- Sales grew 14% to $198.1 million in the quarter

- Operating income increased to $7.6 million in the quarter,

or 3.8% of sales

- Achieved net income for the quarter of $1.5 million, or

$0.04 per diluted share

- Adjusted EBITDA1 grew 28% to $20.2 million, or 10.2% of

sales, an increase of $4.4 million over the second quarter of

the prior year

- Bookings in the quarter were $219.0 million, driving a

record backlog of $633.4 million with book to bill ratio of

1.11x

- Aerospace achieved its tenth consecutive record backlog of

$554.6 million

- Raising 2024 revenue guidance to $780 million to $800

million

Astronics Corporation (Nasdaq: ATRO) (“Astronics” or the

“Company”), a leading supplier of advanced technologies and

products to the global aerospace, defense, and other

mission-critical industries, today reported financial results for

the three and six months ended June 29, 2024.

This press release features multimedia. View

the full release here:

https://www.businesswire.com/news/home/20240801227455/en/

Astronics Segment Sales and Bookings

(Graphic: Business Wire)

Peter J. Gundermann, Chairman, President and Chief Executive

Officer, commented, “Our second quarter confirmed success with

increased demand, new program wins, and our ability to deliver

product to our customers more efficiently and predictably. We

exceeded our guidance with 14% growth in sales and improved

profitability. Bookings were at a post-pandemic high, resulting in

yet another record backlog. Our strong performance supports raising

our expectations for the year. Looking beyond 2024, our market

leadership positions, the significant programs that we have won

recently, and our high level of innovation point to a long runway

for delivering value and improved earnings power.”

____________________________

1 Adjusted EBITDA is a Non-GAAP

Performance Measure. Please see the attached table for a

reconciliation of adjusted EBITDA to GAAP net income (loss).

Second Quarter Results

Three Months Ended

Six Months Ended

($ in thousands)

June 29,

2024

July 1,

2023

%

Change

June 29,

2024

July 1,

2023

%

Change

Sales

$

198,114

$

174,454

13.6

%

$

383,188

$

330,992

15.8

%

Income from Operations

$

7,550

$

2,396

215.1

%

$

9,216

$

26

35,346.2

%

Operating Margin %

3.8

%

1.4

%

2.4

%

—

%

Net Gain on Sale of Business

$

—

$

—

$

—

$

(3,427

)

Net Income (Loss)

$

1,533

$

(11,999

)

112.8

%

$

(1,645

)

$

(16,414

)

90.0

%

Net Income (Loss) %

0.8

%

(6.9

)%

(0.4

)%

(5.0

)%

*Adjusted EBITDA

$

20,243

$

15,844

27.8

%

$

39,316

$

21,922

79.3

%

*Adjusted EBITDA Margin %

10.2

%

9.1

%

10.3

%

6.6

%

*Adjusted EBITDA is a Non-GAAP Performance

Measure. Please see the attached table for a reconciliation of

adjusted EBITDA to GAAP net income (loss).

Second Quarter 2024 Results (compared with

the prior-year period, unless noted otherwise)

Consolidated sales were up $23.7 million, or 13.6%. Aerospace

sales increased $18.6 million and Test Systems sales increased $5.1

million.

Consolidated operating income increased to $7.6 million,

compared with operating income of $2.4 million in the prior-year

period. Improved operating income reflects the operating leverage

gained on higher sales volume, partially offset by $4.0 million in

bonus expense as the Company’s incentive programs resumed in

2024.

Consolidated sales and operating profit were negatively impacted

by $3.5 million due to a revision of estimated costs to complete

certain long-term mass transit contracts in the Test Systems

segment.

Consolidated net income was $1.5 million, or $0.04 per diluted

share, measurably improved compared with the net loss of $12.0

million, or $0.37 per diluted share, in the prior year. Tax benefit

in the quarter was $0.3 million, compared with tax expense of $8.1

million in the prior year.

Consolidated adjusted EBITDA increased to $20.2 million, or

10.2% of consolidated sales, compared with adjusted EBITDA of $15.8

million, or 9.1% of consolidated sales, in the prior-year period

primarily as a result of higher sales.

Bookings were $219.0 million in the quarter resulting in a

book-to-bill ratio of 1.11:1. For the trailing twelve months,

bookings totaled $783.6 million and the book-to-bill ratio was

1.06:1.

