SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of report (Date of earliest event

reported): November 11, 2014

IDEAL POWER INC.

(Exact name of registrant as specified

in Charter)

| Delaware |

|

001-36216 |

|

14-1999058 |

|

(State or other jurisdiction of

incorporation or organization) |

|

(Commission File No.) |

|

(IRS Employee Identification No.) |

4120 Freidrich Lane, Suite 100

Austin, Texas, 78744

(Address of Principal Executive Offices)

512-264-1542

(Issuer Telephone number)

Check the appropriate box below if the Form 8-K filing is intended

to simultaneously satisfy the filing obligation of the Registrant under any of the following provisions (see General Instruction

A.2 below).

| ¨ | Written communications pursuant to Rule 425 under the

Securities Act (17 CFR 230.425) |

| ¨ | Soliciting material pursuant to Rule 14a-12 under the

Exchange Act (17 CFR240.14a-12) |

| ¨ | Pre-commencement communications pursuant to Rule 14d-2(b)

under the Exchange Act (17 CFR 240.14d-2(b)). |

| ¨ | Pre-commencement communications pursuant to Rule 13e-(c)

under the Exchange Act (17 CFR 240.13(e)-4(c)) |

| ITEM 2.02 | RESULTS OF OPERATIONS AND FINANCIAL CONDITION |

On November 11, 2014, Ideal Power Inc. (the

“Company”) issued a press release announcing its financial results for the quarter and nine months ended September

30, 2014 and held a conference call to discuss the Company’s financial results. The press release is furnished herewith as

Exhibit 99.1 and a copy of the Company’s conference call script announcing these financial results is furnished herewith

as Exhibit 99.2 and each is incorporated by reference in its entirety into this Item 2.02. The press release and conference call

contain forward-looking statements regarding the Company, and include cautionary statements identifying important factors that

could cause actual results to differ materially from those anticipated.

The information furnished under this Item

2.02 of this Current Report on Form 8-K, including Exhibit 99.1 and Exhibit 99.2, shall not be deemed to be “filed”

for the purposes of Section 18 of the Securities Exchange Act of 1934 (the “Exchange Act”), as amended, or otherwise

subject to the liabilities of that Section. The information in this Item 2.02, including Exhibit 99.1 and Exhibit 99.2, shall not

be deemed incorporated by reference into any filing under the Securities Act of 1933, as amended, or the Exchange Act regardless

of any general incorporation language in such filing.

| Item 9.01 | Financial

Statements and Exhibits |

| |

Exhibit 99.1 | Press release issued November 11, 2014 |

| |

Exhibit 99.2 | Third Quarter Results Conference Call Script dated November

11, 2014 |

SIGNATURE

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this Current Report to be signed on its behalf by the undersigned hereunto

duly authorized.

| Dated: November 12, 2014 |

|

|

|

| |

|

|

|

| |

IDEAL POWER INC. |

|

| |

|

|

|

| |

|

|

|

| |

By: |

/s/ Timothy Burns |

|

| |

|

Timothy Burns |

|

| |

|

Chief Financial Officer |

|

EXHIBIT INDEX

| Exhibit No. |

Description |

| |

|

| 99.1 |

Press release issued November 11, 2014 |

| 99.2 |

Third Quarter Results Conference Call Script dated November 11, 2014 |

Exhibit 99.1

Ideal Power Inc. Announces Third Quarter

2014 Results

Major order received for energy

storage systems; Company introduces 125kW converter for large scale commercial projects

AUSTIN, TX -- (Marketwired) -- 11/11/14

-- Ideal Power Inc. (NASDAQ: IPWR), a developer of a disruptive technology in the power conversion space, today announced results

for the three and nine months ended September 30, 2014.

