false06-29truetruetrue2024true0000880117falsefalsefalsefalsetruetruefalsefalsetruenilfalsetrueQ1SANFILIPPO JOHN B & SON INC 2,597,4262,597,4262,597,4260000880117us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember2022-07-012022-09-2900008801172022-06-300000880117us-gaap:TradeNamesMember2023-06-290000880117us-gaap:RevolvingCreditFacilityMembersrt:MaximumMemberus-gaap:SubsequentEventMember2023-09-290000880117us-gaap:RevolvingCreditFacilityMember2023-09-280000880117us-gaap:TreasuryStockCommonMember2023-06-2900008801172023-06-290000880117us-gaap:GeneralAndAdministrativeExpenseMember2023-06-302023-09-280000880117us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember2023-06-302023-09-280000880117us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-06-290000880117us-gaap:CommonClassAMember2023-09-280000880117us-gaap:CommonStockMember2022-09-290000880117us-gaap:RetainedEarningsMember2023-06-290000880117jbss:NoncumulativeCommonStockMember2023-09-280000880117us-gaap:TradeNamesMember2022-09-290000880117jbss:JamesJSanfilippoMember2023-06-302023-09-280000880117us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-06-300000880117us-gaap:RevolvingCreditFacilityMember2020-03-050000880117jbss:JeffreyTSanfilippoMember2023-06-302023-09-280000880117jbss:EllenCTaaffeMember2023-09-280000880117us-gaap:NoncompeteAgreementsMember2023-09-2800008801172022-07-012023-06-290000880117us-gaap:TreasuryStockCommonMember2023-09-280000880117us-gaap:AdditionalPaidInCapitalMember2023-09-280000880117jbss:SalesChannelCommercialIngredientsMember2022-07-012022-09-290000880117us-gaap:SalesChannelDirectlyToConsumerMember2022-07-012022-09-290000880117us-gaap:CustomerRelationshipsMember2023-06-290000880117us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-09-280000880117jbss:SalesChannelContractPackagingMember2023-06-302023-09-280000880117us-gaap:TradeNamesMember2023-09-280000880117jbss:NoncumulativeCommonStockMember2022-09-290000880117srt:MinimumMember2023-09-280000880117jbss:SalesChannelContractPackagingMember2022-07-012022-09-290000880117us-gaap:RetainedEarningsMember2022-09-290000880117us-gaap:AccumulatedDefinedBenefitPlansAdjustmentNetUnamortizedGainLossMember2022-07-012022-09-290000880117us-gaap:RetainedEarningsMember2022-07-012022-09-290000880117jbss:JamesJSanfilippoMember2023-09-280000880117us-gaap:CommonClassAMember2023-06-290000880117jbss:JasperBSanfilippoJrMember2023-06-302023-09-280000880117us-gaap:RetainedEarningsMember2022-06-300000880117jbss:JasperBSanfilippoJrMember2023-09-280000880117jbss:SquirrelBrandMember2023-09-280000880117us-gaap:CustomerRelationshipsMember2023-09-280000880117us-gaap:NoncompeteAgreementsMember2022-09-290000880117us-gaap:CustomerRelationshipsMember2022-09-290000880117jbss:EllenCTaaffeMember2023-06-302023-09-280000880117us-gaap:AdditionalPaidInCapitalMember2023-06-302023-09-2800008801172023-09-280000880117us-gaap:CommonClassAMember2023-10-260000880117us-gaap:SubsequentEventMemberjbss:TreehouseFoodsIncMember2023-09-292023-09-290000880117us-gaap:AdditionalPaidInCapitalMember2022-06-300000880117jbss:JeffreyTSanfilippoMember2023-09-280000880117us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-09-290000880117us-gaap:CommonClassAMemberus-gaap:CommonStockMember2022-06-300000880117us-gaap:CommonStockMember2023-06-302023-09-280000880117us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-07-012022-09-290000880117us-gaap:RelatedPartyMember2023-06-302023-09-280000880117us-gaap:RevolvingCreditFacilityMemberus-gaap:SubsequentEventMember2023-09-280000880117us-gaap:CommonClassAMemberus-gaap:CommonStockMember2023-09-280000880117us-gaap:CommonClassAMemberus-gaap:CommonStockMember2023-06-290000880117us-gaap:RetainedEarningsMember2023-09-280000880117jbss:JustTheCheeseBrandAcquisitionMember2023-09-280000880117us-gaap:AdditionalPaidInCapitalMember2023-06-290000880117us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-06-302023-09-280000880117jbss:NoncumulativeCommonStockMember2023-06-290000880117jbss:NoncumulativeCommonStockMember2023-10-260000880117us-gaap:AdditionalPaidInCapitalMember2022-07-012022-09-2900008801172022-07-012022-09-290000880117us-gaap:CommonClassAMember2022-09-290000880117us-gaap:CommonStockMember2023-06-290000880117us-gaap:CommonClassAMemberus-gaap:CommonStockMember2022-09-290000880117us-gaap:SubsequentEventMemberjbss:TreehouseFoodsIncMember2023-09-290000880117us-gaap:TreasuryStockCommonMember2022-09-290000880117us-gaap:CommonStockMember2023-09-280000880117us-gaap:AdditionalPaidInCapitalMember2022-09-290000880117us-gaap:RetainedEarningsMember2023-06-302023-09-280000880117us-gaap:CommonStockMember2022-06-300000880117us-gaap:RelatedPartyMember2022-07-012022-09-290000880117jbss:SalesChannelCommercialIngredientsMember2023-06-302023-09-2800008801172022-09-2900008801172023-06-302023-09-280000880117us-gaap:NoncompeteAgreementsMember2023-06-290000880117us-gaap:SubsequentEventMemberjbss:TreehouseFoodsIncMember2023-11-302023-11-300000880117us-gaap:SalesChannelDirectlyToConsumerMember2023-06-302023-09-280000880117us-gaap:TreasuryStockCommonMember2022-06-300000880117srt:MaximumMember2023-09-280000880117us-gaap:AccumulatedDefinedBenefitPlansAdjustmentNetUnamortizedGainLossMember2023-06-302023-09-28xbrli:purejbss:Channelxbrli:sharesiso4217:USD

c

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM 10-Q

(Mark One)

|

|

☒ |

QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the quarterly period ended September 28, 2023

OR

|

|

☐ |

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

Commission File Number: 0-19681

JOHN B. SANFILIPPO & SON, INC.

(Exact Name of Registrant as Specified in its Charter)

|

|

Delaware |

36-2419677 |

( State or other jurisdiction of incorporation or organization) |

(I.R.S. Employer

Identification No.) |

1703 North Randall Road Elgin, Illinois |

60123-7820 |

(Address of principal executive offices) |

(Zip Code) |

(847) 289-1800

Registrant’s telephone number, including area code

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

Title of each class |

|

Trading Symbol(s) |

|

Name of each exchange on which registered |

Common Stock, $.01 par value per share |

|

JBSS |

|

The NASDAQ Stock Market LLC (NASDAQ Global Select Market) |

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

|

|

|

|

|

|

|

Large accelerated filer |

|

☒ |

|

Accelerated filer |

|

☐ |

Non-accelerated filer |

|

☐ |

|

Smaller reporting company |

|

☐ |

Emerging growth company |

|

☐ |

|

|

|

|

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☒

As of October 26, 2023, 8,973,031 shares of the Registrant’s Common Stock, $0.01 par value per share and 2,597,426 shares of the Registrant’s Class A Common Stock, $0.01 par value per share, were outstanding.

