Form 8-K - Current report

22 Oktober 2024 - 10:20PM

Edgar (US Regulatory)

false

0000859070

0000859070

2024-10-22

2024-10-22

|

UNITED STATES

|

|

SECURITIES AND EXCHANGE COMMISSION

|

|

Washington, D.C. 20549

|

| |

|

FORM 8-K

|

| |

|

CURRENT REPORT

|

|

Pursuant to Section 13 OR 15(d) of The Securities Exchange Act of 1934

|

| |

| |

|

Date of Report (Date of earliest event reported): October 22, 2024

|

| |

| |

| |

FIRST COMMUNITY BANKSHARES, INC.

|

|

|

(Exact name of registrant as specified in its charter)

|

| |

| |

|

Virginia

|

|

000-19297

|

|

55-0694814

|

|

(State or other jurisdiction

|

|

(Commission

|

|

(IRS Employer

|

|

of incorporation)

|

|

File Number)

|

|

Identification No.)

|

| |

| |

|

P.O. Box 989

Bluefield, Virginia

|

|

24605-0989

|

|

(Address of principal executive offices)

|

|

(Zip Code)

|

| |

| |

|

Registrant’s telephone number, including area code: (276) 326-9000

|

| |

| |

|

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

| |

|

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

| |

|

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

| |

|

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

| |

|

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

| |

|

Securities registered pursuant to Section 12(b) of the Act:

|

| Title of each class |

|

Trading Symbol(s) |

|

Name of each exchange on which registered |

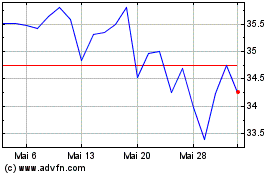

| Common Stock ($1.00 par value) |

|

FCBC |

|

NASDAQ Global Select |

| Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter). |

|

Emerging growth company ☐

|

| |

|

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

|

|

Item 2.02

|

Results of Operations and Financial Condition.

|

On October 22, 2024, First Community Bankshares, Inc. (the “Company”) announced by press release its earnings for the third quarter of 2024. A copy of the press release is attached hereto as Exhibit 99.1.

On October 22, 2024, the Company announced by press release its quarterly cash dividend to common shareholders of thirty-one cents, $0.31 per common share, payable on or about November 22, 2024, to shareholders of record on November 8, 2024. A copy of the press release is attached hereto as Exhibit 99.1.

|

Item 9.01

|

Financial Statements and Exhibits.

|

|

(d)

|

|

The following exhibit is included with this report:

|

| |

|

|

|

Exhibit No.

|

|

Exhibit Description

|

| |

|

|

|

99.1

104

|

|

Cover Page Interactive Data File (formatted as Inline XBRL).

|

Forward-Looking Statements

This Current Report on Form 8-K contains forward-looking statements. These forward-looking statements are based on current expectations that involve risks, uncertainties, and assumptions. Should one or more of these risks or uncertainties materialize or should underlying assumptions prove incorrect, actual results may differ materially. These risks include: changes in business or other market conditions; the timely development, production and acceptance of new products and services; the challenge of managing asset/liability levels; the management of credit risk and interest rate risk; the difficulty of keeping expense growth at modest levels while increasing revenues; and other risks detailed from time to time in the Company’s Securities and Exchange Commission reports, including but not limited to the Annual Report on Form 10-K for the most recent year ended. Pursuant to the Private Securities Litigation Reform Act of 1995, the Company does not undertake to update forward-looking statements to reflect circumstances or events that occur after the date the forward-looking statements are made.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

FIRST COMMUNITY BANKSHARES, INC.

|

| |

|

|

|

Date:

|

October 22, 2024 |

|

By:

|

/s/ David D. Brown

|

| |

|

|

| |

|

David D. Brown

|

| |

|

Chief Financial Officer

|

Exhibit 99.1

|

|

|

NEWS RELEASE

|

|

FOR IMMEDIATE RELEASE:

|

|

FOR MORE INFORMATION, CONTACT:

|

| October 22, 2024 |

|

David D. Brown

|

| |

|

(276) 326-9000

|

First Community Bankshares, Inc. Announces Third Quarter 2024 Results and Quarterly Cash Dividend

Bluefield, Virginia – First Community Bankshares, Inc. (NASDAQ: FCBC) (www.firstcommunitybank.com) (the “Company”) today reported its unaudited results of operations and other financial information for the quarter ended September 30, 2024. The Company reported net income of $13.03 million, or $0.71 per diluted common share, for the quarter ended September 30, 2024. Net income for the nine months ended September 30, 2024, was $38.56 million or $2.09 per diluted common share.

The Company also declared a quarterly cash dividend to common shareholders of thirty-one cents, $0.31 per common share. The quarterly dividend is payable to common shareholders of record on November 8, 2024, and is expected to be paid on or about November 22, 2024. This marks the 39th consecutive year of regular dividends to common shareholders.

The Company is working with borrowers and customers in North Carolina, Tennessee, Virginia, and southern West Virginia affected by the devastating floods, power outages, and water shortages from Hurricane Helene. This includes payment relief for affected borrowers. We will continue to monitor the situation over the coming weeks as it relates to asset quality.

Third Quarter 2024 Highlights

Income Statement

| |

o

|

Net income of $13.03 million for the third quarter of 2024, was a decrease of $1.61 million, or 10.98%, from the same quarter of 2023. Net income of $38.56 million for the first nine months of 2024, was an increase of $2.33 million, or 6.42%, from the same period of 2023.

