Compass Therapeutics Reports 2023 Financial Results and Provides Corporate Update

21 März 2024 - 2:00PM

Compass Therapeutics, Inc. (Nasdaq: CMPX), a clinical-stage,

oncology-focused biopharmaceutical company developing proprietary

antibody-based therapeutics to treat multiple human diseases, today

reported full 2023 financial results and provided business update.

“2023 was an important year for Compass as we strategically

shifted our focus toward the clinical development of our lead

program, CTX-009, which is currently being evaluated in patients

with advanced biliary tract cancer and advanced colorectal cancer,”

said Vered Bisker-Leib, PhD, Chief Executive Officer. “This year we

expect to report top-line data from Stage 1 of the Phase 2

COMPANION-003 trial by mid-year and top-line data from our Phase

2/3 COMPANION-002 trial by the end of the year. Our balance sheet

remains strong and we ended the year with $152 million, extending

our cash runway into the middle of 2026.”

“In 2023, we made significant progress across our clinical

programs,” said Thomas Schuetz, MD, PhD, Co-Founder and President

of Research & Development at Compass. “In the monotherapy study

of CTX-471, our novel CD137 agonist antibody, we reported

additional partial responses in patients with advanced melanoma, a

complete response in a patient with small cell lung cancer, and a

partial response in a patient with mesothelioma, all of whom had

previously progressed on a checkpoint blocker. Importantly, we have

identified a potential biomarker of response in biopsy specimens

from this study and we are now planning a Phase 2 study in patients

whose tumors express this biomarker. We also initiated the

combination arm of the CTX-471 with KEYTRUDA® Phase 1b study under

clinical collaboration with Merck. Finally, we filed and obtained

regulatory clearance to begin clinical trials with CTX-8371, our

novel checkpoint blocker, and advanced this bispecific into a

first-in-human study.”

Development Pipeline Updates:

CTX-009 (DLL4 and VEGF-A bispecific

antibody)

- Continue to enroll patients in

COMPANION-002, a U.S. Phase 2/3 randomized study of CTX-009 in

combination with paclitaxel in patients with advanced BTC.

- This study is designed to enroll

150 patients who have received one prior systemic therapy.

- The primary endpoint of the study

is overall response rate (ORR), and secondary endpoints include

progression free survival (PFS), overall survival (OS), clinical

benefit rate (CBR) and duration of response (DOR).

- Enrollment is expected to be

completed by mid-year 2024; top-line data are expected by year end

2024.

- Completed enrollment of patients in

Stage 1 of COMPANION-003, a U.S. Phase 2 study of CTX-009 as a

monotherapy in patients with advanced, metastatic CRC.

- The study design is an Adaptive

Simon Two-Stage. Stage 1 of the study enrolled 37 patients with CRC

who have received two or three prior systemic therapies

irrespective of their KRAS mutation status.

- Top-line data is expected by

mid-year 2024.

- If adequate efficacy is observed in

Stage 1, the study will continue to Stage 2 where 47 additional

patients are expected to be enrolled.

CTX-471 (CD137 agonist antibody)

- CTX-471 is a CD137 agonist

antibody, which binds to a unique epitope of the co-stimulatory

molecule 4-1BB with an optimized affinity.

- In the Phase 1B monotherapy study,

five responses were observed, all in patients who previously

received checkpoint inhibitors. A durable partial response (PR) in

a patient with SCLC has converted to a complete response (CR), as

confirmed by a PET scan. Additionally, a new PR in a patient with

advanced melanoma, was observed, leading to an objective response

rate (ORR) in the subset of patients with advanced melanoma of 27%

(3 of 11). The fifth response occurred in a patient with

mesothelioma.

- Ongoing analysis of biopsy

specimens from the Phase 1b study revealed a potential biomarker of

response. As a result, planning for a Phase 2 monotherapy study in

patients with melanoma whose tumors express this biomarker is

underway.

- Ongoing enrollment of up to 60

patients in the Phase 1b dose-expansion cohort of the combination

arm of CTX-471 and Merck’s anti-PD-1 therapy KEYTRUDA®

(pembrolizumab) with melanoma, NSCLC and SCLC, who will be randomly

assigned to one of two doses.

CTX-8371 (PD-1 x PD-L1 bispecific antibody)

- CTX-8371 is a next generation

bispecific checkpoint inhibitor that simultaneously targets PD-1

and PD-L1 and exhibits a unique mechanism-of-action that involves

cleavage of cell surface PD-1.

- Following the FDA acceptance of the

IND for CTX-8371, clinical sites were opened and the first patient

is expected to be dosed by early second quarter.

Financial Results

Net loss for the year ended December 31, 2023, was $42.5 million

or $0.33 per common share, compared to $39.2 million or $0.37 per

common share for the same period in 2022.

Research and Development (R&D) Expenses

R&D expenses were $38.1 million for the year ended December

31, 2023, as compared to $30.0 million for the same period in 2022,

an increase of $8.1 million or 27%. This increase was primarily

attributable to a $10.7 million increase in clinical and

manufacturing costs related to our lead program, CTX-009.

General and Administrative (G&A) Expenses

G&A expenses were $12.2 million for the year ended December

31, 2023, as compared to $11.7 million for the same period in 2022,

an increase of $0.6 million or 5%. The increase was primarily

attributable to higher stock compensation expense of $1.0 million

offset by lower insurance costs of $0.3 million.

Cash Position

As of December 31, 2023, cash and marketable securities were

$152.5 million as compared to $186.6 million as of December 31,

2022, providing the Company with an anticipated cash runway into

mid-2026. During 2023, the Company decreased its cash position by

$34.1 million, primarily from $40.6 million of net cash used in

operating activities.

About Compass TherapeuticsCompass Therapeutics,

Inc. is a clinical-stage oncology-focused biopharmaceutical company

developing proprietary antibody-based therapeutics to treat

multiple human diseases. Compass’s scientific focus is on the

relationship between angiogenesis, the immune system, and tumor

growth. The company pipeline of novel product candidates is

designed to target multiple critical biological pathways required

for an effective anti-tumor response. These include modulation of

the microvasculature via angiogenesis-targeted agents, induction of

a potent immune response via activators on effector cells in the

tumor microenvironment, and alleviation of immunosuppressive

mechanisms used by tumors to evade immune surveillance. Compass

plans to advance its product candidates through clinical

development as both standalone therapies and in combination with

proprietary pipeline antibodies based on supportive clinical and

nonclinical data. The company was founded in 2014 and is

headquartered in Boston, Massachusetts. For more information, visit

the Compass Therapeutics website

at https://www.compasstherapeutics.com.

Forward-Looking StatementsThis press release

contains forward-looking statements. Statements in this press

release that are not purely historical are forward-looking

statements. Such forward-looking statements include, among other

things, references to Compass’s financial position to continue

advancing its product candidates, expectations about cash runway,

business and development plans, and statements regarding Compass’s

product candidates, including their development and clinical trial

milestones such as the expected trial design, timing of enrollment,

patient dosing and data readouts, regulatory plans with respect to

Compass’s product candidates and the therapeutic potential thereof.

Actual results could differ from those projected in any

forward-looking statements due to numerous factors. Such factors

include, among others, Compass’s ability to raise the additional

funding it will need to continue to pursue its business and product

development plans, the inherent uncertainties associated with

developing product candidates and operating as a development stage

company, Compass’s ability to identify additional product

candidates for development, Compass’s ability to develop, complete

clinical trials for, obtain approvals for and commercialize any of

its product candidates, competition in the industry in which

Compass operates and market conditions. These forward-looking

statements are made as of the date of this press release, and

Compass assumes no obligation to update the forward-looking

statements, or to update the reasons why actual results could

differ from those projected in the forward-looking statements,

except as required by law. Investors should consult all of the

information set forth herein and should also refer to the risk

factor disclosure set forth in the reports and other documents

Compass files with the U.S. Securities and Exchange Commission

(SEC) available at www.sec.gov, including without limitation

Compass’s latest Annual Report on Form 10-K, Quarterly Report on

Form 10-Q and subsequent filings with the SEC.

Investor Contactir@compasstherapeutics.com

Media Contact Anna Gifford, Senior Manager of

Communications media@compasstherapeutics.com617-500-8099

| |

| Compass

Therapeutics, Inc. and SubsidiariesCondensed Consolidated

Statements of Operations(In thousands, except per share data) |

| |

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended December 31, |

|

Year Ended December 31, |

|

|

|

2023 |

|

2022 |

|

2023 |

|

2022 |

|

|

|

(unaudited) |

|

|

|

|

|

Operating expenses: |

|

|

|

|

|

|

|

|

|

Research and development |

|

$ |

12,428 |

|

|

$ |

9,929 |

|

|

$ |

38,120 |

|

|

$ |

29,997 |

|

|

General and administrative |

|

|

2,961 |

|

|

|

2,959 |

|

|

|

12,243 |

|

|

|

11,658 |

|

|

Total operating loss |

|

|

(15,389 |

) |

|

|

(12,888 |

) |

|

|

(50,363 |

) |

|

|

(41,655 |

) |

|

Other income |

|

|

1,974 |

|

|

|

1,294 |

|

|

|

7,869 |

|

|

|

2,430 |

|

|

Net loss |

|

$ |

(13,415 |

) |

|

$ |

(11,594 |

) |

|

$ |

(42,494 |

) |

|

$ |

(39,225 |

) |

|

Net loss per share - basic and diluted |

|

$ |

(0.11 |

) |

|

$ |

(0.10 |

) |

|

$ |

(0.33 |

) |

|

$ |

(0.37 |

) |

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

| |

|

|

|

|

| |

|

|

|

|

| Compass

Therapeutics, Inc. and SubsidiariesCondensed Consolidated Balance

Sheets(In thousands, except par value) |

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

December 31, |

|

|

|

|

|

|

|

2023 |

|

2022 |

|

|

|

|

|

Assets |

|

|

|

|

|

|

|

|

|

Current assets: |

|

|

|

|

|

|

|

|

|

Cash and cash equivalents |

|

$ |

24,228 |

|

|

$ |

34,946 |

|

|

|

|

|

|

Marketable securities |

|

|

128,233 |

|

|

|

151,663 |

|

|

|

|

|

|

Prepaid expenses and other current assets |

|

|

1,420 |

|

|

|

8,182 |

|

|

|

|

|

|

Total current assets |

|

|

153,881 |

|

|

|

194,791 |

|

|

|

|

|

|

Property and equipment, net |

|

|

898 |

|

|

|

1,567 |

|

|

|

|

|

|

Operating lease, right-of-use ("ROU") asset |

|

|

1,776 |

|

|

|

2,967 |

|

|

|

|

|

|

Other assets |

|

|

320 |

|

|

|

320 |

|

|

|

|

|

|

Total assets |

|

$ |

156,875 |

|

|

$ |

199,645 |

|

|

|

|

|

|

Liabilities and Stockholders' Equity |

|

|

|

|

|

|

|

|

|

Current liabilities: |

|

|

|

|

|

|

|

|

|

Accounts payable |

|

$ |

4,090 |

|

|

$ |

3,382 |

|

|

|

|

|

|

Accrued expenses |

|

|

2,514 |

|

|

|

11,690 |

|

|

|

|

|

|

Operating lease obligations, current portion |

|

|

1,197 |

|

|

|

1,097 |

|

|

|

|

|

|

Total current liabilities |

|

|

7,801 |

|

|

|

16,169 |

|

|

|

|

|

|

Operating lease obligations, long-term portion |

|

|

536 |

|

|

|

1,838 |

|

|

|

|

|

|

Total liabilities |

|

|

8,337 |

|

|

|

18,007 |

|

|

|

|

|

|

Total stockholders' equity |

|

|

148,538 |

|

|

|

181,638 |

|

|

|

|

|

|

Total liabilities and stockholders' equity |

|

$ |

156,875 |

|

|

$ |

199,645 |

|

|

|

|

|

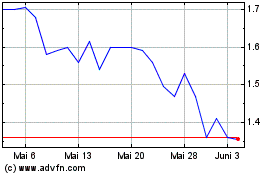

Compass Therapeutics (NASDAQ:CMPX)

Historical Stock Chart

Von Okt 2024 bis Nov 2024

Compass Therapeutics (NASDAQ:CMPX)

Historical Stock Chart

Von Nov 2023 bis Nov 2024