JOHN B. SANFILIPPO & SON, INC.

FORM 10-Q

For the Quarter Ended September 28, 2023

INDEX

|

|

|

Page |

Part I. Financial Information |

|

Item 1. Financial Statements (Unaudited) |

3 |

Consolidated Statements of Comprehensive Income for the Quarter Ended September 28, 2023 and September 29, 2022 |

3 |

Consolidated Balance Sheets as of September 28, 2023, June 29, 2023 and September 29, 2022 |

4 |

Consolidated Statements of Stockholders’ Equity for the Quarter Ended September 28, 2023 and September 29, 2022 |

6 |

Consolidated Statements of Cash Flows for the Quarter Ended September 28, 2023 and September 29, 2022 |

7 |

Notes to Consolidated Financial Statements |

8 |

Item 2. Management’s Discussion and Analysis of Financial Condition and Results of Operations |

16 |

Item 3. Quantitative and Qualitative Disclosures About Market Risk |

25 |

Item 4. Controls and Procedures |

25 |

Part II. Other Information |

|

Item 1. Legal Proceedings |

25 |

Item 1A. Risk Factors |

25 |

Item 5. Other Information |

25 |

Item 6. Exhibits |

25 |

Signature |

28 |

PART I—FINANCIAL INFORMATION

Item 1. Financial Statements

JOHN B. SANFILIPPO & SON, INC.

CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME

(Unaudited)

(Dollars in thousands, except share and per share amounts)

|

|

|

|

|

|

|

|

|

|

|

For the Quarter Ended |

|

|

|

September 28,

2023 |

|

|

September 29,

2022 |

|

Net sales |

|

$ |

234,105 |

|

|

$ |

252,601 |

|

Cost of sales |

|

|

177,083 |

|

|

|

201,958 |

|

Gross profit |

|

|

57,022 |

|

|

|

50,643 |

|

Operating expenses: |

|

|

|

|

|

|

Selling expenses |

|

|

21,992 |

|

|

|

17,982 |

|

Administrative expenses |

|

|

10,453 |

|

|

|

10,247 |

|

Total operating expenses |

|

|

32,445 |

|

|

|

28,229 |

|

Income from operations |

|

|

24,577 |

|

|

|

22,414 |

|

Other expense: |

|

|

|

|

|

|

Interest expense including $178 and $193 to related parties |

|

|

227 |

|

|

|

661 |

|

Rental and miscellaneous expense, net |

|

|

356 |

|

|

|

402 |

|

Pension expense (excluding service costs) |

|

|

350 |

|

|

|

349 |

|

Total other expense, net |

|

|

933 |

|

|

|

1,412 |

|

Income before income taxes |

|

|

23,644 |

|

|

|

21,002 |

|

Income tax expense |

|

|

6,056 |

|

|

|

5,457 |

|

Net income |

|

$ |

17,588 |

|

|

$ |

15,545 |

|

Other comprehensive income: |

|

|

|

|

|

|

Amortization of actuarial loss included in net

periodic pension cost |

|

|

— |

|

|

|

7 |

|

Income tax expense related to pension adjustments |

|

|

— |

|

|

|

(1 |

) |

Other comprehensive income, net of tax |

|

|

— |

|

|

|

6 |

|

Comprehensive income |

|

$ |

17,588 |

|

|

$ |

15,551 |

|

Net income per common share-basic |

|

$ |

1.52 |

|

|

$ |

1.35 |

|

Net income per common share-diluted |

|

$ |

1.51 |

|

|

$ |

1.34 |

|

The accompanying unaudited notes are an integral part of these consolidated financial statements.

3

JOHN B. SANFILIPPO & SON, INC.

CONSOLIDATED BALANCE SHEETS

(Unaudited)

(Dollars in thousands, except share and per share amounts)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

September 28,

2023 |

|

|

June 29,

2023 |

|

|

September 29,

2022 |

|

ASSETS |

|

|

|

|

|

|

|

|

|

CURRENT ASSETS: |

|

|

|

|

|

|

|

|

|

Cash and cash equivalents |

|

$ |

838 |

|

|

$ |

1,948 |

|

|

$ |

298 |

|

Accounts receivable, less allowance for doubtful accounts of $281, $283

and $305 |

|

|

68,363 |

|

|

|

72,734 |

|

|

|

76,401 |

|

Inventories |

|

|

174,789 |

|

|

|

172,936 |

|

|

|

192,098 |

|

Prepaid expenses and other current assets |

|

|

7,603 |

|

|

|

6,812 |

|

|

|

6,746 |

|

TOTAL CURRENT ASSETS |

|

|

251,593 |

|

|

|

254,430 |

|

|

|

275,543 |

|

PROPERTY, PLANT AND EQUIPMENT: |

|

|

|

|

|

|

|

|

|

Land |

|

|

9,150 |

|

|

|

9,150 |

|

|

|

9,150 |

|

Buildings |

|

|

104,982 |

|

|

|

104,150 |

|

|

|

102,837 |

|

Machinery and equipment |

|

|

267,313 |

|

|

|

261,706 |

|

|

|

251,998 |

|

Furniture and leasehold improvements |

|

|

5,275 |

|

|

|

5,275 |

|

|

|

5,296 |

|

Vehicles |

|

|

729 |

|

|

|

729 |

|

|

|

614 |

|

Construction in progress |

|

|

7,480 |

|

|

|

7,123 |

|

|

|

6,926 |

|

|

|

|

394,929 |

|

|

|

388,133 |

|

|

|

376,821 |

|

Less: Accumulated depreciation |

|

|

271,418 |

|

|

|

267,336 |

|

|

|

255,948 |

|

|

|

|

123,511 |

|

|

|

120,797 |

|

|

|

120,873 |

|

Rental investment property, less accumulated depreciation of $14,641,

$14,439 and $13,834 |

|

|

14,482 |

|

|

|

14,684 |

|

|

|

15,289 |

|

TOTAL PROPERTY, PLANT AND EQUIPMENT |

|

|

137,993 |

|

|

|

135,481 |

|

|

|

136,162 |

|

|

|

|

|

|

|

|

|

|

|

Intangible assets, net |

|

|

6,216 |

|

|

|

6,658 |

|

|

|

7,621 |

|

Deferred income taxes |

|

|

3,461 |

|

|

|

3,592 |

|

|

|

3,231 |

|

Goodwill |

|

|

11,750 |

|

|

|

11,750 |

|

|

|

9,650 |

|

Operating lease right-of-use assets |

|

|

6,845 |

|

|

|

6,427 |

|

|

|

2,430 |

|

Other assets |

|

|

6,995 |

|

|

|

6,949 |

|

|

|

6,134 |

|

TOTAL ASSETS |

|

$ |

424,853 |

|

|

$ |

425,287 |

|

|

$ |

440,771 |

|

The accompanying unaudited notes are an integral part of these consolidated financial statements.

4

JOHN B. SANFILIPPO & SON, INC.