|

| |

o |

Net interest income decreased $1.75 million compared to the same quarter in 2023, primarily due to increases in rates paid on interest-bearing deposits. |

| |

o |

Net interest margin of 4.41% was a decrease of 10 basis points over the same quarter of 2023. The yield on earning assets increased 26 basis points from the same period of 2023 and is attributable to an increase in interest income resulting from an increase in yield. While there was an increase in yield for both loans and securities available for sale; the average balances decreased. The average balance for interest-bearing deposits with banks increased $219.59 million over the same period of 2023; however, there was no change in the yield from the same period of 2023. The yield on interest-bearing liabilities increased 58 basis points when compared with the same period of 2023 and is primarily attributable to increased rates on interest-bearing deposit liabilities. |

| |

o |

Noninterest income increased approximately $830 thousand, or 8.63%, when compared to the same quarter of 2023. Noninterest income for the third quarter of 2024 included a gain of $825 thousand from the sale of two closed branch properties; noninterest income for the same period of 2023 included a gain of $204 thousand for the sale of a closed branch property. Noninterest expense increased $1.26 million, or 5.52%. |

| |

o

|

Annualized return on average assets ("ROA") was 1.60% for the third quarter and 1.60% for the first nine months of 2024 compared to 1.74% and 1.49% for the same periods, respectively, of 2023. Annualized return on average common equity ("ROE") was 10.04% for the third quarter and 10.08% for the first nine months of 2024 compared to 11.63% and 10.25% for the same periods, respectively, of 2023. Annualized return on average tangible common equity ("ROTCE") was 14.46% for the third quarter and 14.61% for the first nine months of 2024 compared to 17.11% and 14.94% for the same periods, respectively, of 2023.

|

Balance Sheet and Asset Quality

| |

o

|

Consolidated assets totaled $3.22 billion at September 30, 2024.

|

| |

o |

Loans decreased $128.19 million, or 4.98%, from December 31, 2023. Securities available for sale decreased $114.29 million, or 40.68%, from December 31, 2023. Deposits decreased $63.07 million, or 2.32%. The net effect of these balance sheet changes resulted in an increase in cash and cash equivalents of $198.92 million, or 170.86%. |

| |

o

|

The Company repurchased 12,854 common shares during the third quarter of 2024 at a total cost of $469 thousand. The Company repurchased 257,294 common shares during the first nine months of 2024 at a total cost of $8.72 million.

|

| |

o

|

Non-performing loans to total loans increased to 0.82% when compared with the same quarter of 2023. The Company experienced net charge-offs for the third quarter of 2024 of $1.13 million, or 0.18% of annualized average loans, compared to net charge-offs of $1.46 million, or 0.22%, of annualized average loans for the same period in 2023.

|

Non-GAAP Financial Measures

In addition to financial statements prepared in accordance with U.S. generally accepted accounting principles (“GAAP”), the Company uses certain non-GAAP financial measures that provide useful information for financial and operational decision making, evaluating trends, and comparing financial results to other financial institutions. The non-GAAP financial measures presented in this news release include “tangible book value per common share,” “return on average tangible common equity,” “adjusted earnings,” “adjusted diluted earnings per share,” “adjusted return on average assets,” “adjusted return on average common equity,” “adjusted return on average tangible common equity,” and certain financial measures presented on a fully taxable equivalent (“FTE”) basis. FTE basis is calculated using the federal statutory income tax rate of 21%. Where non-GAAP financial measures are used, the comparable GAAP financial measure, as well as a reconciliation to that comparable GAAP financial measure can be found in the attached tables to this press release. While the Company believes certain non-GAAP financial measures enhance the understanding of its business and performance, they are supplemental and not a substitute for, or more important than, financial measures prepared in accordance with GAAP and may not be comparable to those reported by other financial institutions.

About First Community Bankshares, Inc.

First Community Bankshares, Inc., a financial holding company headquartered in Bluefield, Virginia, provides banking products and services through its wholly owned subsidiary First Community Bank. First Community Bank operated 53 branch banking locations in Virginia, West Virginia, North Carolina, and Tennessee as of September 30, 2024. First Community Bank offers wealth management and investment advice and services through its Trust Division and through its wholly owned subsidiary, First Community Wealth Management, which collectively managed and administered $1.64 billion in combined assets as of September 30, 2024. The Company reported consolidated assets of $3.22 billion as of September 30, 2024. The Company’s common stock is listed on the NASDAQ Global Select Market under the trading symbol, “FCBC”. Additional investor information is available on the Company’s website at www.firstcommunitybank.com.

This news release may include forward-looking statements. These forward-looking statements are based on current expectations that involve risks, uncertainties, and assumptions. Should one or more of these risks or uncertainties materialize or should underlying assumptions prove incorrect, actual results may differ materially. These risks include: changes in business or other market conditions; the timely development, production and acceptance of new products and services; the challenge of managing asset/liability levels; the management of credit risk and interest rate risk; the difficulty of keeping expense growth at modest levels while increasing revenues; changes in banking laws and regulations; the degree of competition by traditional and non-traditional competitors; the impact of natural disasters, extreme weather events, military conflict , terrorism or other geopolitical events; and other risks detailed from time to time in the Company’s Securities and Exchange Commission reports including, but not limited to, the Annual Report on Form 10-K for the most recent fiscal year end. Pursuant to the Private Securities Litigation Reform Act of 1995, the Company does not undertake to update forward-looking statements to reflect circumstances or events that occur after the date the forward-looking statements are made.

|

CONDENSED CONSOLIDATED STATEMENTS OF INCOME (Unaudited)

|

| |

|

Three Months Ended

|

|

|

Nine Months Ended

|

|

| |

|

September 30,

|

|

|

June 30,

|

|

|

March 31,

|

|

|

December 31,

|

|

|

September 30,

|

|

|

September 30,

|

|

|

(Amounts in thousands, except share and per share data)

