Compass Therapeutics, Inc. (Nasdaq: CMPX), a clinical-stage,

oncology-focused biopharmaceutical company developing proprietary

antibody-based therapeutics to treat multiple human diseases, today

reported third quarter and year-to-date, 2023 financial results.

“Enrollment in our Phase 2/3 study, COMPANION-002, in patients

with advanced BTC has increased in the third quarter in part based

on our opening of several clinical sites at large academic medical

centers around the country. In addition, data are continuing to

evolve in our COMPANION-003 study in patients with advanced CRC,

and we expect to report initial data from this study in the fourth

quarter of this year,” said Vered Bisker-Leib, PhD, President and

Chief Operating Officer.

“We are very excited to announce that the FDA cleared the IND

for CTX-8371, our PD-1 and PD-L1 bispecific antibody, the first

StitchMabs® generated bispecific to advance to the clinic. We

believe this next generation checkpoint inhibitor with its unique

mechanism-of-action may have improved activity compared with first

generation checkpoint blockers in a range of solid tumors. We look

forward to initiating a first-in-human clinical study prior to the

end of the year,” said Thomas J. Schuetz, MD, PhD, Co-Founder and

Chief Executive Officer.

Carl Gordon, Chairman of Compass’ Board of Directors, “Vered is

a seasoned biotech executive who has played a key role in building

our pipeline and operations, and she is well positioned to lead

Compass through this next phase of strategic growth. Additionally,

Tom’s expertise and leadership as President of Research and

Development will be invaluable as we continue to deliver on our

mission of advancing next generation antibodies into transformative

cancer therapies. Both Vered and Tom’s commitment to Compass over

the past decade have been instrumental in the value creation of the

company, and I look forward to continuing our work together.”

Development Pipeline Update and Highlights:

CTX-009 (DLL4 and VEGF-A bispecific

antibody)

- Enrolling patients in a U.S. Phase

2 study of CTX-009 as a monotherapy in patients with advanced,

metastatic CRC (COMPANION-003)

- The study design is an Adaptive

Simon Two-Stage, with Stage 1 of the study enrolling 37 patients;

if 3 or more responses are confirmed in Stage 1, the study will

advance to Stage 2, and an additional 47 patients will be

enrolled

- The study is enrolling patients with

CRC who have received two or three prior systemic therapies

irrespective of their KRAS mutation status

- Patients are being evaluated for

safety and tolerability, as well as clinical response

- Initial results from Stage 1 of

this study are expected in the fourth quarter of 2023

- Enrolling patients in a U.S. Phase

2/3 study of CTX-009 in combination with Paclitaxel in BTC

(COMPANION-002)

- This randomized Phase 2/3 study is

designed to enroll 150 patients with BTC who have received one

prior systemic therapy

- The primary endpoint of the study is

overall response rate (ORR), and secondary endpoints include

progression free survival (PFS), overall survival (OS), clinical

benefit rate (CBR) and duration of response (DOR)

- Enrollment in the third quarter has

increased relative to the first half of 2023 in part due to the

opening of several clinical sites at large academic medical centers

across the country

- Top line data is expected from this

study in the second half of 2024

CTX-471 (CD137 + PD-1)

- This Phase 1 study is assessing the

safety and activity of the combination of CTX-471 (CD137 agonistic

antibody) and Merck’s anti-PD-1 therapy KEYTRUDA® (pembrolizumab)

in patients with select solid tumors

- The dose-escalation portion of the

study (n=9) has been completed with no dose limiting toxicities

observed

- The cohort expansion phase of the

trial is expected to begin in in the first quarter of

2024

CTX-8371 (PD-1 x PD-L1)

- CTX-8371 is a next generation

bispecific checkpoint inhibitor that simultaneously targets PD-1

and PD-L1 and exhibits a unique mechanism-of-action that involves

cleavage of cell surface PD-1

- FDA cleared the IND for CTX-8371

and we expect to initiate a Phase 1 clinical trial in the fourth

quarter of 2023

Financial Results

Net loss for the third quarter ended September 30, 2023 was

$10.0 million or $0.08 per common share, compared to $12.0 million

or $0.12 per common share for the same period in 2022. Net loss for

the nine months ended September 30, 2023 was $29.1 million or $0.23

per common share, compared to $27.6 million or $0.27 per common

share for the same period in 2022.

