QUALCOMM INC/DE0000804328false5775 Morehouse DriveSan DiegoCalifornia00008043282024-11-062024-11-06

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of

The Securities Exchange Act of 1934

November 6, 2024

Date of Report (Date of earliest event reported)

QUALCOMM Incorporated

(Exact name of registrant as specified in its charter)

Delaware

(State or other jurisdiction of incorporation)

| | | | | | | | |

| 000-19528 | | 95-3685934 |

| (Commission File Number) | | (IRS Employer Identification No.) |

| | | | | | | | | | | | | | |

| 5775 Morehouse Drive, San Diego, California | | 92121 | |

| (Address of principal executive offices) | | (Zip Code) | |

858-587-1121

(Registrant’s telephone number, including area code)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act: | | | | | | | | |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| Common Stock, $0.0001 par value | QCOM | The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02. Results of Operations and Financial Condition.

On November 6, 2024, QUALCOMM Incorporated (the Company) issued a press release regarding the Company’s financial results for its fourth quarter and fiscal year ended September 29, 2024. A copy of that press release is furnished as Exhibit 99.1 hereto and incorporated herein by reference.

The press release includes Non-GAAP financial measures as defined in Regulation G. The press release also includes the most directly comparable financial measures calculated and presented in accordance with accounting principles generally accepted in the United States (GAAP), information reconciling the Non-GAAP financial measures to the GAAP financial measures and a discussion of the reasons why the Company’s management believes that presentation of the Non-GAAP financial measures provides useful information to investors regarding the Company’s financial condition and results of operations. The Non-GAAP financial measures presented therein should be considered in addition to, not as a substitute for, or superior to, financial measures calculated and presented in accordance with GAAP.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits. | | | | | | | | | | | |

| Exhibit No. | | Description | |

| | Press Release by QUALCOMM Incorporated dated November 6, 2024. | |

| 104 | | Cover Page Interactive Data File, formatted in Inline XBRL and included as Exhibit 101. | |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | | | | | | | |

| | | | QUALCOMM Incorporated |

| | | | |

| Date: | November 6, 2024 | By: | /s/ Akash Palkhiwala |

| | | | | Akash Palkhiwala |

| | | | | Chief Financial Officer and Chief Operating Officer |

Exhibit 99.1

FOR IMMEDIATE RELEASE

Qualcomm Contact:

Mauricio Lopez-Hodoyan

Vice President, Investor Relations

Phone: 1-858-658-4813 | e-mail: ir@qualcomm.com

Qualcomm Announces Fourth Quarter and Fiscal 2024 Results

Fiscal 2024 GAAP Revenues: $39.0 billion

Fiscal 2024 GAAP EPS: $8.97, Non-GAAP EPS: $10.22

—Greater Than 20% Growth in Fiscal Year EPS—

—Record Fiscal Year Operating Cash Flow—

—QCT Automotive: 5th Consecutive Record Quarterly Revenues—

SAN DIEGO - November 6, 2024 - Qualcomm Incorporated (NASDAQ: QCOM) today announced results for its fiscal fourth quarter and year ended September 29, 2024.

“We are pleased to conclude the fiscal year with strong results in the fourth quarter, delivering greater than 30% year-over-year growth in EPS,” said Cristiano Amon, President and CEO of Qualcomm Incorporated. “We are excited about our recent product announcements at Snapdragon Summit and Embedded World, as they continue to extend our technology leadership and position us well across Handsets, PC, Automotive and Industrial IoT. We look forward to providing an update on our growth and diversification initiatives at our Investor Day on November 19.”

Fourth Quarter Results1 | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| GAAP | | Non-GAAP | |

| (in millions, except per share data and percentages) | Q4 Fiscal 2024 | | Q4 Fiscal 2023 | | Change | | Q4 Fiscal 2024 | | Q4 Fiscal 2023 | | | | | Change | |

| Revenues | $10,244 | | $8,631 | | +19% | | $10,244 | | $8,665 | | | | | +18% | |

| Earnings before taxes (EBT) | $2,597 | | $1,420 | | +83% | | $3,491 | | $2,617 | | | | | +33% | |

| Net income | $2,920 | | $1,489 | | +96% | | $3,036 | | $2,277 | | | | | +33% | |

| Diluted earnings per share (EPS) | $2.59 | | $1.32 | | +96% | | $2.69 | | $2.02 | | | | | +33% | |

Fiscal 2024 Results1 | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| GAAP | | Non-GAAP | |

| (in millions, except per share data and percentages) | Fiscal 2024 | | Fiscal 2023 | | Change | | Fiscal 2024 | | Fiscal 2023 | | | | | Change | |

| Revenues | $38,962 | | $35,820 | | +9% | | $38,944 | | $35,832 | | | | | +9% | |

EBT | $10,336 | | $7,443 | | +39% | | $13,287 | | $11,070 | | | | | +20% | |

| Net income | $10,142 | | $7,232 | | +40% | | $11,545 | | $9,486 | | | | | +22% | |

| EPS | $8.97 | | $6.42 | | +40% | | $10.22 | | $8.43 | | | | | +21% | |

(1) Discussion regarding our use of Non-GAAP financial measures and reconciliations between GAAP and Non-GAAP results are included at the end of this news release in the sections labeled “Note Regarding Use of Non-GAAP Financial Measures” and “Reconciliations of GAAP Results to Non-GAAP Results.”

