Filed Pursuant to Rule 424(b)(3)

Registration

No. 333-282536

PROSPECTUS

STARDUST

POWER INC.

6,500,000 Shares of Common Stock

This

prospectus relates to the offer and resale of up to 6,500,000 shares of common stock, par value $0.0001 per share (the “Common

Stock”), of Stardust Power Inc. (the “Company” or “Stardust Power”) by B. Riley Principal

Capital II, LLC (the “Selling Stockholder” or “B. Riley Principal Capital II”). The Company may,

in its discretion, elect to issue and sell Common Stock to the Selling Stockholder, from time to time after the date of this prospectus,

pursuant to a Common Stock Purchase Agreement we entered into with the Selling Stockholder on October 7, 2024 (the “Purchase

Agreement”). Such shares of Common Stock include (i) up to 6,436,306 shares that we may, in our sole discretion, elect

sell to B. Riley Principal Capital II, from time to time after the date of this prospectus, pursuant to the Purchase Agreement and (ii)

63,694 shares of Common Stock we issued to B. Riley Principal Capital II, upon our execution of the Purchase Agreement on October

7, 2024, as consideration for its commitment to purchase shares of our Common Stock that we may, in our sole discretion, direct

B. Riley Principal Capital II to purchase from us pursuant to the Purchase Agreement, from time to time after the date of this prospectus

and during the term of the Purchase Agreement.

We

are not selling any securities under this prospectus and will not receive any of the proceeds from the sale of our Common Stock by the

selling stockholder. However, we may receive up to $50,000,000 aggregate gross proceeds (the “Aggregate Commitment Amount”)

under the Purchase Agreement from sales of Common Stock we may elect to make to B. Riley Principal Capital II pursuant to the Purchase

Agreement after the date of this prospectus. See “The Committed Equity Financing” for a description of the Purchase

Agreement and “Selling Stockholder” for additional information regarding B. Riley Principal Capital II.

The

Selling Stockholder may sell or otherwise dispose of all or a portion of the Common Stock being offered in this prospectus in a number

of different ways and at varying prices. See “Plan of Distribution (Conflict of Interest)” for more information about

how the Selling Stockholder may sell or otherwise dispose of the Common Stock being offered in this prospectus. The Selling Stockholder

is an “underwriter” within the meaning of Section 2(a)(11) of the Securities Act of 1933, as amended (the “Securities

Act”).

We

will pay the expenses incurred in registering under the Securities Act the offer and sale of the shares of Common Stock to which this

prospectus relates by the selling stockholder, including legal and accounting fees. We have also engaged Seaport Global Securities LLC

(“Seaport”), a registered broker-dealer and Financial Industry Regulatory Authority, Inc. (“FINRA”)

member, to act as a “qualified independent underwriter” in this offering, whose fees and expenses will be borne by the Selling

Stockholder. See “Plan of Distribution (Conflict of Interest)” beginning on page 148.

Our

Common Stock is currently traded on The Nasdaq Global Select Market (“Nasdaq”) under the trading symbol “SDST.”

On October 4, 2024, the closing sale price of our Common Stock as reported by Nasdaq was $7.85.

We

are an “emerging growth company” as defined in Section 2(a) of the Securities Act, and a “smaller reporting company”

as defined in Item 10(f)(1) of Regulation S-K of the Securities Exchange Act of 1934, as amended (the “Exchange Act”),

and are subject to reduced public company reporting requirements. As such, we have elected to comply with reduced public company reporting

requirements. This prospectus complies with the requirements that apply to an issuer that is an emerging growth company.

Our

Chief Executive Officer, Roshen Pujari (hereinafter, Roshan Pujari) owns a majority of the voting power of our issued and outstanding

Common Stock. As a result, we qualify as a “controlled company” within the meaning of the corporate governance standards

of Nasdaq. We may take advantage of certain corporate governance exemptions afforded to a “controlled company” under the

rules of Nasdaq.

You

should read this prospectus and any prospectus supplement or amendment carefully before you invest in our Common Stock.

Investing

in our securities involves a high degree of risk. You should review carefully the risks and uncertainties described in the section titled

“Risk Factors” beginning on page 12 of this prospectus, and under similar headings in any amendments or supplements

to this prospectus in addition to documents incorporated by reference in this prospectus before

you make an investment decision.

Neither

the U.S. Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities, or passed

upon the accuracy or adequacy of this prospectus. Any representation to the contrary is a criminal offense.

Prospectus

dated November 6, 2024

ABOUT

THIS PROSPECTUS

This

prospectus is part of a registration statement on Form S-1 (the “Registration Statement”) that we filed with the U.S.

Securities and Exchange Commission (the “SEC”) using the “shelf” registration process. Under this shelf

registration process, we and the Selling Stockholder may, from time to time, issue, offer and sell the securities offered by them described

in this prospectus.

You

should rely only on the information contained or incorporated by reference in this prospectus and any pricing supplement to this prospectus.

We have not, and the Selling Stockholder has indicated that they have not, authorized anyone to give any information or make any representation

about the offering that is different from, or in addition to, what is contained in this prospectus and any pricing supplement, the related

registration statement or in any of the materials that we have incorporated by reference into this prospectus and any pricing supplement.

Therefore, if anyone does give you information of this type, you should not rely on it. We are issuing, and the Selling Stockholder is

offering to sell, and seeking offers to buy, our securities only in jurisdictions where offers and sales are permitted. The information

contained in this prospectus is accurate only as of the date of this prospectus, regardless of the time of delivery of this prospectus

or any sale of our securities. Our business, financial condition, results of operations and prospects may have changed since that date.

The

Selling Stockholder and its permitted transferees may use this prospectus to sell securities from time to time through any means described

in the section titled “Plan of Distribution (Conflict of Interest)”. More specific terms of any securities that the

Selling Stockholder and its permitted transferees offer and sell may be provided in a prospectus supplement that describes, among other

things, the specific amounts and prices of the securities being offered and the terms of the offering.

For

investors outside of the United States: Neither we nor the Selling Stockholder have done anything that would permit this offering or

possession or distribution of this prospectus in any jurisdiction where action for that purpose is required, other than in the United

States. Persons outside the United States who come into possession of this prospectus must inform themselves about, and observe any restrictions

relating to, the offering of our securities and the distribution of this prospectus outside the United States.

We

may also provide a prospectus supplement or post-effective amendment to the Registration Statement to add information to, or update or

change information contained in, this prospectus. Any statement contained in this prospectus will be deemed to be modified or superseded

for purposes of this prospectus to the extent that a statement contained in such prospectus supplement or post-effective amendment modifies

or supersedes such statement. Any statement so modified will be deemed to constitute a part of this prospectus only as so modified, and

any statement so superseded will be deemed not to constitute a part of this prospectus.

You

should read both this prospectus and any applicable prospectus supplement or post-effective amendment to the Registration Statement together

with the additional information to which we refer you in the sections of this prospectus titled “Where You Can Find More Information”

and “Incorporation of Certain Information by Reference.”

TRADEMARKS

This

document contains references to trademarks and service marks belonging to other entities. Solely for convenience, trademarks and trade

names referred to in this Registration Statement may appear without the ® or TM symbols, but such references are not intended to

indicate, in any way, that the applicable licensor will not assert, to the fullest extent under applicable law, its rights to these trademarks

and trade names. The Company does not intend its use or display of other companies’ trade names, trademarks or service marks to

imply a relationship with, or endorsement or sponsorship of the Company by, any other companies.

TABLE

OF CONTENTS

FREQUENTLY

USED TERMS

As

used in this prospectus, unless otherwise noted or the context otherwise requires, references to:

“Additional

Investor Legal Fee Reimbursement Amount” means $5,000 per fiscal quarter the Company has

agreed to reimburse The Selling Stockholder for the reasonable legal fees and disbursements of The Selling Stockholder’s

legal counsel in connection with quarterly and annual bring-down due diligence investigations and related matters as contemplated by

the Purchase Agreement.

“Aggregate

Commitment Amount” means $50,000,000.

“Amended

and Restated Registration Rights Agreement” means the amended and restated registration rights agreement, dated July 8, 2024,

by and among GPAC II, the Sponsor and certain equity holders of Stardust Power.

“Beneficial

Ownership Limitation” means the limit in which the Company may not issue or sell any shares of Common Stock to The Selling

Stockholder under the Purchase Agreement which, when aggregated with all other shares of Common Stock then beneficially owned by the

Selling Stockholder and its affiliates (as calculated pursuant to Section 13(d) of the Exchange Act), and Rule 13d-3 thereunder), would

result in the Selling Stockholder beneficially owning more than 4.99% of the outstanding shares of Common Stock.