|

|

2024

|

|

|

2024

|

|

|

2024

|

|

|

2023

|

|

|

2023

|

|

|

2024

|

|

|

2023

|

|

|

Interest income

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Interest and fees on loans

|

|

$ |

32,120 |

|

|

$ |

32,696 |

|

|

$ |

33,418 |

|

|

$ |

33,676 |

|

|

$ |

33,496 |

|

|

$ |

98,234 |

|

|

$ |

93,051 |

|

|

Interest on securities

|

|

|

1,070 |

|

|

|

1,211 |

|

|

|

1,698 |

|

|

|

1,888 |

|

|

|

1,912 |

|

|

|

3,979 |

|

|

|

6,068 |

|

|

Interest on deposits in banks

|

|

|

3,702 |

|

|

|

2,882 |

|

|

|

913 |

|

|

|

438 |

|

|

|

697 |

|

|

|

7,497 |

|

|

|

2,044 |

|

|

Total interest income

|

|

|

36,892 |

|

|

|

36,789 |

|

|

|

36,029 |

|

|

|

36,002 |

|

|

|

36,105 |

|

|

|

109,710 |

|

|

|

101,163 |

|

|

Interest expense

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Interest on deposits

|

|

|

5,298 |

|

|

|

4,877 |

|

|

|

4,365 |

|

|

|

3,935 |

|

|

|

2,758 |

|

|

|

14,540 |

|

|

|

5,406 |

|

|

Interest on borrowings

|

|

|

- |

|

|

|

- |

|

|

|

35 |

|

|

|

4 |

|

|

|

- |

|

|

|

35 |

|

|

|

136 |

|

|

Total interest expense

|

|

|

5,298 |

|

|

|

4,877 |

|

|

|

4,400 |

|

|

|

3,939 |

|

|

|

2,758 |

|

|

|

14,575 |

|

|

|

5,542 |

|

|

Net interest income

|

|

|

31,594 |

|

|

|

31,912 |

|

|

|

31,629 |

|

|

|

32,063 |

|

|

|

33,347 |

|

|

|

95,135 |

|

|

|

95,621 |

|

|

Provision for credit losses

|

|

|

1,360 |

|

|

|

144 |

|

|

|

1,011 |

|

|

|

1,029 |

|

|

|

1,109 |

|

|

|

2,515 |

|

|

|

6,956 |

|

|

Net interest income after provision

|

|

|

30,234 |

|

|

|

31,768 |

|

|

|

30,618 |

|

|

|

31,034 |

|

|

|

32,238 |

|

|

|

92,620 |

|

|

|

88,665 |

|

|

Noninterest income

|

|

|

10,452 |

|

|

|

9,342 |

|

|

|

9,259 |

|

|

|

10,462 |

|

|

|

9,622 |

|

|

|

29,053 |

|

|

|

26,990 |

|

|

Noninterest expense

|

|

|

24,177 |

|

|

|

24,897 |

|

|

|

23,386 |

|

|

|

26,780 |

|

|

|

22,913 |

|

|

|

72,460 |

|

|

|

68,397 |

|

|

Income before income taxes

|

|

|

16,509 |

|

|

|

16,213 |

|

|

|

16,491 |

|

|

|

14,716 |

|

|

|

18,947 |

|

|

|

49,213 |

|

|

|

47,258 |

|

|

Income tax expense

|

|

|

3,476 |

|

|

|

3,527 |

|

|

|

3,646 |

|

|

|

2,932 |

|

|

|

4,307 |

|

|

|

10,649 |

|

|

|

11,022 |

|

|

Net income

|

|

$ |

13,033 |

|

|

$ |

12,686 |

|

|

$ |

12,845 |

|

|

$ |

11,784 |

|

|

$ |

14,640 |

|

|

$ |

38,564 |

|

|

$ |

36,236 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Earnings per common share

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic

|

|

$ |

0.71 |

|

|

$ |

0.69 |

|

|

$ |

0.70 |

|

|

$ |

0.64 |

|

|

$ |

0.78 |

|

|

$ |

2.10 |

|

|

$ |

2.03 |

|

|

Diluted

|

|

$ |

0.71 |

|

|

$ |

0.71 |

|

|

$ |

0.71 |

|

|

$ |

0.66 |

|

|

$ |

0.79 |

|

|

$ |

2.09 |

|

|

$ |

2.06 |

|

|

Cash dividends per common share

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Regular

|

|

|

0.31 |

|

|

|

0.29 |

|

|

|

0.29 |

|

|

|

0.29 |

|

|

|

0.29 |

|

|

|

0.89 |

|

|

|

0.87 |

|

|

Weighted average shares outstanding

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic

|

|

|

18,279,612 |

|

|

|

18,343,958 |

|

|

|

18,476,128 |

|

|

|

18,530,114 |

|

|

|

18,786,032 |

|

|

|

18,366,249 |

|

|

|

17,816,505 |

|

|

Diluted

|

|

|

18,371,907 |

|

|

|

18,409,876 |

|

|

|

18,545,910 |

|

|

|

18,575,226 |

|

|

|

18,831,836 |

|

|

|

18,432,023 |

|

|

|

17,857,494 |

|

|

Performance ratios

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Return on average assets

|

|

|

1.60 |

% |

|

|

1.58 |

% |

|

|

1.60 |

% |

|

|

1.43 |

% |

|

|

1.74 |

% |

|

|

1.60 |

% |

|

|

1.49 |

% |

|

Return on average common equity

|

|

|

10.04 |

% |

|

|

10.02 |

% |

|

|

10.18 |

% |

|

|

9.39 |

% |

|

|

11.63 |

% |

|

|

10.08 |

% |

|

|

10.25 |

% |

|

Return on average tangible common equity(1)

|

|

|

14.46 |

% |

|

|

14.54 |

% |

|

|

14.82 |

% |

|

|

13.82 |

% |

|

|

17.11 |

% |

|

|

14.61 |

% |

|

|

14.94 |

% |

|

(1)

|

A non-GAAP financial measure defined as net income divided by average stockholders' equity less average goodwill and other intangible assets.

