Regulatory News:

PSA Peugeot Citroën (Paris:UG):

Not for release, publication or distribution,

directly or indirectly, in or into the United States, Canada,

Australia or Japan

In accordance with the announcement of the launch of its capital

increase with preferential subscriptions rights on 29 April 2014

with a ratio of 7 new shares, at a unit subscription price of

€6.77, for 12 existing shares (see the launch press release dated

29 April 2014), PSA Peugeot Citroën indicates today the theoretical

value of the preferential subscription right, after detachment of

the warrants granted to existing shareholders.

Based on the PSA Peugeot Citroën share closing price on 30 April

2014 (€12.755, the theoretical value of preferential subscription

rights is €2.205 and the theoretical ex-rights value of the share

(“Theoretical Ex-right Value of the Share”) is thus €10.55.

The subscription price of €6.77 per new share represents a 46.9%

discount to the closing price of the PSA Peugeot Citroën share on

30 April 2014 and a 35.8% discount to the Theoretical Ex-rights

Value of the Share.

These values are not necessarily indicative of the expected

value of the preferential subscription rights during the

subscription period, nor of the ex-rights value, of the shares, nor

of the discounts, as observed in the market.

PSA Peugeot Citroën reminds that the subscription period for the

new shares will run from 2 May 2014 to the close of trading on 14

May 2014. During this period, the preferential subscription rights

will be listed and traded on the regulated market of Euronext in

Paris (ISIN code FR0011872241). Preferential subscription rights

that are not exercised before the end of the subscription period,

namely before the end of the trading day on 14 May 2014, will lapse

automatically. Subscriptions subject to reduction (à titre

réductible) will be accepted.

Settlement and delivery and admission to trading on the

regulated market of Euronext in Paris of the new shares is

scheduled to take place on 23 May 2014.

Forward-Looking Statements

This press release includes forward-looking statements. These

statements are sometimes identified by the use of the future tense

or conditional mode, as well as terms such as “estimate”,

“believe”, “have the objective of”, “intend to”, “expect”, “result

in”, “should” and other similar expressions. It should be noted

that the realisation of these objectives and forward-looking

statements is dependent on the circumstances and facts that arise

in the future. Forward-looking statements and information about

objectives may be affected by known and unknown risks,

uncertainties and other factors that may significantly alter the

future results, performance and accomplishments planned or expected

by PSA Peugeot Citroën. These factors may include changes in the

economic and geopolitical situation and more generally those

detailed in Chapter 4 of the reference document filed with the

Autorité des marchés financiers (the “AMF”) on 2 April 2014 under

no. D.14-0269.

Information available to the public

A Prospectus approved by the AMF on 28 April 2014 under number

14-162 is comprised of (i) a Document de Référence filed with the

AMF under number D.14-0269 on 2 April 2014 (the “Document de

reference”), (ii) an Actualisation du Document de Référence

filed with the AMF under number D.14-0269-A01 on 28 April 2014,

(iii) a Note d’Opération (the “Note d’opération”) and (iv) a

summary of the Prospectus (included in the Note d’Opération). The

prospectus is available, without charge and upon request to PSA

Peugeot Citroën at 75 avenue de la Grande Armée – 75116 Paris, as

well as on the websites of PSA Peugeot Citroën

(www.psa-peugeotcitroen.com) and of the AMF

(www.amf-france.org)

PSA Peugeot Citroën draws the public’s attention to Chapter 4

"Risk Factors" of the Document de Référence and to Chapter 2 of the

Note d’Opération.

This press release may not be distributed directly or

indirectly in the United States, Canada, Australia or

Japan.

This press release and the information contained herein do not

constitute either an offer to sell or purchase or the solicitation

of an offer to sell or purchase the PSA Peugeot Citroën shares or

preferential subscription rights.

No communication and no information in respect of this

transaction may be distributed to the public in any jurisdiction

where a registration or approval is required. No steps have been or

will be taken in any jurisdiction (other than France) where such

steps would be required. The subscription for shares or the

purchase of PSA Peugeot Citroën’s shares or preferential

subscription rights may be subject to specific legal or regulatory

restrictions in certain jurisdictions. PSA Peugeot Citroën assumes

no responsibility for any violation of any such restrictions by any

person.

European Economic Area

This announcement is not a prospectus within the meaning of

Directive 2003/71/EC of the European Parliament and the Council of

November 4th, 2003, as amended, in particular by Directive

2010/73/EU to the extent such Directive has been transposed in the

relevant member State of the European Economic Area (together, the

“Prospectus Directive”).

The offer is opened to the public only in France. With respect

to the member States of the European Economic Area which have

implemented the Prospectus Directive (each, a “relevant member

State”), other than France, no action has been undertaken or

will be undertaken to make an offer to the public of the securities

requiring a publication of a prospectus in any relevant member

State. As a result, the new shares and the preferential

subscription rights of PSA Peugeot Citroën may only be offered in

relevant member States (i) to qualified investors, as defined by

the Prospectus Directive; or (ii) in any other circumstances, not

requiring PSA Peugeot Citroën to publish a prospectus as provided

under Article 3(2) of the Prospectus Directive.