Cash Position

As of September 30, 2023, cash and marketable securities were

$164 million as compared to $187 million as of December 31, 2022,

providing the Company with an anticipated cash runway into 2026.

During the first nine months of 2023, the Company used $28 million

of cash to fund operations.

Research and development (R&D) Expenses

R&D expenses were $8.8 million for the quarter ended

September 30, 2023, as compared to $9.8 million for the same period

in 2022, a decrease of approximately $1.0 million or 10%. The

decrease was primarily attributable to lower manufacturing expense

related to CTX-009 of $1.6M.

R&D expenses were $25.7 million for the nine months ended

September 30, 2023, as compared to $20.1 million for the same

period in 2022, an increase of $5.6 million or 28%. The increase

was primarily attributable to higher clinical costs of $3.8 million

and higher manufacturing costs of $1.1 million.

General and Administrative (G&A) Expenses

G&A expenses were $3.1 million for the quarter ended

September 30, 2023, as compared to $2.8 million for the same period

in 2022, an increase of $0.3 million or 10%. The increase was

primarily attributable to higher stock compensation expense of $0.3

million. G&A expenses were $9.3 million for the nine months

ended September 30, 2023, as compared to $8.7 million for the same

period in 2022, an increase of $0.6 million or 7%. The increase was

primarily attributable to higher stock compensation expense of $0.5

million.

Upcoming Investor Conferences

Compass management will participate in two upcoming investor

conferences:

- Stifel

Healthcare ConferenceDate: November 14-15, 2023Location:

New York, NY

- Jefferies

London Healthcare ConferenceDate: November 14-16,

2023Location: London, UK

Live webcasts presentations, when available, will be under “News

& Events” in the Investors section of the Company’s website

located at www.compasstherapeutics.com.

KEYTRUDA® is a registered trademark of Merck Sharp & Dohme

LLC, a subsidiary of Merck & Co., Inc., Rahway, NJ,

USA.

About Compass Therapeutics

Compass Therapeutics, Inc. is a clinical-stage oncology-focused

biopharmaceutical company developing proprietary antibody-based

therapeutics to treat multiple human diseases. Compass’s scientific

focus is on the relationship between angiogenesis, the immune

system, and tumor growth. The company pipeline of novel product

candidates is designed to target multiple critical biological

pathways required for an effective anti-tumor response. These

include modulation of the microvasculature via

angiogenesis-targeted agents, induction of a potent immune response

via activators on effector cells in the tumor microenvironment, and

alleviation of immunosuppressive mechanisms used by tumors to evade

immune surveillance. Compass plans to advance its product

candidates through clinical development as both standalone

therapies and in combination with proprietary pipeline antibodies

based on supportive clinical and nonclinical data. The company was

founded in 2014 and is headquartered in Boston, Massachusetts. For

more information, visit the Compass Therapeutics website

at https://www.compasstherapeutics.com

Forward-Looking Statements

This press release contains forward-looking statements.

Statements in this press release that are not purely historical are

forward-looking statements. Such forward-looking statements

include, among other things, references to Compass’s financial

position to continue advancing its product candidates, expectations

about cash runway, business and development plans, and statements

regarding Compass’s product candidates, their development,

regulatory plans with respect thereto and therapeutic potential

thereof. Actual results could differ from those projected in any

forward-looking statements due to numerous factors. Such factors

include, among others, Compass’s ability to raise the additional

funding it will need to continue to pursue its business and product

development plans, the inherent uncertainties associated with

developing product candidates and operating as a development stage

company, Compass’s ability to identify additional product

candidates for development, Compass’s ability to develop, complete

clinical trials for, obtain approvals for and commercialize any of

its product candidates, competition in the industry in which

Compass operates and market conditions. These forward-looking

statements are made as of the date of this press release, and

Compass assumes no obligation to update the forward-looking

statements, or to update the reasons why actual results could

differ from those projected in the forward-looking statements,

except as required by law. Investors should consult all of the

information set forth herein and should also refer to the risk

factor disclosure set forth in the reports and other documents

Compass files with the SEC available at www.sec.gov, including

without limitation Compass’s latest Form 10-Q and subsequent

filings with the SEC.

