0001564708false00015647082024-07-122024-07-120001564708us-gaap:CommonClassAMember2024-07-122024-07-120001564708us-gaap:CommonClassBMember2024-07-122024-07-12

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of The Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): July 12, 2024

NEWS CORPORATION

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | | | | |

| | | | | |

| Delaware | | 001-35769 | | 46-2950970 |

(State or other jurisdiction

of incorporation) | | (Commission

File Number) | | (IRS Employer

Identification No.) |

1211 Avenue of the Americas, New York, New York 10036

(Address of principal executive offices, including zip code)

(212) 416-3400

(Registrant's telephone number, including area code)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| | | | | |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| | | | | |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| | | | | |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| | | | | |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Title of each class | | Trading Symbol(s) | | Name of each exchange on which registered |

| Class A Common Stock, par value $0.01 per share | | NWSA | | The Nasdaq Global Select Market |

| Class B Common Stock, par value $0.01 per share | | NWS | | The Nasdaq Global Select Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 8.01 Other Events.

As previously reported, under News Corporation's (the "Company's") stock repurchase program (the "Repurchase Program"), the Company is authorized to acquire from time to time up to $1 billion in the aggregate of the Company's outstanding shares of Class A common stock and Class B common stock. Under the rules of the Australian Securities Exchange (the "ASX"), the Company is required to provide to the ASX, on a daily basis, disclosure of transactions pursuant to the Repurchase Program, if any. The Company also discloses information concerning the Repurchase Program in the Company's quarterly and annual reports.

Attached as Exhibit 99.1 and Exhibit 99.2 are copies of the information provided to the ASX on the respective dates noted therein. Such information contains "forward-looking statements" within the meaning of the Private Securities Litigation Reform Act of 1995. These forward-looking statements include, but are not limited to, statements regarding the Company's intent to repurchase, from time to time, the Company's Class A common stock and Class B common stock. These statements are based on management's current expectations and beliefs and are subject to uncertainty and changes in circumstances. Actual results may vary materially from those expressed or implied by such statements due to, among other factors, changes in the market price of the Company's stock, general market conditions, applicable securities laws and alternative investment opportunities, as well as the risks, uncertainties and other factors described in the Company's filings with the Securities and Exchange Commission. The "forward-looking statements" included in such information are made only as of the date of this report. We do not have and do not undertake any obligation to publicly update any "forward-looking statements" to reflect subsequent events or circumstances, and we expressly disclaim any such obligation, except as required by law or regulation.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits.

| | | | | | | | |

| Exhibit No. | | Description |

| 99.1 | | |

| 99.2 | | |

| 104 | | Cover Page Interactive Data File (embedded within the Inline XBRL document). |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | |

| | | | |

| | NEWS CORPORATION

(REGISTRANT) |

| | | |

| | | |

| | By: | | /s/ Michael L. Bunder |

| | | | Michael L. Bunder |

| | | | Senior Vice President, Deputy General Counsel and Corporate Secretary |

Dated: July 15, 2024

Appendix 3C

Notification of buy-back

Information or documents not available now must be given to ASX as soon as available. Information and documents given to ASX become ASX’s property and may be made public.

*Denotes minimum information required for first lodgement of this form, with exceptions provided in specific notes for certain questions. The balance of the information, where applicable, must be provided as soon as reasonably practicable by the entity.

Part 1 – Entity and announcement details

| | | | | | | | |

| Question no | Question | Answer |

| 1.1 | *Name of entity We (the entity named above) provide the following information about our buy-back | NEWS CORPORATION |

| 1.2 | *Registration type and number Please supply your ABN, ARSN, ARBN, ACN or another registration type and number (if you supply another registration type, please specify both the type of registration and the registration number). | ARBN 163882933 |

| 1.3 | *ASX issuer code | NWS |

| 1.4 | *The announcement is Select whichever is applicable. | ☐ New announcement ☒ Update/amendment to previous announcement ☐ Cancellation of previous announcement ☒ Daily buy-back notification Not applicable for selective buy-backs (complete Part 4) ☐ Final buy-back notification (complete Part 5) |

| 1.4b | *Reason for update Answer this question if your response to Q 1.4 is “Update/amendment to previous announcement”. | Update to 3A.1 |

