As filed with the U.S. Securities and Exchange

Commission on September 10, 2024

Registration No. 333-281518

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Amendment No. 1 to

FORM F-3

REGISTRATION STATEMENT

UNDER THE SECURITIES ACT OF 1933

BIT

ORIGIN LTD

(Exact name of registrant as specified in its charter)

| Cayman Islands |

N/A |

Not Applicable |

| (State or other jurisdiction |

(Translation of Registrant’s Name |

(I.R.S. Employer |

| of incorporation or organization) |

into English) |

Identification Number) |

27F, Samsung Hub

3 Church Street Singapore 049483

T: 347-556-4747

(Address and telephone number of Registrant’s

principal executive offices)

Cogency Global Inc.

122 East 42nd Street, 18th Floor

New York, NY 10168

(Name, address, and telephone number of agent for

service)

Copies to:

William S. Rosenstadt, Esq.

Mengyi “Jason” Ye, Esq.

Yarona L. Yieh, Esq.

Ortoli Rosenstadt LLP

366 Madison Avenue, 3rd Floor

New York, NY 10017

+1-212-588-0022 – telephone

+1-212-826-9307 – facsimile

Approximate date of commencement of proposed sale to the public: From

time to time after the effective date of this registration statement as determined by the registrant.

If only securities

being registered on this Form are being offered pursuant to dividend or interest reinvestment plans, please check the following box: ¨

If

any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the

Securities Act of 1933, check the following box. x

If

this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the

following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering.

¨

If

this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities

Act registration statement number of the earlier effective registration statement for the same offering. ¨

If

this Form is a registration statement pursuant to General Instruction I.C. or a post-effective amendment thereto that shall become effective

upon filing with the Commission pursuant to Rule 462(e) under the Securities Act, check the following box. ¨

If

this Form is a post-effective amendment to a registration statement filed pursuant to General Instruction I.C. filed to register additional

securities or additional classes of securities pursuant to Rule 413(b) under the Securities Act, check the following box. ¨

Indicate by check mark whether the registrant

is an emerging growth company as defined in Rule 405 of the Securities Act of 1933.

Emerging

growth company ¨

If

an emerging growth company that prepares its financial statements in accordance with U.S. GAAP, indicate by check mark if the registrant

has elected not to use the extended transition period for complying with any new or revised financial accounting standards† provided

pursuant to Section 7(a)(2)(B) of the Securities Act. ¨

† The term “new or revised financial accounting standard”

refers to any update issued by the Financial Accounting Standards Board to its Accounting Standards Codification after April 5, 2012.

The Registrant hereby amends this registration

statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which

specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities

Act of 1933 or until the registration statement shall become effective on such date as the Commission, acting pursuant to said Section

8(a), may determine.

The information in this preliminary

prospectus is not complete and may be changed. The securities may not be sold until the registration statement filed with the Securities

and Exchange Commission is effective. This preliminary prospectus is not an offer to sell these securities and is not soliciting offers

to buy these securities in any state where the offer or sale is not permitted.

| PRELIMINARY PROSPECTUS |

|

SUBJECT TO COMPLETION, DATED SEPTEMBER 10, 2024 |

Bit Origin Ltd

15,062,153 Ordinary Shares Underlying

Senior Secured Convertible Notes

3,545,704 Ordinary Shares Underlying

Warrants

Issuable upon Conversion of Senior Secured

Convertible Notes and Exercise of Outstanding Warrants Sold in Private Placements

This prospectus relates to the resale, from

time to time, by the selling shareholder identified in this prospectus (the “Selling Shareholder”), of 18,607,857

ordinary shares, par value $0.30 per share, of Bit Origin Ltd (“Bit Origin,” “our company,” the

“Company,” “we,” “us,” and “our”), consisting of (i) 11,904,258 ordinary shares (the “Conversion Shares”) issuable upon the conversion of the senior secured convertible

note (the “Initial Note”) issued on December 29, 2023, after the payment of the Amortization Amount (as defined in

the Initial Note) due on each of the initial six Amortization Dates (as defined in the Initial Note) for the Initial Note, (ii) 3,545,704 ordinary shares (the “Warrant Shares”) issuable upon the exercise of the warrants to purchase ordinary shares

(the “Warrants”) issued in a private placement (the “December 2023 Private Placement”) to the Selling

Shareholder pursuant to that certain securities purchase agreement between the Company and the Selling Shareholder, dated December 7,

2023 (the “December 2023 Securities Purchase Agreement”), as further described below under “Recent Financings

- The December 2023 Private Placement” on page 21 of this prospectus; and (iii) 3,157,895 ordinary shares (the “Exchange

Shares,” together with the Conversion Shares, the “Note Shares”) issuable upon the conversion of the senior

secured convertible note (the “Exchange Note,” together with the Initial Note, the “Notes”) issued

on May 31, 2024 to the Selling Shareholder pursuant to that certain exchange agreement (the “Exchange Agreement”)

between the Company and the Selling Shareholder, dated May 31, 2024, as further described below under “Recent Financings - The

May 2024 Private Placement” on page 23 of this prospectus. In this prospectus, the “Shares” refer to the Note

Shares and the Warrant Shares, collectively.

This prospectus also covers any additional ordinary

shares that may become issuable upon any adjustment pursuant to the terms of the Notes and the Warrants issued to the Selling Shareholder

by reason of share splits, share dividends, share combinations, recapitalizations and other events described therein.

The Selling Shareholder, or its respective transferees, pledgees, donees

or other successors-in-interest, may sell the Shares through public or private transactions at prevailing market prices, at prices related

to prevailing market prices or at privately negotiated prices. The Selling Shareholder may sell any, all or none of the securities offered

by this prospectus, and we do not know when or in what amount the Selling Shareholder may sell the Shares hereunder following the effective

date of this registration statement. We provide more information about how the Selling Shareholder may sell the Shares in the section

titled “Plan of Distribution” on page 30.

We are registering the Shares on behalf of the

Selling Shareholder, to be offered and sold by it from time to time. While we will not receive any proceeds from the sale of our ordinary

shares by the Selling Shareholder in the offering described in this prospectus, we will receive proceeds upon the cash exercise of each

of the Warrants. Upon exercise of the Warrants for the 3,545,704 Warrant Shares by payment of cash, we will receive aggregate gross proceeds

of $17,728,520, at the assumed Reset Price of $5.00 per share at the time of exercise. See “Recent Financings - The December 2023

Private Placement” on page 21 of this prospectus for more information. However, we cannot predict when and in what amounts or if

the Warrants will be exercised, and it is possible that the Warrants may expire and never be exercised, in which case we would not receive

any cash proceeds. We have agreed to bear all of the expenses incurred in connection with the registration of the Shares. The Selling

Shareholder will pay or assume discounts, commissions, fees of underwriters, selling brokers or dealer managers and similar expenses,

if any, incurred for the sale of the Shares by the Selling Shareholder. See “Use of Proceeds” on page 27 of this prospectus.

Our ordinary shares are traded on the

Nasdaq Capital Market under the symbol "BTOG". On September 9, 2024, the last reported sales price of our ordinary shares on the

Nasdaq Capital Market was $1.74 per share. During the year immediately prior to the date of this prospectus, the highest and lowest

closing prices were US$1.38 and US$9.35 per share, respectively. We have recently experienced price volatility in our

ordinary shares. See related risk factors in our most recent annual report on Form 20-F.

We are a “foreign private issuer”

under applicable Securities and Exchange Commission rules, and will be subject to reduced public company reporting requirements for this

prospectus and future filings See “Prospectus Summary- Implications of Being a Foreign Private Issuer” on page 17 of this

prospectus.

Investing in our securities being offered pursuant

to this prospectus involves a high degree of risk. You should carefully read and consider the ‘‘Risk Factors’’

section of this prospectus, and risk factors set forth in our most recent annual report on Form 20-F for the year ended June 30, 2023

(the “2023 Annual Report”), along with other reports incorporated by reference herein, and in the applicable prospectus supplement

before you make your investment decision.