CONSOLIDATED BALANCE SHEETS

(Unaudited)

(Dollars in thousands, except share and per share amounts)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

September 28,

2023 |

|

|

June 29,

2023 |

|

|

September 29,

2022 |

|

LIABILITIES & STOCKHOLDERS' EQUITY |

|

|

|

|

|

|

|

|

|

CURRENT LIABILITIES: |

|

|

|

|

|

|

|

|

|

Revolving credit facility borrowings |

|

$ |

6,008 |

|

|

$ |

— |

|

|

$ |

42,624 |

|

Current maturities of long-term debt, net, including

related party debt of $688, $672 and $628 |

|

|

688 |

|

|

|

672 |

|

|

|

2,046 |

|

Accounts payable |

|

|

51,922 |

|

|

|

42,680 |

|

|

|

51,222 |

|

Bank overdraft |

|

|

669 |

|

|

|

285 |

|

|

|

488 |

|

Accrued payroll and related benefits |

|

|

12,034 |

|

|

|

27,572 |

|

|

|

12,166 |

|

Other accrued expenses |

|

|

17,980 |

|

|

|

14,479 |

|

|

|

17,624 |

|

TOTAL CURRENT LIABILITIES |

|

|

89,301 |

|

|

|

85,688 |

|

|

|

126,170 |

|

|

|

|

|

|

|

|

|

|

|

LONG-TERM LIABILITIES: |

|

|

|

|

|

|

|

|

|

Long-term debt, less current maturities, net, including

related party debt of $6,924, $7,102 and $7,612 |

|

|

6,924 |

|

|

|

7,102 |

|

|

|

7,612 |

|

Retirement plan |

|

|

26,788 |

|

|

|

26,653 |

|

|

|

28,753 |

|

Long-term operating lease liabilities, net of current portion |

|

|

5,136 |

|

|

|

4,771 |

|

|

|

1,242 |

|

Long-term workers' compensation liabilities |

|

|

7,304 |

|

|

|

7,321 |

|

|

|

7,422 |

|

Other |

|

|

2,033 |

|

|

|

1,545 |

|

|

|

409 |

|

TOTAL LONG-TERM LIABILITIES |

|

|

48,185 |

|

|

|

47,392 |

|

|

|

45,438 |

|

TOTAL LIABILITIES |

|

|

137,486 |

|

|

|

133,080 |

|

|

|

171,608 |

|

|

|

|

|

|

|

|

|

|

|

COMMITMENTS AND CONTINGENCIES |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

STOCKHOLDERS' EQUITY: |

|

|

|

|

|

|

|

|

|

Class A Common Stock, convertible to Common Stock on

a per share basis, cumulative voting rights of ten votes

per share, $.01 par value; 10,000,000 shares authorized,

2,597,426 shares issued and outstanding |

|

|

26 |

|

|

|

26 |

|

|

|

26 |

|

Common Stock, non-cumulative voting rights of one vote

per share, $.01 par value; 17,000,000 shares authorized,

9,090,931, 9,076,326 and 9,047,359 shares issued |

|

|

91 |

|

|

|

91 |

|

|

|

90 |

|

Capital in excess of par value |

|

|

132,733 |

|

|

|

131,986 |

|

|

|

129,572 |

|

Retained earnings |

|

|

155,925 |

|

|

|

161,512 |

|

|

|

143,153 |

|

Accumulated other comprehensive loss |

|

|

(204 |

) |

|

|

(204 |

) |

|

|

(2,474 |

) |

Treasury stock, at cost; 117,900 shares of Common Stock |

|

|

(1,204 |

) |

|

|

(1,204 |

) |

|

|

(1,204 |

) |

TOTAL STOCKHOLDERS’ EQUITY |

|

|

287,367 |

|

|

|

292,207 |

|

|

|

269,163 |

|

TOTAL LIABILITIES & STOCKHOLDERS’ EQUITY |

|

$ |

424,853 |

|

|

$ |

425,287 |

|

|

$ |

440,771 |

|

The accompanying unaudited notes are an integral part of these consolidated financial statements.

5

JOHN B. SANFILIPPO & SON, INC.

CONSOLIDATED STATEMENTS OF STOCKHOLDERS’ EQUITY

(Unaudited)

(Dollars in thousands, except share and per share amounts)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Accumulated |

|

|

|

|

|

|

|

|

Class A |

|

|

|

|

|

|

|

|

Capital in |

|

|

|

|

|

Other |

|

|

|

|

|

|

|

|

Common Stock |

|

|

Common Stock |

|

|

Excess of |

|

|

Retained |

|

|

Comprehensive |

|

|

Treasury |

|

|

|

|

|

Shares |

|

|

Amount |

|

|

Shares |

|

|

Amount |

|

|

Par Value |

|

|

Earnings |

|

|

Loss |

|

|

Stock |

|

|

Total |

|

Balance, June 29, 2023 |

|

2,597,426 |

|

|

$ |

26 |

|

|

|

9,076,326 |

|

|

$ |

91 |

|

|

$ |

131,986 |

|

|

$ |

161,512 |

|

|

$ |

(204 |

) |

|

$ |

(1,204 |

) |

|

$ |

292,207 |

|

Net income |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

17,588 |

|

|

|

|

|

|

|

|

|

17,588 |

|

Cash dividends ($2.00 per share) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(23,175 |

) |

|

|

|

|

|

|

|

|

(23,175 |

) |

Equity award exercises |

|

|

|

|

|

|

|

14,605 |

|

|

|

— |

|

|

|

— |

|

|

|

|

|

|

|

|

|

|

|

|

— |

|

Stock-based compensation expense |

|

|

|

|

|

|

|

|

|

|

|

|

|

747 |

|

|

|

|

|

|

|

|

|

|

|

|

747 |

|

Balance, September 28, 2023 |

|

2,597,426 |

|

|

$ |

26 |

|

|

|

9,090,931 |

|

|

$ |

91 |

|

|

$ |

132,733 |

|

|

$ |

155,925 |

|

|

$ |

(204 |

) |

|

$ |

(1,204 |

) |

|

$ |

287,367 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Accumulated |

|

|

|

|

|

|

|

|

Class A |

|

|

|

|

|

|

|

|

Capital in |

|

|

|

|

|

Other |

|

|

|

|

|

|

|

|

Common Stock |

|

|

Common Stock |

|

|

Excess of |

|

|

Retained |

|

|

Comprehensive |

|

|

Treasury |

|

|

|

|

|

Shares |

|

|

Amount |

|

|

Shares |

|

|

Amount |

|

|

Par Value |

|

|

Earnings |

|

|

Loss |

|

|

Stock |

|

|

Total |

|

Balance, June 30, 2022 |

|

2,597,426 |

|

|

$ |

26 |

|

|

|

9,047,359 |

|

|

$ |

90 |

|

|

$ |

128,800 |

|

|

$ |

153,589 |

|

|

$ |

(2,480 |

) |

|

$ |

(1,204 |

) |

|

$ |

278,821 |

|

Net income |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

15,545 |

|

|

|

|

|

|

|

|

|

15,545 |

|

Cash dividends ($2.25 per share) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(25,981 |

) |

|

|

|

|

|

|

|

|

(25,981 |

) |

Pension liability amortization, net

of income tax expense of $1 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

6 |

|

|

|

|

|

|

6 |

|

Stock-based compensation expense |

|

|

|

|

|

|

|

|

|

|

|

|

|

772 |

|

|

|

|

|

|

|

|

|

|

|

|

772 |

|

Balance, September 29, 2022 |

|

2,597,426 |

|

|

$ |

26 |

|

|

|

9,047,359 |

|

|

$ |

90 |

|

|

$ |

129,572 |

|

|

$ |

143,153 |

|

|

$ |

(2,474 |

) |

|

$ |

(1,204 |

) |

|

$ |

269,163 |

|

The accompanying unaudited notes are an integral part of these consolidated financial statements.