| | | | | |

| Qualcomm Announces Fourth Quarter and Fiscal 2024 Results | Page 2 of 10 |

Segment Results

Fourth Quarter | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| QCT | | QTL |

| (in millions, except percentages) | Q4 Fiscal 2024 | | Q4 Fiscal 2023 | | Change | | Q4 Fiscal 2024 | | Q4 Fiscal 2023 | | Change | | | |

| | | | | | | | | | | | | | |

| Revenues | $8,678 | | $7,374 | | +18% | | $1,521 | | $1,262 | | +21% | | | |

| EBT | $2,465 | | $1,889 | | +30% | | $1,120 | | $829 | | +35% | | | |

| EBT as % of revenues | 28% | | 26% | | +2 points | | 74% | | 66% | | +8 points | | | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

Fiscal 2024 | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| QCT | | QTL |

| (in millions, except percentages) | Fiscal 2024 | | Fiscal 2023 | | Change | | Fiscal 2024 | | Fiscal 2023 | | Change | | | |

| | | | | | | | | | | | | | |

| Revenues | $33,196 | | $30,382 | | +9% | | $5,572 | | $5,306 | | +5% | | | |

| EBT | $9,527 | | $7,924 | | +20% | | $4,027 | | $3,628 | | +11% | | | |

| EBT as % of revenues | 29% | | 26% | | +3 points | | 72% | | 68% | | +4 points | | | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

QCT Revenue Streams1 | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Fourth Quarter | | Fiscal |

| (in millions, except percentages) | 2024 | | 2023 | | Change | | 2024 | | 2023 | | Change |

| | | | | | | | | | | |

| Handsets | $6,096 | | $5,456 | | +12% | | $24,863 | | $22,570 | | +10% |

| Automotive | 899 | | 535 | | +68% | | 2,910 | | 1,872 | | +55% |

| IoT | 1,683 | | 1,383 | | +22% | | 5,423 | | 5,940 | | (9%) |

| Total QCT revenues | $8,678 | | $7,374 | | +18% | | $33,196 | | $30,382 | | +9% |

(1) We disaggregate QCT revenues based on the industries and applications in which our products are sold.

Return of Capital to Stockholders

The following table summarizes our return of capital to stockholders, through stock repurchases and cash dividends, during the fourth quarter and fiscal 2024.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Stock Repurchases | | Dividend Paid | | Total Amount |

(in millions, except per share data) | Shares | | Amount | | Per Share | | Amount | |

| Q4 Fiscal 2024 | 8 | | $1,302 | | $0.85 | | $947 | | $2,249 |

| Fiscal 2024 | 25 | | $4,121 | | $3.30 | | $3,687 | | $7,808 |

Our Board of Directors has also approved a new $15.0 billion stock repurchase authorization. The new stock repurchase authorization has no expiration date and is in addition to our stock repurchase program announced in October 2021, which had $1.0 billion of repurchase authority remaining as of the end of fiscal 2024.

| | | | | |

| Qualcomm Announces Fourth Quarter and Fiscal 2024 Results | Page 3 of 10 |

Business Outlook

The following statements are forward looking, and actual results may differ materially. The “Note Regarding Forward-Looking Statements” in this news release provides a description of certain risks that we face, and our most recent annual report on file with the Securities and Exchange Commission (SEC) provides a more complete description of our risks.

The following table summarizes GAAP and Non-GAAP guidance based on the current outlook. | | | | | | | | | | | | |

| | | Current Guidance Q1 FY25 Estimates1 | |

| Revenues | | $10.5B - $11.3B | |

| | | | |

| | | | |

| | | | |

| Supplemental Revenue Information | | | |

| QCT revenues | | $9.0B - $9.6B | |

| QTL revenues | | $1.45B - $1.65B | |

| GAAP diluted EPS | | $2.39 - $2.59 | |

| | | | |

| Less diluted EPS attributable to QSI | | $— | | |

| Less diluted EPS attributable to share-based compensation | | ($0.53) | | |

| Less diluted EPS attributable to other items2 | | $0.07 | | |

| Non-GAAP diluted EPS | | $2.85 - $3.05 | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

(1) Our outlook does not include provisions for proposed tax law changes, future asset impairments or for pending legal matters, other than future legal amounts that are probable and estimable. Further, due to their nature, certain income and expense items, such as certain investments, derivative and foreign currency transaction gains or losses, cannot be accurately forecast. Accordingly, we only include such items in our financial outlook to the extent they are reasonably certain. Our outlook includes the impact of any pending business combinations to the extent they are expected to close in the upcoming quarter. Actual results may differ materially from the outlook.