Neither the Securities and Exchange Commission,

the Cayman Islands Monetary Authority, nor any state securities commission has approved or disapproved of these securities or determined

if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The date of this prospectus is ,

2024

TABLE OF CONTENTS

You should rely only on the information contained

in this prospectus and any amendment or prospectus supplement to this prospectus, as well as any information incorporated by reference

herein or therein. Neither we, nor the Selling Shareholder, have authorized any other person to provide you with different or additional

information. Neither we, nor the Selling Shareholder, take responsibility for, nor can we provide assurance as to the reliability of,

any other information that others may provide. If anyone provides you with different or inconsistent information, you should not rely

on it. The Selling Shareholder is not making an offer to sell these securities in any jurisdiction where the offer or sale is not permitted.

The information contained in this prospectus, any applicable prospectus supplement or any documents incorporated by reference herein or

therein is accurate only as of the date hereof or thereof or such other date expressly stated herein or therein, and our business, financial

condition, results of operations or prospects may have changed since those dates.

The distribution or possession of this prospectus

in or from certain jurisdictions may be restricted by law. You should inform yourself about and observe any of these restrictions. If

you are in a jurisdiction where offers to sell, or solicitations of offers to purchase, the securities offered by this document are unlawful,

or if you are a person to whom it is unlawful to direct these types of activities, then the offer presented in this prospectus does not

extend to you.

Except as otherwise set forth in this prospectus,

neither we nor the Selling Shareholder have taken any action to permit a public offering of these securities outside the United States

or to permit the possession or distribution of this prospectus outside the United States. Persons outside the United States who come into

possession of this prospectus must inform themselves about and observe any restrictions relating to the offering of these securities and

the distribution of this prospectus outside the United States.

COMMONLY USED DEFINED TERMS

Unless otherwise indicated or the context requires

otherwise, references in this prospectus to:

| ● |

“Bit Origin,” “our company,” the “Company,” “we,” “us,” and “our” are to Bit Origin Ltd (formerly known as China Xiangtai Food Co., Ltd.), an exempted company incorporated in the Cayman Islands with limited liability; |

| |

|

| ● |

“China” or the “PRC” are to the People’s Republic of China, excluding Taiwan for the purposes of this prospectus only; |

| |

|

| ● |

“RMB” are to the legal currency of China; |

| ● |

“SEC” are to the United States Securities and Exchange Commission; |

| ● |

“Sonic Auspice” are to Sonic Auspice DC LLC, a Delaware limited liability company and a subsidiary of Bit Origin Ltd; |

| ● |

“SonicHash Canada” are to SonicHash Inc., a company organized under the laws of Alberta, Canada, and a subsidiary of Bit Origin Ltd; |

| ● |

“SonicHash US” are to SonicHash LLC, a Delaware limited liability company and a subsidiary of Bit Origin Ltd; and |

| ● |

“U.S. dollars,” “$,” “US$,” and “dollars” are to the legal currency of the United States. |

We have sought to provide current information

in this prospectus and believe that the statistics provided in this prospectus remain up-to-date and reliable, and these materials are

not incorporated in this prospectus other than to the extent specifically cited in this prospectus. On May 23, 2023, as approved and

authorized by ordinary resolution of the shareholders of the Company passed at a general meeting held on May 18, 2023, the board of directors

of the Company approved a one-for-thirty (1-for-30) reverse share split of the Company’s ordinary shares (the “Reverse

Share Split”). The par value of the ordinary shares was increased in proportion to the ratio of the Reverse Share Split to

$0.30 per share and the number of authorized ordinary shares was reduced in proportion to the ratio of the Reverse Share Split to 10,000,000

ordinary shares. On February 6, 2024, at the Company’s general meeting, the Company’s shareholders approved the increase

of the Company’s authorized share capital from US$3,000,000 divided into 10,000,000 shares of US$0.30 each to US$150,000,000 divided

into 500,000,000 shares of US$0.30 each (the “Share Capital Increase”). Unless specified otherwise, and except as

provided in the financial statements and footnotes thereto, all references in this prospectus to share and per share data have been adjusted,

including historical data which has been retroactively adjusted, to give effect to the Reverse Share Split and the Share Capital Increase.

All discrepancies in any table between the amounts identified as total

amounts and the sum of the amounts listed therein are due to rounding.

SPECIAL NOTICE REGARDING FORWARD-LOOKING STATEMENTS

This prospectus contains forward-looking statements.

All statements contained in this prospectus other than statements of historical fact, including statements regarding our future results

of operations and financial position, our business strategy and plans, and our objectives for future operations, are forward-looking statements.

The words “believe,” “may,” “will,” “estimate,” “continue,” “anticipate,”

“intend,” “expect,” and similar expressions are intended to identify forward-looking statements. We have based

these forward-looking statements largely on our current expectations and projections about future events and trends that we believe may

affect our financial condition, results of operations, business strategy, short-term and long-term business operations and objectives,

and financial needs. These forward-looking statements are subject to a number of risks, uncertainties and assumptions, including the factors

described under the section titled “Risk Factors” in the documents incorporated by reference herein and under a similar heading

in any applicable prospectus supplement. Moreover, we operate in a very competitive and rapidly changing environment. New risks emerge

from time to time. It is not possible for our management to predict all risks, nor can we assess the impact of all factors on our business

or the extent to which any factor, or combination of factors, may cause actual results to differ materially from those contained in any

forward-looking statements we may make. In light of these risks, uncertainties and assumptions, the future events and trends discussed

in this prospectus may not occur and actual results could differ materially and adversely from those anticipated or implied in the forward-looking

statements.

You should not rely upon forward-looking statements

as predictions of future events. The events and circumstances reflected in the forward-looking statements may not be achieved or occur.

Although we believe that the expectations reflected in the forward- looking statements are reasonable, we cannot guarantee future results,

levels of activity, performance, or achievements. Except as required by applicable law, we undertake no duty to update any of these forward-looking

statements after the date of this prospectus or to conform these statements to actual results or revised expectations.

PROSPECTUS SUMMARY

Corporate History and Structure

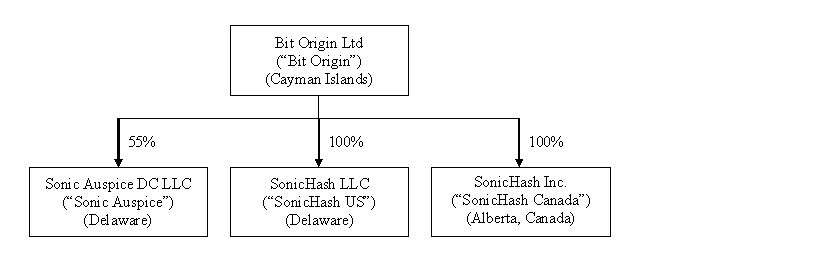

The following diagram illustrates our corporate structure as of the

date of this prospectus:

Bit Origin is a holding company incorporated in

the Cayman Islands on January 23, 2018 with no material operations of its own. As a holding company with no material operations of its

own, Bit Origin primarily conducts its operations through its subsidiaries, SonicHash Canada, SonicHash US and Sonic Auspice.

SonicHash Canada was

formed on December 14, 2021 under the laws of Alberta, Canada. It is a wholly-owned subsidiary of Bit Origin. It is not currently engaging

in any active business.

SonicHash US was formed

on December 17, 2021 under the laws of Delaware. It is a wholly-owned subsidiary of Bit Origin. It was formed to engage in Bitcoin mining

in the United States. As of January 31, 2024, the Company ceased all Bitcoin mining activities.

Sonic Auspice was formed

on November 30, 2023 under the laws of Delaware. Bit Origin owns 55% of the membership interest in Sonic Auspice. It does not have any material operation as of the date of this prospectus.

In addition, SonicHash

Pte. Ltd. (“SonicHash Singapore”) was formed on December 16, 2021 under the laws of Singapore. It was a wholly-owned subsidiary

of Bit Origin and had never engaged in any active business. On April 18, 2024, the board of directors of the Company approved to wind

down SonicHash Singapore. It did not own any assets or have any employees or business operation at the time of winding down.

