false000089544700008954472024-09-052024-09-05

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): September 5, 2024

SHOE CARNIVAL, INC.

(Exact name of Registrant as Specified in Its Charter)

|

|

|

Indiana |

0-21360 |

35-1736614 |

(State or Other Jurisdiction of Incorporation) |

(Commission File Number) |

(IRS Employer Identification No.) |

|

|

|

7500 East Columbia Street Evansville, Indiana |

|

47715 |

(Address of Principal Executive Offices) |

|

(Zip Code) |

Registrant’s Telephone Number, Including Area Code: (812) 867-4034

Not Applicable

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instructions A.2. below):

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

Title of each class |

|

Trading Symbol(s) |

|

Name of each exchange on which registered |

Common Stock, par value $0.01 per share |

|

SCVL |

|

The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02 Results of Operations and Financial Condition.

The following information shall not be deemed "filed" for the purposes of Section 18 of the Securities Exchange Act of 1934 (the "Exchange Act"), or otherwise subject to the liabilities of that Section, nor shall it be incorporated by reference into any registration statement or other document pursuant to the Securities Act of 1933, as amended, or the Exchange Act, except as shall be expressly set forth by specific reference in such filing.

On September 5, 2024, Shoe Carnival, Inc. (the "Company") issued a press release announcing its operating and financial results for its second quarter ended August 3, 2024. A copy of the press release is attached hereto as Exhibit 99.1 and is incorporated herein by reference.

Item 9.01 Financial Statements and Exhibits

(d) Exhibits:

Exhibit No. Exhibits

99.1 Earnings Release – Second Quarter Ended August 3, 2024

104 Cover Page Interactive Data File, formatted in Inline Extensible Business Reporting Language (iXBRL)

2

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

SHOE CARNIVAL, INC. |

|

|

|

(Registrant) |

|

Date: September 5, 2024 |

By: |

/s/ Patrick C. Edwards |

|

|

|

Patrick C. Edwards |

|

|

|

Senior Vice President |

|

|

|

Chief Financial Officer, Treasurer & Secretary |

|

3

SHOE CARNIVAL REPORTS SECOND QUARTER FISCAL 2024 RESULTS

Evansville, Indiana, September 5, 2024 - Shoe Carnival, Inc. (Nasdaq: SCVL) (the “Company”), a leading retailer of footwear and accessories for the family, today reported results for the second quarter ended

August 3, 2024.

•Net sales in the quarter exceeded the Company’s expectation, increasing 12.9 percent versus prior year to $332.7 million.

•EPS also exceeded the Company’s expectation with second quarter 2024 GAAP EPS of $0.82 and Adjusted EPS of $0.83.

•GAAP operating income increased 22.0 percent to $30.1 million and Adjusted operating income increased 23.7 percent to $30.5 million versus prior year.

•Fiscal 2024 sales guidance range is increased to growth of 5 percent to 6 percent.

“Customer engagement continued to exceed our expectations and sales momentum accelerated rapidly during our most important shopping event of the year, the Back-to-School season. We achieved a net sales record this quarter, surpassing all previous second quarter sales in our company’s history. Gross profit margin expanded versus prior year, we gained significant market share, and we delivered earnings above our guidance in the quarter.” said Mark Worden, President and Chief Executive Officer.

“Our Back-to-School results were very strong with comparable sales growth achieved in August, driven by the children’s and athletic categories. Our long-term strategies to increase sales and drive profitability are working, and we are well positioned to further increase shareholder value and execute on our vision to be the nation’s leading family footwear retailer,” concluded Mr. Worden.

Second Quarter Operating Results

Net sales in second quarter 2024 were $332.7 million, increasing 12.9 percent compared to second quarter 2023. The total net sales performance exceeded the Company’s expectation, with double-digit growth in Shoe Station, continued strengthening trends in Shoe Carnival and increases in ecommerce. Sales from the February 2024 acquisition of Rogan Shoes, Incorporated (“Rogan’s”) were in line with the Company’s expectation for the quarter and continue to be in line with the Company’s full year sales expectation.