(2) Our guidance for diluted EPS attributable to other items for the first quarter of fiscal 2025 is primarily related to the requirement to capitalize research and development expenditures under U.S. Federal income tax law, partially offset by acquisition-related items.

| | | | | |

| Qualcomm Announces Fourth Quarter and Fiscal 2024 Results | Page 4 of 10 |

Conference Call and Available Information

Qualcomm’s fourth quarter and fiscal 2024 earnings conference call will be broadcast live on November 6, 2024, beginning at 1:45 p.m. Pacific Time (PT) at https://investor.qualcomm.com/news-events/investor-events. This conference call will include a discussion of “Non-GAAP financial measures” as defined in Regulation G. The most directly comparable GAAP financial measures and information reconciling these Non-GAAP financial measures to our financial results prepared in accordance with GAAP, as well as other financial and statistical information to be discussed on the conference call, will be posted to our Investor Relations website at https://investor.qualcomm.com immediately prior to the commencement of the call. An audio replay will be available on our website and via telephone following the live call for 30 days thereafter. To listen to the replay via telephone, U.S. callers may dial (877) 660-6853 and international callers may dial (201) 612-7415. Callers should use reservation number 13749366.

Our Investor Relations website at https://investor.qualcomm.com contains a significant amount of information about us, including financial and other information for investors, and it is possible that this information could be deemed to be material information. Accordingly, investors and others interested in Qualcomm should review the information posted on our website in addition to following our press releases, SEC filings and public conference calls and webcasts.

About Qualcomm

Qualcomm relentlessly innovates to deliver intelligent computing everywhere, helping the world tackle some of its most important challenges. Our proven solutions drive transformation across major industries, and our Snapdragon® branded platforms power extraordinary consumer experiences. Building on our nearly 40-year leadership in setting industry standards and creating era-defining technology breakthroughs, we deliver leading edge AI, high-performance, low-power computing, and unrivaled connectivity. Together with our ecosystem partners, we enable next-generation digital transformation to enrich lives, improve businesses, and advance societies. At Qualcomm, we are engineering human progress.

Qualcomm Incorporated includes our licensing business, QTL, and the vast majority of our patent portfolio. Qualcomm Technologies, Inc., a subsidiary of Qualcomm Incorporated, operates, along with its subsidiaries, substantially all of our engineering and research and development functions and substantially all of our products and services businesses, including our QCT semiconductor business. Snapdragon and Qualcomm branded products are products of Qualcomm Technologies, Inc. and/or its subsidiaries. Qualcomm patents are licensed by Qualcomm Incorporated.

Note Regarding Forward-Looking Statements

In addition to the historical information contained herein, this news release contains forward-looking statements that are inherently subject to risks and uncertainties, including but not limited to statements regarding: our product announcements and technology leadership; our diversification initiatives; our stock repurchase programs; our business outlook; and our estimates and guidance related to revenues and earnings per share (EPS). Forward-looking statements are generally identified by words such as “estimates,” “guidance,” “expects,” “anticipates,” “intends,” “plans,” “believes,” “seeks” and similar expressions. Actual results may differ materially from those referred to in the forward-looking statements due to a number of important factors, including but not limited to: our dependence on a small number of customers and licensees, and particularly from their sale of premium tier handset devices; our customers vertically integrating; a significant portion of our business being concentrated in China, which is exacerbated by U.S./China trade and national security tensions; our ability to extend our technologies and products into new and expanded product areas, and industries and applications beyond mobile handsets; our strategic acquisitions, transactions and investments, and our ability to consummate strategic acquisitions; our dependence on a limited number of third-party suppliers; risks associated with the operation and control of our manufacturing facilities; security breaches of our information technology systems, or other misappropriation of our technology, intellectual property or other proprietary or confidential information; our ability to attract and retain qualified employees; the continued and future success of our licensing programs, which requires us to continue to evolve our patent portfolio and to renew or renegotiate license agreements that are expiring; efforts by some OEMs to avoid paying fair and reasonable royalties for the use of our intellectual property, and other attacks on our licensing business model; potential changes in our patent licensing practices, whether due to governmental investigations, legal challenges or otherwise; adverse rulings in governmental investigations or proceedings or other legal proceedings; our customers’ and licensees’ sales of products and services based on CDMA, OFDMA and other communications technologies, including 5G, and our customers’ demand for our products based on these technologies; competition in an environment of rapid technological change, and our ability to adapt to such change and compete effectively; failures in our products or in the products of our customers or licensees, including those resulting from security vulnerabilities, defects or errors; difficulties in enforcing and protecting our intellectual property rights; claims by third parties that we infringe their intellectual property; our use of open source software; the cyclical nature of the semiconductor industry, declines in global, regional or local economic conditions, or our stock price and earnings volatility; geopolitical conflicts, natural disasters, pandemics and other health crises, and other factors outside of our control; our ability to comply with laws, regulations, policies and standards; our indebtedness; and potential tax liabilities. These and other risks are set forth in our Annual Report on Form 10-K for the fiscal year ended September 29, 2024 filed with the SEC. Our reports filed with the SEC are available on our website at www.qualcomm.com. We undertake no obligation to update, or continue to provide information with respect to, any forward-looking statement or risk factor, whether as a result of new information, future events or otherwise.