| 1.4c | *Date of initial notification of buy-back Answer this question if your response to Q 1.4 is “Update/amendment to previous announcement” or “Cancellation of previous announcement”. | 22/9/2021 |

| 1.4d | *Date of previous announcement to this update Answer this question if your response to Q 1.4 is “Update/amendment to previous announcement”. | 12/07/2024 |

| 1.5 | *Date of this announcement | 15/07/2024 |

| 1.6 | *Class of +securities the subject of the buy-back: Note: only one type of buy-back for one class of security can be advised in this notification. If a buy-back extends to more than one class of security, a separate notification is required for each class. | ASX Security Code: NWSAA Security Description: COMMON STOCK CLASS A |

| | |

| + See chapter 19 for defined terms |

5 June 2021 Page 1

| | |

Appendix 3C Notification of buy-back |

Part 2 –Type of buy-back

| | | | | | | | |

| Question No. | Question | Answer |

| 2.1 | *The type of buy-back is Note this form is not required for minimum holding buy-backs (i.e. buy-backs of unmarketable parcels). The only notification required to ASX for a minimum holding buy-back is the lodgement of an Appendix 3H within 5 business days of the completion of the minimum holding buy-back notifying ASX of the cancellation of the securities bought back in accordance with listing rule 3.8A. | ☐ Employee share scheme buy-back ☐ On-market buy-back ☐ Equal access scheme buy-back ☐ Selective buy-back ☒ Other buy-back Select one item. Note: “Other buy-back” does not include a minimum holding buy-back. The section “Other buy-back” will generally only be applicable to an entity established outside Australia. |

| 2.2 | Please describe the type of buy-back Answer this question if your response to Q 2.1 is “Other buy-back”. | Repurchase program for up to an aggregate of US$1 billion of the Company’s Nasdaq-listed Class A common stock and Class B common stock. Subject to market conditions and the market price of the Company’s stock, as well as other factors, the Company intends to repurchase, from time to time, in the open market or otherwise, a combination of the Company’s Class A common stock and Class B common stock. No ASX-listed CDIs will be repurchased in this program. |

Part 3 –Buy-back details

Part 3A – Details of +securities, price and reason

| | | | | | | | |

| 3A.1 | *Total number of +securities on issue in the class of +securities to be bought back | 375,021,845 |

| 3A.2 | *Total number of +securities proposed to be bought back Answer this question if your response to Q 2.1 is “Employee share scheme buy-back, “Selective buy-back” or “Other buy-back”. | The Company may purchase up to an aggregate of US$1 billion of Class A common stock and Class B common stock. |

| 3A.4 | *Does the entity intend to buy back a minimum number of +securities Answer this question if your response to Q 2.1 is “On-market buy-back”. | No |

| 3A.5 | *Does the entity intend to buy back a maximum number of securities? Answer this question if your response to Q 2.1 is “On-market buy-back” | Yes |

| | |

| + See chapter 19 for defined terms |

5 June 2021 Page 2

| | |

Appendix 3C Notification of buy-back |

| | | | | | | | |

| 3A.5a | *Maximum number of +securities proposed to be bought back Answer this question if your response to Q 2.1 is “On-market buy-back” and your response to Q 3A.5 is “Yes”. | The Company may purchase up to an aggregate of US$1 billion of Class A common stock and Class B common stock. |

| 3A.6 | *Name of broker or brokers who will offer to buy back +securities on the entity’s behalf Answer this question if your response to Q 2.1 is “On-market buy-back”. | BofA Securities, Inc. |

| 3A.9 | *Are the +securities being bought back for a cash consideration? Note: if the securities are being bought back for nil cash consideration, answer this question “No”. | Yes |

| 3A.9a | *Is the price to be paid for +securities bought back known? Answer this question if your response to Q 3A.9 is “Yes”. | No |

| 3A.9a(i) | *In what currency will the buy-back consideration be paid? Answer this question if your response to Q 3A.9 is “Yes”. Note: all prices below are to be expressed in this currency. | USD – US Dollar |

| 3A.12 | *Reason for buy-back Answer this question if your response to Q 2.1 is “Other buy-back”. | To enhance shareholder value |