|

|

|

|

|

CONDENSED CONSOLIDATED QUARTERLY NONINTEREST INCOME AND EXPENSE (Unaudited)

|

| |

|

Three Months Ended

|

|

|

Nine Months Ended

|

|

| |

|

September 30,

|

|

|

June 30,

|

|

|

March 31,

|

|

|

December 31,

|

|

|

September 30,

|

|

|

September 30,

|

|

|

(Amounts in thousands)

|

|

2024

|

|

|

2024

|

|

|

2024

|

|

|

2023

|

|

|

2023

|

|

|

2024

|

|

|

2023

|

|

|

Noninterest income

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Wealth management

|

|

$ |

1,071 |

|

|

$ |

1,064 |

|

|

$ |

1,099 |

|

|

$ |

1,052 |

|

|

$ |

1,145 |

|

|

$ |

3,234 |

|

|

$ |

3,127 |

|

|

Service charges on deposits

|

|

|

3,661 |

|

|

|

3,428 |

|

|

|

3,310 |

|

|

|

3,637 |

|

|

|

3,729 |

|

|

|

10,399 |

|

|

|

10,359 |

|

|

Other service charges and fees

|

|

|

3,697 |

|

|

|

3,670 |

|

|

|

3,450 |

|

|

|

3,541 |

|

|

|

3,564 |

|

|

|

10,817 |

|

|

|

10,106 |

|

|

(Loss) gain on sale of securities

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

(21 |

) |

|

Other operating income

|

|

|

2,023 |

|

|

|

1,180 |

|

|

|

1,400 |

|

|

|

2,232 |

|

|

|

1,184 |

|

|

|

4,603 |

|

|

|

3,419 |

|

|

Total noninterest income

|

|

$ |

10,452 |

|

|

$ |

9,342 |

|

|

$ |

9,259 |

|

|

$ |

10,462 |

|

|

$ |

9,622 |

|

|

$ |

29,053 |

|

|

$ |

26,990 |

|

|

Noninterest expense

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Salaries and employee benefits

|

|

$ |

13,129 |

|

|

$ |

12,491 |

|

|

$ |

12,581 |

|

|

$ |

12,933 |

|

|

$ |

12,673 |

|

|

$ |

38,201 |

|

|

$ |

36,954 |

|

|

Occupancy expense

|

|

|

1,270 |

|

|

|

1,309 |

|

|

|

1,378 |

|

|

|

1,252 |

|

|

|

1,271 |

|

|

|

3,957 |

|

|

|

3,715 |

|

|

Furniture and equipment expense

|

|

|

1,574 |

|

|

|

1,687 |

|

|

|

1,545 |

|

|

|

1,489 |

|

|

|

1,480 |

|

|

|

4,806 |

|

|

|

4,389 |

|

|

Service fees

|

|

|

2,461 |

|

|

|

2,427 |

|

|

|

2,449 |

|

|

|

2,255 |

|

|

|

2,350 |

|

|

|

7,337 |

|

|

|

6,653 |

|

|

Advertising and public relations

|

|

|

967 |

|

|

|

933 |

|

|

|

796 |

|

|

|

843 |

|

|

|

968 |

|

|

|

2,696 |

|

|

|

2,457 |

|

|

Professional fees

|

|

|

221 |

|

|

|

330 |

|

|

|

372 |

|

|

|

787 |

|

|

|

172 |

|

|

|

923 |

|

|

|

780 |

|

|

Amortization of intangibles

|

|

|

536 |

|

|

|

530 |

|

|

|

530 |

|

|

|

536 |

|

|

|

536 |

|

|

|

1,596 |

|

|

|

1,195 |

|

|

FDIC premiums and assessments

|

|

|

365 |

|

|

|

364 |

|

|

|

369 |

|

|

|

376 |

|

|

|

392 |

|

|

|

1,098 |

|

|

|

1,135 |

|

|

Merger expense

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

2,393 |

|

|

Litigation expense

|

|

|

- |

|

|

|

1,800 |

|

|

|

- |

|

|

|

3,000 |

|

|

|

- |

|

|

|

1,800 |

|

|

|

- |

|

|

Other operating expense

|

|

|

3,654 |

|

|

|

3,026 |

|

|

|

3,366 |

|

|

|

3,309 |

|

|

|

3,071 |

|

|

|

10,046 |

|

|

|

8,726 |

|

|

Total noninterest expense

|

|

$ |

24,177 |

|

|

$ |

24,897 |

|

|

$ |

23,386 |

|

|

$ |

26,780 |

|

|

$ |

22,913 |

|

|

$ |

72,460 |

|

|

$ |

68,397 |

|

|

RECONCILIATION OF GAAP NET INCOME TO NON-GAAP ADJUSTED EARNINGS (Unaudited)

|

| |

|

Three Months Ended

|

|

|

Nine Months Ended

|

|

| |

|

September 30,

|

|

|

June 30,

|

|

|

March 31,

|

|

|

December 31,

|

|

|

September 30,

|

|

|

September 30,

|

|

|

(Amounts in thousands, except per share data)

|

|

2024

|

|

|

2024

|

|

|

2024

|

|

|

2023

|

|

|

2023

|

|

|

2024

|

|

|

2023

|

|

|

Adjusted Net Income for diluted earnings per share

|

|

$ |

13,033 |

|

|

$ |

12,686 |

|

|

$ |

12,845 |

|

|

$ |

12,314 |

|

|

$ |

14,855 |

|

|

$ |

38,564 |

|

|

$ |

36,828 |

|

|

Non-GAAP adjustments:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Loss (gain) on sale of securities

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

21 |

|

|

Merger expense

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

2,393 |

|

|

Day 2 provision for allowance for credit losses - Surrey

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

1,614 |

|

|

Litigation expense

|

|

|

- |

|

|

|

1,800 |

|

|

|

- |

|

|

|

3,000 |

|

|

|

- |

|

|

|

1,800 |

|

|

|

- |

|

|

Other items(1)

|

|

|

(825 |

) |

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

(204 |

) |

|

|

(825 |

) |

|

|

- |

|

|

Total adjustments

|

|

|

(825 |

) |

|

|

1,800 |

|

|

|

- |

|

|

|

3,000 |

|

|

|

(204 |

) |

|

|

975 |

|

|

|

4,028 |

|

|

Tax effect

|

|

|

(198 |

) |

|

|

432 |

|

|

|

- |

|

|

|

720 |

|

|

|

(49 |

) |

|

|

234 |

|

|

|

532 |

|

|

Adjusted earnings, non-GAAP

|

|

$ |

12,406 |

|

|

$ |

14,054 |

|

|

$ |

12,845 |

|

|

$ |

14,594 |

|

|

$ |

14,700 |

|

|

$ |

39,305 |

|

|

$ |

40,324 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Adjusted diluted earnings per common share, non-GAAP

