UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER PURSUANT

TO RULE 13a-16 OR 15d-16

UNDER THE SECURITIES EXCHANGE ACT OF 1934

For the month of January 2025

Commission File Number 000-27663

SIFY TECHNOLOGIES LIMITED

(Translation of registrant’s name into

English)

Tidel Park, Second Floor

No. 4, Rajiv Gandhi Salai, Taramani

Chennai

600 113, India

(91) 44-2254-0770

(Address of principal executive office)

Indicate by check mark whether the registrant files or will

file annual reports under cover Form 20-F or Form 40-F. Form 20-F þ

Form 40 F ¨

Results of Operations and Financial Condition

On January 17, 2025, Sify Technologies Limited

announced its consolidated results under the International Financial Reporting Standards (IFRS) for the third quarter of fiscal year 2024-25.

A copy of the press release is attached hereto

as Exhibit 99.1, which exhibit shall not be deemed to be “filed” for purposes of Section 18 of the Securities Exchange

Act of 1934, as amended, or otherwise subject to the liabilities of that section.

Signature

Pursuant to the requirements of the Securities Exchange Act of 1934,

the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

Date: January 17, 2025

| |

Sify Technologies

Limited |

| |

|

| |

By: |

/s/ M P Vijay Kumar |

| |

|

Name: M P Vijay Kumar |

| |

|

Title: Executive Director and Chief Financial Officer |

Exhibits filed with this Report

Exhibit 99.1

For immediate release Chennai, India

| EARNING CALLS DETAILS |

January 17, 2025| 8:30 AM ET |

Participant Dial in:

To join: +1-888-506-0062 (Toll Free in the U.S. or Canada) or +1-973-528-0011

(International) | Access Code: 260860

On the call: Mr. Raju Vegesna, Chairman of the Board and Mr. M P Vijay

Kumar, Executive Director & Group CFO

Live webcast: https://www.webcaster4.com/Webcast/Page/2184/51869

Archives: +1-877-481-4010 (Toll Free in the U.S. or Canada) or +1-919-882-2331

(International). Passcode 51869.

Replay is available until January 24, 2025.

Sify reports Consolidated Financial Results for

Q3 FY 2024-25

Revenues of INR 10,491 Million. EBITDA of INR 1,914

Million.

Loss for the period INR 258 Million.

HIGHLIGHTS

| |

· |

Revenue

was INR 10,491 Million, an increase of 21% over the same quarter last year. |

| |

· |

EBITDA

was INR 1,914 Million, an increase of 13% over the same quarter last year. |

| · | Loss

before tax was INR 119 Million. Loss after tax was INR 258 Million. |

| |

· |

CAPEX

during the quarter was INR 3,343 Million. |

MANAGEMENT COMMENTARY

Mr. Raju Vegesna, Chairman, said, “India's

growing prominence in the global marketplace is driven by its liberal policies, a supportive business environment, and a wealth of skilled

resources. These factors combine to create a compelling growth opportunity for international companies, making India a critical destination

in their global strategic expansion plans.

India has long established a reputation of being an

IT service provider for the world. That narrative is now maturing to recognize that India can be an important AI test-bed for the emerging

digital economy. Multiple global leaders have also gone on record regarding the importance of the Indian market in their investment roadmap”.

Mr. M P Vijay Kumar, ED & Group CFO, said,

“We stay focussed on cost efficiency and fiscal discipline, ensuring our financial strategies align with long-term value creation.

Our current results are weighed down by depreciation, interest payments and escalating manpower costs.

Our strategic investments are guided by a forward-looking

approach, designed to anticipate evolving market dynamics and drive sustainable growth. Our pursuit of responsible and innovative growth

will be strengthened through such sustainable practices.

We draw your attention to Sify adopting the new standard

of International Accounting Standards Board’s recent issuance of IFRS 18 (Presentation and Disclosure in Financial Statements),

starting with the last quarter ending June 30, 2024. By adopting the new standard, we seek to maintain clarity and consistency in our

financial communications. Importantly, while our presentation may change, there is no alteration in total income or net profit. December

2023 numbers are restated consequent to filing of Amended Form 20-F/A with SEC on January 13, 2025.

The cash balance at the end of the quarter was INR

5,327 Million”.