| | | | | |

| Qualcomm Announces Fourth Quarter and Fiscal 2024 Results | Page 5 of 10 |

QUALCOMM Incorporated

CONSOLIDATED BALANCE SHEETS

(In millions, except par value amounts)

(Unaudited)

| | | | | | | | | | | |

| September 29,

2024 | | September 24,

2023 |

| ASSETS |

| Current assets: | | | |

| Cash and cash equivalents | $ | 7,849 | | | $ | 8,450 | |

| Marketable securities | 5,451 | | | 2,874 | |

| Accounts receivable, net | 3,929 | | | 3,183 | |

| Inventories | 6,423 | | | 6,422 | |

| Held for sale assets | — | | | 341 | |

| Other current assets | 1,579 | | | 1,194 | |

| Total current assets | 25,231 | | | 22,464 | |

| | | |

| Deferred tax assets | 5,162 | | | 3,310 | |

| Property, plant and equipment, net | 4,665 | | | 5,042 | |

| Goodwill | 10,799 | | | 10,642 | |

| Other intangible assets, net | 1,244 | | | 1,408 | |

| Held for sale assets | — | | | 88 | |

| Other assets | 8,053 | | | 8,086 | |

| Total assets | $ | 55,154 | | | $ | 51,040 | |

| | | |

| LIABILITIES AND STOCKHOLDERS’ EQUITY |

| Current liabilities: | | | |

| Trade accounts payable | $ | 2,584 | | | $ | 1,912 | |

| Payroll and other benefits related liabilities | 1,834 | | | 1,685 | |

| Unearned revenues | 297 | | | 293 | |

| Short-term debt | 1,364 | | | 914 | |

| Held for sale liabilities | — | | | 333 | |

| Other current liabilities | 4,425 | | | 4,491 | |

| Total current liabilities | 10,504 | | | 9,628 | |

| Unearned revenues | 88 | | | 99 | |

| | | |

| Long-term debt | 13,270 | | | 14,484 | |

| Held for sale liabilities | — | | | 38 | |

| Other liabilities | 5,018 | | | 5,210 | |

| Total liabilities | 28,880 | | | 29,459 | |

| | | |

| Stockholders’ equity: | | | |

| Preferred stock, $0.0001 par value; 8 shares authorized; none outstanding | — | | | — | |

| Common stock and paid-in capital, $0.0001 par value; 6,000 shares authorized; 1,113 and 1,114 shares issued and outstanding, respectively | — | | | 490 | |

| Retained earnings | 25,687 | | | 20,733 | |

| Accumulated other comprehensive income | 587 | | | 358 | |

| | | |

| | | |

| Total stockholders’ equity | 26,274 | | | 21,581 | |

| Total liabilities and stockholders’ equity | $ | 55,154 | | | $ | 51,040 | |

| | | | | |

| Qualcomm Announces Fourth Quarter and Fiscal 2024 Results | Page 6 of 10 |

QUALCOMM Incorporated

CONSOLIDATED STATEMENTS OF OPERATIONS

(In millions, except per share data)

(Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Three Months Ended | | Twelve Months Ended |

| | | | | | September 29,

2024 | | September 24,

2023 | | September 29,

2024 | | September 24,

2023 |

| Revenues: | | | | | | | | | | | | |

| Equipment and services | | | | | | $ | 8,532 | | | $ | 7,290 | | | $ | 32,791 | | | $ | 30,028 | |

| Licensing | | | | | | 1,712 | | | 1,341 | | | 6,171 | | | 5,792 | |

| Total revenues | | | | | | 10,244 | | | 8,631 | | | 38,962 | | | 35,820 | |

| | | | | | | | | | | | |

| Costs and expenses: | | | | | | | | | | | | |

| Cost of revenues | | | | | | 4,467 | | | 3,880 | | | 17,060 | | | 15,869 | |

| Research and development | | | | | | 2,302 | | | 2,135 | | | 8,893 | | | 8,818 | |

| Selling, general and administrative | | | | | | 762 | | | 628 | | | 2,759 | | | 2,483 | |

Other | | | | | | 132 | | | 577 | | | 179 | | | 862 | |

| Total costs and expenses | | | | | | 7,663 | | | 7,220 | | | 28,891 | | | 28,032 | |

| | | | | | | | | | | | |

| Operating income | | | | | | 2,581 | | | 1,411 | | | 10,071 | | | 7,788 | |

| Interest expense | | | | | | (178) | | | (174) | | | (697) | | | (694) | |

Investment and other income, net | | | | | | 194 | | | 183 | | | 962 | | | 349 | |

| Income from continuing operations before income taxes | | | | | | 2,597 | | | 1,420 | | | 10,336 | | | 7,443 | |

