UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16

UNDER THE SECURITIES EXCHANGE ACT OF 1934

For the Month of: November 2023 (Report No.

3)

Commission File Number: 001-40303

Inspira Technologies Oxy B.H.N. Ltd.

(Translation of registrant’s name into

English)

2 Ha-Tidhar St.

Ra’anana 4366504, Israel

(Address of principal executive office)

Indicate by check mark whether the registrant

files or will file annual reports under cover of Form 20-F or Form 40-F:

☒ Form 20-F ☐ Form

40-F

CONTENTS

On November 16, 2023, Inspira

Technologies Oxy B.H.N. Ltd., or the Registrant, issued a press release titled “Inspira™ Technologies Reports Third Quarter

2023 Financial Results,” a copy of which is furnished as Exhibit 99.1 with this report of foreign private issuer on Form 6-K.

The

first two paragraphs, the sections “Financial Results for the Nine Months Ended September 30, 2023,” “Financial highlights

for the three months ended September 30, 2023,” “Balance Sheet highlights” and “Forward-Looking Statement Disclaimer”

are incorporated by reference into the Registrant’s Registration Statements on Form F-3 (Registration No. 333-266748)

and Form S-8 (Registration No. 333-259057), filed with the Securities and Exchange Commission, to be a part thereof from the

date on which this report is submitted, to the extent not superseded by documents or reports subsequently filed or furnished.

SIGNATURES

Pursuant to the requirements

of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto

duly authorized.

| |

Inspira Technologies Oxy B.H.N. Ltd. |

| |

|

|

| Date: November 16, 2023 |

By: |

/s/ Dagi Ben-Noon |

| |

|

Name: |

Dagi Ben-Noon |

| |

|

Title: |

Chief Executive Officer |

2

Exhibit 99.1

Inspira™ Technologies Reports Third

Quarter 2023 Financial Results

Ra’anana, Israel, November 16, 2023 – Inspira Technologies

OXY B.H.N. Ltd. (Nasdaq: IINN, IINNW) (the “Company” or “Inspira”), a pioneer in acute respiratory care, today

announced its financial results for the third quarter ended September 30, 2023. This quarter, Inspira continued to progress in the

development of its novel technology for oxygenating blood, an alternative to traditional mechanical ventilation for respiratory patients.

This patented technology, recently bolstered by a grant from the Israeli Innovation Authority and new U.S. patents, is at the heart of

Inspira's strategy.

Key business developments include the Company’s preparation for

U.S. Food and Drug Administration (FDA) approval of Inspira’s ART100 device and its securing of potentially significant distribution

agreements in Europe and Central America. These steps align with Inspira's goal to disrupt the $20 billion respiratory ventilator market.

“We are incredibly pleased with our

progress over the last quarter,” remarked Dagi Ben-Noon, Chief Executive Officer of Inspira. “This period has been marked

by significant achievements in both our business strategy and our intellectual property portfolio. Our innovative approach to respiratory

care, which we believe is at the forefront of medical technology, has not only received recognition in the form of patents and grants

but is also steadily moving toward commercial realization.”

Financial Results for the nine months ended September

30, 2023

Research and development

expenses for the nine months ended September 30, 2023, were $5.37 million, compared to $6.24 million for the corresponding period

in 2022. The reason for the decrease in research and development expenses was primarily the result of the decrease in share-based

compensation expenses, which was more significant than the increase in the salary and related expenses from the Company’s recruitment

of employees and the expansion of its research and development department.

Sales and marketing expenses

for the nine months ended September 30, 2023, were $0.59 million compared to $1.08 million for the corresponding period in 2022.

The decrease is attributable to a decrease in share-based compensation expenses and a reduction in marketing activities. The marketing

department increased its efforts in the first half of 2022 with respect to brand awareness and exploring go-to-market capabilities.

General and administrative

expenses for the nine months ended September 30, 2023 were $3.01 million, compared to $4.29 million for the corresponding period

in 2022. The decrease is primarily due to the decrease in share-based compensation expenses and a lower cost of director and officer

insurance.

