IPG Photonics Announces First Quarter 2024 Financial Results

30 April 2024 - 2:00PM

IPG Photonics Corporation (NASDAQ: IPGP) today reported

financial results for the first quarter ended March 31, 2024.

|

|

|

Three Months Ended March 31, |

|

|

|

|

(In millions, except per share data and

percentages) |

|

|

2024 |

|

|

|

2023 |

|

|

Change |

|

Revenue |

|

$ |

252.0 |

|

|

$ |

347.2 |

|

|

(27 |

)% |

|

Gross margin |

|

|

38.7 |

% |

|

|

42.3 |

% |

|

|

|

|

Operating income |

|

$ |

19.1 |

|

|

$ |

75.4 |

|

|

(75 |

)% |

|

Operating margin |

|

|

7.6 |

% |

|

|

21.7 |

% |

|

|

|

| Net

income attributable to IPG Photonics Corporation |

|

$ |

24.1 |

|

|

$ |

60.1 |

|

|

(60 |

)% |

|

Earnings per diluted share |

|

$ |

0.52 |

|

|

$ |

1.26 |

|

|

(59 |

)% |

|

|

|

|

|

|

|

|

|

|

|

|

|

Management Comments

"In the first quarter, we continued to generate

strong cash flow from operations, reduce inventory and control

manufacturing expenses, in spite of the challenging conditions. We

also remained focused on our strategy to unlock additional growth

opportunities for fiber lasers such as welding, cleaning, heating

and medical, which would allow us to diversify our revenue away

from highly competitive markets," said Dr. Eugene Scherbakov, IPG

Photonics' Chief Executive Officer. "While delayed investments in

electric battery capacity worldwide, soft industrial demand across

most of our major geographies, and inventory management by some

large OEM customers impacted first quarter results, we believe that

our strong technology differentiation helps us continue to displace

other laser and non-laser tools across a growing range of

applications, positioning our business for growth in the

future."

Financial Highlights

First quarter revenue of $252 million decreased

27% year over year. Changes in foreign exchange rates reduced

revenue growth by approximately $8 million or 2%. By region,

sales decreased across all major geographies and were down 38% in

China, 16% in North America, 21% in Europe and 23% in Japan on a

year-over-year basis. Materials processing sales accounted for 90%

of total revenue and decreased 28% year over year. The decline was

due to lower revenue in most applications, except for growth in 3D

printing and heating, and flat sales in parts and services. Other

applications sales decreased 25% year over year due to lower

revenue in medical and advanced applications.

Emerging growth products sales accounted for 45%

of total revenue and were negatively impacted by lower demand in

e-mobility and solar cell manufacturing applications, lower sales

in handheld welding applications and inventory adjustment by a

large medical customer.

Gross margin of 38.7% decreased 360 basis points

year over year due to reduced absorption of manufacturing expenses

and increased inventory reserves, partially offset by lower product

and shipping costs. Earnings per diluted share (EPS) of $0.52

decreased 59% year over year. The gain on sale of assets increased

operating income by $7 million and increased diluted EPS by

$0.11. Foreign exchange transaction loss decreased operating income

by $2 million and earnings per share by $0.03 in the first quarter.

The effective tax rate in the quarter was 28%. During the first

quarter, IPG generated $55 million in cash from operations and

spent $28 million on capital expenditures and $90 million on share

repurchases.

Business Outlook and Financial Guidance

“Despite a challenging first quarter, our

book-to-bill was slightly above one for the first time since the

first quarter last year, which may indicate that industrial demand

is stabilizing and could start to improve modestly later in the

year," concluded Dr. Scherbakov.

For the second quarter of 2024, IPG expects

revenue of $240 million to $270 million. The Company expects the

second quarter tax rate to be approximately 25%, including certain

discrete items. IPG anticipates delivering earnings per diluted

share in the range of $0.30 to $0.60.

As discussed in more detail in the "Safe Harbor"

passage of this news release, actual results may differ from this

guidance due to various factors including, but not limited to,

trade policy changes and trade restrictions, product demand, order

cancellations and delays, competition, tariffs, currency

fluctuations and general economic conditions. This guidance is

based upon current market conditions and expectations, and is

subject to the risks outlined in the Company's reports filed with

the SEC, and assumes exchange rates relative to the U.S. dollar of

euro 0.93, Russian ruble 92, Japanese yen 151 and Chinese yuan

7.10, respectively.

Supplemental Financial Information

Additional supplemental financial information is

provided in the unaudited Financial Data Workbook and First Quarter

2024 Earnings Call Presentation available on the investor relations

section of the Company's website at investor.ipgphotonics.com.

Conference Call Reminder

The Company will hold a conference call today,

April 30, 2024 at 10:00 am ET. To access the call, please dial

877-407-6184 in the US or 201-389-0877 internationally. A live

webcast of the call will also be available and archived on the

investor relations section of the Company's website at

investor.ipgphotonics.com.

