Form 8-K - Current report

03 Juni 2024 - 2:32PM

Edgar (US Regulatory)

false000071439500007143952024-06-032024-06-03

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

______________________

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

______________________

Date of Report (Date of earliest event reported): June 3, 2024

GERMAN AMERICAN BANCORP, INC.

(Exact name of registrant as specified in its charter)

Indiana

(State or other jurisdiction of incorporation)

| | | | | | | | |

| 001-15877 | 35-1547518 |

| (Commission File Number) | (IRS Employer Identification No.) |

| 711 Main Street | |

| Jasper, | Indiana | 47546 |

| (Address of Principal Executive Offices) | (Zip Code) |

Registrant’s telephone number, including area code: (812) 482-1314

Not Applicable

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

[☐] Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

[☐] Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

[☐] Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

[☐] Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 under the Securities Act (17 CFR 230.405) or Rule 12b-2 under the Exchange Act (17 CFR 240.12b-2).

Emerging growth company [ ]

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act [☐]

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Title of each class | | Trading Symbol(s) | | Name of each exchange

on which registered |

| Common Stock, no par value | | GABC | | Nasdaq Global Select Market |

Item 7.01. Regulation FD Disclosure.

On June 3, 2024, German American Bancorp, Inc. (the “Company”) announced that its indirect, wholly-owned subsidiary, German American Insurance, Inc. (the “Insurance Subsidiary”), sold substantially all of its assets to The Hilb Group of Indiana, LLC, a Delaware limited liability company (“Hilb”), for a purchase price of $40.0 million in cash. As part of the transaction, the Insurance Subsidiary and its parent, German American Bank (the “Bank”), will provide certain transition services to Hilb for a period of up to nine (9) months. The Bank may receive payments for the referral of customers to Hilb, and the Company and its affiliated entities will refrain from conducting certain insurance activities, in each case, for a period of five (5) years following closing. The effective date of the transaction is June 1, 2024.

Prior to the sale, the Insurance Subsidiary was a full-service agency offering personal and commercial insurance products. For the year ended December 31, 2023, the Insurance Subsidiary had revenue of $9.6 million and net income of $1.7 million.

On June 3, 2024, the Company issued a press release announcing the transaction. A copy of the press release is attached hereto as Exhibit 99.1 and incorporated herein by reference.

Also, on June 3, 2024, the Company will begin conducting a series of meetings with analysts and investors, providing supplemental information regarding the transaction. A copy of the presentation that will be made available in connection with the meetings is attached hereto as Exhibit 99.2 and incorporated herein by reference.

Item 9.01. Financial Statements and Exhibits.

| | | | | | | | | | | |

| (d) | Exhibits | | |

| | | |

| Exhibit No. | | Description |

| | | |

| | | Press Release, dated June 3, 2024. |

| | | Investor Presentation of German American Bancorp, Inc., dated June 3, 2024. |

| 104 | | Cover Page Interactive Data File (embedded within the Inline XBRL document). |

