Filed Pursuant to Rule 424(b)(5)

Registration No. 333-279155

PROSPECTUS SUPPLEMENT

(to Prospectus dated May 16, 2024)

Warrant to purchase up to 6,300,449 Shares of Common Stock

6,300,449 Shares of Common Stock Underlying the Warrant

This is an offering (the “Offering”) by Applied Digital Corporation (the “Company”) of a warrant (the “Warrant”) to purchase up to 6,300,449 shares of our common stock, par value $0.001 per share (“Common Stock”), directly to a single institutional investor pursuant to this prospectus supplement and accompanying prospectus. The Warrant is immediately exercisable for shares of our Common stock at an exercise price of $4.8005 per share and may be exercised for a period of five years following the issuance date. This offering also relates to (and this prospectus supplement covers) the shares of Common Stock issuable upon exercise of the Warrant.

The Warrant is being issued in connection with, and pursuant to the terms of, that certain Promissory Note, by and between APLD Holdings 2 LLC, our subsidiary, and CIM APLD Lender Holdings, LLC (the “Promissory Note”). For additional information, see “Plan of Distribution.”

There is currently no public market for the Warrant. We do not intend to apply for listing of the Warrant on a national securities exchange or over the counter market.

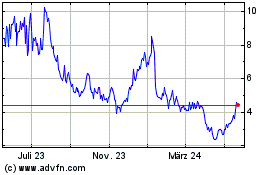

Our Common Stock is traded on the Nasdaq Global Select Market (“Nasdaq”) under the symbol “APLD.” On June 6, 2024, the last reported sale price of our Common Stock on Nasdaq was $4.92 per share.

Investing in our securities involves significant risks. See “Risk Factors” beginning on page S-9 of this prospectus supplement, page 8 of the accompanying prospectus and in the reports we file with the Securities and Exchange Commission pursuant to the Securities Exchange Act of 1934, as amended, incorporated by reference in this prospectus.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or passed upon the accuracy or adequacy of this prospectus supplement or the accompanying prospectus. Any representation to the contrary is a criminal offense.

Delivery of the Warrant being offered pursuant to this prospectus supplement and the accompanying prospectus is expected to be made on or about June 17, 2024.

The date of this prospectus supplement is June 7, 2024

TABLE OF CONTENTS

| | | | | |

| Prospectus Supplement | |

| Page |

| |

| S-1 |

| S-2 |

| S-7 |

| S-9 |

| S-10 |

| S-11 |

| S-12 |

| S-13 |

| S-16 |

| S-17 |

| S-18 |

| S-19 |

| S-20 |

| |

| Prospectus | |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

ABOUT THIS PROSPECTUS SUPPLEMENT

We provide information to you about this offering of the Warrant in two separate documents that are bound together: (1) this prospectus supplement, which describes the specific details regarding this offering, and (2) the accompanying prospectus, which provides general information, some of which may not apply to this offering. Generally, unless the context indicates otherwise, when we refer to this “prospectus,” we are referring to both documents combined. If information in this prospectus supplement is inconsistent with the accompanying prospectus, you should rely on this prospectus supplement. In addition, to the extent there is a conflict between the information contained in this prospectus supplement, on the one hand, and the information contained in any document incorporated by reference that was filed with the Securities and Exchange Commission (the “SEC”) before the date of this prospectus supplement, on the other hand, you should rely on the information in this prospectus supplement. If any statement in one of these documents is inconsistent with a statement in another document having a later date – for example, a document incorporated by reference in this prospectus supplement – the statement in the document having the later date modifies or supersedes the earlier statement as our business, financial condition, results of operations and prospects may have changed since the earlier dates. You should also read and consider the additional information under the captions “Incorporation of Certain Information By Reference” in this prospectus supplement.

In making your investment decision, you should rely only on the information contained or incorporated by reference in this prospectus supplement, in the accompanying prospectus and in any free writing prospectus with respect to this offering filed by us with the SEC. We have not authorized any person to provide you with different or additional information. If anyone provides you with different, additional or inconsistent information you should not rely on it. You should assume that the information appearing in this prospectus supplement, the accompanying prospectus, any free writing prospectus with respect to the offering filed by us with the SEC and the documents incorporated by reference herein and therein is accurate only as of their respective dates. Our business, financial condition, results of operations and prospects may have changed since those dates.

We further note that the representations, warranties and covenants made by us in any agreement that is filed as an exhibit to any document that is incorporated by reference herein were made solely for the benefit of the parties to such agreement, including, in some cases, for the purpose of allocating risk among the parties to such agreements, and should not be deemed to be a representation, warranty or covenant to you. Moreover, such representations, warranties or covenants were accurate only as of the date they were made. In addition, the assertions embodied in any representations, warranties and covenants contained in such agreements may be subject to qualifications with respect to knowledge and materiality different from those applicable to investors and may be qualified by information in disclosure schedules. These disclosure schedules may contain information that modifies, qualifies and creates exceptions to the representations, warranties and covenants set forth in the agreements. Accordingly, such representations, warranties and covenants should not be relied on as accurately representing the current state of our affairs.

We obtained the industry, market and competitive position data in this prospectus supplement from our own internal estimates and research as well as from industry and general publications and research surveys and studies conducted by third parties. These data involve a number of assumptions and limitations, and you are cautioned not to give undue weight to such estimates. In addition, projections, assumptions and estimates of our future performance and the future performance of the industry in which we operate is necessarily subject to a high degree of uncertainty and risk due to a variety of factors, including those described in “Risk Factors” and elsewhere in this prospectus supplement. These and other factors could cause results to differ materially from those expressed in the estimates made by the independent parties and us.

This prospectus supplement and the accompanying prospectus do not constitute, and may not be used in connection with, an offer to sell, or a solicitation of an offer to buy, any securities offered by this prospectus supplement and the accompanying prospectus by any person in any jurisdiction in which it is unlawful for such person to make such an offer or solicitation.

Unless the context indicates otherwise, references in this prospectus supplement and the accompanying prospectus to the “Company,” “APLD,” “Applied Digital,” “we,” “us,” “our” and similar terms refer to Applied Digital Corporation and its consolidated subsidiaries.

PROSPECTUS SUPPLEMENT SUMMARY

This summary highlights information contained elsewhere in this prospectus and the documents incorporated by reference herein. This summary does not contain all of the information that you should consider before deciding to invest in our securities. You should read this entire prospectus carefully, including the section entitled “Risk Factors” beginning on page S-9, our consolidated financial statements and the related notes and the other information incorporated by reference into this prospectus before making an investment decision.

Our Business

We are a United States-based designer, developer and operator of next-generation digital infrastructure across North America. We provide digital infrastructure solutions and cloud services to the rapidly growing industries of High-Performance Computing (HPC) and Artificial Intelligence (AI). We operate in three distinct business segments, including, Blockchain datacenter hosting (the “Datacenter Hosting Business”), cloud services, through a wholly owned subsidiary (the “Cloud Services Business”) and HPC datacenter hosting (the “HPC Hosting Business), as further discussed below.

Despite the challenges posed by the competitive landscape, global supply chain disruptions, and evolving regulatory environment, we remain committed to delivering innovative and responsible solutions to our customers while prioritizing compliance and risk management. As we continue to expand our operations and navigate the uncertainties associated with being a relatively new business in rapidly evolving markets, we believe we are well positioned to capitalize on the increasing demand for datacenter services driven by the rapid adoption of digital technologies across industries.

We completed our initial public offering in April 2022 and our Common Stock began trading on the Nasdaq Global Select Market on April 8, 2022. In November 2022, we changed our name from Applied Blockchain, Inc. to Applied Digital Corporation.