For the purposes of this paragraph, “Securities offered to

the public” in a given Member State, means, any communication

in any form and by any means, of sufficient information about the

terms and conditions of the offer and the securities, so as to

enable an investor to decide to buy or subscribe for the

securities, as the same may be varied in that Member State.

This selling restriction applies in addition to any other

selling restrictions which may be applicable in the Member States

who have implemented the Prospectus Directive.

United Kingdom

The distribution of this press release is not made, and has not

been approved, by an “authorised person” within the meaning of

Article 21(1) of the Financial Services and Markets Act 2000. As a

consequence, this press release is directed only at persons who (i)

are located outside the United Kingdom, (ii) have professional

experience in matters relating to investments within the meaning of

Article 19(5) of the Financial Services and Markets Act 2000

(Financial Promotions) Order 2005 (as amended), (iii) are persons

falling within Article 49(2)(a) to (d) (high net worth companies,

unincorporated associations, etc.) of the Financial Services and

Markets Act 2000 (Financial Promotions) Order 2005 (as amended) or

(iv) are persons to whom this press release may otherwise lawfully

be communicated (all such persons mentioned in paragraphs (i),

(ii), (iii) et (iv) collectively being referred to as “Relevant

Persons”). The securities are directed only at Relevant Persons

and no invitation, offer or agreements to subscribe, purchase or

acquire the securities may be proposed or made other than with

Relevant Persons. Any person other than a Relevant Person may not

act or rely on this document or any provision thereof. This press

release is not a prospectus which has been approved by the

Financial Services Authority or any other United Kingdom regulatory

authority within the meaning of Section 85 of the Financial

Services and Markets Act 2000.

United States

This press release does not constitute or form a part of any

offer or solicitation to purchase or subscribe for securities in

the United States. Securities may not be offered, subscribed or

sold in the United States absent registration under the U.S.

Securities Act of 1933, as amended (the “U.S. Securities

Act”), except pursuant to an exemption from, or in a

transaction not subject to, the registration requirements thereof.

The shares and the preferential subscription rights of PSA Peugeot

Citroën and rights in respect thereof have not been and will not be

registered under the U.S. Securities Act and PSA Peugeot Citroën

does not intend to make a public offer of its securities in the

United States.

Canada, Australia and Japan

The new shares and the preferential subscription rights may not

be offered, sold or purchased in Australia, Japan or, subject to

certain exceptions, Canada.

The distribution of this document in certain countries may

constitute a breach of applicable law.

Stabilization

Not applicable.

PSA Peugeot Citroën

With its three world-renowned brands, Peugeot, Citroën and DS,

the Group sold 2.8 million vehicles worldwide in 2013, out of which

42% outside Europe. As Europe’s second largest carmaker, it

recorded sales of €54 billion in 2013. PSA Peugeot Citroën has

sales offices in 160 countries. The Group confirms its position of

European leader in terms of CO2 emissions, with an average of 116.2

grams of CO2/km in 2013. Its activities also include financing

activities (Banque PSA Finance) and automotive equipment

(Faurecia). For more information go to

http://www.psa-peugeot-citroen.com

SUMMARY OF THE PROSPECTUS

AMF Approval No. 14-162 of 28 April

2014

The summary consists of a set of key disclosures, referred to as

"

Elements", which are addressed in five sections, A to E,

and numbered from A.1 to E.7.

This summary contains all the Elements

that are required in the summary of a prospectus concerning this

category of securities and this type of issuer. Since not all

Elements have to be filled in, the numbering of the Elements in

this summary is not continuous.

It is possible that no relevant

information may be provided about a given Element that should be

included in this summary, given the category of securities and the

type of issuer involved. In that event, a brief description of the

Element in question is given in the summary, with the notation "not

applicable".

Section A - Introduction and

Notices

A.1 Notice to readers This summary

should be read as an introduction to the Prospectus.

Any decision to invest in the financial

securities issued in connection with this public offering or for

which an application is made for admission to trading on a

regulated market should be based on a thorough review of the

Prospectus.

If an action is brought before a court in

respect of information contained in this Prospectus, the plaintiff

investor may be required to bear the costs of translating the

Prospectus prior to the commencement of judicial proceedings,

pursuant to the national legislation of the Member States of the

European Union or of the parties to the agreement regarding the

European Economic Area.

The persons who have prepared this

summary, including its translation, if any, and who have requested

to be notified of that translation as contemplated by Article

212-41 of the General Regulations (Règlement Général) of the AMF,

may be liable only if the contents of the summary are misleading,

inaccurate or contradict other parts of the Prospectus or if, when

read together with the other parts of the Prospectus, they do not

contain the critical information that would help investors who are

considering investing in these financial securities.

A.2 Consent of the issuer concerning the use of

the Prospectus Not applicable.

Section B - Issuer

B.1 Corporate name and business name

Peugeot S.A. (the "

Company")

The terms "PSA Peugeot Citroën" and

the "Group" refer to the Company together with its

consolidated subsidiaries.

B.2 Registered Office 75, avenue de la

Grande Armée - 75116 Paris.

Legal form A French

société anonyme (public limited company) with a Management Board

and a Supervisory Board.

Governing law French law.

Country of incorporation France.

