UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities

Exchange Act of 1934

Date of Report (Date of earliest event reported):

September 4, 2024 (September 4, 2024)

SIRIUS XM HOLDINGS INC.

(Exact Name of Registrant as Specified in Charter)

| Delaware |

001-34295 |

38-3916511 |

|

(State or Other Jurisdiction

of Incorporation) |

(Commission File Number) |

(I.R.S. Employer

Identification No.) |

| 1221 Avenue of the Americas, 35th Fl., New York, NY |

10020 |

| (Address of Principal Executive Offices) |

(Zip Code) |

| Registrant's

telephone number, including area code: (212)

584-5100 |

| |

| (Former

Name or Former Address, if Changed Since Last Report): N/A |

Check the appropriate box below if the Form 8-K

filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| x |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class |

Trading Symbol(s) |

Name of each exchange on which registered |

| |

|

|

| Common Stock, par value $0.001 per share |

SIRI |

The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth

company as defined in Rule 405 of the Securities Act of 1933 or Rule 12b-2 of the Securities Exchange Act of 1934.

Emerging

growth company ¨

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

On September 4, 2024, Sirius XM Holdings Inc.,

a Delaware corporation (“SiriusXM”), and Liberty Media Corporation, a Delaware corporation (“Liberty Media”),

issued a joint press release announcing that, assuming the requisite conditions to the previously announced redemptive split-off (the

“Split-Off”) of Liberty Sirius XM Holdings Inc., a Delaware corporation (“SplitCo”), are satisfied

or waived, as applicable, at 4:05 p.m., New York City time, on September 9, 2024, Liberty Media intends to redeem each outstanding share

of Liberty Media’s Series A, Series B and Series C Liberty SiriusXM common stock in exchange for 0.8375 of a share of common

stock of SplitCo, with cash being paid to entitled record holders of Liberty SiriusXM common stock in lieu of any fractional shares of

common stock of SplitCo.

Additionally, assuming all requisite conditions

are satisfied or waived, as applicable, at 6:00 p.m., New York City time, on September 9, 2024, Radio Merger Sub, LLC, a Delaware limited

liability company and a wholly owned subsidiary of SplitCo, will merge with and into SiriusXM (the “Merger” and together

with the Split-Off, the “Transactions”), with SiriusXM surviving the Merger as a wholly owned subsidiary of SplitCo.

Upon consummation of the Merger, each share of common stock of SiriusXM issued and outstanding immediately prior to the effective time

of the Merger (other than shares owned by SplitCo and its subsidiaries) will be converted into the right to receive one-tenth (0.1) of

a share of SplitCo common stock, with cash being paid to entitled record holders of SiriusXM common stock in lieu of any fractional shares

of common stock of SplitCo.

As part of the Transactions SplitCo will change

its name to Sirius XM Holdings Inc. (“New SiriusXM”). SiriusXM expects that the common stock of New SiriusXM will begin

trading on Nasdaq under the ticker symbol “SIRI” as of September 10, 2024.

The foregoing description is qualified in its entirety

by reference to the full text of the press release, a copy of which is filed herewith as Exhibit 99.1 in compliance with Rule 425 of the

Securities Act of 1933, as amended, and is incorporated by reference into this Item 8.01.

* * *

Forward-Looking Statements

This Current Report on Form 8-K includes certain

forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995, including certain statements relating

to the Transactions and their proposed timing and other matters related to the Transactions. All statements other than statements of historical

fact are “forward-looking statements” for purposes of federal and state securities laws. These forward-looking statements

generally can be identified by phrases such as “possible,” “potential,” “intends” or “expects”

or other words or phrases of similar import or future or conditional verbs such as “will,” “may,” “might,”

“should,” “would,” “could,” or similar variations. These forward-looking statements involve many risks

and uncertainties that could cause actual results and the timing of events to differ materially from those expressed or implied by such

statements, including, without limitation, the satisfaction of conditions to the Transactions. These forward-looking statements speak

only as of the date of this Current Report on Form 8-K, and SiriusXM expressly disclaims any obligation or undertaking to disseminate

any updates or revisions to any forward-looking statement contained herein to reflect any change in SiriusXM’s expectations with

regard thereto or any change in events, conditions or circumstances on which any such statement is based. Please refer to the publicly

filed documents of SiriusXM, including its information statement, and its most recent Forms 10-K and 10-Q, as such risk factors may be

amended, supplemented or superseded from time to time by other reports SiriusXM subsequently files with the SEC, for additional information

about SiriusXM and about the risks and uncertainties related to SiriusXM’s business which may affect the statements made in this

Current Report on Form 8-K.

