains on sales of property assets),

operating Free Cash Flow was a positive €2,182 million.

Total inventory, including independent dealers, stood at 339,100

vehicles at 31 December 2014, down 44,800 units from end-2013.

The manufacturing and sales companies' net financial

position at 31 December 2014 was a positive €548 million,

versus a negative €4,181 million at the previous year-end,

reflecting the €2,995-million proceeds from the April and May 2014

share issues as well as the increase in Free Cash Flow.

As the rebuilding of the Group's financial fundamentals is not

achieved, no dividend payment will be proposed for the financial

year 2014.

Outlook

In 2015, PSA Peugeot Citroën expects to see automotive demand

increase by a modest 1% in Europe and by approximately 7% in China,

but decline by some 10% in Latin America and by around 30% in

Russia.

The Group aims to generate operating free cash flow of around €2

billion over the period 2015-2017. It is also targeting an

operating margin3 of 2% in 2018 for the Automotive division, with

the objective of reaching 5% over the period of the next

medium-term plan, covering 2019-2023.

Financial Calendar

- 29 April 2015: First-quarter 2015

revenues

The PSA Peugeot Citroën Group's consolidated

financial statements for the year ended 31 December 2014 were

approved by the Managing Board on 10 February 2015 and reviewed by

the Supervisory Board on 17 February 2015. The Group's Statutory

Auditors have completed their audit and are currently issuing their

report on the consolidated financial statements.

About PSA Peugeot Citroën

With its three world-renowned brands, Peugeot, Citroën and DS,

PSA Peugeot Citroën sold 3 million vehicles worldwide in 2014. The

second largest carmaker in Europe, PSA Peugeot Citroën recorded

sales and revenue of €54 billion in 2014. The Group confirms its

position of European leader in terms of CO2 emissions, with an

average of 110.3 grams of CO2/km in 2014. PSA Peugeot Citroën has

sales operations in 160 countries. It is also involved in financing

activities (Banque PSA Finance) and automotive equipment

(Faurecia).

For more information, please visit psa-peugeot-citroen.com

3 Recurring operating income relating to revenues

Appendices

Comparative information has been restated to reflect the

application of IFRS 5, 10 and 11 and IFRIC 21.

Recurring Operating Income including Banque PSA

Finance*

2013. 2014.

Manufacturing and

Manufacturing and Finance (in

millions of euros)

Sales Companies Finance

Companies Eliminations

TOTAL

Sales Companies Companies Eliminations

TOTAL Revenues 52,459 1,773

(310)

53,922 53,019 1,703 (363)

54,359 Recurring operating income/(loss) (516)

369 -

(147) 779 337

-

1,116 Non-recurring operating

income/(expense) (1,165) - -

(1,165) (679) (2) (0)

(681) Operating Income/(loss) (1,681) 369

-

(1,312) 100 335 0

435

*Following the announcement of the partnership with Santander,

the Banque PSA Finance operations intended to be transferred to the

partnership vehicles have been excluded from consolidated recurring

operating income for 2014. This table shows consolidated recurring

operating income as if all Banque PSA Finance operations were still

fully consolidated.

Consolidated Income Statement

2013 2014 (in millions of euros)

Manufacturing andSales

Companies

Finance Companies Eliminations

TOTAL

Manufacturing andSales

Companies

Finance Companies Eliminations

TOTAL Revenues 52,459 668 (48)

53,079 53,019 628 (40)

53,607 Recurring operating income/(loss) (516)

152 -

(364) 779 126 -

905 Operating Income/(loss) (1,681) 152

-

(1,529) 100 123 -

223 Net financial expense (664) -

-

(664) (755) (8) -

(763) Income taxes (266) (40) -

(306) (226) (87)

(313) Share in net earnings of companies at equity

165 8 -

173 270 12

-

282 Net income/(loss) from operations intended to

be transferred to new joint ventures (19) 118

-

99 (34) 50 -

16

Consolidated profit/(loss) (2,465) 238 -

(2,227) (645) 90 -

(555) Group share (2,556) 223 6

(2,327) (787) 86 (5)

(706) Attributable to minority interests 91 15

(6)

100 142 4 5

151 (in euros)

Basic earnings per €1 par value share

Group share

(6,80)

(1,15)

