false

0001173489

0001173489

2024-11-07

2024-11-07

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of report (Date of earliest event reported): November 7, 2024

CEVA, INC.

(Exact Name of Registrant as Specified in Charter)

|

Delaware

|

|

000-49842

|

|

77-0556376

|

|

(State or Other Jurisdiction

of Incorporation)

|

|

(Commission

File Number)

|

|

(I.R.S. Employer

Identification No.)

|

15245 Shady Grove Road, Suite 400, Rockville, MD 20850

(Address of Principal Executive Offices, and Zip Code)

(240) 308-8328

Registrant’s Telephone Number, Including Area Code

Not applicable

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| |

☐

|

Written communication pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

| |

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

| |

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

| |

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Securities registered pursuant to Section 12(b) of the Act:

|

Title of each class

|

|

Trading Symbol(s)

|

|

Name of each exchange on which

registered

|

|

Common Stock, $0.001 par value

|

|

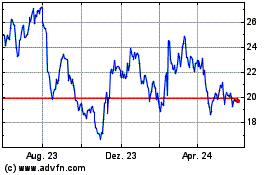

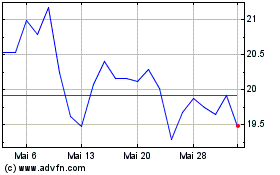

CEVA

|

|

The NASDAQ Stock Market LLC

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR §240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02. Results of Operations and Financial Condition.

On November 7, 2024, Ceva, Inc. (the “Company”) announced its financial results for the quarter ended September 30, 2024. A copy of the press release, dated November 7, 2024, is attached and filed herewith as Exhibit 99.1. On the same day, the Company will hold a conference call to discuss its financial results for the third quarter of 2024. A copy of the script of the conference call is attached hereto as Exhibit 99.2. This information, including Exhibits 99.1 and 99.2 attached hereto, shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended, nor shall they be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended, except as shall be expressly set forth by specific reference to such filing.

In addition to the disclosure of financial results for the quarter and year ended September 30, 2024 and 2023 in accordance with generally accepted accounting principles in the United States (“GAAP”), the press release and script also included non-GAAP gross margin, operating income, net income and diluted earnings per share (EPS) figures for the referenced periods.

Non-GAAP gross margin for the third quarter of 2024 and 2023 each excluded: (a) equity-based compensation expenses and (b) amortization of acquired intangibles.

Non-GAAP operating income for the third quarter of 2024 and 2023 each excluded: (a) equity-based compensation expenses, (b) the impact of the amortization of acquired intangibles and (c) costs associated with business acquisitions.

Non-GAAP net income and diluted earnings per share for the third quarter of 2024 and 2023 each excluded: (a) equity-based compensation expenses, (b) the impact of the amortization of acquired intangibles, (c) costs associated with business acquisitions and (d) income associated with the remeasurement of marketable equity securities.

Non-GAAP net income and diluted earnings per share including the discontinued operations for the third quarter of 2023 excluded: (a) equity-based compensation expenses, (b) the impact of the amortization of acquired intangibles, (c) costs associated with business acquisitions, (d) income associated with the remeasurement of marketable equity securities and (e) loss associated with discontinued operations.

The Company believes that the reconciliation of financial measures in the press release and script is useful to investors in analyzing the results for the quarters ended September 30, 2024 and 2023 because the exclusion of the applicable expenses may provide a more meaningful analysis of the Company’s core operating results and comparison of quarterly results. Further, the Company believes it is useful for investors to understand how the expenses associated with the application of FASB ASC No. 718 are reflected on its statements of income. The reconciliation of financial measures should be reviewed in addition to and in conjunction with results presented in accordance with GAAP, and are intended to provide additional insight into the Company’s operations that, when viewed with its GAAP results and the accompanying reconciliation, offer a more complete understanding of factors and trends affecting the Company’s business. The reconciliation of financial measures should not be viewed as a substitute for the Company’s reported GAAP results.

Item 7.01. Regulation FD Disclosure.

On November 7, 2024, the Company announced the expansion of its share repurchase program in a press release dated as of the same date. A copy of such press release is attached and filed herewith as Exhibit 99.3. This information, including Exhibit 99.3 attached hereto, shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, nor shall they be deemed incorporated by reference in any filing under the Securities Act of 1933, except as shall be expressly set forth by specific reference to such filing.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits:

|

Exhibit

Number

|

|

Description

|

| |

|

|

|

99.1

|

|

|

|

99.2

|

|

|

|

99.3

|

|

|

|

104

|

|

Cover Page Interactive Data File (embedded within the Inline XBRL document).

|

Signature

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

CEVA, INC.

|

| |

|

|

Date: November 7, 2024

|

By:

|

/s/ Yaniv Arieli

|

| |

Name:

|

Yaniv Arieli

|

| |

Title:

|

Chief Financial Officer

|

Exhibit 99.1

Ceva, Inc. Announces Third Quarter 2024 Financial Results

| |

●

|

Total revenue of $27.2 million, up 13% year-over-year

|

| |

●

|

Ceva-powered device shipments of 522 million units in the quarter, driven by a record of more than 400 million Bluetooth, Wi-Fi and cellular IoT combined shipments

|

| |

●

|

Strategic licensing deals signed with satellite OEM for 5G-Advanced platform and smartphone OEM for Spatial Audio software

|

| |

●

|

First licensing deal signed for NeuPro-Nano embedded AI NPU targeting consumer AIoT

|

| |

●

|

Raises financial guidance for full year 2024

|

| |

●

|

Announces expansion of existing share repurchase program with an additional 700,000 shares

|

ROCKVILLE, MD., November 7, 2024 – Ceva, Inc. (NASDAQ: CEVA), the leading licensor of silicon and software IP that enables Smart Edge devices to connect, sense and infer data more reliably and efficiently, today announced its financial results for the third quarter ended September 30, 2024. Financial results for the third quarter ended September 30, 2023, reflect Ceva’s continuing operations only, with the Intrinsix business reflected as a discontinued operation, unless otherwise noted.

Operational Highlights:

|

●

|

Released second NeuPro-Nano embedded AI NPU - NPN64, available for licensing

|

|

●

|

New cellular IoT industrial module launched by STMicroelectronics based on Ceva cellular IoT platform

|

|

●

|

New AI/ML MCU family launched by Alif Semiconductor based on Ceva Bluetooth Low Energy and 802.15.4 IPs

|

|

●

|

Partnership with Edge Impulse to enable faster, easier development of edge AI applications on Ceva-NeuPro NPUs

|

Total revenue for the third quarter of 2024 was $27.2 million, up 13% compared to $24.1 million reported for the third quarter of 2023. Licensing and related revenue for the third quarter of 2024 was $15.6 million, up 12% compared to $13.9 million reported for the same quarter a year ago. Royalty revenue for the third quarter of 2024 was $11.6 million, the fourth sequential year-over-year increase, and up 15% compared to $10.1 million reported for the same quarter a year ago.

