Regulatory News:

PSA Peugeot Citroën (Paris:UG):

2013 Highlights

- 2,819,000 assembled vehicles and CKD

units sold worldwide, down 4.9% on 2012, with sales of assembled

vehicles stable (down 0.1%)

- Reversal of the annual trend in the

fourth quarter, with assembled vehicle sales up 4%

- Another increase in the percentage

of vehicles sold outside Europe, to 42% of the total from 38% in

2012

- Further advances in the upmarket

strategy, with premium models accounting for 19% of total unit

sales versus 9% in 2009.

- Strong demand for the new Peugeot

2008 and 308

- Solid performances by the new

Citroën C4 Picasso and Grand C4 Picasso

- Successful launch of the DS brand in

China

- Continued leadership in

CO2 emissions reduction, with average corporate

emissions of 116.2 g/km representing a 6.2-gram improvement on

2012.

In 2013, the worldwide automobile market showed decidedly mixed

trends, with demand continuing to contract in 30-country Europe

(down 1.6%) and Russia (down 5.4%), while expanding in China (up

19.1%) and Latin America (up 2.9%).

In this environment, PSA Peugeot Citroën recorded worldwide

sales of 2,819,000 units (assembled vehicles and CKD units), down

4.9% in 2012. Assembled vehicle sales held firm, contracting by

just 0.1% to 2,818,000 units, with the fourth quarter seeing growth

of 4%.

Further decline in the European market

In 30-country Europe, the market declined by 1.6% on the back of

an 8.6% fall in 2012.

Only a handful of markets grew during the year, such as the

United Kingdom and Spain, which were up by 11% and 4.1%

respectively.

However, these recovering markets were still far below their

2007 levels. Registrations in Spain, for example, increased by

809,000 units in 2013, compared with 1,892,000 in 2007.

Registrations fell 5.5% in France and 7.6% in Italy to 1,404,000

units – the lowest since 1979 – compared with 2,739,000 in

2007.

The Group retained its leadership position in the European light

commercial vehicle market, with 304,000 registrations and a market

share of 20.7%, virtually unchanged from 2012.

In this environment, the Group focused on the most profitable

distribution channels and its share of the 30-country Europe market

ended the year at 11.94% versus 12.7% in 2012.

Continued progress in the globalisation strategy

The globalisation strategy is continuing to produce results, as

evidenced by the steep rise in the number of vehicles sold outside

Europe since 2009. With markets outside Europe accounting for 42%

of total sales in 2013, the Group is on track to meet its target of

generating 50% of sales in these markets by 2015.

Very fast growth in China

In a Chinese market up 19.1% in 2013, the Group increased its

sales by 26.1% to 557,000 units from 442,000 in 2012, giving it a

3.64% market share. China is PSA Peugeot Citroën’s second largest

market, after France.

Sales of Peugeots rose 25.8% to 272,000 units compared with

216,000 in 2012, while sales of Citroëns were 26.3% higher at

285,000 units versus 226,000 the previous year.

The Peugeot 3008, the Citroën C4L introduced at the start of the

year and the Peugeot 301 and the Citroën C-Elysée brought to market

in the second half also made a strong contribution to the Group’s

sales growth in China.

This growth is expected to continue in 2014, led by the

nationwide expansion of the dealer network and the broader model

line-up.

The middle classes, who are the Group’s prime target, currently

represent 25% of the Chinese population, but their numbers should

swell in the coming years to an estimated 40% of the population by

2020. To keep pace with the growth in demand, the Group plans to

raise production capacity to 950,000 vehicles a year at its plants

in Shenzhen (200,000 units for CAPSA) and Wuhan (750,000 units for

DPCA). Construction of a fourth plant by DPCA is also under

consideration.

A persistently mixed situation in Latin America

The Latin American market (Argentina, Brazil, Chile and Mexico)

expanded by 2.9% overall in 2013, to 5,937,000 units. However, the

situation varied significantly from one country to the next.