B.3

Description of the issuer's operations and main business

lines PSA Peugeot Citroën is an automobile manufacturer

of international scope, which brings together three innovative

brands with differentiated identities: Peugeot, Citroën and DS. The

Group has a commercial presence in 160 countries, and more than one

third of its sales come from outside Western Europe. The Group is

currently focusing on expanding its production facilities close to

priority markets, with manufacturing plants in Europe, Latin

America, China and Russia.

Apart from its car manufacturing business,

the Group includes, in particular, the following companies:

• Faurecia, a subsidiary in which the

Group owns a 51.7% stake, is a car parts manufacturer operating

worldwide;

• Banque PSA Finance, a wholly-owned

subsidiary of the Group, which provides financing to end customers

as well as to the Peugeot, Citroën and DS distribution networks;

and

• Peugeot Motocycles (PMTC), a

wholly-owned subsidiary of the Group, which sells a range of motor

scooters, small motorcycles and mopeds.

The business of PSA Peugeot Citroën is

described in detail in Chapter 6 of the Registration Document.

B.4a Significant recent trends affecting the

issuer and its business lines The Group expects growth

in the automotive market in 2014 of around3% in Europe and

around10% in China, with a 7% decline in Latin America and a 5%

decline in Russia.

B.5 Description of the Group

and issuer's place within the Group The Company is the

parent company of the Group, which had 415 consolidated

subsidiaries as of 31 December 2013 (101 in France and 314 abroad).

B.6 Principal shareholders and control of the

issuer

At 31 December 2013 and based on information brought to the

Company's attention, the shareholding structure of the Company was

as follows:

Shareholders(1) Number of shares

% interest % exercisable voting rights

% theoretical voting rights Etablissements Peugeot Frères

(EPF)(2) 22,312,608 6.29 9.93 9.63

FFP(3) 67,372,689 18.99 27.96 27.13

Maillot I(4) 164 0.00 0.00 0.00

Subtotal EPF, FFP and Maillot I 89,685,461 25.28

37.89 36.76 Other individual shareholders(5)

48,453,904 13.65 11.71 11.36 Employees

12,664,902 3.57 4.50 4.37 Other French

institutions 46,048,734 12.98 11.04

10.71 Other foreign institutions 145,207,364 40.92

34.86 33.82 Treasury shares 12,788,627

3.60 - 2.97 Total 354,848,992 100

100 100

(1) Source: Euroclear TPE 31 December 2013 and Nasdaq OMX.

(2) EPF (Etablissements Peugeot Frères) is an investment holding

company held at the highest level by members of the Peugeot

family.

(3) FFP is controlled by EPF.

(4) Maillot I is controlled by EPF.

(5) Shares held in individual securities accounts and others (by

deduction).

Following the completion of the capital increases reserved for

Dongfeng Motor (Hong Kong) International Co., Limited

("DMHK"), and for SOGEPA, a company wholly owned by the

French Republic, in an amount totalling €1,047,999,990 referred to

in the securities note approved by the AMF on 2 April 2014 under

number 14-121 (the "Reserved Capital Increases") and

following the issue of the New Shares (as that term is defined

hereinafter), covered by this Prospectus, the Company's

shareholding would breakdown as follows in the table below, noting

that this breakdown takes into account the EPF/FFP’s undertaking to

waive their double voting rights:

Shareholder % interest

% voting rights Etablissements Peugeot Frères (EPF)

3.4% 3.4% FFP 10.8% 10.9% Subtotal EPF, FFP

14.1% 14.2% DMHK 14.1% 14.2% SOGEPA

14.1% 14.2% Other 57.6% 57.3% Total

100% 100%

A shareholders' agreement was signed on 28 April 2014 by

Dongfeng Motor Group Company Limited ("DFG"), DMHK, the

French State, SOGEPA, EPF/FFP and the Company and will enter into

force as of the effective date of the Reserved Capital Increase (as

defined above). Under no circumstances may DFG, DMHK, the French

Republic, SOGEPA and EPF/FFP act in concert with respect to the

Company.

B.7 Historical financial data and significant changes

since the last historical financial data

Consolidated income statements

2013

(audited) 1.

2012 (audited)(1) (in

millions of euros)

Manufacturing and sales companies

Finance companies Eliminations

TOTAL Manufacturing and sales companies

Finance companies Eliminations

TOTAL Sales and Revenue 52,627 1,773

(310)

54,090 53,860 1,910 (324)

55,446 Recurring operating income (545)

368 -

(177) (951) 391 -

(560) Non-recurring operating income (expense)

(1,169) - -

(1,169) (4,121)

(1) -

(4,122) Operating income

(1,714) 368 -

(1,346) (5,072)

390 -

(4,682) Consolidated profit

(2,456) 238 -

(2,218)

(5,216) 293 -

(4,923) Attributable to

the Group (2,546) 223 6

(2,317)

(5,294) 281 5

(5,008)

Attributable to minority interests 90 15 (6)

99 78 12 (5)

85

(in euros)

Basic

earnings per €1 nominal value share

Attributable to the Group

(6.77)

(15.59)

1) Restated in accordance with IAS 19R on pensions from 2013

(€16 million on recurring consolidated operating income, of which

€8 million in recurring Automotive operating income).