Contact

Eugene FedotoffSenior Director, Investor Relations IPG Photonics

Corporation 508-597-4713efedotoff@ipgphotonics.com

About IPG Photonics Corporation

IPG Photonics Corporation is the leader in

high-power fiber lasers and amplifiers used primarily in materials

processing and other diverse applications. The Company’s mission is

to develop innovative laser solutions making the world a better

place. IPG accomplishes this mission by delivering superior

performance, reliability and usability at a lower total cost of

ownership compared with other types of lasers and non-laser tools,

allowing end users to increase productivity and decrease costs. IPG

is headquartered in Marlborough, Massachusetts and has more than 30

facilities worldwide. For more information, visit

www.ipgphotonics.com.

Safe Harbor Statement

Information and statements provided by IPG and

its employees, including statements in this press release, that

relate to future plans, events or performance are forward-looking

statements. These statements involve risks and uncertainties. Any

statements in this press release that are not statements of

historical fact are forward-looking statements, including

indications of stabilizing industrial demand and improvements later

in the year, revenue outlook, tax rate and earnings guidance, and

the impact of the U.S. dollar on our guidance for second quarter of

2024. Factors that could cause actual results to differ materially

include risks and uncertainties, including risks associated with

the strength or weakness of the business conditions in industries

and geographic markets that IPG serves, particularly the effect of

downturns in the markets IPG serves; uncertainties and adverse

changes in the general economic conditions of markets; inability to

manage risks associated with international customers and

operations; changes in trade controls and trade policies; IPG's

ability to penetrate new applications for fiber lasers and increase

market share; the rate of acceptance and penetration of IPG's

products; foreign currency fluctuations; high levels of fixed costs

from IPG's vertical integration; the appropriateness of IPG's

manufacturing capacity for the level of demand; competitive

factors, including declining average selling prices; the effect of

acquisitions and investments; inventory write-downs; asset

impairment charges; intellectual property infringement claims and

litigation; interruption in supply of key components; manufacturing

risks; government regulations and trade sanctions; and other risks

identified in IPG's SEC filings. Readers are encouraged to refer to

the risk factors described in IPG's Annual Report on Form 10-K

(filed with the SEC on February 21, 2024) and IPG's reports filed

with the SEC, as applicable. Actual results, events and performance

may differ materially. Readers are cautioned not to rely on the

forward-looking statements, which speak only as of the date hereof.

IPG undertakes no obligation to update the forward-looking

statements that may be made to reflect events or circumstances

after the date hereof or to reflect the occurrence of unanticipated

events.