Income tax benefit (expense) | | | | | | 318 | | | 209 | | | (226) | | | (104) | |

| Income from continuing operations | | | | | | 2,915 | | | 1,629 | | | 10,110 | | | 7,339 | |

| Discontinued operations, net of income taxes | | | | | | 5 | | | (140) | | | 32 | | | (107) | |

| Net income | | | | | | $ | 2,920 | | | $ | 1,489 | | | $ | 10,142 | | | $ | 7,232 | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| Basic earnings (loss) per share: | | | | | | | | | | | | |

| Continuing operations | | | | | | $ | 2.62 | | | $ | 1.46 | | | $ | 9.06 | | | $ | 6.57 | |

| Discontinued operations | | | | | | — | | | (0.13) | | | 0.03 | | | (0.10) | |

| Net income | | | | | | $ | 2.62 | | | $ | 1.33 | | | $ | 9.09 | | | $ | 6.47 | |

| Diluted earnings (loss) per share: | | | | | | | | | | | | |

| Continuing operations | | | | | | $ | 2.59 | | | $ | 1.44 | | | $ | 8.94 | | | $ | 6.52 | |

| Discontinued operations | | | | | | — | | | (0.12) | | | 0.03 | | | (0.10) | |

| Net income | | | | | | $ | 2.59 | | | $ | 1.32 | | | $ | 8.97 | | | $ | 6.42 | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| Shares used in per share calculations: | | | | | | | | | | | | |

| Basic | | | | | | 1,115 | | | 1,116 | | | 1,116 | | | 1,117 | |

| Diluted | | | | | | 1,129 | | | 1,125 | | | 1,130 | | | 1,126 | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | |

| Qualcomm Announces Fourth Quarter and Fiscal 2024 Results | Page 7 of 10 |

QUALCOMM Incorporated

CONSOLIDATED STATEMENTS OF CASH FLOWS

(In millions)

(Unaudited)

| | | | | | | | | | | | | | | | | |

| Twelve Months Ended | | | | | | |

| September 29,

2024 | | September 24,

2023 | | | | | | |

| Operating Activities: | | | | | | | | | |

| Net income from continuing operations | $ | 10,110 | | | $ | 7,339 | | | | | | | |

| Adjustments to reconcile net income to net cash provided by operating activities: | | | | | | | | | |

| Depreciation and amortization expense | 1,706 | | | 1,809 | | | | | | | |

| Indefinite and long-lived asset impairment charges | 7 | | | 182 | | | | | | | |

| Income tax provision less than income tax payments | (3,064) | | | (1,269) | | | | | | | |

| Share-based compensation expense | 2,648 | | | 2,484 | | | | | | | |

Net gains on marketable securities and other investments | (349) | | | (152) | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| Impairment losses on other investments | 79 | | | 132 | | | | | | | |

| Other items, net | (67) | | | 25 | | | | | | | |

| Changes in assets and liabilities: | | | | | | | | | |

| Accounts receivable, net | (768) | | | 2,472 | | | | | | | |

| Inventories | 13 | | | 8 | | | | | | | |

| Other assets | 230 | | | 603 | | | | | | | |

| Trade accounts payable | 682 | | | (1,880) | | | | | | | |

| Payroll, benefits and other liabilities | 1,046 | | | 1 | | | | | | | |

| Unearned revenues | 20 | | | (56) | | | | | | | |

| Net cash used by operating activities from discontinued operations | (91) | | | (399) | | | | | | | |

| Net cash provided by operating activities | 12,202 | | | 11,299 | | | | | | | |

| Investing Activities: | | | | | | | | | |

| Capital expenditures | (1,041) | | | (1,450) | | | | | | | |

| Purchases of debt and equity marketable securities | (5,069) | | | (668) | | | | | | | |

| Proceeds from sales and maturities of debt and equity marketable securities | 2,677 | | | 1,566 | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| Acquisitions and other investments, net of cash acquired | (254) | | | (235) | | | | | | | |

| | | | | | | | | |

| Proceeds from sales of property, plant and equipment | 10 | | | 127 | | | | | | | |

| Proceeds from other investments | 88 | | | 20 | | | | | | | |

| Other items, net | (36) | | | 19 | | | | | | | |

Net cash provided by investing activities from discontinued operations | 2 | | | 1,383 | | | | | | | |

| | | | | | | | | |

| Net cash (used) provided by investing activities | (3,623) | | | 762 | | | | | | | |

| Financing Activities: | | | | | | | | | |

| Proceeds from short-term debt | 799 | | | 5,068 | | | | | | | |

| Repayment of short-term debt | (799) | | | (5,566) | | | | | | | |

| | | | | | | | | |

| Proceeds from long-term debt | — | | | 1,880 | | | | | | | |

| Repayment of long-term debt | (914) | | | (1,446) | | | | | | | |

| | | | | | | | | |

| Proceeds from issuance of common stock | 383 | | | 434 | | | | | | | |

| Repurchases and retirements of common stock | (4,121) | | | (2,973) | | | | | | | |

| Dividends paid | (3,687) | | | (3,462) | | | | | | | |

| Payments of tax withholdings related to vesting of share-based awards | (932) | | | (521) | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| Other items, net | (17) | | | (19) | | | | | | | |