“Business

Combination” means the Transactions contemplated by the Business Combination Agreement.

“Business

Combination Agreement” means the business combination agreement, dated as of November 21, 2023 (as further amended by the First

Amendment and Second Amendment), by and among GPAC II, First Merger Sub, Second Merger Sub and Stardust Power, as it may be amended and

supplemented from time to time.

“business

day” means a day other than a Saturday, Sunday or other day on which commercial banks in New York, New York are authorized

or required by law to close.

“Bylaws”

means the bylaws of the Company that became effective upon the Domestication.

“BRPI”

means B. Riley Principal Investments, LLC.

“BRF”

means B. Riley Financial, Inc.

“BRS”

means B. Riley Securities, Inc.

“Certificate

of Incorporation” means the certificate of incorporation of the Company that became effective upon the Domestication.

“Commencement”

means the initial satisfaction of each of the conditions to the Selling Stockholder’s purchase obligations set forth in the Purchase

Agreement.

“Commencement

Date” means the date on which the Registration Statement has been declared effective by the SEC and all other conditions to

the Selling Stockholder’s obligations to purchase Stardust Power Common Stock set forth in the Purchase Agreement have been initially

satisfied.

“Change

in Control” means (i) a purchase, sale, exchange, merger, business combination or other transaction or series of related transactions

in which substantially all of the GPAC II Common Stock is, directly or indirectly, converted into cash, securities or other property

or non-cash consideration, (ii) a direct or indirect sale, lease, exchange or other transfer (regardless of the form of the transaction)

in one transaction or a series of related transactions of a majority of the Surviving Company’s assets, as determined on a consolidated

basis, to a third party or third parties acting as a “group” (as defined in Section 13(d)(3) of the Exchange Act) or (iii)

any transaction or series of transactions that results, directly or indirectly, in the stockholders of the Surviving Company as of immediately

prior to such transactions holding, in the aggregate, less than 50% of the voting equity interests of the Surviving Company (or any successor

of the Surviving Company) immediately after the consummation thereof, in the case of each of clause (i), (ii) or (iii), whether by amalgamation,

merger, consolidation, arrangement, tender offer, recapitalization, purchase, issuance, sale or transfer of equity interests or assets,

or otherwise.

“Class

A Ordinary Shares” or “Public Shares” means the Class A ordinary shares, par value $0.0001 per share, of

GPAC II.

“Class

B Ordinary Shares” means the Class B ordinary shares, par value $0.0001 per share, of GPAC II.

“Closing”

means the closing of the Business Combination.

“Closing

Date” means the date of the Closing or July 8, 2024.

“Code”

means the Internal Revenue Code of 1986, as amended.

“Common

Stock” means GPAC II Common Stock following the Closing.

“Company”

means the post-combination company at Closing when GPAC II changed its name from “Global Partner Acquisition Corp II” to

“Stardust Power Inc.”

“Company

Support Agreements” means those certain support agreements dated as of November 21, 2023 by and among GPAC II, Stardust Power

and certain Stardust Power Stockholders.

“Continental”

or “Transfer Agent” means Continental Stock Transfer & Trust Company.

“Controlled

Company Event” are to such time that the Company is no longer a “Controlled Company” pursuant to Nasdaq Listing

Rule 5615I(1).

“Convertible

Equity Agreements” means, collectively, the Convertible Equity Agreement, dated April 24, 2024, by and between Stardust Power

and American Investor Group Direct LLC (“AIGD”) for $2,000,000, the Convertible Equity Agreement, dated April 30,

2024 with an individual for $50,000, and the Convertible Equity Agreement, dated April 23, 2024 with an individual for $50,000, all of

which automatically converted into 55,889 shares of the Common Stock immediately prior to the First Effective Time.

“DGCL”

means the Delaware General Corporation Law, as amended.

“DLLCA”

means the Delaware Limited Liability Company Act, as amended.

“DTC”

means The Depository Trust Company.

“Equity

Value” means enterprise value (a) plus cash as of the Measurement Time (b) minus Indebtedness of Stardust Power

as of the Measurement Time (c) minus the Stardust Power Transaction Expenses.

“Exchange

Act” means the U.S. Securities Exchange Act of 1934, as amended.

“Exchange

Cap” means the cap under the applicable Nasdaq rules, in which in no event may the Company issue to the Selling Stockholder

under the Purchase Agreement more than 9,569,701 shares of Common Stock, which number of shares is equal to 19.99% of the shares

of Common Stock outstanding immediately prior to the execution of the Purchase Agreement.

“Exchanged

Company Restricted Common Stock” means the issued and outstanding restricted stock of the Company following the automatic conversion

of the Stardust Power Restricted Stock following the First Effective Time pursuant to the Business Combination Agreement.

“Financial

Derivative/Hedging Arrangement” means any transaction (including an agreement with respect thereto) which is a rate swap transaction,

basis swap, forward rate transaction, commodity swap, commodity option, equity or equity index swap, equity or equity index option, bond

option, interest rate option, foreign exchange transaction, cap transaction, floor transaction, collar transaction, currency swap transaction,

cross-currency rate swap transaction, currency option or any combination of these transactions.

“FINRA”

means the Financial Industry Regulatory Authority, Inc.

“First

Amendment” means Amendment No. 1 to the Business Combination Agreement, dated as of April 24, 2024, by and among GPAC II, First

Merger Sub, Second Merger Sub and Stardust Power, as amended and supplemented from time to time.

“First

Effective Time” means the time at which the First Merger became effective.

“First

Merger” means the merger of First Merger Sub with and into Stardust Power, with Stardust Power being the surviving company

and continuing as a direct, wholly owned subsidiary of GPAC II.

“First

Merger Sub” means Strike Merger Sub I, Inc., a Delaware corporation and direct wholly-owned subsidiary of GPAC II.

“GAAP”

means U.S. generally accepted accounting principles.

“Governmental

Authority” means any federal, state, provincial, municipal, local, or foreign government, governmental authority, regulatory

or administrative agency, governmental commission, department, board, bureau, agency, or instrumentality, arbitrator, arbitral body (public

or private), court or tribunal.

“Governing

Documents” means the Certificate of Incorporation and the Bylaws.

“Government

Official” means any official or employee of any directly or indirectly government-owned or controlled entity, and any officer

or employee of a public international organization, as well as any person acting in an official capacity for or on behalf of any such

entity or for or on behalf of any such public international organization.

“GPAC

II” means Global Partner Acquisition Corp II, a Cayman Islands exempted company, prior to the consummation of the Domestication,

and a Delaware corporation after the Domestication.

“GPAC

II Common Stock” means, collectively, following the Domestication, the shares of common stock, par value $0.0001 per share,

of GPAC II.

“GPAC

II Public Shareholders” means the holders of Class A Ordinary Shares that were sold in the initial public offering (whether

they were purchased in the initial public offering or thereafter in the open market).

“GPAC

II Shareholder” means a holder of Ordinary Shares.

“Indebtedness”

means, with respect to any Person, without duplication, any obligations (whether or not contingent) consisting of (a) the outstanding

principal amount of and accrued and unpaid interest on, and other payment obligations for, borrowed money, or payment obligations issued

or incurred in substitution or exchange for payment obligations for borrowed money, (b) amounts owing as deferred purchase price for

property or services, including “earnout” payments, (c) payment obligations evidenced by any promissory note, bond, debenture,

mortgage or other debt instrument or debt security, (d) contingent reimbursement obligations with respect to letters of credit, bankers’

acceptance or similar facilities (in each case to the extent drawn), (e) payment obligations of a third party secured by (or for which

the holder of such payment obligations has an existing right, contingent or otherwise, to be secured by) any Lien on assets or properties

of such Person, whether or not the obligations secured thereby have been assumed, (f) obligations under capitalized leases, (g) obligations

under any Financial Derivative/Hedging Arrangement, (h) any other indebtedness or obligation reflected or required to be reflected as

indebtedness in a consolidated balance sheet, in accordance with GAAP, (i) all obligations for cash incentive, severance, deferred compensation

or similar obligations in respect of any current or former employee or other individual service provider of Stardust Power (including

the employer portion of any payroll social security, unemployment or similar taxes), accrued prior to the Closing Date, (j) liabilities,

including accounts payable to trade creditors and accrued expenses or purchase commitments, or (k) guarantees, make-whole agreements,

hold harmless agreements or other similar arrangements with respect to any amounts of a type described in clauses (a) through (j) above

and (l) with respect to each of the foregoing, any interest, breakage costs, prepayment or redemption penalties or premiums, or other

fees or obligations (including unreimbursed expenses or indemnification obligations for which a claim has been made), in each case for

this clause (l), to the extent unpaid and accrued as of the Closing Date; provided, however, that Indebtedness will not

include any amounts included as Transaction Expenses.

