Coca-Cola Consolidated, Inc. (NASDAQ: COKE) (the “Company”)

announced today the final results of its modified “Dutch auction”

tender offer, which expired at 5:00 p.m., New York City time, on

June 18, 2024.

Based on the final count by Equiniti Trust Company, LLC, the

depositary for the tender offer, a total of 14,391.5 shares of the

Company’s Common Stock were validly tendered and not validly

withdrawn in the tender offer.

In accordance with the terms and conditions of the tender offer,

the Company has accepted for purchase 14,391.5 shares of its Common

Stock at a price of $925 per share, for an aggregate cost of

approximately $13.3 million, excluding fees and expenses relating

to the tender offer. The Company accepted for purchase all of the

shares that were validly tendered and not validly withdrawn in the

tender offer. The shares accepted for purchase represent

approximately 0.2% of the shares of Common Stock that were issued

and outstanding as of June 18, 2024.

As previously announced, the Company has agreed, following the

completion of the tender offer, to purchase from Carolina Coca-Cola

Bottling Investments, Inc. (“CCCBI”), an indirect wholly-owned

subsidiary of The Coca-Cola Company, at the purchase

price equal to the price paid by the Company in the tender offer, a

number of shares of Common Stock such that CCCBI would beneficially

own 21.5% of the Company’s outstanding shares of Common Stock

immediately following the closing of the repurchase (calculated

assuming all issued and outstanding shares of the Company’s Class B

Common Stock are converted into Common Stock and taking into

account the shares of Common Stock purchased in the tender offer)

(the “Share Repurchase”). Based on the shares of Common Stock the

Company accepted for purchase in the tender offer, the Company

expects to purchase 598,619 shares of Common Stock from CCCBI in

the Share Repurchase, for an aggregate purchase price of

approximately $553.7 million. The closing of the Share Repurchase

is expected to occur on July 5, 2024, the 11th business day after

the expiration of the tender offer, subject to the satisfaction or

waiver of the conditions to the closing.

The Company may purchase additional shares in the future in the

open market subject to market conditions, or in private

transactions, exchange offers, tender offers or otherwise. Under

applicable securities laws, however, the Company may not repurchase

any shares until July 5, 2024. Whether the Company makes additional

repurchases in the future will depend on many factors, including

the market price of the shares, the Company’s business and

financial condition and general economic and market conditions.

Certain Information Regarding the Tender

Offer

The information in this press release describing the tender

offer is for informational purposes only and does not constitute an

offer to buy or the solicitation of an offer to sell shares in the

tender offer. The tender offer was made only pursuant to the Offer

to Purchase and the related materials that Coca-Cola Consolidated

filed with the U.S. Securities and Exchange Commission (the “SEC”),

as amended or supplemented, and distributed to its

stockholders.

Cautionary Note Regarding Forward-Looking

Statements

Certain statements contained in this news release are

“forward-looking statements” that involve risks and uncertainties

which we expect will or may occur in the future and may impact our

business, financial condition and results of operations. The words

“anticipate,” “believe,” “expect,” “intend,” “project,” “may,”