BUSINESS HIGHLIGHTS

| · | The Revenue split between the businesses for

the quarter was Data Center colocation services 36%, Digital services 23% and Network services 41%. |

| · | During the quarter, Sify commissioned 5MW of

additional Data Center capacity. |

| · | As of December 31,2024, Sify provides services

via 1109 fiber nodes across the country, a 14% increase over same quarter last year. |

| · | As of December 31, 2024, Sify has deployed 9473

contracted SDWAN service points across the country. |

CUSTOMER ENGAGEMENTS

Among the most prominent new contracts during the quarter were the following:

Data Center Services

| · | A web hosting company and an ecommerce IT peripherals

player migrated from the competition’s data center to Sify Data Center. |

| · | One of the largest private and public sector

banks contracted to expand their DR at two Sify’s premises. |

| · | The Central Bank’s arm for payments and

settlement contracted for a DR location and a private bank contracted for an Near DR. |

Digital services

| · | An industrial construction major and a mobility

solutions provider contracted to migrate their on-prem DC to Sify’s Cloud platform. |

| · | One of the oldest publishing houses, a retail

automation player, a home grown diversified MNC and inland waterway channel contracted Sify to build greenfield cloud platforms. |

| · | A majority of these entities also signed up for

value added services, such as services like DRaaS, PaaS and IaaS. |

| · | A publicly listed state technology mission signed

up for on-prem commissioning of private cloud services. |

| · | New contracts for Managed services included the

IT mission of a state government, a public sector bank and a national insurance player. |

| · | The technology partner to the Government of India,

multiple banks and a heavy machinery supply chain major signed up for on-prem Security build services. |

| · | A Public sector bank, the technology partner

to the Government of India, an insurance major, a fintech major and the IT mission of a state government signed up for technology refresh. |

| · | Sify delivered more than 2 million online assessments

this quarter. |

| · | A homegrown MNC’s international hospitality

division contracted for supply chain integration. |

Network Services

| · | A global banking major with presence in India

and a retail MNC signed up for Sify’s Global Cloud interconnection. |

| · | One of the largest Investment banks and a global

FMCG contracted for Sify's Cloud interconnect Solutions. |

| · | A global investment bank and the country’s

premier financial transaction settlement assurance platform transitioned their networks to Sify. |

| · | A state government’s police service signed

up for Wide Area Networking. |

| · | Sify landed a second intercontinental cable system

at its Open Cable landing station. |

| · | Sify has also commenced services on the Mumbai

– Noida National Long Distance (NLD) network. |

FINANCIAL HIGHLIGHTS

Unaudited Consolidated Income Statement as per IFRS

(In INR millions)