Aerospace Segment Review (refer to sales by market and

segment data in accompanying tables)

Aerospace Second Quarter 2024 Results

(compared with the prior-year period, unless noted

otherwise)

Aerospace segment sales increased $18.6 million, or 11.7%, to

$176.9 million. The improvement was driven by a 14.6% increase, or

$16.3 million, in Commercial Transport sales. Sales to this market

were $128.4 million, or 64.8% of consolidated sales in the quarter,

compared with $112.1 million, or 64.3% of consolidated sales in the

second quarter of 2023. Higher airline spending drove increased

demand.

Military Aircraft sales increased $11.2 million, or 82.4%, to

$24.8 million, driven by progress on the FLRAA program as well as

higher sales of lighting, safety and avionics products for military

aircraft. General Aviation sales decreased $6.0 million, or 24.0%,

to $19.0 million due to lower antenna and VVIP sales.

Aerospace segment operating profit of $19.3 million grew 41%

compared with operating profit of $13.7 million in the same period

last year. As a percent of sales, operating margin expanded to

10.9%, or 220 basis points over the prior-year period. Operating

margin expansion reflects the leverage gained on higher volume and

improving production efficiencies. Operating profit in the second

quarter of 2024 was impacted by a $3.0 million increase in

litigation-related legal expenses and reserve adjustments related

to an ongoing patent dispute and $2.9 million related to the

resumption of the Company’s incentive programs.

Aerospace bookings were $192.7 million for a book-to-bill ratio

of 1.09:1. Backlog for the Aerospace segment was a record $554.6

million at quarter end.

Mr. Gundermann commented, “The strong demand for our Aerospace

products and technologies continues to gain momentum as the

aerospace industry recovers. Encouragingly, we are seeing strength

across all of our Aerospace product lines. While our significant

position in inflight entertainment and connectivity continues to

grow, we are also seeing strong growth in our flight critical power

and aircraft lighting thrusts. At the same time, we are continuing

to become more efficient at delivering product reliably and

predictably and the higher throughput is beginning to show the

operating leverage that is inherent in our business.”

Test Systems Segment Review (refer to sales by market and

segment data in accompanying tables)

Test Systems Second Quarter 2024 Results

(compared with the prior-year period, unless noted

otherwise)

Test Systems segment sales were $21.2 million, up $5.1 million.

The improvement was driven by radio test sales following the award

of the U.S. Army TS-4549/T contract, which contributed $7.2 million

in sales during the quarter. However, segment sales were negatively

impacted by $3.5 million due to a revision of estimated costs to

complete certain long-term mass transit Test contracts. The

revision resulted in reduced revenue recognized in the period due

to lower estimates of the percentage of work completed on the

programs.

Test Systems segment operating loss was $5.3 million, compared

with operating loss of $6.1 million in the second quarter of 2023.

The positive margin realized on the Army contract was offset by

$3.5 million related to the revision of estimated costs noted

above. Additionally, Test Systems continues to be negatively

affected by mix and under absorption of fixed costs due to current

volume.

In April 2024, the Test Systems segment implemented

restructuring initiatives to align the workforce and management

structure with near-term revenue expectations and operational needs

resulting in $0.7 million in severance expense recognized during

the second quarter. As part of the restructuring the Test business

closed an operation in Kilgore, TX, simplifying its operations. We

expect to realize annual savings of approximately $4 million from

these activities, beginning in the third quarter.

Bookings for the Test Systems segment in the quarter were $26.4

million, including a $15.5 million initial booking for the U.S.

Army TS-4549/T radio test set program. The book-to-bill ratio was

1.25:1 for the quarter. Backlog was $78.8 million at the end of the

second quarter of 2024 compared with a backlog of $73.6 million at

the end of the previous quarter.

Mr. Gundermann commented, “The second quarter was an important

reset for our Test business. We finally were awarded the U.S.

Army’s radio test program known as 4549/T, which we expect will

bring revenue of $215 million or so over the next few years. We

also completed a major restructuring of the business including the

elimination of a peripheral manufacturing facility, our second of

three such consolidations planned for the business. Finally, we

performed our quarterly review of certain long-term mass transit

contracts which resulted in an increase in the estimated costs to

complete as the programs are not progressing as efficiently as

expected. This was certainly a painful adjustment but, combined

with the restructuring and the 4549/T award, we believe the

business is set for a considerably brighter future.”

