false

0001086745

0001086745

2024-12-30

2024-12-30

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

8-K

Current

Report

Pursuant

to Section 13 or 15(d) of the

Securities

Exchange Act of 1934

Date

of Report (Date of earliest event reported): December 30, 2024

AYRO,

Inc.

(Exact

name of Registrant as specified in its charter)

| Delaware |

|

001-34643 |

|

98-0204758 |

(State

or other jurisdiction

of

incorporation) |

|

(Commission

File

No.) |

|

(IRS

Employer

Identification

No.) |

AYRO,

Inc.

900

E. Old Settlers Boulevard, Suite 100

Round

Rock, Texas 78664

(Address

of principal executive offices and zip code)

Registrant’s

telephone number, including area code: 512-994-4917

N/A

(Former

name or former address, if changed since last report.)

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under

any of the following provisions:

| ☐ |

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

| ☐ |

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities

registered pursuant to Section 12(b) of the Act:

| Title

of each class |

|

Trading

Symbol(s) |

|

Name

of each exchange on which registered |

| Common

stock, par value $0.0001 per share |

|

AYRO |

|

The

Nasdaq Stock Market LLC |

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company ☐

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item

5.02 Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of

Certain Officers.

As

reported below under Item 5.07 of this Current Report on Form 8-K, AYRO, Inc. (the “Company”) held its 2024 annual meeting

of stockholders on December 30, 2024 (the “Annual Meeting”), at which the Company’s stockholders approved an amendment

(the “Incentive Plan Amendment”) to the AYRO, Inc. Long-Term Incentive Plan (the “Incentive Plan”) to increase

the aggregate number of shares of the Company’s common stock, par value $0.0001 per share (the “Common Stock”), available

for the grant of awards under the Incentive Plan by 3,000,000 shares of Common Stock, to a total of 4,229,956 shares of Common Stock.

For

more information about the Incentive Plan Amendment, see the Company’s definitive proxy statement on Schedule 14A filed with the

Securities and Exchange Commission on December 2, 2024 (the “Proxy Statement”), the relevant portions of which are incorporated

herein by reference. The foregoing description of the Incentive Plan Amendment does not purport to be complete and is qualified in its

entirety by reference to the complete text of the Incentive Plan Amendment, a copy of which is filed as Exhibit 10.1 to this report and

is incorporated by reference herein.

Item 5.07 Submission of Matters to a Vote of Security Holders.

On

December 30, 2024, the Company held its Annual Meeting. As of the close of business on November 21, 2024, the record date for the Annual

Meeting, there were (i) 6,764,600 shares of common stock, par value $0.0001 per share, entitled to an aggregate of 6,764,600 votes, (ii)

50 shares of Series H-6 Convertible Preferred Stock, par value $0.0001 per share, entitled to an aggregate of 115 votes, and (iii) 12,666.63

shares of Series H-7 Convertible Preferred Stock, par value $0.0001 per share, entitled to an aggregate of 1,380,349 votes, outstanding

and entitled to vote on the proposals described below.

At

the Annual Meeting, the proposals set forth below were submitted to a vote of the Company’s stockholders. Each proposal is described

in detail in the Company’s Proxy Statement. All proposals were approved by the Company’s stockholders. The final voting results

are as follows:

| 1. |

Election

of six directors to serve on the Company’s board of directors for a term of one year or until their successors are elected and

qualified, for which the following are nominees: Joshua Silverman, Wayne R. Walker, George Devlin, Sebastian Giordano, Zvi Joseph, and

Greg Schiffman: |

| Nominee | |

Votes For | | |

Votes Withheld | | |

Broker Non-Votes | |

| Joshua Silverman | |

| 1,583,197 | | |

| 127,599 | | |

| 1,587,495 | |

| Wayne R. Walker | |

| 1,590,230 | | |

| 120,566 | | |

| 1,587,495 | |

| George Devlin | |

| 1,582,977 | | |

| 127,819 | | |

| 1,587,495 | |

| Sebastian Giordano | |

| 1,545,671 | | |

| 165,125 | | |

| 1,587,495 | |

| Zvi Joseph | |

| 1,545,494 | | |

| 165,302 | | |

| 1,587,495 | |

| Greg Schiffman | |

| 1,541,289 | | |

| 169,507 | | |

| 1,587,495 | |

| 2. |

Approval

of a proposed amendment to the AYRO, Inc. Long-Term Incentive Plan, to increase the aggregate number of shares available for

the grant of awards by 3,000,000 shares of Common Stock, to a total of 4,229,956 shares of Common Stock: |

| For | | |

Against | | |

Abstain | | |

Broker Non-Votes | |

| | 1,502,762 | | |

| 192,399 | | |

| 15,635 | | |

| 1,587,495 | |

| 3. |

Ratification

of the appointment of Marcum LLP as the Company’s independent registered public accounting firm for the fiscal year ending

December 31, 2024: |

| For | | |

Against | | |

Abstain | |

| | 3,080,387 | | |

| 152,827 | | |

| 65,077 | |

| 4. |

Approval

of an amendment to the Company’s Amended and Restated Certificate of Incorporation to effect, at the discretion of the Board but

prior to the one-year anniversary of the date on which the reverse stock split is approved by the Company’s stockholders at the