“initial

business combination” means a merger, capital stock exchange, asset acquisition, stock purchase, reorganization or similar

business combination with one or more businesses.

“Initial

Investor Legal Fee Reimbursement Holdback Amount” means $50,000 the Company has agreed to pay by having the

Selling Stockholder withhold an amount in cash equal to 50% of the total aggregate purchase

price payable to us by the Selling Stockholder for the Purchase Shares it is required to purchase from us in the first (and, if necessary,

each subsequent) Market Open Purchase and Intraday Purchase (as applicable) we effect under

the Purchase Agreement, if any, until the Selling Stockholder has withheld an aggregate cash amount equal to $50,000.

“Initial

Investor Legal Fee Reimbursement Amount” means $25,000 reimbursed to the Selling Stockholder for the reasonable legal fees

and disbursements of the Selling Stockholder’s legal counsel in connection with the transactions contemplated by the Purchase Agreement

and the Registration Rights Agreement the Company has paid prior to our execution of the Purchase Agreement and Registration Rights Agreement.

“initial

public offering” is GPAC II’s initial public offering, which GPAC II completed on January 14, 2021.

“Intraday

Purchase” means any trading day that would qualify as a Purchase Date, whether or not a Market Open Purchase is effected on

such Purchase Date, a specified number of shares of Common Stock.

“Intraday

VWAP Minimum Price Threshold” means the applicable minimum price threshold specified by Stardust Power in the Intraday VWAP

Purchase Notice for such Intraday VWAP Purchase (or if no such minimum price threshold is specified by Stardust Power in the Intraday

VWAP Purchase Notice, the minimum price threshold for such Intraday VWAP Purchase will be equal to 75% of the closing sale price of Stardust

Power Common Stock on the trading day immediately prior to the applicable Purchase Date).

“Intraday

VWAP Purchase” means the purchase of Stardust Power Common Stock by the Selling Stockholder when either (i) Stardust Power

does not wish to effect a VWAP Purchase on a trading day that it otherwise could have selected as a Purchase Date for a VWAP Purchase

(or Stardust Power fails to timely deliver to the Selling Stockholder a VWAP Purchase Notice for a VWAP Purchase on such trading day)

or (ii) Stardust Power has timely delivered to the Selling Stockholder a VWAP Purchase Notice for a VWAP Purchase on a Purchase Date,

and the VWAP Purchase Ending Time for such VWAP Purchase occurs prior to 3:30 p.m., Eastern time, on such Purchase Date, and in either

case, Stardust Power exercises the right, to direct the Selling Stockholder to purchase, on such trading day (which may be the same Purchase

Date as a VWAP Purchase, if Stardust Power has determined to effect a VWAP Purchase on such trading day), an amount of Common Stock up

to the Maximum Intraday VWAP Purchase Amount at the Intraday VWAP Purchase Price.

“Intraday

VWAP Purchase Commencement Time” means the latest of (i) Selling Stockholder’s email acknowledgement of its receipt of

an Intraday VWAP Purchase Notice, (ii) the VWAP Purchase Ending Time of a VWAP Purchase effected on the same Purchase Date (as applicable)

and (iii) the Intraday VWAP Purchase Ending Time of the most recent Intraday VWAP Purchase effected on the same Purchase Date (as applicable).

“Intraday

VWAP Purchase Ending Time” means the earliest to occur of (1) the official close of regular trading on Nasdaq, (2) such time

that the total aggregate volume of shares of Stardust Power Common Stock traded on Nasdaq reaches the applicable Intraday VWAP Purchase

Volume Maximum (as applicable) for such VWAP Purchase and (3) such time that the trading price of a share of Stardust Power Common Stock

on Nasdaq falls below the Intraday VWAP Minimum Price Threshold (as applicable).

“Intraday

VWAP Purchase Notices” means an irrevocable written purchase notice, after 10:00 a.m., Eastern time (and after the VWAP Purchase

Ending Time, if Stardust Power has effected a VWAP Purchase on such Purchase Date, and after the Intraday VWAP Purchase Ending Time of

the most recent Intraday VWAP Purchase effected on the same Purchase Date, as applicable), and prior to 3:30 p.m., Eastern time, on such

Purchase Date.

“Intraday

VWAP Purchase Percentage” means the percentage that shall be used for calculating the Intraday VWAP Purchase Volume Maximum

and the Intraday Maximum VWAP Purchase Amount applicable to such Intraday VWAP Purchase, which shall not exceed 25%.

“Intraday

VWAP Purchase Price” means the purchase price for an Intraday VWAP Purchase.

“Intraday

VWAP Purchase Valuation Period” means the period for each Intraday VWAP Purchase, beginning at the Intraday VWAP Purchase Commencement

Time and ending at the applicable Intraday VWAP Purchase Ending Time.

“Intraday

VWAP Purchase Volume Maximum” means the Intraday VWAP Purchase Percentage specified by Stardust Power in the applicable Intraday

VWAP Purchase Notice for such Intraday VWAP Purchase (giving effect to any adjustment as necessary to give effect to the applicable Maximum

Intraday VWAP Purchase Amount limitation).

“IR

Act” means the Inflation Reduction Act of 2022.

“JOBS

Act” means the Jumpstart Our Business Startups Act of 2012.

“KNAV”

means KNAV CPA LLP, the Company’s auditor as of September 17, 2024.

“Lien”

means any mortgage, deed of trust, pledge, hypothecation, easement, right of way, purchase option, right of first refusal, covenant,

restriction, security interest, license, title defect, encroachment or other survey defect, or other lien or encumbrance of any kind,

except for any restrictions arising under any applicable Securities Laws.

“Limit

Order Discontinue Election” means the first sale of Common Stock (unrelated to the Committed Equity Facility) at a price below

the applicable VWAP Minimum Price Threshold specified by the Company in the VWAP Purchase Notice during the applicable VWAP Purchase

Valuation Period will trigger the VWAP Purchase Ending Time of the VWAP Purchase Valuation Period for such VWAP Purchase.

“Limit

Order Continue Election” means when such VWAP Purchase of Stardust Power Common Stock will not cause the VWAP Purchase Valuation

Period for such VWAP Purchase to end, but rather shall be disregarded for purposes of determining whether the VWAP Purchase Volume Maximum

is reached and for purposes of calculating the purchase price for such VWAP Purchase.

“Market

Open Purchase” means a purchase of Common Stock in which the Company directs the Selling Stockholder to purchase a specified

number of shares of Common Stock.

“Market

Open Purchase Maximum Amount” means the lesser of: (i) 1,000,000 shares of Common Stock and (ii) the Market Open Purchase Percentage,

which the Company specifies in the applicable Market Open Purchase Notice for such Market Open Purchase.

“Market

Open Purchase Notice” means a written notice of a Market Open Purchase provided to the Selling Stockholder.

“Market

Open Purchase Percentage” means a certain percentage (not to exceed 25.0%), which the Company will specify in the applicable

Market Open Purchase Notice (as defined below) for such Market Open Purchase, of the total aggregate number (or volume) of shares of

the Common Stock traded on Nasdaq during the applicable Market Open Purchase Valuation Period for such Market Open Purchase.

“Market

Open Purchase Share Amount” means such specified number of shares to be purchased by the Selling Stockholder, adjusted as necessary

to give effect to the applicable Market Open Purchase Maximum Amount as set forth in the Purchase Agreement.

“Market

Open Purchase Valuation Period” means the period beginning at the official open of the regular trading session on Nasdaq on

the applicable Purchase Date for such Purchase, and ending at the earliest to occur of (i) 3:59 p.m., New York City time, on such Purchase

Date or such earlier time publicly announced by the trading market as the official close of the regular trading session on such Purchase

Date, (ii) such time that the total aggregate number (or volume) of shares of Common Stock traded on Nasdaq during such Market Open Purchase

Valuation Period (calculated in accordance with the Purchase Agreement) reaches the applicable share volume maximum amount for such Market

Open Purchase and (iii) if we further specify in the applicable Market Open Purchase Notice for such Market Open Purchase that a “limit

order discontinue election” shall apply to such Market Open Purchase, such time that the trading price of our Common Stock on Nasdaq

during such Market Open Purchase Valuation Period (calculated in accordance with the Purchase Agreement) falls below the applicable minimum

price threshold for such Market Open Purchase specified by us in the Market Open Purchase Notice for such Market Open Purchase, or if

we do not specify a minimum price threshold in such Market Open Purchase Notice, a price equal to 75.0% of the closing sale price of

the Common Stock on the trading day immediately prior to the applicable Purchase Date for such purchase, less a fixed 3.0% discount to

the VWAP for such Market Open Purchase Valuation Period (calculated in accordance with the Purchase Agreement).