Gross profit margin increased 30 basis points to 36.1 percent in second quarter 2024 primarily on leverage in buying, distribution and occupancy on the higher sales. Second quarter 2024 marked the 14th consecutive quarter the Company’s gross profit margin exceeded 35 percent.

As a percent of net sales, SG&A expenses in the quarter were 27.1 percent as compared to 27.4 percent in second quarter 2023, reflecting 30 basis points of leverage on the higher sales. Second quarter 2024 SG&A included higher expenses primarily related to the addition of Rogan’s.

Second quarter 2024 operating income totaled $30.1 million and increased 22.0 percent versus prior year driven by higher net sales combined with gross profit margin expansion. Operating income in the quarter included $0.4 million in expenses related to the Rogan’s acquisition, of which $0.3 million were in cost of sales and $0.1 million were in SG&A.

Second quarter 2024 net income was $22.6 million, or $0.82 per diluted share, compared to second quarter 2023 net income of $19.4 million, or $0.71 per diluted share (“EPS”).

EPS growth in second quarter 2024 compared to prior year was driven by the net sales performance and higher gross profit margin. On an adjusted basis, excluding the $0.4 million of expenses in the quarter related to the acquisition of Rogan’s, second quarter Adjusted EPS was $0.83.

Comparable store sales for the thirteen-week period ended August 3, 2024, declined 2.1 percent compared to the thirteen-week period ended August 5, 2023, reflecting positive momentum versus first quarter 2024 and demonstrating flat comp sales results during June versus prior year.

Merchandise Inventory

Second quarter 2024 inventory totaled $425.5 million, an increase of approximately $16.1 million versus second quarter 2023. The increase reflected the impacts of Rogan’s inventory acquired in February 2024, partially offset by continued inventory efficiencies in Shoe Carnival and Shoe Station as part of the Company’s on-going inventory optimization improvement plan.

Consistent with previous guidance, Fiscal 2024 year end inventory dollars are expected to be lower by approximately $20 million, or 5 percent, versus Fiscal 2023 year end, excluding the impacts of the Rogan’s acquisition.

Store Count and Planned Store Growth

As of September 5, 2024, the Company operated 430 stores, with 368 Shoe Carnival stores, 34 Shoe Station stores and the 28 Rogan’s locations acquired in February 2024.

The Company has a strategic growth roadmap in place to surpass 500 stores in 2028, inclusive of organic growth and strategic M&A activity.

Share Repurchase Program

As of September 5, 2024, the Company has $50 million available for future repurchases under its share repurchase program. During second quarter 2024, the Company did not repurchase any shares.

Capital Management and Cash Flow

The 2023 fiscal year end marked the 19th consecutive year the Company ended a year with no debt, and through second quarter 2024, the Company continued funding its operations and growth investments from operating cash flow and without debt.

Operating cash flow year to date 2024 totaled $40.7 million compared to $22.4 million in prior year. At the end of second quarter 2024, the Company had approximately $84.5 million of cash, cash equivalents and marketable securities, an increase of $37.7 million compared to prior year.

Third Quarter 2024 Update

Sales accelerated during the peak Back-to-School season and continued through the month of August. The Company achieved low-single digit comparable store sales growth for Fiscal August 2024, driven by growth of the children’s and athletics categories.

The Company currently expects third quarter 2024 net sales to be approximately $320 million. This expectation includes the impact of the retail calendar shift, which resulted in approximately $20 million in net sales moving out of third quarter 2024 and into second quarter 2024 as compared to prior year.

The Company currently expects GAAP EPS to be approximately $0.70 in third quarter 2024, with an income tax rate of approximately 25 percent.

Fiscal 2024 Outlook

Based on year-to-date results and the comparable store sales growth achieved during Back-to-School, the Company is increasing guidance ranges as follows:

Net Sales: Increased range to $1.23 billion to $1.25 billion, representing growth of 5 percent to 6 percent versus Fiscal 2023. (Prior guidance range $1.21 billion to $1.25 billion)

Comparable Store Sales: Increased range to down 1.5 percent to up 1 percent versus Fiscal 2023 with expected growth of flat to up 5 percent for combined Q3 and Q4 of Fiscal 2024 compared to prior year. (Prior guidance range down 3 percent to up 1 percent)

GAAP EPS: Increased range to $2.55 to $2.70. (Prior guidance range $2.50 to $2.70)

Non-GAAP EPS (“Adjusted EPS”): Increased range to $2.60 to $2.75. (Prior guidance range $2.55 to $2.75)

The Company notes that its Fiscal 2024 is a 52-week year and compares to a 53-week year in Fiscal 2023 and, combined with the impact of the retail calendar shift versus prior year, results in the loss of approximately $20 million in net sales in fourth quarter 2024 compared to fourth quarter 2023 with an estimated negative impact of approximately $0.10 on EPS.