The Brazilian market contracted by 1.5%, the first decline in

ten years. Demand softened even though the government maintained

throughout the year the reduction in the IPI* tax introduced in

2012 and carmakers engaged in aggressive promotional activity,

particularly in the second half. Moreover, in Latin America as a

whole, regional exchange rates against the euro moved very

unfavourably and weighed heavily on the Group’s financial

performance. This currency effect was exacerbated by the low local

content of the Group’s operations in the region.

In this environment, PSA Peugeot Citroën sales in Latin America

rose by 7% to 303,000 units, representing a 4.9% market share.

Sales continued to climb rapidly in Argentina, up 25.5% to 140,100

units, lifted by the successful launch of the Peugeot 208 and

Citroën C4 Lounge, which have already exceeded their first-year

sales targets. Group registrations also rose steeply in Chile (up

31.5%) and Mexico (up 33.4%), far outstripping the market growth

rates of 10.3% and 7.9% respectively.

* “Imposto sobre Produtos Industrializados” (tax on manufactured

products)

Sharply narrower automotive market in Russia

In a slowing Russian economy, the automotive market contracted

by 5.4% in 2013. The Group’s share of the market narrowed by 0.3

points to 2.3%.

In 2013, Peugeot and Citroën expanded their offer by introducing

three new models aligned with local demand, the Peugeot 301 and 208

and the Citroën C-Elysée. In addition, the month of June saw the

launch of the Citroën C4 Sedan manufactured locally at the Kaluga

plant. Together, these models will help the Group to expand its

presence in the Russian market in 2014.

Rest of the world

Lifted by the success of the Peugeot 301 and the Citroën C4L and

C-Elysée, Group sales also increased in other markets, led by

Algeria (up 6.9%) and Turkey (up 7.6%).

Sales of premium models up on 2012

The Group’s upmarket strategy is backed by strong brands

catering to clearly differentiated customer territories.

The strategy has led to an increase in sales of premium* models,

from 505,000 units in 2012 to 540,000 last year, representing 19%

of total unit sales.

Diesel hybrids equipped with HYbrid4 technology have contributed

to moving the ranges up market. In Europe, these models account for

11% of Peugeot 3008 sales, 16% of Peugeot 508 sales and 34% of

Citroën DS5 sales.

In all, the Group sold 24,319 diesel hybrids in 2013, ranking

second in this market segment in Europe in terms of volumes.

*Premium vehicles offer a level of driving pleasure, safety,

quality of finish, connectivity and comfort that serves as a

benchmark in their segment. They include distinctive models from

the A, B and C segments (Peugeot 207CC, 2008, 308CC, RCZ, 3008 and

4008; Citroën DS3, DS3 Cabrio, DS4 and C4 AirCross) and models from

the D and E segments (Peugeot 508 and 407; Citroën DS5, C5 and

C6).

Successful model launches

2013 saw the successful launch of several new models.

The Peugeot 2008 urban crossover introduced last spring and the

new Peugeot 308 surpassed first-year sales estimates, with 82,000

and 34,000 orders respectively, while at Citroën, the 58,000 orders

taken for the new C4 Picasso and Grand C4 Picasso helped to

revitalize the brand’s sales.

PSA Peugeot Citroën leads in reducing CO2

emissions and exceeds European requirements

The Group is continuing to reduce its vehicles’ carbon

emissions, maintaining its position as one of the European leaders

in this area. With average corporate emissions of 116.2 g/km* of

CO2 versus 122.4 g/km in 2012, it has already exceeded the target

of 130 g/km set by Brussels for 2015.

* Updated figures as of 30 November 2013

55.3% of Group vehicles sold in Europe in 2013 emit less than

111 g/km of CO2, versus 39.1% in 2012.