| Description | |

Quarter ended December 2024 | | |

Quarter ended December 2023 (restated) | | |

Quarter ended September 2024 | |

| Revenue | |

| 10,491 | | |

| 8,659 | | |

| 10,275 | |

| Cost of Sales | |

| (6,725 | ) | |

| (5,390 | ) | |

| (6,362 | ) |

| Gross Profit | |

| 3,766 | | |

| 3,269 | | |

| 3,913 | |

| Other Operating Income | |

| 64 | | |

| (17 | ) | |

| 135 | |

| Selling, General and Administrative Expenses | |

| (1,845 | ) | |

| (1,579 | ) | |

| (1,945 | ) |

| Depreciation and Amortisation expense | |

| (1,446 | ) | |

| (1,183 | ) | |

| (1,323 | ) |

| Operating Profit | |

| 539 | | |

| 490 | | |

| 780 | |

| Investment Income | |

| 52 | | |

| 101 | | |

| 2 | |

| Profit before financing and income taxes | |

| 591 | | |

| 591 | | |

| 782 | |

| Finance income | |

| 19 | | |

| - | | |

| - | |

| Interest expenses on borrowings and lease liabilities | |

| (729 | ) | |

| (558 | ) | |

| (641 | ) |

| Interest expenses on pension liabilities | |

| - | | |

| (1 | ) | |

| (1 | ) |

| Profit/(Loss) before income taxes | |

| (119 | ) | |

| 32 | | |

| 140 | |

| | |

| | | |

| | | |

| | |

| Income Tax Expense | |

| (139 | ) | |

| 6 | | |

| (38 | ) |

| | |

| | | |

| | | |

| | |

| Profit/(Loss) for the period | |

| (258 | ) | |

| 38 | | |

| 102 | |

| | |

| | | |

| | | |

| | |

| Profit attributable to: | |

| | | |

| | | |

| | |

| Reconciliation with Non-GAAP measure | |

| | | |

| | | |

| | |

| | |

| | | |

| | | |

| | |

| Profit/(Loss) for the period | |

| (258 | ) | |

| 38 | | |

| 102 | |

| Add: | |

| | | |

| | | |

| | |

| Depreciation and Amortisation expense | |

| 1,446 | | |

| 1,183 | | |

| 1,323 | |

| Net Finance Expenses | |

| 636 | | |

| 473 | | |

| 534 | |

| Current Tax | |

| 190 | | |

| 9 | | |

| 184 | |

| Less: | |

| | | |

| | | |

| | |

| Deferred Tax | |

| (51 | ) | |

| (15 | ) | |

| (146 | ) |

| Other Income (including exchange gain/loss) | |

| (49 | ) | |

| 1 | | |

| (34 | ) |

| | |

| | | |

| | | |

| | |

| EBITDA | |

| 1,914 | | |

| 1,689 | | |

| 1,963 | |

Management-defined Performance Measures (MPMs)

Sify uses Earnings before Interest, Tax, Depreciation

and Amortisation (EBITDA) as the management-defined performance measure in its public communications. This measure is not specified by

IFRS Accounting Standards and therefore might not be comparable to apparently similar measures used by other entities.

Management believes adjusting operating profit for

these items provides comprehensive information of the company’s operating performance.

Reconciliation with Management-defined Performance

Measures:

(In INR millions)

| Description | |

Quarter ended December 2024 | | |

Quarter ended December 2023 (restated) | | |

Quarter ended September 2024 | |

| Operating Profit | |

| 539 | | |

| 490 | | |

| 780 | |

| Add: | |

| | | |

| | | |

| | |

| Depreciation and Amortisation expense | |

| 1,446 | | |

| 1,183 | | |

| 1,323 | |

| Less: | |

| | | |

| | | |

| | |

| Interest expenses on pension liabilities | |

| - | | |

| (1 | ) | |

| (1 | ) |

| Other Income (including exchange gain/loss) | |

| (71 | ) | |

| 17 | | |

| (139 | ) |

| EBITDA | |

| 1,914 | | |

| 1,689 | | |

| 1,963 | |

Segment Reporting:

(In INR millions)

| | |

Q3 2024-25 | | |

Q3 2023-24 (restated) | |

| Particulars | |

Network Services (A) | | |

Data center Services (B) | | |

Digital Services (C) | | |

Total (D=A+B+C) | | |

Network Services (A) | | |

Data center Services (B) | | |

Digital Services (C) | | |

Total (D=A+B+C) | |

| Revenue | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| External customers Revenue | |