“Market

Open Purchase Share Volume Maximum” means he applicable share volume maximum amount for a Market Open Purchase calculated by

dividing (a) the applicable Market Open Purchase Share Amount for such Market Open Purchase, by (b) the Market Open Purchase Percentage

we specified in the applicable Market Open Purchase Notice for such Market Open Purchase.

“Material

Adverse Effect” means any event, change, circumstance or development that has or would reasonably be expected to have a material

adverse effect on the assets, business, results of operations or financial condition of the Company; provided, however, that in no event

would any of the following (or the effect of any of the following), alone or in combination, be deemed to constitute, or be taken into

account in determining whether there has been or will be, a “Material Adverse Effect”: (i) any change or development in applicable

laws or GAAP or any official interpretation thereof, (ii) any change or development in interest rates or economic, political, legislative,

regulatory, business, financial, commodity, currency or market conditions generally affecting the economy or the industry in which the

Company operates, (iii) the announcement or the execution of the Business Combination Agreement, the pendency or consummation of the

Mergers or the performance of the Business Combination Agreement, including the impact thereof on relationships, contractual or otherwise,

with customers, suppliers, licensors, distributors, partners, providers and employees (provided, that the exceptions in this clause (iii)

any change generally affecting any of the industries or markets in which the Company operates or the economy as a whole), (iv) any earthquake,

hurricane, tsunami, tornado, flood, mudslide, wild fire or other natural disaster, epidemic, disease outbreak, pandemic, weather condition,

explosion fire, act of God or other force majeure event, (v) any national or international political or social conditions in countries

in which, or in the proximate geographic region of which, the Company operates, including the engagement by the United States or such

other countries in hostilities or the escalation thereof, whether or not pursuant to the declaration of a national emergency or war,

or the occurrence or the escalation of any military or terrorist attack upon the United States or such other country, or any territories,

possessions or diplomatic or consular offices of the United States or such other countries or upon any United States or such other country

military installation, equipment or personnel and (vi) any failure of the Company to meet any projections, forecasts or budgets; provided,

that clause (vi) shall not prevent or otherwise affect a determination that any change or effect underlying such failure to meet projections

or forecasts has resulted in, or contributed to, or would reasonably be expected to result in or contribute to, a Material Adverse Effect

(to the extent such change or effect is not otherwise excluded from this definition of Material Adverse Effect), except in the case of

clause (i), (ii), (iii), (iv) and (v) to the extent that such change has a disproportionate impact on the Company, as compared to other

industry participants.

“Maximum

VWAP Purchase Amount” means such number of shares of Stardust Power Common Stock equal to the lesser of (a) 1 million shares

and (b) the total aggregate number (or volume) of shares of Stardust Power Common Stock actually traded on Nasdaq during the applicable

VWAP Purchase Valuation Period, multiplied by the VWAP Purchase Percentage specified by Stardust Power in the applicable VWAP Purchase

Notice for such VWAP Purchase (excluding the first and last regular way trade per above and, if a Limit Order Continue Election is made,

excluding each transaction in the Common Stock in which the trading price of a share of Common Stock is below the applicable VWAP Minimum

Price Threshold).

“Maximum

Intraday VWAP Purchase Amount” means such number of shares of Stardust Power Common Stock equal to the lesser of (a) 1 million

shares and (b) the total aggregate number (or volume) of shares of Common Stock actually traded on Nasdaq during the applicable Intraday

VWAP Purchase Valuation Period, multiplied by the Intraday VWAP Purchase Percentage specified by Stardust Power in the applicable Intraday

VWAP Purchase Notice for such Intraday VWAP Purchase (excluding the first and last regular way trade per above and, if a Limit Order

Continue Election is made, excluding each transaction in Stardust Power Common Stock in which the trading price of a share of Common

Stock is below the applicable Intraday VWAP Minimum Price Threshold).

“Measurement

Time” means 12:01 a.m. New York time on the Closing Date.

“Merger

Consideration” means the aggregate number of shares of GPAC II Common Stock equal to the Equity Value divided by (b) $10.00.

“Mergers”

means the First Merger and the Second Merger.

“Minimum

Price Threshold” means a price equal to 75.0% of the closing sale price of the Common Stock on the trading day immediately

prior to the applicable Purchase Date for such purchase.

“Nasdaq”

means The Nasdaq Global Market.

“Nasdaq

Commencement” means the beginning at the official open of the regular trading session on Nasdaq on the applicable Purchase

Date.

“Non-Redemption

Agreements” means those agreements between the Sponsor and several unaffiliated third parties, who were GPAC II Public Shareholders,

pursuant to which such third parties agreed not to redeem (or to validly rescind any redemption requests on) an aggregate of 1,503,254

Class A Ordinary Shares in connection with the 2024 Extension Amendment Proposal. In exchange for the foregoing commitments not to redeem

such Class A Ordinary Shares, at Closing 127,777 shares (“Non-Redemption Shares”) of Common Stock were issued to such

unaffiliated third parties for no consideration.

“Ordinary

Shares” means, collectively, the Class A Ordinary Shares and the Class B Ordinary Shares.

“Per

Share Consideration” means the number of shares of GPAC II Common Stock equal to the Merger Consideration divided by the number

of shares of Stardust Power Fully-Diluted Shares.

“Person”

means any individual, firm, corporation, partnership, limited liability company, incorporated or unincorporated association, joint venture,

joint stock company, Government Official, Governmental Authority or other entity of any kind.

“PIPE

Financing” means the Company consummating the transactions contemplated by the PIPE Subscription

Agreements with the PIPE Investors pursuant to which the PIPE Investors agreed to purchase a total of 1,077,541 shares of Common Stock

in a private placement at a price of $9.35 per share, for an aggregate commitment amount of $10,075,000.

“PIPE

Investors” means a large institutional investor and two other investors that entered into PIPE Subscription Agreements.

“PIPE

Subscription Agreements” means the subscription agreements entered into by and between GPAC II (at the time, and now Stardust

Power) and the PIPE Investors on June 20, 2024.

“Private

Warrants” means warrants representing the right to purchase shares of Stardust Power Common Stock.

“Public

Warrants” or “Redeemable Warrants” means our detachable redeemable warrants and our distributable redeemable

warrants.

“Purchase

Agreement” means the purchase agreement, dated October 7, 2024 by and between Stardust Power and the Selling Stockholder.

“Purchase

Date” means any trading day selected by Stardust Power from and after the Commencement Date.

“QIU

Fee Reimbursement Holdback Amount” means the amount B. Riley Principal Capital II has withheld (in addition to the Initial

Investor Legal Fee Reimbursement Holdback Amount of $50,000 that B. Riley Principal Capital II will also withhold from such aggregate

purchase price amounts) equal to $50,000 as compensation for their services,

“Registration

Rights Agreement” means the registration rights agreement, dated October 7, 2024 by and between Stardust Power and

the Selling Stockholder.

“SAFEs”

means, collectively, (i) the Simple Agreement of Future Equity (“SAFE”), dated August 15, 2023 (as amended on November

18, 2023 and as further amended and restated on April 24, 2024, the “August 2023 SAFE”), that provided $2,000,000

from AIGD, (ii) the SAFE, dated November 18, 2023, that provided $3,000,000 from AIGD (as amended and restated on April 24, 2024, the

“November 2023 SAFE”), and (iii) a SAFE with an individual, dated February 23, 2024 (as amended on May 1, 2024, the

“February 2024 SAFE”), that provided $200,000. Immediately prior to the First Effective Time, the SAFEs automatically

converted into the number of shares of Stardust Power Common Stock equal to 138,393 shares of Stardust Power Common Stock immediately

prior to Closing.

“SAFE

Conversion” means the automatic conversion of the SAFEs into the number of shares of Stardust Power Common Stock equal to 138,393

shares of Stardust Power Common Stock immediately prior to the First Effective Time in accordance with the terms of the SAFEs.

“Seaport”

means Seaport Global Securities LLC.

“SEC”

means the United States Securities and Exchange Commission.

“Second

Effective Time” means the time at which the Second Merger becomes effective.

“Second

Amendment” means Amendment No. 2 to the Business Combination Agreement, dated as of June 20, 2024, by and among GPAC II, First

Merger Sub, Second Merger Sub and Stardust Power, as amended and supplemented from time to time.