Finance income for the

nine months ended September 30, 2023, was $0.86 million, compared to $4.51 million for the corresponding period in 2022. The

decrease in finance income is primarily due to the calculation of the fair market value of the Company’s warrants issued to investors

in its pre-initial public offering and initial public offering (IPO) as financial equity liabilities and the fluctuation in the U.S. Dollar

– New Israeli Shekel exchange rate during the first half of 2023.

Finance expenses for

the nine months ended September 30, 2023 were $0.16 million, compared to $0.04 million for the corresponding period in 2022.

The increase in finance expenses is primarily due to the calculation of the fair market value of the Company’s warrants issued to

investors in its pre-IPO and IPO as financial equity liabilities.

The net loss for the

nine months ended September 30, 2023, was $8.28 million, compared to a net loss of $7.15 million for the nine months ended September

30, 2022.

Financial highlights

for the three months ended September 30, 2023

Research and development

expenses for the three months ended September 30, 2023, were $1.54 million, compared to $1.95 million for the corresponding

period in 2022. The decrease is due to the decrease in share-based compensation expenses and a decrease in expenses related to projects

initiated in the third quarter of 2022.

Sales and marketing expenses

for the three months ended September 30, 2023, were $0.19 million compared to $0.3 million for the corresponding period in 2022.

The reason for the decrease in sales and marketing expenses was due to the decrease in share-based compensation expenses.

General and administrative

expenses for the three months ended September 30, 2023, were $0.91 million, compared to $1.36 million for the corresponding

period in 2022. The decrease is due primarily to a decrease in share-based compensation expenses and a lower cost of director and officer

insurance.

Finance income for the

three months ended September 30, 2023 was $0.22 million, compared to $0.07 million for the corresponding period in 2022. The

decrease in finance income is due primarily to the calculation of the fair market value of the Company’s warrants issued to investors

in its pre-IPO and IPO as financial equity liabilities, in addition to the fluctuation in the U.S. Dollar – New Israeli Shekel exchange

rate during the first half of 2023.

There were no finance

expenses for the three months ended September 30,2023, compared to $0.14 million for the corresponding period in 2022.

Balance Sheet Highlights

Cash, cash equivalents

and short-term bank deposits were $6.39 million as of September 30, 2023, compared to $13.9 million as of December 31, 2022.

Financial liabilities

at fair market value totaled $0.36 million as of September 30, 2023, compared to $0.37 million as of December 31, 2022. The financial

liabilities represent the fair market value of the Company’s warrants being accounted for as equity liabilities issued to pre-IPO

and IPO investors.

As of September 30, 2023,

the Company’s shareholders’ equity totaled $5.17 million, compared to shareholders’ equity totaling $12.82 million as

of December 31, 2022.

Inspira Technologies OXY B.H.N. Ltd.

Inspira Technologies is at the forefront of

revolutionizing acute respiratory care by introducing groundbreaking medical technologies. Central to its mission is the development of

innovative solutions that enable direct blood oxygenation, bypassing the lungs. This pioneering approach sets Inspira apart by potentially

eliminating the reliance on traditional mechanical ventilation, which is often associated with higher risks and complexities. Beyond this,

the Company is committed to advancing blood circulation technology and incorporating AI-driven monitoring systems. These advancements

are part of its strategy to offer more patient-focused, data-informed care. The integration of these technologies signifies the potential

to enhancing patient outcomes and streamlining hospital operations, marking a new era in respiratory care.