* * * * * *

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | |

| GERMAN AMERICAN BANCORP, INC. |

Date: June 3, 2024 | By: | /s/ D. Neil Dauby |

| | D. Neil Dauby, Chairman and Chief Executive Officer |

Media Contact: D. Neil Dauby Chairman & Chief Executive Officer Bradley M Rust President & Chief Financial Officer 812-482-1314 6/3/2024 German American Bancorp, Inc. announces the sale of the assets of German American Insurance, Inc. to Hilb Group JASPER, IN: German American Bancorp, Inc. (Nasdaq: GABC) today announced and closed the sale of the assets of its wholly-owned subsidiary German American Insurance (GAI) to Hilb Group, an industry- leading insurance broker. The all-cash transaction is for $40 million, and creates a significant after-tax gain, net of transaction costs, of approximately $27 million. The purchase price represents approximately four times 2023 GAI revenues and approximately 24 times 2023 GAI after-tax earnings. “Our decision to partner with Hilb Group for this transaction ensures the continued access to the best insurance products and services for our customers and provides a great new home for GAI’s employees,” said D. Neil Dauby, Chairman and CEO of German American Bancorp, Inc. “This sale allows us to realize significant value at an opportune time. The GAI team has done a tremendous job building the agency in the last 25 years, and we are confident the expanded access to products, services and expertise through Hilb Group will support a strong future for all.” As part of the transaction, German American Insurance will continue to operate throughout southern Indiana and Kentucky under the name “German American Insurance – A Hilb Group Company” and will remain under the leadership of Diana Wilderman, President of German American Insurance. Wilderman said, “We are very excited that our entire insurance team will join Hilb Group. Hilb’s dedication to the communities they serve and their culture of providing the very best service to their customers is exactly what built the success of German American Insurance.” “We are pleased to welcome the highly respected German American Insurance team and to expand upon our existing Midwest presence,” Hilb Group CEO Ricky Spiro said. “This addition of GAI fits with our strategy of growing through leading insurance brokers in key markets, and building on the great reputation – and innovative resources we provide – among the clients and communities we are privileged to serve.” In addition to retaining all GAI team members, an ongoing referral relationship to Hilb Group will provide German American Bank customers access to market-leading insurance brokerage services.

Hilb Group is a Top 25 US Insurance Agency and has been an Inc. 5000 fastest-growing private company for nine years. Founded in 2009, the company is a leading property and casualty and employee benefits insurance brokerage and advisory firm. Headquartered in Richmond, Virginia, Hilb Group is backed by The Carlyle Group, one of the world’s leading investment firms, and has more than 2,200 employees with 125+ locations in 29 states – and service to all 50 states. Piper Sandler & Co. served as financial advisor to German American and Dentons Bingham Greenebaum LLP served as legal counsel. About German American Bank German American Bancorp, Inc. is a Nasdaq-traded (symbol: GABC) financial holding company based in Jasper, Indiana. German American, through its banking subsidiary German American Bank, operates 74 banking offices in 20 contiguous southern Indiana counties and 14 counties in Kentucky.

Investor Presentation German American Bancorp, Inc. (Nasdaq: GABC) Sale of the Assets of German American Insurance June 3, 2024

When used in this presentation and our related oral statements, the words or phrases “believe,” “will likely result,” “are expected to,” “will continue,” “is anticipated,” “estimate,” “project,” “plans,” or similar expressions are intended to identify “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. You are cautioned not to place undue reliance on any forward-looking statements, which speak only as of the date of this presentation, and we do not undertake any obligation to update any forward- looking statement to reflect circumstances or events that occur in the future. By their nature, these statements are subject to numerous risks and uncertainties that could cause actual results to differ materially from those anticipated in the statements. Factors that could cause actual results and performance to vary materially from those expressed or implied by any forward-looking statement include those that are discussed in Item 1, “Business – Forward Looking Statements and Associated Risk,” and Item 1A, “Risk Factors,” in our Annual Report on Form 10-K for 2023 as updated and supplemented by our other SEC reports filed from time to time. 2 CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

GABC Announces Sale of the Assets of German American Insurance 3 • Effective June 1, 2024, GABC sold the assets of its wholly-owned subsidiary, German American Insurance (“GAI”), to Hilb Group, a privately-held insurance broker • All-cash transaction of $40 million in proceeds – ~4x 2023 insurance revenue – ~24x 2023 net income – After-tax gain of ~$27 million (net of transaction costs) – Eliminates $1.3 million of goodwill and other intangibles • Allows GABC to reallocate capital in its core banking and wealth management businesses, while partnering with a leading national insurance broker to continue serving GABC clients’ insurance needs • Transition services agreement for six-month period post-closing to support business continuity and client service $40M Cash Proceeds from Transaction $27M After-Tax Gain (Net of Transaction Costs) Transaction captures significant value for GABC’s long-term investment in its insurance business, while positioning that business for future success