“Second

Merger” means the merger of Stardust Power with and into Second Merger Sub, with Second Merger Sub being the Surviving Company

and continuing as a direct, wholly owned subsidiary of GPAC II.

“Second

Merger Sub” means Strike Merger Sub II, LLC, a Delaware limited liability company and a direct and wholly owned subsidiary

of GPAC II.

“Securities

Act” means the Securities Act of 1933, as amended.

“Selling

Stockholder” means B. Riley Principal Capital II, LLC.

“SPAC”

is one or more special purpose acquisition companies, including, when required by the context, Stardust Power.

“Sponsor”

means Global Partner Sponsor II LLC, a Delaware limited liability company, the managers of which are Chandra R. Patel, Richard C. Davis

and Jarett Goldman.

“Sponsor

Earnout Shares” refers to the 1,000,000 shares of GPAC II Common Stock held by Sponsor that are subject to forfeiture pursuant

to the Sponsor Letter Agreement.

“Sponsor

Letter Agreement” means the agreement, dated November 21, 2023, as amended, by and among the Sponsor and the directors and

officers of GPAC II, pursuant to which, among other things, the Sponsor agreed to, among other things, (a) vote, in their capacity as

shareholders of GPAC II, in favor of the Business Combination Agreement and the transactions, (b) be bound by certain transfer restrictions

with respect to its Ordinary Shares prior to Closing, (c) terminate certain lock-up provisions included in that certain Letter Agreement,

dated as of January 11, 2021, as amended by that certain Letter Agreement Amendment, dated as of January 13, 2023, by and among Sponsor

and GPAC II, on the terms and subject to the conditions set forth in the Sponsor Letter Agreement, (d) fully vest 3,000,000 of its Class

B Ordinary Shares immediately upon the Closing (and convert into GPAC II Common Stock), (e) subject 1,000,000 of its Class B Ordinary

Shares to vesting (or forfeiture) on the basis of achieving (or failing to achieve) certain trading price thresholds following the Closing,

(f) forfeit 3,500,000 of its Class B Ordinary Shares (reduced by any Non-Redemption Shares) for no consideration, and (g) waive any anti-dilution

adjustment to the conversion ratio set forth in GPAC II’s governing documents or similar protection with respect to the GPAC II

Common Stock.

“Sponsor

Loan” means that certain Investment Agreement by and between GPAC II and Sponsor, dated as of January 13, 2023, together with

any additional loans issued by Sponsor to GPAC II prior to closing of the Business Combination.

“Stardust

Power” or “Stardust” means Stardust Power Inc., a Delaware corporation, and includes its wholly owned subsidiary,

Stardust Power LLC, a Delaware corporation.

“Stardust

Power Common Stock” means the common stock of Stardust Power, par value $0.00001 per share.

“Stardust

Power Fully-Diluted Shares” means the sum of (without duplication) (a) the aggregate number of shares of Stardust Power Common

Stock issued and outstanding immediately prior to the First Effective Time, including without limitation any Stardust Power Restricted

Stock whether vested or unvested, plus (b) the aggregate number of shares of Stardust Power Common Stock issuable upon exercise

of all vested and unvested Stardust Power Options as of immediately prior to the First Effective Time but, for the avoidance of doubt,

excluding any unissued Stardust Power Options plus (c) the number of shares of Stardust Power Common Stock issuable upon the SAFE

Conversion.

“Stardust

Power Option” means an option to purchase Stardust Power Common Stock.

“Stardust

Power Restricted Stock” means (a) shares of Stardust Power Common Stock acquired by the holder thereof pursuant to a “Restricted

Stock Purchase Agreement” or (b) pursuant to an award under the Stardust 2023 Plan, including pursuant to an early exercise of

a Stardust Power Option, and which shares of Stardust Power Common Stock remain unvested under the terms of the “Restricted Stock

Purchase Agreement” or the “Stock Option Agreement - Early Exercise,” as applicable.

“Stardust

2023 Plan” means the Stardust Power’s 2023 Equity Incentive Plan and each other plan that provides for the award, to

any current or former director, manager, officer, employee, individual independent contractor or other service provider of Stardust Power,

of rights of any kind to receive equity securities of Stardust Power or benefits measured in whole or in part by reference to securities

of Stardust Power.

“Stardust

Power Transaction Expenses” means all Transaction Expenses of Stardust Power as of the Measurement Time.

“Stardust

Power 2024 Equity Plan” means the Stardust Power 2024 Equity Plan, which became effective at Closing.

“Stockholder

Agreement” means the agreement, dated July 8, 2024, by and among the Sponsor, Roshan Pujari and his affiliates, providing the

Sponsor with the right to designate one nominee to the Stardust Power Inc. board of directors until the date upon which the Sponsor’s

and it’s affiliates’ aggregate ownership interest of the issued and outstanding Common Stock decreases to one-half of their

aggregate initial ownership interest as of the Closing.

“Support

Agreements” means the Company Support Agreements and the Sponsor Letter Agreement.

“sustainability”

or “sustainable” as used in this prospectus refers to business operations and processes that Stardust Power believes

generally have a positive environmental and/or social impact.

“Trading

Day” means a day on which Stardust Power’s Common Stock is traded on a national securities exchange.

“Transaction

Expenses” means any fees, costs and expenses incurred or subject to reimbursement by the GPAC II and Stardust Power, whether

accrued for or not, in each case in connection with the transactions contemplated by the Business Combination Agreement and its ancillary

agreements, including (a) any brokerage fees, commissions, finders’ fees or financial advisory fees, and, in each case, related

costs and expenses, (b) any fees, costs and expenses of counsel, accountants or other advisors or service providers, (c) any fees, costs

and expenses or payments of any of the Company related to any transaction bonus, discretionary bonus, change-of-control payment, retention

or other compensatory payments or obligations made to any employee of the Company as a result of the execution of the Business Combination

Agreement and its ancillary agreements or in connection with the transactions contemplated hereby and thereby, including in combination

with any other event (including the employer portion of any payroll, social security, unemployment or similar taxes) and (d) and solely

with respect to GPAC II, (i) any extension expenses, (ii) any amounts owed pursuant to the Sponsor Loan and (iii) any operating or other

ordinary course expenses from and after October 3, 2023.

“Transactions”

means the transactions contemplated by the Business Combination Agreement to occur at or immediately prior to the Closing, including

the Domestication and the Mergers.

“Threshold

Price” means $1.00 or greater as of the closing sale price of the Common Stock on Nasdaq the trading day immediately prior

to a Purchase Date.

“VWAP”

means, for any specified period, the volume weighted average price of Stardust Power’s Common Stock on Nasdaq for such specified

period, as reported by Bloomberg Financial LP using the AQR function (excluding, as applicable, (i) the above-referenced opening/first

purchase transaction, (ii) the last sale transaction in the Common Stock during the primary trading session on Nasdaq on such Purchase

Date and (iii) if a Limit Order Continue Election is made, each transaction in the Common Stock in which the trading price of a share

of Common Stock is below the applicable VWAP Minimum Price Threshold or below the applicable Intraday VWAP Minimum Price Threshold (as

applicable)).

“VWAP

Minimum Price Threshold” means the applicable minimum price threshold specified by Stardust Power in the Intraday VWAP Purchase

Notice for such Intraday VWAP Purchase (or if no such minimum price threshold is specified by Stardust Power in the Intraday VWAP Purchase

Notice, the minimum price threshold for such Intraday VWAP Purchase will be equal to 75% of the closing sale price of the Stardust Power

Common Stock on the trading day immediately prior to the applicable Purchase Date).

“VWAP

Purchase” means the purchase of Stardust Power Common Stock by the Selling Stockholder on any trading day selected by Stardust

Power from and after the Commencement Date, provided the closing sale price of the Stardust Power Common Stock on the immediately preceding

trading day is not less than $1.00, in which Stardust Power directs the Selling Stockholder, by the delivery to the Selling Stockholder

of a VWAP Purchase Notice to purchase on such Purchase Date, the VWAP Purchase Share Amount, at the applicable purchase price.

“VWAP

Purchase Commencement Time” means the time beginning at 9:30:01am, Eastern time on any applicable Purchase Date.

“VWAP

Purchase Ending Time” means the earliest to occur of (1) the official close of regular trading on Nasdaq, (2) such time that

the total aggregate volume of shares of Stardust Power Common Stock traded on Nasdaq reaches the applicable VWAP Purchase Volume Maximum

(as applicable) for such VWAP Purchase and (3) such time that the trading price of a share of Stardust Power Common Stock on Nasdaq falls

below the VWAP Minimum Price Threshold (as applicable).