Liquidity and Financing

Capital expenditures in the quarter were $1.8 million and $3.4

million year-to-date. Net debt was $174.0 million, up from $161.2

million at December 31, 2023.

Cash used for operations in the second quarter of 2024 was

primarily the result of a $16.7 million increase in accounts

receivable which was related to increased sales and the timing of

shipments.

On July 11, 2024, the Company announced it had amended and

expanded its revolving line of credit and refinanced its term loan.

The refinancing provides improved liquidity, lower cash costs, and

greater financial flexibility for the Company. The refinancing is

comprised of an expanded asset-based line of credit and a reduced,

lower-cost term loan.

The revolving line of credit was expanded from $115 million to a

$200 million maximum subject to the borrowing base, with an

interest rate of SOFR plus 2.5% to 3.0% varying based on the

Company’s consolidated leverage ratio. At closing, Astronics had

$128 million drawn on the facility.

The new $55 million term loan has an interest rate of SOFR plus

5.5% to 6.75% varying based on the Company’s consolidated leverage

ratio. Cash amortization of the new term loan will be approximately

$550,000 annually, down from the previous rate of approximately

$9.0 million.

The lower combined interest rate is expected to reduce interest

expense by $2.0 million annually. The new debt structure afforded

the Company approximately $50 million of available liquidity at

closing, which was up from approximately $15 million prior.

Third quarter 2024 expenses will include refinancing-related

fees, the call premium on the previous term loan and the write-off

of deferred financing costs related to the previous financing.

These expenses in total are estimated to be $7.5 million.

2024 Outlook

The Company is increasing its 2024 revenue guidance to $780

million to $800 million. The midpoint of this range would be a 15%

increase over 2023 sales. Astronics considered the broad range of

tailwinds affecting the business balanced against certain risks,

including those associated with OEM production rates, in issuing

its guidance.

The Company expects third quarter revenue to be in the range of

$195 million to $205 million.

Backlog at the end of the second quarter was a record $633.4

million, of which approximately $402.3 million is expected to ship

in 2024. Planned capital expenditures in 2024 are expected to be in

the range of $17 million to $22 million.

Peter Gundermann commented, “We are making excellent progress as

an organization, with first half 2024 sales up 15.8% and strong

margin improvement. We believe the table is set for current trends

to continue, and that 2024 will finish as a very strong year. Our

innovative products are valued by our customers, we are executing

on key wins after significant investments of time and money over

the last few years, and we are regaining our operational stride

which allows continued expansion of our margin profile and

earnings.”

Second Quarter 2024 Webcast and Conference Call

The Company will host a teleconference today at 4:45 p.m. ET.

During the teleconference, management will review the financial and

operating results for the period and discuss Astronics’ corporate

strategy and outlook. A question-and-answer session will

follow.

The Astronics conference call can be accessed by calling (412)

317-0518. The listen-only audio webcast can be monitored at

investors.astronics.com. To listen to the archived call, dial (412)

317-6671 and enter replay pin number 10189526. The telephonic

replay will be available from 8:00 p.m. on the day of the call

through Thursday, August 15, 2024. The webcast replay can be

accessed via the investor relations section of the Company’s

website where a transcript will also be posted once available.

About Astronics

Corporation

Astronics Corporation (Nasdaq: ATRO) serves the world’s

aerospace, defense, and other mission-critical industries with

proven innovative technology solutions. Astronics works

side-by-side with customers, integrating its array of power,

connectivity, lighting, structures, interiors, and test

technologies to solve complex challenges. For over 50 years,

Astronics has delivered creative, customer-focused solutions with

exceptional responsiveness. Today, global airframe manufacturers,

airlines, military branches, completion centers, and Fortune 500

companies rely on the collaborative spirit and innovation of

Astronics. The Company’s strategy is to increase its value by

developing technologies and capabilities that provide innovative

solutions to its targeted markets.

Safe Harbor Statement

This news release contains forward-looking statements as defined

by the Securities Exchange Act of 1934. One can identify these

forward-looking statements by the use of the words “expect,”

“anticipate,” “plan,” “may,” “will,” “estimate,” “feeling” or other

similar expressions and include all statements with regard to

achieving any revenue or profitability expectations, aircraft

production rates, the predictability of the supply chain and

productivity of manufacturing personnel and efficiency of staff,

the effectiveness on profitability of cost reduction efforts, the

effect of pricing on margins, the execution of program wins, the

benefit of market position, success with program awards and

contributions of innovation, the length of the runway for improved

earnings, the level of liquidity and its sufficiency to meet

current needs, the rate of acceleration of the business, the level

of cash generation, the level of demand by customers and markets.