Conference Call

Today, at 9:00 a.m. Eastern Time, the Company will host a conference call to discuss its second quarter results. Participants can listen to the live webcast of the call by visiting Shoe Carnival's Investors webpage at www.shoecarnival.com. While the question-and-answer session will be available to all listeners, questions from the audience will be limited to institutional analysts and investors. A replay of the webcast will be available on the Company’s website beginning approximately two hours after the conclusion of the conference call and will be archived for one year.

Non-GAAP Financial Measures

The non-GAAP adjusted results for second quarter 2024 and in the Fiscal 2024 outlook discussed herein exclude purchase accounting impacts associated with the Company’s acquisition of Rogan’s. These impacts include the amortization expense included in cost of sales associated with the fair value adjustment to acquisition inventory and expenses included in SG&A related to deal formation and legal and accounting advice and purchase accounting and integration expenses. These adjusted results are provided to enhance the user's overall understanding of the Company's historical operations and financial performance and future projections. Specifically, the Company believes the adjusted results

provide investors with relevant comparisons of the Company’s core operations. Unaudited adjusted results are provided in addition to, and not as alternatives for, the Company’s reported results and guidance determined in accordance with generally accepted accounting principles. A reconciliation of these non-GAAP measures to the Company's GAAP results and guidance appears below in the tables entitled "Reconciliation of GAAP to Non-GAAP Financial Measures" and entitled “Reconciliation of GAAP to Non-GAAP Financial Measures for Fiscal 2024 Outlook” with respect to adjusted EPS in the Fiscal 2024 outlook.

About Shoe Carnival

Shoe Carnival, Inc. is one of the nation’s largest family footwear retailers, offering a broad assortment of dress, casual and athletic footwear for men, women and children with emphasis on national name brands. As of September 5, 2024, the Company operates 430 stores in 36 states and Puerto Rico under its Shoe Carnival and Shoe Station banners and offers shopping at www.shoecarnival.com and www.shoestation.com. Headquartered in Evansville, IN, Shoe Carnival, Inc. trades on The Nasdaq Stock Market LLC under the symbol SCVL. Press releases and annual reports are available on the Company's website at www.shoecarnival.com.

Contact Information

Steve R. Alexander

Shoe Carnival

Vice President Investor Relations

(812) 867-4034

Cautionary Statement Regarding Forward-Looking Information

As used herein, “we”, “our” and “us” refer to Shoe Carnival, Inc. This press release contains forward-looking statements, within the meaning of the Private Securities Litigation Reform Act of 1995, that involve a number of risks and uncertainties, such as statements about our future growth, operations, cash flows and shareholder returns, as well as our growth strategy and profit transformation.

A number of factors could cause our actual results, performance, achievements or industry results to be materially different from any future results, performance or achievements expressed or implied by these forward-looking statements. These factors include, but are not limited to: our ability to control costs and meet our labor needs in a rising wage, inflationary, and/or supply chain constrained environment; the impact of competition and pricing, including our ability to maintain current promotional intensity levels; the effects and duration of economic downturns and unemployment rates; our ability to achieve expected operating results from, and planned growth of, our Shoe Station banner, which includes the recently acquired stores and operations of Rogan’s, within expected time frames, or at all; the potential impact of national and international security concerns, including those caused by war and terrorism, on the retail environment; general economic conditions in the areas of the continental United States and Puerto Rico where our stores are located; changes in the overall retail environment and more specifically in the apparel and footwear retail sectors; our ability to successfully utilize the e-commerce sales channel and its impact on traffic and transactions in our physical stores; the success of the open-air shopping centers where many of our stores are located and the impact on our ability to attract customers to our stores; our ability to attract customers to our e-commerce platform and to successfully grow our omnichannel sales; the effectiveness of our inventory management, including our ability to manage key merchandise vendor relationships and direct-to-consumer initiatives; changes in our relationships with other key suppliers; changes in the political and economic environments in, the status of trade relations with, and the impact of changes in trade policies and tariffs impacting, China and other countries which are the major manufacturers of footwear; our ability to successfully manage and execute our marketing initiatives and maintain positive brand perception and recognition; our ability to successfully manage our current real