Business Segments

Datacenter Hosting Business

Our Datacenter Hosting Business operates datacenters, providing energized space to crypto mining customers. Our custom-designed datacenters allow customers to rent space based on their power requirements. We currently serve four crypto-mining customers, all of which have entered into contracts with us ranging from three to five years. We began generating revenue from this business segment in February 2022 and to date, this business segment accounts for the majority of the revenue we generate from our operations (approximately 87% as of February 29, 2024).

We currently operate sites in Jamestown and Ellendale, North Dakota, with a total hosting capacity of approximately 286 MW:

•Jamestown, North Dakota: 106 MW facility.

•Ellendale, North Dakota: 180 MW facility.

In March 2021, we executed a strategy planning and portfolio advisory services agreement (the “Services Agreement”) with GMR Limited, a British Virgin Island limited liability company (“GMR”), Xsquared Holding Limited, a British Virgin Island limited liability company (“SparkPool”) and Valuefinder, a British Virgin Islands limited liability company (“Valuefinder” and, together with GMR and SparkPool, the “Service Provider(s)”). Under the Services Agreement, the Service Providers agreed to provide crypto asset mining management and analysis and assist us in securing difficult-to-obtain mining equipment. Under the terms of the Services Agreement, we issued 7,440,148 shares of Common Stock to each of GMR and SparkPool and 3,156,426 shares of Common Stock to

Valuefinder. In June 2022, SparkPool ceased all operations and forfeited 4,965,432 shares of Common Stock back to us.

In March 2022, we decided to terminate our crypto mining operations, shifting our focus and our business strategy to developing the HPC Hosting Business and our other two business segments (including the Bitcoin Hosting Business). Each Service Provider advised us concerning the design and buildout of our hosting operations. We continue to partner with GMR, Bitmain, and other providers as they remain our strategic equity investors. Beyond GMR’s use of our hosting capabilities, our partners have strong relationships across the cryptocurrency ecosystem, which we may leverage to identify leads for the expansion of our operations and business segments.

Compared to our previous mining operations, co-hosting revenues are less subject to volatility related to the underlying crypto-asset markets. We have a contractual ceiling for our energy costs through our Amended and Restated Electric Service Agreement, entered into in September 2023 with a utility in the upper Midwest (the “Electric Service Agreement”). One of the main benefits of the Electric Service Agreement is the low cost of power for mining. Even before the recently imposed crypto mining restrictions in China, power capacity available for Bitcoin mining was scarce, especially at scalable sites with over 100 MW of potential capacity. This scarcity of mining power allows us to realize attractive hosting rates in the current market. The Electric Service Agreement has also enabled us to launch our hosting business with long-term customer contracts.

In March 2024, we announced that we entered into a definitive agreement to sell our 200 MW campus in Garden City, TX, to Marathon Digital Holdings (Nasdaq: MARA). We completed the sale transaction on April 1, 2024.

Cloud Services

We operate our Cloud Services Business through our wholly owned subsidiary, Sai Computing, LLC (“Sai Computing”), which provides cloud services to customers, such as artificial intelligence and machine learning developers. Our Cloud Services Business specializes in providing graphics processing unit (GPU) computing solutions to empower customers in executing critical workloads related to artificial intelligence (AI), machine learning (ML), rendering, and other high-performance computing (HPC) tasks. Our managed hosting cloud service allows customers to sign service contracts, utilizing our Company-provided equipment for seamless and cost-effective operations.

We are rolling out numerous GPU clusters, each comprising 1,024 GPUs, which are available for lease by our customers. Additionally, we have secured contracts with colocation service providers to ensure secure space and energy for our hosting services. Our strategy is to in the future utilize a blend of third-party colocation and our own HPC datacenters to deliver cloud services to our customers. In 2023, we constructed a separate and unique building, designed and purpose-built for GPUs, which is separate from our crypto hosting buildings, next to the Company’s currently operating 100-MW hosting facility in Jamestown, North Dakota, with a total capacity of 9 MW. This location is just one aspect of our comprehensive plan, and we intend to leverage it based on customer requirements.

In May 2023, we officially launched our Cloud Services Business. We currently rely on a few major suppliers for our products in this business segment: Super Micro Computer Inc. (“Super Micro”), NVIDIA Corp. (“NVIDIA”), Hewlett Packard Enterprise (“HPE”) and Dell Technologies Inc. (“Dell”). In May 2023, we partnered with Super Micro, a renowned provider of Application-Optimized Total IT Solutions. Together, we aim to deliver the Company’s cloud service to our customers. Super Micro’s high-performance server and storage solutions are designed to address a wide range of computational-intensive workloads. Their next-generation GPU servers are incredibly power-efficient, which is vital for datacenters as the power requirements for large-scale AI models continue to increase. Optimizing the Total Cost of Ownership (TCO) and Total Cost to Environment (TCE) is critical for datacenter operators to ensure sustainable operations.

In June 2023, we announced a partnership with HPE, a global company specializing in edge-to-cloud technology. As part of this collaboration, HPE will provide its powerful and energy-efficient supercomputers to support large-scale artificial intelligence (AI) through our cloud service. HPE has been supportive in core design

considerations and engineering of Company-owned facilities which will support Sai Computing’s infrastructure. In addition, we have supply agreements with Dell for delivery to us of AI and GPU servers. NVIDIA supplies GPUs to these GPU server providers.

Sai Computing secured its first major AI customer in May 2023 and in June 2023, entered into a 36-month contract with a second customer in the Cloud Services Business. As of the date of this report, our Cloud Services Business provides services to several customers.

By February 2024, the Company had received 4,092 GPUs, deployed a total of 3,072 GPUs and began recognizing revenue from our first and second cloud services contract. The Cloud Services Business is expected to account for approximately 13% or more of our revenue in fiscal year 2024. As we ramp up operations in this business segment, we expect to acquire and deploy additional GPUs, increase revenue from the Cloud Services Business and increase the percentage of our revenue produced by our Cloud Services Business.

HPC Hosting Business

Our High Performance Computing (HPC) Hosting Business specializes in designing, constructing, and managing datacenters tailored to support HPC applications, including artificial intelligence (AI).

Currently, we have 9 MW of hosting capacity at our Jamestown, ND, location. In 2023, we commenced the construction of our first 100 MW HPC datacenter in Ellendale, North Dakota (the “HPC Ellendale Facility”). We plan to continue building this datacenter in 2024 and designing and developing additional HPC datacenter sites in the future.

We anticipate that this business segment will begin generating meaningful revenues once the HPC Ellendale Facility becomes operational, which is expected sometime in the early calendar year 2025.

Recent Developments

AI Note

On April 26, 2024, we entered into Amendment No. 2 (the “AI Amendment”) to that certain Unsecured Promissory Note made by the Company on January 30, 2024 and amended on March 27, 2024 (as amended by the AI Amendment, the “AI Note”) in favor of AI Bridge Funding LLC (“AI”). Pursuant to the AI Amendment, among other things, we may repay the AI Note with shares of our Common Stock and we issued warrants to purchase up to 3,000,000 shares of our Common Stock to AI.

Any shares of Common Stock issued to repay the AI Note will be issued pursuant our effective shelf registration statement on Form S-3 (File No. 333-272023), filed with the SEC on May 17, 2023, and declared effective by the SEC on June 5, 2023, and the accompanying base prospectus included therein as supplemented by the prospectus supplement, dated April 29, 2024, filed with the SEC.

Sales Agreement

On May 6, 2024, we entered into a Sales Agreement (the “Sales Agreement”) with Roth Capital Partners, LLC (the “Agent”), pursuant to which we may offer and sell, from time to time, through the Agent, up to $25,000,000 of shares of our Common Stock.

The shares of Common Stock are being issued pursuant to our effective shelf registration statement on Form S-3 (File No. 333-272023), filed with the SEC on May 17, 2023, and declared effective by the SEC on June 5, 2023, and the accompanying base prospectus included therein as supplemented by the prospectus supplement, dated May 6, 2024, filed with the SEC.