Amir Panush, Chief Executive Officer of Ceva, commented: “We delivered another strong performance in the third quarter, driven by double-digit year-over-year revenue growth for both licensing and royalties. We continue to experience exceptional demand for our IP portfolio, as evidenced by strategic OEM customer deals for 5G-Advanced satellite communications and spatial audio for headphones and earbuds. We also achieved a significant milestone in embedded AI, with our first licensing deal signed for our NeuPro-Nano NPU targeting consumer AIoT devices. In royalties, strength in the consumer and industrial markets drove Ceva-powered shipments to the second highest quarter on record, including record combined shipments of Bluetooth, Wi-Fi and cellular IoT devices of more than 400 million units.”

During the quarter, 10 IP licensing agreements were concluded, targeting a wide range of end markets and applications, including embedded AI solutions for consumer AIoT devices, 5G-Advanced satellite broadband for infrastructure and terminals, 5G for cellular IoT and V2X, spatial audio for headphones and TWS earbuds, and Bluetooth, Wi-Fi and UWB connectivity for wearables and hearables. Three of the deals signed in the quarter were with OEMs and three deals signed were with first-time customers.

GAAP gross margin for the third quarter of 2024 was 85%, as compared to 90% in the third quarter of 2023. GAAP operating loss for the third quarter of 2024 was $2.6 million, as compared to a GAAP operating loss of $2.7 million for the same period in 2023. GAAP net loss for the third quarter of 2024 was $1.3 million, as compared to a GAAP net loss of $2.8 million reported for the same period in 2023. GAAP diluted loss per share for the third quarter of 2024 was $0.06, as compared to GAAP diluted loss per share of $0.12 for the same period in 2023.

GAAP net loss with the discontinued operation for the third quarter of 2023 was $5.0 million. GAAP diluted loss per share with the discontinued operation for the third quarter of 2023 was $0.21.

Non-GAAP gross margin for the third quarter of 2024 was 87%, as compared to 92% for the same period in 2023. Non-GAAP operating income for the third quarter of 2024 increased 30% to $2.1 million, as compared to non-GAAP operating income of $1.6 million reported for the third quarter of 2023. Non-GAAP net income and diluted income per share for the third quarter of 2024 increased 137% and 133% to $3.4 million and $0.14, respectively, compared with non-GAAP net income and diluted income per share of $1.4 million and $0.06, respectively, reported for the third quarter of 2023.

Non-GAAP net income, including the discontinued operation for the third quarter of 2023, was $0.4 million. Non-GAAP diluted income per share, including the discontinued operation for the third quarter of 2023, was $0.02.

Yaniv Arieli, Chief Financial Officer of Ceva, stated: “Our robust third quarter earnings more than doubled our non-GAAP net income and diluted income per share year-over-year. For the full year, we now expect overall revenues to be higher than previous guidance, at a new range of 7%-9% growth, enabling us to double our non-GAAP fully diluted EPS year-over-year. We continued to buy back the company’s stock during the quarter, repurchasing approximately 186,000 shares for approximately $4.2 million under our stock repurchase program. Furthermore, the Ceva Board of Directors today authorized the expansion of the company's share repurchase program with an additional 700,000 shares of common stock available for repurchase, bringing the total shares available for repurchase to approximately 1 million. At the end of the quarter, our cash and cash equivalent balances, marketable securities and bank deposits were approximately $158 million, ensuring we are well-positioned to explore opportunities for non-organic growth.”

Ceva Conference Call

On November 7, 2024, Ceva management will conduct a conference call at 8:30 a.m. Eastern Time to discuss the operating performance for the quarter.

The conference call will be available via the following dial in numbers:

| |

●

|

U.S. Participants : Dial 1-844-435-0316 (Access Code : Ceva)

|

| |

●

|

International Participants: Dial +1-412-317-6365 (Access Code: Ceva)

|

The conference call will also be available live via webcast at the following link: https://app.webinar.net/pyMYRB4aBXo. Please go to the web site at least fifteen minutes prior to the call to register.

For those who cannot access the live broadcast, a replay will be available by dialing +1-877-344-7529 or +1-412-317-0088 (access code: 2106460) from one hour after the end of the call until 9:00 a.m. (Eastern Time) on November 14, 2024. The replay will also be available at Ceva's web site www.ceva-ip.com.

Forward Looking Statements

This press release contains forward-looking statements that involve risks and uncertainties, as well as assumptions that if they materialize or prove incorrect, could cause the results of Ceva to differ materially from those expressed or implied by such forward-looking statements and assumptions. Forward-looking statements include statements regarding customer demand for Ceva’s IP portfolio, Ceva’s positioning for non-organic growth given its current assets and updated guidance for the full year 2024. The risks, uncertainties and assumptions that could cause differing Ceva results include: the effect of intense industry competition; the ability of Ceva's technologies and products incorporating Ceva's technologies to achieve market acceptance; Ceva's ability to meet changing needs of end-users and evolving market demands; the cyclical nature of and general economic conditions in the semiconductor industry; Ceva's ability to diversify its royalty streams and license revenues; Ceva's ability to continue to generate significant revenues from the handset baseband market and to penetrate new markets; instability and disruptions related to the ongoing Israel-Gaza conflict; and general market conditions and other risks relating to Ceva's business, including, but not limited to, those that are described from time to time in our SEC filings. Ceva assumes no obligation to update any forward-looking statements or information, which speak as of their respective dates.

Non-GAAP Financial Measures

Non-GAAP gross margin for both the third quarter of 2024 and 2023 excluded: (a) equity-based compensation expenses of $0.2 million and (b) amortization of acquired intangibles of $0.1 million.

Non-GAAP operating income for the third quarter of 2024 excluded: (a) equity-based compensation expenses of $4.2 million, (b) the impact of the amortization of acquired intangibles of $0.3 million and (c) $0.3 million of costs associated with business acquisitions.

Non-GAAP operating income for the third quarter of 2023 excluded: (a) equity-based compensation expenses of $4.0 million, (b) the impact of the amortization of acquired intangibles of $0.3 million and (c) $0.1 million of costs associated with business acquisitions.

Non-GAAP net income and diluted income per share for the third quarter of 2024 excluded: (a) equity-based compensation expenses of $4.2 million, (b) the impact of the amortization of acquired intangibles of $0.3 million, (c) $0.3 million of costs associated with business acquisitions and (d) Income of $0.02 million associated with the remeasurement of marketable equity securities. Non-GAAP net income and diluted income per share for the third quarter of 2023 excluded: (a) equity-based compensation expenses of $4.0 million, (b) the impact of the amortization of acquired intangibles of $0.3 million, (c) $0.1 million of costs associated with business acquisitions and (d) Income of $0.2 million associated with the remeasurement of marketable equity securities.