|

|

$ |

0.68 |

|

|

$ |

0.76 |

|

|

$ |

0.69 |

|

|

$ |

0.79 |

|

|

$ |

0.78 |

|

|

$ |

2.13 |

|

|

$ |

2.26 |

|

|

Performance ratios, non-GAAP

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Adjusted return on average assets

|

|

|

1.53 |

% |

|

|

1.75 |

% |

|

|

1.60 |

% |

|

|

1.77 |

% |

|

|

1.75 |

% |

|

|

1.63 |

% |

|

|

1.66 |

% |

|

Adjusted return on average common equity

|

|

|

9.56 |

% |

|

|

11.10 |

% |

|

|

10.18 |

% |

|

|

11.63 |

% |

|

|

11.68 |

% |

|

|

10.27 |

% |

|

|

11.40 |

% |

|

Adjusted return on average tangible common equity (2)

|

|

|

13.77 |

% |

|

|

16.11 |

% |

|

|

14.82 |

% |

|

|

17.11 |

% |

|

|

17.18 |

% |

|

|

14.89 |

% |

|

|

16.62 |

% |

|

(1)

|

Includes other non-recurring income and expense items.

|

|

|

|

|

(2)

|

A non-GAAP financial measure defined as adjusted earnings divided by average stockholders' equity less average goodwill and other intangible assets.

|

|

|

|

|

AVERAGE BALANCE SHEETS AND NET INTEREST INCOME ANALYSIS (Unaudited)

|

| |

|

Three Months Ended September 30,

|

|

| |

|

2024

|

|

|

2023

|

|

| |

|

Average

|

|

|

|

|

|

|

Average Yield/

|

|

|

Average

|

|

|

|

|

|

|

Average Yield/

|

|

|

(Amounts in thousands)

|

|

Balance

|

|

|

Interest(1)

|

|

|

Rate(1)

|

|

|

Balance

|

|

|

Interest(1)

|

|

|

Rate(1)

|

|

|

Assets

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Earning assets

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Loans(2)(3)

|

|

$ |

2,455,807 |

|

|

$ |

32,201 |

|

|

|

5.22 |

% |

|

$ |

2,604,885 |

|

|

$ |

33,566 |

|

|

|

5.11 |

% |

|

Securities available for sale

|

|

|

133,654 |

|

|

|

1,099 |

|

|

|

3.27 |

% |

|

|

284,659 |

|

|

|

1,952 |

|

|

|

2.72 |

% |

|

Interest-bearing deposits

|

|

|

270,440 |

|

|

|

3,701 |

|

|

|

5.44 |

% |

|

|

50,855 |

|

|

|

697 |

|

|

|

5.44 |

% |

|

Total earning assets

|

|

|

2,859,901 |

|

|

|

37,001 |

|

|

|

5.15 |

% |

|

|

2,940,399 |

|

|

|

36,215 |

|

|

|

4.89 |

% |

|

Other assets

|

|

|

371,358 |

|

|

|

|

|

|

|

|

|

|

|

393,001 |

|

|

|

|

|

|

|

|

|

|

Total assets

|

|

$ |

3,231,259 |

|

|

|

|

|

|

|

|

|

|

$ |

3,333,400 |

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Liabilities and stockholders' equity

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Interest-bearing deposits

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Demand deposits

|

|

$ |

656,780 |

|

|

$ |

234 |

|

|

|

0.14 |

% |

|

$ |

699,066 |

|

|

$ |

165 |

|

|

|

0.09 |

% |

|

Savings deposits

|

|

|

886,766 |

|

|

|

3,735 |

|

|

|

1.68 |

% |

|

|

862,121 |

|

|

|

1,941 |

|

|

|

0.89 |

% |

|

Time deposits

|

|

|

245,020 |

|

|

|

1,329 |

|

|

|

2.16 |

% |

|

|

263,940 |

|

|

|

652 |

|

|

|

0.98 |

% |

|

Total interest-bearing deposits

|

|

|

1,788,566 |

|

|

|

5,298 |

|

|

|

1.18 |

% |

|

|

1,825,127 |

|

|

|

2,758 |

|

|

|

0.60 |

% |

|

Borrowings

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Retail repurchase agreements

|

|

|

1,054 |

|

|

|

- |

|

|

|

0.05 |

% |

|

|

1,254 |

|

|

|

- |

|

|

|

N/M |

|

|

Total borrowings

|

|

|

1,054 |

|

|

|

- |

|

|

|

0.05 |

% |

|

|

1,254 |

|

|

|

- |

|

|

|

N/M |

|

|

Total interest-bearing liabilities

|

|

|

1,789,620 |

|

|

|

5,298 |

|

|

|

1.18 |

% |

|

|

1,826,381 |

|

|

|

2,758 |

|

|

|

0.60 |

% |

|

Noninterest-bearing demand deposits

|

|

|

877,472 |

|

|

|

|

|

|

|

|

|

|

|

964,093 |

|

|

|

|

|

|

|

|

|

|

Other liabilities

|

|

|

47,892 |

|

|

|

|

|

|

|

|

|

|

|

43,574 |

|

|

|

|

|

|

|

|

|

|

Total liabilities

|

|

|

2,714,984 |

|

|

|

|

|

|

|

|

|

|

|

2,834,048 |

|

|

|

|

|

|

|

|

|

|

Stockholders' equity

|

|

|

516,275 |

|

|

|

|

|

|

|

|

|

|

|

499,352 |

|

|

|

|

|

|

|

|

|

|

Total liabilities and stockholders' equity

|

|

$ |

3,231,259 |

|

|

|

|

|

|

|

|

|

|

$ |

3,333,400 |

|

|

|

|

|

|

|

|

|

|

Net interest income, FTE(1)

|

|

|

|

|

|

$ |

31,703 |

|

|

|

|

|

|

|

|

|

|

$ |

33,457 |

|

|

|

|

|

|

Net interest rate spread

|

|

|

|

|

|

|

|

|

|

|

3.97 |

% |

|

|

|

|

|

|

|

|

|

|

4.29 |

% |

|

Net interest margin, FTE(1)

|

|

|

|

|

|

|

|

|

|

|

4.41 |

% |

|

|

|

|

|

|

|

|

|

|

4.51 |

% |

|

(1)

|

Interest income and average yield/rate are presented on a FTE, non-GAAP, basis using the federal statutory income tax rate of 21%.