|

IPG PHOTONICS CORPORATIONCONDENSED

CONSOLIDATED STATEMENTS OF INCOME (UNAUDITED) |

|

|

|

|

|

|

|

Three Months Ended March 31, |

|

|

|

|

2024 |

|

|

|

2023 |

|

|

|

|

(In thousands, except per share data) |

| Net

sales |

|

$ |

252,009 |

|

|

$ |

347,174 |

|

|

Cost of sales |

|

|

154,473 |

|

|

|

200,236 |

|

|

Gross profit |

|

|

97,536 |

|

|

|

146,938 |

|

|

Operating expenses: |

|

|

|

|

|

Sales and marketing |

|

|

22,998 |

|

|

|

21,088 |

|

|

Research and development |

|

|

29,381 |

|

|

|

22,770 |

|

|

General and administrative |

|

|

31,158 |

|

|

|

30,128 |

|

|

Gain on sale of assets |

|

|

(6,776 |

) |

|

|

— |

|

|

Restructuring charges, net |

|

|

— |

|

|

|

181 |

|

|

Loss (gain) on foreign exchange |

|

|

1,675 |

|

|

|

(2,655 |

) |

|

Total operating expenses |

|

|

78,436 |

|

|

|

71,512 |

|

|

Operating income |

|

|

19,100 |

|

|

|

75,426 |

|

|

Other income, net: |

|

|

|

|

|

Interest income, net |

|

|

14,177 |

|

|

|

7,533 |

|

|

Other income, net |

|

|

325 |

|

|

|

331 |

|

|

Total other income |

|

|

14,502 |

|

|

|

7,864 |

|

|

Income before provision of income taxes |

|

|

33,602 |

|

|

|

83,290 |

|

|

Provision for income taxes |

|

|

9,503 |

|

|

|

23,155 |

|

| Net

income attributable to IPG Photonics Corporation |

|

$ |

24,099 |

|

|

$ |

60,135 |

|

| Net

income attributable to IPG Photonics Corporation per share: |

|

|

|

|

|

Basic |

|

$ |

0.52 |

|

|

$ |

1.26 |

|

|

Diluted |

|

$ |

0.52 |

|

|

$ |

1.26 |

|

|

Weighted average common shares outstanding: |

|

|

|

|

|

Basic |

|

|

45,960 |

|

|

|

47,542 |

|

|

Diluted |

|

|

46,175 |

|

|

|

47,776 |

|

|

IPG PHOTONICS CORPORATIONCONDENSED

CONSOLIDATED BALANCE SHEETS (UNAUDITED) |

|

|

|

|

|

|

|

|

|

March 31, |

|

December 31, |

|

|

|

|

2024 |

|

|

|

2023 |

|

|

|

|

(In thousands, except share and per

share data) |

|

ASSETS |

|

Current assets: |

|

|

|

|

|

Cash and cash equivalents |

|

$ |

496,452 |

|

|

$ |

514,674 |

|

|

Short-term investments |

|

|

643,655 |

|

|

|

662,807 |

|

|

Accounts receivable, net |

|

|

184,012 |

|

|

|

219,053 |

|

|

Inventories |

|

|

431,899 |

|

|

|

453,874 |

|

|

Prepaid income taxes |

|

|

24,530 |

|

|

|

26,038 |

|

|

Prepaid expenses and other current assets |

|

|

49,071 |

|

|

|

38,208 |

|

|

Total current assets |

|

|

1,829,619 |

|

|

|

1,914,654 |

|

|

Deferred income taxes, net |

|

|

84,452 |

|

|

|

88,788 |

|

|

Goodwill |

|

|

38,351 |

|

|

|

38,540 |

|

|

Intangible assets, net |

|

|

24,802 |

|

|

|

26,234 |

|

|

Property, plant and equipment, net |

|

|

585,751 |

|

|

|

602,257 |

|

|

Other assets |

|

|

35,461 |

|

|

|

28,425 |

|

|

Total assets |

|

$ |

2,598,436 |

|

|

$ |

2,698,898 |

|

|

LIABILITIES AND EQUITY |

|

Current liabilities: |

|

|

|

|

|

Accounts payable |

|

$ |

26,675 |

|

|

$ |

28,618 |

|

|

Accrued expenses and other current liabilities |

|

|

163,011 |

|

|

|

181,350 |

|

|

Income taxes payable |

|

|

2,441 |

|

|

|

4,893 |

|

|

Total current liabilities |

|

|

192,127 |

|

|

|

214,861 |

|

|

Other long-term liabilities and deferred income taxes |

|

|

65,589 |

|

|

|

68,652 |

|

|

Total liabilities |

|

|

257,716 |

|

|

|

283,513 |

|

|

Commitments and contingencies |

|

|

|

|

| IPG

Photonics Corporation equity: |

|

|

|

|

|

Common stock, $0.0001 par value, 175,000,000 shares authorized;

56,521,438 and 45,566,746 shares issued and outstanding,

respectively, at March 31, 2024; 56,317,438 and 46,320,671

shares issued and outstanding, respectively, at December 31,

2023. |

|

|

6 |

|

|

|

6 |

|

|

Treasury stock, at cost, 10,954,692 and 9,996,767 shares held at

March 31, 2024 and December 31, 2023, respectively. |

|

|

(1,251,121 |

) |

|

|

(1,161,505 |

) |

|

Additional paid-in capital |

|

|

1,002,600 |

|

|

|

994,020 |

|

|

Retained earnings |

|

|

2,819,493 |

|

|

|

2,795,394 |

|

|

Accumulated other comprehensive loss |

|

|

(230,258 |

) |

|

|

(212,530 |

) |

|

Total IPG Photonics Corporation equity |

|

|

2,340,720 |

|

|

|

2,415,385 |

|

|

Total liabilities and equity |

|

$ |

2,598,436 |

|

|

$ |

2,698,898 |

|

|

IPG PHOTONICS CORPORATIONCONDENSED

CONSOLIDATED STATEMENTS OF CASH FLOWS (UNAUDITED) |

|

|

|

|

|

|

|

Three Months Ended March 31, |

|

|

|

|

2024 |

|

|

|

2023 |

|

|

|

|

(In thousands) |

|

Cash flows from operating activities: |

|

|

|

|

|

Net income |

|

$ |

24,099 |

|

|

$ |

60,135 |

|

|

Adjustments to reconcile net income to net cash provided by

operating activities: |

|

|

|

|

|

Depreciation and amortization |

|

|

16,214 |

|

|

|

17,889 |

|

|

Provisions for inventory, warranty & bad debt |

|

|

14,761 |

|

|

|

17,214 |

|

|

Other |

|

|

143 |

|

|

|

19,561 |

|

|

Changes in assets and liabilities that provided (used) cash, net of

acquisitions: |

|

|

|

|

|

Accounts receivable and accounts payable |

|

|

32,579 |

|

|

|

(29,242 |

) |

|

Inventories |

|

|

1,498 |

|

|

|

(8,989 |

) |

|

Other |

|

|

(34,698 |

) |

|

|

(39,288 |

) |

|

Net cash provided by operating activities |

|

|

54,596 |

|

|

|

37,280 |

|

|

Cash flows from investing activities: |

|

|

|

|

|

Purchases of and deposits on property, plant and equipment |

|

|

(28,052 |

) |

|

|

(33,404 |

) |

|

Proceeds from sales of property, plant and equipment |

|

|

25,262 |

|

|

|

1,600 |

|

|

Purchases of short-term investments |

|

|

(226,521 |

) |

|

|

(343,820 |

) |

|

Proceeds from short-term investments |

|

|

252,890 |

|

|

|

279,499 |

|

|

Other |

|

|

157 |

|

|

|

107 |

|

|

Net cash provided by (used in) investing activities |

|

|

23,736 |

|

|

|

(96,018 |

) |

|

Cash flows from financing activities: |

|

|

|

|

|

Principal payments on long-term borrowings |

|

|

— |

|

|

|

(298 |

) |

|

Proceeds from issuance of common stock under employee stock option

and purchase plans less payments for taxes related to net share

settlement of equity awards |

|

|

(1,158 |

) |

|

|

(3,844 |

) |

|

Purchase of treasury stock, at cost |

|

|

(89,616 |

) |

|

|

(113,094 |

) |

|

Net cash used in financing activities |

|

|

(90,774 |

) |

|

|

(117,236 |

) |

|

Effect of changes in exchange rates on cash and cash

equivalents |

|

|

(5,780 |

) |

|

|

(1,098 |

) |

| Net

decrease in cash and cash equivalents |

|

|

(18,222 |

) |

|

|

(177,072 |

) |

|

Cash and cash equivalents — Beginning of period |

|

|

514,674 |

|

|

|

698,209 |

|

|

Cash and cash equivalents — End of period |

|

|

496,452 |

|

|

|

521,137 |

|

|

Supplemental disclosures of cash flow information: |

|

|

|

|

|

Cash paid for interest |

|

$ |

4 |

|

|

$ |

525 |

|

|

Cash paid for income taxes |

|

$ |

8,005 |

|

|

$ |

19,203 |

|

|

IPG PHOTONICS CORPORATIONSUPPLEMENTAL

SCHEDULE OF AMORTIZATION OF INTANGIBLE ASSETS

(UNAUDITED) |

|

|

|

|

|

Three Months Ended March 31, |

|

|

|

2024 |

|

2023 |

|

|

|

(In thousands) |

|

Amortization of intangible assets: |

|

|

|

|

|

Cost of sales |

|

$ |

488 |

|

$ |

564 |

|

Sales and marketing |

|

|

937 |

|

|

1,457 |

|

Total amortization of intangible assets |

|

$ |

1,425 |

|

$ |

2,021 |

|

IPG PHOTONICS CORPORATIONSUPPLEMENTAL

SCHEDULE OF STOCK-BASED COMPENSATION (UNAUDITED) |

|

|

|

|

|

Three Months Ended March 31, |

|

|

|

|

2024 |

|

|

|

2023 |

|

|

|

|

(In thousands) |

|

Cost of sales |

|

$ |

2,075 |

|

|

$ |

2,646 |

|

|

Sales and marketing |

|

|

1,502 |

|

|

|

1,293 |

|

|

Research and development |

|

|

2,631 |

|

|

|

1,796 |

|

|

General and administrative |

|

|

3,524 |

|

|

|

3,876 |

|

|

Total stock-based compensation |

|

|

9,732 |

|

|

|

9,611 |

|

| Tax

effect of stock-based compensation |

|

|

(2,140 |

) |

|

|

(2,096 |

) |

| Net

stock-based compensation |

|

$ |

7,592 |

|

|

$ |

7,515 |

|

|

|

|

Three Months Ended March 31, |

|

|

|

|

2024 |

|

|

|

2023 |

|

|

|

|

(In thousands) |

|

Excess tax benefit (detriment) on stock-based compensation |

|

$ |

(3,649 |

) |

|

$ |

(1,708 |

) |

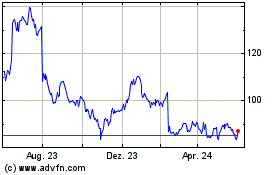

IPG Photonics (NASDAQ:IPGP)

Historical Stock Chart

Von Apr 2024 bis Mai 2024

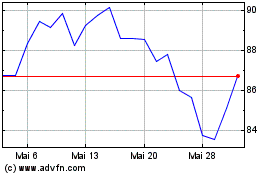

IPG Photonics (NASDAQ:IPGP)

Historical Stock Chart

Von Mai 2023 bis Mai 2024