Name Change and Symbol

Change

Effective February 15,

2022, the Company changed the trading symbol of its ordinary shares from “PLIN” to “BTOG”. Effective April 27,

2022, the Company changed its name from “China Xiangtai Food Co., Ltd.” to “Bit Origin Ltd”.

Reverse Share Split

On May 23, 2023, as approved

and authorized by ordinary resolution of the shareholders of the Company passed at a general meeting held on May 18, 2023, the board of

directors of the Company approved a one-for-thirty (1-for-30) Reverse Share Split. Upon the opening of the market on May 30, 2023, the

Company’s ordinary shares began trading on the Nasdaq Capital Market on a post-Reverse Share Split basis under the current symbol

“BTOG”. The new CUSIP number following the Reverse Share Split is G21621118. The Reverse Share Split reduced the number of

outstanding shares of the Company from approximately 100.9 million to approximately 3.3 million and affected all outstanding ordinary

shares. Every thirty (30) outstanding ordinary shares were combined into and automatically became one post-Reverse Share Split ordinary

share. No fractional shares were issued in connection with the Reverse Share Split. Instead, the Company issued one full post-Reverse

Share Split ordinary share to any shareholder who would have been entitled to receive a fractional share as a result of the process. The

par value of the ordinary shares was increased in proportion to the ratio of the Reverse Share Split to $0.30 per share and the number

of authorized ordinary shares was reduced in proportion to the ratio of the Reverse Share Split to 10,000,000 ordinary shares. After the

Reverse Share Split, all options, warrants and other convertible securities of the Company outstanding immediately prior to the Reverse

Share Split were adjusted by dividing the number of ordinary shares into which the options, warrants and other convertible securities

are exercisable or convertible by thirty (30) and multiplying the exercise or conversion price thereof by thirty (30), all in accordance

with the terms of the plans, agreements or arrangements governing such options, warrants and other convertible securities and subject

to rounding to the nearest whole share. In connection with the Reverse Share Split, the Company amended and restated its memorandum and

articles of association to reflect the adjustment of the number of authorized ordinary shares and the par value.

Share Capital Increase

On February 6, 2024,

at the Company’s general meeting, the Company’s shareholders approved the increase of the share capital from US$3,000,000

divided into 10,000,000 shares of US$0.30 each to US$150,000,000 divided into 500,000,000 shares of US$0.30 each.

Business Overview

Bit Origin is a Cayman

Islands exempted company and conducts business primarily through its operating subsidiaries, SonicHash US and Sonic Auspice, in the United

States.

As part of our growth

strategy, we have been actively seeking opportunities to deploy emerging technologies, including crypto asset mining and blockchain technologies

with diversified expansion strategy recently. In particular, we were engaged in Bitcoin mining. Due to the recent development in the cryptocurrency

industry (See “Impact of Recent Developments Regarding Crypto Asset Market” below), we have focused on building new cryptocurrency

mining facilities in the United States. As of January 31, 2024, the Company ceased all Bitcoin mining activities.

We used specialized computers,

known as miners, to generate Bitcoins, a digital asset (also known as a cryptocurrency). The miners use application specific integrated

circuit (“ASIC”) chips. These chips enable the miners to apply greater computational power, or “hash rate,”

to provide transaction verification services (known as solving a block) which helps support the Bitcoin blockchain. For every block added,

the Bitcoin blockchain awards a Bitcoin award equal to a set number of Bitcoins per block. These Bitcoin awards are subject to “halving,”

whereby the Bitcoin award per block is reduced by half in order to control the supply of Bitcoins on the market. When Bitcoin was first

launched in 2009, miners were awarded 50 Bitcoins if they first solved a new block; this award was halved to 25 Bitcoins per new block

in 2012, and halved again in 2016 to 12.5 Bitcoins per new block. Most recently, in April 2024, the then prevailing reward of 6.25 Bitcoins

per new block was halved to 3.125 Bitcoins. This reward rate is expected to next halve during March or April in 2028 to 1.5625 Bitcoins

per new block and will continue to halve at approximately four-year intervals until all potential 21 million Bitcoins have been mined.

Miners with a greater hash rate have a higher chance of solving a block and receiving a Bitcoin award.

Miners

As of the date of this

prospectus, the Company ceased all Bitcoin mining activities and owns no Bitcoin miners.

SonicHash US holds the mined Bitcoin in order

to enjoy the potential benefits of the appreciation of the Bitcoin price. SonicHash US currently does not store Bitcoin on any trading

platform. We do not hold any virtual assets other than Bitcoin. The price of Bitcoins is volatile. It has decreased recently and may continue

to decrease if the liquidity of the digital assets markets continues to be negatively impacted by the recent bankruptcy of some well-known

crypto asset market participants and negative publicity surrounding digital assets. Our finance department is constantly monitoring the

trend of Bitcoin price and will make proposals to our Chief Financial Officer (“CFO”). The CFO will determine whether

the Bitcoin trading price is favorable and whether it is necessary for the Company to sell Bitcoins to improve the cashflow. If the CFO

approves the trading of Bitcoins, she will instruct the Vice President to transfer the Bitcoins to the Coinbase exchange and execute the

trade. We do not have an agreement with the Coinbase exchange. If the Bitcoins cannot be sold at the approved price within one day after

the transfer, the CFO will review the recalibrated proposal prepared by the finance department and approve the new price and new number

of Bitcoins to be sold if the CFO deems the proposal is reasonable. If we trade Bitcoins for fiat currency, we will withdraw the fiat

currency immediately from the Coinbase exchange and deposit it into the Company’s bank account. If the Bitcoins price decreases

when we trade the Bitcoins for fiat currency, the amount of fiat currency we receive will decrease as well and our results of operation

will be negatively impact. See “Impact of Recent Developments Regarding Crypto Asset Market” below.

All of our crypto assets are Bitcoins, and we

currently keep our Bitcoins in a secured crypto and Bitcoin wallet, imToken. imToken is a hot wallet that supports not only Bitcoins but

also ETH and support stablecoins. The management of the Company is responsible to supervise the Bitcoin and the auditor of the Company

is responsible to verify the existence for the Bitcoin held in the wallet. We do not have any insurance

that covers our miners or Bitcoin in the event of loss or fraud. We have not used a third-party custodian to store our Bitcoins.

The Chief Executive Officer (“CEO”) of the Company maintain control of and have access to the private key. We have

policy to safeguard our crypto assets. All the transactions involving the Bitcoins, such as withdrawing, transferring, or selling the

Bitcoins from our wallet must be set up by the finance manager, authorized and executed by the CEO. We also verbally confirm the wallet

address with the receiver and perform a trial transaction with 0.01 Bitcoin before any transaction to verify the wallet address of the

receiver.

The

cost of mining consists primarily of hosting costs and depreciation expense of our own mining equipment. The hosting costs include installment

fees, electricity, internet services and other necessary services to maintain the operation of the mining equipment. The depreciation

expenses are the sunk cost to the mining operation, at $17,600/BTC mined. Our breakeven price is around $37,517 per Bitcoin assuming the

Company pays $0.08 per kWh to mine, as of the date of this prospectus.

