As filed with the Securities and Exchange Commission

on June 13, 2024

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

SCHEDULE TO

(AMENDMENT NO. 4)

TENDER OFFER STATEMENT UNDER SECTION

14(d)(1) OR 13(e)(1)

OF THE SECURITIES EXCHANGE ACT

OF 1934

INCYTE CORPORATION

(Name of Subject Company (Issuer))

INCYTE CORPORATION

(Names of Filing Persons (Issuer and

Offeror))

COMMON STOCK, $.001 PAR VALUE

(Title of Class of Securities)

45337C102

(CUSIP Number of Class of Securities)

Hervé Hoppenot

President and Chief Executive

Officer

Incyte Corporation

1901 Augustine Cut-Off

Wilmington, Delaware 19803

(302) 498-6700

(Name, Address and Telephone Number

of Person Authorized to Receive Notices and Communications on Behalf of Filing Persons)

With copies to:

|

Stanton D. Wong

Pillsbury Winthrop Shaw Pittman LLP

Four Embarcadero Center, 22nd Floor

San Fransisco, California 94111

(415) 983-1000 |

Stephen C. Ashley

Pillsbury Winthrop Shaw Pittman LLP

31 West 52nd Street

New York, NY 10019-6131

(212) 858-1000 |

¨ Check

the box if the filing relates solely to preliminary communications made before the commencement of a tender offer. Check the appropriate

boxes below to designate any transactions to which the statement relates:

| ¨ | third-party tender offer subject to Rule 14d-1. |

| x | issuer tender offer subject to Rule 13e-4. |

| ¨ | going-private transaction subject to Rule 13e-3. |

| ¨ | amendment to Schedule 13D under Rule 13d-2. |

Check the following box if the filing

is a final amendment reporting the results of the tender offer: x

If applicable, check the appropriate box(es) below to designate the

appropriate rule provision(s) relied upon:

| ¨ | Rule 13e-4(i) (Cross-Border Issuer Tender Offer) |

| ¨ | Rule 14d-1(d) (Cross-Border Third-Party Tender Offer) |

INTRODUCTION

This Amendment No. 4 (this “Amendment”)

amends and supplements the Tender Offer Statement on Schedule TO originally filed with the Securities and Exchange Commission on May 13,

2024, as amended and supplemented on May 15, 2024, June 4, 2024 and June 11, 2024 (as amended and supplemented, the “Schedule TO”),

relating to the offer by Incyte Corporation, a Delaware corporation (the “Company”), to purchase up to $1.672 billion in value

of its common stock, $.001 par value, at a price not greater than $60.00 per share nor less than $52.00 per share, net to the seller in

cash, less any applicable withholding taxes and without interest, upon the terms and subject to the conditions set forth in the Offer

to Purchase dated May 13, 2024 (the “Offer to Purchase”), and in the related Letter of Transmittal (the “Letter of Transmittal”),

copies of which were previously filed as Exhibits (a)(1)(A) and (a)(1)(B), respectively, to the Schedule TO.

This Amendment is intended to satisfy

the reporting requirements of Rule 13e-4(c)(4) under the Securities Exchange Act of 1934, as amended. Only those items amended are reported

in this Amendment. Except as specifically provided herein, the information contained in the Schedule TO remains unchanged and this Amendment

does not modify any of the information previously reported on the Schedule TO. This Amendment should be read in conjunction with the Schedule

TO and all of the exhibits thereto, including the Offer to Purchase and the Letter of Transmittal, as each may be amended or supplemented

from time to time.

ITEM 11. ADDITIONAL INFORMATION.

Item 11 of the Schedule TO is hereby

amended and supplemented by adding the following:

“On June 13, 2024, the Company

issued a press release announcing the final results of the Offer, which expired at 12:00 midnight, at the end of the day, New York City

time, on Monday June 10, 2024. A copy of the press release is filed as Exhibit (a)(5)(D) and is incorporated by reference herein.”

ITEM 12. EXHIBITS.

Item 12 of the Schedule TO is hereby amended and supplemented

by adding the following exhibit:

(a)(5)(D) Press release issued June 13, 2024, announcing the final results of the Tender Offer.

SIGNATURE

After due inquiry and to the best of my knowledge and belief,

I certify that the information set forth in this statement is true, complete and correct.

Date: June 13, 2024

| |

INCYTE CORPORATION |

| |

|

| |

By: |

/s/ Christiana Stamoulis |

| |

|

Christiana Stamoulis |

| |

|

Executive Vice President and Chief Financial Officer |

| |

|

(Principal Financial Officer) |

Exhibit (a)(5)(D)

Incyte Announces

Final Results of Tender Offer

WILMINGTON, Del. – June 13,

2024 – Incyte Corporation (Nasdaq: INCY) (“Incyte” or the “Company”) announced today the final results

of its modified “Dutch auction” tender offer to purchase up to $1.672 billion in value of shares of its common stock, which

expired at 12:00 midnight, at the end of the day, New York City time, on June 10, 2024.

Based on the final count by Computershare

Trust Company, N.A., the depositary for the tender offer, a total of 29,821,563 shares of Incyte’s common stock were properly tendered

and not properly withdrawn at or below the purchase price of $60.00 per share.

Incyte has accepted for purchase 27,866,666

shares of its common stock at a purchase price of $60.00 per share, for a total cost of approximately $1.672 billion, excluding fees

and expenses relating to the tender offer. These shares represent approximately 12.4 percent of the Company’s total outstanding

shares of common stock as of June 7, 2024. The final proration factor for the shares that Incyte will purchase pursuant to the tender

offer is approximately 93.5 percent.

As previously

announced, on May 12, 2024, Incyte entered into a separate stock purchase agreement with

Julian C. Baker (a member of Incyte’s Board of Directors), Felix J. Baker, and entities affiliated with Julian C. and Felix J.

Baker, including funds advised by Baker Bros. Advisors LP (collectively, the “Baker Entities”), under which the Baker Entities

agreed not to tender or sell any shares in the tender offer and instead agreed to sell to the Company, following completion of the tender

offer, a pro rata number of shares at the same price per share as will be paid by the Company in the tender offer, such that the Baker

Entities’ aggregate percentage ownership in the Company will be substantially the same as prior to the tender offer. The closing

of the purchase under the stock purchase agreement is subject to customary conditions and is expected to occur on June 26, 2024,

the eleventh business day following the expiration date of the tender offer, or on such later date as the parties shall mutually agree.

Based on the 27,866,666 shares the Company accepted for purchase in the tender offer, the Company expects to purchase 5,459,183 shares

from the Baker Entities under the stock purchase agreement at a purchase price of $60.00 per share for an aggregate purchase price of

approximately $328 million. As such, the Company expects to repurchase a total of 33,325,849 shares of its common stock through the tender

offer and the stock purchase agreement at a price of $60.00 per share, for a total cost of approximately $2.0 billion, excluding fees

and expenses. These shares represent approximately 14.8 percent of the Company’s total outstanding shares of common stock as of

June 7, 2024.

The dealer manager for the tender offer

was Goldman Sachs & Co. LLC. D.F. King & Co., Inc. served as information agent for the tender offer. Stockholders

who have questions or would like additional information about the tender offer may contact D.F. King & Co., Inc. toll-free

at (866) 864-4943.

About Incyte

A global biopharmaceutical company on

a mission to Solve On., Incyte follows the science to find solutions for patients with unmet medical needs. Through

the discovery, development, and commercialization of proprietary therapeutics, Incyte has established a portfolio of first-in-class

medicines for patients and a strong pipeline of products in Oncology and Inflammation & Autoimmunity. Headquartered in Wilmington,

Delaware, Incyte has operations in North America, Europe, and Asia.

Forward-Looking Statements

Except for the historical information

set forth herein, the matters set forth in this release contain predictions, estimates and other forward-looking statements, including

statements regarding the expected consummation of the stock purchase from the Baker Entities and the expected

total number of shares to be purchased through the tender offer and stock purchase agreement and the total cost of those shares.

These forward-looking statements are

based on Incyte’s current expectations and subject to risks and uncertainties that may cause actual results to differ materially,

including risks related to the satisfaction of closing conditions under the stock purchase agreement, developments or changes in economic

or market conditions; developments or changes in the securities markets, developments or changes in the Company’s business, financial

condition or cash flows, and other risks detailed in Incyte’s reports filed with the Securities and Exchange Commission, including

its quarterly report on Form 10-Q for the quarter ended March 31, 2024. Incyte disclaims any intent or obligation to update

these forward-looking statements.

# # #

| Contacts |

|

| |

|

| Media |

Investors |

| media@incyte.com |

ir@incyte.com |

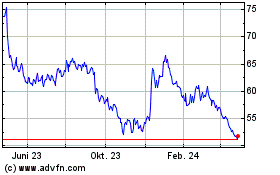

Incyte (NASDAQ:INCY)

Historical Stock Chart

Von Mai 2024 bis Jun 2024

Incyte (NASDAQ:INCY)

Historical Stock Chart

Von Jun 2023 bis Jun 2024