Net cash provided (used) by financing activities from discontinued operations | 19 | | | (58) | | | | | | | |

| | | | | | | | | |

| Net cash used by financing activities | (9,269) | | | (6,663) | | | | | | | |

| | | | | | | | | |

| Effect of exchange rate changes on cash and cash equivalents | 12 | | | 30 | | | | | | | |

| Net (decrease) increase in total cash and cash equivalents | (678) | | | 5,428 | | | | | | | |

| Total cash and cash equivalents at beginning of period (including $77 and $326 classified as held for sale at September 24, 2023 and September 25, 2022) | 8,527 | | | 3,099 | | | | | | | |

Total cash and cash equivalents at end of period (including $77 classified as held for sale at September 24, 2023) | $ | 7,849 | | | $ | 8,527 | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | |

| Qualcomm Announces Fourth Quarter and Fiscal 2024 Results | Page 8 of 10 |

Note Regarding Use of Non-GAAP Financial Measures

The Non-GAAP financial measures presented herein should be considered in addition to, not as a substitute for or superior to, financial measures calculated in accordance with GAAP. In addition, “Non-GAAP” is not a term defined by GAAP, and as a result, our Non-GAAP financial measures might be different than similarly titled measures used by other companies. Reconciliations between GAAP and Non-GAAP financial measures are presented herein.

We use Non-GAAP financial information: (i) to evaluate, assess and benchmark our operating results on a consistent and comparable basis; (ii) to measure the performance and efficiency of our ongoing core operating businesses, including our QCT (Qualcomm CDMA Technologies) and QTL (Qualcomm Technology Licensing) segments; and (iii) to compare the performance and efficiency of these segments against competitors. Non-GAAP measurements used by us include revenues, cost of revenues, research and development (R&D) expenses, selling, general and administrative (SG&A) expenses, other income or expenses, operating income, interest expense, net investment and other income, income or earnings before income taxes, effective tax rate, net income and diluted earnings per share. We are able to assess what we believe is a meaningful and comparable set of financial performance measures by using Non-GAAP information. In addition, the HR and Compensation Committee of our Board of Directors uses certain Non-GAAP financial measures in establishing portions of the performance-based incentive compensation programs for our executive officers. We present Non-GAAP financial information to provide greater transparency to investors with respect to our use of such information in financial and operational decision-making. This Non-GAAP financial information is also used by institutional investors and analysts in evaluating our business and assessing trends and future expectations.

Non-GAAP information presented herein excludes our QSI (Qualcomm Strategic Initiatives) segment and certain share-based compensation, acquisition-related items, tax items and other items.

•QSI is excluded because we generally expect to exit our strategic investments in the foreseeable future, and the effects of fluctuations in the value of such investments and realized gains or losses are viewed as unrelated to our operational performance.

•Share-based compensation expense primarily relates to restricted stock units. We believe that excluding share-based compensation from Non-GAAP financial information allows us and investors to make additional comparisons of the operating activities of our ongoing core businesses over time and with respect to other companies.

•Certain other items are excluded because we view such items as unrelated to the operating activities of our ongoing core businesses, as follows:

◦Acquisition-related items include amortization of acquisition-related intangible assets, substantially all of which relate to the amortization of technology-based intangible assets that is recorded in cost of revenues and will recur in future periods until the related intangible assets have been fully amortized. We view acquisition-related intangible assets as items arising from pre-acquisition activities determined at the time of an acquisition. Acquisition-related intangible assets contribute to revenue generation that has not been excluded from our Non-GAAP financial information. Acquisition-related items also include recognition of the step-up of inventories and property, plant and equipment to fair value and the related tax effects of acquisition-related items, as well as any effects from restructuring the ownership of such acquired assets. We also exclude the operating results of acquired and/or consolidated businesses that, as of close, are expected or required to be sold. Additionally, we exclude certain other acquisition-related charges such as third-party acquisition and integration services costs and costs related to temporary debt facilities and letters of credit executed prior to the close of an acquisition.

◦We exclude certain other items that we view as unrelated to our ongoing businesses, such as major restructuring and restructuring-related costs, asset impairments and awards, settlements and/or damages arising from legal or regulatory matters. We exclude gains and losses driven by the revaluation of our deferred compensation plan liabilities recognized in operating expenses and the offsetting gains and losses on the related plan assets recognized in investment and other income (expense).

◦Certain tax items that are unrelated to the fiscal year in which they are recorded are excluded in order to provide a clearer understanding of our ongoing Non-GAAP tax rate and after-tax earnings. Beginning in the first quarter of fiscal 2023 and for the initial five-year period in which we are required to capitalize and amortize R&D expenditures for U.S. federal income tax purposes, we also exclude the favorable impact to our provision for income taxes and results of operations resulting from such change in treatment of R&D expenditures. The favorable tax provision impact will diminish in future years as capitalized research and development expenditures continue to amortize.