Additional Information

Nothing in this Current Report on Form 8-K shall

constitute a solicitation to buy or an offer to sell shares of common stock of Liberty Media, SiriusXM or SplitCo. The proposed offer

and issuance of shares of SplitCo common stock in the Transactions will be made only pursuant to SplitCo’s effective registration

statement on Form S-4, which includes a prospectus of SplitCo. Liberty Media and SiriusXM stockholders and other investors are urged to

read the registration statement, Liberty Media’s definitive proxy statement and SiriusXM’s information statement, together

with all relevant Securities and Exchange Commission (“SEC”) filings regarding the Transactions, and any other relevant

documents filed as exhibits therewith, as well as any amendments or supplements to those documents, because they contain important information

about the Transactions. The prospectus/proxy statement/information statement and other relevant materials for the proposed Transactions

have previously been provided to all LSXMA, LSXMB and SiriusXM stockholders. Copies of these SEC filings are available, free of charge,

at the SEC's website (http://www.sec.gov). Copies of the filings together with the materials incorporated by reference therein are available,

without charge, by directing a request to Liberty Media Corporation, 12300 Liberty Boulevard, Englewood, Colorado 80112, Attention: Investor

Relations, Telephone: (877) 772-1518 or Sirius XM Holdings Inc., 1221 Avenue of the Americas, 35th Floor, New York, New York 10020, Attention:

Investor Relations, (212) 584-5100.

| Item 9.01. | Financial Statements and Exhibits. |

(d) Exhibits.

SIGNATURE

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

| |

SIRIUS XM HOLDINGS INC. |

| |

|

| |

By: |

/s/ Patrick L. Donnelly |

| |

|

Patrick L. Donnelly |

| |

|

Executive Vice President, General Counsel and Secretary |

Dated: September 4, 2024

Exhibit 99.1

September

4, 2024

Liberty Media and Sirius XM Announce Final

Exchange Ratio for the Split-Off Transactions

ENGLEWOOD, Colo. and NEW YORK, NY—(BUSINESS WIRE)—Liberty

Media Corporation (“Liberty Media”) (Nasdaq: LSXMA, LSXMB, LSXMK, FWONA, FWONK, LLYVA, LLYVK) and Sirius XM Holdings Inc.

(Nasdaq: SIRI) (“Sirius XM”) announced today that, assuming the requisite conditions to the previously announced redemptive

split-off (the “Split-Off”) of Liberty Sirius XM Holdings Inc. (“New Sirius”) are satisfied or waived, as applicable,

at 4:05 p.m., New York City time, on September 9, 2024, Liberty Media will redeem each outstanding share of Series A Liberty

SiriusXM common stock (“LSXMA”), Series B Liberty SiriusXM common stock (“LSXMB”) and Series C Liberty

SiriusXM common stock (“LSXMK”, and together with LSXMA and LSXMB, the “Liberty SiriusXM common stock”) in exchange

for 0.8375 of a share of common stock of New Sirius, with cash paid in lieu of any fractional shares. Upon the Split-Off, New Sirius

will be the owner of all of the businesses, assets and liabilities previously attributed to the Liberty SiriusXM Group.

Following the Split-Off at 6:00 p.m., New York City time, on September 9,

2024, a wholly owned subsidiary of New Sirius will merge with Sirius XM (the “Merger”), and Sirius XM stockholders (other

than New Sirius and its subsidiaries) will receive one-tenth (0.1) of a share of New Sirius common stock, with cash paid in lieu of any

fractional shares. The Split-Off and the Merger will create a new public company which will continue to operate under the Sirius XM name

and brand. The shares of New Sirius common stock will be listed on the Nasdaq Stock Market under the ticker symbol “SIRI”

and will begin trading on the Nasdaq Stock Market on September 10, 2024.

Liberty Media and Sirius XM expect that New Sirius will have approximately

339.1 million shares of New Sirius common stock outstanding immediately following the consummation of the Split-Off and Merger, of which

former holders of Liberty SiriusXM common stock are expected to own approximately 81% of New Sirius and former Sirius XM minority stockholders

are expected to own the remaining 19% of New Sirius.

Forward-Looking Statements

This communication includes certain forward-looking statements within

the meaning of the Private Securities Litigation Reform Act of 1995, including certain statements relating to the Split-Off and the Merger

(collectively, the “Transactions”) and their proposed timing and other matters related to the Transactions. All statements

other than statements of historical fact are “forward-looking statements” for purposes of federal and state securities laws.