Investor Contactir@compasstherapeutics.com

Media Contact Anna Gifford, Communications

Manager media@compasstherapeutics.com617-500-8099

Compass Therapeutics, Inc. and

SubsidiariesCondensed Consolidated Statements of Operations

(unaudited)(In thousands, except per share data)

| |

Three Months EndedSeptember

30, |

|

Nine Months EndedSeptember

30, |

|

|

|

2023 |

|

|

|

2022 |

|

|

|

2023 |

|

|

|

2022 |

|

|

|

|

|

|

|

|

|

Operating expenses: |

|

|

|

|

|

|

|

|

Research and development |

$ |

8,831 |

|

|

$ |

9,791 |

|

|

$ |

25,694 |

|

|

$ |

20,069 |

|

|

General and administrative |

|

3,095 |

|

|

|

2,807 |

|

|

|

9,276 |

|

|

|

8,698 |

|

|

Total operating expenses |

|

11,926 |

|

|

|

12,598 |

|

|

|

34,970 |

|

|

|

28,767 |

|

|

Loss from operations |

|

(11,926 |

) |

|

|

(12,598 |

) |

|

|

(34,970 |

) |

|

|

(28,767 |

) |

|

Other income |

|

1,962 |

|

|

|

623 |

|

|

|

5,891 |

|

|

|

1,136 |

|

| Net

loss |

$ |

(9,964 |

) |

|

$ |

(11,975 |

) |

|

$ |

(29,079 |

) |

|

$ |

(27,631 |

) |

| Net loss

per share - basic and diluted |

$ |

(0.08 |

) |

|

$ |

(0.12 |

) |

|

$ |

(0.23 |

) |

|

$ |

(0.27 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Compass Therapeutics, Inc. and

SubsidiariesCondensed Consolidated Balance Sheets(In thousands)

| |

September 30,2023 |

|

December 31,2022 |

|

|

(unaudited) |

|

|

|

Assets |

|

|

|

| Current

assets: |

|

|

|

|

Cash and cash equivalents |

$ |

30,426 |

|

|

$ |

34,946 |

|

|

Marketable securities |

|

133,277 |

|

|

|

151,663 |

|

|

Prepaid expenses and other current assets |

|

2,881 |

|

|

|

8,182 |

|

|

Total current assets |

|

166,584 |

|

|

|

194,791 |

|

|

Property and equipment, net |

|

1,051 |

|

|

|

1,567 |

|

|

Operating lease, right-of-use ("ROU") asset |

|

2,083 |

|

|

|

2,967 |

|

|

Other assets |

|

320 |

|

|

|

320 |

|

|

Total assets |

$ |

170,038 |

|

|

$ |

199,645 |

|

|

Liabilities and Stockholders' Equity |

|

|

|

| Current

liabilities: |

|

|

|

|

Accounts payable |

$ |

2,306 |

|

|

$ |

3,382 |

|

|

Accrued expenses |

|

5,644 |

|

|

|

11,690 |

|

|

Operating lease obligations, current portion |

|

1,174 |

|

|

|

1,097 |

|

|

Total current liabilities |

|

9,124 |

|

|

|

16,169 |

|

|

Operating lease obligations, long-term portion |

|

869 |

|

|

|

1,838 |

|

|

Total liabilities |

|

9,993 |

|

|

|

18,007 |

|

|

Total stockholders' equity |

|

160,045 |

|

|

|

181,638 |

|

|

Total liabilities and stockholders' equity |

$ |

170,038 |

|

|

$ |

199,645 |

|

|

|

|

|

|

|

|

|

|

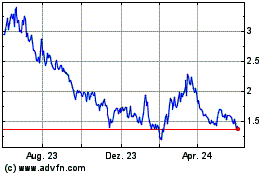

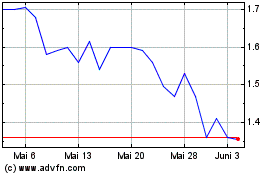

Compass Therapeutics (NASDAQ:CMPX)

Historical Stock Chart

Von Apr 2024 bis Mai 2024

Compass Therapeutics (NASDAQ:CMPX)

Historical Stock Chart

Von Mai 2023 bis Mai 2024