| | | | | |

| Qualcomm Announces Fourth Quarter and Fiscal 2024 Results | Page 9 of 10 |

Reconciliations of GAAP Results to Non-GAAP Results | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| (in millions, except per share data and percentages) | | | | GAAP to Non-GAAP Reconciliation | Non-GAAP Supplemental Information |

| | | GAAP Results | Less QSI | Less Share-Based Compensation | Less Other Items1 | Non-GAAP Results | QCT | QTL | Non-GAAP Reconciling Items2 |

| Q4 Fiscal 2024 | | | | | | | | | | | | |

| Revenues | | | | $10,244 | | $— | | $— | | | $— | | | $10,244 | | $8,678 | | $1,521 | | $45 | |

| Operating income (loss) | | | | 2,581 | | (4) | | (695) | | (226) | | 3,506 | | | | | | | |

| EBT | | | | 2,597 | | (16) | | (695) | | (183) | | 3,491 | | 2,465 | | 1,120 | | (94) | |

| EBT as % of revenues | | | | 25 | % | | | | | | | | 34 | % | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| Net income (loss) | | | | 2,920 | | (13) | | (483) | | 380 | | 3,036 | | | | | | | |

| Diluted EPS | | | | $2.59 | | ($0.01) | | ($0.43) | | $0.34 | | $2.69 | | | | | | | |

| Diluted shares | | | | 1,129 | | 1,129 | | 1,129 | | 1,129 | | 1,129 | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| Q4 Fiscal 2023 | | | | | | | | | | | |

| Revenues | | | | $8,631 | | $6 | | $— | | | ($40) | | $8,665 | | $7,374 | | $1,262 | | $29 | |

| Operating income (loss) | | | | 1,411 | | — | | (608) | | (650) | | 2,669 | | | | | | | |

| EBT | | | | 1,420 | | 70 | | (608) | | (659) | | 2,617 | | 1,889 | | 829 | | (101) | |

| | | | | | | | | | | | | | | | | | | |

| EBT as % of revenues | | | | 16 | % | | | | | | | | 30 | % | | | | | | | |

| Net income (loss) | | | | 1,489 | | 55 | | (480) | | (363) | | 2,277 | | | | | | | |

| Diluted EPS | | | | $1.32 | | $0.05 | | ($0.43) | | ($0.32) | | $2.02 | | | | | | | |

| Diluted shares | | | | 1,125 | | 1,125 | | 1,125 | | 1,125 | | 1,125 | | | | | | | |

| Fiscal 2024 | | | | | | | | | | | | |

| Revenues | | | | $38,962 | | $18 | | $— | | | $— | | | $38,944 | | $33,196 | | $5,572 | | $176 | |

| Operating income (loss) | | | | 10,071 | | (1) | | (2,648) | | (600) | | 13,320 | | | | | | | |

| EBT | | | | 10,336 | | 104 | | (2,648) | | (407) | | 13,287 | | 9,527 | | 4,027 | | (267) | |

| EBT as % of revenues | | | | 27 | % | | | | | | | | 34 | % | | | | | | | |

| Net income (loss) | | | | 10,142 | | 82 | | (1,986) | | 501 | | 11,545 | | | | | | | |

| Diluted EPS | | | | $8.97 | | $0.07 | | ($1.76) | | $0.44 | | $10.22 | | | | | | | |

| Diluted shares | | | | 1,130 | | 1,130 | | 1,130 | | 1,130 | | 1,130 | | | | | | | |

| Fiscal 2023 | | | | | | | | | | | | | | | |

| Revenues | | | | $35,820 | | $28 | | $— | | ($40) | | $35,832 | | $30,382 | | $5,306 | | $144 | |

| Operating income (loss) | | | | 7,788 | | 1 | | (2,484) | | (1,189) | | 11,460 | | | | | | | |

| EBT | | | | 7,443 | | (12) | | (2,484) | | (1,131) | | 11,070 | | 7,924 | | 3,628 | | (482) | |

| EBT as % of revenues | | | | 21 | % | | | | | | | | 31 | % | | | | | | | |

| Net income (loss) | | | | 7,232 | | (10) | | (2,021) | | (223) | | 9,486 | | | | | | | |

| Diluted EPS | | | | $6.42 | | ($0.01) | | ($1.80) | | ($0.20) | | $8.43 | | | | | | | |

| Diluted shares | | | | 1,126 | | 1,126 | | 1,126 | | 1,126 | | 1,126 | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

(1) Further details of amounts included in the “Other Items” column for the current periods are included at the end of this news release in the sections labeled “Supplemental Information and Reconciliations.” Details of amounts included in the “Other Items” column for the prior periods are included in the news release for those periods.

(2) Non-GAAP reconciling items related to revenues consisted primarily of nonreportable segment revenues. Non-GAAP reconciling items related to EBT consisted primarily of certain cost of revenues, R&D expenses, SG&A expenses, other expenses or income, interest expense and certain investment income (expense) that are not allocated to segments for management reporting purposes; and nonreportable segment results.

