UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the Securities

Exchange Act of 1934 (Amendment No. )

Filed by the Registrant ☒

Filed by a Party other than the Registrant ☐

Check the appropriate box:

☐ Preliminary Proxy Statement

☐ Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

☐ Definitive Proxy Statement

☒ Definitive Additional Materials

☐ Soliciting Material Pursuant to §240.14a-12

Nexstar Media Group, Inc.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check all boxes that apply):

☒ No fee required

☐ Fee paid previously with preliminary materials

☐ Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11

SUPPLEMENT TO

PROXY STATEMENT

ANNUAL MEETING OF STOCKHOLDERS

June 18, 2024

This Supplement to Nexstar Media Group, Inc.’s (“Nexstar,” the “Company,” “we,” “us,” “our”) Proxy Statement dated April 29, 2024 (the “2024 Proxy Statement”) is furnished in connection with the solicitation by the Board of Directors of proxies to be voted at the annual meeting of stockholders of the company to be held in Irving, Texas on June 18, 2024.

This Supplement is dated June 7, 2024.

This Supplement is being distributed by Nexstar to respond to inaccurate statements and flawed conclusions leading to misguided recommendations by Institutional Shareholder Services (“ISS”) and Glass Lewis (collectively, the “Proxy Advisory Firms” and each, a “Proxy Advisory Firm”) with respect to our Proposal No. 1, Election of Directors and Proposal No. 3, Advisory Vote on Executive Compensation.

WE RECOMMEND THAT OUR STOCKHOLDERS VOTE “FOR” ALL DIRECTOR NOMINEES AND “FOR” THE ADVISORY VOTE ON EXECUTIVE COMPENSATION.

|

|

|

|

|

|

Nexstar Media Group, Inc. |

1 |

Supplement to 2024 Proxy Statement |

Introduction:

Both Proxy Advisory Firms recommended that Nexstar stockholders vote “against” Nexstar’s Advisory Vote on Executive Compensation, or “Say on Pay,” proposal, and to vote “against” the election of two of the members of the Compensation Committee of Nexstar’s Board of Directors (the “Compensation Committee”). One Proxy Advisory Firm also recommended that stockholders vote “against” the election of one of the members of the Nominating and Corporate Governance Committee of Nexstar’s Board of Directors. Below we address the concerns of the Proxy Advisory Firms.

Proxy Advisory Firm Concern #1:

The Proxy Advisory Firms suggest that the Compensation Committee was not responsive enough to the 2023 Say on Pay vote.

Company Response #1:

A strong majority (68%) of our stockholders voted “FOR” Say on Pay in connection with our 2023 annual meeting of stockholders (the “2023 Annual Meeting”). Nonetheless, following the 2023 Annual Meeting, the Company engaged with stockholders holding a large percentage of the Company’s outstanding shares to understand the outcome of the vote and, in particular, the reasons behind votes “AGAINST” Say on Pay.

Page 16 of the 2024 Proxy Statement states that we reached out to our 26 largest institutional stockholders (and one affiliated stockholder), representing 69% of shares outstanding (73%, including the one affiliated stockholder). Although not every stockholder that we contacted felt the need to engage, the Company engaged with each stockholder that responded to our request, and we took into account their feedback and concerns. The most common stockholder feedback we received regarding executive compensation during our stockholder outreach process is stated on page 17 of the 2024 Proxy Statement: “Generally fine with executive compensation, especially since pay is aligned with stockholder returns.”

The Compensation Committee has a track record of responsiveness to stockholder concerns regarding executive compensation.

Page 37 of our 2024 Proxy Statement explains how we changed our executive compensation packages based on past stockholder feedback, including with respect to: (i) elimination of long-term entitlements to salary increases and specified variable compensation, (ii) use of performance-based stock awards, (iii) inclusion of management employees and non-employee directors in equity awards and (iv) implementation of a formulaic short-term incentive program.

In addition, the 2022 employment contract for Perry A. Sook, our Founder, Chairman and CEO (as described and defined below), included a number of changes responsive to past stockholder input, including: (i) elimination of annual increases in salary and bonus, (ii) increases in the minimum performance thresholds for a bonus to be paid, (iii) implementation of a sliding scale for bonus payout based on various levels of achievement of targets, (iv) increased percentage of restricted stock unit awards that are performance based to 50%, (v) annual determination by the Compensation Committee of the amount of restricted stock unit awards (both time-based and performance-based) to be targeted, instead of being preset.