Consolidated balance sheets

ASSETS

31 December

2013 (audited) 31 December 2012 (audited) (in

millions of euros)

Manufacturing and sales companies

Finance companies Eliminations

TOTAL Manufacturing and sales companies

Finance companies Eliminations

TOTAL Total non-current assets 19,583 389

(1) 19,971 21,208 424 -

21,632 Total current assets 15,550 24,668

(568) 39,650 17,200 26,699 (656)

43,243 Total assets held for sale 43 - -

43 9 - - 9 TOTAL ASSETS

35,176 25,057 (569)

59,664 38,417 27,123

(656) 64,884 EQUITY AND LIABILITIES

31 December 2013 (audited) 31 December 2012

(audited) (in millions of euros)

Manufacturing and

sales companies Finance companies

Eliminations TOTAL Activities:

Manufacturing and Sales

Finance companies Eliminations

TOTAL Total equity

7,791

10,167 Total non-current liabilities 12,668 363

(1) 13,030 12,650 345 -

12,995 Total current liabilities 18,006 21,405

(568) 38,843 18,971 23,361 (656)

41,676 Total equity and liabilities held for sale - -

- - 46 - - 46 TOTAL

EQUITY AND LIABILITIES

59,664

64,884

Simplified consolidated statements of cash flows

2013

(audited) 2012 (audited) (in millions of euros)

Manufacturing and sales companies Finance

companies Eliminations TOTAL

Activities:

Manufacturing and Sales

Finance companies Eliminations

TOTAL Consolidated profit (loss) from operations

(2,453) 238 -

(2,215) (6,019) 293

- (5,726) Funds from operations

700 287 - 987

1,033 290 -

1,323 Net cash from (used in) operating activities

1,097 469 64 1,630 431 1,050

(64) 1,417 Net cash from (used in) investing

activities (2,431) (42) - (2,473)

(2,450) (1) 3 (2,448) Net cash from

(used in) financing activities 2,204 (286) -

1,918 2,387 (532) 4 1,859 Effect

of changes in exchange rates (91) (6) 5

(92) (6) (2) 2 (6)

Net increase

(decrease) in cash and cash equivalent 779

135 69 983 362

515 (55) 822 Net cash and

cash equivalent at beginning of year 5,399 1,669

(279) 6,789 4,692 1,154 (223)

5,623

Net cash and cash equivalent at end of year

6,137 1,804 (210)

7,731 5,399 1,669

(279) 6,789

To the best of the Company's knowledge, no significant change in

the Group's financial or business condition has occurred since the

publication of the consolidated financial statements for the period

ended 31 December 2013.

B.8 Pro forma

financial information Not applicable.

B.9

Earnings forecasts or estimates Not applicable.

B.10 Reserves about the historical financial

data Not applicable.

B.11 Net working

capital The Company declares that it believes that the

Group’s net working capital is sufficient to meet its obligations

over the next 12 months following the date of approval of the

Prospectus.

Section C - Securities

C.1 Type, class and identification number

288,506,351 ordinary shares (the "

New Shares") of the

same class as the Company's existing shares, to be issued at the

unit price of €6.77, including issue premium (the "

Capital

Increase by way of Preferential Subscription Rights"). They

will be entitled to receive dividends and all other distributions

the Company may declare as from the date of their issuance and will

be traded on the same listing line as the existing shares.

- ISIN Code: FR0000121501;

- Mnemonic: UG;

- ICB sector classification: 3353

Automotive;

- Place of listing: Euronext Paris,

Compartment A.

C.2 Issue currency Euro.

C.3

Shares of the Company issued and nominal value per

share On the date of approval of the Prospectus, the

capital stock is €354,848,992 fully paid up and divided into

354,848,992 shares with a nominal value of €1 each.

After completion of the Reserved Capital

Increases, the number of shares in the Company's share capital will

rise to 494,582,324 shares with a nominal value of €1 each.

After completion of the Reserved Capital

Increases and the issue of the New Shares whose admission to

trading has been requested, the number of shares in the Company's

share capital will rise to 783,088,675 shares with a nominal value

of €1.

C.4 Rights attached to the New Shares

Pursuant to applicable French law and the Company's bylaws in their

current form, the principal rights attached to the New Shares

issued as part of the Capital Increase by way of Preferential

Subscription Rights are as follows:

- dividend rights;

- voting rights;

- preferential subscription rights of same class securities;

- right to share in any surplus in the event of liquidation.

Double voting rights are allocated to all fully paid up shares

that can be shown to have been registered in the name of the same

shareholder for at least two years (Article L. 225-123 of the

French Commercial Code and Article 11 of the Company’s bylaws).

Form: the New Shares will be in

registered form or bearer form, at the subscribers' discretion.

Dividend rights and listing of the New

Shares: the New Shares will be entitled to receive dividends

and all other distributions declared by the Company as from the

date of their issuance.

The New Shares will be admitted to trading

on the regulated market Euronext in Paris ("Euronext Paris")

on 23 May 2014.

C.5 Restrictions on the sale of the shares

Not applicable.

C.6 Application for

admission Application will be made to admit the New

Shares to trading on Euronext Paris upon their issuance, which is

scheduled for 23 May 2014, under the same ISIN code as the

Company’s existing shares (ISIN code: FR 0000121501).

C.7

Dividend policy The Company paid a dividend of

€1.10 per share in 2011 for the 2010 fiscal year and did not pay

any dividend in 2012 and 2013.