Sums may not equal totals due to rounding.

| | | | | |

| Qualcomm Announces Fourth Quarter and Fiscal 2024 Results | Page 10 of 10 |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Q4 Fiscal 2024 Supplemental Information and Reconciliations | |

| (in millions) | GAAP Results | Less QSI | Less Share-Based Compensation | Less Other Items1, 2 | Non-GAAP Results |

| Cost of revenues | | $4,467 | | | $— | | | $22 | | | $37 | | | $4,408 | |

| Research and development expenses | | 2,302 | | | — | | | 539 | | | 33 | | | 1,730 | |

| Selling, general and administrative expenses | | 762 | | | 4 | | | 134 | | | 24 | | | 600 | |

Other | | 132 | | | — | | | — | | | 132 | | | — | | |

| Interest expense | | 178 | | | — | | | — | | | 1 | | | 177 | |

Investment and other income (expense), net | | 194 | | | (12) | | | — | | | 44 | | | 162 | |

Income tax (benefit) expense | | (318) | | | (3) | | | (212) | | | (558) | | | 455 | |

| Discontinued operations, net of income taxes | | 5 | | | — | | | — | | | 5 | | | — | | |

(1) Other items excluded from Non-GAAP results included $135 million of restructuring and restructuring-related charges, $51 million of acquisition-related charges, $1 million of interest expense related to a fine imposed on us by the European Commission in 2019 (2019 EC fine), partially offset by a $3 million benefit resulting from a reduction to the 2019 EC fine. Other items excluded from Non-GAAP results also included $43 million of losses driven by the revaluation of our deferred compensation plan liabilities, which increases operating expenses, offset by corresponding $44 million of gains driven by the revaluation of the associated plan assets, which were included within investment and other income (expense), net, as well as $5 million of income, net of income taxes, from the discontinued operations of Veoneer’s Non-Arriver businesses.

(2) At fiscal year end, the quarterly tax expense for each column equals the annual tax expense (benefit) for each column computed in accordance with GAAP. In interim quarters, the sum of these expenses (benefits) may not equal the total GAAP tax expense, and this difference is included in the tax expense (benefit) in the “Other Items” column. Tax benefit in the “Other Items” column included a $317 million benefit related to the transfer of intellectual property between foreign subsidiaries, a $93 million benefit from the foreign-derived intangible income (FDII) deduction resulting from the requirement to capitalize and amortize R&D expenditures, a $73 million foreign currency gain related to a noncurrent receivable resulting from our refund claim of Korean withholding taxes paid in prior periods, a $55 million benefit related to the one-time repatriation tax accrued in fiscal 2018, a $14 million benefit from the combined effect of other items in EBT, a $7 million benefit for the tax effect of acquisition-related charges, partially offset by a $1 million expense to reconcile the tax provision of each column to the total GAAP tax provision for the quarter.

Sums may not equal totals due to rounding.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Fiscal 2024 Supplemental Information and Reconciliations | |

| (in millions) | GAAP Results | Less QSI | Less Share-Based Compensation | Less Other Items1, 2 | Non-GAAP Results |

| | |

| Cost of revenues | | $17,060 | | | $7 | | | $89 | | | $134 | | | $16,830 | |

| Research and development expenses | | 8,893 | | | — | | | 2,024 | | | 147 | | | 6,722 | |

| Selling, general and administrative expenses | | 2,759 | | | 12 | | | 535 | | | 140 | | | 2,072 | |

Other | | 179 | | | — | | | — | | | 179 | | | — | | |

| Interest expense | | 697 | | | — | | | — | | | 5 | | | 692 | |

| Investment and other income, net | | 962 | | | 105 | | | — | | | 198 | | | 659 | |

| Income tax expense (benefit) | | 226 | | | 22 | | | (662) | | | (876) | | | 1,742 | |

| Discontinued operations, net of income taxes | | 32 | | | — | | | — | | | 32 | | | — | | |

(1) Other items excluded from Non-GAAP results included $211 million of acquisition-related charges, $120 million of restructuring and restructuring-related charges, a $75 million charge related to the settlement of a securities class action lawsuit, $5 million of interest expense related to the 2019 EC fine, partially offset by a $3 million benefit resulting from a reduction to the 2019 EC fine. Other items excluded from Non-GAAP results also included $197 million of losses driven by the revaluation of our deferred compensation plan liabilities, which increases operating expenses, offset by corresponding $198 million of gains driven by the revaluation of the associated plan assets, which were included within investment and other income, net, as well as $32 million of income, net of income taxes, from the discontinued operations of Veoneer’s Non-Arriver businesses.

(2) Tax benefit in the “Other Items” column included a $431 million benefit from the FDII deduction resulting from the requirement to capitalize and amortize R&D expenditures, a $317 million benefit related to the transfer of intellectual property between foreign subsidiaries, a $55 million benefit related to the one-time repatriation tax accrued in fiscal 2018, a $31 million benefit for the tax effect of acquisition-related charges, a $19 million foreign currency gain related to a noncurrent receivable resulting from our refund claim of Korean withholding taxes paid in prior periods, a $17 million benefit related to a prior period and a $6 million benefit from the combined effect of other items in EBT.

Sums may not equal totals due to rounding.

v3.24.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

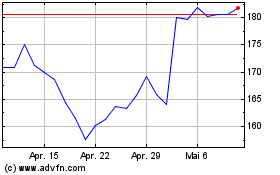

QUALCOMM (NASDAQ:QCOM)

Historical Stock Chart

Von Mär 2025 bis Apr 2025

QUALCOMM (NASDAQ:QCOM)

Historical Stock Chart

Von Apr 2024 bis Apr 2025