Annual Meeting, a reverse stock split of all of the outstanding shares of the Company’s Common Stock at a ratio in the range of

1-for-2 to 1-for-13, with such ratio to be determined by the Board in its discretion and included in a public announcement. |

| For | | |

Against | | |

Abstain | |

| | 2,774,623 | | |

| 454,471 | | |

| 69,197 | |

| 5. |

Approval

of a proposal to adjourn the Annual Meeting to a later date or dates, if necessary or appropriate, to permit further solicitation

and vote of proxies in the event that there are insufficient votes for, or otherwise in connection with, the approval of any one

or more of the proposals presented at the Annual Meeting. |

| For | | |

Against | | |

Abstain | |

| | 2,807,923 | | |

| 420,437 | | |

| 69,931 | |

The

proposals described above were acted upon by the Company’s stockholders at the Annual Meeting and received a sufficient number

of votes to be approved. For more information about the foregoing proposals, see the Proxy Statement, the relevant portions of which

are incorporated herein by reference. The results reported above are final voting results. No other matters were considered or voted

upon at the meeting.

Item

9.01 Financial Statements and Exhibits.

(d)

Exhibits.

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

| |

AYRO,

INC. |

| |

|

|

| Date: |

December 31, 2024 |

By:

|

/s/

Joshua Silverman |

| |

|

Joshua

Silverman |

| |

|

Executive

Chairman |

Exhibit

10.1

THIRD

AMENDMENT TO

AYRO,

INC. LONG-TERM INCENTIVE PLAN

This

THIRD AMENDMENT TO AYRO, INC. LONG-TERM INCENTIVE PLAN (this “Amendment”), effective as of December 30, 2024,

is made and entered into by AYRO, Inc., a Delaware corporation (the “Company”). Terms used in this Amendment

with initial capital letters that are not otherwise defined herein shall have the meanings ascribed to such terms in the AYRO, Inc. Long-Term

Incentive Plan, as amended by the First Amendment effective December 17, 2020, and by the Second Amendment effective September 14, 2023

(collectively, the “Plan”).

RECITALS

WHEREAS,

Article 9 of the Plan provides that the Board of Directors of the Company (the “Board”) may amend the Plan

at any time and from time to time;

WHEREAS,

the Board desires to amend the Plan to increase the aggregate number of shares of Common Stock that may be issued under the Plan, as

set forth in Article 5 of the Plan, by an additional 3,000,000 shares of Common Stock; and

WHEREAS,

the Board intends to submit this Amendment to the Company’s stockholders for their approval.

NOW,

THEREFORE, in accordance with Article 9 of the Plan, the Company hereby amends the Plan as follows:

| 1. |

Section

5.1 of the Plan is hereby amended by deleting said section in its entirety and substituting in lieu thereof the following new Section

5.1: |

5.1

Number Available for Awards. Subject to adjustment as provided in Articles 11 and 12, the maximum number of shares of Common Stock

that may be delivered pursuant to Awards granted under the Plan is four million two hundred twenty-nine thousand nine hundred fifty-six

(4,229,956) shares, of which one hundred percent (100%) may be delivered pursuant to Incentive Stock Options. Shares to be issued may

be made available from authorized but unissued Common Stock, Common Stock held by the Company in its treasury, or Common Stock purchased

by the Company on the open market or otherwise. During the term of the Plan, the Company will at all times reserve and keep available

the number of shares of Common Stock that shall be sufficient to satisfy the requirements of the Plan.

| 2. |

Except

as expressly amended by this Amendment, the Plan shall continue in full force and effect in accordance with the provisions thereof. |

[Signature

page follows.]

IN

WITNESS WHEREOF, the Company has caused this Amendment to be duly executed as of the date first written above.

|

AYRO,

INC. |

| |

|

|

| |

By:

|

/s/

Joshua Silverman |

| |

Name: |

Joshua

Silverman |

| |

Title:

|

Executive

Chairman |

v3.24.4

Cover

|

Dec. 30, 2024 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Dec. 30, 2024

|

| Entity File Number |

001-34643

|

| Entity Registrant Name |

AYRO,

Inc.

|

| Entity Central Index Key |

0001086745

|

| Entity Tax Identification Number |

98-0204758

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity Address, Address Line One |

AYRO,

Inc.

|

| Entity Address, Address Line Two |

900

E. Old Settlers Boulevard

|

| Entity Address, Address Line Three |

Suite 100

|

| Entity Address, City or Town |

Round

Rock

|

| Entity Address, State or Province |

TX

|

| Entity Address, Postal Zip Code |

78664

|

| City Area Code |

512

|

| Local Phone Number |

994-4917

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common

stock, par value $0.0001 per share

|

| Trading Symbol |

AYRO

|

| Security Exchange Name |

NASDAQ

|

| Entity Emerging Growth Company |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 3 such as an Office Park

| Name: |

dei_EntityAddressAddressLine3 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

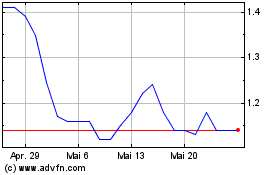

AYRO (NASDAQ:AYRO)

Historical Stock Chart

Von Dez 2024 bis Jan 2025

AYRO (NASDAQ:AYRO)

Historical Stock Chart

Von Jan 2024 bis Jan 2025