For more information, please visit our corporate

website:

https://inspira-technologies.com/

Forward-Looking Statement Disclaimer

This press release contains express or implied forward-looking statements

pursuant to U.S. Federal securities laws. These forward-looking statements and their implications are based on the current expectations

of the management of the Company only and are subject to a number of factors and uncertainties that could cause actual results to differ

materially from those described in the forward-looking statements. For example, the Company is using forward-looking statements when it

discusses the Company’s goal to disrupt the respiratory ventilator market and the Company’s move toward commercial realization

of its medical technology. Except as otherwise required by law, the Company undertakes no obligation to publicly release any revisions

to these forward-looking statements to reflect events or circumstances after the date hereof or to reflect the occurrence of unanticipated

events. More detailed information about the risks and uncertainties affecting the Company is contained under the heading “Risk Factors”

in the Company’s annual report on Form 20-F for the fiscal year ended December 31, 2022 filed with the SEC, which is available on

the SEC’s website, www.sec.gov.

MRK-ARS-057 Copyright © 2018-2023 Inspira

Technologies OXY B.H.N. LTD., All rights reserved.

UNAUDITED CONDENSED INTERIM STATEMENTS OF

FINANCIAL POSITION

(U.S. dollars in thousands)

| | |

September 30, | | |

December 31, | |

| | |

2023 | | |

2022 | |

| ASSETS | |

| | |

| |

| Current Assets: | |

| | |

| |

| Cash and cash equivalents | |

| 3,327 | | |

| 6,783 | |

| Cash deposits | |

| 3,061 | | |

| 7,120 | |

| Other current assets | |

| 431 | | |

| 591 | |

| Total current assets | |

| 6,819 | | |

| 14,494 | |

| | |

| | | |

| | |

| Non-Current Assets: | |

| | | |

| | |

| Right of use assets, net | |

| 862 | | |

| 1,107 | |

| Property, plant and equipment, net | |

| 482 | | |

| 411 | |

| Total non-current assets | |

| 1,344 | | |

| 1,518 | |

| Total Assets | |

| 8,163 | | |

| 16,012 | |

| | |

September 30, | | |

December 31, | |

| | |

2023 | | |

2022 | |

| LIABILITIES AND SHAREHOLDERS’ EQUITY | |

| | |

| |

| Current Liabilities: | |

| | |

| |

| Trade accounts payables | |

| 307 | | |

| 150 | |

| Other accounts payable | |

| 1,083 | | |

| 1,217 | |

| Lease liabilities | |

| 287 | | |

| 329 | |

| Financial liabilities at fair value | |

| 363 | | |

| 368 | |

| Total current liabilities | |

| 2,040 | | |

| 2,064 | |

| | |

| | | |

| | |

| Non-Current Liabilities: | |

| | | |

| | |

| Lease liabilities | |

| 502 | | |

| 728 | |

| Loan from the Israeli Innovation Authority | |

| 452 | | |

| 398 | |

| Total non- current liabilities | |

| 954 | | |

| 1,126 | |

| | |

| | | |

| | |

| Shareholders’ Equity: | |

| | | |

| | |

| Share capital and additional paid-in capital | |

| 55,131 | | |

| 53,814 | |

| Foreign exchange reserve | |

| (2,620 | ) | |

| (1,928 | ) |

| Accumulated deficit | |

| (47,342 | ) | |

| (39,064 | ) |

| Total equity | |

| 5,169 | | |

| 12,822 | |

| Total liabilities and shareholders’ equity | |

| 8,163 | | |

| 16,012 | |

UNAUDITED CONDENSED INTERIM STATEMENTS OF

COMPREHENSIVE LOSS

(U.S. dollars in thousands)