estate portfolio and leasing obligations; changes in weather, including patterns impacted by climate change; changes in consumer buying trends and our ability to identify and respond to emerging fashion trends; the impact of disruptions in our distribution or information technology operations including at our distribution center located in Evansville, IN; the impact of natural disasters, public health and political crises, civil unrest, and other catastrophic events on our operations and the operations of our suppliers, as well as on consumer confidence and purchasing in general; the duration and spread of a public health crisis and the mitigating efforts deployed, including the effects of government stimulus on consumer spending; risks associated with the seasonality of the retail industry; the impact of unauthorized disclosure or misuse of personal and confidential information about our customers, vendors and employees, including as a result of a cybersecurity breach; our ability to effectively integrate Rogan’s, retain Rogan’s employees, and achieve the expected operating results, synergies, efficiencies and other benefits from the Rogan’s acquisition within the expected time frames, or at all; risks that the Rogan’s acquisition may disrupt our current plans and operations or negatively impact our relationship with our vendors and other suppliers; our ability to successfully execute our business strategy, including the availability of desirable store locations at acceptable lease terms, our ability to identify, consummate or effectively integrate future acquisitions, our ability to implement and adapt to new technology and systems, our ability to open new stores in a timely and profitable manner, including our entry into major new markets, and the availability of sufficient funds to implement our business plans; higher than anticipated costs associated with the closing of underperforming stores; the inability of manufacturers to deliver products in a timely manner; an increase in the cost, or a disruption in the flow, of imported goods; the impact of regulatory changes in the United States, including minimum wage laws and regulations, and the countries where our manufacturers are located; the resolution of litigation or regulatory proceedings in which we are or may become involved; continued volatility and disruption in the capital and credit markets; future stock repurchases under our stock repurchase program and future dividend payments.; and other factors described in the Company’s SEC filings, including the Company’s latest Annual Report on Form 10-K. In addition, these forward-looking statements necessarily depend upon assumptions, estimates and dates that may be incorrect or imprecise and involve known and unknown risks, uncertainties and other factors. Accordingly, any forward-looking statements included in this press release do not purport to be predictions of future events or circumstances and may not be realized. Forward-looking statements can be identified by, among other things, the use of forward-looking terms such as “believes,” “expects,” “aims,” “on track,” “may,” “will,” “should,” “seeks,” “pro forma,” “anticipates,” “intends” or the negative of any of these terms, or comparable terminology, or by discussions of strategy or intentions. Given these uncertainties, we caution investors not to place undue reliance on these forward-looking statements, which speak only as of the date hereof. We disclaim any obligation to update any of these factors or to publicly announce any revisions to the forward-looking statements contained in this press release to reflect future events or developments.

Financial Tables Follow

SHOE CARNIVAL, INC.

CONDENSED CONSOLIDATED STATEMENTS OF INCOME

(In thousands, except per share data)

(Unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Thirteen |

|

|

Thirteen |

|

|

Twenty-six |

|

|

Twenty-six |

|

|

|

Weeks Ended |

|

|

Weeks Ended |

|

|

Weeks Ended |

|

|

Weeks Ended |

|

|

|

August 3, 2024 |

|

|

July 29, 2023 |

|

|

August 3, 2024 |

|

|

July 29, 2023 |

|

Net sales |

|

$ |

332,696 |

|

|

$ |

294,615 |

|

|

$ |

633,061 |

|

|

$ |

575,799 |

|

Cost of sales (including buying,

distribution and occupancy costs) |

|

|

212,753 |

|

|

|

189,150 |

|

|

|

406,318 |

|

|

|

371,817 |

|

Gross profit |

|

|

119,943 |

|

|

|

105,465 |

|

|

|

226,743 |

|

|

|

203,982 |

|

Selling, general and administrative expenses |

|

|

89,864 |

|

|

|

80,803 |

|

|

|

174,157 |

|

|

|

158,381 |

|

Operating income |

|

|

30,079 |

|

|

|

24,662 |

|

|

|

52,586 |

|

|

|

45,601 |

|

Interest income |

|

|

(672 |

) |

|

|

(433 |

) |

|

|

(1,475 |

) |

|

|

(911 |

) |

Interest expense |

|

|

137 |

|

|

|

71 |

|

|

|

273 |

|

|

|

137 |

|

Income before income taxes |

|

|

30,614 |

|

|

|

25,024 |

|

|

|

53,788 |

|

|

|

46,375 |

|

Income tax expense |

|

|

8,041 |

|

|

|

5,583 |

|

|

|

13,929 |

|

|

|

10,408 |

|

Net income |

|

$ |

22,573 |

|

|

$ |

19,441 |

|

|

$ |

39,859 |

|

|

$ |

35,967 |

|

Net income per share: |

|

|

|

|

|

|

|

|

|

|

|

|

Basic |

|

$ |

0.83 |

|

|

$ |

0.71 |

|

|

$ |

1.47 |

|

|

$ |

1.32 |

|

Diluted |

|

$ |

0.82 |

|

|

$ |

0.71 |

|

|

$ |

1.45 |

|

|

$ |

1.31 |

|

Weighted average shares: |

|

|

|

|

|

|

|

|

|

|

|

|

Basic |

|

|

27,159 |

|

|

|

27,336 |

|

|

|

27,151 |

|

|

|

27,280 |

|

Diluted |

|

|

27,500 |

|

|

|

27,410 |

|

|

|

27,452 |

|

|

|

27,449 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cash dividends declared per share |

|

$ |

0.135 |

|

|

$ |

0.100 |

|

|

$ |

0.270 |

|

|

$ |

0.200 |

|

SHOE CARNIVAL, INC.

CONDENSED CONSOLIDATED BALANCE SHEETS

(In thousands)

(Unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

August 3, |

|

|

February 3, |

|

|

July 29, |

|

|

|

2024 |

|

|

2024 |

|

|

2023 |

|

ASSETS |

|

|

|

|

|

|

|

|

|

Current Assets: |

|

|

|

|

|

|

|

|

|

Cash and cash equivalents |

|

$ |

71,633 |

|

|

$ |

99,000 |

|

|

$ |

34,562 |

|

Marketable securities |

|

|

12,831 |

|

|

|

12,247 |

|

|

|

12,218 |

|

Accounts receivable |

|

|

5,519 |

|

|

|

2,593 |

|

|

|

3,961 |

|

Merchandise inventories |

|

|

425,462 |

|

|

|

346,442 |

|

|

|

409,342 |

|

Other |

|

|

21,651 |

|

|

|

21,056 |

|

|

|

25,281 |

|

Total Current Assets |

|

|

537,096 |

|

|

|

481,338 |

|

|

|

485,364 |

|

Property and equipment – net |

|

|

170,717 |

|

|

|

168,613 |

|

|

|

159,186 |

|

Operating lease right-of-use assets |

|

|

337,926 |

|

|

|

333,851 |

|

|

|

339,598 |

|

Intangible assets |

|

|

40,990 |

|

|

|

32,600 |

|

|

|

32,600 |

|

Goodwill |

|

|

15,376 |

|

|

|

12,023 |

|

|

|

12,023 |

|

Other noncurrent assets |

|

|

12,922 |

|

|

|

13,600 |

|

|

|

14,433 |

|

Total Assets |

|

$ |

1,115,027 |

|

|

$ |

1,042,025 |

|

|

$ |

1,043,204 |

|

|

|

|

|

|

|

|

|

|

|

LIABILITIES AND SHAREHOLDERS' EQUITY |

|

|

|

|

|

|

|

|

|

Current Liabilities: |

|

|

|

|

|

|

|

|

|

Accounts payable |

|

$ |

73,916 |

|

|

$ |

58,274 |

|

|

$ |

77,429 |

|

Accrued and other liabilities |

|

|

30,204 |

|

|

|

16,620 |

|

|

|

19,999 |

|

Current portion of operating lease liabilities |

|

|

55,870 |

|

|

|

52,981 |

|

|

|

57,335 |

|

Total Current Liabilities |

|

|

159,990 |

|

|

|

127,875 |

|

|

|

154,763 |

|

Long-term portion of operating lease liabilities |

|

|

304,578 |

|

|

|

301,355 |

|

|

|

307,326 |

|

Deferred income taxes |

|

|

15,187 |

|

|

|

17,341 |

|

|

|

14,631 |

|

Deferred compensation |

|

|

12,564 |

|

|

|

11,639 |

|

|

|

10,596 |

|

Other |

|

|

4,213 |

|

|

|

426 |

|

|

|

369 |

|

Total Liabilities |

|

|

496,532 |

|

|

|

458,636 |

|

|

|

487,685 |

|

Total Shareholders’ Equity |

|

|

618,495 |

|

|

|

583,389 |

|

|

|

555,519 |

|

Total Liabilities and Shareholders’ Equity |

|

$ |

1,115,027 |

|

|

$ |

1,042,025 |

|

|

$ |

1,043,204 |

|

SHOE CARNIVAL, INC.

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

(In thousands)

(Unaudited)

|

|

|

|

|

|

|

|

|

|

|

Twenty-six |

|

|

Twenty-six |

|

|

|

Weeks Ended |

|

|

Weeks Ended |

|

|

|

August 3, 2024 |

|

|

July 29, 2023 |

|

Cash Flows From Operating Activities |

|

|

|

|

|

|

Net income |

|

$ |

39,859 |

|

|

$ |

35,967 |

|

Adjustments to reconcile net income to net

cash provided by operating activities: |

|

|

|

|

|

|

Depreciation and amortization |

|

|

15,116 |

|

|

|

13,822 |

|

Stock-based compensation |

|

|

3,574 |

|

|

|

2,326 |

|

Loss on retirement and impairment of assets, net |

|

|

215 |

|

|

|

59 |

|

Deferred income taxes |

|

|

(486 |

) |

|

|

2,787 |

|

Non-cash operating lease expense |

|

|

28,307 |

|

|

|

27,627 |

|

Other |

|

|

810 |

|

|

|

251 |

|

Changes in operating assets and liabilities: |

|

|

|

|

|

|

Accounts receivable |

|

|

(561 |

) |

|

|

(909 |

) |

Merchandise inventories |

|

|

(37,177 |

) |

|

|

(18,952 |

) |

Operating leases |

|

|

(29,223 |

) |

|

|

(27,181 |

) |

Accounts payable and accrued liabilities |

|

|

20,498 |

|

|

|

(927 |

) |

Other |

|

|

(190 |

) |

|

|

(12,518 |

) |

Net cash provided by operating activities |

|

|

40,742 |

|

|

|

22,352 |

|

|

|

|

|

|

|

|

Cash Flows From Investing Activities |

|

|

|

|

|

|

Purchases of property and equipment |

|

|

(15,722 |

) |

|

|

(30,629 |

) |

Investments in marketable securities |

|

|

(35 |

) |

|

|

(41 |

) |

Acquisition, net of cash acquired |

|

|

(44,384 |

) |

|

|

0 |

|

Net cash used in investing activities |

|

|

(60,141 |

) |

|

|

(30,670 |

) |

|

|

|

|

|

|

|

Cash Flow From Financing Activities |

|

|

|

|

|

|

Proceeds from issuance of stock |

|

|

92 |

|

|

|

110 |

|

Dividends paid |

|

|

(7,372 |

) |

|

|

(5,675 |

) |

Shares surrendered by employees to pay taxes on

stock-based compensation awards |

|

|

(688 |

) |

|

|

(2,927 |

) |

Net cash used in financing activities |

|

|

(7,968 |

) |

|

|

(8,492 |

) |

Net decrease in cash and cash equivalents |

|

|

(27,367 |

) |

|

|

(16,810 |

) |

Cash and cash equivalents at beginning of period |

|

|

99,000 |

|

|

|

51,372 |

|

Cash and cash equivalents at end of period |

|

$ |

71,633 |

|

|

$ |

34,562 |

|

SHOE CARNIVAL, INC.