Prior to December 2022, pursuant to the original

hosting agreement and service agreement (see “Mining Facilities” below for more detail), based on the average of the hosting

price of approximately $0.08/kWh, the breakeven price was $17,599/BTC mined.

| Prior to December 2022 | |

| |

| BTC reward/Day/TH as at 2023-01-03 12:22:50 | |

| 0.00000356 | |

| Hosting Price ($/kWh) | |

| 0.08 | |

| Number of Miners | |

| 1,700.00 | |

| Total Hashrate (TH) | |

| 161,500.00 | |

| Total Daily Power Consumption (kw) | |

| 126,480.00 | |

| Total Daily Hosting Cost ($) | |

| 10,118.40 | |

| Breakeven Price ($) | |

| 17,599 | |

In December 2022, the hosting fee was adjusted

to equal to the sum of (i) the electricity cost of the mining activities and (ii) 50% of SonicHash US’s profit generated from the

Indiana site, i.e., the difference of the market price of the Bitcoins mined from the Indiana site and the electricity cost. The market

price of the Bitcoins was the daily Bitcoin closing price available at CoinMarketCap.com as of the day immediately prior to the day that

we receive the electricity bill. Based on the adjusted profit sharing model, the hosting fee was approximately $0.065/kWh, and therefore,

the breakeven price was $14,299.

| From December 2022 to January 2023 | |

| |

| BTC reward/Day/TH as at 2023-01-03 12:22:50 | |

| 0.00000356 | |

| Hosting Price ($/kWh) | |

| 0.065 | |

| Number of Miners | |

| 1,700.00 | |

| Total Hashrate (TH) | |

| 161,500.00 | |

| Total Daily Power Consumption(kw) | |

| 126,480.00 | |

| Total Daily Hosting Cost ($) | |

| 8,221.20 | |

| Breakeven Price ($) | |

| 14,299 | |

In February 2023, we reverted to the original

hosting term, pursuant to which the hosting fee was based on the average of the hosting price of approximately $0.08/kWh. The breakeven

price was $37,517/BTC mined as of February 2, 2024.

| From February 2023 to January 2024 | |

| |

| BTC reward/Day/TH as at 2024-1-31 23:42:06 | |

| 0.00000167 | |

| Hosting Price ($/kWh) | |

| 0.08 | |

| Number of Miners | |

| 3,200.00 | |

| Total Hashrate (TH) | |

| 304,000.00 | |

| Total Daily Power Consumption(kw) | |

| 238,080.00 | |

| Total Daily Hosting Cost ($) | |

| 19,046.40 | |

| Breakeven Price ($) | |

| 37,517 | |

From May 1, 2022 to November 30, 2022, the Bitcoin

price range was between $15,787 and $39,698. From December 1, 2022 to January 31, 2023, the Bitcoin price range was between $16,440 and

$23,775. From February 1, 2023 to January 31, 2024, the Bitcoin price range was between $20,187 and $46,970. Our revenue recognition was

based on the daily BTC reward and daily BTC lowest price available at CoinMarketCap.com.

As of January 31, 2024, the Company ceased all

Bitcoin mining activities.

Mining Facilities

Macon, Georgia

The mining facility in

Macon, Georgia was managed by Horizon Mining Ltd. SonicHash US entered into a hosting agreement with Horizon Mining Ltd on May 1, 2022,

pursuant to which Horizon Mining Ltd provided electricity, internet, as well as installation service, loading and unloading service, security

service, inventory management service, and other maintenance services to maintain the operation of the mining equipment. The hosting agreement

was for a term of one year from execution and can be extended at any time upon agreement of both parties. If either party commits a material

breach of the hosting agreement and fails to cure within 30 days after such breach, the non-breaching party can terminate the hosting

agreement. The service fee was $295,082 per month, which included all of the electricity and internet costs, the cost of maintenance services

to maintain the operation of the mining equipment (not including insurance for loss of power or damage to the hosted mining machines).

SonicHash US has paid a deposit in the amount of $741,585 pursuant to the hosting agreement and such deposit will be returned to SonicHash

US within seven days after all the mining equipment is removed from the facilities. The hosting agreement expired on April 30, 2023. Either

party can extend the agreement with prior notice to the other party. In December 2022, due to high energy price and the Georgia site’s

weak condition in general, SonicHash US suspended the operation of the miners in the Georgia site and shipped the 1,490 miners that were

deployed in the Georgia site to the mining facility in Marion, Indiana and were deployed since January 2023.

The aggregate average, mean and range of Bitcoins

mined on a monthly basis by the miners located in Macon Georgia during the periods from May 2022 through November 2022 are as follows:

| Bitcoin Production | |

Macon, Georgia | |

| May 2022 | |

2.33 | |

| June 2022 | |

4.84 | |

| July 2022 | |

4.54 | |

| August 2022 | |

3.74 | |

| September 2022 | |

9.63 | |

| October 2022 | |

8.26 | |

| November 2022 | |

2.33 | |

| Average | |

5.10 | |

| Range | |

2.33 to 9.63 | |

Marion, Indiana

The mining facility in

Marion, Indiana was managed by Your Choice Four CA, Inc. On June 6, 2022, SonicHash US entered into a hosting agreement with Your Choice

Four CA, Inc., pursuant to which SonicHash US delivered 1,000 Bitcoin mining equipment to the Your Choice Four CA, Inc.’s facilities

in the State of Indiana and Your Choice Four CA, Inc. installed the mining equipment and provide electricity, internet and other maintenance

services to maintain the operation of the mining equipment. The hosting agreement was for a term of one year and can be renewed with a

four months’ advance notice to Your Choice Four CA, Inc. If either party has material breach of the hosting agreement and fails

to cure with 30 days after such breach, the non-breaching party can terminate the hosting agreement. In addition, SonicHash US can terminate

the hosting agreement if Your Choice Four CA, Inc. fails to furnish the services during any two-month period or for seven consecutive

days excluding downtime caused by scheduled maintenance, demand response curtailment and/or force majeure. SonicHash US has paid a deposit

in the amount of $404,914 and such deposit will be returned to SonicHash US within 30 days upon termination of the hosting agreement.

On June 10, 2022, Sonic

Hash US also entered into a service agreement with Ever Best Bit Limited, which served as an advisor and consultant to help the Company

to find the data mining host service which meets Company’s requirements. Ever Best Bit Limited facilitated SonicHash US to enter

into the hosting agreement with Your Choice Four CA, Inc. SonicHash US agreed to pay Ever Best Bit Limited a service fee of $0.024/kWh,

calculated based on the following formula: Total Services Fee: (Electrical Meter Reading + Electrical Meter Reading * 3% Electrical Power

Loss) * Electricity Rate $0.024/kWh. The service agreement shall only terminate when the hosting agreement terminates. The term of the

service and the termination date is the same as the agreement with Your Choice Four CA, Inc. The agreement with Ever Best Bit Limited

will be renewed if the agreement with Your Choice Four CA, Inc. is renewed.

On July 6, 2022, SonicHash

US entered into another hosting agreement with Your Choice Four CA, Inc., pursuant to which SonicHash US delivered 700 units of Bitcoin

mining equipment to Your Choice Four CA, Inc.’s facilities in the State of Indiana and Your Choice Four CA, Inc. installed the mining

equipment and provide electricity, internet and other maintenance services to maintain the operation of the mining equipment. The hosting

agreement was for a term of one year and can be renewed with a four months’ advance notice to Your Choice Four CA, Inc. If either

party has material breach of the hosting agreement and fails to cure within 30 days after such breach, the non-breaching party can terminate

the Hosting Agreement. In addition, SonicHash US can terminate the hosting agreement if Your Choice Four CA, Inc. fails to furnish the

services during any two-month period or for seven consecutive days excluding downtime caused by scheduled maintenance, demand response

curtailment and/or force majeure. Pursuant to the hosting agreement, the host shall maintain a minimum service level of at least 90% uptime

during any 30-day period, except in the event of maintenance, miner failure, repair, and force majeure. The host shall also be responsible

for, repair or reimburse any cosmetic damage or operation deficiency to the miners due to the host’s intentional acts, willful misconduct,

gross negligence or omission. SonicHash US has paid a deposit in the amount of $250,286 and such deposit will be returned to SonicHash

US within 30 days upon termination of the hosting agreement.

On July 7, 2022, SonicHash

US entered into another service agreement with Ever Best Bit Limited, which served as an advisor and consultant to help the Company to

find the data mining host service which meet Company’s requirements. Ever Best Bit Limited facilitated SonicHash US to enter into

the hosting agreement with Your Choice Four CA, Inc. SonicHash US agreed to pay Ever Best Bit Limited a service fee of $0.020/kWh, calculated

based on the following formula: Total Services Fee: (Electrical Meter Reading + Electrical Meter Reading * 3% Electrical Power Loss) *

Electricity Rate $0.020/kWh. The service agreement shall only terminate when the hosting agreement terminates. The term of the service

and the termination date is the same as the agreement with Your Choice Four CA, Inc. The agreement with Ever Best Bit Limited will be

renewed if the agreement with Your Choice Four CA, Inc. is renewed.