Because such statements apply to future events, they are subject to

risks and uncertainties that could cause actual results to differ

materially from those contemplated by the statements. Important

factors that could cause actual results to differ materially from

what may be stated here include the impact of global pandemics and

related governmental and other actions taken in response, the trend

in growth with passenger power and connectivity on airplanes, the

state of the aerospace and defense industries, the market

acceptance of newly developed products, internal production

capabilities, the timing of orders received, the status of customer

certification processes and delivery schedules, the demand for and

market acceptance of new or existing aircraft which contain the

Company’s products, the impact of regulatory activity and public

scrutiny on production rates of a major U.S. aircraft manufacturer,

the need for new and advanced test and simulation equipment,

customer preferences and relationships, the effectiveness of the

Company’s supply chain, and other factors which are described in

filings by Astronics with the Securities and Exchange Commission.

The Company assumes no obligation to update forward-looking

information in this news release whether to reflect changed

assumptions, the occurrence of unanticipated events or changes in

future operating results, financial conditions or prospects, or

otherwise.

FINANCIAL TABLES FOLLOW

ASTRONICS CORPORATION

CONSOLIDATED STATEMENT OF OPERATIONS DATA

(Unaudited, $ in thousands except

per share data)

Three

Months Ended

Six

Months Ended

6/29/2024

7/1/2023

6/29/2024

7/1/2023

Sales1

$

198,114

$

174,454

$

383,188

$

330,992

Cost of products sold

156,760

141,759

307,643

270,787

Gross profit

41,354

32,695

75,545

60,205

Gross margin

20.9

%

18.7

%

19.7

%

18.2

%

Selling, general and administrative

33,804

30,299

66,329

60,179

SG&A % of sales

17.1

%

17.4

%

17.3

%

18.2

%

Income from operations

7,550

2,396

9,216

26

Operating margin

3.8

%

1.4

%

2.4

%

—

%

Net gain on sale of business2

—

—

—

(3,427

)

Other expense (income)3

435

378

871

(910

)

Interest expense, net

5,856

5,920

11,615

11,390

Income (loss) before tax

1,259

(3,902

)

(3,270

)

(7,027

)

Income tax (benefit) expense

(274

)

8,097

(1,625

)

9,387

Net income (loss)

$

1,533

$

(11,999

)

$

(1,645

)

$

(16,414

)

Net income (loss) % of sales

0.8

%

(6.9

)%

(0.4

)%

(5.0

)%

Basic earnings (loss) per share:

$

0.04

$

(0.37

)

$

(0.05

)

$

(0.50

)

Diluted earnings (loss) per share:

$

0.04

$

(0.37

)

$

(0.05

)

$

(0.50

)

Weighted average diluted shares

outstanding (in thousands)

35,547

32,614

34,936

32,560

Capital expenditures

$

1,796

$

2,233

$

3,394

$

3,806

Depreciation and amortization

$

6,203

$

6,711

$

12,531

$

13,373

____________________________

1 In the six months ended July 1, 2023,

$5.8 million was recognized in sales related to the reversal of a

deferred revenue liability recorded with a previous acquisition

within our Test Systems Segment.

2 Net gain on sale of business for the six

months ended July 1, 2023 is comprised of the additional gain on

the sale of the Company’s former semiconductor test business

resulting from the contingent earnout for the 2022 calendar

year.

3 Other expense (income) for the six

months ended July 1, 2023 includes income of $1.8 million

associated with the reversal of a liability related to an equity

investment, as we will no longer be required to make the associated

payment.