In light of the Group's 2013 results and

in order to give priority to allocating financial resources to the

Group's development, the Company will not pay a dividend in 2014

for the 2013 fiscal year.

Section D - Risks

D.1 Principal risks specific to the issuer and its

business sector The principal risk factors relating to

the Company, the Group and its industry are listed below. These

comprise:

- operational risks and in particular risks associated with the

economic and geopolitical environment, risks associated with the

development, launch and sale of new vehicles, customer and dealer

risks, raw material risks and supplier risks;

- industrial and environmental risks: damage to one of the

Group's manufacturing plants could compromise the production as

well as the marketing of several hundred thousand vehicles;

- workplace health and safety risks;

- risks associated with the cooperation agreements;

- information system risks;

- financial market risks: the Group is exposed to liquidity

risks, as well as interest rate, counterparty, credit, currency and

other market risks, and particularly to risks associated with

changes in raw materials prices and in stock market

variations;

- risks relating to the business of Banque PSA Finance, in

particular risks associated with the financing of Banque PSA

Finance (and to the planned partnership with Santander), credit

risks and liquidity risks;

- legal and contractual risks relating to the Company’s roles as

an employer, designer and distributor of the Group's vehicles

(particularly including risks associated with judicial and

arbitration proceedings, competition law, changes in regulations,

loan covenants, pension obligations, intellectual property rights

and off-balance sheet commitments);

- risks related to the purchase of components and the supply of

services;

- risks related to the fact that the implementation of the

partnership with Dongfeng Motor Group Company Limited is contingent

on meeting a certain set of conditions;

- risk related to the fact that the synergies or objectives

expected from the reinforced partnership with DFG might not be

achieved.

D.3 Principal risks related to the Company's

shares The principal risk factors related to the

Company's New Shares are listed below:

- The market for the preferential subscription rights may only

offer limited liquidity and be subject to high volatility.

- Shareholders not exercising their preferential subscription

rights will see their ownership stake in the Company’s share

capital diluted.

- The market price for the Company’s shares may fluctuate and

fall below the subscription price for shares issued upon exercise

of the preferential subscription rights.

- The volatility and liquidity of the Company’s shares may

fluctuate significantly.

- Sales of the Company's shares or preferential subscription

rights may occur on the market during the subscription period in

the case of preferential subscription rights, or during or after

the subscription period in the case of shares, and may have a

negative impact on the market price of the shares or of the

preferential subscription rights.

- In the event of a decrease in the market price of the Company’s

shares, the value of the preferential subscription rights may

decline.

- Investors who have acquired preferential subscription rights on

the market may have acquired rights that ultimately become null and

void, if the underwriting agreement is terminated and if, in the

latter event, the amount of subscriptions received is less than

three-quarters of the contemplated issue.

Section E - Offering

E.1 Total net proceeds of the offering

Estimate of total costs of the

offering

By way of illustration, the gross proceeds of the Capital

Increase by way of Preferential Subscription Rights total

€1,953,187,996.27 and the net proceeds of the Capital Increase by

way of Preferential Subscription Rights are estimated at €1,892.96

million.

Estimate of costs of the Capital Increase

by way of Preferential Subscription Rights: fees of financial

intermediaries and legal and administrative fees: €60.23

million.

E.2a Reasons for the offering The issue

of the New Shares, together with the Reserved Capital Increases and

the issue of warrants and the signing of a new €3 billion

syndicated line of credit (consisting of a €2 billion tranche

maturing in five years and a €1 billion tranche maturing in three

years with two options for one-year extensions), (subject to the

completion of the warrants issue, the Reserved Capital Increases

and the Capital Increase by way of Preferential Subscription

Rights), is to strengthen the balance sheet and the Group's

liquidity.

The total amount of the Reserved Capital

Increases, including issue premiums, is €1.048 billion and the

total amount of the Capital Increase by way of Preferential

Subscription Rights, including issue premiums, is €1.953 billion,

for a total amount of €3.0 billion.

These transactions will enable PSA Peugeot

Citroën to make key investments to implement its "Back in the Race"

plan and to reinforce its competitiveness in Europe and its

globalisation strategy:

- transform the business model of PSA Peugeot Citroën in Latin

America and Russia to restore profitability;

- develop state-of-the-art CO2 technologies and advanced driving

assistance systems;

- invest to establish a competitive industrial footprint in

Europe;

- reduce net debt.

E.3 Terms and conditions of the offering

Number of New Shares to be issued:

288,506,351 ordinary shares in the Company.

Subscription price: the

subscription price for the New Shares under the Capital Increase by

way of Preferential Subscription Rights is €6.77 per share, where

€1 represents the nominal value per share and €5.77 represents the

issue premium.

The Company will publish a press release

on 30 April 2014, after the detachment of the warrants allocated

free of charge to existing shareholders but before the detachment

of the preferential subscription rights, indicating the face value

of the discount compared with the traded exchange price of the

shares of Peugeot S.A.

Preferential Subscription

Rights

The subscription of New Shares will be

reserved preferentially to holders of existing shares recorded in

their securities account at the close of trading on 30 April 2014,

who will be allocated preferential subscription rights, and to

transferees of preferential subscription rights.