| 4,274 | | |

| 3,837 | | |

| 2,380 | | |

| 10,491 | | |

| 3,477 | | |

| 2,732 | | |

| 2,450 | | |

| 8,659 | |

| Intersegment Revenue | |

| - | | |

| 22 | | |

| 55 | | |

| 77 | | |

| - | | |

| 22 | | |

| 55 | | |

| 77 | |

| Operating expenses | |

| (3,823 | ) | |

| (2,119 | ) | |

| (2,655 | ) | |

| (8,597 | ) | |

| (2,985 | ) | |

| (1,584 | ) | |

| (2,410 | ) | |

| (6,979 | ) |

| Intersegment expenses | |

| (63 | ) | |

| - | | |

| (14 | ) | |

| (77 | ) | |

| (63 | ) | |

| - | | |

| (14 | ) | |

| (77 | ) |

| Segment Result | |

| 388 | | |

| 1,740 | | |

| (234 | ) | |

| 1,894 | | |

| 429 | | |

| 1,170 | | |

| 81 | | |

| 1,680 | |

| Unallocated Expense (Support Service Unit Costs) | |

| | | |

| | | |

| | | |

| 27 | | |

| | | |

| | | |

| | | |

| 10 | |

| Depreciation & Amortisation | |

| | | |

| | | |

| | | |

| (1,446 | ) | |

| | | |

| | | |

| | | |

| (1,183 | ) |

| Other income / (expense), net | |

| | | |

| | | |

| | | |

| 116 | | |

| | | |

| | | |

| | | |

| 84 | |

| Finance Income | |

| | | |

| | | |

| | | |

| 19 | | |

| | | |

| | | |

| | | |

| - | |

| Finance Expense | |

| | | |

| | | |

| | | |

| (729 | ) | |

| | | |

| | | |

| | | |

| (559 | ) |

| Profit / (loss) before tax | |

| | | |

| | | |

| | | |

| (119 | ) | |

| | | |

| | | |

| | | |

| 32 | |

| Income taxes (expense)/ benefit | |

| | | |

| | | |

| | | |

| (139 | ) | |

| | | |

| | | |

| | | |

| 6 | |

| Profit / (loss) for the period | |

| | | |

| | | |

| | | |

| (258 | ) | |

| | | |

| | | |

| | | |

| 38 | |

Equity and Debt:

(In INR millions)

| | |

31.12.2024 | | |

31.12.2023 | | |

30.09.2024 | |

| EQUITY | |

| 17,391 | | |

| 15,261 | | |

| 17,627 | |

| BORROWINGS | |

| | | |

| | | |

| | |

| Long term | |

| 26,306 | | |

| 20,386 | | |

| 26,905 | |

| Short term | |

| 7,326 | | |

| 6,334 | | |

| 7,719 | |

About Sify Technologies

A multiple times award winner of the Golden Peacock

from Institute of Directors for Corporate Governance, Sify Technologies is India’s most comprehensive ICT service & solution

provider. With Cloud at the core of our solutions portfolio, Sify is focussed on the changing ICT requirements of the emerging Digital

economy and the resultant demands from large, mid and small-sized businesses.

Sify’s infrastructure comprising state-of-the-art

Data Centers, the largest MPLS network, partnership with global technology majors and deep expertise in business transformation solutions

modelled on the cloud, make it the first choice of start-ups, SMEs and even large Enterprises on the verge of a revamp.

More than 10000 businesses across multiple verticals

have taken advantage of our unassailable trinity of Data Centers, Networks and Digital services and conduct their business seamlessly

from more than 1700 cities in India. Internationally, Sify has presence across North America, the United Kingdom and Singapore. Sify,

www.sify.com, Sify Technologies and www.sifytechnologies.com are registered trademarks of Sify Technologies Limited.

Non-IFRS Measures

This press release contains a financial measure not

prepared in accordance with IFRS. In particular, EBITDA is referred to as “non-IFRS” measure. The non-IFRS financial measure

we use may be calculated differently from, and therefore may not be comparable to, similarly titled measures used by other companies -

refer to the reconciliation provided in the table labelled Financial Highlights for more information. In addition, these non-IFRS measures

should not be considered in isolation as a substitute for, or as superior to, financial measures calculated in accordance with IFRS, and

our financial results calculated in accordance with IFRS and reconciliation to those financial statements should be carefully evaluated.

Forward Looking Statements

This press release contains forward-looking statements

within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act

of 1934, as amended. The forward-looking statements contained herein are subject to risks and uncertainties that could cause actual results

to differ materially from those reflected in the forward-looking statements. Sify undertakes no duty to update any forward-looking statements.

For a discussion of the risks associated with Sify’s

business, please see the discussion under the caption “Risk Factors” in the company’s Annual Report on Form 20-F/A for

the year ended March 31, 2024, which has been filed with the United States Securities and Exchange Commission and is available by accessing

the database maintained by the SEC at www.sec.gov, and Sify’s other reports filed with the SEC.

For further information, please contact:

|

Sify Technologies Limited

Mr. Praveen Krishna

Investor Relations & Public

Relations

+91 9840926523

praveen.krishna@sifycorp.com |

20:20 Media

Nikhila Kesavan

+91 9840124036

nikhila.kesavan@2020msl.com

|

Weber Shandwick

Lucia Domville

+1-212 546-8260

LDomville@webershandwick.com |

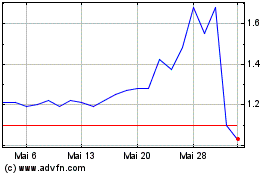

Sify Technologies (NASDAQ:SIFY)

Historical Stock Chart

Von Dez 2024 bis Jan 2025

Sify Technologies (NASDAQ:SIFY)

Historical Stock Chart

Von Jan 2024 bis Jan 2025