|

|

(2)

|

Nonaccrual loans are included in the average balance; however, no related interest income is recorded during the period of nonaccrual.

|

|

(3)

|

Interest on loans includes non-cash and accelerated purchase accounting accretion of $592 thousand and $874 thousand for the three months ended September 30, 2024 and 2023, respectively.

|

AVERAGE BALANCE SHEETS AND NET INTEREST INCOME ANALYSIS (Unaudited)

| |

|

Nine Months Ended September 30,

|

|

| |

|

2024

|

|

|

2023

|

|

| |

|

Average

|

|

|

|

|

|

|

Average Yield/

|

|

|

Average

|

|

|

|

|

|

|

Average Yield/

|

|

|

(Amounts in thousands)

|

|

Balance

|

|

|

Interest(1)

|

|

|

Rate(1)

|

|

|

Balance

|

|

|

Interest(1)

|

|

|

Rate(1)

|

|

|

Assets

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Earning assets

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Loans(2)(3)

|

|

$ |

2,501,209 |

|

|

$ |

98,479 |

|

|

|

5.26 |

% |

|

$ |

2,523,814 |

|

|

$ |

93,261 |

|

|

|

4.94 |

% |

|

Securities available for sale

|

|

|

172,331 |

|

|

|

4,073 |

|

|

|

3.16 |

% |

|

|

306,435 |

|

|

|

6,191 |

|

|

|

2.70 |

% |

|

Interest-bearing deposits

|

|

|

182,773 |

|

|

|

7,499 |

|

|

|

5.48 |

% |

|

|

51,759 |

|

|

|

2,047 |

|

|

|

5.29 |

% |

|

Total earning assets

|

|

|

2,856,313 |

|

|

|

110,051 |

|

|

|

5.15 |

% |

|

|

2,882,008 |

|

|

|

101,499 |

|

|

|

4.71 |

% |

|

Other assets

|

|

|

372,663 |

|

|

|

|

|

|

|

|

|

|

|

366,243 |

|

|

|

|

|

|

|

|

|

|

Total assets

|

|

$ |

3,228,976 |

|

|

|

|

|

|

|

|

|

|

$ |

3,248,251 |

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Liabilities and stockholders' equity

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Interest-bearing deposits

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Demand deposits

|

|

$ |

662,433 |

|

|

$ |

570 |

|

|

|

0.11 |

% |

|

$ |

682,820 |

|

|

$ |

225 |

|

|

|

0.04 |

% |

|

Savings deposits

|

|

|

875,797 |

|

|

|

10,730 |

|

|

|

1.64 |

% |

|

|

850,411 |

|

|

|

3,731 |

|

|

|

0.59 |

% |

|

Time deposits

|

|

|

247,088 |

|

|

|

3,240 |

|

|

|

1.75 |

% |

|

|

272,435 |

|

|

|

1,450 |

|

|

|

0.71 |

% |

|

Total interest-bearing deposits

|

|

|

1,785,318 |

|

|

|

14,540 |

|

|

|

1.09 |

% |

|

|

1,805,666 |

|

|

|

5,406 |

|

|

|

0.40 |

% |

|

Borrowings

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Federal funds purchased

|

|

|

839 |

|

|

|

35 |

|

|

|

5.52 |

% |

|

|

3,532 |

|

|

|

135 |

|

|

|

5.11 |

% |

|

Retail repurchase agreements

|

|

|

1,061 |

|

|

|

- |

|

|

|

0.05 |

% |

|

|

1,674 |

|

|

|

1 |

|

|

|

0.06 |

% |

|

Total borrowings

|

|

|

1,900 |

|

|

|

35 |

|

|

|

2.46 |

% |

|

|

5,206 |

|

|

|

136 |

|

|

|

3.49 |

% |

|

Total interest-bearing liabilities

|

|

|

1,787,218 |

|

|

|

14,575 |

|

|

|

1.09 |

% |

|

|

1,810,872 |

|

|

|

5,542 |

|

|

|

0.41 |

% |

|

Noninterest-bearing demand deposits

|

|

|

883,013 |

|

|

|

|

|

|

|

|

|

|

|

924,591 |

|

|

|

|

|

|

|

|

|

|

Other liabilities

|

|

|

47,772 |

|

|

|

|

|

|

|

|

|

|

|

40,014 |

|

|

|

|

|

|

|

|

|

|

Total liabilities

|

|

|

2,718,003 |

|

|

|

|

|

|

|

|

|

|

|

2,775,477 |

|

|

|

|

|

|

|

|

|

|

Stockholders' equity

|

|

|

510,973 |

|

|

|

|

|

|

|

|

|

|

|

472,774 |

|

|

|

|

|

|

|

|

|

|

Total liabilities and stockholders' equity

|

|

$ |

3,228,976 |

|

|

|

|

|

|

|

|

|

|

$ |

3,248,251 |

|

|

|

|

|

|

|

|

|

|

Net interest income, FTE(1)

|

|

|

|

|

|

$ |

95,476 |

|

|

|

|

|

|

|

|

|

|

$ |

95,957 |

|

|

|

|

|

|

Net interest rate spread

|

|

|

|

|

|

|

|

|

|

|

4.06 |

% |

|

|

|

|

|

|

|

|

|

|

4.30 |

% |

|

Net interest margin, FTE(1)

|

|

|

|

|

|

|

|

|

|

|

4.46 |

% |

|

|

|

|

|

|

|

|

|

|

4.45 |

% |

|

(1)

|

Interest income and average yield/rate are presented on a FTE, non-GAAP, basis using the federal statutory income tax rate of 21%.

|

|

(2)

|

Nonaccrual loans are included in the average balance; however, no related interest income is recorded during the period of nonaccrual.

|

|

(3)

|

Interest on loans includes non-cash and accelerated purchase accounting accretion of $2.04 million and $1.95 million for the nine months ended September 30, 2024 and 2023, respectively.