Holders of preferential subscription

rights will be entitled to subscribe:

- by irrevocable entitlement (à titre irréductible), for 7 New

Shares for every 12 existing shares owned (12 preferential

subscription rights will entitle the holder of such rights to

subscribe for 7 New Shares at a price of €6.77 per share);

- and, subject to reduction (à titre réductible),any additional

New Shares over and above the number of shares to which they are

entitled as part of the exercise of their preferential subscription

rights by irrevocable entitlement.

The preferential subscription rights will

be detached on 2 May 2014 and traded on Euronext Paris until the

end of the subscription period, i.e. up to and including 14 May

2014, under the ISIN code FR0011872241.

Theoretical value of the preferential

subscription rights

By way of an exception to the usual

practice, given the detachment of, and the number of, the warrants

allocated free of charge to existing shareholders which will occur

after this prospectus, the Company will issue a press release on 30

April 2014, i.e. before the detachment of the preferential

subscription rights, in which it will indicate the theoretical

value of preferential subscription rights, the theoretical

ex-rights value of the share, and the discounts of the issue price

of the New Shares compared with the market price of the share and

with the theoretical ex-rights value of the share. The theoretical

value of the preferential subscription rights will therefore be

based on a reported market price of the ex-warrant shares, given

that the warrants will have been allocated on 29 April and will be

listed separately as of that date.

Subscription intentions of the

principal shareholders

Pursuant to the subscription commitments

signed on 28 April 2014 by DMHK, SOGEPA, EPF and FFP, who will hold

14.13%, 14.13%, 4.51% and 13.62%, respectively, of the share

capital and 12.54%, 12.54%, 7.44% and 20.95%, respectively, of the

voting rights of the Company upon completion of the Reserved

Capital Increases to the benefit of DMHK and SOGEPA, which is the

subject matter of the Securities Note approved by the AMF under

number 14-121, it has been irrevocably agreed that:

- DMHK shall exercise 69,866,664 preferential subscription rights

detached from the 69,866,666 shares it will hold upon completion of

the Reserved Capital Increases, in order to subscribe by

irrevocable entitlement for 40,755,554 New Shares (which reflects a

subscription amount including premiums of €275,915,100.58);

- SOGEPA shall exercise 69,866,664 preferential subscription

rights detached from the 69,866,666 shares it will hold upon

completion of the Reserved Capital Increases, in order to subscribe

by irrevocable entitlement for 40,755,554 New Shares (which

reflects a subscription amount including premium of

€275,915,100.58);

- EPF shall exercise 6,833,916 preferential subscription rights

among the 22,312,608 preferential subscription rights detached from

its 22,312,608 shares (i.e. exercise of 30.63% of its detached

preferential subscription rights), in order to subscribe by

irrevocable entitlement for 3,986,451 New Shares (which reflects a

subscription amount including premium of €26,988,273.27);

- FFP shall exercise 29,057,952 preferential subscription rights

among the 67,372,689 preferential subscription rights detached from

its 67,372,689 shares (i.e. exercise of 43.13% of its detached

preferential subscription), in order to subscribe by irrevocable

entitlement for 16,950,472 New Shares (which reflects a

subscription amount including premium of €114,754,695.44).

The preferential subscription rights

detached but not exercised by EPF and FFP, amounting to 53,793,429

preferential subscription rights, and representing approximately

(i) 10.88% of the total number of preferential subscription rights,

and (ii) 16.87% of the number of preferential subscription rights

not taken up under the subscription undertakings of DMHK, SOGEPA,

EPF and FFP

will consequently be sold by EPF and FFP.

The sale of these rights could take place in an orderly manner,

according to opportunities arising over the subscription period,

either through an accelerated book-building procedure (in the

latter case, EPF and FFP will issue a press release in relation to

the operation), or during OTC transactions.

Underwriting

Pursuant to an underwriting agreement

relating to the New Shares which will be entered into on 28 April

2014 between the Company and a banking syndicate led by Banco

Santander, BNP PARIBAS, Citigroup, Crédit Agricole Corporate and

Investment Bank, Deutsche Bank, HSBC, Morgan Stanley, Natixis,

Société Générale CIB, Banca IMI, CM-CIC Securities, Commerzbank,

and UniCrédit Bank AG acting as underwriters (collectively the

"Underwriters"), the Underwriters severally but not jointly

undertake to arrange for the subscription of, or, in the event that

any New Shares remain unsubscribed for at the end of the

subscription period, to subscribe for, all the New Shares issued,

except for those subject to DMHK, SOGEPA,EPF and FFP’s subscription

undertakings

This underwriting agreement does not

constitute a performance guarantee (garantie de bonne fin) within

the meaning of Article L. 225-145 of the French Commercial Code.

This underwriting agreement may be terminated under certain

circumstances described in section 5.4.3 of this Securities Note.

The Capital Increase by way of Preferential Subscription Rights may

not be completed and subscriptions may be retroactively cancelled

if the underwriting agreement is terminated and if, in the latter

event, the amount of subscriptions received is less than

three-quarters of the proposed issue.

Lock-up commitment of the Company and

standstill commitments of the main shareholders

Company: undertaking not to carry out any

transactions, either immediately or going forward, on the capital

of the Company for a period of 180 days after the

settlement-delivery of the Capital Increase by way of Preferential

Subscription Rights (excluding capital transactions carried out for

the benefit of employees, shares issued or exchanged as part of the

exercise of the conversion/exchange option of OCEANEs or the

implementation of the share buy-back programme).