Series E Preferred Stock Offering

On May 16, 2024, we entered into a Dealer Manager Agreement (the “Dealer Manager Agreement”) with Preferred Capital Securities, LLC (the “Dealer Manager”), pursuant to which the Dealer Manager has agreed to serve as the Company’s agent and dealer manager for an offering of up to 2,000,000 shares of our Series E Redeemable Preferred Stock, par value $0.001 (the “Series E Preferred Stock”).

The Series E Preferred Stock will be offered and sold pursuant to a shelf registration statement on Form S-3 (File No. 333-279155), filed with the SEC on May 6, 2024, and declared effective by the SEC on May 16, 2024, and the accompanying base prospectus included therein as supplemented by the prospectus supplement dated May 16, 2024, filed with the SEC.

Promissory Note

On June 7, 2024, our subsidiary, APLD Holdings 2 LLC entered into a Promissory Note with CIM APLD Lender Holdings, LLC (“CIM”), which provides for an initial borrowing of $15 million, which was drawn on June 7, 2024, and subsequent borrowings of up to $110 million which will be available subject to the satisfaction of certain conditions. In addition, the Promissory Note includes an accordion feature that permits up to an additional $75 million of borrowings subject to the mutual agreement of CIM and the Company. As partial consideration for the initial $15 million, we are issuing the first tranche of warrants (the “Registered Warrants”) to CIM to purchase up to 6,300,449 shares of Common Stock pursuant to this prospectus supplement.

Consent, Waiver and First Amendment to Prepaid Advance Agreements

In connection with the Promissory Note, we also entered into a Consent, Waiver and First Amendment to Prepaid Advance Agreements (the “Consent”) with YA II PN, LTD. (“YA”). In exchange for giving its consent to the transaction under the Promissory Note, the Company agreed to issue to YA an aggregate of 100,000 shares of Common Stock and to conditionally lower the floor price from $3.00 to $2.00 if the daily VWAP is less than $3.00 per share of Common Stock for five out of seven trading days. The Company further agreed to deliver a security agreement whereby its subsidiary, Applied Digital Cloud Corporation, would grant a springing lien on substantially all of its assets subject to customary carve-outs to secure the promissory notes issued in favor of YA. Pursuant to the Consent, YA also consented to future project-level financing at the Ellendale Campus.

In addition, pursuant to the terms of the Consent, certain provisions of the Prepaid Advance Agreements were amended as previously disclosed in the Company’s Current Report on Form 8-K filed with the SEC on June 7, 2024.

Charter Amendment

On June 11, 2024, we filed an amendment to our Second Amended and Restated Articles of Incorporation, increasing the number of shares of Common Stock authorized for issuance thereunder to 300,000,000.

Corporate Information

Our principal executive office is located at 3811 Turtle Creek Blvd., Suite 2100, Dallas, Texas 75219, and our phone number is (214) 427-1704. Our principal website address is www.applieddigital.com.

We make available free of charge on or through our website access to press releases and investor presentations, as well as all materials that we file electronically with the SEC, including our annual reports on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K and amendments to those reports, filed or furnished pursuant to Section 13(a) or 15(d) of the Exchange Act as soon as reasonably practicable after electronically filing such materials with, or furnishing them to, the SEC. The SEC maintains an Internet website, www.sec.gov, that contains reports, proxy and information statements and other information that we file electronically with the SEC.

Information contained in, or accessible through, our website does not constitute part of this prospectus or the registration statement of which it forms a part and inclusions of our website address in this prospectus or the registration statement are inactive textual references only. You should not rely on any such information in making your decision whether to purchase our securities.

We are a “smaller reporting company” as defined in Rule 12b-2 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”) and have elected to take advantage of certain of the scaled disclosure available for smaller reporting companies in this prospectus as well as our filings under the Exchange Act.

THE OFFERING

The following summary contains the principal terms of this offering. The summary is not intended to be complete. You should read the full text and more specific details contained elsewhere in this prospectus supplement and the accompanying prospectus.

| | | | | |

| Warrants Offered by us | We are offering the Warrant to purchase up to 6,300,449 shares of our Common Stock. The Warrant is immediately exercisable at an exercise price of $4.8005 per share and may be exercised at any time until the five-year anniversary of the issuance date. This prospectus supplement and the accompanying base prospectus also relate to the offering of the shares of Common Stock issuable upon exercise of the Warrant. |

| |

| Common Stock to be outstanding immediately after this offering | 145,370,851 shares of our Common Stock, assuming the full exercise of the Warrant issued in this offering |

| |

| Use of Proceeds | The holder may exercise this Warrant on a cashless basis, unless there is an effective registration statement covering the underlying Common Stock, in which case, the holder has the option to exercise in cash or on a cashless basis, or a combination thereof. If exercised in full in cash, we will receive up to an aggregate of approximately $30.2 million. We may use the net proceeds from the exercise of the Warrant for working capital requirements, general corporate purposes and the advancement of our business objectives. We will have broad discretion over the use of proceeds from the exercise of the Warrant. There is no assurance that the holder of the Warrant will elect to exercise any or all of such Warrant, or to exercise in cash. See “Use of Proceeds.” |

| |

| National Securities Exchange Listing | Our Common Stock is currently listed on The Nasdaq Global Select Market under the symbol “APLD.” There is currently no public market for the Warrant. We do not intend to apply for listing of the Warrant on a national securities exchange or over the counter market |

| |

| Risk Factors | An investment in our securities involves a high degree of risk. See “Risk Factors” beginning on page S-9 of this prospectus supplement. In addition, before deciding whether to invest in our securities, you should consider carefully the risks and uncertainties described in the section captioned “Risk Factors” contained in our Annual Report on Form 10-K for the fiscal year ended May 31, 2023, filed with the SEC, on August 2, 2023, as amended on October 12, 2023, and other filings we make with the SEC from time to time, which are incorporated by reference herein in their entirety, together with other information in this prospectus and the information incorporated by reference herein. |

The number of shares of Common Stock to be outstanding is based on 139,070,402 shares of our Common Stock outstanding as of June 6, 2024 and excludes the following:

| | | | | | | | |

| | ● | 17,158,340 shares of Common Stock reserved for future issuance under our 2022 Incentive Plan, as amended; |

| | |

| ● | 652,964 shares of Common Stock reserved for future issuance under our 2022 Non-Employee Director Stock Plan, as amended; |

| | |

| ● | 204,168 shares of Common Stock reserved for issuance under restricted stock unit awards to certain consultants; |

| | |

| ● | 5,032,802 shares of Common Stock held in treasury; |

| | |

| ● | 18,792,419 shares of our Common Stock to be issued upon the conversion of certain outstanding promissory notes issued by us to YA II PN, LTD. on March 27, 2024, which shares have been registered for resale on our Registration Statement on Form S-3, Reg. No. 333-278699; |

| | |

| ● | 3,000,000 shares of Common Stock reserved for issuance upon exercise of outstanding warrants; |

| | |

| ● | Up to $25,000,000 in shares of our Common Stock to be issued if and when sold pursuant to that certain Sales Agreement, dated as of May 6, 2024, by and between the Company and Roth Capital Partners, LLC (the “ATM Offering”); and |

| | |

| ● | Up to 20,000,000 shares of our Common Stock to be issued upon the conversion of a certain outstanding promissory note issued by us to YA II PN, LTD. on May 24, 2024, which shares have been registered for resale on our Registration Statement on Form S-1, Reg. No. 333-279884. |

RISK FACTORS

An investment in our securities involves a high degree of risk and uncertainty. In addition to the other information included in this prospectus supplement and the accompanying prospectus, you should carefully consider each of the risk factors set forth in our most recent Annual Report on Form 10-K and subsequent Quarterly Reports on Form 10-Q on file with the SEC, which are incorporated by reference into this prospectus supplement, and any subsequent Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q or Current Reports on Form 8-K we file after the date of this prospectus supplement. The risks described are not the only ones facing our company. Additional risks not presently known to us or that we presently consider immaterial may also adversely affect our company. If any of the risks described occur, our business, financial condition, results of operations and prospects could be materially adversely affected. In that case, the trading price of our securities could decline, and you could lose all or part or your investment. In assessing these risks, you should also refer to the other information included or incorporated by reference in this prospectus supplement and the accompanying prospectus.