The hosting fee payable

to Your Choice Four CA, Inc. was calculated by: (Electrical Meter Reading + Electrical Meter Reading * 3% Electrical Power Loss) * Electricity

Rate ($0.060/kW). The service fee payable to Ever Best Bit Limited was calculated by: (Electrical Meter Reading + Electrical Meter Reading

* 3% Electrical Power Loss) * Electricity Rate ($0.060/kWh). For example, assuming the miners consumes 10,000 kWh in electricity, the

hosting fee payable to Your Choice Four CA, Inc. will be (10000+3%*10000)*$0.06=$618.00 and the service fee payable to Ever Best Bit Limited

will be (10000+3%*10000)*$0.024=$247.20. The total fee for the 10,000 kWh electricity consumption will be $618.00+$247.20=$865.20.

In December 2022, we

reached an agreement with Your Choice Four CA, Inc., the host of the mining facility in Marion, Indiana, that the hosting fee was adjusted

to equal to the sum of (i) the electricity cost of the mining activities and (ii) 50% of SonicHash US’s profit generated from the

Indiana site, i.e., the difference of the market price of the Bitcoins mined from the Indiana site and the electricity cost. The market

price of the Bitcoins was the daily Bitcoin closing price available at CoinMarketCap.com as of the day immediately prior to the day that

we receive the electricity bill.

The aggregate average, mean and range of monthly

fees paid to Your Choice Four CA, Inc. and Ever Best Bit Limited for the installation of, hosting of and services for the miners located

in Indiana during the periods from July 2022 through September 2023 are as follows:

| | |

Your Choice Four CA, Inc. | | |

Ever Best Bit Limited | |

| | |

Fees Paid in US$ | | |

Fees Paid in US$ | |

| July 2022 | |

$ | 31,290.60 | | |

$ | 12,516.24 | |

| August 2022 | |

$ | 152,058.45 | | |

$ | 60,823.38 | |

| September 2022 | |

$ | 225,411.77 | | |

$ | 90,164.71 | |

| October 2022 | |

$ | 210,924.82 | | |

$ | 84,369.93 | |

| November 2022 | |

$ | 150,215.87 | | |

$ | 60,086.35 | |

| December 2022 | |

$ | 123,542.52 | | |

$ | 49,417.01 | |

| January 2023 | |

$ | 401,223.31 | | |

$ | 133,741.10 | |

| February 2023 | |

$ | 366,943.89 | | |

$ | 122,314.63 | |

| March 2023 | |

$ | 448,236.36 | | |

$ | 149,412.12 | |

| April 2023 | |

$ | 504,977.69 | | |

$ | 168,325.90 | |

| May 2023 | |

$ | 492,175.70 | | |

$ | 164,058.57 | |

| June 2023 | |

$ | 500,936.08 | | |

$ | 166,978.69 | |

| July 2023 | |

$ | 453,851.03 | | |

$ | 151,283.68 | |

| August 2023 | |

$ | 398,464.50 | | |

$ | 132,821.50 | |

| September 2023 | |

$ | 195,362.77 | | |

$ | 65,120.92 | |

| Average | |

$ | 310,374.36 | | |

$ | 107,428.98 | |

| Range | |

| $ 31,290.60 to 504,977.69 | | |

| $ 12,516.24 to 168,325.90 | |

The aggregate average, mean and range of Bitcoins

mined on a monthly basis by the miners located in Marion, Indiana during the periods from July 2022 through September 2023 are as follows:

| Bitcoin Production | |

Marion, Indiana |

| July 2022 | |

3.75 |

| August 2022 | |

18.21 |

| September 2022 | |

16.83 |

| October 2022 | |

16.04 |

| November 2022 | |

6.26 |

| December 2022 | |

12.77 |

| January 2023 | |

30.04 |

| February 2023 | |

26.36 |

| March 2023 | |

30.04 |

| April 2023 | |

26.98 |

| May 2023 | |

29.94 |

| June 2023 | |

26.66 |

| July 2023 | |

22.67 |

| August 2023 | |

23.47 |

| September 2023 | |

15.93 |

| Average | |

20.40 |

| Range | |

3.75 to 30.04 |

As of September 30, 2023, the Company ceased

its operation in the Indiana facility.

Cheyenne, Wyoming

On June 10, 2022, the

Company entered into a subscription agreement with a limited partnership, MineOne Cloud Computing Investment I L.P. (the “Partnership”),

pursuant to which the Company invested $3,000,000 in fiat currency in the Partnership as a limited partner and hold a partnership interest

and a sharing percentage of 8.8235% in the Partnership. The Company will receive dividends or other returns in fiat currency.

The Partnership is a

limited partnership registered under the laws of the British Virgin Islands on May 12, 2022. The general partner, MineOne Partners Limited,

a British Virgin Islands business company with limited liability, will seek to obtain opportunities for the Partnership to only make debt

or equity investments in the portfolio company (as defined in the limited partnership agreement) in accordance with the primary purpose

of the Partnership, which is to seek long-term capital appreciation by acquiring, holding, financing, refinancing and disposing of securities

in the portfolio company. The general partner shall have the exclusive authority to cause the Partnership to make investments in the portfolio

company. The Partnership commenced on May 12, 2022 and shall continue, unless the Partnership is sooner de-registered, until the Partnership’s

entire interest in the portfolio company has been disposed of and any ongoing arrangements related thereto (including any escrow arrangement)

have been terminated and all proceeds thereof have been distributed. The general partner can by a determination in good faith, terminate

or wind up the Partnership if it has determined that there is a substantial likelihood that due to a change in the text, application or

interpretation of the provisions of the applicable securities laws, or any other applicable statute, regulation, case law, administrative

ruling or other similar authority, the Partnership cannot operate effectively in the manner contemplated herein. The Partnership will

also terminated upon the commencement of liquidation, bankruptcy or dissolution proceedings or the withdrawal, or making of a winding

up or dissolution order of the General Partner, or the occurrence of any other event that causes the General Partner to cease to be a

general partner of the Partnership under the Partnership Act, by the entry of a decree of judicial dissolution, or at such time as there

are no limited partners.

As a limited partner,

the Company shall not take part in the management of the Partnership or in the management or control of the Partnership’s investment

or other activities, transact any business in the Partnership’s name, deal with any person on behalf of the Partnership who or that

is not a partner or have the power to sign documents for or otherwise bind the Partnership. Any election, vote, waiver or consent of the

limited partners shall be calculated as a percentage of the respective capital commitments of the limited partners entitled to make such

election, vote, waiver or consent. The liability of the Company for the debts and obligations of the Partnership is limited to its capital

commitment in the amount of $3,000,000. Cash received by the Partnership from the sale or other disposition of, or dividends, interests

or other income from or in respect of, a portfolio investment, or otherwise received by the Partnership from any source (other than capital

contributions and other payments made by the Partners pursuant to the Partnership Agreement and temporary investment income), in excess

of the amount necessary or appropriate for the payment of the Partnership’s expenses, liabilities and other obligations, shall be

distributed upon dissolution of the Partnership, apportioned among the partners in proportion to the sharing percentages as of the time

of distribution.

The general partner and

associated indemnified persons generally will not be liable to the Partnership or the limited partners for any act or omission relating

to the Partnership, other than acts or omissions constituting certain disabling conduct, including such person’s conviction of a

felony or a willful violation of law by such person in each case having a material adverse effect on the Partnership; actual fraud, willful

malfeasance or gross negligence by or of such person; or reckless disregard of duties by such person in the conduct of such person’s

office. If the Partnership’s assets are insufficient to meet such liabilities, the Partnership may recall distributions to meet

all or any portion of the indemnification or repayment obligations of the Partnership.

Dr. Jiaming Li, the former

President of our company, was a director at MineOne Partners Limited and resigned from MineOne Partners Limited before joining our company.

We do not believe that the limited partnership was a related party transaction. The terms of the partnership were negotiated at arm’s

length.