The Compensation Committee committed to taking stockholder feedback into consideration as executive contracts come up for renewal.

Page 17 of the 2024 Proxy Statement states “The Company and the Compensation Committee of its Board of Directors will evaluate the stockholder feedback regarding executive compensation in connection with its plans regarding future executive contracts and contract renewals.”

The employment contract amendment for Perry A. Sook, Founder, Chairman, and Chief Executive Officer of the Company (the “CEO”) was entered into on August 1, 2022 and provides for a term that extends through March 31, 2026.

The Amendment to Amended Executive Employment Agreement with Chairman and CEO, Perry A. Sook was entered into on August 1, 2022 and is in effect for the period beginning on March 1, 2023 through March 31, 2026

|

|

|

|

|

|

Nexstar Media Group, Inc. |

2 |

Supplement to 2024 Proxy Statement |

(the “2022 Sook Employment Agreement”). ISS recommended a vote “FOR” Say on Pay in connection with our 2023 Annual Meeting when the 2022 Sook Employment Agreement was in place. The Company has no grounds to disavow the legally binding contract with our CEO. If a new contract for Mr. Sook is negotiated in 2025, likely after the 2025 annual meeting of stockholders, the Compensation Committee will take into consideration the feedback of all stockholders.

Proxy Advisory Firm Concern #2:

ISS states that the 2024 Proxy Statement does not disclose director participation in shareholder engagement efforts.

Company Response #2:

The Chair of the Compensation Committee participated in our stockholder outreach initiative and that fact is disclosed in the 2024 Proxy Statement.

Page 16 of the 2024 Proxy Statement states “In the first quarter of 2024, we contacted our 27 largest stockholders … to offer a call with members of senior management as well as a member of the Compensation Committee of the Board of Directors… stockholders representing approximately 48% of the shares held by our top 27 stockholders participated in calls (with one participating in an ad hoc call regarding these topics held in October 2023) …” In total, we conducted 9 calls (8 with institutional investors) during the first quarter stockholder outreach program (10, including the October 2023 call). Based on responses from institutional investors, Jay Grossman, the Chair of the Compensation Committee, participated in 3 of the 8 institutional investor calls (or 38%) with top 10 institutional stockholders representing 16% of shares outstanding.

Further, we also stated “We report the results of our annual stockholder outreach initiative to the Company’s Board of Directors.” This comprehensive report was reviewed with our Board of Directors at our April 25, 2024 board meeting.

Our Board of Directors and Compensation Committee are highly engaged with respect to understanding and responding to stockholder compensation concerns.

Proxy Advisory Firm Concern #3:

Both Proxy Advisory Firms indicate that Pay for Performance was disconnected.

Company Response #3:

The CEO’s pay is aligned with the Company’s stock price performance and strong TSR metrics.

ISS’s assessment of Nexstar’s Pay for Performance indicates a “high” level of concern. However, its own measures show a “low” level of concern for two of the three quantitative tests that compare CEO pay to TSR performance and a “medium” level of concern for the third test which compares the quantum of compensation versus the median of peers. We note that Nexstar’s multiple of median result of 2.48 was only just above the threshold to be characterized as “medium” concern of 2.33x. Further, we note that the ISS peer group includes at least one company which did not grant any LTI to its CEO and two companies (including the aforementioned) which had stock prices in the single-dollar range that could have impacted the quantum of LTI issued. In light of notable distinctions between us and members of the peer group, we question whether the quantum of compensation is an appropriate metric for comparison. In addition, it is difficult to understand how any qualitative judgement for a measure that quantitatively is two-thirds “low concern” and one-third “medium concern” could translate to a final result of “high concern.”

Page 63 of the 2024 Proxy Statement shows that the “Total Stockholder Return” in each of 2020, 2021, 2022, and 2023 significantly exceeded the “Peer Group Total Stockholder Return.” The illustrations below from pages 65 and 66 of the 2024 Proxy Statement support the alignment of pay and performance. The charts provide a graphical description of the relationship between CAP (as calculated in accordance with SEC rules) and the information presented in the Pay versus Performance table. The Peer Group referenced in the “Company

|

|

|

|

|

|

Nexstar Media Group, Inc. |

3 |

Supplement to 2024 Proxy Statement |

Cumulative TSR and Peer Group Cumulative TSR” table below is comprised of: Gray Television, Inc., TEGNA Inc., Sinclair, Inc., The E.W. Scripps Company, Fox Corporation and Paramount Global.

Further, we note that Mr. Sook received significantly less than his targeted bonus in 2023 due to financial performance of the Company, earning only 82% of the targeted bonus.

Proxy Advisory Firm Concern #4:

ISS claims that we did not disclose specific targets for financial metrics.

Company Response #4:

Both the 2024 Proxy Statement and the employment agreements with our Named Executive Officers (“NEOs”) which are filed with the SEC disclosed specific targets for financial metrics for NEOs.

Pages 44 - 46 of the 2024 Proxy Statement include two tables which denote the specific targets contained in all NEO contracts, including Mr. Sook’s contract.

Per 2024 Proxy Statement:

“Annual Bonus Opportunity and 2023 Actual Results – Mr. Sook

As provided in his employment agreement, as amended on August 1, 2022 (the “2022 Sook Amended Employment Agreement”), Mr. Sook, is eligible to receive an annual bonus with a “Target” amount equal to 200% of his annual base salary, subject to increase or decrease based on the criteria set forth in the tables below and approval of the Compensation Committee. The Compensation Committee may alter the criteria set forth in the tables below as circumstances warrant and in consultation with Mr. Sook:

|

|

|

|

|

|

Component |

Weight |

No Payout |

Threshold |

Target |

Maximum |

Adjusted EBITDA(a) |

35% |

< 85% of Target |

85% of Target |

Budgeted Target(a) |

105% of Target |

Net Revenues(a) |

35% |

< 85% of Target |

85% of Target |

Budgeted Target(a) |

105% of Target |

Individual Performance(b) |

30% |

Discretionary |

Payout Opportunity |

100% |

0% (no payout) |

50% of Target |

100% of Target |

200% of Target |

(a)As defined in the 2022 Sook Employment Agreement.

(b)Individual performance will be earned at the Compensation Committee’s discretion based on Mr. Sook’s achievement of the objectives established by Compensation Committee and/or Board at the beginning of the applicable fiscal year.

|

|

|

|

|

|

Nexstar Media Group, Inc. |

4 |

Supplement to 2024 Proxy Statement |

|

|

|

Criteria |

2023 Results |

% of Target Bonus Achieved |

35% earned if the Company achieves its Adjusted EBITDA Target for the applicable year |

Adjusted EBITDA(1) was 89% of budget |

63% |

35% earned if the Company achieves its Net Revenue Target for the applicable year. |

Net Revenue(1) was 95% of budget |

84% |

30% earned at the discretion of the Compensation Committee based on Mr. Sook’s achievement of the objectives established by the Committee and/or Board at the beginning of the applicable fiscal year. |

Approved by the Compensation Committee |

100% |

Weighted combined total |

|

82% |

(1)The actual Net Revenue and actual Adjusted EBITDA includes an adjustment for the temporary disruption of a large customer in the third quarter of 2023. The adjustment was approved by the Compensation Committee given the successful multi-year renewal with such customer in September 2023. Additionally, the target (2023 budget), which was approved by the Company’s Board of Directors in January 2023, did not consider customer disruptions.”

We refer you to the 2024 Proxy Statement for disclosures relating to our remaining NEO, including any specific targets and achievements.

Proxy Advisory Firm Concern #5:

ISS indicated concern over the value of Mr. Sook’s annual equity grant, the one-year vesting period that applied to his performance-based restricted stock units, and that such performance-based restricted stock units vested at the maximum level even though the Company’s absolute TSR performance during the performance period was negative.

Company Response #5:

The one-year TSR performance is a relative metric, benchmarked against a peer group. The Compensation Committee believes that this approach appropriately rewards executives to drive superior performance versus a peer group even during a down business cycle.