|

|

CONDENSED CONSOLIDATED QUARTERLY BALANCE SHEETS (Unaudited)

|

| |

|

September 30,

|

|

|

June 30,

|

|

|

March 31,

|

|

|

December 31,

|

|

|

September 30,

|

|

|

(Amounts in thousands, except per share data)

|

|

2024

|

|

|

2024

|

|

|

2024

|

|

|

2023

|

|

|

2023

|

|

|

Assets

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cash and cash equivalents

|

|

$ |

315,338 |

|

|

$ |

329,877 |

|

|

$ |

248,905 |

|

|

$ |

116,420 |

|

|

$ |

113,397 |

|

|

Debt securities available for sale, at fair value

|

|

|

166,669 |

|

|

|

129,686 |

|

|

|

166,247 |

|

|

|

280,961 |

|

|

|

275,332 |

|

|

Loans held for investment, net of unearned income

|

|

|

2,444,113 |

|

|

|

2,473,268 |

|

|

|

2,519,833 |

|

|

|

2,572,298 |

|

|

|

2,593,472 |

|

|

Allowance for credit losses

|

|

|

(35,118 |

) |

|

|

(34,885 |

) |

|

|

(35,461 |

) |

|

|

(36,189 |

) |

|

|

(36,031 |

) |

|

Loans held for investment, net

|

|

|

2,408,995 |

|

|

|

2,438,383 |

|

|

|

2,484,372 |

|

|

|

2,536,109 |

|

|

|

2,557,441 |

|

|

Premises and equipment, net

|

|

|

49,654 |

|

|

|

50,528 |

|

|

|

51,333 |

|

|

|

50,680 |

|

|

|

51,205 |

|

|

Other real estate owned

|

|

|

346 |

|

|

|

100 |

|

|

|

374 |

|

|

|

192 |

|

|

|

243 |

|

|

Interest receivable

|

|

|

9,883 |

|

|

|

9,984 |

|

|

|

10,719 |

|

|

|

10,881 |

|

|

|

10,428 |

|

|

Goodwill

|

|

|

143,946 |

|

|

|

143,946 |

|

|

|

143,946 |

|

|

|

143,946 |

|

|

|

143,946 |

|

|

Other intangible assets

|

|

|

13,550 |

|

|

|

14,085 |

|

|

|

14,615 |

|

|

|

15,145 |

|

|

|

15,681 |

|

|

Other assets

|

|

|

115,980 |

|

|

|

116,230 |

|

|

|

115,470 |

|

|

|

114,211 |

|

|

|

116,552 |

|

|

Total assets

|

|

$ |

3,224,361 |

|

|

$ |

3,232,819 |

|

|

$ |

3,235,981 |

|

|

$ |

3,268,545 |

|

|

$ |

3,284,225 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Liabilities

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Deposits

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Noninterest-bearing

|

|

$ |

869,723 |

|

|

$ |

889,462 |

|

|

$ |

902,396 |

|

|

$ |

931,920 |

|

|

$ |

944,301 |

|

|

Interest-bearing

|

|

|

1,789,530 |

|

|

|

1,787,810 |

|

|

|

1,779,819 |

|

|

|

1,790,405 |

|

|

|

1,801,835 |

|

|

Total deposits

|

|

|

2,659,253 |

|

|

|

2,677,272 |

|

|

|

2,682,215 |

|

|

|

2,722,325 |

|

|

|

2,746,136 |

|

|

Securities sold under agreements to repurchase

|

|

|

954 |

|

|

|

894 |

|

|

|

1,006 |

|

|

|

1,119 |

|

|

|

1,029 |

|

|

Interest, taxes, and other liabilities

|

|

|

43,460 |

|

|

|

45,769 |

|

|

|

45,816 |

|

|

|

41,807 |

|

|

|

41,393 |

|

|

Total liabilities

|

|

|

2,703,667 |

|

|

|

2,723,935 |

|

|

|

2,729,037 |

|

|

|

2,765,251 |

|

|

|

2,788,558 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Stockholders' equity

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Common stock

|

|

|

18,291 |

|

|

|

18,270 |

|

|

|

18,413 |

|

|

|

18,502 |

|

|

|

18,671 |

|

|

Additional paid-in capital

|

|

|

168,691 |

|

|

|

168,272 |

|

|

|

173,041 |

|

|

|

175,841 |

|

|

|

180,951 |

|

|

Retained earnings

|

|

|

342,121 |

|

|

|

334,756 |

|

|

|

327,389 |

|

|

|

319,902 |

|

|

|

313,489 |

|

|

Accumulated other comprehensive loss

|

|

|

(8,409 |

) |

|

|

(12,414 |

) |

|

|

(11,899 |

) |

|

|

(10,951 |

) |

|

|

(17,444 |

) |

|

Total stockholders' equity

|

|

|

520,694 |

|

|

|

508,884 |

|

|

|

506,944 |

|

|

|

503,294 |

|

|

|

495,667 |

|

|

Total liabilities and stockholders' equity

|

|

$ |

3,224,361 |

|

|

$ |

3,232,819 |

|

|

$ |

3,235,981 |

|

|

$ |

3,268,545 |

|

|

$ |

3,284,225 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Shares outstanding at period-end

|

|

|

18,290,938 |

|

|

|

18,270,273 |

|

|

|

18,413,088 |

|

|

|

18,502,396 |

|

|

|

18,671,470 |

|

|

Book value per common share

|

|

$ |

28.47 |

|

|

$ |

27.85 |

|

|

$ |

27.53 |

|

|

$ |

27.20 |

|

|

$ |

26.55 |

|

|

Tangible book value per common share(1)

|

|

|

19.86 |

|

|

|

19.20 |

|

|

|

18.92 |

|

|

|

18.60 |

|

|

|

18.00 |

|

|

(1)

|

A non-GAAP financial measure defined as stockholders' equity less goodwill and other intangible assets, divided by shares outstanding.