Reconciliation to Non-GAAP Performance Measures

In addition to reporting net income, a U.S. generally accepted

accounting principle (“GAAP”) measure, we present Adjusted EBITDA

(earnings before interest, income taxes, depreciation and

amortization, non-cash equity-based compensation expense, goodwill,

intangible and long-lived asset impairment charges, equity

investment income or loss, legal reserves, settlements and

recoveries, restructuring charges, gains or losses associated with

the sale of businesses and grant benefits recorded related to the

AMJP program), which is a non-GAAP measure. The Company’s

management believes Adjusted EBITDA is an important measure of

operating performance because it allows management, investors and

others to evaluate and compare the performance of its core

operations from period to period by removing the impact of the

capital structure (interest), tangible and intangible asset base

(depreciation and amortization), taxes, equity-based compensation

expense, goodwill, intangible and long-lived asset impairment

charges, equity investment income or loss, non-cash reserves

related to customer bankruptcy filings, legal reserves, settlements

and recoveries, litigation-related expenses, restructuring charges,

gains or losses associated with the sale of businesses and grant

benefits recorded related to the AMJP program, which is not

commensurate with the core activities of the reporting period in

which it is included. As such, the Company uses Adjusted EBITDA as

a measure of performance when evaluating its business and as a

basis for planning and forecasting. Adjusted EBITDA is not a

measure of financial performance under GAAP and is not calculated

through the application of GAAP. As such, it should not be

considered as a substitute for the GAAP measure of net income and,

therefore, should not be used in isolation of, but in conjunction

with, the GAAP measure. Adjusted EBITDA, as presented, may produce

results that vary from the GAAP measure and may not be comparable

to a similarly defined non-GAAP measure used by other

companies.

ASTRONICS CORPORATION

RECONCILIATION OF NET INCOME (LOSS) TO ADJUSTED

EBITDA

(Unaudited, $ in thousands)

Consolidated

Three

Months Ended

Six

Months Ended

6/29/2024

7/1/2023

6/29/2024

7/1/2023

Net income (loss)

$

1,533

$

(11,999

)

$

(1,645

)

$

(16,414

)

Add back (deduct):

Interest expense

5,856

5,920

11,615

11,390

Income tax (benefit) expense

(274

)

8,097

(1,625

)

9,387

Depreciation and amortization expense

6,203

6,711

12,531

13,373

Equity-based compensation expense

1,840

1,593

4,642

3,992

Non-cash annual stock bonus accrual

—

—

1,448

—

Non-cash 401K contribution and quarterly

bonus accrual

—

1,328

3,454

2,536

Restructuring-related charges including

severance

657

564

774

564

Legal reserve, settlements and

recoveries

—

(1,305

)

—

(1,305

)

Litigation-related legal expenses

4,428

4,935

8,122

9,450

Equity investment accrued payable

write-off

—

—

—

(1,800

)

Net gain on sale of business

—

—

—

(3,427

)

Deferred liability recovery

—

—

—

(5,824

)

Adjusted EBITDA

$

20,243

$

15,844

$

39,316

$

21,922

Sales

$

198,114

$

174,454

$

383,188

$

330,992

Adjusted EBITDA margin on sales

10.2

%

9.1

%

10.3

%

6.6

%

ASTRONICS CORPORATION

CONSOLIDATED BALANCE SHEET DATA

($ in thousands)

(unaudited)

6/29/2024

12/31/2023

ASSETS

Cash and cash equivalents

$

2,857

$

4,756

Restricted cash

1,535

6,557

Accounts receivable and uncompleted

contracts

186,295

172,108

Inventories

200,679

191,801

Other current assets

21,039

14,560

Property, plant and equipment, net

82,511

85,436

Other long-term assets

32,957

34,944

Intangible assets, net

58,843

65,420

Goodwill

58,143

58,210

Total assets

$

644,859

$

633,792

LIABILITIES AND

SHAREHOLDERS' EQUITY

Current maturities of long-term debt

$

1,300

$

8,996

Accounts payable and accrued expenses

122,207

112,309

Customer advances and deferred revenue

17,635

22,029

Long-term debt

172,635

159,237

Other liabilities

73,202

81,703

Shareholders' equity

257,880

249,518

Total liabilities and shareholders'

equity

$

644,859

$

633,792

ASTRONICS CORPORATION

CONSOLIDATED CASH FLOWS DATA

Six

Months Ended

(Unaudited, $ in thousands)

6/29/2024

7/1/2023

Cash flows from operating

activities:

Net loss

$

(1,645

)

$

(16,414

)

Adjustments to reconcile net loss to cash

from operating activities:

Non-cash items:

Depreciation and amortization

12,531

13,373

Amortization of deferred financing

fees

1,695

1,363

Provisions for non-cash losses on

inventory and receivables

2,415

1,705

Equity-based compensation expense

4,642

3,992

Net gain on sale of business

—

(3,427

)

