Form 6-K - Report of foreign issuer [Rules 13a-16 and 15d-16]

12 Dezember 2024 - 12:40PM

Edgar (US Regulatory)

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

Report of Foreign Private Issuer

Pursuant to Rule 13a-16 or 15d-16

of the Securities Exchange Act of 1934

For the

month of December 2024

RYANAIR HOLDINGS PLC

(Translation

of registrant's name into English)

c/o Ryanair Ltd Corporate Head Office

Dublin Airport

County Dublin Ireland

(Address

of principal executive offices)

Indicate

by check mark whether the registrant files or will file

annual

reports

under cover Form 20-F or Form 40-F.

Form

20-F..X.. Form 40-F

Indicate

by check mark whether the registrant by furnishing the

information

contained

in this Form is also thereby furnishing the information to

the

Commission

pursuant to Rule 12g3-2(b) under the Securities

Exchange

Act of

1934.

Yes

No ..X..

If

"Yes" is marked, indicate below the file number assigned to the

registrant

in

connection with Rule 12g3-2(b): 82- ________

|

Standard Form TR-1

Standard

form for notification of major holdings

|

|

NOTIFICATION OF MAJOR

HOLDINGS (to be sent to

the relevant issuer and to

the Central Bank of Ireland)

|

|

|

|

1. Identity of the issuer or the underlying issuer of existing

shares to which voting rights are attached:

Ryanair

Holdings PLC

|

|

2. Reason for

the notification (please tick the appropriate box

or boxes):

[X]

An acquisition or disposal of voting rights

[ ]

An acquisition or disposal of financial instruments

[ ]

An event changing the breakdown of voting rights

[ ]

Other (please specify):

|

|

3. Details of person subject to the notification

obligation:

|

|

Name:

The

Capital Group Companies, Inc.

|

City

and country of registered office (if applicable):

Los

Angeles, USA

|

|

4. Full name

of shareholder(s) (if different from

3.):

See

Box 10

|

|

5. Date on which the threshold was crossed or reached:

10

Dec 2024

|

|

6. Date on which issuer notified:

11

Dec 2024

|

|

7. Threshold(s) that is/are crossed or reached:

The

Capital Group Companies, Inc. increased above 13.00% of total

voting rights outstanding. Capital Research and Management Company

increased above 13.00% of total voting rights

outstanding.

|

|

8. Total positions of person(s) subject to the notification

obligation:

|

|

|

% of voting rights attached to shares

(total of 9.A)

|

% of voting rights through financial instruments

(total of 9.B.1 + 9.B.2)

|

Total of both in %

(9.A + 9.B)

|

Total number of voting rights of issuer

|

|

Resulting

situation on the date on which threshold was crossed or

reached

|

13.02%

|

0.00%

|

13.02%

|

1,083,167,981

|

|

Position

of previous notification (if applicable)

|

12.99%

|

0.00%

|

12.99%

|

|

|

|

|

9. Notified details of the resulting situation on the date on which

the threshold was crossed or reached:

|

|

A: Voting rights attached to shares

|

|

Class/type of

shares ISIN

code (if possible)

|

Number of voting rights

|

% of voting rights

|

|

Direct

|

Indirect

|

Direct

|

Indirect

|

|

US7835132033 Depository Receipt

|

|

140,616,564

|

|

12.98%

|

|

IE00BYTBXV33 Ordinary Shares

|

|

412,079

|

|

0.04%

|

|

|

|

|

|

|

|

SUBTOTAL A

|

141,028,643

|

13.02%

|

|

|

|

B 1: Financial Instruments according to Regulation 17(1)(a) of the

Regulations

|

|

Type of financial instrument

|

Expiration date

|

Exercise/ Conversion Period

|

Number of voting rights that may be acquired if the instrument is

exercised/converted

|

% of voting rights

|

|

N/A

|

|

|

|

|

|

|

|

SUBTOTAL B.1

|

|

|

|

|

|

B 2: Financial Instruments with similar economic effect according

to Regulation 17(1)(b) of the Regulations

|

|

Type of financial instrument

|

Expiration date

|

Exercise/ Conversion Period

|

Physical or cash settlement

|

Number of voting rights

|

% of voting rights

|

|

N/A

|

|

|

|

|

|

|

|

|

|

SUBTOTAL B.2

|

|

|

|

|

|

|

|

|

|

|

10.

Information in relation to the person subject to the notification

obligation (please

tick the applicable box):

|

|

[ ] Person subject to the notification obligation is not controlled

by any natural person or legal entity and does not control any

other undertaking(s) holding directly or indirectly an interest in

the (underlying) issuer.

|

|

[X] Full chain

of controlled undertakings through which the voting rights and/or

the financial instruments are effectively held starting with the

ultimate controlling natural person or legal

entity:

|

|

Name

|

% of voting rights if it equals or is higher than the notifiable

threshold

|

% of voting rights through financial instruments if it equals or is

higher than the notifiable threshold

|

Total of both if it equals or is higher than the notifiable

threshold

|

|

Capital Research and Management Company

|

13.02%

|

|

13.02%

|

|

Capital International, Inc.

|

|

|

|

|

Capital Group Private Client Services, Inc.

|

|

|

|

|

Capital International Sarl

|

|

|

|

|

Capital International Limited

|

|

|

|

|

Total

|

13.02%

|

|

13.02%

|

|

|

|

11. In case of proxy voting: [name of the proxy

holder] will cease

to hold [% and number] voting rights as of [date].

|

|

|

|

12. Additional information:

The

Capital Group Companies, Inc. ("CGC") is the parent company of

Capital Research and Management Company ("CRMC") and Capital Bank

& Trust Company ("CB&T"). CRMC is a U.S.-based investment

management company that serves as investment manager to the

American Funds family of mutual funds, other pooled investment

vehicles, as well as individual and institutional clients. CRMC and

its investment manager affiliates manage equity assets for various

investment companies through three divisions, Capital Research

Global Investors, Capital International Investors and Capital World

Investors. CRMC is the parent company of Capital Group

International, Inc. ("CGII"), which in turn is the parent company

of six investment management companies ("CGII management

companies"): Capital International, Inc., Capital International

Limited, Capital International Sàrl, Capital International

K.K., Capital Group Private Client Services Inc, and Capital Group

Investment Management Private Limited. CGII management companies

primarily serve as investment managers to institutional and high

net worth clients. CB&T is a U.S.-based registered investment

adviser and an affiliated federally chartered bank.

Neither

CGC nor any of its affiliates own shares of the Issuer for its own

account. Rather, the shares reported on this Notification are owned

by accounts under the discretionary investment management of one or

more of the investment management companies described

above.

|

|

|

|

Done

at Los Angeles on 11 Dec 2024.

|

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the

Registrant has duly caused this report to be signed on its behalf

by the undersigned, hereunto duly authorized.

Date: 12

December, 2024

|

|

By:___/s/

Juliusz Komorek____

|

|

|

|

|

|

Juliusz

Komorek

|

|

|

Company

Secretary

|

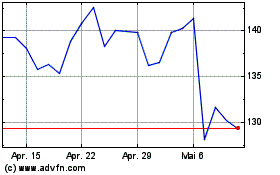

Ryanair (NASDAQ:RYAAY)

Historical Stock Chart

Von Nov 2024 bis Dez 2024

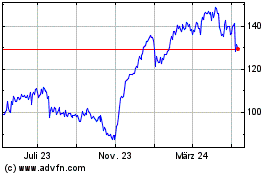

Ryanair (NASDAQ:RYAAY)

Historical Stock Chart

Von Dez 2023 bis Dez 2024