“will,” “should,” “could” and similar expressions are intended to

identify those forward-looking statements. These forward-looking

statements reflect the Company’s best judgment based on current

information, and, although we base these statements on

circumstances that we believe to be reasonable when made, there can

be no assurance that future events will not affect the accuracy of

such forward-looking information. As such, the forward-looking

statements are not guarantees of future performance, and actual

results may vary materially from the projected results and

expectations discussed in this news release. Factors that might

cause the Company’s actual results to differ materially from those

anticipated in forward-looking statements include, but are not

limited to: increased costs (including due to inflation),

disruption of supply or unavailability or shortages of raw

materials, fuel and other supplies; the reliance on purchased

finished products from external sources; changes in public and

consumer perception and preferences, including concerns related to

product safety and sustainability, artificial ingredients, brand

reputation and obesity; changes in government regulations related

to nonalcoholic beverages, including regulations related to

obesity, public health, artificial ingredients and product safety

and sustainability; decreases from historic levels of marketing

funding support provided to us by The Coca-Cola Company

and other beverage companies; material changes in the performance

requirements for marketing funding support or our inability to meet

such requirements; decreases from historic levels of advertising,

marketing and product innovation spending by

The Coca-Cola Company and other beverage companies,

or advertising campaigns that are negatively perceived by the

public; any failure of the several Coca-Cola system governance

entities of which we are a participant to function efficiently or

on our best behalf and any failure or delay of ours to receive

anticipated benefits from these governance entities; provisions in

our beverage distribution and manufacturing agreements with

The Coca-Cola Company that could delay or prevent a

change in control of us or a sale of our Coca-Cola distribution or

manufacturing businesses; the concentration of our capital stock

ownership; our inability to meet requirements under our beverage

distribution and manufacturing agreements; changes in the inputs

used to calculate our acquisition related contingent consideration

liability; technology failures or cyberattacks on our information

technology systems or our effective response to technology failures

or cyberattacks on our customers’, suppliers’ or other third

parties’ information technology systems; unfavorable changes in the

general economy; the concentration risks among our customers and

suppliers; lower than expected net pricing of our products

resulting from continued and increased customer and competitor

consolidations and marketplace competition; the effect of changes

in our level of debt, borrowing costs and credit ratings on our

access to capital and credit markets, operating flexibility and

ability to obtain additional financing to fund future needs; the

failure to attract, train and retain qualified employees while

controlling labor costs, and other labor issues; the failure to

maintain productive relationships with our employees covered by

collective bargaining agreements, including failing to renegotiate

collective bargaining agreements; changes in accounting standards;

our use of estimates and assumptions; changes in tax laws,

disagreements with tax authorities or additional tax liabilities;

changes in legal contingencies; natural disasters, changing weather

patterns and unfavorable weather; climate change or legislative or

regulatory responses to such change; and the impact of any pandemic

or public health situation. These and other factors are discussed

in the Company’s regulatory filings with the SEC, including those

in “Item 1A. Risk Factors” of the Company’s Annual Report on Form

10-K for the fiscal year ended December 31, 2023. The

forward-looking statements contained in this news release speak

only as of this date, and the Company does not assume any

obligation to update them, except as may be required by applicable

law.

About Coca-Cola Consolidated, Inc.

Coca-Cola Consolidated is the largest Coca-Cola bottler in the

United States. Our Purpose is to honor God in all we do, to serve

others, to pursue excellence and to grow profitably. For over

122 years, we have been deeply committed to the consumers,

customers and communities we serve and passionate about the broad

portfolio of beverages and services we offer. We make, sell and

distribute beverages of The Coca-Cola Company and other

partner companies in more than 300 brands and flavors across

14 states and the District of Columbia, to approximately

60 million consumers.

Headquartered in Charlotte, N.C., Coca-Cola Consolidated is

traded on The Nasdaq Global Select Market under the symbol “COKE”.

More information about the Company is available at

www.cokeconsolidated.com. Follow Coca-Cola Consolidated on

Facebook, X, Instagram and LinkedIn.

|

CONTACTS: |

|

| Ashley Brown

(Media) |

Scott Anthony

(Investors) |

| Director, External

Communications |

Executive Vice President &

Chief Financial Officer |

| (803) 979-2849 |

(704) 557-4633 |

|

Ashley.Brown@cokeconsolidated.com |

Scott.Anthony@cokeconsolidated.com |

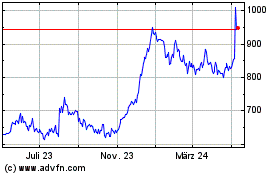

Coca Cola Consolidated (NASDAQ:COKE)

Historical Stock Chart

Von Nov 2024 bis Dez 2024

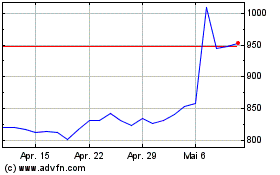

Coca Cola Consolidated (NASDAQ:COKE)

Historical Stock Chart

Von Dez 2023 bis Dez 2024