Third Quarter 2014 and Subsequent Highlights:

| · | Received multiple purchase orders for over 7.5 Megawatts of Ideal’s 30kW battery converters

for commercial storage and distributed wind turbine applications, with orders expected to be shipped through mid-year. |

| · | Signed strategic alliance agreement to incorporate Ideal’s 30kW hybrid converter into EnerDel’s

3rd generation Mobile Hybrid Power System (MHPS), which integrates battery storage, diesel generators and proprietary

control systems for both remote and grid-tied microgrid applications. |

| · | Introduced the new 125kW battery and hybrid converter for use in larger scale commercial installations;

received first purchase order from Coda Energy. |

| · | Announced the appointment of industry veteran Ryan O’Keefe as SVP of Business

Development. He brings key relationships and industry knowledge to help expand Ideal’s customer base and sales

pipeline. |

"Our leading customers in commercial

storage are scaling their businesses and we are receiving increased orders for our products due to our compelling value proposition,”

stated Dan Brdar, Chairman and CEO. “To drive future growth and diversification, we continue to sign agreements with customers

whose products are well positioned in multiple high growth verticals, including commercial storage and micro-grid applications

which are both forecasted to become multi-billion dollar markets. Our recently introduced 125kW converter demonstrates the scalability

of our PPSA technology platform and the inherent competitive advantages our Company has in responding rapidly to market demands,”

concluded Mr. Brdar.

Third Quarter and Year-to-Date 2014 Financial Results

| · | Third quarter revenues were $438,029, including product revenues of $289,000 and ARPA-E grant revenue

of $149,029. Revenues for the first nine months of 2014 were $1,289,650, including product revenues of $841,600 and ARPA-E grant

revenue of $448,050. |

| · | Third quarter net loss was $1.9 million compared to a net loss of $2.2 million in the third quarter

of 2013. Net loss for the first nine months of 2014 was $4.9 million compared to a net loss of $6.0 million for the first nine

months of 2013. |

| · | Cash used in operations was $3.8 million for the first nine months of 2014 while cash used in investing

activities was $592,084 for patents, property and equipment. |

| · | Cash and cash equivalents totalled $9.7 million at September 30, 2014 with no long-term debt outstanding. |

"Our financial results are in line

with our plan as we have prudently managed our expenses while leveraging our capital efficient business model and executing our

business strategy,” said Tim Burns, Chief Financial Officer of Ideal

Power.

Business Overview

Ideal Power's Power Packet Switching Architecture™

(PPSA) technology enables significant improvements over conventional power converters, thus improving efficiency, reliability and

installed cost. Our initial target markets are commercial energy storage, integrated solar and storage, and microgrids. Ideal Power’s

current products include 30kW and 125kW 2-port battery and 3-port hybrid converters based on our patented PPSA technology. Our

award winning products allow us to address several multi-billion dollar vertical markets including commercial energy storage, integrated

storage with solar or wind, and on-grid and off-grid microgrid applications.

Our strategy is to form relationships with

leaders in target vertical markets to provide a superior value proposition and then support their growth as they gain market share.

Direct product sales will be complemented by licensing agreements, enabling both high volume and internationally based customers.

Conference Call Details

CEO Dan Brdar and CFO Tim Burns will host a conference call

with investors. To access the call, please use the following information:

Date: Tuesday, November 11, 2014

Time: 4:30 PM ET, 1:30 PM PT

US dial-in: 1-888-256-9132

International Dial-in: 913-312-0417 Passcode: 9585817 (or reference Ideal Power Q3 Update Call)

Webcast: http://public.viavid.com/index.php?id=111731

The webcast replay will be available on the Company's Web site,

www.idealpower.com

About Ideal Power Inc.

Ideal Power Inc. (NASDAQ: IPWR) has developed

a novel, patented power conversion technology called Power Packet Switching Architecture™ (PPSA). PPSA improves the size,

cost, efficiency, flexibility and reliability of electronic power converters. PPSA can scale across several large and growing

markets, including solar photovoltaic generation, electrified vehicle charging, and commercial grid storage. Ideal Power also

has a licensing-based, capital-efficient business model that can enable it to address these markets simultaneously. Ideal Power

has won multiple grants for its PPSA technology, including a $2.5 million grant from the Department of Energy's Advanced Research

Projects Agency - Energy (ARPA-E) program, and market-leading customers are incorporating PPSA as a key component of their systems.

For more information, visit www.idealpower.com

Safe Harbor Statement

All statements in this release and on the

associated conference call that are not based on historical fact are "forward looking statements" within the meaning

of the Private Securities Litigation Reform Act of 1995 and the provisions of Section 27A of the Securities Act of 1933, as amended,

and Section 21E of the Securities Exchange Act of 1934, as amended. These statements include our statements regarding addressable

vertical markets, our partners potentially gaining market share in their vertical markets, and our complementing product sales

with licensing agreements. While management has based any forward looking statements included in this release on its current expectations,

the information on which such expectations were based may change. These forward looking statements rely on a number of assumptions

concerning future events and are subject to a number of risks, uncertainties and other factors, many of which are outside of our

control that could cause actual results to materially differ from such statements. Such risks, uncertainties, and other factors

include, but are not limited to, whether the patents for our technology provide adequate protection and whether we can be successful

in maintaining, enforcing and defending our patents, whether a demand for energy storage products will grow, whether demand for

our products, which we believe are disruptive, will develop and whether we can compete successfully with other manufacturers and

suppliers of energy conversion products, both now and in the future, as new products are developed and marketed. Furthermore, we

operate in a highly competitive and rapidly changing environment where new and unanticipated risks may arise. The product orders

described in this release are subject to commercial terms that, under certain circumstances, may allow the customer to delay delivery

of product and associated revenue. Accordingly, investors should not place any reliance on forward-looking statements as a prediction

of actual results. We disclaim any intention to, and undertake no obligation to, update or revise forward-looking statements.

# # #

| IDEAL POWER INC. |

| BALANCE SHEETS |

| | |

| | |

| |

| | |

September 30, | | |

December 31, | |

| | |

2014 | | |

2013 | |

| ASSETS | |

| | |

| |

| Current assets: | |

| | |

| |

| Cash and cash equivalents | |

$ | 9,730,268 | | |

$ | 14,137,097 | |

| Accounts receivable, net | |

| 399,769 | | |

| 252,406 | |

| Inventories, net | |

| 343,911 | | |

| 519,657 | |

| Prepayments and other current assets | |

| 106,699 | | |

| 231,495 | |

| Total current assets | |

| 10,580,647 | | |

| 15,140,655 | |

| Property and equipment, net | |

| 331,218 | | |

| 85,718 | |

| Patents, net | |

| 912,249 | | |

| 608,913 | |

| Other non-current assets | |

| 35,840 | | |

| - | |

| Total assets | |

$ | 11,859,954 | | |

$ | 15,835,286 | |

| | |

| | | |

| | |

| LIABILITIES AND STOCKHOLDERS’ EQUITY | |

| | | |

| | |

| Current liabilities: | |

| | | |

| | |

| Accounts payable | |

$ | 429,428 | | |

$ | 539,145 | |

| Accrued expenses | |

| 741,803 | | |

| 461,193 | |

| Total current liabilities | |

| 1,171,231 | | |

| 1,000,338 | |

| | |

| | | |

| | |

| Stockholders’ equity: | |

| | | |

| | |

| Common stock, $0.001 par value; 50,000,000 shares authorized; 7,021,721 and 6,931,968 shares issued and outstanding at September 30, 2014 and December 31, 2013, respectively | |

| 7,022 | | |

| 6,932 | |

| Common stock to be issued | |

| - | | |

| 151,665 | |

| Additional paid-in capital | |

| 32,336,720 | | |

| 31,431,220 | |

| Treasury stock | |

| (2,657 | ) | |

| (2,657 | ) |

| Accumulated deficit | |

| (21,652,362 | ) | |

| (16,752,212 | ) |

| Total stockholders’ equity | |

| 10,688,723 | | |

| 14,834,948 | |

| Total liabilities and stockholders’ equity | |

$ | 11,859,954 | | |

$ | 15,835,286 | |

| IDEAL POWER INC. |

| STATEMENTS OF OPERATIONS |

| | |

| | |

| | |

| | |

| |

| | |

For the Quarter Ended

September 30, | | |

For the Nine Months Ended

September 30, | |

| | |

2014 | | |

2013 | | |

2014 | | |

2013 | |

| Revenues: | |

| | |

| | |

| | |

| |

| Products | |

$ | 289,000 | | |

$ | 212,495 | | |

$ | 841,600 | | |

$ | 396,465 | |

| Royalties | |

| - | | |

| 25,000 | | |

| - | | |

| 75,000 | |

| Grants | |

| 149,029 | | |

| 370,672 | | |

| 448,050 | | |

| 1,167,121 | |

| Total revenue | |

| 438,029 | | |

| 608,167 | | |

| 1,289,650 | | |

| 1,638,586 | |

| | |

| | | |

| | | |

| | | |

| | |

| Cost of revenues: | |

| | | |

| | | |

| | | |

| | |

| Products and services | |

| 393,665 | | |

| 236,505 | | |

| 1,078,843 | | |

| 539,342 | |

| Grant research and development costs | |

| 165,588 | | |

| 383,347 | | |

| 497,833 | | |

| 1,200,288 | |

| Total cost of revenue | |

| 559,253 | | |

| 619,852 | | |

| 1,576,676 | | |

| 1,739,630 | |

| | |

| | | |

| | | |

| | | |

| | |

| Gross loss | |

| (121,224 | ) | |

| (11,685 | ) | |

| (287,026 | ) | |

| (101,044 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Operating expenses: | |

| | | |

| | | |

| | | |

| | |

| General and administrative | |

| 762,741 | | |

| 475,353 | | |

| 2,225,996 | | |

| 1,254,193 | |

| Research and development | |

| 663,678 | | |

| 261,053 | | |

| 1,568,711 | | |

| 825,610 | |

| Sales and marketing | |

| 310,818 | | |

| 95,734 | | |

| 840,565 | | |

| 308,080 | |

| Total operating expenses | |

| 1,737,237 | | |

| 832,140 | | |

| 4,635,272 | | |

| 2,387,883 | |

| | |

| | | |

| | | |

| | | |

| | |

| Loss from operations | |

| (1,858,461 | ) | |

| (843,825 | ) | |

| (4,922,298 | ) | |

| (2,488,927 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Interest (income) expense, net (including amortization of debt discount of $1,273,512 and $3,348,284, respectively, for the quarter and nine months ended September 30, 2013) | |

| (6,617 | ) | |

| 1,320,943 | | |

| (22,148 | ) | |

| 3,487,802 | |

| | |

| | | |

| | | |

| | | |

| | |

| Net loss | |

$ | (1,851,844 | ) | |

$ | (2,164,768 | ) | |

$ | (4,900,150 | ) | |

$ | (5,976,729 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Net loss per share – basic and fully diluted | |

$ | (0.26 | ) | |

$ | (1.46 | ) | |

$ | (0.70 | ) | |

$ | (4.04 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Weighted average number of shares outstanding – basic and fully diluted | |

| 7,015,156 | | |

| 1,480,262 | | |

| 7,008,634 | | |

| 1,480,262 | |

| IDEAL POWER INC. |

| STATEMENTS OF CASH FLOWS |

| | |

| | |

| |

| | |

| | |

| |

| | |

Nine Months Ended September 30, | |

| | |

2014 | | |

2013 | |

| Cash flows from operating activities: | |

| | |

| |

| Net loss | |

$ | (4,900,150 | ) | |

$ | (5,976,729 | ) |

| Adjustments to reconcile net loss to net cash used in operating activities: | |

| | | |

| | |

| Depreciation and amortization | |

| 43,248 | | |

| 21,155 | |

| Write-down of inventory | |

| - | | |

| 5,199 | |

| Stock-based compensation | |

| 597,055 | | |

| 150,340 | |

| Common stock issued or to be issued for services | |

| 50,004 | | |

| 124,393 | |

| Fair value of warrants issued for services | |

| 101,879 | | |

| - | |

| Amortization of debt discount | |

| - | | |

| 3,348,284 | |

| Accrued interest on promissory note | |

| - | | |

| 60,000 | |

| Issuance of note payable in connection with services | |

| - | | |

| 213,293 | |

| Decrease (increase) in operating assets: | |

| | | |

| | |

| Accounts receivable | |

| (147,363 | ) | |

| (483,603 | ) |

| Inventories | |

| 175,746 | | |

| (168,076 | ) |

| Prepaid expenses | |

| 88,956 | | |

| (440,257 | ) |

| Increase (decrease) in operating liabilities: | |

| | | |

| | |

| Accounts payable | |

| (109,717 | ) | |

| 754,753 | |

| Accrued expenses | |

| 280,610 | | |

| 233,142 | |

| Deferred revenue | |

| - | | |

| 25,000 | |

| Net cash used in operating activities | |

| (3,819,732 | ) | |

| (2,133,106 | ) |

| | |

| | | |

| | |

| Cash flows from investing activities: | |

| | | |

| | |

| Purchase of property and equipment | |

| (278,318 | ) | |

| (32,036 | ) |

| Acquisition of patents | |

| (313,766 | ) | |

| (139,631 | ) |

| Net cash used in investing activities | |

| (592,084 | ) | |

| (171,667 | ) |

| | |

| | | |

| | |

| Cash flows from financing activities: | |

| | | |

| | |

| Borrowings on notes payable | |

| - | | |

| 611,256 | |

| Exercise of warrants | |

| 4,987 | | |

| - | |

| Net cash provided by financing activities | |

| 4,987 | | |

| 611,256 | |

| | |

| | | |

| | |

| Net decrease in cash and cash equivalents | |

| (4,406,829 | ) | |

| (1,693,517 | ) |

| Cash and cash equivalents at beginning of period | |

| 14,137,097 | | |

| 1,972,301 | |

| Cash and cash equivalents at end of the period | |

$ | 9,730,268 | | |

$ | 278,784 | |

Exhibit 99.2

Ideal Power

Third Quarter 2014 Results Conference

Call Script

November 11, 2014

4:30 PM ET

Matthew Hayden: Good afternoon everyone.

Thank you very much for listening today to Ideal Power’s third quarter and Year-to-Date results. Your hosts are Mr. Dan Brdar,

Chairman and CEO, and Mr. Tim Burns, Chief Financial Officer. Dan will provide a business update, including recent commercial orders

and product announcements, while Tim will discuss the financial results in detail.

A press release detailing the earnings

results crossed the wire at 4 p.m. today and is available on the Company's Web site, www.idealpower.com.

Following Management's prepared comments,

we will open the floor to your questions for those dialing in and participants who are joining us via webcast.

Before we begin the formal management presentation,

I'd like to remind everyone that some statements made on the call and webcast, including those regarding both future financial

results and industry prospects are forward-looking, and may be subject to a number of risks and uncertainties that could cause

actual results to differ materially than those described in this conference call. Please refer to the Company's SEC filings for

a list of all associated risks. In addition, we also encourage investors to visit the Corporate Web site, www.idealpower.com, for

supporting investor and industry information to help you deepen your understanding of the technology and market.

At this time, I'd like to turn the call

over to Dan -- the floor is yours.

Daniel Brdar: Thank you, Matt, and

thanks everyone for joining us on the call.

For those of you on the call today that

are new to Ideal Power we have developed a unique power conversion technology called the Power Packet Switching Architecture which

we believe can significantly change the landscape for power conversion. The power conversion markets available to us are large

– by some estimates in excess of $50 billion per year. Our technology allows the development of power conversion products

that can have higher efficiency, one fifth the size and weight, higher reliability and lower cost than conventional power converters.

Our initial focus is on renewable energy

applications and in particular, for the near term, commercial and industrial energy storage applications. Due to rapidly declining

battery costs and increasing utility demand charges, energy storage solutions for commercial and industrial customers now represent

an economically attractive solution for businesses and building owners to control their utility costs. Our initial product incorporating

our PPSA technology is a 30 kW battery converter that is used by system integration companies to provide a storage solution for

commercial and industrial customers. Today I am pleased to report to you on our progress in scaling sales of our first product

and developing a compelling product family that will further expand our growth opportunities.

In the past I have discussed our initial

focus on the commercial energy storage market in California and other states. We decided to target this emerging market segment

since we feel it will be one of the most economic markets for energy storage with potential customer financial paybacks of 3 to

5 years. In many cases our initial customers, energy storage system integrators, will provide financing for a zero capital cost

model to commercial and industrial building owners with guaranteed savings to the end user. We feel that the favorable economics

and performance-based contracts offered by our system integration customers will enable rapid market growth. By working with industry

leaders in this market we expect to benefit from this growth.

Our 30kW battery converter is an attractive

solution that offers a compelling value proposition for this market. Our product can provide superior efficiency and significantly

lower size and weight than conventional power converters. According to independent and publicly available testing, our product

efficiency is 96.5% compared to 92.5% from a typical competitor. Two power conversions are required in energy storage, so our product

can lower roundtrip efficiency losses by 8 percentage points. This can enhance the return on investment for our customers. By using

our product versus a conventional power converter an Ideal Power based-system requires 8 percentage points less electricity when

charging and discharging the batteries and can enable a system to get more work out of the system capital invested in batteries.

The product size and weight is also an important factor. Our

product weighs less than 100 pounds while conventional products weigh as much as 650 pounds. This significantly reduces shipping

and installation costs, as our product can be delivered by UPS ground, and can be mounted on a wall. Competing products require

a freight truck for delivery and the use of a forklift to install them on a concrete pad. All of these adds to their installed

system cost. Also, in many urban locations, fitting a conventional power converter into an existing building can be challenging

due to its size and weight. Our small size and weight allows our units to be readily deployed in almost any building.

Product weight also correlates to manufacturing

costs. Since our PPSA technology eliminates 90% of the passive components of a conventional power converter, items such as bulk

capacitors and transformers, we are inherently a lower cost design. As order volume increases with our contract manufacturers,

this cost advantage will become evident.

Another key factor for our products is their low noise. In many locations such as office and apartment buildings and commercial

businesses, storage solutions are being installed in close proximity to where people are working and living. The quiet operation

of our products allows their use in locations where using a conventional power converter would disturb the building occupants.

Our focus on commercial and industrial

storage is showing results. With today’s announcement of an additional 3MW of orders for our 30kW battery converter, we have

received over 7.5MW of orders since early September. This represents over 250 units and is a significant step change in our order

flow. While we are only at the beginning of the adoption curve for our technology, we believe the recent increase in orders represents

several key signals for Ideal Power and the energy storage market as a whole. First, since the majority of these units are from

our previously announced system integration customers in commercial energy storage - Sharp Electronics, Green Charge Networks and

Coda Energy it indicates that customers who have been using and evaluating our technology are pleased with its performance and

its value proposition. Secondly, it indicates that the education of the commercial and industrial end user customer by our system

integration partners is beginning to produce meaningful order flow for their businesses. The long promise of storage to mitigate

the problems of intermittent sources of generation such as solar and wind has finally reached the point where it represents an

economically attractive solution for the commercial and industrial markets. Today storage solutions are primarily driven by demand

charge reductions. However, as the cost of batteries continue to decline other markets such as utility and residential users will

also become addressable markets for us. Since our PPSA technology is very scalable, we will be able to introduce highly competitive

product offerings for those markets as well.

The units covered by our recent announcements

are scheduled for delivery through mid-2015. We anticipate adding additional unit orders from our current and new customers as

the market continues to ramp. The units from our recent announcements will primarily be installed in California. California is

often a leader in energy and environmental policy and technology adoption. We are now seeing other markets follow their lead as

increased demand charges and high time of use charges from utilities are creating opportunities in other parts of the U.S. such

as New York, New England and Hawaii and international opportunities as well.

We expect that our products used for commercial

and industrial demand charge reduction will provide us with a solid and rapidly growing revenue base in 2015. In the third quarter

our leading customers prepared for the high forecasted growth in the commercial storage market, securing orders from end customers

and equity and project financing. For example Green Charge Network raised $56 million from K Road, a leading utility scale solar

developer, to provide them adequate customer project and equity financing while Sharp launched its SmartStorage business unit in

late July.

Our success in capturing the business of

the early commercial and industrial market leaders is also drawing others to evaluate Ideal Power’s PPSA technology for their

businesses as well. With the economics of energy storage becoming increasingly attractive and third party financing beginning to

flow to the market we are being increasingly approached by other potential partners due to our novel technology and compelling

value proposition. We anticipate adding other channel partners in the coming months as several successful companies in the renewable

energy markets evaluate their own offerings for the increasingly attractive markets being enabled by declining battery costs and

novel technologies such as ours.

The other major topic that I wish to discuss

is the significant progress in broadening our product family for other vertical markets, but first I would like to turn the floor

over to our CFO, Tim Burns, to discuss our financial results. Tim….

Tim Burns:

Thank you, Dan. Total revenue for the third

quarter was $438,000, consisting of product revenues of $289,000 and the balance coming from grants. Total cost of revenue was

$559,000 which included $166,000 in grant research and development costs. Operating expenses, which includes $664,000 in research

and development spending, totaled $1.7 million yielding a net loss of $1.9 million.

Total revenue for the nine months ended

September 30 was $1.3 million with $842,000 from product sales and $448,000 coming from grants. Total cost of revenue was $1.6

million which included $498,000 in grant research and development costs. Total operating expenses were $4.6 million including $1.6

million in research and development costs. The net loss was $4.9 million for the first nine months of the year, consistent with

our expectations.

At September 30, 2014 our balance sheet

had $9.7 million in cash and cash equivalents and no debt. We have a federal NOL which will shield us from income taxes when we

become profitable.

At September 30, 2014, we had 7 million

shares of common stock outstanding and just under 10 million shares on a fully diluted basis which includes approximately 1.6 million

warrants and 1.3 million options outstanding.

I will now turn it back over to Dan. Dan?

Dan Brdar: We discussed our initial

vertical market in commercial and industrial storage and how we are winning in this high growth emerging market. We are leveraging

our early success in standalone storage applications to capture other adjacent vertical markets.

Our technology allows us to use a standard

hardware design to support multiple applications. You can think of it as a software-defined power converter platform that can address

multiple vertical markets. This flexibility allows our products to be used in a wide variety of applications. It also allows us

to scale our product offerings relatively quickly since our technology platform is very flexible. Two trends that we see in the

market drove our two most recent product introductions.

First, a macro driver we see in the renewable

energy markets is what we feel is the inevitable convergence of solar and storage. As the penetration of solar continues it creates

a variety of problems for the utility grid due to its intermittent nature. As more and more solar is deployed the grid itself can

become unstable since our electric utility systems were never designed to have any significant amount of intermittent generation.

Coupling storage with solar solves the problems of intermittency and grid instability while also mitigating the demand charges

for users. Today solutions that put storage and solar together have been cumbersome and expensive. In response to the coming convergence

of solar and storage we introduced our award winning 30 kW hybrid converter which puts the functionality of a solar inverter and

a battery converter into one compact, cost effective, efficient unit. It is our view that the conventional solar inverter will

become obsolete in an increasing number of locations where it will be required to install solar and storage together.

Secondly, our 30 kW product serves as an

excellent modular building block that enables our customers to address a wide range of project sizes. As commercial and industrial

customers have become increasingly aware of and comfortable with storage to address their demand charge issues, we have seen projects

growing larger in size. Based on the market feedback we received we felt it was time to leverage our existing 30 kW development

efforts and introduce our 125 kW family of products. The 125 kW hybrid and battery converter products not only allow us to provide

an even more cost effective answer for large commercial and industrial installations but it also gives us a building block to capture

opportunities being developed for small utility scale storage projects. Our 125 kW family of products offer similar efficiency,

size and weight advantages as our 30 kW unit. Using multiple 125 kW units provides an attractive building block for MW scale applications

– particularly for the increasingly popular shipping container based solutions being developed by several companies looking

to provide industrial and utility scale storage solutions. We already announced the sale of our first 125 kW unit was to our long

term customer Coda Energy. We will be announcing additional sales of the larger unit in the coming months since initial market

feedback would indicate it will be a successful addition to our product offerings. The product was part of our booth at Solar Power

International and generated great interest by both potential end users and a new set of potential customers and channel partners

who are focused on larger industrial and utility applications. We will be making announcements in coming months about new relationships

that are the result of our larger product offering.