Part 3B – Buy-back restrictions and conditions

| | | | | | | | |

| 3B.1 | *Does the buy-back require security holder approval? Disregard any security holder approval that has already been obtained. | No |

| 3B.2 | *Are there any restrictions on foreign participation in the buy-back Answer this question if your response to Q 2.1 is “Equal access scheme buy-back”, “Selective buy-back” or “Other buy-back”. | No |

| 3B.3 | *Are there any other conditions that need to be satisfied before the buy-back offer becomes unconditional Answer this question if your response to Q 2.1 is “Employee share scheme buy-back, “Equal access scheme buy-back”, “Selective buy-back” or “Other buy-back” | No |

Part 3C - Key dates

| | | | | | | | |

Employee Share Scheme, Selective and Other Buy-Backs Answer the questions in this part if your response to Q 2.1 is “Employee share scheme buy-back”, “Selective buy-back” or “Other buy-back” |

| 3C.1 | *Anticipated date buy-back will occur | 22/9/2021 |

Part 3D – Other information

| | | | | | | | |

| 3D.1 | Any other information the entity wishes to notify to ASX about the buy-back | |

| | |

| + See chapter 19 for defined terms |

5 June 2021 Page 3

| | |

Appendix 3C Notification of buy-back |

Part 4 – Daily buy-back notification

Answer the questions in this part if your response to Q 2.1 is “Employee share scheme buy-back”, “On-market buy-back”, “Equal access share scheme buy-back” or “Other buy-back”) and you are giving a daily buy-back notification under listing rule 3.8A.

A daily buy-back notification must be submitted for these types of buy-backs at least half an hour before the commencement of trading on the business day after any day on which securities are bought back (per listing rule 3.8A).

| | | | | | | | | | | |

| 4.1 | *Date of this notification | 15/07/2024 |

| 4.2 | *Previous day on which +securities were bought back | 12/07/2024 |

| | Before previous day | On previous day |

| 4.3 | *Total number of +securities bought back, or in relation to which acceptances have been received | 18,804,850 | 14,506

|

| 4.4 | *Total consideration paid or payable for the +securities | US$363,020,591.80

| US$404,736.26

|

| 4.5 | *Highest price paid Answer these questions if your response to Q 2.1 is “On-market buy-back”. | US$28.02 *Date highest price was paid: 11/07/2024 | US$28.07 |

| 4.6 | *Lowest price paid Answer these questions if your response to Q 2.1 is “On-market buy-back”. | US$14.88 *Date lowest price was paid: 29/09/2022 | US$27.79 |

| 4.8 | *If the entity has disclosed an intention to buy back a maximum number of +securities, the remaining number of +securities to be bought back as at the end of the previous day Note: ASX has calculated this number for you based on previous notifications. If it is not correct, please amend it to the correct number and consider whether any updates need to be made to previous notifications. | The company is authorized to acquire up to an aggregate of US$1 billion of the Company’s Nasdaq-listed Class A common stock and Class B common stock. To date, the company has purchased approximately US$545,039,051.73 worth of Class A and Class B shares (based on total consideration paid). |

Introduced 05/06/21

| | |

| + See chapter 19 for defined terms |

5 June 2021 Page 4

Appendix 3C

Notification of buy-back

Information or documents not available now must be given to ASX as soon as available. Information and documents given to ASX become ASX’s property and may be made public.

*Denotes minimum information required for first lodgement of this form, with exceptions provided in specific notes for certain questions. The balance of the information, where applicable, must be provided as soon as reasonably practicable by the entity.

Part 1 – Entity and announcement details

| | | | | | | | |

| Question no | Question | Answer |

| 1.1 | *Name of entity We (the entity named above) provide the following information about our buy-back | NEWS CORPORATION |

| 1.2 | *Registration type and number Please supply your ABN, ARSN, ARBN, ACN or another registration type and number (if you supply another registration type, please specify both the type of registration and the registration number). | ARBN 163882933 |

| 1.3 | *ASX issuer code | NWS |

| 1.4 | *The announcement is Select whichever is applicable. | ☐ New announcement ☒ Update/amendment to previous announcement ☐ Cancellation of previous announcement ☒ Daily buy-back notification Not applicable for selective buy-backs (complete Part 4) ☐ Final buy-back notification (complete Part 5) |

| 1.4b | *Reason for update Answer this question if your response to Q 1.4 is “Update/amendment to previous announcement”. | Update to 3A.1 |

| 1.4c | *Date of initial notification of buy-back Answer this question if your response to Q 1.4 is “Update/amendment to previous announcement” or “Cancellation of previous announcement”. | 22/9/2021 |

| 1.4d | *Date of previous announcement to this update Answer this question if your response to Q 1.4 is “Update/amendment to previous announcement”. | 12/07/2024 |

| 1.5 | *Date of this announcement | 15/07/2024 |

| 1.6 | *Class of +securities the subject of the buy-back: Note: only one type of buy-back for one class of security can be advised in this notification. If a buy-back extends to more than one class of security, a separate notification is required for each class. | ASX Security Code: NWSAB Security Description: COMMON STOCK CLASS B |

| | |

| + See chapter 19 for defined terms |

5 June 2021 Page 1

| | |

Appendix 3C Notification of buy-back |

Part 2 –Type of buy-back

| | | | | | | | |

| Question No. | Question | Answer |

| 2.1 | *The type of buy-back is Note this form is not required for minimum holding buy-backs (i.e. buy-backs of unmarketable parcels). The only notification required to ASX for a minimum holding buy-back is the lodgement of an Appendix 3H within 5 business days of the completion of the minimum holding buy-back notifying ASX of the cancellation of the securities bought back in accordance with listing rule 3.8A. | ☐ Employee share scheme buy-back ☐ On-market buy-back ☐ Equal access scheme buy-back ☐ Selective buy-back ☒ Other buy-back Select one item. Note: “Other buy-back” does not include a minimum holding buy-back. The section “Other buy-back” will generally only be applicable to an entity established outside Australia. |

| 2.2 | Please describe the type of buy-back Answer this question if your response to Q 2.1 is “Other buy-back”. | Repurchase program for up to an aggregate of US$1 billion of the Company’s Nasdaq-listed Class A common stock and Class B common stock. Subject to market conditions and the market price of the Company’s stock, as well as other factors, the Company intends to repurchase, from time to time, in the open market or otherwise, a combination of the Company’s Class A common stock and Class B common stock. No ASX-listed CDIs will be repurchased in this program. |

Part 3 –Buy-back details

Part 3A – Details of +securities, price and reason

| | | | | | | | |

| 3A.1 | *Total number of +securities on issue in the class of +securities to be bought back | 162,137,568 |

| 3A.2 | *Total number of +securities proposed to be bought back Answer this question if your response to Q 2.1 is “Employee share scheme buy-back, “Selective buy-back” or “Other buy-back”. | The Company may purchase up to an aggregate of US$1 billion of Class A common stock and Class B common stock. |

| 3A.4 | *Does the entity intend to buy back a minimum number of +securities Answer this question if your response to Q 2.1 is “On-market buy-back”. | No |

| 3A.5 | *Does the entity intend to buy back a maximum number of securities? Answer this question if your response to Q 2.1 is “On-market buy-back” | Yes |

| | |

| + See chapter 19 for defined terms |

5 June 2021 Page 2

| | |

Appendix 3C Notification of buy-back |

| | | | | | | | |

| 3A.5a | *Maximum number of +securities proposed to be bought back Answer this question if your response to Q 2.1 is “On-market buy-back” and your response to Q 3A.5 is “Yes”. | The Company may purchase up to an aggregate of US$1 billion of Class A common stock and Class B common stock. |

| 3A.6 | *Name of broker or brokers who will offer to buy back +securities on the entity’s behalf Answer this question if your response to Q 2.1 is “On-market buy-back”. | BofA Securities, Inc. |

| 3A.9 | *Are the +securities being bought back for a cash consideration? Note: if the securities are being bought back for nil cash consideration, answer this question “No”. | Yes |

| 3A.9a | *Is the price to be paid for +securities bought back known? Answer this question if your response to Q 3A.9 is “Yes”. | No |

| 3A.9a(i) | *In what currency will the buy-back consideration be paid? Answer this question if your response to Q 3A.9 is “Yes”. Note: all prices below are to be expressed in this currency. | USD – US Dollar |

| 3A.12 | *Reason for buy-back Answer this question if your response to Q 2.1 is “Other buy-back”. | To enhance shareholder value |