Operating lease non-cash expense

2,562

2,563

Non-cash 401K contribution and quarterly

bonus accrual

3,454

2,536

Non-cash annual stock bonus accrual

1,448

—

Non-cash deferred liability reversal

—

(5,824

)

Other

1,827

(1,275

)

Cash flows from changes in operating

assets and liabilities:

Accounts receivable

(15,281

)

(22,619

)

Inventories

(11,398

)

(22,638

)

Accounts payable

(4,661

)

14,081

Accrued expenses

9,255

5,611

Income taxes

(4,487

)

7,422

Operating lease liabilities

(2,447

)

(2,674

)

Customer advance payments and deferred

revenue

(4,280

)

959

Supplemental retirement plan

liabilities

(209

)

(206

)

Other assets and liabilities

356

321

Net cash used by operating activities

(4,223

)

(21,151

)

Cash flows from investing

activities:

Proceeds on sale of business and

assets

—

3,427

Capital expenditures

(3,394

)

(3,806

)

Net cash used by investing activities

(3,394

)

(379

)

Cash flows from financing

activities:

Proceeds from long-term debt

15,392

131,732

Principal payments on long-term debt

(9,498

)

(112,774

)

Stock award and employee stock purchase

plan activity

(3,172

)

(601

)

Financing-related costs

(1,837

)

(6,388

)

Finance lease principal payments

(70

)

(24

)

Other

(10

)

—

Net cash provided by financing

activities

805

11,945

Effect of exchange rates on cash

(109

)

101

Decrease in cash and cash equivalents and

restricted cash

(6,921

)

(9,484

)

Cash and cash equivalents and restricted

cash at beginning of period

11,313

13,778

Cash and cash equivalents and restricted

cash at end of period

$

4,392

$

4,294

ASTRONICS CORPORATION

SEGMENT

DATA

(Unaudited, $ in thousands)

Three

Months Ended

Six

Months Ended

6/29/2024

7/1/2023

6/29/2024

7/1/2023

Sales

Aerospace

$

176,948

$

158,386

$

340,623

$

294,101

Less inter-segment

(5

)

(4

)

(42

)

(122

)

Total Aerospace

176,943

158,382

340,581

293,979

Test Systems1

21,171

16,072

42,607

37,013

Less inter-segment

—

—

—

—

Total Test Systems

21,171

16,072

42,607

37,013

Total consolidated sales

198,114

174,454

383,188

330,992

Segment operating profit and

margins

Aerospace

19,280

13,719

31,377

17,806

10.9

%

8.7

%

9.2

%

6.1

%

Test Systems1

(5,336

)

(6,143

)

(8,415

)

(6,740

)

(25.2

)%

(38.2

)%

(19.8

)%

(18.2

)%

Total segment operating profit

13,944

7,576

22,962

11,066

Net gain on sale of business

—

—

—

(3,427

)

Interest expense

5,856

5,920

11,615

11,390

Corporate expenses and other2

6,829

5,558

14,617

10,130

Income (loss) before taxes

$

1,259

$

(3,902

)

$

(3,270

)

$

(7,027

)

____________________________

1 In the six months ended July 1, 2023,

$5.8 million was recognized in sales related to the reversal of a

deferred revenue liability recorded with a previous acquisition

within our Test Systems Segment, which also benefits operating loss

for the period. Absent that benefit, Test Systems operating loss

was $12.6 million.

2 Corporate expenses and other for the six

months ended July 1, 2023 includes income of $1.8 million

associated with the reversal of a liability related to an equity

investment, as we will no longer be required to make the associated

payment.

ASTRONICS CORPORATION

SALES BY MARKET

(Unaudited, $ in thousands)

Three

Months Ended

Six

Months Ended

2024

YTD

6/29/2024

7/1/2023

%

Change

6/29/2024

7/1/2023

%

Change

% of

Sales

Aerospace Segment

Commercial Transport

$

128,399

$

112,079

14.6

%

$

249,829

$

206,292

21.1

%

65.2

%

Military Aircraft

24,781

13,584

82.4

%

41,860

27,648

51.4

%

10.9

%

General Aviation

19,015

25,015

(24.0

)%

38,566

44,463

(13.3

)%

10.1

%

Other

4,748

7,704

(38.4

)%

10,326

15,576

(33.7

)%

2.7

%

Aerospace Total

176,943

158,382

11.7

%

340,581

293,979

15.9

%

88.9

%

Test Systems Segment1

Government & Defense

21,171

16,072

31.7

%

42,607

37,013

15.1

%

11.1

%

Total Sales

$

198,114

$

174,454

13.6

%

$

383,188

$

330,992

15.8

%

SALES BY PRODUCT LINE

(Unaudited, $ in thousands)