| | |

For the Three Months Ended

September 30, | | |

For the Nine Months Ended

September 30, | |

| | |

2023 | | |

2022 | | |

2023 | | |

2022 | |

| | |

| | |

| | |

| | |

| |

| Research and development expenses | |

| 1,542 | | |

| 1,948 | | |

| 5,372 | | |

| 6,242 | |

| Marketing expenses | |

| 193 | | |

| 301 | | |

| 594 | | |

| 1,078 | |

| General and administrative expenses | |

| 907 | | |

| 1,357 | | |

| 3,011 | | |

| 4,293 | |

| Operating loss | |

| 2,642 | | |

| 3,606 | | |

| 8,977 | | |

| 11,613 | |

| Finance income | |

| (219 | ) | |

| (69 | ) | |

| (856 | ) | |

| (4,508 | ) |

| Finance expenses | |

| - | | |

| 135 | | |

| 157 | | |

| 40 | |

| Loss (profit) before tax | |

| 2,423 | | |

| 3,672 | | |

| 8,278 | | |

| 7,145 | |

| Taxes on income | |

| | | |

| | | |

| | | |

| | |

| Loss (profit) for the period | |

| | | |

| | | |

| | | |

| | |

| Other comprehensive loss (profit), net of tax: | |

| | | |

| | | |

| | | |

| | |

| Items that will not be reclassified to profit or loss: | |

| | | |

| | | |

| | | |

| | |

| Exchange profits (losses) arising

on translation to presentation currency | |

| 260 | | |

| (58 | ) | |

| 692 | | |

| (2,293 | ) |

| Total comprehensive loss for the period | |

| 2,683 | | |

| 3,730 | | |

| 8,970 | | |

| 9,438 | |

UNAUDITED CONDENSED INTERIM STATEMENTS OF

CHANGES IN SHAREHOLDERS’ EQUITY

(U.S. dollars in thousands)

For the Three-Month Period Ended September

30, 2023 (Unaudited):

| | |

Share

capital and

additional

paid-in

capital | | |

Adjustments

arising from

translating

financial

operation | | |

Accumulated

deficit | | |

Total | |

| Balance on June 30, 2023 | |

| | |

| | |

| | |

| |

| Changes during the period: | |

| 54,831 | | |

| (2,360 | ) | |

| (44,919 | ) | |

| 7,552 | |

| Loss for the period | |

| - | | |

| - | | |

| (2,423 | ) | |

| (2,423 | ) |

| Other comprehensive loss | |

| - | | |

| (260 | ) | |

| - | | |

| (260 | ) |

| Total comprehensive loss | |

| - | | |

| (260 | ) | |

| (2,423 | ) | |

| (2,683 | ) |

| Share-based compensation | |

| 300 | | |

| - | | |

| - | | |

| 300 | |

| Balance on September 30, 2023 | |

| 55,131 | | |

| (2,620 | ) | |

| (47,342 | ) | |

| 5,169 | |

For the nine-month Period Ended September

30, 2023 (Unaudited):

| | |

Share

capital and

additional

paid-in

capital | | |

Adjustments

arising from

translating

financial

operation | | |

Accumulated

deficit | | |

Total | |

| Balance on January 1, 2023 | |

| | |

| | |

| | |

| |

| Changes during the period: | |

| 53,814 | | |

| (1,928 | ) | |

| (39,064 | ) | |

| 12,822 | |

| Loss for the period | |

| - | | |

| - | | |

| (8,278 | ) | |

| (8,278 | ) |

| Other comprehensive loss | |

| - | | |

| (692 | ) | |

| - | | |

| (692 | ) |

| Total comprehensive loss | |

| - | | |

| (692 | ) | |

| (8,278 | ) | |

| (8,970 | ) |

| Share-based compensation | |

| 1,317 | | |

| - | | |

| - | | |

| 1,317 | |

| Balance on September 30, 2023 | |

| 55,131 | | |

| (2,620 | ) | |

| (47,342 | ) | |

| 5,169 | |

6

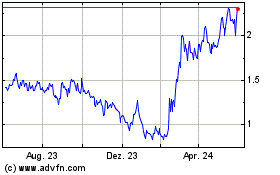

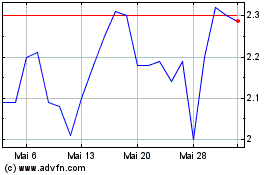

Inspira Technologies Oxy... (NASDAQ:IINN)

Historical Stock Chart

Von Mai 2024 bis Mai 2024

Inspira Technologies Oxy... (NASDAQ:IINN)

Historical Stock Chart

Von Mai 2023 bis Mai 2024