6

JOHN B. SANFILIPPO & SON, INC.

CONSOLIDATED STATEMENTS OF CASH FLOWS

(Unaudited)

(Dollars in thousands)

|

|

|

|

|

|

|

|

|

|

|

For the Quarter Ended |

|

|

|

September 28,

2023 |

|

|

September 29,

2022 |

|

CASH FLOWS FROM OPERATING ACTIVITIES: |

|

|

|

|

|

|

Net income |

|

$ |

17,588 |

|

|

$ |

15,545 |

|

Depreciation and amortization |

|

|

5,236 |

|

|

|

4,961 |

|

Loss on disposition of assets, net |

|

|

126 |

|

|

|

5 |

|

Deferred income tax expense |

|

|

131 |

|

|

|

5 |

|

Stock-based compensation expense |

|

|

747 |

|

|

|

772 |

|

Change in assets and liabilities: |

|

|

|

|

|

|

Accounts receivable, net |

|

|

4,511 |

|

|

|

(6,790 |

) |

Inventories |

|

|

(1,853 |

) |

|

|

12,757 |

|

Prepaid expenses and other current assets |

|

|

(791 |

) |

|

|

1,537 |

|

Accounts payable |

|

|

8,796 |

|

|

|

3,216 |

|

Accrued expenses |

|

|

(15,881 |

) |

|

|

(5,265 |

) |

Income taxes payable |

|

|

3,844 |

|

|

|

3,815 |

|

Other long-term assets and liabilities |

|

|

(348 |

) |

|

|

215 |

|

Other, net |

|

|

(225 |

) |

|

|

(127 |

) |

Net cash provided by operating activities |

|

|

21,881 |

|

|

|

30,646 |

|

|

|

|

|

|

|

|

CASH FLOWS FROM INVESTING ACTIVITIES: |

|

|

|

|

|

|

Purchases of property, plant and equipment |

|

|

(5,993 |

) |

|

|

(5,918 |

) |

Other, net |

|

|

(53 |

) |

|

|

(56 |

) |

Net cash used in investing activities |

|

|

(6,046 |

) |

|

|

(5,974 |

) |

|

|

|

|

|

|

|

CASH FLOWS FROM FINANCING ACTIVITIES: |

|

|

|

|

|

|

Net short-term borrowings |

|

|

6,008 |

|

|

|

2,185 |

|

Principal payments on long-term debt |

|

|

(162 |

) |

|

|

(1,267 |

) |

Increase in bank overdraft |

|

|

384 |

|

|

|

274 |

|

Dividends paid |

|

|

(23,175 |

) |

|

|

(25,981 |

) |

Net cash used in financing activities |

|

|

(16,945 |

) |

|

|

(24,789 |

) |

|

|

|

|

|

|

|

NET DECREASE IN CASH AND CASH EQUIVALENTS |

|

|

(1,110 |

) |

|

|

(117 |

) |

Cash and cash equivalents, beginning of period |

|

|

1,948 |

|

|

|

415 |

|

Cash, end of period |

|

$ |

838 |

|

|

$ |

298 |

|

The accompanying unaudited notes are an integral part of these consolidated financial statements.

7

JOHN B. SANFILIPPO & SON, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(Unaudited)

(Dollars in thousands, except where noted and per share data)

Note 1 – Basis of Presentation and Description of Business

As used herein, unless the context otherwise indicates, the terms “we”, “us”, “our” or “Company” collectively refer to John B. Sanfilippo & Son, Inc. and our wholly-owned subsidiary, JBSS Ventures, LLC. Our fiscal year ends on the final Thursday of June each year, and typically consists of fifty-two weeks (four thirteen-week quarters). Additional information on the comparability of the periods presented is as follows:

•References herein to fiscal 2024 and fiscal 2023 are to the fiscal year ending June 27, 2024 and the fiscal year ending June 29, 2023, respectively.

•References herein to the first quarter of fiscal 2024 and fiscal 2023 are to the quarters ended September 28, 2023 and September 29, 2022, respectively.

We are one of the leading processors and distributors of peanuts, pecans, cashews, walnuts, almonds and other nuts in the United States. These nuts are sold under our Fisher, Orchard Valley Harvest, Squirrel Brand and Southern Style Nuts brand names and under a variety of private brands. We also market and distribute, and in most cases, manufacture or process, a diverse product line of food and snack products, including peanut butter, almond butter, cashew butter, candy and confections, snack and trail mixes, nutrition bars, snack bites, sunflower kernels, dried fruit, corn snacks, chickpea snacks, sesame sticks, other sesame snack products and baked cheese snack products under our brand names, including Just the Cheese, and under private brands. Our products are sold through three primary distribution channels, including food retailers in the consumer channel, commercial ingredient users and contract packaging customers.

The accompanying unaudited financial statements fairly present the consolidated statements of comprehensive income, consolidated balance sheets, consolidated statements of stockholders’ equity and consolidated statements of cash flows, and reflect all adjustments, consisting only of normal recurring adjustments which are necessary for the fair statement of the results of the interim periods. Preparing financial statements requires management to make estimates and assumptions that affect the reported amounts of assets, liabilities, revenues and expenses.

The interim results of operations are not necessarily indicative of the results to be expected for a full year. The balance sheet data as of June 29, 2023 was derived from audited financial statements, but does not include all disclosures required by accounting principles generally accepted in the United States of America (“GAAP”). Accordingly, these unaudited financial statements and related notes should be read in conjunction with the audited consolidated financial statements and notes thereto included in our 2023 Annual Report on Form 10-K for the fiscal year ended June 29, 2023.

Note 2 – Revenue Recognition

We recognize revenue to depict the transfer of promised goods or services to customers in an amount that reflects the consideration to which we expect to be entitled in exchange for those goods or services. For each customer contract, a five-step process is followed in which we identify the contract, identify performance obligations, determine the transaction price, allocate the contract transaction price to the performance obligations, and recognize the revenue when (or as) the performance obligation is transferred to the customer.

When Performance Obligations Are Satisfied

A performance obligation is a promise in a contract to transfer a distinct good or service to the customer and is the unit of account for revenue recognition. A contract’s transaction price is allocated to each distinct performance obligation and recognized as revenue when, or as, the performance obligation is satisfied. The Company’s performance obligations are primarily for the delivery of raw and processed recipe and snack nuts, nut butters and trail mixes.

Our customer contracts do not include more than one performance obligation. If a contract were to contain more than one performance obligation, we are required to allocate the contract’s transaction price to each performance obligation based on its relative standalone selling price. The standalone selling price for each distinct good is generally determined by directly observable data.

8

Revenue recognition is generally completed at a point in time when product control is transferred to the customer. For virtually all of our revenues, control transfers to the customer when the product is shipped or delivered to the customer based upon applicable shipping terms. This allows the customer to then direct the use and obtain substantially all of the remaining benefits from the asset at that point in time. Therefore, the timing of our revenue recognition requires little judgment.

Variable Consideration

Some of our products are sold through specific incentive programs including, but not limited to, promotional allowances, volume and customer rebates, in-store display incentives and marketing allowances to consumer and some commercial ingredient customers. The ultimate cost of these programs is dependent on certain factors such as actual purchase volumes or customer activities and is dependent on significant management judgment when determining estimates. The Company accounts for these programs as variable consideration and recognizes a reduction in revenue (and a corresponding reduction in the transaction price) in the same period as the underlying program based upon the terms of the specific arrangements.

Trade promotions, consisting primarily of customer pricing allowances, merchandising funds and consumer coupons, are also offered through various programs to customers and consumers. A provision for estimated trade promotions is recorded as a reduction of revenue (and a reduction in the transaction price) in the same period when the sale is recognized. Revenues are also recorded net of expected customer deductions which are provided for based upon past experiences. Evaluating these estimates requires management judgment.

We generally use the most likely amount method to determine the variable consideration. We believe there will not be significant changes to our estimates of variable consideration when any related uncertainties are resolved with our customers. The Company reviews and updates its estimates and related accruals of variable consideration and trade promotions at least quarterly based on the terms of the agreements and historical experience. Any uncertainties in the ultimate resolution of variable consideration due to factors outside of the Company’s influence are typically resolved within a short timeframe. Therefore, no additional constraint on the variable consideration is required.

Contract Balances

Contract assets or liabilities result from transactions with revenue recorded over time. If the measure of remaining rights exceeds the measure of the remaining performance obligations, the Company records a contract asset. Conversely, if the measure of the remaining performance obligations exceeds the measure of the remaining rights, the Company records a contract liability. The contract asset balance at September 29, 2022 was $562 and was recorded in the caption “Prepaid expenses and other current assets” on the Consolidated Balance Sheets. There was no contract asset balance for the other periods presented. The Company generally does not have material deferred revenue or contract liability balances arising from transactions with customers.

Disaggregation of Revenue

Revenue disaggregated by sales channel is as follows:

|

|

|

|

|

|

|

|

|

|

|

For the Quarter Ended |

|

Distribution Channel |

|

September 28,

2023 |

|

|

September 29,

2022 |

|

Consumer |

|

$ |

184,334 |

|

|

$ |

196,547 |

|

Commercial Ingredients |

|

|

28,135 |

|

|

|

31,507 |

|

Contract Packaging |

|

|

21,636 |

|

|

|

24,547 |

|

Total |

|

$ |

234,105 |

|

|

$ |

252,601 |

|

Note 3 – Leases

Description of Leases

We lease equipment used in the transportation of goods in our warehouses, as well as a limited number of automobiles and a small warehouse near our Bainbridge, Georgia facility. Our leases generally do not contain non-lease components and do not contain any explicit guarantees of residual value. Our leases for warehouse transportation equipment generally require the equipment to be returned to the lessor in good working order.

9

Through a review of our contracts, we determine if an arrangement is a lease at inception and analyze the lease to determine if it is operating or finance. Operating lease right-of-use assets represent our right to use an underlying asset for the lease term and lease liabilities represent our obligation to make lease payments arising from the lease. Operating lease right-of-use assets and liabilities are recognized at the lease commencement date based on the present value of lease payments over the lease term. As most of our leases do not provide an implicit rate, we use our incremental collateralized borrowing rate based on the information available at the commencement date in determining the present value of lease payments. Implicit rates are used when readily determinable. None of our leases currently contain options to extend the term. In the event of an option to extend the term of a lease, the lease term used in measuring the liability would include options to extend or terminate the lease if it is reasonably certain that the Company will exercise that option. Lease expense for operating lease payments is recognized on a straight-line basis over the respective lease term. Our leases have remaining terms of up to 5.8 years.

It is our accounting policy not to apply lease recognition requirements to short term leases, defined as leases with an initial term of 12 months or less. As such, leases with an initial term of 12 months or less are not recorded in the Consolidated Balance Sheets. We have also made the policy election to not separate lease and non-lease components for all leases.

The following table provides supplemental information related to operating lease right-of-use assets and liabilities:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

September 28,

2023 |

|

|

June 29,

2023 |

|

|

September 29,

2022 |

|

|

Affected Line Item in Consolidated Balance Sheets |

Assets |

|

|

|

|

|

|

|

|

|

|

Operating lease right-of-use assets |

$ |

6,845 |

|

|

$ |

6,427 |

|

|

$ |

2,430 |

|

|

Operating lease right-of-use assets |

Total lease right-of-use assets |

$ |

6,845 |

|

|

$ |

6,427 |

|

|

$ |

2,430 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Liabilities |

|

|

|

|

|

|

|

|

|

|

Current: |

|

|

|

|

|

|

|

|

|

|

Operating leases |

$ |

1,775 |

|

|

$ |

1,729 |

|

|

$ |

1,215 |

|

|

Other accrued expenses |

Noncurrent: |

|

|

|

|

|

|

|

|

|

|

Operating leases |

|

5,136 |

|

|

|

4,771 |

|

|

|

1,242 |

|

|

Long-term operating lease liabilities |

Total lease liabilities |

$ |

6,911 |

|

|

$ |

6,500 |

|

|

$ |

2,457 |

|

|

|

The following tables summarize the Company’s total lease costs and other information arising from operating lease transactions:

|

|

|

|

|

|

|

|

|

|

|

For the Quarter Ended |

|

|

|

September 28,

2023 |

|

|

September 29,

2022 |

|

Operating lease costs (a) |

|

$ |

670 |

|

|

$ |

474 |

|

Variable lease costs (b) |

|

|

(174 |

) |

|

|

57 |

|

Total lease cost |

|

$ |

496 |

|

|

$ |

531 |

|

(a)Includes short-term leases which are immaterial.

(b)Variable lease costs consist of sales tax and lease overtime charges.

Supplemental cash flow and other information related to leases was as follows:

|

|

|

|

|

|

|

|

|

|

|

For the Quarter Ended |

|

|

|

September 28,

2023 |

|

|

September 29,

2022 |

|

Operating cash flows information: |

|

|

|

|

|

|

Cash paid for amounts included in measurements for lease liabilities |

|

$ |

578 |

|

|

$ |

402 |

|

|

|

|

|

|

|

|

Non-cash activity: |

|

|

|

|

|

|

Right-of-use assets obtained in exchange for new operating lease obligations |

|

$ |

860 |

|

|

$ |

496 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

September 28,

2023 |

|

|

June 29,

2023 |

|

|

September 29,

2022 |

|

Weighted average remaining lease term (in years) |

|

|

4.4 |

|

|

|

4.4 |

|

|

|

2.5 |

|

Weighted average discount rate |

|

|

6.8 |

% |

|

|

6.7 |

% |

|

|

4.6 |

% |

10

Maturities of operating lease liabilities as of September 28, 2023 are as follows:

|

|

|

|

|

Fiscal Year Ending |

|

|

|

June 27, 2024 (excluding the quarter ended September 28, 2023) |

|

$ |

1,709 |

|

June 26, 2025 |

|

|

1,827 |

|

June 25, 2026 |

|

|

1,622 |

|

June 24, 2027 |

|

|

1,372 |

|

June 29, 2028 |

|

|

1,210 |

|

June 28, 2029 |

|

|

252 |

|

Thereafter |

|

|

— |

|

Total lease payment |

|

|

7,992 |

|

Less imputed interest |

|

|

(1,081 |

) |

Present value of operating lease liabilities |

|

$ |

6,911 |

|

At September 28, 2023, the Company has additional operating leases of approximately $351 that have not yet commenced and therefore are not reflected in the Consolidated Balance Sheets and tables above. The leases are scheduled to commence in the second quarter of fiscal 2024 with an initial lease term ranging from 2 to 6 years.

Lessor Accounting

We lease office space in our four-story office building located in Elgin, Illinois. As a lessor, we retain substantially all of the risks and benefits of ownership of the investment property and under Topic 842: Leases we continue to account for all of our leases as operating leases. Lease agreements may include options to renew. We accrue fixed lease income on a straight‑line basis over the terms of the leases. There is generally no variable lease consideration and an immaterial amount of non-lease components such as recurring utility and storage fees. Leases between related parties are immaterial.

Leasing revenue is as follows:

|

|

|

|

|

|

|

|

|

|

|

For the Quarter Ended |

|

|

|

September 28,

2023 |

|

|

September 29,

2022 |

|

Lease income related to lease payments |

|

$ |

444 |

|

|

$ |

402 |

|

The future minimum, undiscounted fixed cash flows under non-cancelable tenant operating leases for each of the next five years and thereafter are as follows:

|

|

|

|

|

Fiscal Year Ending |

|

|

|

June 27, 2024 (excluding the quarter ended September 28, 2023) |

|

$ |

1,543 |

|

June 26, 2025 |

|

|

1,477 |

|

June 25, 2026 |

|

|

972 |

|

June 24, 2027 |

|

|

930 |

|

June 29, 2028 |

|

|

328 |

|

June 28, 2029 |

|

|

336 |

|

Thereafter |

|

|

1,478 |

|

|

|

$ |

7,064 |

|

Note 4 – Inventories

Inventories consist of the following:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

September 28,

2023 |

|

|

June 29,

2023 |

|

|

September 29,

2022 |

|

Raw material and supplies |

|

$ |

49,565 |

|

|

$ |

65,430 |

|

|

$ |

60,657 |

|

Work-in-process and finished goods |

|

|

125,224 |

|

|

|

107,506 |

|

|

|

131,441 |

|

Total |

|

$ |

174,789 |

|

|

$ |

172,936 |

|

|

$ |

192,098 |

|

11

Note 5 – Goodwill and Intangible Assets

Identifiable intangible assets that are subject to amortization consist of the following:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

September 28,

2023 |

|

|

June 29,

2023 |

|

|

September 29,

2022 |

|

Customer relationships |

|

$ |

21,350 |

|

|

$ |

21,350 |

|

|

$ |

21,100 |

|

Brand names |

|

|

17,070 |

|

|

|

17,070 |

|

|

|

16,990 |

|

Non-compete agreement |

|

|

300 |

|

|

|

300 |

|

|

|

270 |

|

|

|

|

38,720 |

|

|

|

38,720 |

|

|

|

38,360 |

|

Less accumulated amortization: |

|

|

|

|

|

|

|

|

|

Customer relationships |

|

|

(20,095 |

) |

|

|

(19,834 |

) |

|

|

(19,053 |

) |

Brand names |

|

|

(12,134 |

) |

|

|

(11,955 |

) |

|

|

(11,425 |

) |

Non-compete agreement |

|

|

(275 |

) |

|

|

(273 |

) |

|

|

(261 |

) |

|

|

|

(32,504 |

) |

|

|

(32,062 |

) |

|

|

(30,739 |

) |

Net intangible assets |

|

$ |

6,216 |

|

|

$ |

6,658 |

|

|

$ |

7,621 |

|

Customer relationships are being amortized on an accelerated basis. The brand names remaining to be amortized consist of the Squirrel Brand, Southern Style Nuts and Just the Cheese brand names.

Total amortization expense related to intangible assets, which is classified in administrative expense in the Consolidated Statement of Comprehensive Income, was $442 for the quarter ended September 28, 2023. Amortization expense for the remainder of fiscal 2024 is expected to be approximately $1,123 and expected amortization expense the next five fiscal years is as follows:

|

|

|

|

|

Fiscal Year Ending |

|

|

|

June 26, 2025 |

|

$ |

1,213 |

|

June 25, 2026 |

|

|

880 |

|

June 24, 2027 |

|

|

706 |

|

June 29, 2028 |

|

|

528 |

|

June 28, 2029 |

|

|

400 |

|

Our net goodwill at September 28, 2023 was comprised of $9,650 from the Squirrel Brand acquisition completed in fiscal 2018 and $2,100 from the Just the Cheese brand acquisition completed in fiscal 2023. The changes in the carrying amount of goodwill since June 30, 2022 are as follows:

|

|

|

|

|

Gross goodwill balance at June 30, 2022 |

|

$ |

18,416 |

|

Accumulated impairment losses |

|

|

(8,766 |

) |

Net goodwill balance at June 30, 2022 |

|

|

9,650 |

|

Goodwill acquired during fiscal 2023 |

|

|

2,100 |

|

Net balance at June 29, 2023 |

|

|

11,750 |

|

Goodwill acquired during fiscal 2024 |

|

|

— |

|

Net balance at September 28, 2023 |

|

$ |

11,750 |

|

Note 6 – Credit Facility

Our Amended and Restated Credit Agreement dated March 5, 2020 provides for a $117,500 senior secured revolving credit facility (the “Credit Facility”). The Credit Facility is secured by substantially all our assets other than machinery and equipment, real property and fixtures.

At September 28, 2023, we had $107,302 of available credit under the Credit Facility which reflects borrowings of $6,008 and reduced availability as a result of $4,190 in outstanding letters of credit. As of September 28, 2023, we were in compliance with all financial covenants under the Credit Facility.

For information about the most recent amendment to our Amended and Restated Credit Agreement (as defined below) see Note 14‒Subsequent Events.

12

Note 7 – Earnings Per Common Share

The following table presents the reconciliation of the weighted average shares outstanding used in computing basic and diluted earnings per share:

|

|

|

|

|

|

|

|

|

|

|

For the Quarter Ended |

|

|

|

September 28,

2023 |

|

|

September 29,

2022 |

|

Weighted average number of shares outstanding – basic |

|

|

11,594,960 |

|

|

|

11,553,432 |

|

Effect of dilutive securities: |

|

|

|

|

|

|

Restricted stock units |

|

|

79,782 |

|

|

|

63,681 |

|

Weighted average number of shares outstanding – diluted |

|

|

11,674,742 |

|

|

|

11,617,113 |

|

There were no anti-dilutive awards excluded from the computation of diluted earnings per share for any periods presented.

Note 8 – Stock-Based Compensation Plans

During the quarter ended September 28, 2023 there was no significant restricted stock unit ("RSU") activity. Compensation expense attributable to stock-based compensation during the first quarter of fiscal 2024 and fiscal 2023 was $747 and $772, respectively. As of September 28, 2023, there was $3,341 of total unrecognized compensation expense related to non-vested RSUs granted under our stock-based compensation plans. We expect to recognize that cost over a weighted average period of 1.1 years.

Note 9 – Retirement Plan

The Supplemental Employee Retirement Plan (“Retirement Plan”) is an unfunded, non-qualified deferred compensation plan that will provide eligible participants with monthly benefits upon retirement, disability or death, subject to certain conditions. The monthly benefit is based upon each participant’s earnings and his or her number of years of service. The components of net periodic benefit cost are as follows:

|

|

|

|

|

|

|

|

|

|

|

For the Quarter Ended |

|

|

|

September 28,

2023 |

|

|

September 29,

2022 |

|

Service cost |

|

$ |

63 |

|

|

$ |

200 |

|

Interest cost |

|

|

350 |

|

|

|

342 |

|

Amortization of loss |

|

|

— |

|

|

|

7 |

|

Net periodic benefit cost |

|

$ |

413 |

|

|

$ |

549 |

|

The components of net periodic benefit cost other than the service cost component are included in the line item “Pension expense (excluding service costs)” in the Consolidated Statements of Comprehensive Income.

