U.S. Global Investors, Inc. (NASDAQ: GROW), a registered

investment advisory firm with longstanding experience in global

markets and specialized sectors, is pleased to announce that it

will continue its payment of monthly dividends.

The Company’s Board of Directors (the “Board”) approved payment

of the $0.0075 per share per month dividend beginning in July 2024

and continuing through September 2024. The record dates are July

15, August 12 and September 16, and the payment dates will be July

29, August 26 and September 30.

The Company has paid a monthly dividend since June 2007, and at

the June 12, 2024, closing price of $2.60, the $0.0075 monthly

dividend equals a 3.46% yield on an annualized basis. The Company’s

shareholder yield in May was 9.45%,[1] which exceeded the yields on

the five-year and 10-year Treasury.

Share Buybacks Up 45% From Last Year

The Company is also pleased to announce that it repurchased

59,891 of its own shares in May 2024, at a net cost of

approximately $160,000. This represents a substantial increase of

approximately 45% from the number of shares purchased the same

month a year earlier.

“We remain deeply committed to enhancing shareholder value,”

says CEO and Chief Investment Officer Frank Holmes. “Our continued

monthly dividend payments and increased share buybacks underscore

our confidence in the company's financial health and our dedication

to delivering consistent returns to our shareholders.”

The Company buys back its shares when the price is flat or down

from the previous trading day. Warren Buffett is famous for

highlighting the value proposition of buying back one’s own stock

at “value-accretive prices.” Doing so, Buffett says, benefits all

shareholders, not just the biggest holders. We agree.

All-Time High (ATH) Gold Prices Shine Light on Thematic

Product Offerings

U.S. Global Investors is excited to witness the surge in gold

prices thus far in 2024, particularly as first-movers in the gold

fund space, and currently offering two mutual funds and one ETF

focused on this niche area of the market. This uptrend in price has

been reflected in increased interest in the Company’s gold-themed

products, as well as its award-winning research and thought

leadership, affirming the impact of our quantamental approach to

the markets.

Upgraded Profitability Projections for Airlines, Elliot

Management Buys Into Southwest

The International Air Transport Association (IATA) significantly

upgraded its profitability projections for airlines in 2024, which

bodes well for the Company’s airlines-focused ETF. The trade group

now expects net profits to reach $30.5 billion, an

increase from $27.4 billion in 2023.

This surge in profitability is accompanied by record-high

traveler numbers and revenues.

On Monday, June 10, Elliot Investment Management, a hedge fund

led by billionaire Paul Singer, announced that it amassed a stake

of almost $2 billion in Southwest Airlines, a top holding in the

Company’s airlines ETF.

“I believe its important to follow the smart money,” said Frank

Holmes. “This buy in by Elliot Management helps shine a light on an

industry that has historically traded at a massive discount to the

S&P 500.”

To sign up for news and research on a variety of asset

classes, from gold to airlines to digital assets, please

click here.

Follow U.S. Global Investors on Twitter

by clicking here.

Subscribe to U.S. Global Investors’ YouTube channel

by clicking here.

About U.S. Global Investors, Inc.The story of

U.S. Global Investors goes back more than 50 years when it began as

an investment club. Today, U.S. Global Investors, Inc.

(www.usfunds.com) is a registered investment adviser that focuses

on niche markets around the world. Headquartered in San Antonio,

Texas, the Company provides investment advisory and other services

to U.S. Global Investors Funds and U.S. Global ETFs.

# # #

The continuation of future cash dividends will be determined by

U.S. Global Investors’ Board of Directors, at its sole discretion,

after review of the Company's financial performance and other

factors, and is dependent on earnings, operations, capital

requirements, general financial condition of the Company and

general business conditions. The shareholder yield is a ratio

that shows how much money the company is sending back to

shareholders through a combination of dividends and share

repurchases.

The S&P 500 is widely regarded as the best single gauge of

large-cap U.S. equities and serves as the foundation for a wide

range of investment products. The index includes 500 leading

companies and captures approximately 80% coverage of available

market capitalization.

Fund portfolios are actively managed, and holdings may change

daily. Holdings are reported as of the most recent quarter-end. The

following securities mentioned in the press release were held by

one or more of U.S. Global Investors Funds as of 3/31/2024:

Southwest Airlines Co.

[1] The Company calculates shareholder yield by adding cash

dividends and net share repurchases, divided by market

capitalization, for the 12 months ending May 31, 2024. The Company

did not have debt; therefore, no debt reduction was included.

- GROW's Shareholder Yield More Than Double the Yield on

Government Bonds

Holly Schoenfeldt

U.S. Global Investors, Inc.

210.308.1268

hschoenfeldt@usfunds.com

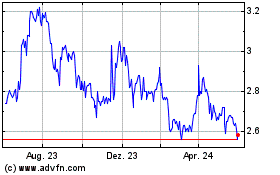

US Global Investors (NASDAQ:GROW)

Historical Stock Chart

Von Mai 2024 bis Jun 2024

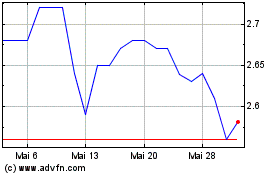

US Global Investors (NASDAQ:GROW)

Historical Stock Chart

Von Jun 2023 bis Jun 2024