Based on the amended

and restated limited partnership agreement of the Partnership, the primary purpose of the Partnership is to seek long-term capital appreciation

by acquiring, holding, financing, refinancing and disposing of securities in the portfolio company. The Partnership is constructing a

mining site with capacity up to 75 megawatts (“MW”) in Cheyenne, Wyoming. The Partnership expected to provide miner

hosting services and earn hosting fees. The Partnership planned to host 23,000 miners of S19j pro or equivalent type. The construction

was completed and the mining site started the hosting operations with a capacity of 45 MW in late March 2023. The Company entered a hosting

agreement with MineOne Wyoming Data Center LLC, a company majority owned by the Partnership, to host the 3,200 miners in Cheyenne, Wyoming,

which was terminated on January 31, 2024. As of the date of this prospectus, the Company offloaded the miners due to increasing mining

difficulties and owns no miners.

Mining Pool

SonicHash US entered

into a cryptocurrency mining pool with F2pool. The verbal agreement can be terminated at any time by either party. F2pool provided computing

power to the mining pool for SonicHash US’s 3,200 operating miners in Cheyenne. SonicHash US provided computing power and in exchange

for successfully adding a block to the blockchain, SonicHash US shall receive a fractional share of the fixed cryptocurrency award the

mining pool operator receives (less cryptocurrency transaction fees to the mining pool operator which are recorded net with revenues)

in Bitcoins. SonicHash US’s fractional share is based on the proportion of computing power SonicHash US contributed to the mining

pool operator to the total computing power contributed by all mining pool participants in solving the current algorithm. F2pool is a high-performance

mining pool that supports Proof of Work (PoW) assets such as Bitcoin (BTC) and Bitcoin Cash (BCH), with more coins in the pipeline. F2pool

provides users with a low mining fee of 2.5%, along with optimized algorithms for higher mining efficiency.

Recent Developments

On June 7, 2024, the Company entered into a sales

representative agreement (the “Sales Representative Agreement”) with NGH Computer Pte. Ltd. (“NGH”), which was

subsequently assigned to AEAI Pte. Ltd. (“AEAI”), pursuant to which AEAI agreed to engage the Company as its non-exclusive

representative to market and solicit orders for Aethir Edgar miners, hardware devices for contributing rendering services to Aethir Cloud

Depin network (the “Devices”). The Company shall determine in its sole discretion the sale price at which the Company markets

and sells the Devices. AEAI agreed to pay a commission to the Company in the form of a credit towards the Company’s next purchase

order. The Company has also agreed to make an advance payment in the amount of $1 million within 15 days from the execution of the Sales

Representative Agreement. The advance payment will be used as credit in the purchase orders for purchasing the Devices from AEAI. The

term of the Agreement is 12 months and shall be automatically renewed for another 12 months unless either party gives the other party

written notice not to renew the Agreement. The Sales Representative Agreement can be terminated by either party by giving the other party

a 15 days’ advance written notice.

As a result, the Company became a sales representative

for Aethir, the premier enterprise-focused distributed graphics processing units cloud provider. On June 12 2024, Aethir completed the

token generation event for its $ATH token, with a fully diluted valuation of $2.6 billion as of June 24, 2024, according to coinmarketcap.com.

The Company aims to expand Aethir’s market reach and has plans to acquire and deploy Aethir devices in Singapore and/or Malaysia.

As of the date of this prospectus, no revenue has been generated from the Sales Representative Agreement.

Previous Disposition and Discontinued

Operations

Prior to April 2021,

our then subsidiaries and variable interest entities engaged in the pork processing business and had operations across key sections of

the industry value chain, including slaughtering, packing, distribution, wholesale, and retail of a variety of fresh pork meat and parts.

Prior to February 2020, one of our then subsidiaries operated a grocery store in Chongqing, China that sold our pork and meat products

and other consumer goods. In February 2020, the grocery store operation was discontinued. In April 2021, the pork processing business

was discontinued.

On April 27, 2022, we

sold 100% equity interest in WVM Inc. and China Silanchi Holding Limited, including the subsidiaries and consolidated variable entities

of WVM Inc. and China Silanchi Holding Limited (See “-Corporate History and Structure”), to an unrelated third party for a

total of $1,000,000 pursuant to a securities purchase agreement dated March 31, 2022. Such disposition includes the sale of the grocery

store and meat processing business.

Grocery Store

In July 2018, we acquired

CQ Pengmei and opened two grocery stores in Chongqing in November 2017 that offered a variety of consumer goods. One of the grocery stores

was closed in August 2018 due to the landlord’s failure to meet the fire safety requirements. We filed a lawsuit against the landlord

for breach of the store operating lease. The lawsuit is still ongoing. In February 2020, due to the increase in inventory purchase cost

and the quarantine restrictions as a result of the COVID-19 pandemic in China, we closed the other grocery store.

Meat Processing

We used to engage

in the slaughtering, packing, distribution, wholesale, and retail of a variety of fresh pork meat and parts through CQ Penglin and

GA Yongpeng. We used to sell fresh pork to distributors, who then sold to pork vendors in farmers’ markets. Due to the African

Swine fever affecting China in October 2018, the supply of hogs decreased. Also, starting from March 2019, the Chongqing government

started requiring all local slaughtering houses to only purchase hogs from hog farms in Chongqing, which further limited the supply

of hogs. The decrease in supply increased the price of hogs and increased our cost of per unit slaughtering and processing. Starting

in January 2020, due to the COVID-19 pandemic and quarantine measures, our sales volume in farmers markets decreased. We were

operating at losses during the fiscal year ended June 30, 2021. In addition, in March 2021, we ceased operation of the slaughtering

and food processing facilities as a result of a legal dispute between CQ Penglin and Chongqing Puluosi Small Mortgage Co., Ltd. The

food processing facility was sealed by the court and is subject to a lien. The court ordered the sale of this facility to enforce

the court verdict against CQ Penglin. The slaughtering facility is subject to the same lien pursuant to the same court order, and

pursuant to which order the facility cannot be sold, transferred or otherwise disposed without approval of the court. As a result,

in April 2021, we discontinued the meat processing business.

Industry Overview

Blockchain

A blockchain is a digital, decentralized, public

ledger that exists across a network. Unlike a centralized database, a blockchain ledger typically maintains copies of itself across many

computers (“nodes”) in the network so that the record cannot be altered retroactively without the alteration of all

subsequent blocks and the collusion of the network.

The network organizes transactions by putting

them into groups called blocks. Each block contains a defined set of transactions and a link to the previous block in the chain. Adding

a new entry or block requires a method of consensus between nodes the block to post to the ledger and become permanent.

Cryptocurrency

Currently, the most common application of blockchain

technology is cryptocurrency. Cryptocurrency is an encrypted decentralized digital currency transferred between peers and confirmed on

the blockchain via a process known as mining. Cryptocurrencies are not backed by a central bank or a national, supra-national or quasi-national

organization and are typically used as a medium of exchange.

Cryptocurrencies can be used to purchase goods

and services, either online or at physical locations, although data is not readily available about the retail and commercial market penetration

of cryptocurrencies. To date, the rate of adoption and use of cryptocurrencies for paying merchants has trailed the broad expansion of

retail and commercial acceptance of cryptocurrency. Other markets, such as credit card companies and certain financial institutions are

not accepting such digital assets. It is likely that there will be a strong correlation between the continued expansion of the Cryptocurrency

Network and its retail and commercial market penetration.

Bitcoin

Bitcoin is the most common cryptocurrency currently

in use. Bitcoin was invented in 2008 and launched in 2009 by an anonymous person under the pseudonym Satoshi Nakamoto. As described in

the original white paper, Bitcoin is a decentralized currency that allows online payments to be sent from one party to another without

the use of financial institutions. Upon verification by devices, authenticated transactions are forever added to a public ledger for all

to view in the Bitcoin network. The goal of Bitcoin was to eliminate the use of third parties to authenticate transactions, and thereby

minimizing transaction costs, reducing practical transaction size, and enabling the ability to make non-reversible payments for non-reversible

services.