Note 10 – Accumulated Other Comprehensive Loss

The table below sets forth the changes to accumulated other comprehensive loss (“AOCL”) for the quarter ended September 28, 2023 and September 29, 2022. These changes are all related to our defined benefit pension plan.

|

|

|

|

|

|

|

|

|

|

|

For the Quarter Ended |

|

Changes to AOCL (a) |

|

September 28,

2023 |

|

|

September 29,

2022 |

|

Balance at beginning of period |

|

$ |

(204 |

) |

|

$ |

(2,480 |

) |

Other comprehensive income before reclassifications |

|

|

— |

|

|

|

— |

|

Amounts reclassified from accumulated other comprehensive loss |

|

|

— |

|

|

|

7 |

|

Tax effect |

|

|

— |

|

|

|

(1 |

) |

Net current-period other comprehensive income |

|

|

— |

|

|

|

6 |

|

Balance at end of period |

|

$ |

(204 |

) |

|

$ |

(2,474 |

) |

(a)Amounts in parenthesis indicate debits/expense.

13

The reclassifications out of AOCL for the quarter ended September 28, 2023 and September 29, 2022 were as follows:

|

|

|

|

|

|

|

|

|

|

|

For the Quarter Ended |

|

|

Affected Line Item |

Reclassifications from AOCL to Earnings (b) |

September 28,

2023 |

|

|

September 29,

2022 |

|

|

Consolidated Statements of

Comprehensive Income |

Amortization of defined benefit pension items: |

|

|

|

|

|

|

|

Unrecognized net loss |

$ |

— |

|

|

$ |

(7 |

) |

|

Pension expense (excluding service costs) |

Tax effect |

|

— |

|

|

|

1 |

|

|

Income tax expense |

Amortization of defined pension items, net of tax |

$ |

— |

|

|

$ |

(6 |

) |

|

|

(b)Amounts in parenthesis indicate debits to expense. See Note 9 – “Retirement Plan” above for additional details.

Note 11 – Commitments and Contingent Liabilities

We are currently a party to various legal proceedings in the ordinary course of business. While management presently believes that the ultimate outcomes of these proceedings, individually and in the aggregate, will not materially affect our Company’s financial position, results of operations or cash flows, legal proceedings are subject to inherent uncertainties, and unfavorable outcomes could occur. Unfavorable outcomes could include substantial monetary damages in excess of any appropriate accruals, which management has established. Were such unfavorable final outcomes to occur, there exists the possibility of a material adverse effect on our financial position, results of operations and cash flows.

Note 12 – Fair Value of Financial Instruments

The Financial Accounting Standards Board defines fair value as the price that would be received for an asset or paid to transfer a liability in an orderly transaction between market participants on the measurement date. The guidance establishes a fair value hierarchy that prioritizes observable and unobservable inputs used to measure fair value into three broad levels:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Level 1 |

|

|

– |

|

|

Quoted prices in active markets that are accessible at the measurement date for identical assets and liabilities. |

|

|

|

Level 2 |

|

|

– |

|

|

Observable inputs other than quoted prices in active markets. For example, quoted prices for similar assets or liabilities in active markets or quoted prices for identical assets or liabilities in inactive markets. |

|

|

|

Level 3 |

|

|

– |

|

|

Unobservable inputs for which there is little or no market data available. |

The carrying values of cash, trade accounts receivable and accounts payable approximate their fair values at each balance sheet date because of the short-term maturities and nature of these balances.

The carrying value of our revolving credit facility borrowings approximates fair value at each balance sheet date because interest rates on this instrument approximate current market rates (Level 2 criteria) and because of the short-term maturity and nature of this balance. In addition, there has been no significant change in our inherent credit risk.

The following table summarizes the carrying value and fair value estimate of our current and long-term debt, excluding unamortized debt issuance costs:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

September 28,

2023 |

|

|

June 29,

2023 |

|

|

September 29,

2022 |

|

Carrying value of current and long-term debt: |

|

$ |

7,612 |

|

|

$ |

7,774 |

|

|

$ |

9,660 |

|

Fair value of current and long-term debt: |

|

|

7,033 |

|

|

|

7,421 |

|

|

|

9,583 |

|

The estimated fair value of our long-term debt was determined using a market approach based upon Level 2 observable inputs, which estimates fair value based on interest rates currently offered on loans with similar terms to borrowers of similar credit quality or broker quotes. In addition, there have been no significant changes in the underlying assets securing our long-term debt.

14

Note 13 – Recent Accounting Pronouncements

There were no recent accounting pronouncements adopted in the current fiscal year.

There are no recent accounting pronouncements that have been issued and not yet adopted that are expected to have a material impact on our Consolidated Financial Statements.

Note 14 – Subsequent Events

On September 29, 2023, we completed the acquisition of certain assets from TreeHouse Foods, Inc. (the “Seller”) relating to its snack bars business. The acquired assets include inventory, a manufacturing facility and related equipment located in Lakeville, Minnesota, and customer relationships, among others (the "Lakeville Acquisition"). The initial purchase price was approximately $61,252 in cash, which included approximately $37,346 of inventory, and is subject to certain post-closing adjustments. In November 2023, we expect to receive $2,435 from the Seller for a purchase price adjustment to the final inventory acquired, for a revised net purchase price of approximately $58,817. The initial accounting for this business combination is incomplete as we are awaiting the fair value analysis and therefore the required ASC 805 disclosures are not available to be made. The purchase price for the Lakeville Acquisition was funded from borrowings under the Credit Facility as amended by the Second Amendment.

On September 29, 2023, we entered into the Second Amendment to our Amended and Restated Credit Agreement (the "Second Amendment"), which (among other things) increased the borrowing capacity under the Credit Facility to $150,000 from $117,500 to provide extra available capacity for the short-term working capital requirements of the business acquired pursuant to the Lakeville Acquisition. The Second Amendment also extends the maturity date of the Credit Facility to September 29, 2028.

15

Item 2. Management's Discussion and Analysis of Financial Condition and Results of Operations

OVERVIEW

The following discussion and analysis should be read in conjunction with the unaudited Consolidated Financial Statements and the Notes to Consolidated Financial Statements.

Our fiscal year ends on the final Thursday of June each year, and typically consists of fifty-two weeks (four thirteen-week quarters). Additional information on the comparability of the periods presented is as follows:

•References herein to fiscal 2024 and fiscal 2023 are to the fiscal year ending June 27, 2024 and the fiscal year ending June 29, 2023, respectively.

•References herein to the first quarter of fiscal 2024 and fiscal 2023 are to the quarters ended September 28, 2023 and September 29, 2022, respectively.

As used herein, unless the context otherwise indicates, the terms “we”, “us”, “our” or “Company” collectively refer to John B. Sanfilippo & Son, Inc. and our wholly-owned subsidiary, JBSS Ventures, LLC.

We are one of the leading processors and distributors of peanuts, pecans, cashews, walnuts, almonds and other nuts in the United States. These nuts are sold under our Fisher, Orchard Valley Harvest, Squirrel Brand and Southern Style Nuts brand names and under a variety of private brands. We also market and distribute, and in most cases, manufacture or process, a diverse product line of food and snack products, including peanut butter, almond butter, cashew butter, candy and confections, snack and trail mixes, nutrition bars, snack bites, sunflower kernels, dried fruit, corn snacks, chickpea snacks, sesame sticks, other sesame snack products and baked cheese snack products under our brand names, including Just the Cheese, and under private brands. We distribute our products in the consumer, commercial ingredients and contract packaging distribution channels.

During fiscal 2022, we created a Long-Range Plan to define our future growth priorities. Our Long-Range Plan focuses on growing our non-branded business across key customers, as well as transforming Fisher, Orchard Valley Harvest and Squirrel Brand into leading brands while increasing distribution and diversifying our portfolio into high growth snacking segments. We will execute on our Long-Range Plan by providing non-branded customer value-added solutions based on our extensive industry and consumer expertise with innovative products such as our newly developed product line of private brand nutrition bars which were introduced during fiscal 2023. We will grow our branded business by reaching new consumers via product expansion and packaging innovation, expanding distribution across current and alternative channels, diversifying our product offerings and focusing on new ways for consumers to buy our products, including sales via e-commerce platforms. This Long-Range Plan also contemplates increasing our sales through product innovation and targeted, opportunistic acquisitions, such as the acquisition of the Just the Cheese brand completed during fiscal 2023 and the recent Lakeville Acquisition completed in the second quarter of fiscal 2024, which will expand our ability to produce private brand snack bars.

We will continue to focus our promotional and advertising activity to invest in our brands to achieve growth. We intend to execute an omnichannel approach to win in key categories including recipe nuts, snack nuts, trail mix and other snacking categories. We continue to see e-commerce growth across our branded portfolio and anticipate taking various actions with the goal of accelerating that growth across a variety of established and emerging platforms. We will continue to face the ongoing challenges specific to our business, such as food safety and regulatory issues and the maintenance and growth of our customer base for branded and private label products. See the information referenced in Part II, Item 1A — “Risk Factors” of this report for additional information about our risks, challenges and uncertainties.

We face a number of challenges in the future, which include the impacts of ongoing inflation in food prices, rising interest rates that reduce economic growth, consumers reducing their purchases in the nut category, including branded nut products, potential for economic downturn in the markets in which we operate and continued supply chain challenges. We continue to experience a tight labor market which has led to increased labor costs.

Inflation and Consumer Trends

We face changing industry trends as consumers' purchasing preferences evolve. Due to the ongoing inflationary environment, we have seen higher selling prices at retail. With higher prices across our categories and the broader food market, and also due to any actual or potential economic downturn or tightening of consumer finances due to inflation or other causes, consumers are purchasing fewer snack products. We have seen this through the decline in the recipe and snack nut categories since fiscal 2023 and into fiscal 2024, as consumers shift their preferences to private brands or lower priced nuts or purchase snack products outside the nut and trail mix

16

category. With the inflationary environment, we are also seeing signs of consumers shifting to more value-focused retailers, such as mass merchandising retailers, club stores and dollar stores, not all of which we distribute or sell to.

Supply Chain and Transportation

In the first quarter of fiscal 2024, we faced supply chain challenges related to certain raw material shortages, extended lead-times, supplier capacity constraints and inflationary pressures. While we do not have direct exposure to suppliers in Russia, Ukraine or Israel, the conflicts in these regions could continue to result in volatile commodity markets, supply chain disruptions and increased costs. Global supply chain pressures have eased, but we continue to see negative impacts related to macro-economics, geo-political unrest, growing political instability and climate-related events. Overall packaging and ingredient inflation appears to be leveling off but is expected to remain above historical levels. We anticipate pricing relief in some areas in the current fiscal year, if and as shortages decrease and supply chains improve. However, we expect that some costs may remain above historical levels or unpredictable for a longer period.

While we have seen stabilization in truckload capacity and volume at U.S. ports and improvements with driver hiring, there are still warehouse and dock staff shortages and fuel and energy concerns due to continued unrest abroad coupled with persistent inflation. Instability and prices in the transportation industry may increase further into fiscal 2024 due to the bankruptcy of a major U.S.-based trucking company. Fuel prices that were at record highs during spring and summer 2022 have continued to decrease, yet still remain volatile and unpredictable. While there are indicators of transportation cost improvement, and despite our mitigation of some of the transportation shortages, we may continue to face an unpredictable transportation environment. There is no guarantee that our mitigation strategies will continue to be effective, that any transportation capacity easing will continue or that transportation prices will return to more normalized levels.

We have remained agile by proactively identifying risks, modifying inventory plans and diversifying our supplier base to mitigate risk of customer order shortages and maintain our supply chain. We will continue to proactively manage our business in response to the evolving global economic environment and related uncertainty. We continue to prioritize and take steps to mitigate impacts to our supply chain. If these supply chain pressures continue, or we cannot obtain the transportation and labor services needed to fulfill customer orders, such shortages and supply chain issues could have an unfavorable impact on net sales and our operations during fiscal 2024. Additionally, as costs increase due to these issues or due to overall inflationary pressures, there is an additional risk of not being able to pass (in part or in full) such potential cost increases onto our customers or in a timely manner. If we cannot align costs with prices for our products, our operating performance could be adversely impacted.

17

QUARTERLY HIGHLIGHTS

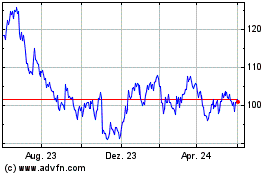

Our net sales of $234.1 million for the first quarter of fiscal 2024 decreased 7.3% from our net sales of $252.6 million for the first quarter of fiscal 2023.

Sales volume, measured as pounds sold to customers, decreased 7.3% compared to the first quarter of fiscal 2023.

Gross profit increased $6.4 million, and our gross profit margin, as a percentage of net sales, increased to 24.4% for the first quarter of fiscal 2024 compared to 20.0% for the first quarter of fiscal 2023.

Total operating expenses for the first quarter of fiscal 2024 increased by $4.2 million, or 14.9%, compared to the first quarter of fiscal 2023. As a percentage of net sales, total operating expenses in the first quarter of fiscal 2024 increased to 13.9% from 11.2% for the first quarter of fiscal 2023.

The total value of inventories on hand at the end of the first quarter of fiscal 2024 decreased $17.3 million, or 9.0%, in comparison to the total value of inventories on hand at the end of the first quarter of fiscal 2023.

We expect acquisition costs for most major tree nuts, other than walnuts, to be flat or decrease, and we expect acquisition costs for peanuts to increase modestly in the 2023 crop year (which falls into our current 2024 fiscal year). While we began to procure inshell walnuts during the first quarter of fiscal 2024, the total payments due to our walnut growers will not be determined until the second and/or third quarters of fiscal 2024. We will determine the final prices to be paid to the walnut growers based upon current market prices and other factors such as crop size and export demand. We have estimated the liability to our walnut growers and our walnut inventory costs using currently available information. Any difference between our estimated liability and the actual payments will be determined during the second and/or third quarters of fiscal 2024 and will be recognized in our financial results at that time.

18

RESULTS OF OPERATIONS

Net Sales

Our net sales decreased 7.3% to $234.1 million in the first quarter of fiscal 2024 compared to net sales of $252.6 million for the first quarter of fiscal 2023. The decrease in net sales was attributable to a 7.3% decrease in sales volume, which is defined as pounds sold to customers. The decrease in sales volume was driven by decreased sales volume for all product types.