“VWAP

Purchase Notice” means an irrevocable written purchase notice, after 6:00 a.m., Eastern time, and prior to 9:00 a.m., Eastern

time, on any Purchase Date.

“VWAP

Purchase Percentage” means the percentage that shall be used for calculating the VWAP Purchase Volume Maximum and the Maximum

VWAP Purchase Amount applicable to such VWAP Purchase, which shall not exceed 25%.

“VWAP

Purchase Valuation Period” means the period for each VWAP Purchase, beginning at the VWAP Purchase Commencement Time and ending

at the applicable VWAP Purchase Ending Time.

“VWAP

Purchase Volume Maximum” means the VWAP Purchase Share Amount to be purchased by the

Selling Stockholder, divided by (b) the VWAP Purchase Percentage specified by Stardust Power in the applicable VWAP Purchase Notice for

such VWAP Purchase (giving effect to any adjustment as necessary to give effect to the applicable Maximum VWAP Purchase Amount limitation).

“VWAP

Purchase Share Amount” means an amount of Stardust Power Common Stock, up to the applicable Maximum VWAP Purchase Amount, directed

to be purchased by the Selling Stockholder by Stardust Power.

“Warrant

Agreement” means that certain Warrant Agreement, dated as of January 11, 2021, by and between GPAC II and Continental Stock

Transfer & Trust Company, a New York corporation, as warrant agent.

“Warrants”

means the warrants representing the right to purchase shares of Common Stock following the Closing.

“Withum”

means WithumSmith+Brown, PC, the Company’s auditor prior to September 17, 2024.

“2024

Extension Amendment Proposal” means the proposal presented at the 2024 Extension Meeting to extend the date by which GPAC II

must complete its initial business combination from January 14, 2024 to a date no earlier than July 14, 2024.

“2024

Extension Meeting” means the extraordinary general meeting of GPAC II Shareholders held on January 9, 2024 to consider the

2024 Extension Amendment Proposal.

SPECIAL

NOTE REGARDING FORWARD-LOOKING STATEMENTS

Certain

statements in this prospectus may constitute “forward-looking statements” for purposes of the federal securities laws. Our

forward-looking statements include, but are not limited to, statements regarding our and our management team’s expectations, hopes,

beliefs, intentions or strategies regarding the future. In addition, any statements that refer to projections, forecasts or other characterizations

of future events or circumstances, including any underlying assumptions, are forward-looking statements. The words “anticipate,”

“believe,” “continue,” “could,” “estimate,” “expect,” “intends,”

“may,” “might,” “plan,” “possible,” “potential,” “predict,” “project,”

“should,” “will,” “would” and similar expressions may identify forward-looking statements, but the

absence of these words does not mean that a statement is not forward-looking. These forward-looking statements are provided for illustrative

purposes only and are not intended to serve as, and must not be relied on by any investor as, a guarantee, an assurance, a prediction

or a definitive statement of fact or probability. Actual events and circumstances are difficult or impossible to predict and will differ

from assumptions. Many actual events and circumstances are beyond the control of Stardust Power. Forward-looking statements in this prospectus

may include, for example, statements about:

| ● | the

financial and business performance of the Company; |

| | | |

| ● | the

failure to realize the anticipated benefits of the Business Combination that the Company

consummated in July 2024 or those benefits taking longer than anticipated to be realized; |

| | | |

| ● | risks

related to the uncertainty of estimates and forecasts of financial and performance metrics

and expectations related to realizing the potential benefits of the Business Combination; |

| | | |

| ● | the

ability to maintain the listing of the Common Stock and the Warrants on Nasdaq, and the potential

liquidity and trading of such securities; |

| | | |

| ● | the

Company’s ability to implement business plans, identify and realize additional opportunities

and achieve forecasts and other expectations; |

| | | |

| ● | the

risk that the Company may never achieve or sustain profitability; |

| | | |

| ● | the

risks that the industry is subject to fluctuations including the changes in consumer demand

for electric vehicles and market volatility; |

| | | |

| ● | risks

relating to lithium being highly combustible, and if Stardust Power has incidences where

releases of hazardous substances occur, the Company could be subject to substantial financial

liabilities; |

| | | |

| ● | risks

relating to the Company’s status as a development stage company with a history of net

losses and no revenue; |

| | | |

| ● | risks

relating to exploration, construction, and extraction of brine by the Company’s suppliers; |

| | | |

| ● | the

Company’s dependence on battery-grade lithium production activities to generate revenues,

achieve and maintain profitability, and develop cash flows; |

| | | |

| ● | risks

relating to the uncertainty of success, any commercial viability, or delays of the Company’s

research and development efforts; |

| | | |

| ● | the

Company’s ability to qualify for existing federal and state level grants and incentives; |

| | | |

| ● | disruptions

in the supply chain, fluctuation in price of product inputs, and market conditions and global

and economic factors beyond the Company’s control; |

| ● | risks

relating to the development of non-lithium battery technologies; |

| | | |

| ● | the

Company’s ability to obtain financing for future projects; |

| | | |

| ● | Stardust

Power management’s identification of conditions that raise substantial doubt about

Stardust Power’s ability to continue as a going concern; |

| | | |

| ● | the

Company’s success in retaining or recruiting, or changes required in, its officers,

key employees or directors; |

| | | |

| ● | the

Company’s ability to grow and manage growth profitably, maintain relationships with

customers and suppliers and retain key employees; |

| | | |

| ● | the

Company’s ability to identify, develop and operate anticipated and new projects; |

| | | |

| ● | delays

in acquisition, financing, construction and development of new projects; |

| | | |

| ● | the

Company’s ability to execute its business model, including market adoption and future

performance of lithium energy; |

| | | |

| ● | existing

laws and regulations and developments or effects of, or changes to, laws, regulations and

policies that affect the Company’s operations; |

| | | |

| ● | the

outcome of any potential litigation, government and regulatory proceedings, investigations

and inquiries; |

| | | |

| ● | the

risks that the non-binding letters of intent with potential suppliers and customers would

not result in legally binding, definitive agreements; and |

| | | |

| ● | other

factors detailed or referenced in this Registration Statement, GPAC II’s definitive

proxy dated May 24, 2024 (as further amended) and its most recent Annual Report on Form 10-K

for the year ended December 31, 2023 dated March 19, 2024 (as further amended), in each case,

under the heading “Risk Factors,” and other documents of GPAC II and the

Company filed from time to time with the SEC. |

If

any of these risks materialize or our assumptions prove incorrect, actual results could differ materially from the results implied by

these forward-looking statements. There may be additional risks that we do not presently know or that we currently believe are immaterial

that could also cause actual results to differ from those contained in the forward-looking statements.

In

addition, forward-looking statements reflect our expectations, plans or forecasts of future events and views as of the date hereof. We

anticipate that subsequent events and developments will cause our assessments to change. However, while we may elect to update these

forward-looking statements at some point in the future, we specifically disclaim any obligation to do so except as otherwise required

by applicable law. These forward-looking statements should not be relied upon as representing our assessment as of any date subsequent

to the date hereof.

These

statements are inherently uncertain, and investors are cautioned not to unduly rely upon these statements. As a result of a number of

known and unknown risks and uncertainties, actual results or our performance of the Company may be materially different from those expressed

or implied by these forward-looking statements.

You

should read this prospectus and the documents that we reference in this prospectus and have filed as exhibits to the Registration Statement,

of which this prospectus is a part, completely and with the understanding that our actual future results may be materially different

from what we expect. We qualify all of our forward-looking statements by these cautionary statements.

PROSPECTUS

SUMMARY

This

summary highlights information contained elsewhere in this prospectus and does not contain all of the information that you should consider

in making your investment decision. Before investing in our securities, you should carefully read this entire prospectus, including our

consolidated financial statements and the related notes thereto and the information set forth in the sections titled “Risk Factors”

and “Management’s Discussion and Analysis of Financial Condition and Results of Operations.” Unless the context otherwise

requires, we use the terms “Stardust Power,” “Company,” “we,” “us” and “our”

in this prospectus to refer to Stardust Power Inc. and our consolidated subsidiaries.