Risks Related to This Offering

There is no public market for the Warrant being offered in this offering.

There is no established public trading market for the Warrant being offered in this offering, and we do not expect a market to develop. In addition, we do not intend to apply to list the Warrant on any securities exchange or nationally recognized trading system. Without an active market, the liquidity of the Warrant will be limited.

The Holder of the Warrant purchased in this offering will have no rights as a common stockholder until such holder exercises such Warrant and acquires our Common Stock.

Until the holder of the Warrant acquires shares of our Common Stock upon exercise of such Warrant, the holder will have no rights with respect to the shares of our Common Stock underlying such Warrant. Upon exercise of the Warrant, the holder will be entitled to exercise the rights of a common stockholder only as to matters for which the record date occurs after the exercise date.

The Warrant being offered is speculative in nature.

The Warrant does not confer any rights of Common Stock ownership on its holder, such as voting rights or the right to receive dividends, but rather merely represent the right to acquire shares of Common Stock at a fixed price for a limited period of time. Moreover, following this offering, the market value of the Warrant, if any, will be uncertain and there can be no assurance that the market value of the Warrant will equal or exceed its imputed offering price. The Warrant will not be listed or quoted for trading on any market or exchange. There can be no assurance that the market price of our Common Stock will ever equal or exceed the exercise price of the Warrant, and consequently, the Warrant may expire valueless.

Our management team may invest or spend the proceeds of this offering in ways with which you may not agree or in ways which may not yield a significant return.

Our management will have broad discretion over the use of proceeds from this offering, including for any of the purposes described in the section entitled “Use of Proceeds,” and you will not have the opportunity, as part of your investment decision, to assess whether the proceeds are being used appropriately. However, we have not determined the specific allocation of any net proceeds among these potential uses, and the ultimate use of the net proceeds may vary from the currently intended uses.

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

Except for historical information, this prospectus supplement and the accompanying prospectus contain forward-looking statements made pursuant to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995 under Section 27A of the Securities Act of 1933, as amended (the “Securities Act”) and Section 21E of the Exchange Act. Forward-looking statements include statements with respect to our beliefs, plans, objectives, goals, expectations, anticipations, assumptions, estimates, intentions and future performance, and involve known and unknown risks, uncertainties and other factors, which may be beyond our control, and which may cause our actual results, performance or achievements to be materially different from future results, performance or achievements expressed or implied by such forward-looking statements. All statements other than statements of historical fact are statements that could be forward-looking statements. You can identify these forward-looking statements through our use of words such as “may,” “can,” “anticipate,” “assume,” “should,” “indicate,” “would,” “believe,” “contemplate,” “expect,” “seek,” “estimate,” “continue,” “plan,” “point to,” “project,” “predict,” “could,” “intend,” “target,” “potential” and other similar words and expressions of the future.

There are a number of important factors that could cause the actual results to differ materially from those expressed in any forward-looking statement made by us. These factors include, but are not limited to:

•labor and other workforce shortages and challenges;

•our dependence on principal customers;

•the addition or loss of significant customers or material changes to our relationships with these customers;

•our sensitivity to general economic conditions including changes in disposable income levels and consumer spending trends;

•our ability to timely and successfully build new hosting facilities with the appropriate contractual margins and efficiencies;

•our ability to continue to grow sales in our hosting business;

•volatility of cryptoasset prices;

•uncertainties of cryptoasset regulation policy; and

•equipment failures, power or other supply disruptions.

The foregoing does not represent an exhaustive list of matters that may be covered by the forward-looking statements contained herein or risk factors that we are faced with that may cause our actual results to differ from those anticipated in such forward-looking statements. The events and circumstances reflected in our forward-looking statements may not be achieved or occur and actual results could differ materially from those projected in the forward-looking statements. You should review the factors and risks and other information we describe in our most recent Annual Report on Form 10-K, as well as any amendments thereto reflected in subsequent reports we will file from time to time with the SEC.

All forward-looking statements are expressly qualified in their entirety by this cautionary note. You are cautioned to not place undue reliance on any forward-looking statements, which speak only as of the date of this prospectus supplement, the date of the accompanying prospectus or the date of the document incorporated by reference herein. You should read this prospectus supplement, the accompanying prospectus supplement and the documents that we incorporate by reference and have filed as exhibits to the registration statement, of which this prospectus supplement is a part, completely and with the understanding that our actual future results may be materially different from what we expect. In light of the significant uncertainties in these forward-looking statements, you should not regard these statements as a representation or warranty by us or any other person that will achieve our objectives and plans in any specified time frame, or at all. We have no obligation, and expressly disclaims any obligation, to update, revise or correct any of the forward-looking statements, whether as a result of new information, future events or otherwise. We have expressed our expectations, beliefs and projections in good faith and believe they have a reasonable basis. However, we cannot assure you that our expectations, beliefs or projections will result or be achieved or accomplished.

USE OF PROCEEDS

The holder may exercise this Warrant on a cashless basis, unless there is an effective registration statement covering the underlying Common Stock, in which case, the holder has the option to exercise in cash or on a cashless basis, or a combination thereof. If exercised in full in cash, we will receive up to an aggregate of approximately $30.2 million. We expect to use the net proceeds from the exercise of the Warrant for working capital requirements, general corporate purposes and the advancement of our business objectives. We will have broad discretion over the use of proceeds from the exercise of the Warrant. There is no assurance that the holder of the Warrant will elect to exercise any or all of such Warrant. We will pay all of the fees and expenses incurred by us in connection with this registration.

DILUTION

If you invest in our shares of Common Stock pursuant to the exercise of the Warrant, your interest may be immediately and substantially diluted to the extent of the difference between the exercise price you pay per share and the pro forma net tangible book value per share of our Common Stock. Net tangible book value per share is equal to the amount of our total tangible assets, less total liabilities, divided by the number of outstanding shares of our Common Stock. As of February 29, 2024, our historical net tangible book value was approximately $118.3 million, or approximately $0.97 per share.

Assuming the cash exercise of the Warrant, resulting in the issuance of 6,300,449 shares of Common Stock upon the exercise of the Warrant and our receipt of aggregate gross proceeds of $30,245,305.42, our as adjusted net tangible book value would have been approximately $148.6 million, or $1.15 per share at February 29, 2024. This represents an immediate increase in net tangible book value of approximately $0.19 per share to our existing stockholders, and an immediate dilution of $3.65 per share to investors purchasing the Warrant.

The following table illustrates the per share dilution to investors purchasing shares in an offering using this prospectus:

| | | | | | | | |

| Exercise price of the Warrant | | $ | 4.8005 | |

| Net tangible book value per share as of February 29, 2024 | $ | 0.97 | | |

| Decrease in net tangible book value per share | $ | 0.19 | | |

| As adjusted net tangible book value per share after this offering | | $ | 1.15 | |

| Dilution per share to investors exercising the Warrant | | $ | 3.65 | |

The table and discussion above are based on 122,417,839 shares of common stock outstanding on February 29, 2024, and excludes, as of that date, the following:

| | | | | | | | |

| | ● | 17,233,063 shares of Common Stock reserved for future issuance under our 2022 Incentive Plan, as amended; |

| | |

| ● | 652,964 shares of Common Stock reserved for future issuance under our 2022 Non-Employee Director Stock Plan, as amended; |

| | |

| ● | 204,168 shares of Common Stock reserved for issuance under restricted stock unit awards to certain consultants; |

| | |

| ● | 5,032,802 shares of Common Stock held in treasury; |

| | |

| ● | 23,585,000 shares of our Common Stock to be issued upon the conversion of certain outstanding promissory notes issued by us to YA II PN, LTD. on March 27, 2024, which shares have been registered for resale on our Registration Statement on Form S-3, Reg. No. 333-278699; |

| | |

| ● | 3,000,000 shares of Common Stock reserved for issuance upon exercise of outstanding warrants; |

| | |

| ● | Up to $25,000,000 in shares of our Common Stock to be issued if and when sold pursuant to the ATM Offering; and |

| | |

| ● | Up to 20,000,000 shares of our Common Stock to be issued upon the conversion of a certain outstanding promissory note issued by us to YA II PN, LTD. on May 24, 2024, which shares have been registered for resale on our Registration Statement on Form S-1, Reg. No. 333-279884. |

DESCRIPTION OF SECURITIES

The following summary of the rights of our capital stock is not complete and is subject to and qualified in its entirety by reference to our second amended and restated articles of incorporation, as amended from time to time and currently in effect (the “Articles of Incorporation”), and our third amended and restated bylaws, as amended from time to time and currently in effect (the “Bylaws”), copies of which are filed as exhibits to our Annual Report on Form 10-K for the year ended May 31, 2023, as filed with the SEC on August 2, 2023, and as amended by that Form 10-K/A on October 12, 2023 and our Current Report on Form 8-K, as filed with the SEC on April 29, 2024, respectively, which are incorporated by reference herein..

General

We are authorized to issue 305,000,000 shares of capital stock, $0.001 par value per share, of which 300,000,000 are Common Stock and 5,000,000 are Preferred Stock.

As of June 6, 2024, there were 139,070,402 shares of Common Stock outstanding and no shares of Preferred Stock outstanding.

Common Stock

Holders of our Common Stock are entitled such dividends as may be declared by our Board out of funds legally available for such purposes. Holders of our Common Stock are entitled to receive proportionately any dividends as may be declared by our Board, subject to any preferential dividend rights of any series of Preferred Stock that we may designate and issue in the future. There are no redemption or sinking fund provisions applicable to our Common Stock. The holders of our Common Stock have no conversion rights. Holders of Common Stock have no preemptive or subscription rights to purchase any of our securities. The rights, preferences and privileges of holders of our Common Stock are subject to and may be adversely affected by the rights of the holders of shares of any series of Preferred Stock that we may designate and issue in the future. Each holder of our Common Stock is entitled to one vote for each such share outstanding in the holder’s name. No holder of Common Stock is entitled to cumulative votes in voting for directors.

In the event of our liquidation, dissolution or winding up, the holders of our Common Stock are entitled to receive a pro rata share of our assets, which are legally available for distribution, after payments of all debts and other liabilities. All of the outstanding shares of our Common Stock are fully paid and non-assessable.

Warrant

The following is a summary of the material terms and provisions of the Warrant that is being offered hereby. This summary is subject to and qualified in its entirety by the form of warrant, which has been provided to the investor in this offering and which was filed with the SEC as an exhibit to a Current Report on Form 8-K filed on June 7, 2024, as amended on June 10, 2024, in connection with this offering and incorporated by reference into the registration statement of which this prospectus supplement forms a part. Prospective investors should carefully review the terms and provisions of the form of the Warrant for a complete description of the terms and conditions of the Warrant.

Duration and Exercise Price

The Warrant offered hereby will have an exercise price of $4.8005 per share. The Warrant will be immediately exercisable upon issuance and will be exercisable for five years from the date of issuance. The exercise price and number of shares of Common Stock issuable upon exercise are subject to appropriate adjustment in the event of share dividends, share splits, reorganizations or similar events affecting our shares of Common Stock. The Warrant will be issued in certificated form only.

Exercisability

The Warrant will be exercisable, at the option of each holder, in whole or in part, by delivering to us a duly executed exercise notice accompanied by payment in full for the number of shares of Common Stock purchased upon such exercise (except in the case of a cashless exercise as discussed below). A holder (together with its affiliates) may not exercise any portion of such holder’s Warrant to the extent that the holder would own more than 9.99% of our outstanding shares of Common Stock immediately after exercise, except that upon at least 75 days’ prior notice from the holder to us, the holder may increase the amount of ownership of outstanding shares of Common Stock after exercising the holder’s Warrant to any other percentage as specified in such notice.

Cashless Exercise

If at the time of exercise of the Warrant there is no effective registration statement registering, or the prospectus contained therein is not available for the resale of the shares of Common Stock issuable upon exercise of the Warrant, then the Warrant will only be exercisable on a “cashless exercise” basis under which the holder will receive upon such exercise a net number of common shares determined according to a formula set forth in the Warrant.

Reclassifications, Reorganizations, Consolidations, Mergers and Sales

In the event of any reclassification, reorganization, consolidation, merger, sale or similar transaction, as described in the Warrant, then upon any subsequent exercise of the Warrant, the holder will have the right to receive as alternative consideration, for each share of Common Stock that would have been issuable upon such exercise immediately prior to the occurrence of such reclassification, reorganization, consolidation, merger, sale or similar transaction.

Transferability

In accordance with its terms and subject to applicable laws, the Warrant may be transferred at the option of the holder upon surrender of the Warrant to us together with the appropriate instruments of transfer and payment of funds sufficient to pay any transfer taxes (if applicable).

Fractional Shares

No fractional shares of Common Stock will be issued upon the exercise of the Warrant. Rather, the number of shares of Common Stock to be issued will, at our election, either be rounded up to the nearest whole number or we will pay a cash adjustment in respect of such final fraction in an amount equal to such fraction multiplied by the exercise price.

Trading Market

There is no established trading market for the Warrant, and we do not expect a market to develop. We do not intend to apply for a listing for the Warrant on any securities exchange or other nationally recognized trading system. Without an active trading market, the liquidity of the Warrant will be limited.

Rights as a Shareholder

Except as otherwise provided in the Warrant or by virtue of the holder’s ownership of shares of Common Stock, the holder of the Warrant does not have the rights or privileges of holders of our shares of Common Stock, including any voting rights, until such holder exercises the Warrant.

Transfer Agent

The transfer agent and registrar for our Common Stock is Computershare Trust Company, N.A. (the “Transfer Agent”). The Transfer Agent’s address and phone number is: 150 Royall St., Canton, MA 02021, telephone number: (781) 575-2000.

Listing

Our Common Stock is presently traded on The Nasdaq Global Select Market under the symbol “APLD.”

PLAN OF DISTRIBUTION

This offering is in connection with that certain Promissory Note, dated June 7, 2024, by and between APLD Holdings 2 LLC, our subsidiary, and CIM APLD Lender Holdings, LLC (the “Promissory Note”). The Warrant sold (and the shares of Common Stock issuable upon exercise of the Warrant) pursuant to this prospectus supplement are being sold to an institutional investor.

Our obligation to issue and sell the Warrant (and the shares of Common Stock issuable upon exercise of the Warrant) to the investor is subject to the conditions set forth in the Promissory Note. The investor’s obligation to purchase the Warrant (and the shares of Common Stock issuable upon exercise of the Warrant) is subject to the conditions set forth in the Promissory Note. We currently anticipate that the delivery of the Warrant will occur on or about June 17, 2024, subject to customary closing conditions.

Expenses

We estimate the total offering expenses of this offering that will be payable by us will be approximately $0.3 million, which includes legal, printing, financial advisor and various other fees.

