Registration of Securities by Certain Investment Companies. Declaration of Election Rule 24f-2 Notice (24f-2nt)

23 Dezember 2021 - 10:03PM

Edgar (US Regulatory)

U.S. SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 24F-2

Annual Notice of Securities Sold

Pursuant to Rule 24f-2

1. Name and address of issuer:

Invesco QQQ Trust, Series 1

Invesco Capital Management LLC

3500 Lacey Road, Suite 700

Downers Grove, IL 60515

2. Name of each series or class of securities for which this

Form is filed (If the Form is being filed for all series and

classes of securities of the issuer, check the box but do not

list series or classes):[ X ]

3. Investment Company Act File Number: 811-8947

Securities Act File Number: 333-61001

4. (a) Last day of fiscal year for which this Form is filed: 9/30/2021

(b) Check box if this Form is being filed late (i.e., more than 90

calendar days after the end of the Issuer's fiscal year). [ ]

(c) Check box if this is the last time the issuer will be filing

this form. [ ]

5. Calculation of registration fee:

(i) Aggregate sale price of securities sold during

the fiscal year pursuant to section 24(f): $ 266,841,591,066

(ii) Aggregate price of securities

redeemed or repurchased during the

fiscal year: $ 257,700,453,113

(iii) Aggregate price of securities

redeemed or repurchased during any

prior fiscal year ending no earlier

than October 11, 1995 that were not

previously used to reduce registration

fees payable to the Commission: $ 0

(iv) Total available redemption credits [add

items 5(ii) and 5(iii): - $257,700,453,113

(v) Net sales - if item 5(i) is greater than

Item 5(iv) [subtract Item 5(iv) from Item 5(i)]: $9,141,137,953

(vi) Redemption credits available for

use in future years - if Item 5(i) is

less than Item 5(iv) [subtract Item

5(iv) from Item 5(i)]: $0

(vii) Multiplier for determining registration fee: x 0.0000927

(viii) Registration fee due [multiply Item 5(v) by

Item 5(vii)]: = $847,383.49

6. Prepaid Shares

If the response to item 5(i) was determined by deducting an amount of

securities that were registered under the Securities Act of 1933

pursuant to rule 24e-2 as in effect before October 11, 1997, then

report the amount of securities (number of shares or other units)

deducted here: $0. If there is a number of shares or other

units that were registered pursuant to rule 24e-2 remaining unsold

at the end of the fiscal year for which this form is filed that are

available for use by the issuer in future fiscal years, than state

that number here: $0.

7. Interest due - if this Form is being filed more than 90 days after

the end of the issuer's fiscal year:

+ $0

8. Total of the amount of the registration fee due plus any interest

due [line 5(viii) plus line 7]:

= $847,383.49

9. Date the registration fee and any interest payment was sent to the

Commission's lockbox depository: December 14, 2021

CIK: 0001067839

Method of Delivery:

[X] Wire Transfer

[ ] Mail or other means

SIGNATURES

This report has been signed below by the following persons on behalf

of the issuer and in the capacities and on the dates indicated.

By: /s/ Spencer Pollock

Spencer Pollock

Vice President, Bank of New York Mellon,

As Trustee for Invesco BLDRS Funds Trust

Date: December 14, 2021

|

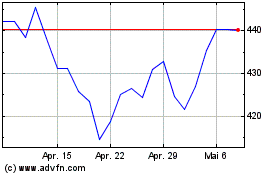

Invesco QQQ Trust Series 1 (NASDAQ:QQQ)

Historical Stock Chart

Von Nov 2024 bis Dez 2024

Invesco QQQ Trust Series 1 (NASDAQ:QQQ)

Historical Stock Chart

Von Dez 2023 bis Dez 2024