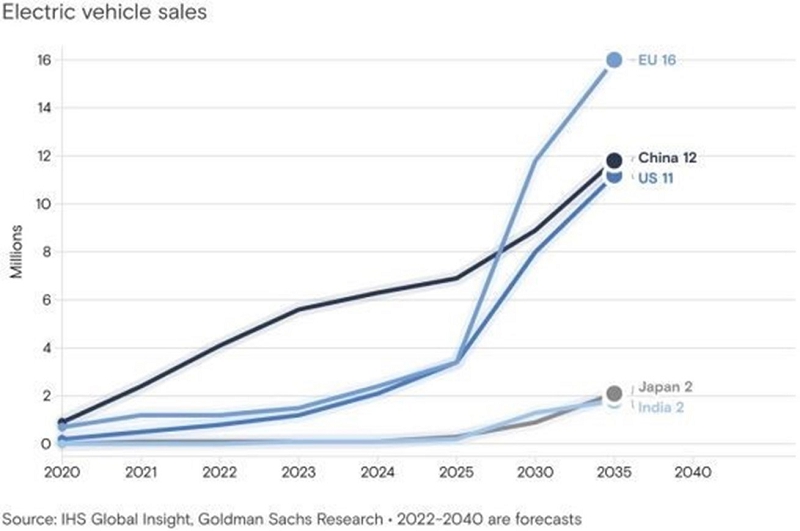

Overview

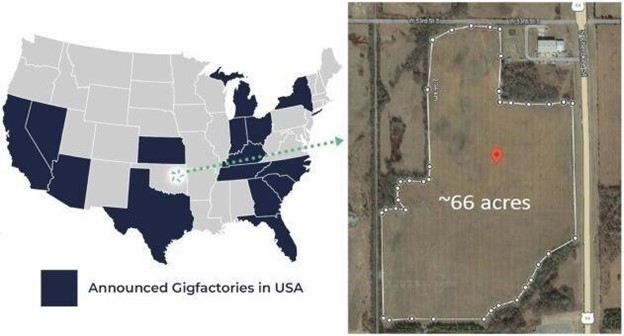

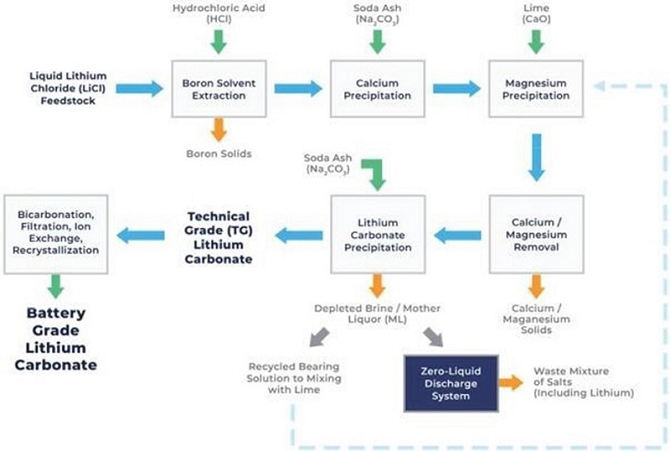

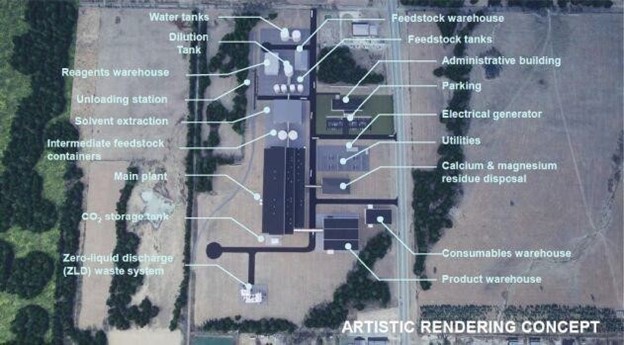

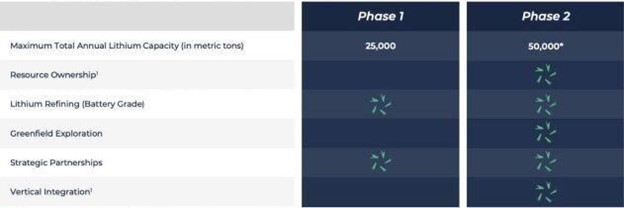

Stardust

Power is a development stage American manufacturer of battery-grade lithium products designed to supply the electric vehicle (“EV”)

industry and help to secure America’s leadership in the energy transition. Stardust Power is a newly incorporated company, formed

on March 16, 2023, which intends to construct a lithium refinery facility in Oklahoma, U.S. (the “Facility”), with

a projected capacity of producing up to 50,000 tons per annum (“tpa”) of battery grade lithium. Stardust Power is

focused on the midstream refinery process, and currently, is not undertaking any exploration activities. Stardust Power has engaged advisors

who have conducted various environmental and geotechnical/technical studies that are a prerequisite to establishing the Facility. Stardust

Power seeks to establish a refinery serving as a hub to process multiple sources of lithium brine primarily from the U.S. to supply battery

grade lithium carbonate to domestic battery manufacturers. Stardust Power intends to enter into letters of intent and memoranda of understanding

to avail itself of brine feedstock supply. Stardust Power’s business strategy will depend on such agreements and its ability to

source lithium brine.

Stardust

Power has also engaged with established advisors with varied expertise in lithium refining, for the development of the refinery to oversee

the construction of the Facility. As a newly incorporated entity, Stardust Power is dependent on the expertise of, and agreements with,

its various consultants to execute its business strategy. Having been incorporated on March 16, 2023, Stardust Power has a limited history

of operations. The Company has not generated any revenue and has a history of losses, that stood at $3.79 million, for the period since

its inception on March 16, 2023, to December 31, 2023. For more information, see the sections titled “Business” and

“Management’s Discussion and Analysis of Financial Condition and Results of Operations.”

Corporate

Information

We

were originally known as Global Partner Acquisition Corp II. In connection with the consummation of the business combination on July

8, 2024, we changed our name from Global Partner Acquisition Corp II to Stardust Power Inc.

Our

principal executive office is located at 15 E. Putnam Ave, Suite 378, Greenwich, CT 06830. Our corporate website address is www.stardust-power.com.

Our website and the information contained on, or that can be accessed through, the website is not deemed to be incorporated by reference

in, and is not considered part of, this prospectus. The website address is included as an inactive textual reference only. “Stardust

Power” and our other registered and common law trade names, trademarks and service marks are property of Stardust Power Inc. This

prospectus contains additional trade names, trademarks and service marks of others, which are the property of their respective owners.

Solely for convenience, trademarks and trade names referred to in this prospectus may appear without the ® or TM symbols.

Emerging

Growth Company Status

We

are an “emerging growth company,” as defined in Section 2(a) of the Securities Act, as modified by the Jumpstart Our Business

Startups Act of 2012, as amended (the “JOBS Act”), and they may take advantage of certain exemptions from various

reporting requirements that are applicable to other public companies that are not emerging growth companies, including, but not limited

to, not being required to comply with the auditor attestation requirements of Section 404 of the Sarbanes-Oxley Act of 2002, as amended

(“Sarbanes-Oxley Act”), reduced disclosure obligations regarding executive compensation in their periodic reports

and proxy statements, and exemptions from the requirements of holding a nonbinding advisory vote on executive compensation and stockholder

approval of any golden parachute payments not previously approved.

Further,

Section 102(b)(1) of the JOBS Act exempts emerging growth companies from being required to comply with new or revised financial accounting

standards until private companies (that is, those that have not had a Securities Act registration statement declared effective or do

not have a class of securities registered under the Exchange Act) are required to comply with the new or revised financial accounting

standards. The JOBS Act provides that a company can elect to opt out of the extended transition period and comply with the requirements

that apply to non-emerging growth companies but any such election to opt out is irrevocable. We have elected not to opt out of such extended

transition period, which means that when a standard is issued or revised and it has different application dates for public or private

companies we, as an emerging growth company, can adopt the new or revised standard at the time private companies adopt the new or revised

standard. This may limit comparability of our financial statements with certain other public companies because of the potential differences

in accounting standards used.

We

will remain an emerging growth company until the earlier of: (i) the last day of the fiscal year (a) ending after the fifth anniversary

of the closing of the initial public offering (i.e., December 31, 2027), (b) in which we have total annual gross revenue of at

least $1.235 billion or (c) in which we are deemed to be a large accelerated filer, which means the market value of our common equity

that is held by non-affiliates equals or exceeds $700 million as of the prior June 30th; and (ii) the date on which we have issued more

than $1.0 billion in non-convertible debt securities during the prior three-year period.