Listing

Our shares are listed on the Nasdaq Global Select Market under the symbol “APLD”. On June 6, the last reported sale price of our Common Stock on the Nasdaq Capital Market was $4.92 per share. There is no established public trading market for the Warrant, and we do not expect a market to develop. In addition, we do not intend to list the Warrant, nor do we expect the Warrant to be quoted, on the Nasdaq Global Select Market or any other national securities exchange or any other nationally recognized trading system.

LEGAL MATTERS

The validity of the securities offered in this prospectus supplement is being passed upon for us by Snell & Wilmer LLP. Unless otherwise indicated in the applicable prospectus supplement, certain legal matters in connection with the offering and the enforceability of the Warrant offered by this prospectus supplement is being passed upon for us by Milbank LLP.

EXPERTS

The consolidated balance sheets of Applied Digital Corporation and its subsidiaries as of May 31, 2023 and 2022, and the related consolidated statements of comprehensive loss, changes in shareholders’ equity, and cash flows for each of the years then ended have been audited by Marcum LLP, independent registered public accounting firm, as stated in their report which is incorporated by reference herein. Such financial statements have been incorporated herein by reference in reliance on the report of such firm given upon their authority as experts in accounting and auditing.

WHERE YOU CAN FIND MORE INFORMATION

We have filed with the SEC a registration statement on Form S-3 under the Securities Act with respect to the Warrant and shares of Common Stock underlying such Warrant offered by this prospectus. This prospectus supplement, which is part of the registration statement, omits certain information, exhibits, schedules and undertakings set forth in the registration statement. For further information pertaining to us and our securities, reference is made to our SEC filings and the registration statement and the exhibits and schedules to the registration statement. Statements contained in this prospectus as to the contents or provisions of any documents referred to in this prospectus are not necessarily complete, and in each instance where a copy of the document has been filed as an exhibit to the registration statement, reference is made to the exhibit for a more complete description of the matters involved.

In addition, registration statements and certain other filings made with the SEC electronically are publicly available through the SEC’s web site at http://www.sec.gov. The registration statement, including all exhibits and amendments to the registration statement, has been filed electronically with the SEC.

We are subject to the information and periodic reporting requirements of the Exchange Act, and, in accordance with such requirements, will file periodic reports, proxy statements, and other information with the SEC. These periodic reports, proxy statements, and other information will be available for inspection and copying at the web site of the SEC referred to above. We also maintain a website at www.applieddigital.com, where you may access these materials free of charge as soon as reasonably practicable after they are electronically filed with, or furnished to, the SEC. The information contained in, or that can be accessed through, our website is not part of, and is not incorporated into, this prospectus. We have included our website address in this prospectus solely as an inactive textual reference.

INCORPORATION OF CERTAIN INFORMATION BY REFERENCE

The SEC allows us to “incorporate by reference” information that we file with it into this prospectus, which means that we can disclose important information to you by referring you to those documents. The information incorporated by reference is an important part of this prospectus. The information incorporated by reference is considered to be a part of this prospectus, and information that we file later with the SEC will automatically update and supersede information contained in this prospectus and any accompanying prospectus supplement.

We incorporate by reference the documents listed below that we have previously filed with the SEC:

•our Annual Report on Form 10-K for the year ended May 31, 2023, as filed with the SEC on August 2, 2023, and as amended by that Form 10-K/A on October 12, 2023;

•our Quarterly Reports on Form 10-Q for the quarter ended August 31, 2023, filed with the SEC on October 10, 2023, for the quarter ended November 30, 2023, filed with the SEC on January 16, 2024 and for the quarter ended February 29, 2024, filed with the SEC on April 11, 2024;

•our Current Reports on Form 8-K as filed with the SEC on August 15, 2023, August 23, 2023, September 11, 2023, September 28, 2023, November 13, 2023, January 23, 2024, February 6, 2024, February 9, 2024, February 15, 2024, February 22, 2024, February 29, 2024, March 5, 2024, March 8, 2024, March 15, 2024, April 1, 2024, April 5, 2024, April 29, 2024, April 29, 2024, April 30, 2024, April 30, 2024, May 1, 2024, May 6, 2024, May 14, 2024, May 17, 2024, May 21, 2024, May 24, 2024, June 5, 2024 (as amended on June 6, 2024), June 7, 2024 (as amended on June 10, 2024) and June 11, 2024 (other than any portions thereof deemed furnished and not filed); and

•The description of our Common Stock in our Registration Statement on Form 8-A, filed with the SEC on April 11, 2022, including any amendment or reports filed for the purpose of updating such description, including the Description of Capital Stock filed as Exhibit 4.5 to our Annual Report on Form 10-K for the year ended May 31, 2023, as filed with the SEC on August 2, 2023, and as amended by that Form 10-K/A on October 12, 2023

All reports and other documents that we file with the SEC under Sections 13(a), 13(c), 14 or 15(d) of the Exchange Act after (i) the date of the initial registration statement and prior to effectiveness of the registration statement, and (ii) after the date of this prospectus supplement but before the termination of the offering of the securities hereunder, will also be considered to be incorporated by reference into this prospectus supplement from the date of the filing of these reports and documents, and will supersede the information herein; provided, however, that all reports, exhibits and other information that we “furnish” to the SEC will not be considered incorporated by reference into this prospectus supplement or the accompanying prospectus. We undertake to provide without charge to each person (including any beneficial owner) who receives a copy of this prospectus supplement, upon written or oral request, a copy of all of the preceding documents that are incorporated by reference (other than exhibits, unless the exhibits are specifically incorporated by reference into these documents). You may request a copy of these materials in the manner set forth under the heading “Where You Can Find More Information,” above.

We will provide you without charge, upon your oral or written request, with a copy of any or all reports, proxy statements and other documents we file with the SEC, as well as any or all of the documents incorporated by reference into this prospectus or the registration statement (other than exhibits to such documents unless such exhibits are specifically incorporated by reference into such documents). Requests for such copies should be directed to

Applied Digital Corporation

Attn: Wes Cummins

Chief Executed Officer

3811 Turtle Creek Blvd., Suite 2100

Dallas, Texas 75219

Phone number: (214) 427-1704

PROSPECTUS

$300,000,000

Common Stock

Preferred Stock

Warrants

Debt Securities

We may offer from time to time

| | | | | |

| ñ | shares of common stock; |

| ñ | shares of preferred stock in one or more series; |

| ñ | warrants to purchase preferred stock or common stock; |

| ñ | debt securities; or |

| ñ | any combination of preferred stock, common stock, warrants, or debt securities. |

at an aggregate offering price not to exceed $300,000,000.

The number, amount, prices, and specific terms of the securities, and the net proceeds to Applied Digital Corp. will be determined at or before the time of sale and will be set forth in an accompanying prospectus supplement. The net proceeds to us from the sale of securities will be the offering price or the purchase price of those securities less any applicable commission or discount, and less any other expenses we incur in connection with the issuance and distribution of those securities.

This prospectus may not be used for the sale of any securities unless it is accompanied by a prospectus supplement. Any accompanying prospectus supplement may modify or supersede any statement in this prospectus.

Our common stock is traded on the Nasdaq Global Select Market (“Nasdaq”) under the symbol APLD. On May 1, 2024, the last reported sale price of our common stock on Nasdaq was $3.00 per share. None of the other securities that we may offer under this prospectus are currently publicly traded. Each prospectus supplement will indicate whether the securities offered thereby will be listed on any securities exchange.

We may amend or supplement this prospectus from time to time. You should read this prospectus and any amendments or prospectus supplements carefully before you invest.

Investing in our securities involves a high degree of risk. See “Risk Factors” on page 8 of this prospectus and in the reports we file with the Securities and Exchange Commission (the “SEC”) pursuant to the Securities Act of 1934, as amended, incorporated by reference into this prospectus, to read about factors you should consider before buying our securities.

Neither the SEC nor any state securities commission has approved or disapproved of these securities or passed upon the accuracy or adequacy of this prospectus. Any representation to the contrary is a criminal offense.

The date of this prospectus is May 16, 2024.

TABLE OF CONTENTS

ABOUT THIS PROSPECTUS

This prospectus is part of a registration statement that we have filed with the Securities and Exchange Commission (the “SEC”) using a “shelf” registration process, pursuant to which we may, from time to time and in one or more offerings, offer and sell or otherwise dispose of the securities covered by this prospectus. You should not assume that the information contained in this prospectus is accurate on any date subsequent to the date set forth on the front cover of this prospectus or that any information we have incorporated by reference is correct on any date subsequent to the date of the document incorporated by reference, even though this prospectus is delivered or securities are sold or otherwise disposed of on a later date. It is important for you to read and consider all information contained in this prospectus, including the documents incorporated by reference herein, and any applicable supplement in making your investment decision. You should also read and consider the information in the documents to which we have referred you under the caption “Additional Information” and “Incorporation of Certain Information by Reference” in this prospectus.

You should rely only on the information provided in this prospectus and any applicable prospectus supplement, including any documents incorporated by reference into this prospectus or a prospectus supplement. We have not authorized any dealer, salesman or other person to give any information or to make any representation other than those contained or incorporated by reference into this prospectus. You must not rely upon any information or representation not contained or incorporated by reference into this prospectus. This prospectus does not constitute an offer to sell or the solicitation of an offer to buy any of our securities other than the securities covered hereby, nor does this prospectus constitute an offer to sell or the solicitation of an offer to buy any securities in any jurisdiction to any person to whom it is unlawful to make such offer or solicitation in such jurisdiction.

This prospectus contains our trademarks, tradenames and servicemarks and also contains certain trademarks, tradenames and servicemarks of other parties.

This prospectus contains forward-looking statements that are subject to a number of risks and uncertainties, many of which are beyond our control. See “Risk Factors” and “Forward-Looking Statements.”

Unless the context indicates otherwise, references in this prospectus to the “Company,” “APLD,” “we,” “us,” “our” and similar terms refer to Applied Digital Corporation and its consolidated subsidiaries.

PROSPECTUS SUMMARY

This summary highlights selected information that is presented in greater detail elsewhere in this prospectus supplement and the accompanying prospectus. This summary does not contain all of the information you should consider before investing in our common stock. You should carefully read the entire prospectus supplement and the accompanying prospectus and the documents incorporated by reference before investing in our common stock, including the sections titled “Forward-Looking Statements” and “Risk Factors” provided elsewhere in this prospectus supplement and accompanying prospectus. Some of the statements in this prospectus supplement and accompanying prospectus constitute forward-looking statements. See the section titled “Forward-Looking Statements.”

Our Business

We are a United States-based designer, developer and operator of next-generation digital infrastructure across North America. We provide digital infrastructure solutions and cloud services to the rapidly growing industries of High-Performance Computing (HPC) and Artificial Intelligence (AI). We operate in three distinct business segments, including, Blockchain datacenter hosting (the “Datacenter Hosting Business”), cloud services, through a wholly owned subsidiary (the “Cloud Services Business”) and HPC datacenter hosting (the “HPC Hosting Business), as further discussed below.

Despite the challenges posed by the competitive landscape, global supply chain disruptions, and evolving regulatory environment, we remain committed to delivering innovative and responsible solutions to our customers while prioritizing compliance and risk management. As we continue to expand our operations and navigate the uncertainties associated with being a relatively new business in rapidly evolving markets, we believe we are well positioned to capitalize on the increasing demand for datacenter services driven by the rapid adoption of digital technologies across industries.

We completed our initial public offering in April 2022 and our common stock began trading on the Nasdaq Global Select Market on April 8, 2022. In November 2022, we changed our name from Applied Blockchain, Inc. to Applied Digital Corporation.

Business Segments

Datacenter Hosting Business

Our Datacenter Hosting Business operates datacenters, providing energized space to crypto mining customers. Our custom-designed datacenters allow customers to rent space based on their power requirements. We currently serve four crypto-mining customers, all of which have entered into contracts with us ranging from three to five years. We began generating revenue from this business segment in February 2022 and to date, this business

segment accounts for the majority of the revenue we generate from our operations (approximately 87% as of February 29, 2024).

We currently operate sites in Jamestown and Ellendale, North Dakota, with a total hosting capacity of approximately 286 MW:

•Jamestown, North Dakota: 106 MW facility.

•Ellendale, North Dakota: 180 MW facility.

In March 2021, we executed a strategy planning and portfolio advisory services agreement (the “Services Agreement”) with GMR Limited, a British Virgin Island limited liability company (“GMR”), Xsquared Holding Limited, a British Virgin Island limited liability company (“SparkPool”) and Valuefinder, a British Virgin Islands limited liability company (“Valuefinder” and, together with GMR and SparkPool, the “Service Provider(s)”). Under the Services Agreement, the Service Providers agreed to provide crypto asset mining management and analysis and assist us in securing difficult-to-obtain mining equipment. Under the terms of the Services Agreement, we issued 7,440,148 shares of Common Stock to each of GMR and SparkPool and 3,156,426 shares of Common Stock to Valuefinder. In June 2022, SparkPool ceased all operations and forfeited 4,965,432 shares of Common Stock back to us.

In March 2022, we decided to terminate our crypto mining operations, shifting our focus and our business strategy to developing the HPC Hosting Business and our other two business segments (including the Bitcoin Hosting Business). Each Service Provider advised us concerning the design and buildout of our hosting operations. We continue to partner with GMR, Bitmain, and other providers as they remain our strategic equity investors. Beyond GMR’s use of our hosting capabilities, our partners have strong relationships across the cryptocurrency ecosystem, which we may leverage to identify leads for the expansion of our operations and business segments.

Compared to our previous mining operations, co-hosting revenues are less subject to volatility related to the underlying crypto-asset markets. We have a contractual ceiling for our energy costs through our Amended and Restated Electric Service Agreement, entered into in September 2023 with a utility in the upper Midwest (the “Electric Service Agreement”). One of the main benefits of the Electric Service Agreement is the low cost of power for mining. Even before the recently imposed crypto mining restrictions in China, power capacity available for Bitcoin mining was scarce, especially at scalable sites with over 100 MW of potential capacity. This scarcity of mining power allows us to realize attractive hosting rates in the current market. The Electric Service Agreement has also enabled us to launch our hosting business with long-term customer contracts.

In March 2024, we announced that we entered into a definitive agreement to sell our 200 MW campus in Garden City, TX, to Marathon Digital Holdings (Nasdaq: MARA). We completed the sale transaction on April 1, 2024.

Cloud Services

We operate our Cloud Services Business through our wholly owned subsidiary, Sai Computing, LLC (“Sai Computing”), which provides cloud services to customers, such as artificial intelligence and machine learning developers. Our Cloud Services Business specializes in providing graphics processing unit (GPU) computing solutions to empower customers in executing critical workloads related to artificial intelligence (AI), machine learning (ML), rendering, and other high-performance computing (HPC) tasks. Our managed hosting cloud service allows customers to sign service contracts, utilizing our Company-provided equipment for seamless and cost-effective operations.

We are rolling out numerous GPU clusters, each comprising 1,024 GPUs, which are available for lease by our customers. Additionally, we have secured contracts with colocation service providers to ensure secure space and energy for our hosting services. Our strategy is to in the future utilize a blend of third-party colocation and our own HPC datacenters to deliver cloud services to our customers. In 2023, we constructed a separate and unique building, designed and purpose-built for GPUs, which is separate from our crypto hosting buildings, next to the Company’s currently operating 100-MW hosting facility in Jamestown, North Dakota, with a total capacity of 9 MW. This location is just one aspect of our comprehensive plan, and we intend to leverage it based on customer requirements.