|

|

SELECTED CREDIT QUALITY INFORMATION (Unaudited)

|

| |

|

September 30,

|

|

|

June 30,

|

|

|

March 31,

|

|

|

December 31,

|

|

|

September 30,

|

|

|

(Amounts in thousands)

|

|

2024

|

|

|

2024

|

|

|

2024

|

|

|

2023

|

|

|

2023

|

|

|

Allowance for Credit Losses

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Balance at beginning of period:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Allowance for credit losses - loans

|

|

$ |

34,885 |

|

|

$ |

35,461 |

|

|

$ |

36,189 |

|

|

$ |

36,031 |

|

|

$ |

36,177 |

|

|

Allowance for credit losses - loan commitments

|

|

|

441 |

|

|

|

746 |

|

|

|

746 |

|

|

|

758 |

|

|

|

964 |

|

|

Total allowance for credit losses beginning of period

|

|

|

35,326 |

|

|

|

36,207 |

|

|

|

36,935 |

|

|

|

36,789 |

|

|

|

37,141 |

|

|

Adjustments to beginning balance:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Allowance for credit losses - loans - Surrey acquisition for purchased credit deteriorated loans

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

Allowance for credit losses - loan commitments

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

Net Adjustments

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

Provision for credit losses:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Provision for credit losses - loans

|

|

|

1,360 |

|

|

|

449 |

|

|

|

1,011 |

|

|

|

1,041 |

|

|

|

1,315 |

|

|

(Recovery of) provision for credit losses - loan commitments

|

|

|

- |

|

|

|

(305 |

) |

|

|

- |

|

|

|

(12 |

) |

|

|

(206 |

) |

|

Total provision for credit losses - loans and loan commitments

|

|

|

1,360 |

|

|

|

144 |

|

|

|

1,011 |

|

|

|

1,029 |

|

|

|

1,109 |

|

|

Charge-offs

|

|

|

(1,799 |

) |

|

|

(1,599 |

) |

|

|

(2,448 |

) |

|

|

(2,105 |

) |

|

|

(2,157 |

) |

|

Recoveries

|

|

|

672 |

|

|

|

574 |

|

|

|

709 |

|

|

|

1,222 |

|

|

|

696 |

|

|

Net (charge-offs) recoveries

|

|

|

(1,127 |

) |

|

|

(1,025 |

) |

|

|

(1,739 |

) |

|

|

(883 |

) |

|

|

(1,461 |

) |

|

Balance at end of period:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Allowance for credit losses - loans

|

|

|

35,118 |

|

|

|

34,885 |

|

|

|

35,461 |

|

|

|

36,189 |

|

|

|

36,031 |

|

|

Allowance for credit losses - loan commitments

|

|

|

441 |

|

|

|

441 |

|

|

|

746 |

|

|

|

746 |

|

|

|

758 |

|

|

Ending balance

|

|

$ |

35,559 |

|

|

$ |

35,326 |

|

|

$ |

36,207 |

|

|

$ |

36,935 |

|

|

$ |

36,789 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Nonperforming Assets

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Nonaccrual loans

|

|

$ |

19,754 |

|

|

$ |

19,815 |

|

|

$ |

19,617 |

|

|

$ |

19,356 |

|

|

$ |

18,366 |

|

|

Accruing loans past due 90 days or more

|

|

|

176 |

|

|

|

19 |

|

|

|

30 |

|

|

|

104 |

|

|

|

59 |

|

|

Modified loans past due 90 days or more

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

Total nonperforming loans

|

|

|

19,930 |

|

|

|

19,834 |

|

|

|

19,647 |

|

|

|

19,460 |

|

|

|

18,425 |

|

|

OREO

|

|

|

346 |

|

|

|

100 |

|

|

|

374 |

|

|

|

192 |

|

|

|

243 |

|

|

Total nonperforming assets

|

|

$ |

20,276 |

|

|

$ |

19,934 |

|

|

$ |

20,021 |

|

|

$ |

19,652 |

|

|

$ |

18,668 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Additional Information

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total modified loans

|

|

$ |

2,320 |

|

|

$ |

2,290 |

|

|

$ |

2,177 |

|

|

$ |

1,873 |

|

|

$ |

1,674 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Asset Quality Ratios

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Nonperforming loans to total loans

|

|

|

0.82 |

% |

|

|

0.80 |

% |

|

|

0.78 |

% |

|

|

0.76 |

% |

|

|

0.71 |

% |

|

Nonperforming assets to total assets

|

|

|

0.63 |

% |

|

|

0.62 |

% |

|

|

0.62 |

% |

|

|

0.60 |

% |

|

|

0.57 |

% |

|

Allowance for credit losses to nonperforming loans

|

|

|

176.21 |

% |

|

|

175.88 |

% |

|

|

180.49 |

% |

|

|

185.97 |

% |

|

|

195.55 |

% |

|

Allowance for credit losses to total loans

|

|

|

1.44 |

% |

|

|

1.41 |

% |

|

|

1.41 |

% |

|

|

1.41 |

% |

|

|

1.39 |

% |

|

Annualized net charge-offs (recoveries) to average loans

|

|

|

0.18 |

% |

|

|

0.16 |

% |

|

|

0.27 |

% |

|

|

0.14 |

% |

|

|

0.22 |

% |

v3.24.3

Document And Entity Information

|

Oct. 22, 2024 |

| Document Information [Line Items] |

|

| Entity, Registrant Name |

FIRST COMMUNITY BANKSHARES, INC.

|

| Document, Type |

8-K

|

| Document, Period End Date |

Oct. 22, 2024

|

| Entity, Incorporation, State or Country Code |

VA

|

| Entity, File Number |

000-19297

|

| Entity, Tax Identification Number |

55-0694814

|

| Entity, Address, Address Line One |

P.O. Box 989

|

| Entity, Address, City or Town |

Bluefield

|

| Entity, Address, State or Province |

VA

|

| Entity, Address, Postal Zip Code |

24605-0989

|

| City Area Code |

276

|

| Local Phone Number |

326-9000

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock

|

| Trading Symbol |

FCBC

|

| Security Exchange Name |

NASDAQ

|

| Entity, Emerging Growth Company |

false

|

| Amendment Flag |

false

|

| Entity, Central Index Key |

0000859070

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |