Alphatec Holdings, Inc. (Nasdaq:ATEC), the parent company of

Alphatec Spine, Inc., a medical device company that designs,

develops, manufactures and markets products for the surgical

treatment of spine disorders, with a focus on treating conditions

related to the aging spine, announced today financial results for

the first quarter of fiscal 2012, ended March 31, 2012.

First Quarter 2012 Highlights

- Sales levels in core U.S. Hospital business remains strong and

grew sequentially from Q411

- Sales growth in select international markets, most notably

Japan and Latin America, remains strong

- Gross margin improves 140 basis points vs. Q111 to 65.7%

- Gross profit margin improvement and operating expense control

drives record Adjusted EBITDA of $6.2 million

First Quarter 2012 Financial Results

Consolidated revenues for the first quarter of 2012 were $48.5

million compared to $49.7 million reported for the first quarter of

2011. U.S. revenues for the first quarter 2012 were $32.6 million,

compared to $33.9 million reported for the first quarter of 2011.

International revenues in the first quarter of 2012 were $15.9

million, which is equal to the amount reported for the first

quarter of 2011. International revenue continued to benefit from

growth in Japan and Latin America.

Gross profit and gross margin for the first quarter of 2012 was

$31.8 million and 65.7 percent, respectively, compared to $32.0

million and 64.3 percent, respectively, for the first quarter of

2011. Gross profit in the first quarter of 2012 was reduced by $1.0

million for the amortization of a licensed intangible asset as part

of the Cross Medical settlement that will be recorded in the first

quarter of 2012 and the subsequent six quarters, as noted below.

Excluding this amount, gross profit and gross profit margin would

have been $32.9 million and 67.8 percent, respectively.

As previously reported in January 2012, the Company announced

that it had reached a global settlement agreement with Cross

Medical Products regarding a license agreement dispute initiated by

Cross Medical and a patent infringement suit initiated by the

Company. As part of the settlement, the Company agreed to pay Cross

Medical $18 million. An initial payment of $5 million dollars was

made in January 2012. The Company expensed $9.8 million in the

fourth quarter of 2011, which was charged to operating expenses as

a legal settlement adjustment. With respect to the remaining $8.2

million, $8.0 million will be recorded as a licensed intangible

asset to be amortized over the first quarter of 2012 and the

subsequent six quarters in 2012 and 2013, plus imputed interest of

$0.2 million.

Total operating expenses for the first quarter of 2012 were

$31.9 million, or 65.9 percent of revenues, reflecting a decrease

of $2.4 million, compared to the first quarter of 2011.

Net loss for the first quarter of 2012 was $1.3 million, or

($0.01) per share (basic and diluted), compared to a net loss of

$1.9 million, or ($0.02) per share (basic and diluted) for the

first quarter of 2011.

Adjusted EBITDA in the first quarter of 2012 was $6.2 million,

or 12.8 percent of revenues, compared to $4.4 million, or 8.8

percent reported for the first quarter of 2011. Adjusted EBITDA in

the first quarter of 2012 was the highest result since the

Company's initial public offering in 2006.

Cash and cash equivalents were $16.9 million at March 31, 2012,

reflecting a decrease of $3.8 million, compared to the cash

position as of December 31, 2011. The Company's cash position at

March 31, 2012 reflects a payment of $5.0 million to Cross Medical

as part of the settlement noted above.

"Considering the ongoing headwinds in the spine market and the

difficult comparison we faced with the first quarter of 2011, our

first quarter of 2012 was respectable," said Les Cross, chairman

and chief executive officer. "We are pleased with the improved

operating performance for the Company that helped drive strong

Adjusted EBITDA growth.

"Pricing and lower procedure volumes continue to challenge

global spine markets and contributed to lower first quarter revenue

of about $1.3 million compared to the first quarter of 2011.

"In our U.S. Hospital channel, our primary domestic business,

sales were in line with the first quarter of 2011. Excluding our

Xenon pedicle screw system, U.S. Hospital sales grew about 3% over

the first quarter of 2011 and about 1% sequentially from the fourth

quarter of last year, in spite of market pressures. U.S. Hospital

sales were driven by Biologics and our MIS products.

"Sales in our U.S. Stocking Distributor channel were lower by

about $1 million, compared to Q1 2011. The first quarter of 2011

benefitted from several initial large stocking orders that we did

not replicate in Q1 2012. Additionally, we believe many of our

Stocking Distributors are reducing their on-hand inventory levels

in response to lower procedure volumes.

"International revenue continues to be driven by strong growth

in Japan and Latin America. Sales in Europe and the Middle East

continue to struggle as political and economic conditions as well

as government healthcare spending remain challenging.

"On the operational side of our business, we made good progress

in the first quarter with our performance improvement initiatives.

Our initial efforts have been focused on those initiatives that

support near-term revenue generation and enhance our customers'

experience.

"To help strengthen gross margins, we plan to begin in-house

manufacturing of certain products currently manufactured by

third-parties. Our first product will be Trestle Luxe® and we are

nearing the completion of the manufacturing validation for this

product.

"We are also implementing lean practices in our manufacturing

operations. We have recently mapped many of our current processes

and identified significant opportunities to reduce work-in-process

(WIP), shorten cycle times, improve fill rates and lower shipping

costs. Collectively, we believe these streamlining activities

should contribute to our cost savings goal of approximately $2

million in annualized benefit once fully implemented."

Mr. Cross finished by saying, "While we still have a lot more

work to do to implement our sales productivity initiatives,

strengthen our gross profit margins and reduce our global operating

expense profile, we are pleased with our progress and the benefit

this has had on our margin structure and on our long-term goal of

achieving 20%-plus non-GAAP Adjusted EBITDA margins. Additionally,

today's 8K filing of a new equity line of credit arrangement for

Alphatec Spine should strengthen our balance sheet and enable us to

accelerate investment in our product commercialization efforts. You

have our commitment that Alphatec Spine will remain dedicated to

conducting its business with a sense of urgency, accountability and

excellence."

2012 Financial Guidance

Financial guidance for the remainder of 2012 is as follows: For

full year 2012 annual revenue guidance will be in the range of $204

million to $209 million, or 3% to 6% growth over 2011. Adjusted

EBITDA guidance will be in the range of $23 million to $27 million

(or 11% to 13% of sales). The Company expects to generate positive

cash flow for the full year 2012 after fulfilling its banking and

legal settlement obligations. Revenue accumulation throughout 2012

will be biased towards the second half of the year.

Conference Call Information

Alphatec Spine has scheduled a conference call to discuss its

financial results beginning today, May 8, 2012, at 2:00 p.m.

Pacific Time / 5:00 p.m. Eastern Time. Individuals interested in

listening to the conference call may do so by dialing (877)

556-5251 for domestic callers and (720) 545-0036 for international

callers. A live webcast of the conference call will be available

online from the investor relations section of the Alphatec Spine

website at www.alphatecspine.com. The webcast will be recorded and

will remain available on the investor relations section of Alphatec

Spine's website for at least 30 days.

About Alphatec Spine

Alphatec Spine, Inc. is a wholly owned subsidiary of Alphatec

Holdings, Inc. (Nasdaq: ATEC). Alphatec Spine is a medical device

company that designs, develops, manufactures and markets products

for the surgical treatment of spine disorders, primarily focused on

the aging spine. The Company's mission is to combine world-class

customer service with innovative, surgeon-driven products that will

help improve the aging patient's quality of life. The Company is

poised to achieve its goal through new solutions for patients with

osteoporosis, stenosis and other aging spine deformities, improved

minimally invasive products and techniques and integrated biologics

solutions. In addition to its U.S. operations, the Company also

markets its products in over 50 international markets through its

affiliate, Scient'x S.A.S., via a direct sales force in France,

Italy and the United Kingdom and via independent distributors in

the rest of Europe, the Middle East and Africa. In Latin America,

the Company conducts its business through its subsidiary, Cibramed

Produtos Medicos. In Japan, the Company markets its products

through its subsidiary, Alphatec Pacific, Inc. In the rest of Asia

and Australia, the Company sells its and Scient'x's products

through it's and Scient'x's distributors.

The Alphatec Holdings, Inc. logo is available at

http://www.globenewswire.com/newsroom/prs/?pkgid=3520

Non-GAAP Information

Adjusted EBITDA included in this press release is a non-GAAP

financial measure that represents net income (loss) excluding the

effects of interest, taxes, depreciation, amortization, stock-based

compensation expenses, and other non-recurring income or expense

items, such as in-process research and development expense and

transaction-related expenses. Adjusted EBITDA, as defined above,

may not be similar to adjusted EBITDA measures used by other

companies and is not a measurement under GAAP. Though management

finds non-GAAP-based earnings or loss and EBITDA useful for

evaluating aspects of the Company's business, its reliance on these

measures is limited because excluded items often have a material

effect on the Company's earnings and earnings per common share

calculated in accordance with GAAP. Therefore, management uses

non-GAAP adjusted EBITDA in conjunction with GAAP earnings and

earnings per common share measures. The Company believes that

non-GAAP adjusted EBITDA provides investors with an additional tool

for evaluating the Company's core performance, which management

uses in its own evaluation of continuing operating performance, and

a base-line for assessing the future earnings potential of the

Company. While the GAAP results are more complete, the Company

prefers to allow investors to have supplemental metrics since, with

reconciliation to GAAP, they may provide greater insight into the

Company's financial results.

Forward Looking Statements

This press release may contain "forward-looking statements"

within the meaning of the Private Securities Litigation Reform Act

of 1995 that involve risks and uncertainty. Such statements are

based on management's current expectations and are subject to a

number of risks and uncertainties that could cause actual results

to differ materially from those described in the forward-looking

statements. Alphatec Spine cautions investors that there can be no

assurance that actual results or business conditions will not

differ materially from those projected or suggested in such

forward-looking statements as a result of various factors. Forward

looking statements include references to Alphatec Spine's 2012

revenue, adjusted EBITDA, free cash flow and earnings projections;

new product development and market success of those products; and

reductions in the Company's manufacturing costs and operating

expenses. The words "believe," "will," "should," "expect,"

"intend," "estimate" and "anticipate," variations of such words and

similar expressions identify forward-looking statements, but their

absence does not mean that a statement is not a forward-looking

statement. The important factors that could cause actual operating

results to differ significantly from those expressed or implied by

such forward-looking statements include, but are not limited to;

the uncertainty of success in developing new products or products

currently in Alphatec Spine's pipeline; the successful global

launch of the Company's new products and the products in its

development pipeline; ; failure to achieve acceptance of Alphatec

Spine's products by the surgeon community, including Trestle Luxe;

failure to successfully implement streamlining activities to create

anticipated savings; failure to successfully begin in-house

manufacturing of certain products; failure to obtain FDA clearance

or approval for new products, or unexpected or prolonged delays in

the process; Alphatec Spine's ability to develop and expand its

U.S. and/or global revenues; continuation of favorable third party

payor reimbursement for procedures performed using Alphatec Spine's

products; unanticipated expenses or liabilities or other adverse

events affecting cash flow or Alphatec Spine's ability to

successfully control its costs or achieve profitability;

uncertainty of additional funding; Alphatec Spine's ability to

compete with other competing products and with emerging new

technologies; product liability exposure; failure to meet all

financial obligations in the Cross Medical Settlement; patent

infringement claims and claims related to Alphatec Spine's

intellectual property. Please refer to the risks detailed from time

to time in Alphatec Spine's SEC reports, including its Annual

Report Form 10-K for the year ended December 31, 2011, filed on

March 5, 2012 with the Securities and Exchange Commission, as well

as other filings on Form 10-Q and periodic filings on Form 8-K.

Alphatec Spine disclaims any intention or obligation to update or

revise any forward-looking statements, whether as a result of new

information, future events, or otherwise, unless required by

law.

| |

| ALPHATEC HOLDINGS,

INC. |

| CONDENSED CONSOLIDATED

BALANCE SHEETS |

| (in thousands -

unaudited) |

| |

|

|

| |

March 31, |

December 31, |

| |

2012 |

2011 |

| ASSETS |

|

|

| Current assets: |

|

|

| Cash and cash equivalents |

$ 16,859 |

$ 20,666 |

| Accounts receivable, net |

40,570 |

41,711 |

| Inventories, net |

48,155 |

45,916 |

| Prepaid expenses and other current

assets |

5,901 |

6,888 |

| Deferred income tax assets |

1,401 |

1,248 |

| Total current assets |

112,886 |

116,429 |

| |

|

|

| Property and equipment, net |

32,089 |

31,476 |

| Goodwill |

171,386 |

168,609 |

| Intangibles, net |

45,628 |

47,144 |

| Other assets |

2,693 |

3,034 |

| Total assets |

$ 364,682 |

$ 366,692 |

| |

|

|

| LIABILITIES AND STOCKHOLDERS'

EQUITY |

|

|

| Current liabilities: |

|

|

| Accounts payable |

$ 14,431 |

$ 17,390 |

| Accrued expenses |

28,359 |

32,583 |

| Deferred revenue |

3,124 |

2,768 |

| Current portion of long-term

debt |

3,653 |

4,396 |

| Total current liabilities |

49,567 |

57,137 |

| |

|

|

| Total long term liabilities |

42,637 |

40,624 |

| Redeemable preferred stock |

23,603 |

23,603 |

| Stockholders' equity |

248,875 |

245,328 |

| Total liabilities and stockholders'

equity |

$ 364,682 |

$ 366,692 |

| |

| |

| ALPHATEC HOLDINGS,

INC. |

| CONDENSED CONSOLIDATED

STATEMENTS OF OPERATIONS |

| (in thousands,

except per share amounts - unaudited) |

| |

|

|

| |

Three Months Ended |

| |

March 31, |

| |

2012 |

2011 |

| |

|

|

| Revenues |

$ 48,461 |

$ 49,720 |

| Cost of revenues |

16,263 |

17,373 |

| Amortization of acquired intangible

assets |

379 |

396 |

| Total cost of revenues |

16,642 |

17,769 |

| Gross profit |

31,819 |

31,951 |

| |

|

|

| Operating expenses: |

|

|

| Research and development |

4,010 |

5,413 |

| Sales and marketing |

18,536 |

18,629 |

| General and administrative |

8,825 |

9,142 |

| Amortization of acquired intangible

assets |

574 |

530 |

| Restructuring expenses |

-- |

599 |

| Total operating expenses |

31,945 |

34,313 |

| Operating loss |

(126) |

(2,362) |

| Interest and other income (expense),

net |

(928) |

(254) |

| Loss before taxes |

(1,054) |

(2,616) |

| Income tax provision (benefit) |

207 |

(749) |

| |

|

|

| Net loss |

$ (1,261) |

$ (1,867) |

| |

|

|

| Net loss per common share: |

|

|

| Basic and diluted net loss per share |

$ (0.01) |

$ (0.02) |

| |

|

|

| Weighted-average shares - basic and

diluted |

88,938 |

88,697 |

| |

| |

| ALPHATEC HOLDINGS,

INC. |

| RECONCILIATION OF

NON-GAAP FINANCIAL MEASURES |

| (in thousands, except

per share amounts - unaudited) |

| |

|

|

| |

Three Months Ended |

| |

March 31, |

| |

2012 |

2011 |

| |

|

|

| Operating loss, as reported |

$ (126) |

$ (2,362) |

| Add back: |

|

|

| Depreciation |

3,456 |

3,772 |

| Amortization of intangible assets |

1,394 |

305 |

| Amortization of acquired intangible

assets |

953 |

926 |

| Total EBITDA |

5,677 |

2,641 |

| |

|

|

| Add back significant items: |

|

|

| Stock-based compensation |

547 |

714 |

| Acquisition-related inventory

step-up |

-- |

430 |

| Restructuring expenses |

-- |

599 |

| |

|

|

| EBITDA, as adjusted for significant

items |

$ 6,224 |

$ 4,384 |

| |

| |

| ALPHATEC HOLDINGS,

INC. |

| RECONCILIATION OF

GEOGRAPHIC SEGMENT REVENUES AND GROSS PROFIT |

| (in thousands, except

percentages - unaudited) |

| |

|

|

|

|

| |

|

|

|

|

| |

Three Months Ended |

|

Impact from |

| |

March 31, |

|

Foreign |

| |

2012 |

2011 |

% Change |

Currency |

| |

|

|

|

|

| Revenues by geographic segment |

|

|

|

|

| U.S. |

$ 32,561 |

$ 33,860 |

-3.8% |

0.0% |

| International |

15,900 |

15,860 |

0.3% |

-0.7% |

| Total revenues |

$ 48,461 |

$ 49,720 |

-2.5% |

-0.2% |

| |

|

|

|

|

| Gross profit by geographic segment |

|

|

|

|

| U.S. |

$ 22,847 |

$ 24,420 |

|

|

| International |

8,972 |

7,531 |

|

|

| Total gross profit |

$ 31,819 |

$ 31,951 |

|

|

| |

|

|

|

|

| Gross profit margin by geographic

segment |

|

|

|

|

| U.S. |

70.2% |

72.1% |

|

|

| International |

56.4% |

47.5% |

|

|

| Total gross profit margin |

65.7% |

64.3% |

|

|

| |

|

|

|

|

| |

|

|

|

|

| Footnotes: |

|

|

|

|

| 1) The impact from foreign

currency represents the percentage change in 2011 revenues due to

the change in foreign exchange rates for the periods

presented. |

CONTACT: Investor/Media Contact:

Mark Francois

Senior Director, Investor Relations

Alphatec Spine, Inc.

(760) 494-6610

mfrancois@alphatecspine.com

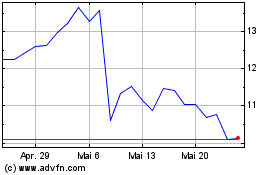

Alphatec (NASDAQ:ATEC)

Historical Stock Chart

Von Jun 2024 bis Jul 2024

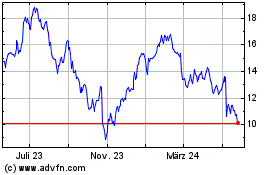

Alphatec (NASDAQ:ATEC)

Historical Stock Chart

Von Jul 2023 bis Jul 2024