Part 3B – Buy-back restrictions and conditions

| | | | | | | | |

| 3B.1 | *Does the buy-back require security holder approval? Disregard any security holder approval that has already been obtained. | No |

| 3B.2 | *Are there any restrictions on foreign participation in the buy-back Answer this question if your response to Q 2.1 is “Equal access scheme buy-back”, “Selective buy-back” or “Other buy-back”. | No |

| 3B.3 | *Are there any other conditions that need to be satisfied before the buy-back offer becomes unconditional Answer this question if your response to Q 2.1 is “Employee share scheme buy-back, “Equal access scheme buy-back”, “Selective buy-back” or “Other buy-back” | No |

Part 3C - Key dates

| | | | | | | | |

Employee Share Scheme, Selective and Other Buy-Backs Answer the questions in this part if your response to Q 2.1 is “Employee share scheme buy-back”, “Selective buy-back” or “Other buy-back” |

| 3C.1 | *Anticipated date buy-back will occur | 22/9/2021 |

Part 3D – Other information

| | | | | | | | |

| 3D.1 | Any other information the entity wishes to notify to ASX about the buy-back | |

| | |

| + See chapter 19 for defined terms |

5 June 2021 Page 3

| | |

Appendix 3C Notification of buy-back |

Part 4 – Daily buy-back notification

Answer the questions in this part if your response to Q 2.1 is “Employee share scheme buy-back”, “On-market buy-back”, “Equal access share scheme buy-back” or “Other buy-back”) and you are giving a daily buy-back notification under listing rule 3.8A.

A daily buy-back notification must be submitted for these types of buy-backs at least half an hour before the commencement of trading on the business day after any day on which securities are bought back (per listing rule 3.8A).

| | | | | | | | | | | |

| 4.1 | *Date of this notification | 15/07/2024 |

| 4.2 | *Previous day on which +securities were bought back | 12/07/2024 |

| | Before previous day | On previous day |

| 4.3 | *Total number of +securities bought back, or in relation to which acceptances have been received | 9,269,038

| 6,893

|

| 4.4 | *Total consideration paid or payable for the +securities | US$181,416,166.15

| US$197,557.52

|

| 4.5 | *Highest price paid Answer these questions if your response to Q 2.1 is “On-market buy-back”. | US$28.85 *Date highest price was paid: 11/07/2024 | US$28.88 |

| 4.6 | *Lowest price paid Answer these questions if your response to Q 2.1 is “On-market buy-back”. | US$15.17 *Date lowest price was paid: 29/09/2022 | US$28.41 |

| 4.8 | *If the entity has disclosed an intention to buy back a maximum number of +securities, the remaining number of +securities to be bought back as at the end of the previous day Note: ASX has calculated this number for you based on previous notifications. If it is not correct, please amend it to the correct number and consider whether any updates need to be made to previous notifications. | The company is authorized to acquire up to an aggregate of US$1 billion of the Company’s Nasdaq-listed Class A common stock and Class B common stock. To date, the company has purchased approximately US$545,039,051.73 worth of Class A and Class B shares (based on total consideration paid). |

Introduced 05/06/21

| | |

| + See chapter 19 for defined terms |

5 June 2021 Page 4

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_CommonClassAMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_CommonClassBMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

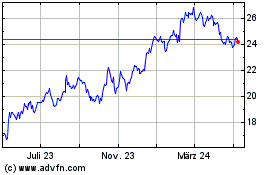

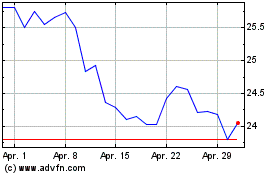

News (NASDAQ:NWSA)

Historical Stock Chart

Von Nov 2024 bis Dez 2024

News (NASDAQ:NWSA)

Historical Stock Chart

Von Dez 2023 bis Dez 2024