Three

Months Ended

Six

Months Ended

2024

YTD

6/29/2024

7/1/2023

%

Change

6/29/2024

7/1/2023

%

Change

% of

Sales

Aerospace Segment

Electrical Power & Motion

$

90,328

$

67,946

32.9

%

$

173,452

$

121,400

42.9

%

45.4

%

Lighting & Safety

46,454

41,918

10.8

%

88,241

78,471

12.5

%

23.0

%

Avionics

28,971

30,923

(6.3

)%

54,565

60,664

(10.1

)%

14.2

%

Systems Certification

3,364

7,620

(55.9

)%

7,812

13,297

(41.2

)%

2.0

%

Structures

3,078

2,271

35.5

%

6,185

4,571

35.3

%

1.6

%

Other

4,748

7,704

(38.4

)%

10,326

15,576

(33.7

)%

2.7

%

Aerospace Total

176,943

158,382

11.7

%

340,581

293,979

15.9

%

88.9

%

Test Systems Segment1

21,171

16,072

31.7

%

42,607

37,013

15.1

%

11.1

%

Total Sales

$

198,114

$

174,454

13.6

%

$

383,188

$

330,992

15.8

%

____________________________

1 Test Systems sales in the six months

ended July 1, 2023 included a $5.8 million reversal of a deferred

revenue liability recorded with a previous acquisition.

ASTRONICS CORPORATION

ORDER

AND BACKLOG TREND

(Unaudited, $ in thousands)

Q3 2023

Q4 2023

Q1 2024

Q2 2024

Trailing

Twelve Months

9/30/2023

12/31/2023

3/30/2024

6/29/2024

6/29/2024

Sales

Aerospace

$

142,104

$

168,747

$

163,638

$

176,943

$

651,432

Test Systems

20,818

26,545

21,436

21,171

89,970

Total Sales

$

162,922

$

195,292

$

185,074

$

198,114

$

741,402

Bookings

Aerospace

$

153,272

$

172,106

$

185,269

$

192,664

$

703,311

Test Systems

22,724

11,176

19,986

26,359

80,245

Total Bookings

$

175,996

$

183,282

$

205,255

$

219,023

$

783,556

Backlog

Aerospace1

$

513,881

$

517,240

$

538,871

$

554,592

Test Systems

90,405

75,036

73,586

78,774

Total Backlog

$

604,286

$

592,276

$

612,457

$

633,366

N/A

Book:Bill Ratio

Aerospace

1.08

1.02

1.13

1.09

1.08

Test Systems

1.09

0.42

0.93

1.25

0.89

Total Book:Bill

1.08

0.94

1.11

1.11

1.06

____________________________

1 In November of 2023, a non-core

contract manufacturing customer reported within the Aerospace

segment declared bankruptcy, and as a result, Aerospace and Total

Backlog was reduced by $19.9 million in all periods affected. In

the bar chart presented above, Aerospace and Total Bookings was

reduced by $2.6 million and $17.2 million in second and third

quarters of 2021, respectively.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240801227455/en/

Company: David C. Burney, Chief Financial Officer (716)

805-1599, ext. 159 david.burney@astronics.com

Investor Relations: Deborah K. Pawlowski, Kei Advisors LLC (716)

843-3908 dpawlowski@keiadvisors.com

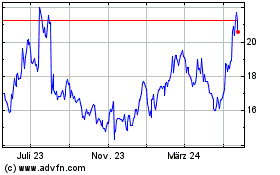

Astronics (NASDAQ:ATRO)

Historical Stock Chart

Von Okt 2024 bis Nov 2024

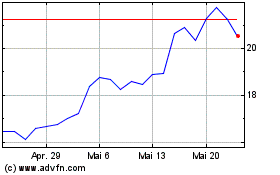

Astronics (NASDAQ:ATRO)

Historical Stock Chart

Von Nov 2023 bis Nov 2024