Bitcoin Mining

“Mining” describes the process whereby

a blockchain consensus is formed. The Bitcoin consensus, for example, entails solving complex mathematical problems using custom-designed

computers.

When Bitcoins are sent, the transaction(s) are

broadcasted to all nodes in the Bitcoin network. Each node bundles a collection of transactions into an encrypted block and attempts to

solve the code to the encrypted block, to verify that all transactions within the block are valid. Once the code is deciphered, that code

is sent to all other miners who can easily verify that the hash is indeed correct. When enough nodes agree that the hash is correct, this

block is added to the existing chain and miners move on to work on the next block. This mechanism where “miners” solve cryptographic

puzzles and prove that they have done so by writing the solution to the blockchain is known as “proof-of-work.” The verification

is necessary because, unlike physical cash that can only be held by one party at any point in time, cryptocurrency can be copied and sent

to multiple recipients if there are no safeguards.

Mining Incentives

As an incentive to expend time, power and other

resources to mine Bitcoin, miners are rewarded in Bitcoin and transaction fees. Each computation is a hash, and the speed at which these

problems can be solved at is measured in hash rate.

However, the number of Bitcoin rewarded is reduced

by 50% for every 210,000 blocks mined. Given that a block is added to the ledger about every 10 minutes, the “halving” takes

place approximately once every 4 years until all 21 million Bitcoins have been “unearthed”. Currently, each block mined rewards

3.125 Bitcoins and the next halving is expected to occur in March or April in 2028, at which point each block mined would only reward

1.5625 Bitcoins.

In addition to mining rewards, miners can also

earn money through transaction fees. When a user decides to send Bitcoin, the transaction is first broadcasted to a memory pool before

being added to a block. Because each block can only contain up to 1 megabyte of information, miners can pick and choose from the memory

pool which transactions to bundle into the next block.

During periods of heavy

network usage, there can oftentimes be more transactions awaiting confirmation than there is space in a block. In such situations, users

compete for miners’ computation power by adding fees (“tips”) onto their transactions in the hope that miners

would prioritize their transactions. Larger “tips” are required to incentivize miners to mine larger transactions.

Impact

of Recent Developments Regarding Crypto Asset Market

In 2022 and the beginning of 2023, some of the

well-known crypto asset market participants, including Celsius Network, Voyager Digital Ltd., Three Arrows Capital and Genesis Global

Holdco, LLC declared bankruptcy. In November 2022, FTX, the third largest digital asset exchange by volume at the time, halted customer

withdrawals and shortly thereafter, FTX and its subsidiaries filed for bankruptcy, resulting in a loss of confidence in participants of

the digital asset ecosystem and negative publicity surrounding digital assets more broadly. Furthermore, it also revealed potential systemic

risks and industry contagion as a significant number of other major market participants were affected by FTX’s bankruptcy –

namely, among others, BlockFi Inc., as one of the largest digital assets lending companies.

In response to these events, the digital asset

markets, including the market for Bitcoin specifically, have experienced extreme price volatility and several other entities in the digital

asset industry have been, and may continue to be, negatively affected, further undermining confidence in the digital assets markets and

in Bitcoin. These events have also negatively impacted the liquidity of the digital assets markets as certain entities affiliated with

FTX engaged in significant trading activity. If the liquidity of the digital assets markets continues to be negatively impacted by these

events, digital asset prices (including the price of Bitcoin) may continue to experience significant volatility and confidence in the

digital asset markets may be further undermined. These events are continuing to develop and it is not possible to predict at this time

all of the risks that they may pose to us, our service providers or on the digital asset industry as a whole. A perceived lack of stability

in the digital asset exchange market and the closure or temporary shutdown of digital asset exchanges due to business failure, hackers

or malware, government-mandated regulation, or fraud, may reduce confidence in digital asset networks and result in greater volatility

in cryptocurrency values.

We had no direct and

material exposure to FTX or any of the above-mentioned cryptocurrency companies. We will not have material assets that may not be recovered

or may otherwise be lost or misappropriated due to the bankruptcies. However, the failure or insolvency of large exchanges and key institutions

in the cryptocurrency asset industry like FTX may cause the price of Bitcoin to fall and decrease confidence in the ecosystem, which could

adversely affect an investment in us. Such volatility and decrease in Bitcoin price have had a material and adverse effect on our results

of operations and financial condition and we expect our results of operations to continue to be affected by the Bitcoin price as all our

revenue has been from Bitcoin mining production. In particular, our production in November 2022 was negatively affected by the strong

volatility of the Bitcoin price. As a result, we scaled down our operations to cut down costs. In December 2022, due to high energy price

and the Georgia site’s weak condition in general, SonicHash US suspended the operation of the miners in the Georgia site and shipped

1,490 miners that were deployed in the Georgia site to the mining facility in Marion, Indiana and were deployed since January 2023. In

addition, in December 2022, we reached an agreement with Your Choice Four CA, Inc., the host of the mining facility in Marion, Indiana,

that the hosting fee was adjusted to equal to the sum of (i) the electricity cost of the mining activities and (ii) 50% of SonicHash US’s

profit generated from the Indiana site, i.e., the difference of the market price of the Bitcoins mined from the Indiana site and the electricity

cost. The market price of the Bitcoins was the daily Bitcoin closing price available at CoinMarketCap.com as of the day immediately prior

to the day that we receive the electricity bill. The new fee structure has decreased our cost significantly in December 2022. We continued

adjusting our short-term strategy to optimize our operating efficiency in the current dynamic market conditions. As of January 31, 2024,

we ceased all Bitcoin mining activities. We cannot assure that the Bitcoin price will remain high enough to sustain our operation or that

the Bitcoin price will not decline significantly in the future. Fluctuations in the Bitcoin price have had and are expected to continue

to have an immediate impact on the trading price of our ordinary shares even before our financial performance is affected, if at all.

To the extent investors view our ordinary shares as linked to the value of our bitcoin holdings, these potential consequences of a Bitcoin

trading venue’s failure could have a material adverse effect on the market value of our ordinary shares.

In addition, novel or

unique assets such as Bitcoin and other digital assets may be classified as securities if they meet the definition of investment contracts

under U.S. law. In recent years, the offer and sale of digital assets other than Bitcoin, most notably Kik Interactive Inc.’s Kin

tokens and Telegram Group Inc.’s TON tokens, have been deemed to be investment contracts by the SEC. While we believe that Bitcoin

is unlikely to be considered an investment contract, and thus a security under the investment contract definition, we cannot provide any

assurances that digital assets that we mine or otherwise acquire or hold for our own account, including Bitcoin, will never be classified

as securities under U.S. law. This would obligate us to comply with registration and other requirements by the SEC and, therefore, cause

us to incur significant, non-recurring expenses, thereby materially and adversely impacting an investment in the Company.

Moreover, current IRS

guidance indicates that for U.S. federal income tax purposes digital assets such as Bitcoins should be treated and taxed as property,

and that transactions involving the payment of Bitcoins for goods and services should be treated in effect as barter transactions. The

IRS has also released guidance to the effect that, under certain circumstances, hard forks of digital currencies are taxable events giving

rise to taxable income and guidance with respect to the determination of the tax basis of digital currency. However, current IRS guidance

does not address other significant aspects of the U.S. federal income tax treatment of digital assets and related transactions. There

continues to be uncertainty with respect to the timing and amount of income inclusions for various crypto asset transactions, including,

but not limited to, staking rewards and other crypto asset incentives and rewards products. While current IRS guidance creates a potential

tax reporting requirement for any circumstance where the ownership of a Bitcoin passes from one person to another, it preserves the right

to apply capital gains treatment to those transactions, which is generally favorable for investors in Bitcoin.