Strategic Rationale and Impact 4 Achieves strong value for GABC’s shareholders while creating opportunities for the Bank, its customers and GAI employees Compelling price of $40 million (~4x 2023 revenues and ~24x 2023 net income) Capitalizes on favorable market valuations for insurance brokerage businesses GAI customers will enjoy ongoing access to market-leading insurance brokerage services through Hilb Group GABC will maintain an ongoing referral relationship with Hilb Group GAI employees will be retained by Hilb Group to help extend its presence in Indiana and to build out its business in Kentucky Strengthens GABC’s capital position Improves efficiency ratio by 0.9% Creates strategic opportunity for redeployment of capital into core banking and wealth management franchises +6.1% Tangible Book Value per Share Accretion +48 bps Tangible Common Equity Ratio Accretion $1.3M Elimination of Goodwill and Other Intangibles +46 bps Leverage Ratio Accretion

Strengthens Capital Position 5 Capital Ratios and Per Share Data 3/31/2024 Estimated Impact Pro Forma 3/31/2024 Tier 1 Capital (to Average Assets) 12.01% 0.46% 12.47% Common Equity Tier 1 (CET 1) Capital Ratio (to Risk Weighted Assets) 14.27% 0.59% 14.86% Tier 1 (Core) Capital Ratio (to Risk Weighted Assets) 14.97% 0.59% 15.56% Total Capital (to Risk Weighted Assets) 16.57% 0.58% 17.15% Tangible Common Equity to Tangible Assets (1) 7.92% 0.48% 8.40% Tangible Book Value Per Share (2) $15.82 $0.97 $16.79 Year Ended 12/31/2023 Estimated Transaction Impact Pro Forma Year Ended 12/31/2023 Efficiency Ratio (3) 55.09% -0.87% 54.22% 48 basis point positive impact to TCE/TA ratio based on pro forma 3/31/24 ratio 1) Tangible Common Equity is defined as Total Shareholders’ Equity less Goodwill and Other Intangible Assets. Tangible Assets is defined as Total Assets less Goodwill and Other Intangible Assets. 2) Tangible Book Value per Share is defined as Total Shareholders’ Equity less Goodwill and Other Intangible Assets divided by End of Period Shares Outstanding. 3) Efficiency Ratio is defined as Non-interest Expense less Intangible Amortization divided by the sum of Net Interest Income, on a tax equivalent basis, and Non-interest Income less Net Gain on Securities.

Thank You Thank you for your interest in German American Bancorp, Inc. (Nasdaq: GABC) Learn more at www.germanamerican.com

v3.24.1.1.u2

Cover page

|

Jun. 03, 2024 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Document Period End Date |

Jun. 03, 2024

|

| Entity Registrant Name |

GERMAN AMERICAN BANCORP, INC.

|

| Entity Incorporation, State or Country Code |

IN

|

| Entity File Number |

001-15877

|

| Entity Tax Identification Number |

35-1547518

|

| Entity Address, Address Line One |

711 Main Street

|

| Entity Address, City or Town |

Jasper,

|

| Entity Address, State or Province |

IN

|

| Entity Address, Postal Zip Code |

47546

|

| City Area Code |

812

|

| Local Phone Number |

482-1314

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity Emerging Growth Company |

false

|

| Title of 12(b) Security |

Common Stock, no par value

|

| Trading Symbol |

GABC

|

| Security Exchange Name |

NASDAQ

|

| Amendment Flag |

false

|

| Entity Central Index Key |

0000714395

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

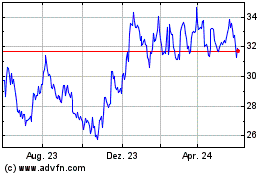

German American Bancorp (NASDAQ:GABC)

Historical Stock Chart

Von Mai 2024 bis Jun 2024

German American Bancorp (NASDAQ:GABC)

Historical Stock Chart

Von Jun 2023 bis Jun 2024