DMHK: undertaking to refrain from selling

shares in any manner whatsoever for a period of 180 days after the

settlement-delivery of the Capital Increase by way of Preferential

Subscription Rights (excluding, in particular, sales made with the

prior written consent of the Global Coordinators, Lead Managers and

Bookrunners or in case of transfer to an affiliate of DFG).

SOGEPA: undertaking to refrain from

selling shares in any manner whatsoever for a period of 180 days

after the settlement-delivery of the Capital Increase by way of

Preferential Subscription Rights (excluding, in particular, sales

made with the prior written consent of the Global Coordinators,

Lead Managers and Bookrunners or in case of transfer to an

affiliate of the French Republic).

EPF: undertaking to refrain from selling

shares in any manner whatsoever for a period of 180 days after the

settlement-delivery of the Capital Increase by way of Preferential

Subscription Rights (excluding, in particular, sales made with the

prior written consent of the Global Coordinators, Lead Managers and

Bookrunners or in case of transfer to an affiliate of EPF or

FFP).

FFP: undertaking to refrain from selling

shares in any manner whatsoever for a period of 180 days after the

settlement-delivery of the Capital Increase by way of Preferential

Subscription Rights (excluding, in particular, sales made with the

prior written consent of the Global Coordinators, Lead Managers and

Bookrunners or in case of transfer to an affiliate of EPF or

FFP).

Countries in which the Capital Increase

by way of Preferential Subscription Rights will be open to the

public

The offering will be extended to the

public in France only.

Restrictions applicable to the

offering

The distribution of this Prospectus, the

sale of the shares and of the preferential subscription rights and

the subscription of the New Shares may, in certain countries

including the United States of America, be governed by specific

regulations.

Procedure for exercising preferential

subscription rights

To exercise their preferential

subscription rights, holders must submit a request to their

authorised financial intermediary at any time between 2 May 2014

and up to and including 14 May 2014, and pay the applicable

subscription price. Any preferential subscription rights not

exercised by the end of the subscription period, i.e., at the close

of trading on 14 May 2014, will automatically become null and

void.

Financial intermediaries

Shareholders holding shares in registered

form administered by an intermediary or bearer shares:

subscriptions should be submitted to the financial intermediaries

holding their accounts up to and including 14 May 2014.

Shareholders holding shares in registered

form administered by the Company: subscriptions should be submitted

to Société Générale Securities Services, 32, rue du Champ-de-tir,

BP 81236, 44312 Nantes Cedex 03, France, up to and including 14 May

2014.

Centralising institution charged with

delivering the certificate of deposit of funds confirming the

completion of the Capital Increase by way of Preferential

Subscription Rights: Société Générale Securities Services, 32, rue

du Champ-de-tir, BP 81236, 44312 Nantes Cedex 03, France.

Joint Global Coordinators, Co-Lead

Managers and Joint Bookrunners

Banco Santander, BNP PARIBAS, Citigroup,

Crédit Agricole Corporate and Investment Bank, Deutsche Bank, HSBC,

Morgan Stanley, Natixis and Société Générale Corporate and

Investment Bank

Co-Lead Managers of the offer

Banca IMI, CM-CIC Securities, Commerzbank

and UniCredit Bank AG

Indicative timetable of the capital

increase

24 March 2014 Publication of a notice in

the Bulletin des Annonces Légales Obligatoires with respect to the

suspension of the right to exercise stock options and bonds

convertible into and/or exchangeable for new or existing shares

issued by the Company ("OCEANE").

31 March 2014 Commencement of the

suspension period for the exercise of stock options and

OCEANEs.

28 April 2014 AMF approval on the

Prospectus.

Execution of the underwriting

agreement.

Record date* for the allocation of

warrants.

29 April 2014 Publication of a press

release by the Company describing the main characteristics of the

Capital Increase by way of Preferential Subscription Rights and the

availability of the Prospectus.

Publication by Euronext Paris of the

issuance notice regarding the Capital Increase by way of

Preferential Subscription Rights.

Subscription and payment of new shares by

DMHK and SOGEPA and issue of new shares as part of the Reserved

Capital Increases.

Delivery of warrants and admission of the

new shares to trading on Euronext Paris.

30 April 2014 Publication of a notice in

the BALO to inform holders of OCEANEs and warrants.

Publication of a press release by the

Company indicating the discount to the stock market price and the

theoretical value of the preferential subscription rights.

2 May 2014 Opening of the subscription

period of the Capital Increase by way of Preferential Subscription

Rights.

Detachment and commencement of trading of

the preferential subscription rights on Euronext Paris.

14 May 2014 Closing of the subscription

period for the Capital Increase by way of Preferential Subscription

Rights.

End of trading of the preferential

subscription rights.

21 May 2014 Publication by Euronext Paris

of the press release announcing the result of the Capital Increase

by way of Preferential Subscription Rights.

Publication by Euronext Paris of the

admission notice for the New Shares, indicating the final amount of

the Capital Increase by way of Preferential Subscription Rights and

the allotment ratio for subscriptions subject to reduction.