RECONCILIATION OF GAAP TO NON-GAAP FINANCIAL MEASURES

(In thousands, except per share data)

(Unaudited)

|

|

|

|

|

|

|

|

|

|

Thirteen

Weeks Ended

August 3, 2024 |

|

% of

Net

Sales |

Thirteen

Weeks Ended

July 29, 2023 |

|

% of

Net

Sales |

|

|

|

|

|

|

|

Reported gross profit |

$ |

119,943 |

|

36.1% |

$ |

105,465 |

|

35.8% |

Amortization expense related to fair value

adjustment to acquisition inventory |

|

333 |

|

0.1% |

|

0 |

|

0.0% |

Adjusted gross profit, pre-tax |

$ |

120,276 |

|

36.2% |

$ |

105,465 |

|

35.8% |

|

|

|

|

|

|

|

Reported selling, general and administrative

expenses |

$ |

89,864 |

|

27.1% |

$ |

80,803 |

|

27.4% |

Acquisition related fees and expenses |

|

(97 |

) |

0.0% |

|

0 |

|

0.0% |

Adjusted selling, general and administrative

expenses, pre-tax |

$ |

89,767 |

|

27.1% |

$ |

80,803 |

|

27.4% |

|

|

|

|

|

|

|

Reported operating income |

$ |

30,079 |

|

9.0% |

$ |

24,662 |

|

8.4% |

Amortization expense related to fair value

adjustment to acquisition inventory |

|

333 |

|

0.1% |

|

0 |

|

0.0% |

Acquisition related fees and expenses |

|

97 |

|

0.0% |

|

0 |

|

0.0% |

Adjusted operating income, pre-tax |

$ |

30,509 |

|

9.1% |

$ |

24,662 |

|

8.4% |

|

|

|

|

|

|

|

Reported income tax expense |

$ |

8,041 |

|

2.4% |

$ |

5,583 |

|

1.9% |

Tax effect of amortization of acquisition inventory

fair value adjustment and acquisition related fees and

expenses |

|

105 |

|

0.0% |

|

0 |

|

0.0% |

Adjusted income tax expense |

$ |

8,146 |

|

2.4% |

$ |

5,583 |

|

1.9% |

|

|

|

|

|

|

|

Reported net income |

$ |

22,573 |

|

6.8% |

$ |

19,441 |

|

6.6% |

Amortization expense related to fair value

adjustment to acquisition inventory |

|

333 |

|

0.1% |

|

0 |

|

0.0% |

Acquisition related fees and expenses |

|

97 |

|

0.0% |

|

0 |

|

0.0% |

Tax effect of acquisition related fees and expenses |

|

(105 |

) |

0.0% |

|

0 |

|

0.0% |

Adjusted net income |

$ |

22,898 |

|

6.9% |

$ |

19,441 |

|

6.6% |

|

|

|

|

|

|

|

Reported net income per diluted share |

$ |

0.82 |

|

|

$ |

0.71 |

|

|

Amortization expense related to fair value

adjustment to acquisition inventory |

|

0.01 |

|

|

|

0.00 |

|

|

Acquisition related fees and expenses |

|

0.00 |

|

|

|

0.00 |

|

|

Tax effect of acquisition related fees and expenses |

|

0.00 |

|

|

|

0.00 |

|

|

Adjusted diluted net income per share |

$ |

0.83 |

|

|

$ |

0.71 |

|

|

SHOE CARNIVAL, INC.

RECONCILIATION OF GAAP TO NON-GAAP FINANCIAL MEASURES

(In thousands, except per share data)

(Unaudited)

|

|

|

|

|

|

|

|

|

|

Twenty-six

Weeks Ended

August 3, 2024 |

|

% of

Net

Sales |

Twenty-six

Weeks Ended

July 29, 2023 |

|

% of Net Sales |

|

|

|

|

|

|

|

Reported gross profit |

$ |

226,743 |

|

35.8% |

$ |

203,982 |

|

35.4% |

Amortization expense related to fair value

adjustment to acquisition inventory |

|

497 |

|

0.1% |

|

0 |

|

0.0% |

Adjusted gross profit, pre-tax |

$ |

227,240 |

|

35.9% |

$ |

203,982 |

|

35.4% |

|

|

|

|

|

|

|

Reported selling, general and administrative

expenses |

$ |

174,157 |

|

27.5% |

$ |

158,381 |

|

27.5% |

Acquisition related fees and expenses |

|

(417 |

) |

-0.1% |

|

0 |

|

0.0% |

Adjusted selling, general and administrative

expenses, pre-tax |

$ |

173,740 |

|

27.4% |

$ |

158,381 |

|

27.5% |

|

|

|

|

|

|

|

Reported operating income |

$ |

52,586 |

|

8.3% |

$ |

45,601 |

|

7.9% |

Amortization expense related to fair value

adjustment to acquisition inventory |

|

497 |

|

0.1% |

|

0 |

|

0.0% |

Acquisition related fees and expenses |

|

417 |

|

0.1% |

|

0 |

|

0.0% |

Adjusted operating income, pre-tax |

$ |

53,500 |

|

8.5% |

$ |

45,601 |

|

7.9% |

|

|

|

|

|

|

|

Reported income tax expense |

$ |

13,929 |

|

2.2% |

$ |

10,408 |

|

1.8% |

Tax effect of amortization of acquisition inventory

fair value adjustment and acquisition related fees and

expenses |

|

222 |

|

0.1% |

|

0 |

|

0.0% |

Adjusted income tax expense |

$ |

14,151 |

|

2.3% |

$ |

10,408 |

|

1.8% |

|

|

|

|

|

|

|

Reported net income |

$ |

39,859 |

|

6.3% |

$ |

35,967 |

|

6.3% |

Amortization expense related to fair value

adjustment to acquisition inventory |

|

497 |

|

0.1% |

|

0 |

|

0.0% |

Acquisition related fees and expenses |

|

417 |

|

0.1% |

|

0 |

|

0.0% |

Tax effect of acquisition related fees and expenses |

|

(222 |

) |

-0.1% |

|

0 |

|

0.0% |

Adjusted net income |

$ |

40,551 |

|

6.4% |

$ |

35,967 |

|

6.3% |

|

|

|

|

|

|

|

Reported net income per diluted share |

$ |

1.45 |

|

|

$ |

1.31 |

|

|

Amortization expense related to fair value

adjustment to acquisition inventory |

|

0.02 |

|

|

|

0.00 |

|

|

Acquisition related fees and expenses |

|

0.02 |

|

|

|

0.00 |

|

|

Tax effect of acquisition related fees and expenses |

|

(0.01 |

) |

|

|

0.00 |

|

|

Adjusted diluted net income per share |

$ |

1.48 |

|

|

$ |

1.31 |

|

|

SHOE CARNIVAL, INC.

RECONCILIATION OF GAAP TO NON-GAAP FINANCIAL MEASURES

FOR FISCAL 2024 OUTLOOK

(Unaudited)

|

|

|

|

|

|

|

|

|

|

Low End of Fiscal

2024 Outlook |

|

|

High End of Fiscal

2024 Outlook |

|

|

|

|

|

|

|

|

|

Net income per diluted share (GAAP) |

$ |

2.55 |

|

|

$ |

2.70 |

|

|

Amortization expense related to fair value adjustment to acquisition inventory and acquisition related fees and expenses |

|

0.07 |

|

|

|

0.07 |

|

|

Tax effect of amortization of acquisition inventory fair value adjustment and acquisition related fees and expenses |

|

(0.02 |

) |

|

|

(0.02 |

) |

|

Adjusted diluted net income per share |

$ |

2.60 |

|

|

$ |

2.75 |

|

|

v3.24.2.u1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

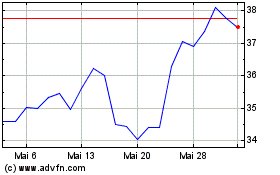

Shoe Carnival (NASDAQ:SCVL)

Historical Stock Chart

Von Okt 2024 bis Nov 2024

Shoe Carnival (NASDAQ:SCVL)

Historical Stock Chart

Von Nov 2023 bis Nov 2024