These forward-looking statements generally can be identified by phrases such as “possible,” “potential,” “intends”

or “expects” or other words or phrases of similar import or future or conditional verbs such as “will,” “may,”

“might,” “should,” “would,” “could,” or similar variations. These forward-looking statements

involve many risks and uncertainties that could cause actual results and the timing of events to differ materially from those expressed

or implied by such statements, including, without limitation, the satisfaction of conditions to the Transactions. These forward-looking

statements speak only as of the date of this communication, and Liberty Media and Sirius XM expressly disclaim any obligation or undertaking

to disseminate any updates or revisions to any forward-looking statement contained herein to reflect any change in Liberty Media’s

or Sirius XM’s expectations with regard thereto or any change in events, conditions or circumstances on which any such statement

is based. Please refer to the publicly filed documents of Liberty Media and Sirius XM, including Liberty Media’s definitive proxy

statement materials for the special meeting, Sirius XM’s information statement and their most recent Forms 10-K and 10-Q, as such

risk factors may be amended, supplemented or superseded from time to time by other reports Liberty Media or Sirius XM subsequently file

with the SEC, for additional information about Liberty Media, Sirius XM and about the risks and uncertainties related to Liberty Media’s

and Sirius XM’s businesses which may affect the statements made in this communication.

Additional Information

Nothing in this press release shall constitute a solicitation to buy

or an offer to sell shares of common stock of Liberty Media, Sirius XM or New Sirius. The proposed offer and issuance of shares of New

Sirius common stock in the Transactions will be made only pursuant to New Sirius’ effective registration statement on Form S-4,

which includes a prospectus of New Sirius. Liberty Media and Sirius XM stockholders and other investors are urged to read the registration

statement, Liberty Media’s definitive proxy statement materials for the special meeting and Sirius XM’s information statement,

together with all relevant SEC filings regarding the Transactions, and any other relevant documents filed as exhibits therewith, as well

as any amendments or supplements to those documents, because they contain important information about the Transactions. The prospectus/proxy

statement/information statement and other relevant materials for the proposed Transactions have previously been provided to all LSXMA,

LSXMB and Sirius XM stockholders. Copies of these SEC filings are available, free of charge, at the SEC's website (http://www.sec.gov).

Copies of the filings together with the materials incorporated by reference therein are available, without charge, by directing a request

to Liberty Media Corporation, 12300 Liberty Boulevard, Englewood, Colorado 80112, Attention: Investor Relations, Telephone: (877) 772-1518

or Sirius XM Holdings Inc., 1221 Avenue of the Americas, 35th Floor, New York, New York 10020, Attention: Investor Relations, (212) 584-5100.

About Liberty Media Corporation

Liberty Media Corporation operates and owns interests in a broad range

of media, communications, sports and entertainment businesses. Those businesses are attributed to three tracking stock groups: the Liberty

SiriusXM Group, the Formula One Group and the Liberty Live Group. The businesses and assets attributed to the Liberty SiriusXM Group

(NASDAQ: LSXMA, LSXMB, LSXMK) include Liberty Media’s interest in Sirius XM. The businesses and assets attributed to the Formula

One Group (NASDAQ: FWONA, FWONK) include Liberty Media’s subsidiaries Formula 1 and Quint, and other minority investments. The

businesses and assets attributed to the Liberty Live Group (NASDAQ: LLYVA, LLYVK) include Liberty Media’s interest in Live Nation

and other minority investments.

About Sirius XM Holdings Inc.

Sirius XM is the leading audio entertainment company in North America

with a portfolio of audio businesses including its flagship subscription entertainment service SiriusXM; the ad-supported and premium

music streaming services of Pandora; an expansive podcast network; and a suite of business and advertising solutions. Reaching a combined

monthly audience of approximately 150 million listeners, Sirius XM offers a broad range of content for listeners everywhere they tune

in with a diverse mix of live, on-demand, and curated programming across music, talk, news, and sports. For more about Sirius XM, please

go to: www.siriusxm.com.

Contact for Liberty Media Corporation

Shane Kleinstein, 720-875-5432

Contact for Sirius XM

Hooper Stevens

212-901-6718

hooper.stevens@siriusxm.com

Natalie Candela

212-901-6672

natalie.candela@siriusxm.com

Maggie Mitchell

Maggie.mitchell@siriusxm.com

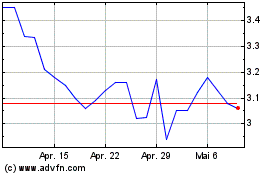

SiriusXM (NASDAQ:SIRI)

Historical Stock Chart

Von Nov 2024 bis Dez 2024

SiriusXM (NASDAQ:SIRI)

Historical Stock Chart

Von Dez 2023 bis Dez 2024