The

Committed Equity Facility

On

October 7, 2024, we entered into the Purchase Agreement and a related registration rights agreement (the “Registration

Rights Agreement”) with the Selling Stockholder. Upon the terms and subject to the satisfaction of the conditions contained

in the Purchase Agreement, we have the right, in our sole discretion, to sell to the Selling Stockholder up to $50,000,000 of shares

of our Common Stock (subject to certain limitations contained in the Purchase Agreement), from time to time after the date of this prospectus

and during the term of the Purchase Agreement through an Market Open Purchase or one or more Intraday Purchases on any Purchase Date

(each term as defined below). Sales of Common Stock pursuant to the Purchase Agreement, and the timing of any sales, are solely at our

option, and we are under no obligation to sell any securities to the Selling Stockholder under the Purchase Agreement. In accordance

with our obligations under the Registration Rights Agreement, we have filed the registration statement that includes this prospectus

with the SEC to register under the Securities Act, the offer and resale by the Selling Stockholder of up to 6,500,000 shares

of Common Stock, consisting of (i) up to 6,436,306 shares of Common Stock (the “Purchase Shares”) that we

may, in our sole discretion, elect to sell to the Selling Stockholder, from time to time from and after the Commencement Date (defined

below) pursuant to the Purchase Agreement and (ii) 63,694 shares of Common Stock (the “Commitment Shares”)

we issued to the Selling Stockholder, upon our execution of the Purchase Agreement on October 7, 2024, as consideration for

its commitment to purchase shares of our Common Stock that we may, in our sole discretion, direct the Selling Stockholder to purchase

from us pursuant to the Purchase Agreement, from time to time after the date of this prospectus and during the term of the Purchase Agreement.

Upon

the initial satisfaction of each of the conditions to the Selling Stockholder’s purchase obligations set forth in the Purchase

Agreement (the initial satisfaction of all of such conditions, the “Commencement”), none of which are within the Selling

Stockholder’s control, including that the registration statement that includes this prospectus shall have become or been

declared effective by the SEC, we have the right, but not the obligation, from time to time at our sole discretion for a period of up

to 36 months (unless the Purchase Agreement is earlier terminated), beginning on the date on which the Commencement occurs (such date,

the “Commencement Date”), to direct the Selling Stockholder to purchase a specified number of shares of Common Stock

(each, an “Market Open Purchase”), not to exceed the lesser of (such lesser number of shares, the “Market

Open Purchase Maximum Amount”): (i) 1,000,000 shares of Common Stock and (ii) up to a certain percentage (not to exceed 25.0%),

which we will specify in the applicable Market Open Purchase Notice (as defined below) for such Market Open Purchase (such specified

percentage, the “Market Open Purchase Percentage”), of the total aggregate number (or volume) of shares of our Common

Stock traded on Nasdaq during the applicable Market Open Purchase Valuation Period (as defined below) for such Market Open Purchase (such

specified number of shares to be purchased by the Selling Stockholder, adjusted as necessary to give effect to the applicable Market

Open Purchase Maximum Amount as set forth in the Purchase Agreement, the “Market Open Purchase Share Amount”), by

timely delivering written notice of such Market Open Purchase to the Selling Stockholder (each, a “Market Open Purchase Notice”)

prior to 9:00 a.m., New York City time, on any trading day (each, a “Purchase Date”), so long as (a) the closing sale

price of our Common Stock on Nasdaq on the trading day immediately prior to such Purchase Date is not less than $1.00 (the “Threshold

Price”), and (b) all shares of Common Stock subject to all prior Market Open Purchases and all prior Intraday Purchases (defined

below) effected by us under the Purchase Agreement (as applicable) have been received by the Selling Stockholder at such time and in

the manner set forth in the Purchase Agreement.

The

per share purchase price that the Selling Stockholder is required to pay for shares of Common Stock in a Market Open Purchase effected

by us pursuant to the Purchase Agreement, if any, will be determined by reference to the volume weighted average price of the Company’s

Common Stock on Nasdaq as reported by Bloomberg Financial LP using the AQR function (“VWAP”), calculated in accordance

with the Purchase Agreement, for the period (the “Market Open Purchase Valuation Period”) beginning at the official

open (or “Nasdaq Commencement”) of the regular trading session on Nasdaq on the applicable Purchase Date for

such Purchase, and ending at the earliest to occur of (i) 3:59 p.m., New York City time, on such Purchase Date or such earlier time publicly

announced by the trading market as the official close of the regular trading session on such Purchase Date, (ii) such time that the total

aggregate number (or volume) of shares of Common Stock traded on Nasdaq during such Market Open Purchase Valuation Period (calculated

in accordance with the Purchase Agreement) reaches the applicable share volume maximum amount for such Market Open Purchase (the “Market

Open Purchase Share Volume Maximum”), calculated by dividing (a) the applicable Market Open Purchase Share Amount for such

Market Open Purchase, by (b) the Market Open Purchase Percentage we specified in the applicable Market Open Purchase Notice for such

Market Open Purchase, and (iii) if we further specify in the applicable Market Open Purchase Notice for such Market Open Purchase that

a “limit order discontinue election” (a “Limit Order Discontinue Election”) shall apply to such Market

Open Purchase, such time that the trading price of our Common Stock on Nasdaq during such Market Open Purchase Valuation Period (calculated

in accordance with the Purchase Agreement) falls below the applicable minimum price threshold for such Market Open Purchase specified

by us in the Market Open Purchase Notice for such Market Open Purchase, or if we do not specify a minimum price threshold in such Market

Open Purchase Notice, a price equal to 75.0% of the closing sale price of the Common Stock on the trading day immediately prior to the

applicable Purchase Date for such purchase (the “Minimum Price Threshold”), less a fixed 3.0% discount to the VWAP

for such Market Open Purchase Valuation Period (calculated in accordance with the Purchase Agreement).

Under

the Purchase Agreement, for purposes of calculating the volume of shares of Common Stock traded during a Market Open Purchase Valuation

Period, as well as the VWAP for a Market Open Purchase Valuation Period, the following transactions, to the extent they occur during

such Market Open Purchase Valuation Period, shall be excluded: (x) the opening or first purchase of Common Stock at or following the

official open of the regular trading session on Nasdaq on the applicable Purchase Date for such Market Open Purchase, (y) the last or

closing sale of Common Stock at or prior to the official close of the regular trading session on Nasdaq on the applicable Purchase Date

for such Market Open Purchase, and (z) if we have specified in the applicable Market Open Purchase Notice for such Market Open Purchase

that a “limit order continue election” (a “Limit Order Continue Election”), rather than a Limit Order

Discontinue Election, shall apply to such Market Open Purchase, all purchases and sales of Common Stock on Nasdaq during such Market

Open Purchase Valuation Period at a price per share that is less than the applicable Minimum Price Threshold for such Market Open Purchase.

From

and after the Commencement Date, in addition to Market Open Purchases described above, we will also have the right, but not the obligation,

subject to the continued satisfaction of the conditions set forth in the Purchase Agreement, to direct the Selling Stockholder to purchase,

on any trading day that would qualify as a Purchase Date, whether or not a Market Open Purchase is effected on such Purchase Date, a

specified number of shares of Common Stock (each, an “Intraday Purchase”), not to exceed the lesser of (such lesser

number of shares, the “Intraday Purchase Maximum Amount”): (i) 1,000,000 shares of Common Stock and (ii) up to a certain

percentage (not to exceed 25.0%), which we will specify in the applicable Intraday Purchase Notice (as defined below) for such Intraday

Purchase (such specified percentage, the “Intraday Purchase Percentage”), of the total aggregate volume of shares

of our Common Stock traded on Nasdaq during the applicable “Intraday Purchase Valuation Period” (determined in a similar

manner as the Market Open Purchase Valuation Periods for a Market Open Purchase) for such Intraday Purchase (such specified number of

shares to be purchased by the Selling Stockholder, adjusted to the extent necessary to give effect to the applicable Intraday Purchase

Maximum Amount as set forth in the Purchase Agreement, the “Intraday Purchase Share Amount”), by the delivery to the

Selling Stockholder of an irrevocable written purchase notice for such Intraday Purchase, after 10:00 a.m., New York City time (and after

the Market Open Purchase Valuation Period for any earlier Market Open Purchase and the Intraday Purchase Valuation Period for the most

recent prior Intraday Purchase effected on the same Purchase Date as such applicable Intraday Purchase, if applicable, have ended), and

prior to 3:30 p.m., New York City time, on such Purchase Date (each, an “Intraday Purchase Notice”), so long as (i)

the closing sale price of the Common Stock on Nasdaq on the trading day immediately prior to such Purchase Date is not less than the

Threshold Price and (ii) all shares of Common Stock subject to all prior Market Open Purchases and all prior Intraday Purchases (as applicable)

effected by us under the Purchase Agreement, including all prior purchases effected on the same Purchase Date as such applicable Intraday

Purchase, have been received by the Selling Stockholder at such time and in the manner set forth in the Purchase Agreement.

The