23 May 2014 Settlement and delivery of the

Capital Increase by way of Preferential Subscription Rights.

Admission of the New Shares to trading on

Euronext Paris.

1 July 2014 Resumption of the right to

exercise stock options and OCEANEs.

* Accounting registration date used for

the allocation of warrants

A reserved capital increase will also be

offered to employees to involve them in the Group’s recovery.

E.4 Interests that might significantly affect the

issue The Underwriters (and/or certain of their

affiliates) have provided and/or may in the future provide the

Company or companies within the Group, their shareholders or their

directors and officers with various banking, financial, investment,

commercial and other services, for which they have received or may

receive a fee

. E.5 Individual or entity

offering the securities for sale Preferential

subscription rights detached from the Company's treasury shares

:

Pursuant to Article L. 225-206 of the

French Commercial Code, the Company cannot subscribe for its own

shares. Preferential subscription rights detached from the

12,788,627 treasury shares held by the Company at 28 April 2014,

i.e. 3.6% of the share capital at 28 April 2014, will be sold on

the market before the end of the subscription period, on the

conditions mentioned in Article L. 225-210 of the French Commercial

Code.

Lock-up agreements See information given at

Element E.3.

E.6 Amount and percentage of dilution

Dilution

Impact of the Capital Increase by way of Preferential

Subscription Rights on shareholders’ equity

By way of illustration, and without accounting for adjustments

of the OCEANEs due to the warrants issue and adjustments of the

warrants and OCEANEs due to the Capital Increase by way of

Preferential Subscription Rights, the impact of the Capital

Increase by way of Preferential Subscription Rights on the portion

per share of consolidated shareholders’ equity attributable to the

Group (a calculation made using consolidated shareholders’ equity

attributable to the Group as at 31 December 2013 as stated on the

consolidated financial statements at 31 December 2013 and the

342,060,365 shares making up the Company's share capital after

deducting the treasury shares) would be as follows:

Portion of shareholders'

equityper share (in euros) Non-diluted

basis Diluted basis(1) Prior to the issue

of 139,733,332 shares as part of the Reserved Capital Increases and

New Shares arising from this Capital Increase by way of

Preferential Subscription Rights 20.12 17.46 After

the issue of the 139,733,332 shares as part of the Reserved Capital

Increases 16.46 15.20 After the issue of the

139,733,332 shares as part of the Reserved Capital Increases and

issue of the 288,506,351 New Shares arising from this Capital

Increase by way of Preferential Subscription Rights 12.75

12.44

(1) In the event of the exercise of all of the 3,259,035 stock

options and the conversion or exchange of the 22,907,053 OCEANEs

outstanding, and of all the 342,060,365 warrants.

Impact of the Capital Increase by way of Preferential

Subscription Rights on shareholders

By way of illustration, and without accounting for adjustments

of the OCEANEs due to the warrants issue and adjustments of the

warrants and OCEANEs due to the Capital Increase by way of

Preferential Subscription Rights, the impact of the Capital

Increase by way of Preferential Subscription Rights on the equity

investment of a shareholder owning 1% of the Company's share

capital before the issues and not subscribing for them (calculated

on the 354,848,992 shares making up the Company's share capital as

at 31 December 2013) would be as follows:

Shareholder interest (%)

Non-diluted basis Diluted

basis(1) Prior to the issue of 139,733,332 shares as part of

the Reserved Capital Increases and New Shares arising from this

Capital Increase by way of Preferential Subscription Rights

1.00% 0.73% After the issue of the 139,733,332 shares as

part of the Reserved Capital Increases 0.72% 0.57%

After the issue of the 139,733,332 shares as part of the Reserved

Capital Increases and the issue of the 288,506,351 New Shares

arising from this Capital Increase by way of Preferential

Subscription Rights 0.45% 0.39%

(1) In the event of the conversion into New Shares of the

22,907,053 OCEANEs outstanding and the exercise of all of the

342,060,365 warrants.

E.7 Estimate of costs invoiced to the investor

Not applicable.

Media RelationsPierre-Olivier Salmon, +33 (0) 1 40 66 49

94pierreolivier.salmon@mpsa.comorXiaoyan Hua-Schwab, +33 (0) 1 40

66 54 22xiaoyan.hua-schwab@mpsa.comorAntonia Krpina, +33 (0) 1 40

66 48 02antonia.krpina@mpsa.comorInvestors RelationsCarole

Dupont-Pietri, +33 (0) 1 40 66 42

59carole.dupont-pietri@mpsa.comorAnne-Laure Descleves, +33 (0) 1 40

66 43 65annelaure.descleves@mpsa.comorKarine Douet, +33 (0) 1 40 66

57 45karine.douet@mpsa.com

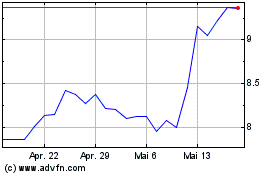

United Guardian (NASDAQ:UG)

Historical Stock Chart

Von Jun 2024 bis Jul 2024

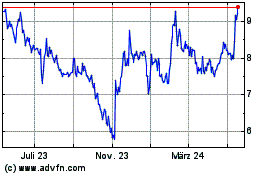

United Guardian (NASDAQ:UG)

Historical Stock Chart

Von Jul 2023 bis Jul 2024