The wide variety of generator, storage

and loads required by the industry are served today by different products, from different vendors, with different control systems.

We believe the industry urgently needs a building block set of power converter solutions that will allow system integrators to

easily configure and install integrated systems that combine these systems with greater value, lower cost and improved reliability.

Another vertical market we see being enabled

by both our technology and the declining cost of batteries are microgrids for islands, defense installations, hospitals, and locations

served by diesel fuel for power generation.

In third quarter we announced our first

strategic partnership and customer agreement in hybrid systems. EnerDel, jointly announced with us, that they are developing a

new generation of Mobile Hybrid Power Systems by integrating our 30kW hybrid converter with their lithium-ion batteries, control

systems and a conventional diesel generator. This system is expected reduce diesel fuel consumption for remote off-grid applications

by over 70 percent. Their mobile platform can also incorporate solar into the mix of batteries and engines and provide improved

power quality and greater reliability. EnerDel plans to sell a family of trailer and skid mounted solutions worldwide with our

hybrid converter. Their skid mounted micro-grid solution will be available for sale later this year and we anticipate micro-grid

applications contributing meaningfully to our 2015 revenue.

We estimate that there are 1 billion people

globally without access to a power grid and another 1 billion dependent on expensive diesel generators for electricity, so a large

market exists for providing superior off-grid solutions integrating storage, solar and diesel generators. For many applications

we believe these systems can have a two year financial payback by dramatically reducing the amount of diesel fuel used for power

generation.

The market for commercial solar and energy

storage and the market for off grid microgrids using solar and energy storage are both at an early stage, but are forecasted to

roughly double annually for the next several years, creating a new power converter market of almost a billion dollars by 2018.

We believe our announced products are significantly better for these applications than those from any other company, and we are

well positioned to benefit from these growing markets.

Lastly I want to mention that we are continuing

to invest in the development of our next generation bi-directional power switches. This effort started with support and funding

from the U.S. Department of Energy’s ARPA-e program, and continues to make good technical progress. The first switches are

now in fabrication and once they are evaluated by our technical team we will make our first prototypes using the new switch design.

Our performance expectations for the technology have been confirmed by third party simulations and we remain excited about the

potential of this next generation of our technology. The bi-directional switch development is expected to have significant impact

on our already unique products. As a result of the bi-directional switch development, the efficiency of our products is anticipated

to increase to 98% or greater. The effect of this improvement would enable us to potentially double the power density of our power

converter designs. For example, the box that today makes 30 kW could produce close to 60 kW in roughly the same size and weight

device. Obviously this would have a significant impact on our unit costs. We will be making announcements in the coming months

to update you on our progress and to highlight key accomplishments in our development efforts.

Before we open the call up to questions

I wanted to cover a couple other items. This quarter we made a new addition to our team by adding Ryan O’Keefe as Sr. VP

of Business Development. Ryan is an industry veteran who has held senior positions at start-ups and Fortune 100 companies alike

in the energy storage and renewable energy industry. These include companies such as General Electric and NextEra Energy. As evidenced

by our recent order announcements, he has hit the ground running and we look forward to his continued contribution to our sales

and partner development efforts.

Also, during the past 3 months I have attended

investor meetings in NYC, California and Las Vegas at the SPI conference. We frequently host visitors to our new Austin facility

located 10 minutes from the airport and we will participate in the Ideas Conference in Dallas which is held on November 19-20.

If you have an interest in arranging an in person meeting or scheduling a call or visit to our facilities please contact Matt Hayden

from MZ Group.

At this time I would like to open up the

call for questions, operator?

Dan – closing remarks to thanks participants

for joining.

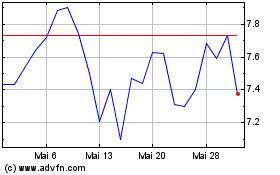

Ideal Power (NASDAQ:IPWR)

Historical Stock Chart

Von Jun 2024 bis Jul 2024

Ideal Power (NASDAQ:IPWR)

Historical Stock Chart

Von Jul 2023 bis Jul 2024