There can be no assurance that the IRS will not

alter its existing position with respect to digital assets in the future or that other state, local and non-U.S. taxing authorities or

courts will follow the approach of the IRS with respect to the treatment of digital assets such as Bitcoins for income tax and sales tax

purposes. Any such alteration of existing guidance or issuance of new or different guidance may have negative consequences including the

imposition of a greater tax burden on investors in Bitcoin or imposing a greater cost on the acquisition and disposition of Bitcoin, generally;

in either case potentially having a negative effect on the trading price of Bitcoin or otherwise negatively impacting our business. In

addition, future technological and operational developments that may arise with respect to digital currencies may increase the uncertainty

with respect to the treatment of digital currencies for U.S. federal income and applicable state, local and non-U.S. tax purposes.

Furthermore, on March

9, 2022, President Biden signed an executive order on cryptocurrencies. While the executive order did not mandate any specific regulations,

it instructs various federal agencies to consider potential regulatory measures, including the evaluation of the creation of a U.S. Central

Bank digital currency.

In addition, the Commodity

Exchange Act, as amended (the “CEA”), does not currently impose any direct obligations on us related to the mining

or exchange of Bitcoins. Generally, the Commodity Futures Trading Commission (“CFTC”), the federal agency that administers

the CEA, regards Bitcoin and other cryptocurrencies as commodities. This position has been supported by decisions of federal courts.

However, the CEA imposes

requirements relative to certain transactions involving Bitcoin and other digital assets that constitute a contract of sale of a commodity

for future delivery (or an option on such a contract), a swap, or a transaction involving margin, financing or leverage that does not

result in actual delivery of the commodity within 28 days to persons not defined as “eligible contract participants” or “eligible

commercial entities” under the CEA (e.g., retail persons). Changes in the CEA or the regulations promulgated by the CFTC thereunder,

as well as interpretations thereof and official promulgations by the CFTC, may impact the classification of Bitcoins and, therefore, may

subject them to additional regulatory oversight by the agency. Although to date the CFTC has not enacted regulations governing non-derivative

or non-financed, margined or leveraged transactions in Bitcoin, it has authority to commence enforcement actions against persons who violate

certain prohibitions under the CEA related to transactions in any contract of sale of any commodity, including Bitcoin, in interstate

commerce (e.g., manipulation and engaging in certain deceptive practices).

Furthermore, on September

16, 2022, the U.S. Department of the Treasury (Treasury), the Department of Justice (the DOJ), and other U.S. government agencies released

eight reports (the “Reports”), including Action Plan to Address Illicit Financial Risks of Digital Assets issued by

Treasury, Crypto-Assets: Implications for Consumers, Investors and Businesses issued by Treasury, The Future of Money and Payments issued

by Treasury, Climate and Energy Implications of Crypto-Assets in the United States issued by the White House, Policy Objectives for a

U.S. Central Bank Digital Currency System issued by the White House, Technical Evaluation for a U.S. Central Bank Digital Currency System

issued by the White House, The Role of Law Enforcement in Directing, Investigating, and Prosecuting Criminal Activity Related to Digital

Assets issued by the DOJ, and Responsible Advancement of US Competitiveness in Digital Assets issued by the U.S. Department of Commerce.

The Reports were issued in response to White House Executive Order 14067 on Ensuring Responsible Development of Digital Assets, which

calls for a whole-of-government alignment of the federal government’s approach to digital assets.

In December 2022, Senator Edward J. Markey, Chair

of the Senate Environment and Public Works Subcommittee on Clean Air, Climate, and Nuclear Safety, and Representative Jared Huffman Senate

introduced the Crypto-Asset Environmental Transparency Act. The legislation would require the Environmental Protection Agency (EPA) to

conduct a comprehensive impact study of U.S. cryptomining activity and require the reporting of greenhouse gas emissions from cryptomining

operations that consume more than 5 megawatts of power. If the bill is passed by both the Senate and the House and signed into law, mining

facilities may be required to report greenhouse gas emissions and to obtain permits and the price to rent mining facilities may increase.

If the price increase significantly and if we are not able to find alternative facilities with reasonable price acceptable to us, our

operation will be disrupted and our results of operation will be negatively impact.

Legal Proceedings

Except as discussed in

this section, there are no actions, suits, proceedings, inquiries or investigation before or by any court, public board, government agency,

self-regulatory organization or body pending or, to the knowledge of the executive officers of our company or any of our subsidiaries,

threatened against or affecting our company that are outside the ordinary course of business or in which an adverse decision could have

a material adverse effect.

However, from time to

time, we may become involved in various lawsuits and legal proceedings which arise in the ordinary course of business. Litigation is subject

to inherent uncertainties, and an adverse result in these or other matters may arise.

In March 2023, Bit Origin

and SonicHash US, along with other named entities, were named as defendants in a state court civil lawsuit filed in Cheyenne, Wyoming

by BCB Cheyenne LLC (“BCB”) who had contractual relationship with two of the named defendants, MineOne Wyoming Data

Center LLC, the other with Terra Crypto, Inc. Defendant alleges these parties breached their respective contracts. For its part, Bit Origin

and SonicHash US, who had no relationship with BCB, were nevertheless alleged to have intentionally interfered with BCB’s contractual

relationships with these other parties. Both Bit Origin and SonicHash US were also named as what is known as an “alter ego”

defendant pursuant to which a party may be found liable if its later discovered it was acting, in essence, as the alter ego of the primary

wrongdoer. Prior to the Company discovering it had been named in this Wyoming lawsuit, the case had been dismissed but simultaneously

recommenced in the U.S. District Court in Wyoming against the same parties, with substantively the same causes of action. Bit Origin and

SonicHash US were made aware of and appeared in this new federal court litigation denying all material allegations alleged against each

of them.

In September 2023, BCB

filed an amended complaint to add parties and substitute parties in place of others but leaving Bit Origin and Sonichash US as named defendants

accused of intentionally interfering with BCB’s contractual relations. Once again, both companies were also alleged to be alter

egos of the primary wrongdoers. In its lawsuit, BCB seeks “no less than $38 million” in compensatory damages. The Company

denies any liability to BCB arising out of this lawsuit and is defending this matter vigorously.

The parties mediated

this dispute from August 6 to August 8, 2024 but did not agree on a settlement. The trial of this case is scheduled to begin on January

27, 2025.

Corporate Information

Our principal executive offices are located at

27F, Samsung Hub, 3 Church Street Singapore 049483. The telephone number of our principal executive offices is 347-556-4747. Our registered

office in the Cayman Islands is provided by McGrath Tonner Corporate Services Limited and located at 5th Floor, Genesis Close,

George Town, PO Box 446, Grand Cayman, KYl-1106, Cayman Islands. Our agent for service of process in the United States is Cogency Global

Inc. located at 122 East 42nd Street, 18th Floor, New York, NY 10168. Our corporate website is http://bitorigin.io/. The information contained

in our website is not a part of this prospectus.

The SEC maintains an internet site at http://www.sec.gov

that contains reports, information statements, and other information regarding issuers that file electronically with the SEC.

Implications of Being a Foreign Private Issuer

We are a foreign private issuer within the meaning

of the rules under the Securities Exchange Act of 1934, as amended (the “Exchange Act”). As such, we are exempt from

certain provisions applicable to United States domestic public companies. For example:

| · |

we are not required to provide as many Exchange Act reports or provide periodic and current reports as frequently, as a domestic public company; |

| · |

for interim reporting, we are permitted to comply solely with our home country requirements, which are less rigorous than the rules that apply to domestic public companies; |

| · |

we are not required to provide the same level of disclosure on certain issues, such as executive compensation; |

| · |

we are exempt from provisions of Regulation FD aimed at preventing issuers from making selective disclosures of material information; |

| · |

we are not required to comply with the sections of the Exchange Act regulating the solicitation of proxies, consents or authorizations in respect of a security registered under the Exchange Act; and |

| · |

we are not required to comply with Section 16 of the Exchange Act requiring insiders to file public reports of their share ownership and trading activities and establishing insider liability for profits realized from any “short-swing” trading transaction. |

ABOUT THIS OFFERING

| Securities offered by the

Selling Shareholder: |

|

18,607,857 shares of

ordinary shares, which includes (i) 11,904,258 ordinary shares, par value $0.30 per share issuable upon the conversion of the

Initial Note(1), after the payment of the Amortization Amount (as defined in the Initial Note) due on each of the initial