The drive to reduce carbon emissions is being supported by the

new technologies developed and introduced in 2013:

- The new generation EMP2 modular

platform deployed during the year at the Vigo plant for the new

Citroën C4 Picasso and at the Sochaux plant for the new Peugeot

308. The platform will be used to develop a variety of body styles

for C and D-segment vehicles, all delivering unrivalled performance

particularly in terms of carbon emissions.

- Optimized internal combustion

powertrains, with the family of 3-cylinder petrol engines,

including the Turbo PureTech 110 and 130 hp versions that started

rolling off the production line at the Française de Mécanique plant

in France in late October.

- The exclusive Diesel Blue HDi emissions

control technology used to manufacture Euro 6-compliant exhaust

systems and to reduce nitrous oxide emissions to the same level as

for petrol engines. This new exhaust system line introduced in late

2013 on the Peugeot 508 and Citroën C4 will be gradually deployed

across the diesel line-up during 2014.

- Hybrid technologies, with the fitment

of the second-generation e-HDi Stop & Start on all Peugeot and

Citroën diesel models.

- Hybrid4 diesel technology, which is

continuing to gain ground in Europe with over 50,000 Hybrid4

Peugeots and Citroëns sold since the technology was launched.

PSA Peugeot Citroën: Worldwide Sales of

Passenger Cars and Light Commercial Vehicles, 2012 and

2013

2012

2013 Europe*

Peugeot 948,000

879,000 Citroën

811,000

750,000 Total PSA

1,758,000

1,629,000 Russia Peugeot

45,000

33,000 Citroën 34,000

29,000 Total PSA 78,000

61,000 Latin America Peugeot 173,000

183,000 Citroën 110,000

120,000 Total PSA 283,000

303,000 China Peugeot 216,000

272,000 Citroën 226,000

285,000

Total PSA 442,000

557,000

Rest of the world Peugeot 174,000

185,000 Citroën 84,000

82,000

Total PSA 239,000

267,000

Total assembledvehicles

Peugeot 1,555,000

1,552,000

Citroën 1,265,000

1,266,000

Total PSA 2,820,000

2,818,000 CKD Units Peugeot 145,000

1,100 Citroën 0

0

Total PSA 145,000

1,100

TOTAL AssembledVehicles and

CKDUnits

Peugeot 1,700,000

1,553,000

Citroën 1,265,000

1,266,000

Total PSA 2,965,000

2,819,000

* Europe = EU + EFTA + Bosnia + Croatia + Kosovo + Macedonia +

Montenegro + Serbia

PSA Peugeot CitroënMedia RelationsJean-Baptiste

Thomas, +33 (1) 40 66 47

59jean-baptiste.thomas@mpsa.comorPierre-Olivier Salmon, +33 (0) 1

40 66 49 94pierreolivier.salmon@mpsa.comorAntonia Krpina, +33 (1)

40 66 48 02antonia.krpina@mpsa.comorLaure de Servigny, +33 (0) 1 40

66 35 42Laure.deservigny@mpsa.comorInvestor RelationsCarole

Dupont-Pietri, +33 (0) 1 40 66 42

59carole.dupont-pietri@mpsa.comorAnne-Laure Descleves, +33 (0) 1 40

66 43 65annelaure.descleves@mpsa.comorKarine Douet, +33 (0) 1 40 66

57 45karine.douet@mpsa.com

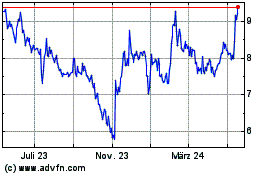

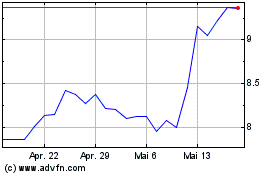

United Guardian (NASDAQ:UG)

Historical Stock Chart

Von Jun 2024 bis Jul 2024

United Guardian (NASDAQ:UG)

Historical Stock Chart

Von Jul 2023 bis Jul 2024