Non-GAAP net income including the discontinued operation and diluted income per share including the discontinued operation for the third quarter of 2023 excluded: (a) equity-based compensation expenses of $4.0 million, (b) the impact of the amortization of acquired intangibles of $0.3 million, (c) $0.1 million of costs associated with business acquisitions, (d) Income of $0.2 million associated with the remeasurement of marketable equity securities and (e) $1.2 million loss associated with discontinued operations.

About Ceva, Inc.

At Ceva, we are passionate about bringing new levels of innovation to the smart edge. Our wireless communications, sensing and Edge AI technologies are at the heart of some of today’s most advanced smart edge products. From wireless connectivity IPs (Bluetooth, Wi-Fi, UWB and 5G platform IP), to scalable Edge AI NPU IPs and sensor fusion solutions, we have the broadest portfolio of IP to connect, sense and infer data more reliably and efficiently. We deliver differentiated solutions that combine outstanding performance at ultra-low power within a very small silicon footprint. Our goal is simple – to deliver the silicon and software IP to enable a smarter, safer, and more interconnected world. This philosophy is in practice today, with Ceva powering more than 18 billion of the world’s most innovative smart edge products from AI-infused smartwatches, IoT devices and wearables to autonomous vehicles and 5G mobile networks.

Our headquarters are in Rockville, Maryland with a global customer base supported by operations worldwide. Our employees are among the leading experts in their areas of specialty, consistently solving the most complex design challenges, enabling our customers to bring innovative smart edge products to market.

Ceva is a sustainability- and environmentally-conscious company, adhering to our Code of Business Conduct and Ethics. As such, we emphasize and focus on environmental preservation, recycling, the welfare of our employees and privacy – which we promote on a corporate level. At Ceva, we are committed to social responsibility, values of preservation and consciousness towards these purposes.

Ceva: Powering the Smart Edge™

Visit us at www.ceva-ip.com and follow us on LinkedIn, X, YouTube, Facebook, and Instagram.

For more information, contact:

|

Yaniv Arieli

Ceva, Inc.

CFO

+1.650.417.7941

yaniv.arieli@ceva-ip.com

|

Richard Kingston

Ceva, Inc.

VP Market Intelligence, Investor & Public Relations

+1.650.417.7976

richard.kingston@ceva-ip.com

|

Ceva, Inc. AND ITS SUBSIDIARIES

INTERIM CONDENSED CONSOLIDATED STATEMENTS OF LOSS – U.S. GAAP

U.S. dollars in thousands, except per share data

| |

|

Three months ended

|

|

|

Nine months ended

|

|

| |

|

September 30,

|

|

|

September 30,

|

|

| |

|

2024

|

|

|

2023

|

|

|

2024

|

|

|

2023

|

|

| |

|

Unaudited

|

|

|

Unaudited

|

|

|

Unaudited

|

|

|

Unaudited

|

|

|

Revenues:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Licensing and related revenues

|

|

$ |

15,574 |

|

|

$ |

13,940 |

|

|

$ |

44,266 |

|

|

$ |

45,739 |

|

|

Royalties

|

|

|

11,633 |

|

|

|

10,133 |

|

|

|

33,450 |

|

|

|

27,518 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total revenues

|

|

|

27,207 |

|

|

|

24,073 |

|

|

|

77,716 |

|

|

|

73,257 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cost of revenues

|

|

|

3,961 |

|

|

|

2,357 |

|

|

|

9,397 |

|

|

|

9,389 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Gross profit

|

|

|

23,246 |

|

|

|

21,716 |

|

|

|

68,319 |

|

|

|

63,868 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Operating expenses:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Research and development, net

|

|

|

17,990 |

|

|

|

17,814 |

|

|

|

54,739 |

|

|

|

54,544 |

|

|

Sales and marketing

|

|

|

3,088 |

|

|

|

2,862 |

|

|

|

8,999 |

|

|

|

8,213 |

|

|

General and administrative

|

|

|

4,642 |

|

|

|

3,608 |

|

|

|

11,751 |

|

|

|

11,346 |

|

|

Amortization of intangible assets

|

|

|

150 |

|

|

|

149 |

|

|

|

449 |

|

|

|

445 |

|

|

Total operating expenses

|

|

|

25,870 |

|

|

|

24,433 |

|

|

|

75,938 |

|

|

|

74,548 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Operating loss

|

|

|

(2,624 |

) |

|

|

(2,717 |

) |

|

|

(7,619 |

) |

|

|

(10,680 |

) |

|

Financial income, net

|

|

|

2,299 |

|

|

|

924 |

|

|

|

4,962 |

|

|

|

3,497 |

|

|

Reevaluation of marketable equity securities

|

|

|

21 |

|

|

|

160 |

|

|

|

(97 |

) |

|

|

(76 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Loss before taxes on income

|

|

|

(304 |

) |

|

|

(1,633 |

) |

|

|

(2,754 |

) |

|

|

(7,259 |

) |

|

Income tax expense

|

|

|

1,007 |

|

|

|

1,117 |

|

|

|

4,296 |

|

|

|

3,080 |

|

|

Net loss from continuing operation

|

|

|

(1,311 |

) |

|

|

(2,750 |

) |

|

|

(7,050 |

) |

|

|

(10,339 |

) |

|

Discontinued operation

|

|

|

— |

|

|

|

(2,207 |

) |

|

|

— |

|

|

|

(5,308 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net loss

|

|

$ |

(1,311 |

) |

|

$ |

(4,957 |

) |

|

$ |

(7,050 |

) |

|

$ |

(15,647 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic and diluted net loss per share:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Continuing operation

|

|

$ |

(0.06 |

) |

|

$ |

(0.12 |

) |

|

$ |

(0.30 |

) |

|

$ |

(0.44 |

) |

|

Discontinued operation

|

|

|

— |

|

|

|

(0.09 |

) |

|

|

— |

|

|

|

(0.23 |

) |

|

Basic and diluted net loss per share

|

|

$ |

(0.06 |

) |

|

$ |

(0.21 |

) |

|

$ |

(0.30 |

) |

|

$ |

(0.67 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Weighted-average shares used to compute net loss per share (in thousands):