Consolidated Balance Sheet

Assets

31 December 2013 31 December

2014 (in millions of euros)

Manufacturing andSales

Companies

Finance Companies Eliminations

TOTAL

Manufacturing andSales

Companies

Finance Companies Eliminations

TOTAL Total non-current assets 19,709 389

(1)

20,097 20,331 279 (5)

20,605 Total current assets 15,524

24,668 (568)

39,624 16,526 6,209

(704)

22,031 Total assets intended to be

transferred to new joint ventures 43 - -

43 167 18,529 (120)

18,576 TOTAL ASSETS

35,276

25,057 (569) 59,764

37,024 25, 017 (829)

61,212 EQUITY AND LIABILITIES

31 December 2013

31 December 2014 (in millions of euros)

Manufacturing andSales

Companies

Finance Companies Eliminations

TOTAL

Manufacturing andSales

Companies

Finance Companies Eliminations

TOTAL Total equity

7,837

10,418 Total non-current liabilities 12,622

364 (1)

12,985 11,637 2

(1)

11,638 Total current liabilities

18,109 21,401 (568)

38,942

18,071 13,368 (537)

30,903 Liabilities

intended to be transferred to new joint ventures - -

- - 37 8,508 (292)

8,253 TOTAL EQUITY & LIABILITIES

59,764

61,212

Consolidated Statement of Cash Flows

2013 2014 (in millions of euros)

Manufacturing andSales

Companies

Finance Companies Eliminations

TOTAL

Manufacturing andSales

Companies

Finance Companies Eliminations

TOTAL Consolidated profit/(loss) from continuing

operations (2,446) (128)

- (2,547) (611)

(211) - (822) Funds from

operations 804 (21) -

783 2,126 13

- 2,139 Net cash from/(used in) operating

activities 1,244 (478) (9) 757

3,878 448 (262) 4,064 Net cash used in

investing activities of continuing operations (2,474)

(33) - (2,507) (2,314) (22) -

(2,336) Net cash from/(used in) financing activities of

continuing operations 2,058 (153) -

1,905 675 3 334 1,012

Net cash used

by new borrowings and repayments of borrowings of finance

operations not transferred to new joint ventures

- (2,294) -

(2,294) - (1,448)

- (1,448) Net cash from/(used by) changes

in assets and liabilities of finance operations intended to be

transferred to new joint ventures (72)

3,099 74 3,101

(20) 1,817 10

1,807 Effect of changes in exchange rates (91)

(6) 4 (93) 47 1 - 48

Increase/(decrease) in cash and cash equivalents of continuing

operations and operations intended to be transferred to new joint

ventures 665 135 69

869 2,266 799

82 3,147 Net cash and cash equivalents at

beginning of period 5,496 1,669 (279)

6,886 6,161 1,804 (210) 7,755

Net

cash and cash equivalents at end of period – continuing

operations 6,161 1,804

(210) 7,755 8,427

2,603 (128) 10,902

PSA Peugeot CitroënMedia RelationsJean-Baptiste Thomas,

+33 (0) 1 40 66 47 59jean-baptiste.thomas@mpsa.comorPierre-Olivier

Salmon, +33 (0) 1 40 66 49 94pierreolivier.salmon@mpsa.comorAntonia

Krpina, +33 (0) 1 40 66 58 54antonia.krpina@mpsa.comorInvestor

RelationsFrédéric Brunet, +33 (0) 1 40 66 42

59frederic.brunet@mpsa.comorAnne-Laure Desclèves, +33 (0) 1 40 66

43 65annelaure.descleves@mpsa.comorKarine Douet, +33 (0) 1 40 66 57

45karine.douet@mpsa.com

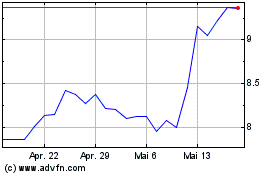

United Guardian (NASDAQ:UG)

Historical Stock Chart

Von Jun 2024 bis Jul 2024

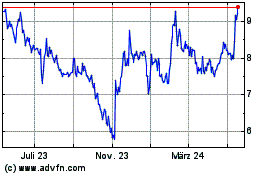

United Guardian (NASDAQ:UG)

Historical Stock Chart

Von Jul 2023 bis Jul 2024