In May 2023, we officially launched our Cloud Services Business. We currently rely on a few major suppliers for our products in this business segment: Super Micro Computer Inc. (“Super Micro”), NVIDIA Corp. (“NVIDIA”), Hewlett Packard Enterprise (“HPE”) and Dell Technologies Inc. (“Dell”). In May 2023, we partnered with Super Micro, a renowned provider of Application-Optimized Total IT Solutions. Together, we aim to deliver the Company’s cloud service to our customers. Super Micro’s high-performance server and storage solutions are designed to address a wide range of computational-intensive workloads. Their next-generation GPU servers are incredibly power-efficient, which is vital for datacenters as the power requirements for large-scale AI models continue to increase. Optimizing the Total Cost of Ownership (TCO) and Total Cost to Environment (TCE) is critical for datacenter operators to ensure sustainable operations.

In June 2023, we announced a partnership with HPE, a global company specializing in edge-to-cloud technology. As part of this collaboration, HPE will provide its powerful and energy-efficient supercomputers to support large-scale artificial intelligence (AI) through our cloud service. HPE has been supportive in core design considerations and engineering of Company-owned facilities which will support Sai Computing’s infrastructure. In addition, we have supply agreements with Dell for delivery to us of AI and GPU servers. NVIDIA supplies GPUs to these GPU server providers.

Sai Computing secured its first major AI customer in May 2023 and in June 2023, entered into a 36-month contract with a second customer in the Cloud Services Business. As of the date of this report, our Cloud Services Business provides services to several customers.

By February 2024, the Company had received 4,092 GPUs, deployed a total of 3,072 GPUs and began recognizing revenue from our first and second cloud services contract. The Cloud Services Business is expected to account for approximately 13% or more of our revenue in fiscal year 2024. As we ramp up operations in this business segment, we expect to acquire and deploy additional GPUs, increase revenue from the Cloud Services Business and increase the percentage of our revenue produced by our Cloud Services Business.

HPC Hosting Business

Our High Performance Computing (HPC) Hosting Business specializes in designing, constructing, and managing datacenters tailored to support HPC applications, including artificial intelligence (AI).

Currently, we have 9 MW of hosting capacity at our Jamestown, ND, location. In 2023, we commenced the construction of our first 100 MW HPC datacenter in Ellendale, North Dakota (the “HPC Ellendale Facility”). We plan to continue building this datacenter in 2024 and designing and developing additional HPC datacenter sites in the future.

We anticipate that this business segment will begin generating meaningful revenues once the HPC Ellendale Facility becomes operational, which is expected sometime in the early calendar year 2025.

Corporate Information

Our principal executive office is located at 3811 Turtle Creek Blvd., Suite 2100, Dallas, Texas 75219, and our phone number is (214) 427-1704. Our principal website address is www.applieddigital.com.

We make available free of charge on or through our website access to press releases and investor presentations, as well as all materials that we file electronically with the SEC, including our annual reports on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K and amendments to those reports, filed or furnished pursuant to Section 13(a) or 15(d) of the Exchange Act as soon as reasonably practicable after electronically filing such materials with, or furnishing them to, the SEC. The SEC maintains an Internet website, www.sec.gov, that contains reports, proxy and information statements and other information that we file electronically with the SEC.

Information contained in, or accessible through, our website does not constitute part of this prospectus or the registration statement of which it forms a part and inclusions of our website address in this prospectus or the

registration statement are inactive textual references only. You should not rely on any such information in making your decision whether to purchase our securities.

We are a “smaller reporting company” as defined in Rule 12b-2 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”) and have elected to take advantage of certain of the scaled disclosure available for smaller reporting companies in this prospectus as well as our filings under the Exchange Act.

THE OFFERING

| | | | | |

Common Stock, par value $0.001 per share | To be set forth in a prospectus supplement |

| Preferred Stock, par value $0.001 (the “Preferred Stock”) | To be set forth in a prospectus supplement |

| Warrants | To be set forth in a prospectus supplement |

| Debt Securities | To be set forth in a prospectus supplement |

| Total | $300,000,000 |

| Use of proceeds | Except as otherwise set forth in the applicable prospectus supplement, we expect to use the net proceeds from the sale of our securities to address the Company’s working capital needs. |

| Nasdaq symbol | APLD |

RISK FACTORS

An investment in our securities involves a high degree of risk and uncertainty. In addition to the other information included in this prospectus or in any applicable prospectus supplement, you should carefully consider each of the risk factors set forth in our most recent Annual Report on Form 10-K and subsequent Quarterly Reports on Form 10-Q on file with the SEC, which are incorporated by reference into this prospectus, and any subsequent Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q or Current Reports on Form 8-K we file after the date of this prospectus. The risks described are not the only ones facing our company. Additional risks not presently known to us or that we presently consider immaterial may also adversely affect our company. If any of the risks described occur, our business, financial condition, results of operations and prospects could be materially adversely affected. In that case, the trading price of our securities could decline, and you could lose all or part or your investment. In assessing these risks, you should also refer to the other information included or incorporated by reference into this prospectus or any applicable prospectus supplement.

Substantial blocks of our Common Stock may be sold into the market as a result of our registration of the issuance or resale of Common Stock pursuant to previously filed registration statements.

The price of our Common Stock could decline if there are substantial sales of shares of our Common Stock, if there is a large number of shares of our Common Stock available for sale, or if there is the perception that these sales could occur.

We currently have convertible notes outstanding in the aggregate principal amount of $50,000,000 (the “Promissory Notes”). The Promissory Notes are convertible into shares of our Common Stock (the “Note Conversion Shares”), at the request and sole discretion of the holder, subject to a minimum floor conversion price (which may be reduced by us from time to time in our discretion, subject to the rules and regulations of Nasdaq). We have registered the resale of up to 23,585,000 of Conversion Shares.

We also have a promissory note outstanding in the aggregate principal amount of $20,000,000 (as amended from time to time, the “AI Promissory Note”) in favor of AI Bridge Funding LLC. The AI Promissory Note may be paid with up to 24,532,449 shares of our Common Stock (the “AI Payment Shares”), subject to certain requirements and limitations, the issuance of which are registered.

We have registered the issuance of up to $25,000,000 of our Common Stock (the “ATM Common Stock”) in an “at the market equity offering” as defined in Rule 415 promulgated under the Securities Act of 1933, as amended. The actual number of shares issued in the offering will vary depending on the sales prices when, and if, shares are sold from time to time.

Any issuances of Note Conversion Shares, AI Payment Shares or ATM Common Stock will dilute the percentage ownership of stockholders and may dilute the per share projected earnings (if any) or book value of our Common Stock. Sales of a substantial number of such shares in the public market or other issuances of shares of our Common Stock, or the perception that these sales or issuances could occur, could cause the market price of our Common Stock to decline and may make it more difficult for you to sell your shares at a time and price that you deem appropriate.

FORWARD-LOOKING STATEMENTS

Except for historical information, this prospectus contains forward-looking statements made pursuant to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995 under Section 27A of the Securities Act of 1933, as amended (the “Securities Act”) and Section 21E of the Exchange Act. Forward-looking statements include statements with respect to our beliefs, plans, objectives, goals, expectations, anticipations, assumptions, estimates, intentions and future performance, and involve known and unknown risks, uncertainties and other factors, which may be beyond our control, and which may cause our actual results, performance or achievements to be materially different from future results, performance or achievements expressed or implied by such forward-looking statements. All statements other than statements of historical fact are statements that could be forward-looking statements. You can identify these forward-looking statements through our use of words such as “may,” “can,” “anticipate,” “assume,” “should,” “indicate,” “would,” “believe,” “contemplate,” “expect,” “seek,” “estimate,” “continue,” “plan,” “point to,” “project,” “predict,” “could,” “intend,” “target,” “potential” and other similar words and expressions of the future.