While the one-year TSR performance for Nexstar Media Group, Inc. was negative, it was the third best performing stock in the peer group of fourteen companies, ranking in the 85th percentile. Of the fourteen companies in the peer group, only one, Cinemark Holdings, had a positive TSR. The peer group (ranked from highest to lowest TSR) included Cinemark Holdings, Inc., Clear Channel Outdoor Holdings, Nexstar Media Group, Inc., The Liberty SiriusXM Group, Fox Corp., Gannett Co, Inc., Sinclair, Inc., TEGNA Inc., AMC Networks, Inc. Gray Television, Inc., Warner Bros. Discovery, Inc., Paramount Global, The EW Scripps Company, and iHeartMedia, Inc.

Proxy Advisory Firm Concern #6:

Glass Lewis indicated a concern regarding the gender composition of our Board of Directors and a concern that the Company does not have a lead director.

Company Response #6:

The Nexstar Board of Directors has been executing an active refreshment process for the last several years. In 2021, we added Bernadette Aulestia (female/minority) to the Board and in 2023 we added Tony Wells (male/minority) to the Board. During our stockholder outreach calls, we received positive comments about these appointments and this trend. The Board is currently seeking a replacement for Mr. Pompadur, whose resignation is effective on June 18, 2024.

|

|

|

|

|

|

Nexstar Media Group, Inc. |

5 |

Supplement to 2024 Proxy Statement |

As described in our 2024 Proxy Statement, the independent directors prefer not to place one individual between themselves and the Chairman of the Board and Chief Executive Officer as well as other management as they believe this will reduce their ability to actively engage with management.

Proxy Advisory Firm Concern #7:

Glass Lewis indicated a concern regarding guaranteed bonuses.

Company Response #7:

In 2023, two of five NEOs had guaranteed bonuses. The first was paid to incoming President and Chief Operating Officer, Michael Biard, who joined the Company in August 2023 from Fox Corporation where he held the position of President, Operations and Distribution. The guaranteed bonus was incentive for him to leave his former employer and abandon the bonus he expected from Fox. The second was paid to existing Chief Financial Officer, Lee Ann Gliha, as incentive to extend her contract through December 2026. Even with the guaranteed bonus, her 2023 compensation in comparison to 2022 proxy disclosures, including targets for newly appointed CFOs, for peers in her position, was in the bottom quartile of the peer group, despite her strong performance for the Company. The employment contracts for both executives contain performance-based measurements for achieving their bonuses in 2024 and beyond. In particular, Mr. Biard’s contract includes a sliding scale for bonus payout based on various levels of achievement of targets.

Proxy Advisory Firm Concern #8:

Glass Lewis indicated a concern regarding liberal share counting under ownership policy.

Company Response #8:

We note that the multiple of the average value of our NEOs stock ownership in Nexstar divided by the average NEO salary is very high at 33x. The calculation is based on the Beneficial Ownership Table of Nexstar Common Stock on page 33 of the 2024 Proxy Statement, excluding any unvested restricted stock units or unexercised stock options, and using the closing stock price for Nexstar on June 3, 2024.

Proxy Advisory Firm Concern #9:

Glass Lewis indicated a concern regarding internal pay equity as the Chief Executive Officer’s compensation during the past fiscal year was more than four times the average compensation received by other NEOs.

Company Response #9:

The Company’s Chief Executive Officer is also the Company’s founder and third largest stockholder. Mr. Sook has been responsible for the Company’s tremendous stock price appreciation and his foresight and vision continue to drive the Company today. We believe the outperformance of the Company relative to peers more than justifies his compensation. In fact, Nexstar was recently recognized by Quartr, as the third best performing stock in all of North America and Europe with market capitalizations greater than $500 million, over the last fifteen years. Further, no such pay inequity exists for the non-founder NEOs, as the difference between the highest non-founder NEO and the average of other three NEOs is less than two times.

Other:

Please note we update the disclosure on Page 37 of the 2024 Proxy Statement to “From 2021 to 2023, 66% of the equity awards granted were to non-employee directors and management employees other than our Named Executive Officers.”

|

|

|

|

|

|

Nexstar Media Group, Inc. |

6 |

Supplement to 2024 Proxy Statement |

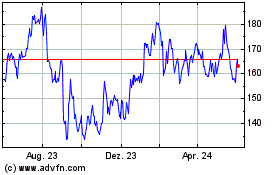

Nexstar Media (NASDAQ:NXST)

Historical Stock Chart

Von Mai 2024 bis Jun 2024

Nexstar Media (NASDAQ:NXST)

Historical Stock Chart

Von Jun 2023 bis Jun 2024