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic and diluted

|

|

|

23,678 |

|

|

|

23,605 |

|

|

|

23,605 |

|

|

|

23,473 |

|

Unaudited Reconciliation of GAAP to Non-GAAP Financial Measures

U.S. Dollars in thousands, except per share amounts

| |

|

Three months ended

|

|

|

Nine months ended

|

|

| |

|

September 30,

|

|

|

September 30,

|

|

| |

|

2024

|

|

|

2023

|

|

|

2024

|

|

|

2023

|

|

| |

|

Unaudited

|

|

|

Unaudited

|

|

|

Unaudited

|

|

|

Unaudited

|

|

|

GAAP net loss

|

|

$ |

(1,311 |

) |

|

$ |

(4,957 |

) |

|

$ |

(7,050 |

) |

|

$ |

(15,647 |

) |

|

Equity-based compensation expense included in cost of revenues

|

|

|

176 |

|

|

|

216 |

|

|

|

570 |

|

|

|

636 |

|

|

Equity-based compensation expense included in research and development expenses

|

|

|

2,421 |

|

|

|

2,257 |

|

|

|

6,866 |

|

|

|

6,703 |

|

|

Equity-based compensation expense included in sales and marketing expenses

|

|

|

491 |

|

|

|

478 |

|

|

|

1,307 |

|

|

|

1,305 |

|

|

Equity-based compensation expense included in general and administrative expenses

|

|

|

1,120 |

|

|

|

1,018 |

|

|

|

2,936 |

|

|

|

2,787 |

|

|

Amortization of intangible assets related to acquisition of businesses

|

|

|

279 |

|

|

|

278 |

|

|

|

835 |

|

|

|

753 |

|

|

Costs associated with business and asset acquisitions

|

|

|

251 |

|

|

|

100 |

|

|

|

783 |

|

|

|

195 |

|

|

(Income) loss associated with the remeasurement of marketable equity securities

|

|

|

(21 |

) |

|

|

(160 |

) |

|

|

97 |

|

|

|

76 |

|

|

Non-GAAP from discontinued operations

|

|

|

— |

|

|

|

1,184 |

|

|

|

— |

|

|

|

3,233 |

|

|

Non-GAAP net income

|

|

$ |

3,406 |

|

|

$ |

414 |

|

|

$ |

6,344 |

|

|

$ |

41 |

|

|

GAAP weighted-average number of Common Stock used in computation of diluted net loss and loss per share (in thousands)

|

|

|

23,678 |

|

|

|

23,605 |

|

|

|

23,605 |

|

|

|

23,473 |

|

|

Weighted-average number of shares related to outstanding stock-based awards (in thousands)

|

|

|

1,544 |

|

|

|

1,304 |

|

|

|

1,462 |

|

|

|

1,172 |

|

|

Weighted-average number of Common Stock used in computation of diluted earnings per share, excluding the above (in thousands)

|

|

|

25,222 |

|

|

|

24,909 |

|

|

|

25,067 |

|

|

|

24,645 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

GAAP diluted loss per share

|

|

$ |

(0.06 |

) |

|

$ |

(0.21 |

) |

|

$ |

(0.30 |

) |

|

$ |

(0.67 |

) |

|

Equity-based compensation expense

|

|

$ |

0.18 |

|

|

$ |

0.17 |

|

|

$ |

0.48 |

|

|

$ |

0.49 |

|

|

Amortization of intangible assets related to acquisition of businesses

|

|

$ |

0.01 |

|

|

$ |

0.01 |

|

|

$ |

0.04 |

|

|

$ |

0.03 |

|

|

Costs associated with business and asset acquisitions

|

|

$ |

0.01 |

|

|

$ |

0.00 |

|

|

$ |

0.03 |

|

|

$ |

0.01 |

|

|

Income (loss) associated with the remeasurement of marketable equity securities

|

|

$ |

0.00 |

|

|

$ |

0.00 |

|

|

$ |

0.00 |

|

|

$ |

0.00 |

|

|

Non-GAAP from discontinued operation

|

|

|

— |

|

|

$ |

0.05 |

|

|

|

— |

|

|

$ |

0.14 |

|

|

Non-GAAP diluted earnings per share

|

|

$ |

0.14 |

|

|

$ |

0.02 |

|

|

$ |

0.25 |

|

|

$ |

0.00 |

|

| |

|

Three months ended

|

|

|

Nine months ended

|

|

| |

|

September 30,

|

|

|

September 30,

|

|

| |

|

2024

|

|

|

2023

|

|

|

2024

|

|

|

2023

|

|

| |

|

Unaudited

|

|

|

Unaudited

|

|

|

Unaudited

|

|

|

Unaudited

|

|

|

GAAP Operating loss

|

|

$ |

(2,624 |

) |

|

$ |

(2,717 |

) |

|

$ |

(7,619 |

) |

|

$ |

(10,680 |

) |

|

Equity-based compensation expense included in cost of revenues

|

|

|

176 |

|

|

|

216 |

|

|

|

570 |

|

|

|

636 |

|

|

Equity-based compensation expense included in research and development expenses

|

|

|

2,421 |

|

|

|

2,257 |

|

|

|

6,866 |

|

|

|

6,703 |

|

|

Equity-based compensation expense included in sales and marketing expenses

|

|

|

491 |

|

|

|

478 |

|

|

|

1,307 |

|

|

|

1,305 |

|

|

Equity-based compensation expense included in general and administrative expenses

|

|

|

1,120 |

|

|

|

1,018 |

|

|

|

2,936 |

|

|

|

2,787 |

|

|

Amortization of intangible assets related to acquisition of businesses

|

|

|

279 |

|

|

|

278 |

|

|

|

835 |

|

|

|

753 |

|

|

Costs associated with business and asset acquisitions

|

|

|

251 |

|

|

|

100 |

|

|

|

783 |

|

|

|

195 |

|

|

Total non-GAAP Operating Income

|

|

$ |

2,114 |

|

|

$ |

1,630 |

|

|

$ |

5,678 |

|

|

$ |

1,699 |

|

| |

|

Three months ended

|

|

|

Nine months ended

|

|

| |

|

September 30,

|

|

|

September 30,

|

|

| |

|

2024

|

|

|

2023

|

|

|

2024

|

|

|

2023

|

|

| |

|

Unaudited

|

|

|

Unaudited

|

|

|

Unaudited

|

|

|

Unaudited

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

GAAP Gross Profit

|

|

$ |

23,246 |

|

|

$ |

21,716 |

|

|

$ |

68,319 |

|

|

$ |

63,868 |

|

|

GAAP Gross Margin

|

|

|

85 |

% |

|

|

90 |

% |

|

|

88 |

% |

|

|

87 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Equity-based compensation expense included in cost of revenues

|

|

|

176 |

|

|

|

216 |

|

|

|

570 |

|

|

|

636 |

|

|

Amortization of intangible assets related to acquisition of businesses

|

|

|

129 |

|

|

|

129 |

|

|

|

386 |

|

|

|

308 |

|

|

Total Non-GAAP Gross profit

|

|

$ |

23,551 |

|

|

$ |

22,061 |

|

|

$ |

69,275 |

|

|

$ |

64,812 |

|

|

Non-GAAP Gross Margin

|

|

|

87 |

% |

|

|

92 |

% |

|

|

89 |

% |

|

|

88 |

% |

Ceva, Inc. AND ITS SUBSIDIARIES

INTERIM CONDENSED CONSOLIDATED BALANCE SHEETS

(U.S. Dollars in thousands)

| |

|

September 30,

|

|

|

December 31,

|

|

| |

|

2024

|

|

|

2023 (*)

|

|

| |

|

Unaudited

|

|

|

Unaudited

|

|

|

ASSETS

|

|

|

|

|

|

|

|

|

|

Current assets:

|

|

|

|

|

|

|

|

|

|

Cash and cash equivalents

|

|

$ |

13,228 |

|

|

$ |

23,287 |

|

|

Marketable securities and short-term bank deposits

|

|

|

144,884 |

|

|

|

143,251 |

|

|

Trade receivables, net

|

|

|

15,250 |

|

|

|

8,433 |

|

|

Unbilled receivables

|

|

|

23,380 |

|

|

|

21,874 |

|

|

Prepaid expenses and other current assets

|

|

|

13,970 |

|

|

|

12,526 |

|

|

Total current assets

|

|

|

210,712 |

|

|

|

209,371 |

|

|

Long-term assets:

|

|

|

|

|

|

|

|

|

|

Severance pay fund

|

|

|

6,851 |

|

|

|

7,070 |

|

|

Deferred tax assets, net

|

|

|

1,685 |

|

|

|

1,609 |

|

|

Property and equipment, net

|

|

|

6,875 |

|

|

|

6,732 |

|

|

Operating lease right-of-use assets

|

|

|

5,625 |

|

|

|

6,978 |

|

|

Investment in marketable equity securities

|

|

|

309 |

|

|

|

406 |

|

|

Goodwill

|

|

|

58,308 |

|

|

|

58,308 |

|

|

Intangible assets, net

|

|

|

2,132 |

|

|

|

2,967 |

|

|

Other long-term assets

|

|

|

12,394 |

|

|

|

10,644 |

|

|

Total assets

|

|

$ |

304,891 |

|

|

$ |

304,085 |

|

| |

|

|

|

|

|

|

|

|

|

LIABILITIES AND STOCKHOLDERS’ EQUITY

|

|

|

|

|

|

|

|

|

|

Current liabilities:

|

|

|

|

|

|

|

|

|

|

Trade payables

|

|

$ |

1,960 |

|

|

$ |

1,154 |

|

|

Deferred revenues

|

|

|

3,418 |

|

|

|

3,018 |

|

|

Accrued expenses and other payables

|

|

|

19,770 |

|

|

|

20,202 |

|

|

Operating lease liabilities

|

|

|

2,571 |

|

|

|

2,513 |

|

|

Total current liabilities

|

|

|

27,719 |

|

|

|

26,887 |

|

|

Long-term liabilities:

|

|

|

|

|

|

|

|

|

|

Accrued severance pay

|

|

|

7,304 |

|

|

|

7,524 |

|

|

Operating lease liabilities

|

|

|

2,627 |

|

|

|

3,943 |

|

|

Other accrued liabilities

|

|

|

1,471 |

|

|

|

1,390 |

|

|

Total liabilities

|

|

|

39,121 |

|

|

|

39,744 |

|

|

Stockholders’ equity:

|

|

|

|

|

|

|

|

|

|

Common stock

|

|

|

24 |

|

|

|

23 |

|

|

Additional paid in-capital

|

|

|

256,685 |

|

|

|

252,100 |

|

|

Treasury stock

|

|

|

(2,943 |

) |

|

|

(5,620 |

) |

|

Accumulated other comprehensive loss

|

|

|

(956 |

) |

|

|

(2,329 |

) |

|

Retained earnings

|

|

|

12,960 |

|

|

|

20,167 |

|

|

Total stockholders’ equity

|

|

|

265,770 |

|

|

|

264,341 |

|

|

Total liabilities and stockholders’ equity

|

|

$ |

304,891 |

|

|

$ |

304,085 |

|

(*) Derived from audited financial statements.

Exhibit 99.2

| Ceva, Inc. Q3 2024 Financial Results Conference Call - Prepared Remarks :: November 7, 2024 |

|

Ceva, Inc.

Third Quarter 2024 Financial Results Conference Call

Prepared Remarks of Amir Panush, Chief Executive Officer and

Yaniv Arieli, Chief Financial Officer

November 7, 2024

8:30 A.M. Eastern

Richard

Good morning everyone and welcome to Ceva’s third quarter 2024 earnings conference call. Joining me today on the call are Amir Panush, Chief Executive Officer, and Yaniv Arieli, Chief Financial Officer of Ceva.

Forward Looking Statements and Non-GAAP Financial Measures

Before handing over to Amir, I would like to remind everyone that today’s discussion contains forward-looking statements that involve risks and uncertainties, as well as assumptions that if they materialize or prove incorrect, could cause the results of Ceva to differ materially from those expressed or implied by such forward-looking statements and assumptions. Forward-looking statements include statements regarding our market positioning, strategy and growth opportunities, market trends and dynamics, expectations regarding demand for and benefits of our technologies, our sales pipeline and backlog, our financial goals and guidance regarding future performance, and our expectations regarding utilization of our stock repurchase program. Ceva assumes no obligation to update any forward-looking statements or information, which speak as of their respective dates.

In addition, following the divestment of the Intrinsix business, financial results from Intrinsix were transitioned to a discontinued operation beginning in the third quarter of 2023, and all prior period financial results have been recast accordingly. We will also be discussing certain non-GAAP financial measures which we believe provide a more meaningful analysis of our core operating results and comparison of quarterly results. A reconciliation of non-GAAP financial measures is included in the earnings release we issued this morning and in the SEC filings section of our investors relations website at investors.ceva-ip.com.

| Ceva, Inc. Q3 2024 Financial Results Conference Call - Prepared Remarks :: November 7, 2024 |

|

With that said, I’d like to turn the call over to Amir who will review our business performance for the quarter and provide some insight into our ongoing business. Amir;

Amir

Thank you, Richard. Welcome everyone and thank you for joining us today. Our third quarter delivered another impressive consecutive performance, executing effectively against our strategic plan and exceeding market expectations. Our results surpassed targets, with both top-line revenue growth and non-GAAP fully diluted EPS coming in above projections.

Total revenue for the quarter came in at $27.2 million, up 13% year-over-year, benefiting from our innovative product offerings to the market and positive tailwinds in both our licensing and royalty businesses. Our backlog and pipeline continue to improve and we’re in a healthy position as we head into the fourth quarter and 2025. As a result, we are raising our guidance for the full year 2024, which Yaniv will elaborate on later in the call.

In licensing, the third quarter produced several important milestones for Ceva that reinforce our strategy of delivering leading-edge IP that enables smart edge devices to connect, sense and infer data. Highlights include the first licensing deal for our NeuPro-Nano embedded AI NPU, multiple deals for our PentaG 5G-Advanced Wide Access Network and Satellite communications platform, and a high-profile smartphone OEM customer for our RealSpace spatial audio software. Overall, licensing revenue came in at $15.6 million, up 12% year-over-year, with 10 deals completed in the quarter across all geographies, and with multiple OEM customers. In royalties, the momentum in the consumer and industrial end markets continued, driving 15% year-over-year royalty revenue growth to $11.6 million, and year-over-year royalty revenue growth for the fourth successive quarter.

Before I provide more color on our business, I want to reiterate that we are steadfast in our belief that our broad IP portfolio is highly synergistic with the most pressing needs of semiconductor companies and OEMs as they develop their smart edge products and rely on our unique IP to advance and augment their internal developments. The level of global customer engagement we are experiencing today is the highest I have seen during my time with Ceva and provides us with tremendous insights and opportunities to partner with some of the world’s leading fabless companies and brands across their short and long-term roadmaps. Our technology leadership across multiple core disciplines and commitment to long term partnership is key to winning licensing deals that garner higher licensing fees, improved royalty rates and overall better economics.

| Ceva, Inc. Q3 2024 Financial Results Conference Call - Prepared Remarks :: November 7, 2024 |

|

The third quarter provided multiple proof points that our “connect, sense and infer” strategy is operating in full flow, with deals signed across our IP portfolio and the continuous trend of customers licensing multiple technologies from our portfolio for their products.

In connect, we expanded our market leadership and customer base in Bluetooth, Wi-Fi and UWB, with new deals across all platforms, including our newest Bluetooth 6 IP. More significantly, we signed a strategic licensing agreement with an innovative OEM for its development of a 5G-Advanced modem based on our PentaG 5G-Advanced Wide Access Network and Satellite communications platform. This OEM intends to build a transformative peer-to-peer satellite network constellation that will enable ubiquitous 5G communications globally and bring cost-effective cellular IoT services to the masses. As the only IP provider with a comprehensive modem platform for 5G-Advanced communications, we are the partner-of-choice for any systems company or OEM looking to develop advanced wireless communications ASICs. Our leading-edge IP and deep wireless expertise significantly reduce the entry barriers for the development of these highly complex chip designs. The economics and scale of this deal reflect the trust they have placed in Ceva for this project, and we are incredibly proud to partner with this OEM to help make their vision a reality. In addition to this strategic deal, and illustrative of the broad market opportunities we are seeing for our 5G-Advanced IPs, we signed two other agreements this quarter – one with a leader in 5G cellular IoT modems and another with an automotive semiconductor for their next-generation V2X vehicle-to-everything communications chipset. These deals, combined with the two large deals signed last quarter and our robust pipeline for 5G-Advanced IP cement Ceva’s position as the leader in this market. Our market leadership translates into higher license fees per deal, higher royalties per unit and creates sticky, long-term relationships that are incredibly beneficial to Ceva’s business.

In sense, we continued to expand the market penetration for our RealSpace spatial audio software. We signed a new licensing deal with a high-profile smartphone OEM to include RealSpace in multiple SKUs of headphones and TWS earbuds, with the first products expected to launch in the first half of 2025. This OEM specializes in developing smartphones and accessories with incredible detail for aesthetic design, while delivering a unique user experience. Overall, we are experiencing increasing interest in our RealSpace software in multiple categories of products due to the excellent user experience based on our superior spatial audio and head tracking technology. Our ability to deliver this software on embedded platforms across multiple architectures and on higher-end smartphone and PC platforms is a key driver for this demand. In the case of this OEM, our superior solution quality, reflected in the tight integration of our spatial audio rendering and head tracking technologies, and coupled with our capability to efficiently support the full product integration and tuning, helped us to secure this deal. As I have mentioned previously, the royalties for software licensed directly to OEMs are at the higher end of our overall range, and the customers get to market faster than typical semiconductor customers involved in lengthy chip design programs.

| Ceva, Inc. Q3 2024 Financial Results Conference Call - Prepared Remarks :: November 7, 2024 |

|

In inference, while training neural networks in the cloud is the most practical way of developing new AI models, inferencing is the path to monetizing these investments. The preferred way to inference is to process it on the smart edge device itself, due to the near-zero marginal cost of performing each query, in addition to other benefits such as lower latency and privacy. From laptops, smartphones and self-driving cars, scaling all the way down to tiny neural networks on power-constrained IoT devices, the industry is experiencing unprecedented demand for power and cost-efficient solutions to run AI on-device.

In line with this trend, we secured our first licensing deal this quarter for our NeuPro-Nano NPU, which was only introduced in June of this year — a significant milestone for our embedded AI product line. Embedded AI is highly synergistic with our connectivity and sensing offerings, from the high-volume end markets we serve to the customers we work with and through the growing need for connectivity, sensing and AI to be increasingly integrated into every smart edge device. This specific customer is an existing licensee of our Bluetooth Dual Mode IP, which it ships in high volume today in their wireless audio chips. This customer required a highly efficient NPU to add to their products for audio and other embedded AI processing in order to increase performance and add new AI-based features. NeuPro-Nano was the outstanding choice for them due to its single-core, highly efficient architecture that can execute CPU, DSP and Neural Network workloads with high performance and low energy utilization, all in a small area. This deal is indicative of our belief that many of our existing connectivity customers will require an NPU for their product roadmaps, and is reflected in multiple opportunities in our pipeline. Through our proven relationships based on market success together, we are very well positioned to capitalize on this and license our NeuPro-Nano IPs, which leads to higher royalties on each device.

| Ceva, Inc. Q3 2024 Financial Results Conference Call - Prepared Remarks :: November 7, 2024 |

|

In addition to signing the first licensee in the third quarter, we also achieved other important milestones for Embedded AI – we delivered a second, higher performance implementation of NeuPro-Nano, which is available for customers now, giving them another option for their NPU requirements. And we also expanded access for AI developers to rapidly develop, train and deploy advanced embedded machine learning applications for the NeuPro NPUs via a partnership with Edge Impulse whose Platform is widely used in the AI developer community for IoT devices. These developments are part of our strategy to leverage our significant investment in AI to create a strong growth engine for Ceva.

Overall, I am incredibly pleased with licensing performance in the quarter, and through the key deals signed in each domain we specialize in, there is a clear indication that our strategy is working and resonating with our customers, worldwide.

Turning to royalties, continued strength in consumer and industrial IoT end markets helped us to achieve 15% year-over-year royalty revenue growth and delivered the second-highest quarterly unit shipments in Ceva’s history of 522 million units. Cellular IoT units were at an all-time record high, while Bluetooth and Wi-Fi continued to be very robust. Overall, combined shipments of Bluetooth, Wi-Fi and cellular IoT surpassed 400 million units in a quarter for the first time, an impressive milestone for our IoT connectivity product line. Also, we drove sequential and year-over-year growth of TVs and PCs powered by our sensor fusion software. Smartphone shipment volumes were down moderately on a sequential and year-over-year basis, and muted 5G RAN shipments reflected the soft environment for 5G operator CAPEX this year. Of note, we saw several of our customers ship record volumes of their Ceva-powered products, reflecting a combination of improved demand and continued market share gains, particularly in the wireless connectivity space. Overall, I remain very confident in the resilience of our royalty business, with many different customers and end markets contributing to the fourth sequential quarter of year-over-year royalty growth. Our royalty pipeline continues to show strong momentum, with a growing number of customers preparing to launch Ceva-powered products, spanning wireless combo chips, new 5G and cellular IoT use cases, vision and sensor fusion for ADAS systems and spatial audio software, to name just a few.

| Ceva, Inc. Q3 2024 Financial Results Conference Call - Prepared Remarks :: November 7, 2024 |

|

Now I will turn the call over to Yaniv for the financials.

Yaniv

Thank you, Amir. I’ll now start by reviewing the results of our operations for the third quarter of 2024.

Revenue for the third quarter was $27.2 million, up 13% compared to $24.1 million for the same quarter last year. The revenue breakdown is as follows:

Licensing and related revenue was $15.6 million, reflecting 57% of total revenues, increased 12% year-over-year.

Royalty revenue was $11.6 million, reflecting 43% of total revenues, increased 15% year-over-year.

Gross margins came below our guidance, 85% on a GAAP and 87% on non-GAAP basis compared to 90% and 92% on GAAP and non-GAAP, respectively, a year ago. This is mainly due to strategically beneficial customization work associated with the key 5G-Advanced deals we signed recently. Our ability to provide the most advanced 5G platform IP together with customization expertise to semiconductors and OEMs is highly compelling and is enabling us to sign deals with higher license fees, higher royalty rates and creates sticky, long-term relationships.

Total GAAP operating expenses for the third quarter were $25.9 million, at the higher end of our guidance, due to slightly higher equity-based compensation.

Total non-GAAP operating expenses for the third quarter, excluding equity-based compensation expenses, amortization of intangibles and related acquisition costs, were $21.4 million, just over the mid-range of our guidance and at the same expense level as the second quarter.

| Ceva, Inc. Q3 2024 Financial Results Conference Call - Prepared Remarks :: November 7, 2024 |

|

Non-GAAP operating margins and income were 8% of revenue and $2.1 million, 14% and 30% higher, than operating margins of 7% and operating income of $1.6 million recorded in the third quarter of 2023, respectively. This plays well with our commitment to increase growth and profitability aligned with new IP developments and disciplined expense growth.

GAAP operating loss for the third quarter of 2024 was $2.6 million, as compared to a GAAP operating loss of $2.7 million for the same period in 2023.

GAAP and non-GAAP taxes were $1.0 million, lower than our guidance and affected by geographies of deals signed.

GAAP net loss for the third quarter of 2024 quarter was $1.3 million and diluted loss per share was 6 cents, as compared to net loss of $2.8 million and diluted loss per share of 12 cents for the same period last year.

Non-GAAP net income and diluted income per share for the third quarter of 2024 increased significantly, by 137% and 133%, to $3.4 million and 14 cents, respectively, as compared to net income of $1.4 million and diluted income per share of 6 cents reported for the same period last year.

With respect to other related data

Shipped units by Ceva licensees during the third quarter of 2024 were 522 million units, up 4% from the third quarter 2023 reported shipments, and the second-highest quarterly shipments in Ceva’s history.

Of the 522 million units reported, 72 million units, or 14%, were for mobile handset modems.

| |

●

|

414 million units were for consumer IoT markets, up 4% from 398 million units in the third quarter of 2023. Of note, royalty revenues for consumer IoT increased 21% year-over-year, due to shipment growth for our higher ASP products.

|

| |

●

|

36 million units were for Industrial IoT markets, up 50% from 24 million in the third quarter of 2023.

|

| Ceva, Inc. Q3 2024 Financial Results Conference Call - Prepared Remarks :: November 7, 2024 |

|

| |

●

|

Bluetooth shipments were 306 million units in the quarter, down slightly by 2% year-over-year.

|

| |

●

|

Cellular IoT shipments were a record all-time high 48 million units, up 37% year-over-year.

|

| |

●

|

Wi-Fi shipments also increased significantly, to 47 million units, up 100% year-over-year.

|

Overall, a strong mix of shipments across our key end markets delivered year-over-year royalty revenue growth for the fourth successive quarter.

As for the balance sheet items

As of September 30, 2024, Ceva’s cash and cash equivalent balances, marketable securities and bank deposits were approximately $158 million. In the third quarter of 2024 we repurchased approximately 186,000 shares for approximately $4.2 million.

Earlier today, our board of directors authorized a new increase of 700,000 shares to the existing 10b-18 repurchase program. As of today, just over 1 million shares are available for repurchase under the repurchase program after giving effect to this expansion. We believe in our future business prospects and intend to take advantage of the program to increase shareholder value.

Our DSO for the third quarter of 2024 is 51 days, better than the 59 days in the prior quarter.

During the third quarter, we generated $0.4 million cash from operating activities, on-going depreciation and amortization was $1.0 million, and purchase of fixed assets was $0.4 million. At the end of the third quarter, our headcount was 431 people, of whom 354 are engineers.

Now for the guidance for the fourth quarter of 2024 and the full year

| |

●

|

As evident from the last two quarters, our annual growth plans progress well. Also, as Amir stated earlier, our backlog and pipeline improved, both for the fourth quarter of 2024 and well as for 2025. Therefore, we expect overall revenues for the year to be higher than the last two guidance’s we provided earlier, and at a new higher range of 7%-9% growth.

|

| Ceva, Inc. Q3 2024 Financial Results Conference Call - Prepared Remarks :: November 7, 2024 |

|

We continue to manage our OPEX closely and implement cost control measures from time to time. This should enable us to double our non-GAAP operating margins and operating profit for 2024 over 2023, and also generate stronger earnings power and double our non-GAAP fully diluted EPS.

As for the fourth quarter

| |

●

|

Total revenue is expected to be $26.5 to $28.5 million.

|

| |

●

|

Gross margin is expected to be approximately 88% on a GAAP basis and 89% on a non-GAAP basis, excluding an aggregate of $0.2 million of equity-based compensation expenses and $0.1 million amortization of acquired intangibles. This is a bit lower than originally expected due to higher allocation of engineering efforts to support key 5G-Advanced customers.

|

| |

●

|

GAAP OPEX is expected to be in the range of $25.2 million to $26.2 million, at the average level of our last 2 quarters. Of our anticipated total operating expenses for the fourth quarter, $3.7 million is expected to be attributable to equity-based compensation expenses, $0.2 million for amortization of acquired intangibles and $0.3 million for expenses related to business acquisition.

|

| |

●

|

Non-GAAP OPEX is expected to be similar to the last two quarters, in the range of $21.0 million to $22.0 million, reflecting our continued expense control and enabling strong earning power.

|

| |

●

|

Net interest income is expected to be approximately $1.2 million.

|

| |

●

|

Taxes are expected to be approximately $1.4 million, pending deal geography closure.

|

| |

●

|

Share count is expected to be 25.3 million shares.

|

| Ceva, Inc. Q3 2024 Financial Results Conference Call - Prepared Remarks :: November 7, 2024 |

|

Operator: You can now open the Q&A session

Closing Remarks: Amir

On behalf of the Ceva team, thank you for joining us today. We delivered another strong quarter, on the back of continued business momentum and increased demand for our IPs. The semiconductor industry has returned to good growth driven by AI, and through our stellar customer base, we are already seeing this growth through our royalty business, with four consecutive quarters of year-over-year growth. And with our leading-edge portfolio of technologies that enable smart edge devices to connect, sense and infer data, we are realizing many licensing opportunities with the world’s leading semiconductor companies and OEMs that ensure we are well positioned to meet our long-term growth objectives. We look forward to meeting many of you during the fourth quarter on the road at investor conferences and non-deal roadshows. Richard, I’ll hand over to you to wrap it up.

Wrap Up: Richard

Thank you Amir. As a reminder, the prepared remarks for this conference call are filed as an exhibit to the Current Report on Form 8-K and accessible through the investor section of our website. With regards to upcoming events, we will be participating in the following conferences:

| |

●

|

13th Annual ROTH Technology Conference, November 20th in New York

|

| |

●

|

Barclays 22nd Annual Global Technology Conference, December 11th in San Francisco

|

| |

●

|

Northland Growth Conference 2024 2.0, December 12th, being held virtually

|

| |

●

|

CES 2025, January 7th to 10th, 2025 in Las Vegas

|

| |

●

|

27th Annual Needham Growth Conference, January 14th and 15th in New York

|

Further information on these events and all events we will be participating in can be found on the investors section of our website.

Thank you and goodbye

Exhibit 99.3

Ceva, Inc. Announces Expansion of Existing Share Repurchase Program

ROCKVILLE, MD., November 7, 2024 - Ceva, Inc. (NASDAQ: CEVA), the leading licensor of silicon and software IP that enables Smart Edge devices to connect, sense and infer data more reliably and efficiently, today announced that its Board of Directors authorized the expansion of the company's share repurchase program with an additional 700,000 shares of common stock available for repurchase. As of September 30, 2024, Ceva had approximately 356,000 shares of common stock available for repurchase under the existing plan, bringing the aggregate to approximately 1,056,000 shares available for repurchase.

Amir Panush, CEO of Ceva, commented: “The share repurchase program expansion reflects the management and Board of Director’s confidence in the ongoing performance of Ceva’s business and long-term strategy to drive profitable growth. Our balance sheet remains strong and ensures we are well positioned to pursue non-organic growth opportunities while also returning capital to our shareholders.”

Under the share repurchase program, shares of the company's common stock may be repurchased from time to time pursuant to Rule 10(b)-18 of the Securities Exchange Act of 1934, as amended outside of periods when the Company's trading window is closed. Such repurchases may be made in the open market or through privately negotiated transactions depending on market conditions, share price, trading volume and other factors.

###

About Ceva, Inc.

At Ceva, we are passionate about bringing new levels of innovation to the smart edge. Our wireless communications, sensing and Edge AI technologies are at the heart of some of today’s most advanced smart edge products. From wireless connectivity IPs (Bluetooth, Wi-Fi, UWB and 5G platform IP), to scalable Edge AI NPU IPs and sensor fusion solutions, we have the broadest portfolio of IP to connect, sense and infer data more reliably and efficiently. We deliver differentiated solutions that combine outstanding performance at ultra-low power within a very small silicon footprint. Our goal is simple – to deliver the silicon and software IP to enable a smarter, safer, and more interconnected world. This philosophy is in practice today, with Ceva powering more than 18 billion of the world’s most innovative smart edge products from AI-infused smartwatches, IoT devices and wearables to autonomous vehicles and 5G mobile networks.

Our headquarters are in Rockville, Maryland with a global customer base supported by operations worldwide. Our employees are among the leading experts in their areas of specialty, consistently solving the most complex design challenges, enabling our customers to bring innovative smart edge products to market.

Ceva is a sustainability- and environmentally-conscious company, adhering to our Code of Business Conduct and Ethics. As such, we emphasize and focus on environmental preservation, recycling, the welfare of our employees and privacy – which we promote on a corporate level. At Ceva, we are committed to social responsibility, values of preservation and consciousness towards these purposes.

Ceva: Powering the Smart Edge™

Visit us at www.ceva-ip.com and follow us on LinkedIn, X, YouTube, Facebook, and Instagram.

Forward Looking Statements

This press release contains forward-looking statements that involve risks and uncertainties, as well as assumptions that if they materialize or prove incorrect, could cause the results of Ceva to differ materially from those expressed or implied by such forward-looking statements and assumptions. Forward-looking statements include Mr. Panush’s statements regarding management and the Board’s confidence in the ongoing performance of Ceva’s business and long-term strategy to drive profitable growth and belief that the strength of Ceva’s balance sheet ensures Ceva is well positioned to pursue non-organic growth opportunities while returning capital to shareholders. The risks, uncertainties and assumptions that could cause differing Ceva results include: the effect of intense industry competition; the ability of Ceva’s technologies and products incorporating Ceva’s technologies to achieve market acceptance; Ceva’s ability to meet changing needs of end-users and evolving market demands; the cyclical nature of and general economic conditions in the semiconductor industry; Ceva’s ability to diversify its royalty streams and license revenues; Ceva’s ability to continue to generate significant revenues from the handset baseband market and to penetrate new markets; instability and disruptions related to the ongoing Israel-Gaza conflict; and general market conditions and other risks relating to Ceva’s business, including, but not limited to, those that are described from time to time in our SEC filings. Ceva assumes no obligation to update any forward-looking statements or information, which speak as of their respective dates.

For more information, contact:

|

Yaniv Arieli

Ceva, Inc.

CFO

+1.650.417.7941

yaniv.arieli@ceva-ip.com

|

Richard Kingston

Ceva, Inc.

VP Market Intelligence, Investor & Public Relations

+1.650.417.7976

richard.kingston@ceva-ip.com

|

v3.24.3

Document And Entity Information

|

Nov. 07, 2024 |

| Document Information [Line Items] |

|

| Entity, Registrant Name |

CEVA, INC.

|

| Document, Type |

8-K

|

| Document, Period End Date |

Nov. 07, 2024

|

| Entity, Incorporation, State or Country Code |

DE

|

| Entity, File Number |

000-49842

|

| Entity, Tax Identification Number |

77-0556376

|

| Entity, Address, Address Line One |

15245 Shady Grove Road, Suite 400

|

| Entity, Address, City or Town |

Rockville

|

| Entity, Address, State or Province |

MD

|

| Entity, Address, Postal Zip Code |

20850

|

| City Area Code |

240

|

| Local Phone Number |

308-8328

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock

|

| Trading Symbol |

CEVA

|

| Security Exchange Name |

NASDAQ

|

| Entity, Emerging Growth Company |

false

|

| Amendment Flag |

false

|

| Entity, Central Index Key |

0001173489

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC