UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement

Pursuant to Section 14(a)

of the Securities Exchange Act of 1934

(Amendment No. )

| Filed by the Registrant |

x |

| Filed by a Party other than the Registrant |

¨ |

Check the appropriate box:

| ¨ | Preliminary Proxy Statement |

| ¨ | Confidential,

for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| x | Definitive Proxy Statement |

| ¨ | Definitive Additional Materials |

| ¨ | Soliciting Material Pursuant to §240.14a-12 |

Applied

DNA Sciences, Inc.

(Name of Registrant as Specified

In Its Charter)

(Name of Person(s) Filing

Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check all boxes that

apply):

| ¨ | Fee paid previously with preliminary materials. |

| ¨ | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11. |

APPLIED DNA SCIENCES, INC.

50 HEALTH SCIENCES DRIVE

STONY BROOK, NEW YORK

11790

(631) 240-8800

December 10, 2024

Dear Fellow Stockholder:

You are cordially invited to attend a

Special Meeting of Stockholders (the “Special Meeting”) of Applied DNA Sciences, Inc. (“Applied DNA Sciences,”

the “Company,” “we” or “us”) to be held at 11:00 a.m., Eastern Time, on

Thursday, January 23, 2025.

We

are very pleased that the Special Meeting will be a completely virtual meeting of stockholders, which will be conducted via live webcast.

The Special Meeting will be held in a virtual format only, via the Internet, with no physical in-person meeting. You will be able to attend

the Special Meeting online and submit your questions during the meeting by visiting www.virtualshareholdermeeting.com/APDN2025SM.

You will also be able to vote your shares electronically at the Special Meeting.

We are pleased to use the latest technology

to increase access, to improve communication and to obtain cost savings for our stockholders and the Company. Use of a virtual meeting

will enable increased stockholder attendance and participation as stockholders can participate from any location.

At the meeting, you will be asked to approve,

in accordance with Nasdaq Listing Rule 5635(d), the exercisability of certain common stock purchase warrants and the issuance of

the common stock underlying such warrants, which warrants were issued in connection with an offering of securities of the Company that

occurred on October 30, 2024. Detailed information with respect to this matter is set forth in the Proxy Statement, which we encourage

you to carefully read in its entirety.

We look forward to greeting personally

those stockholders who are able to attend the meeting online. However, whether or not you plan to join us at the meeting, it is important

that your shares be represented. Stockholders of record at the close of business on November 25, 2024 are entitled to notice of and

to vote at the meeting. Such stockholders are urged to promptly submit the enclosed proxy card, even if their shares were sold after the

record date.

We will be using the “Notice and

Access” method of providing proxy materials to you via the Internet. On or about December 10, 2024, we will mail to our stockholders

a Notice of Availability of Proxy Materials (the “Notice”) containing instructions on how to access our Proxy Statement

and our 2023 Annual Report on Form 10-K and vote electronically via the Internet. The Notice also contains instructions on how to

receive a printed copy of your proxy materials.

You may vote over the

Internet, as well as by telephone or, if you requested to receive printed proxy materials, you can also vote by mail pursuant to instructions

provided on the proxy card. Please review the instructions for each of your voting options described in the Proxy Statement, as well as

in the Notice you will receive in the mail.

Thank you for your ongoing support of Applied DNA Sciences.

| |

Very truly yours, |

| |

|

| |

/s/ James A. Hayward |

| |

James A. Hayward |

| |

Chairman, President and Chief

Executive Officer |

| |

|

APPLIED DNA SCIENCES, INC.

NOTICE OF SPECIAL MEETING OF STOCKHOLDERS

Notice is hereby

given that a Special Meeting of Stockholders (the “Special Meeting”) of Applied DNA Sciences, Inc. (“Applied

DNA Sciences” or the “Company”), will be held online at 11:00 a.m., Eastern Time, on Thursday,

January 23, 2025, for the following purposes:

| · | to approve, in accordance with Nasdaq Listing Rule 5635(d), the exercisability of certain common stock purchase warrants, and

the issuance of the common stock underlying such warrants, which warrants were issued in connection with an offering of securities of

the Company that occurred on October 30, 2024 (the “Warrant Exercise Proposal”); and |

| · | to consider and act upon such other matters as may properly come before the meeting or any postponement or adjournment of the meeting. |

These matters are more fully described in the accompanying

Proxy Statement.

Only

stockholders of record at the close of business on November 25, 2024 are entitled to notice of and to vote at the Special Meeting

and any adjournment or postponement thereof. The Special Meeting will be held in a virtual format only, via the Internet, with no physical

in-person meeting. Stockholders will have the ability to attend, vote and submit questions before and during the virtual meeting from

any location via the Internet at www.virtualshareholdermeeting.com/APDN2025SM.

A complete list of these stockholders

will be available in electronic form at the Special Meeting and will be accessible for ten days prior to the Special Meeting. All stockholders

are cordially invited to virtually attend the Special Meeting.

Your vote is very important. Whether

or not you plan to attend the Special Meeting, we encourage you to read the Proxy Statement and submit your proxy or voting instructions

as soon as possible by Internet, telephone or mail. For specific instructions on how to vote your shares,

please refer to the instructions on the Notice of Internet Availability of Proxy Materials you will receive in the mail, the section entitled

“About the Special Meeting” beginning on page 1 of the Proxy Statement or, if you request to receive printed proxy materials,

your enclosed proxy card. Please note that shares held beneficially in street name may be voted by you in person at the Special

Meeting only if you obtain a legal proxy from the broker, bank, trustee, or other nominee that holds your shares giving you the right

to vote the shares.

| |

Very truly yours, |

| |

|

| |

/s/ James A. Hayward |

| |

James A. Hayward |

| |

Chairman, President and Chief

Executive Officer |

Stony Brook, New York

December 10, 2024

Important Notice Regarding the Availability

of Proxy Materials

for the Special Meeting of Stockholders

To Be Held on January 23, 2025

The

Proxy Statement, along with our 2023 Annual Report, as amended, is available free of charge at the following website: www.proxyvote.com

Table of Contents

APPLIED DNA SCIENCES, INC.

50 HEALTH SCIENCES DRIVE

STONY BROOK, NEW YORK 11790

PROXY STATEMENT

The board of directors (the “Board

of Directors”) of Applied DNA Sciences, Inc. (“Applied DNA Sciences” or the “ Company”)

has made this proxy statement and related materials (this “Proxy Statement”) available to you on the Internet, or,

upon your request, has delivered printed proxy materials to you by mail, in connection with the Board of Directors’ solicitation

of proxies for use at a Special Meeting of Stockholders (the “Special Meeting”) of Applied DNA Sciences, Inc.

to be held online on Thursday, January 23, 2025, beginning at 11:00 a.m., Eastern Time, and at any postponements or adjournments

of the Special Meeting. As a stockholder, you are invited to attend the Special Meeting and are requested to vote on the items of business

described in this Proxy Statement.

ABOUT THE SPECIAL MEETING

Why did I receive a notice in the mail regarding the

Internet availability of proxy materials instead of a full set of proxy materials?

In accordance with rules adopted

by the Securities and Exchange Commission (“SEC”), we are providing access to our proxy materials over the Internet.

Accordingly, we are sending a Notice Regarding Availability of Proxy Materials (the “Notice”) to our stockholders of

record and beneficial owners as of the record date (as defined below) (for more information on the record date, see “— Who

is entitled to vote at the Special Meeting?”). The mailing of the Notice to our stockholders is scheduled to begin on or about

December 10, 2024. All stockholders will have the ability to access the proxy materials and our Annual Report on Form 10-K for

the fiscal year ended September 30, 2023 (the “Annual Report”) on a website referred to in the Notice or to request

to receive a printed set of the proxy materials and the Annual Report. Instructions on how to access the proxy materials over the Internet

or to request a printed copy may be found in the Notice. Stockholders may also request to receive proxy materials and our Annual Report

in printed form by mail or electronically by email on an ongoing basis.

How do I get electronic access to the proxy materials?

The Notice will provide you with instructions regarding

how you can:

| · | View our proxy materials for the Special Meeting and our Annual Report on the Internet; and |

| · | Instruct us to send our future proxy materials to you electronically by email. |

Choosing to receive your future proxy

materials by email will save us the cost of printing and mailing documents to you, and will reduce the impact of printing and mailing

these materials on the environment. Stockholders may also request to receive proxy materials and our Annual Report in printed form by

mail or electronically by email on an ongoing basis. If you choose to receive future proxy materials by email, you will receive an email

prior to our next stockholder meeting with instructions containing a link to those materials and a link to the proxy voting website. Your

election to receive proxy materials by email will remain in effect until you terminate it.

What is the purpose of the Special Meeting?

At the Special Meeting, stockholders will

act upon the matters outlined in the notice of meeting accompanying this Proxy Statement, consisting of (i) the approval, in accordance

with Nasdaq Listing Rule 5635(d), of the exercisability of certain common stock purchase warrants, and the issuance of the common

stock, $.001 par value (“Common Stock”), underlying such warrants, which warrants were issued in connection with an

offering of securities of the Company that occurred on October 30, 2024 (the “Warrant Exercise Proposal”) and

(ii) such other business that may properly come before the meeting or any postponement or adjournment thereof. Our Board of Directors

is not currently aware of any other matters which will come before the meeting.

How do proxies work and how are votes counted?

The Board of Directors is asking for your

proxy. Giving us your proxy means that you authorize us to vote your shares at the Special Meeting in the manner you direct. You may vote

to approve or not approve the Warrant Exercise Proposal. If a stockholder of record does not indicate instructions with respect to one

or more matters on his, her or its proxy, the shares represented by that proxy will be voted as recommended by the Board of Directors

(for more information, see “— How does the Board of Directors’ recommend that I vote?”). If a beneficial

owner of shares held in street name does not provide instructions to the bank, broker, or other nominee holding those shares, please see

the information below under the caption “—What if I am a beneficial owner and do not give voting instructions to my broker

or other nominee?”

Who is entitled to vote at the Special Meeting?

Only stockholders of record at the close

of business on November 25, 2024, the record date for the meeting (the “Record Date”), are entitled to receive

notice of and to participate in the Special Meeting, or any postponements and adjournments of the meeting. If you were a stockholder of

record on that date, you will be entitled to vote all of the shares you held on that date at the meeting, or any postponements or adjournments

of the meeting.

On the Record Date, there were 51,221,123

shares of our Common Stock outstanding. Each outstanding share of Common Stock is entitled to one vote on each of the matters presented

at the Special Meeting or postponements and adjournments of the meeting.

What constitutes a quorum?

The presence at the meeting, in person

or by proxy, of the holders of one-third of the issued and outstanding shares of Common Stock as of the Record Date will constitute a

quorum, permitting the Special Meeting to conduct its business. As of the Record Date, 51,221,123 shares of Common Stock, representing

the same number of votes, were outstanding. Thus, the presence of holders representing at least 17,073,708 shares will be required to establish

a quorum.

If a stockholder abstains from voting

as to any matter or matters, the shares held by such stockholder shall be deemed present at the Special Meeting for purposes of determining

a quorum. If a bank, broker, or other nominee fails to vote because of a lack of voting instructions by the beneficial holder of the shares

and a lack of discretionary authority on the part of the bank, broker, or other nominee to vote on a particular matter, then such shares

shall not be counted at the Special Meeting for purposes of determining a quorum. For more information on discretionary and non- discretionary

matters, see “— What if I am a beneficial owner and do not give voting instructions to my broker or other nominee?”

What vote is required to approve each matter and how

are votes counted?

Proposal No. 1: Approval, in Accordance

with Nasdaq Listing Rule 5635(d), of the exercisability of certain common stock purchase warrants, and the issuance of the Common

Stock underlying such warrants, which warrants were issued in connection with an offering of Securities of the Company that occurred on

October 30, 2024.

The affirmative vote of a majority of

the outstanding shares of our Common Stock present in person or represented by proxy at the Special Meeting and entitled to vote on this

proposal is required for the approval of the Warrant Exercise Proposal. An abstention from voting by a stockholder present in person or

represented by proxy at the meeting has the same legal effect as a vote “against” the matter. A failure to vote by a bank,

broker or other nominee for which the bank, broker or other nominee does not have voting discretion for the matter will be excluded entirely

from the vote and will therefore have no effect on the outcome of the vote for this matter.

How can you attend the Special Meeting?

We

will be hosting the Special Meeting live via audio webcast. Any stockholder can attend the Special Meeting live online at www.virtualshareholdermeeting.com/APDN2025SM.

If you were a stockholder as of the Record Date, or you hold a valid proxy for the Special Meeting, you can vote at the Special

Meeting. A summary of the information you need to attend the Special Meeting online is provided below:

| · | Instructions on how to attend and participate via the Internet, including how to demonstrate proof of stock ownership, are posted

at www.virtualshareholdermeeting.com/APDN2025SM. |

| · | Assistance with questions regarding how to attend and participate via the Internet will be provided at www.virtualshareholdermeeting.com/APDN2025SM

on the day of the Special Meeting. |

| · | Webcast will start on January 23, 2025, at 11:00 a.m., Eastern Time. |

| · | You will need your 11-digit control number to enter the Special Meeting. |

| · | Stockholders may submit questions while attending the Special Meeting via the Internet. |

| · | Webcast replay of the Special Meeting will be available until January 23, 2026. |

To attend and participate in the Special

Meeting, you will need the 11-digit control number included on your proxy card, or on the instructions that accompanied your proxy materials.

If your shares are held in “street name,” you should contact your bank or broker to obtain your 11-digit control number or

otherwise vote through the bank or broker. If you lose your 11-digit control number, you may join the Special Meeting as a “Guest”,

but you will not be able to vote, ask questions or access the list of stockholders as of the Record Date.

Why hold a virtual meeting?

We are excited to use the latest technology

to provide expanded access, improved communication and cost savings for our stockholders and the Company while providing stockholders

the same rights and opportunities to participate as they would have at an in-person meeting. We believe the virtual meeting format enables

increased stockholder attendance and participation because stockholders can participate from any location around the world.

How do I ask questions at the virtual Special Meeting?

During

the virtual Special Meeting, you may only submit questions in the question box provided at www.virtualshareholdermeeting.com/APDN2025SM.

We will respond to as many inquiries at the virtual Special Meeting as time allows.

What if during the check-in time or during the virtual

Special Meeting I have technical difficulties or trouble accessing the virtual meeting website?

We will have technicians ready to assist

you with any technical difficulties you may have accessing the virtual meeting website. If you encounter any difficulties accessing the

virtual Special Meeting during the check-in or meeting time, please call the technical support number that will be posted on the Special

Meeting website log-in page.

How can I vote my shares?

Record Owners and Beneficial Owners Who Have Been Provided

With an 11-Digit Control Number

If you are a record holder, meaning your

shares are registered in your name and not in the name of a broker, trustee, or other nominee, or a beneficial owner who has been provided

by your broker with an 11- digit control number, you may vote:

| 1. | Over the Internet — If you have Internet access, you may authorize the voting of your shares by accessing www.proxyvote.com

and following the instructions set forth in the proxy materials. You must specify how you want your shares voted or your vote will not

be completed, and you will receive an error message. Your shares will be voted according to your instructions. You can also vote during

the meeting by visiting www.virtualshareholdermeeting.com/APDN2025SM and having available the control number included on your proxy card

or on the instructions that accompanied your proxy materials. |

| 2. | By Telephone — If you are a registered stockholder or a beneficial owner who has been provided with a control

number on the voting instruction form that accompanied your proxy materials, you may call 1-800-690-6903 in the United States (toll-free)

or from foreign countries (tolls may apply) to vote by telephone. Your shares will be voted according to your instructions. |

| 3. | By Mail — Complete and sign the proxy card and mail it in the postage prepaid envelope. Your shares will be voted

according to your instructions. If you sign your proxy card but do not specify how you want your shares voted, they will be voted as recommended

by our Board of Directors. Unsigned proxy cards will not be voted. |

If your shares are held in a brokerage

account or by a bank or other nominee, your ability to vote by telephone or the Internet depends on your broker’s voting process.

Please follow the directions provided to you by your broker, bank or nominee.

Beneficial Owners

As the beneficial owner, you have the

right to direct your broker, trustee, or other nominee on how to vote your shares. In most cases, when your broker provides you with proxy

materials, they will also provide you with an 11-digit control number, which will allow you to vote as described above or at the Special

Meeting. If your broker has not provided you with an 11-digit control number, please contact your broker for instructions on how to vote

your shares.

Stockholders who submit a proxy

by Internet or telephone need not return a proxy card or any form forwarded by your broker, bank, trust or nominee. Stockholders who submit

a proxy through the Internet or telephone should be aware that they may incur costs to access the Internet or telephone, such as usage

charges from telephone companies or Internet service providers, and that these costs must be borne by the stockholder.

What am I voting on at the Special Meeting?

The following proposal is scheduled for a vote at the Special

Meeting:

| · | Proposal No. 1: to approve, in accordance with Nasdaq Listing Rule 5635(d), the exercisability of certain

common stock purchase warrants, and the issuance of the Common Stock underlying such warrants, which warrants were issued in connection

with an offering of Securities of the Company that occurred on October 30, 2024. |

The proposal is described in further detail below.

What happens if additional matters are presented at the

Special Meeting?

Other than the items of business described

in this Proxy Statement, we are not currently aware of any other business to be acted upon at the Special Meeting. If you grant a proxy,

the persons named as proxy holders, Ms. Beth Jantzen and Ms. Judith Murrah, will have the discretion to vote your shares on

any additional matters properly presented for a vote at the meeting.

How does the Board of Directors’ recommend that

I vote?

As to the proposal to be voted on at the

Special Meeting, the Board of Directors unanimously recommends that you vote FOR the Warrant Exercise Proposal, to approve,

in accordance with Nasdaq Listing Rule 5635(d), the exercisability of certain common stock purchase warrants, and the issuance of

the Common Stock underlying such warrants, which warrants were issued in connection with an offering of securities of the Company that

occurred on October 30, 2024.

What if I am a stockholder of record and do not indicate

voting instructions on my proxy?

If

you are a stockholder of record and provide specific instructions on your proxy with regard to certain items, your shares will be

voted as you instruct on such items. If no instructions are indicated on your proxy for the proposal to be voted on, the shares will

be voted as recommended by the Board of Directors for the approval of the Warrant Exercise Proposal, to approve, in accordance with

Nasdaq Listing Rule 5635(d), the exercisability of certain common stock purchase warrants, and the issuance of the Common Stock

underlying such warrants, which warrants were issued in connection with an offering of securities of the Company that occurred on

October 30, 2024. If any other matters are properly presented for consideration at the meeting, the individuals named as proxy

holders, Ms. Beth Jantzen and Ms. Judith Murrah, will vote the shares that they represent on those matters as recommended

by the Board of Directors. If the Board of Directors does not make a recommendation, then they will vote in accordance with their

best judgment.

What if I am a beneficial owner and do not give voting

instructions to my broker or other nominee?

As a beneficial owner, in order to ensure

your shares are voted in the way you would like, you must provide voting instructions to your bank, broker, or other nominee by the deadline

provided in the materials you receive from your bank, broker, or other nominee or vote by mail, telephone or Internet according to instructions

provided by your bank, broker, or other nominee.

The Warrant Exercise Proposal is a non-discretionary

item and may not be voted on by brokers, banks or other nominees who have not received specific voting instructions from beneficial owners.

We encourage you to provide instructions to your broker

regarding the voting of your shares.

Can I change my vote or revoke my proxy?

Yes.

(1) If

you are a stockholder of record, you may revoke your proxy by (i) entering a new vote by telephone or over the Internet up

until 11:59 P.M. Eastern Time on January 22, 2025; (ii) attending the Special Meeting and voting in person (although

attendance at the Special Meeting will not in and of itself revoke a proxy); or (iii) entering a new vote by mail. Any written

notice of revocation or subsequent proxy card must be received by the Secretary of the Company prior to the holding of the vote at

the Special Meeting at 11:00 a.m., Eastern Time, on January 23, 2025. Such written notice of revocation or subsequent proxy

card should be hand delivered to the Secretary of the Company or sent to the Company’s principal executive offices at 50

Health Sciences Drive, Stony Brook, New York 11790, Attention: Corporate Secretary. (2) If a broker, bank, or other nominee

holds your shares, you must contact them in order to find out how to change your vote.

The last proxy or vote that we receive from you will

be the vote that is counted.

Who will bear the cost of soliciting votes for the Special

Meeting?

We will pay the entire cost of preparing,

assembling, printing, mailing, and distributing these proxy materials and soliciting votes. If you choose to access the proxy materials

and/or vote over the Internet, you are responsible for Internet access charges you may incur. If you choose to vote by telephone, you

are responsible for telephone charges you may incur. In addition to the mailing of these proxy materials, the solicitation of proxies

or votes may be made in person, by telephone, or by electronic communication by our directors, officers, and employees, who will not receive

any additional compensation for such solicitation activities. We have engaged Kingsdale Shareholder Services US LLC (“Kingsdale

Advisors”) to assist in soliciting proxies on our behalf. Kingsdale Advisors may solicit proxies personally, electronically

or by telephone. We have agreed to pay Kingsdale Advisors a fee of $9,000 plus reimburse them for certain out- of-pocket disbursements

and expenses. We have also agreed to indemnify Kingsdale Advisors and its employees against certain liabilities arising from or in connection

with the engagement.

What is “householding” and where can I get

additional copies of proxy materials?

For information about householding and

how to request additional copies of proxy materials, please see the section captioned “Householding of Proxy Materials.”

Whom may I contact if I have other questions about the

Special Meeting or voting?

You

may contact the Company at 50 Health Sciences Drive, Stony Brook, New York 11790, Attention: Beth Jantzen, or by telephone at 631-240-8800,

or you may contact Kingsdale Advisors by telephone at 1- 855-682-9644 (toll free) or 1-646-491-9095 (call or text outside North America)

or by email at contactus@kingsdaleadvisors.com.

Where can I find the voting results of the Special Meeting?

We will announce preliminary voting results

at the Special Meeting. Final voting results will be disclosed on a Form 8-K filed with the SEC within four business days after the

Special Meeting, which will also be available on our website.

We

encourage you to vote by proxy over the Internet, by mail or telephone pursuant to instructions provided on the proxy

card or the instructions that accompanied your proxy materials.

PROPOSAL NO. 1

APPROVAL, IN ACCORDANCE WITH NASDAQ

LISTING RULE 5635(d), OF THE EXERCISABILITY OF CERTAIN COMMON STOCK PURCHASE WARRANTS, AND THE ISSUANCE OF THE COMMON STOCK

UNDERLYING SUCH WARRANTS, WHICH WARRANTS WERE ISSUED IN CONNECTION WITH AN OFFERING OF SECURITIES OF THE COMPANY THAT OCCURRED ON

OCTOBER 30, 2024

We are seeking stockholder approval, for

purposes of complying with Nasdaq Listing Rule 5635(d), for the exercisability of an aggregate of 41,640,625 warrants, consisting

of (i) 20,312,500 Series C warrants, each to purchase one share of the Company’s Common Stock (“Series C

Warrants”), (ii) 20,312,500 Series D warrants, each to purchase one share of the Company’s Common Stock (“Series D

Warrants”, and, together with the Series C Warrants, the “Series Warrants”) and (iii) 1,015,625

Placement Agent Warrants, each to purchase one share of the Company’s Common Stock (“Placement Agent Warrants, and,

together with the Series Warrants, the “Private Placement Warrants”), and the issuance of the Common Stock underlying

such Private Placement Warrants, which warrants were issued in connection with an offering of securities of the Company that occurred

on October 30, 2024.

The information set forth in this Proposal

No. 1 is qualified in its entirety by reference to the full text of the form of Purchase Agreement (as defined below), form of Series C

Warrant, form of Series D Warrant and form of Placement Agent Warrant, attached as exhibits 10.1, 4.2, 4.3 and 4.4, respectively,

to our Current Report on Form 8-K filed with the SEC on October 31, 2024.

Stockholders are urged to carefully read these documents.

Background

On October 30, 2024, the Company

entered into a securities purchase agreement (the “Purchase Agreement”) with certain institutional investors (each,

a “Purchaser” and, collectively, the “Purchasers”), pursuant to which the Company agreed to issue

and sell (i) in a registered direct public offering (the “Registered Direct Offering”) of 19,247,498 shares (“Shares”)

of the Company’s Common Stock and pre-funded warrants (“Pre-Funded Warrants”) to purchase up to 1,065,002 shares

of Common Stock, and (ii) in a concurrent private placement (the “Private Placement”, and together with the Registered

Direct Offering the “Offering”), unregistered Series C Warrants to purchase up to 20,312,500 shares of Common

Stock and unregistered Series D Warrants to purchase up to 20,312,500 shares of Common Stock. The purchase price for each Share and

accompanying Series C Warrant and Series D Warrant was $0.32 and the purchase price for each Pre-Funded Warrant and accompanying

Series C Warrant and Series D Warrant was $0.3199. Craig-Hallum Capital Group LLC (“Craig-Hallum”

or the “Placement Agent”) acted as placement agent in connection with the Offering.

Pursuant to that certain engagement letter,

dated August 23, 2024, by and between the Company and the Placement Agent (the “Engagement Letter”), the Company

paid the Placement Agent a cash placement fee equal to 6.0% of the aggregate gross proceeds raised in the Offering from sales arranged

for by the Placement Agent. Subject to certain conditions, the Company also reimbursed certain expenses of the Placement Agent in connection

with the Offering, including but not limited to legal fees, up to a maximum of $100,000. The Company also issued to the Placement

Agent, or its respective designees, Placement Agent Warrants (“Placement Agent Warrants”) to purchase up to 1,015,625

shares of Common Stock (which equals 5.0% of the number of shares of Common Stock and Pre-Funded Warrants offered in the Offering).

The Offering closed and the Private Placement

Warrants were issued on October 31, 2024. The Company received gross proceeds from the Offering, before deducting placement agent

fees and other estimated offering expenses payable by the Company, of approximately $6.5 million.

The exercisability of the Private Placement

Warrants will be available only upon receipt of such stockholder approval (the “Warrant Stockholder Approval”) as may

be required by the applicable rules and regulations of The Nasdaq Stock Market LLC. Each Series C Warrant has an exercise price

of $0.32 per share of Common Stock, will become exercisable upon the first trading day following the Company’s notice to warrantholders

of Warrant Stockholder Approval (the “Stockholder Approval Date”), and will expire on the five-year anniversary of

the Stockholder Approval Date. Each Series D Warrant has an exercise price of $0.32 per share of Common Stock, will become exercisable

upon the Stockholder Approval Date, and will expire on the 18-month anniversary of the Stockholder Approval Date. Each Placement Agent

Warrant has an exercise price of $0.32 per share of Common Stock, will become exercisable upon the Stockholder Approval Date and will

expire on October 30, 2029.

Upon the receipt of Warrant Stockholder

Approval, if all Private Placement Warrants are exercised as described in the immediately preceding paragraph (including if the Series D

Warrants are exercised pursuant to the alternative cashless exercise mechanism described below), the Company will have 92,861,748 shares

of Common Stock outstanding (based on 51,221,123 shares of Common Stock outstanding as of the Record Date). In addition to the Private

Placement Warrants, the Company has 95,758,768 warrants and 108,176 options to purchase Common Stock outstanding as of the Record Date.

If at the time of exercise there is no

effective registration statement registering, or the prospectus contained therein is not available for the issuance of the common stock

underlying the Private Placement Warrants, then the Private Placement Warrants may also be exercised, in whole or in part, at such time

by means of a cashless exercise, in which case the holder would receive upon such exercise the net number of common shares determined

according to the formula set forth in the Private Placement Warrants.

Under the alternate cashless exercise

option of the Series D Warrants, the holder of a Series D Warrant, has the right to receive, without payment of additional consideration,

an aggregate number of shares equal to the product of (x) the aggregate number of shares of common stock that would be issuable upon

a cash exercise of the Series D Warrant and (y) 1.0. In addition, the Series D Warrants include a provision that resets

their exercise price in the event of a reverse split of our common stock, to a price equal to the lesser of (i) the then exercise

price and (ii) lowest volume weighted average price (VWAP) during the period commencing five trading days immediately preceding and

the five trading days commencing on the date we effect a reverse stock split in the future with a proportionate adjustment to the number

of shares underlying the Series D Warrants, subject to a floor of $0.0634.

In the case of certain fundamental transactions

affecting the Company, a holder of Private Placement Warrants, upon exercise of such Private Placement Warrants after such fundamental

transaction, will have the right to receive, in lieu of shares of the Company’s common stock, the same amount and kind of securities,

cash or property that such holder would have been entitled to receive upon the occurrence of the fundamental transaction, had the Private

Placement Warrants been exercised immediately prior to such fundamental transaction. In lieu of such consideration, a holder of Private

Placement Warrants may instead, without exercise, elect to receive a cash payment based upon the Black-Scholes value of their Private

Placement Warrants.

The Company carefully considered its financing

alternatives and the expense of conducting one or more special stockholder meetings to approve the exercise of the Private Placement Warrants

pursuant to Nasdaq listing Rule 5635(d) and concluded that the Offering, including the issuance of the Private Placement Warrants,

was the best available financing alternative.

We are seeking approval for Proposal No. 1

because, pursuant to the Purchase Agreement, the Engagement Letter and the Private Placement Warrants, we issued the Private Placement

Warrants in the Offering, and the Private Placement Warrants are not exercisable until we receive Warrant Stockholder Approval. In addition,

in the event Warrant Stockholder Approval is obtained and the Private Placement Warrants are exercised for cash, the Company would receive

approximately $13,325,000 million if the holders of the Series D warrants do not elect to utilize the alternate cashless exercise

option. Alternatively, in the event that Warrant Stockholder Approval is obtained, and the holders of the Series D Warrants elect

to utilize the alternate cashless exercise option, the Company would only receive $6,825,000 if the remaining Private Placement Warrants

were exercised for cash.

Pursuant to the Purchase Agreement, the

Company has agreed to file a preliminary proxy statement with respect to obtaining Warrant Stockholder Approval at the Special Meeting

within 20 days following the closing date of the Purchase Agreement. Further, pursuant to the Purchase Agreement, in the event the Company

does not obtain Warrant Stockholder Approval at the Special Meeting, it is obligated to call a meeting every ninety (90) days after each

Special Meeting until the earlier of Warrant Stockholder Approval is obtained or the Series Warrants are no longer outstanding. If

we are able to obtain approval for Proposal No. 1 at the Special Meeting, we will save time and avoid the expense of having additional

meetings to obtain approval.

Nasdaq Stockholder Approval Requirement; Reasons for the

Warrant Exercise Proposal

Nasdaq

Listing Rule 5635(d) requires stockholder approval in connection with a transaction, other than a public offering,

involving the sale or issuance by the issuer of common stock (or securities convertible into or exchangeable for common stock) equal

to 20% or more of the common stock or 20% or more of the voting power of such company outstanding before the issuance for a price

that is less than the lower of: (i) the closing price of the common stock immediately preceding the signing of the binding

agreement for the issuance of such securities and (ii) the average closing price of the common stock for the five trading days

immediately preceding the signing of the binding agreement for the issuance of such securities (such price, the “Nasdaq

Minimum Price”).

The Private Placement Warrants were issued

in a private placement which is not a public offering and which resulted in the issuance of securities convertible into our Common Stock

equal to more than 20% of the voting power of our outstanding Common Stock below the Nasdaq Minimum Price. Because of this, the Private

Placement Warrants provide that they may not be exercised, and therefore have no value, unless stockholder approval of their exercise

is obtained.

The Board of Directors Recommends That Stockholders

Vote “For” The Warrant Exercise Proposal.

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL

OWNERS AND MANAGEMENT AND RELATED STOCKHOLDER MATTERS

The following table sets forth certain

information regarding the shares of our Common Stock beneficially owned as of the Record Date, by (i) each person, or group of affiliated

persons, who is known to us to beneficially own 5% or more of the outstanding Common Stock, (ii) each of our named executive officers

and current executive officers, (iii) each of our directors and (iv) all of our current executive officers and directors as

a group.

We have determined beneficial ownership

in accordance with the rules of the SEC, and thus it represents sole or shared voting or investment power with respect to our securities.

Unless otherwise indicated below, to our knowledge, the persons and entities named in the table have sole voting and sole investment power

with respect to all shares that they beneficially owned, subject to community property laws where applicable. The information does not

necessarily indicate beneficial ownership for any other purpose, including for purposes of Sections 13(d) and 13(g) of the Securities

Exchange Act of 1934, as amended (the “Exchange Act”).

We have based our calculation of the percentage

of beneficial ownership on 51,221,123 shares of our Common Stock outstanding on the Record Date. We have deemed shares of Common Stock

subject to stock options or warrants that are currently exercisable or exercisable within 60 days of the Record Date to be outstanding

and to be beneficially owned by the person holding the stock option or warrant, as applicable, for the purpose of computing the percentage

ownership of that person. We did not deem these shares outstanding, however, for the purpose of computing the percentage ownership of

any other person. Unless otherwise indicated below, the address of each beneficial owner listed in the table below is c/o 50 Health Sciences

Drive, Stony Brook, New York 11790. The information in the table below is based solely on a review of Schedules 13D and 13G and information

provided by certain investors as well as the Company’s knowledge of holdings with respect to its employees and directors.

| | |

Title of Class | |

Number of Shares

Owned(1) | | |

Percentage

of Class(2) | |

| Executive Officers and Directors: | |

| |

| | | |

| | |

| James A. Hayward | |

Common Stock | |

| 25,212 | (3) | |

| * | |

| Yacov A. Shamash | |

Common Stock | |

| 8,994 | (4) | |

| * | |

| Joseph D. Ceccoli | |

Common Stock | |

| 8,554 | (5) | |

| * | |

| Sanford R. Simon | |

Common Stock | |

| 8,356 | (6) | |

| * | |

| Robert B. Catell | |

Common Stock | |

| 8,436 | (7) | |

| * | |

| Elizabeth Schmalz Shaheen | |

Common Stock | |

| 8,373 | (8) | |

| * | |

| Beth M. Jantzen | |

Common Stock | |

| 6,911 | (9)(12) | |

| * | |

| Judith Murrah | |

Common Stock | |

| 7,721 | (10)(12) | |

| * | |

| Clay Shorrock | |

Common Stock | |

| 6,305 | (11)(12) | |

| * | |

| All directors and officers as a group (9 persons) | |

Common Stock | |

| 88,862 | (13) | |

| * | |

| 5% Stockholder: | |

| |

| | | |

| | |

| Altium Growth Fund, LP | |

Common Stock | |

| 21,048,579 | (14)(15) | |

| 31.23 | % |

| Anson Master Funds | |

Common Stock | |

| 19,955,769 | (16)(17) | |

| 29.45 | % |

| Michael Bigger | |

Common Stock | |

| 19,723,289 | (18)(19) | |

| 29.35 | % |

| L1 Capital Global Opportunities Master Fund | |

Common Stock | |

| 18,555,128 | (20)(21) | |

| 27.84 | % |

| Sabby Volatility Warrant Master Fund, Ltd. | |

Common Stock | |

| 19,471,005 | (22)(23) | |

| 29.31 | % |

| S.H.N. Financial Investments Ltd | |

Common Stock | |

| 18,955,127 | (24)(25) | |

| 28.55 | % |

| * | indicates less than one percent |

|

(1) | Beneficial ownership is determined in accordance with the rules of

the SEC and generally includes voting or investment power with respect to the shares shown. Except as indicated by footnote and subject

to community property laws where applicable, to our knowledge, the stockholders named in the table have sole voting and investment power

with respect to all shares of Common Stock shown as beneficially owned by them. A person is deemed to be the beneficial owner of securities

that can be acquired by such person within 60 days upon the exercise of options, warrants or convertible securities (in any case, the

“Currently Exercisable Options”). |

| (2) | Based upon 51,221,123

shares of Common Stock outstanding as of the Record Date. Each beneficial owner’s percentage ownership is determined by assuming

that the Currently Exercisable Options that are beneficially held by such person (but not those held by any other person) have been

exercised and converted. |

| (3) | Includes 18,503 shares underlying currently exercisable options. |

| (4) | Includes 8,915 shares underlying currently exercisable options. |

| (5) | Includes 8,526 shares underlying currently exercisable options. |

| (6) | Includes 8,352 shares underlying currently exercisable options. |

| (7) | Includes 8,339 shares underlying currently exercisable options. |

| (8) | Includes 8,334 shares underlying currently exercisable options. |

| (9) | Includes 4,861 shares underlying currently exercisable options. |

| (10) | Includes 5,384 shares underlying currently exercisable options. |

| (11) | Includes 3,507 shares underlying currently exercisable options. |

| (12) | Excludes 3,752, 3,752 and 4,064 shares underlying options for Ms. Jantzen, Mr. Shorrock and Ms. Murrah, respectively that were granted on March 23,

2023 and vest 25% per year commencing on the first anniversary of grant date. |

| (13) | Includes 74,721 shares underlying currently exercisable options. |

| (14) | The securities are directly held as of November 6, 2024, by Altium Growth Fund, LP (“Altium”),

and may be deemed to be beneficially owned by Jacob Gottlieb, who exercises investment and voting control over the securities. The address

of Altium is c/o Altium Capital Management, LP, 152 West 57th Street, 20th Floor, New York, NY 10019. |

| (15) | Consists of (i) 4,877,375 shares of Common Stock, (ii) warrants to purchase up to 15,846,791 shares

of Common Stock and (iii) Pre-Funded Warrants to purchase up to 324,413 shares of Common Stock. Certain of the warrants held by Altium

are subject to a beneficial ownership limitation of 4.99% or 9.99%, as applicable, which such limitation restricts Altium from exercising

that portion of the warrants that would result in Altium and its affiliates owning, after exercise, a number of shares of common stock

in excess of the beneficial ownership limitation. The beneficial ownership of Altium reported in this table does not reflect this limitation.

Excludes (i) Series C Warrants to purchase up to 3,750,000 shares of Common Stock and (ii) Series D Warrants to purchase

up to 3,750,000 shares of Common Stock, whose exercise are subject to Warrant Stockholder Approval. |

| (16) | The securities are directly held as of November 6, 2024, by (i) Anson East Master Fund LP (“Anson

East”) and (ii) Anson Investments Master Fund LP (“Anson Investments”, and, collectively with Anson East, the “Anson

Master Funds”). Anson Advisors Inc and Anson Funds Management LP, the Co-Investment Advisers of the Anson Master Funds, hold voting

and dispositive power over the shares of Common Stock held by the Anson Master Funds. Tony Moore is the managing member of Anson Management

GP LLC, which is the general partner of Anson Funds Management LP. Moez Kassam and Amin Nathoo are directors of Anson Advisors Inc. Mr. Moore,

Mr. Kassam and Mr. Nathoo each disclaim beneficial ownership of these shares of Common Stock except to the extent of their pecuniary

interest therein. The principal business address of the Anson Master Funds is Maples Corporate Services Limited, PO Box 309, Ugland House,

Grand Cayman, KY1-1104, Cayman Islands. |

| (17) | Consists of (i) 3,425,587 shares of Common Stock, (ii) warrants to purchase up to 16,205,769 shares

of Common Stock and (iii) Pre-Funded Warrants to purchase up to 324,413 shares of Common Stock. Certain of the warrants held by the

Anson Master Funds are subject to a beneficial ownership limitation of 4.99% or 9.99%, as applicable, which such limitation restrict the

Anson Master Funds from exercising that portion of the warrants that would result in the Anson Master Funds and their affiliates owning,

after exercise, a number of shares of common stock in excess of the beneficial ownership limitation. The beneficial ownership of the Anson

Master Funds reported in this table do not reflect this limitation. Excludes (i) Series C Warrants to purchase up to 3,750,000

shares of Common Stock and (ii) Series D Warrants to purchase up to 3,750,000 shares of Common Stock, whose exercise are subject

to Warrant Stockholder Approval. |

| (18) | The securities are directly held as of November 6, 2024, by (i) Bigger Capital Fund, LP (“Bigger”)

and (ii) District 2 Capital Fund LP (“District 2”), and may be deemed to be beneficially owned by Michael Bigger, who

exercises investment and voting control over the securities. The address of Bigger is 11700 W. Charleston Blvd. 170-659, Las Vegas, NV

89135, and the address of District 2 is 14 Wall Street, Huntington, NY 11743. |

| (19) | Consists of (i) 3,750,000 shares of Common Stock and (ii) warrants to purchase up to 15,973,289

shares of Common Stock. Certain of the warrants held by Bigger and District 2 are subject to a beneficial ownership limitation of 4.99%

or 9.99%, as applicable, which such limitation restrict Bigger and District 2 from exercising that portion of the warrants that would

result in Bigger and District 2 and their affiliates owning, after exercise, a number of shares of common stock in excess of the beneficial

ownership limitation. The beneficial ownership of Bigger and District 2 reported in this table do not reflect this limitation. Excludes

(i) Series C Warrants to purchase up to 3,750,000 shares of Common Stock and (ii) Series D Warrants to purchase up

to 3,750,000 shares of Common Stock, whose exercise are subject to Warrant Stockholder Approval. |

| (20) | The securities are directly held as of November 6, 2024, by L1 Capital Global Opportunities Master

Fund (“L1”), and may be deemed to be beneficially owned by David Feldman and Joel Arber. The address of L1 is 161A Shedden

Road, 1 Artillery Court, PO Box 10085, Grand Cayman KY1-1001, Cayman Islands. |

| (21) | Consists of (i) 3,125,000 shares of Common Stock and (ii) warrants to purchase up to 15,430,128

shares of Common Stock. Certain of the warrants held by L1 are subject to a beneficial ownership limitation of 4.99% or 9.99%, as applicable,

which such limitation restrict L1 from exercising that portion of the warrants that would result in L1 and its affiliates owning, after

exercise, a number of shares of common stock in excess of the beneficial ownership limitation. The beneficial ownership of L1 reported

in this table does not reflect this limitation. Excludes (i) Series C Warrants to purchase up to 3,125,000 shares of Common

Stock and (ii) Series D Warrants to purchase up to 3,125,000 shares of Common Stock, whose exercise are subject to Warrant Stockholder

Approval. |

| (22) | The securities are directly held as of November 7, 2024, by Sabby Volatility Warrant Master Fund, Ltd.

(“Sabby”). Sabby Management, LLC is the investment manager of Sabby and shares voting and investment power with respect to

these shares in this capacity. As manager of Sabby Management, LLC, Hal Mintz also shares voting and investment power on behalf of Sabby.

Each of Sabby Management, LLC and Hal Mintz disclaims beneficial ownership over the securities listed except to the extent of their pecuniary

interest therein. The address of Sabby is Captiva (Cayman) Ltd., Governors Square, Bld. 4, 2nd Floor, 23 Lime Tree Bay Avenue,

P.O. Box 32315, Grand Cayman KY1-1209, Cayman Islands. |

| (23) | Consists of (i) 4,259,627 shares of Common Stock and (ii) warrants to purchase up to 15,211,378

shares of Common Stock. Certain of the warrants held by Sabby are subject to a beneficial ownership limitation of 4.99% or 9.99%, as applicable,

which such limitation restrict Sabby from exercising that portion of the warrants that would result in Sabby and its affiliates owning,

after exercise, a number of shares of common stock in excess of the beneficial ownership limitation. The beneficial ownership of Sabby

reported in this table does not reflect this limitation. Excludes (i) Series C Warrants to purchase up to 3,750,000 shares of

Common Stock and (ii) Series D Warrants to purchase up to 3,750,000 shares of Common Stock, whose exercise are subject to Warrant

Stockholder Approval. |

| (24) | The securities are directly held as of November 6, 2024, by S.H.N. Financial Investments Ltd. (“SHN”),

and may be deemed to be beneficially owned by Nir Shamir and Hadar Shamir. The address of SHN is Arik Einstein 3, Herzliya, Israel. |

| (25) | Consists of (i) 3,775,000 shares of Common Stock and (ii) warrants to purchase up to 15,180,127

shares of Common Stock. Certain of the warrants held by SHN are subject to a beneficial ownership limitation of 4.99% or 9.99%, as applicable,

which such limitation restricts SHN from exercising that portion of the warrants that would result in SHN and its affiliates owning, after

exercise, a number of shares of common stock in excess of the beneficial ownership limitation. The beneficial ownership of SHN reported

in this table does not reflect this limitation. Excludes (i) Series C Warrants to purchase up to 2,187,500 shares of Common

Stock and (ii) Series D Warrants to purchase up to 2,187,500 shares of Common Stock, whose exercise are subject to Warrant Stockholder

Approval. |

HOUSEHOLDING OF PROXY MATERIALS

The SEC has adopted rules that permit

companies and intermediaries such as brokers to satisfy delivery requirements for proxy materials with respect to two or more stockholders

sharing the same address by delivering a single proxy statement addressed to those stockholders. This process, which is commonly referred

to as “householding,” potentially provides extra convenience for stockholders and cost savings for companies. The Company,

as well as some brokers (or other nominees), household the Company’s proxy materials, which means that we or they deliver a single

proxy statement or notice, as applicable, to multiple stockholders sharing an address unless contrary instructions have been received

from the affected stockholders. Once you have received notice from your broker (or other nominee) or from us that they or we will be householding

materials to your address, householding will continue until you are notified otherwise or until you revoke your consent. If, at any time,

you no longer wish to participate in householding and would prefer to receive a separate proxy statement in the future, or if you are

receiving multiple copies of the proxy statement and wish for only one copy to be delivered to your household in the future, please notify

(i) your broker (or other nominee) if your shares are held in a brokerage or similar account or (ii) the Company if you hold

registered shares in your own name. We will promptly deliver a separate proxy statement to record stockholders upon written or oral request.

You can notify us of your instructions by telephone at 631-240-8800 or by sending a written request to:

Corporate Secretary

Applied DNA Sciences, Inc.

50 Health Sciences Drive

Stony Brook, New York 11790

OTHER BUSINESS

We do not know of any matters that are

to be presented for action at the Special Meeting other than those set forth above. If any other matters properly come before the Special

Meeting, the person named in the enclosed proxy card will vote the shares represented by proxies as recommended by the Board of Directors.

If the Board of Directors does not make a recommendation, then they will vote in accordance with their best judgment.

STOCKHOLDER PROPOSALS AND NOMINATIONS

In order for a stockholder proposal to

be considered for inclusion in the proxy statement for the 2025 annual meeting of stockholders, the written proposal must be received

by the Corporate Secretary at the address below no earlier than June 2, 2025 and no later than July 2, 2025. In

the event that the annual meeting of stockholders is called for a date that is not within 30 days before or after the first anniversary

of the date of this year’s annual meeting, the proposal must be received no later than a reasonable time before the Company begins

to print and mail its proxy materials. The proposal will also need to comply with the SEC’s regulations under Rule 14a-8 under

the Exchange Act regarding the inclusion of stockholder proposals in company sponsored proxy materials. Proposals should be addressed

to:

Corporate Secretary

Applied DNA Sciences, Inc.

50 Health Sciences Drive

Stony Brook, New York 11790

For a stockholder proposal that is not

intended to be included in the proxy statement for the 2025 annual meeting of stockholders, or if you want to nominate a person for election

as a director, you must provide written notice to the Corporate Secretary at the address above. The Secretary must receive this notice

not earlier than June 2, 2025 and no later than July 2, 2025. However, if our 2024 annual meeting of stockholders

is held more than 30 days before or more than 60 days after September 30, 2025, then the Secretary must receive this notice

not earlier than the close of business on the 120th day prior to the date of our 2025 annual meeting and not later than the close of business

on the later of the 90th day prior to such annual meeting or the 10th day following the day on which we make a public announcement of

the date of the meeting. The notice of a proposed item of business must provide information as required in our bylaws which, in general,

require that the notice include for each matter a brief description of the matter to be brought before the meeting; the reason for bringing

the matter before the meeting; the text of the proposal or matter; your name, address, and number of shares you own beneficially or of

record; and any material interest you have in the proposal.

Effective September 1, 2022, Rule 14a-19

under the Exchange Act requires the use of a universal proxy card in contested director elections. Under this “universal proxy rule,”

a stockholder intending to engage in a director election contest with respect to an annual meeting of stockholders must give the Company

notice of its intent to solicit proxies by providing the name(s) of the stockholder’s nominee(s) and certain other information

at least 60 calendar days prior to the anniversary of the previous year’s annual meeting date, or August 1, 2025 (except

that, if the Company did not hold an annual meeting during the previous year, or if the date of the meeting has changed by more than 30

calendar days from the previous year, then notice must be provided by the later of 60 calendar days prior to the date of the annual meeting

or the 10th calendar day following the day on which public announcement of the date of the annual meeting is first made by the Company).

The notice of a proposed director nomination

must provide information and documentation as required in our bylaws which, in general, require that the notice of a director nomination

include the information about the nominee that would be required to be disclosed in the solicitation of proxies for the election of a

director under federal securities laws; the nominee’s written consent to be named in the proxy statement as a nominee and to serve

as a director if elected; a description of any transaction or arrangement during the last three years between the stockholder making the

nomination and the nominee in which the nominee had a direct or indirect material interest; and a completed and signed questionnaire,

together with a written representation and agreement that such nominee is not and will not become a party to certain voting commitments.

A copy of the bylaw requirements will be provided upon request to the Corporate Secretary at the address above.

ANNUAL REPORT ON FORM 10-K AND OTHER INFORMATION

A

copy of our Annual Report on Form 10-K for the fiscal year ended September 30, 2023, including financial statements and any

financial statement schedules required to be filed in accordance with SEC rules, will be sent without charge to any stockholder of the

Company requesting it in writing from: Applied DNA Sciences, Inc., 50 Health Sciences Drive, Stony Brook, New York 11790, Attention:

Beth Jantzen. We also make available, free of charge on our website, all of our filings that are publicly filed on the SEC’s EDGAR

website, including Forms 10-K, 10-Q and 8-K, at www.adnas.com.

| |

By Order of the Board of Directors |

| |

|

| |

/s/ James A. Hayward |

| |

James A. Hayward |

| |

Chairman, President and Chief

Executive Officer |

Stony Brook, New York

December 10, 2024

| Signature [PLEASE SIGN WITHIN BOX] Date Signature (Joint Owners) Date

TO VOTE, MARK BLOCKS BELOW IN BLUE OR BLACK INK AS FOLLOWS:

KEEP THIS PORTION FOR YOUR RECORDS

DETACH AND RETURN THIS PORTION ONLY THIS PROXY CARD IS VALID ONLY WHEN SIGNED AND DATED.

V59782-S01990

For Against Abstain

! ! !

APPLIED DNA SCIENCES, INC.

The Board of Directors recommends you vote FOR the following proposal:

1. Approval, in accordance with Nasdaq Listing Rule 5635(d), of the exercisability of certain common stock purchase warrants, and the

issuance of the common stock underlying such warrants, which warrants were issued in connection with an offering of securities of

the Company that occurred on October 30, 2024.

Please sign exactly as your name(s) appear(s) hereon. When signing as attorney, executor, administrator, or other fiduciary, please give full

title as such. Joint owners should each sign personally. All holders must sign. If a corporation or partnership, please sign in full corporate

or partnership name by authorized officer.

SCAN TO APPLIED DNA SCIENCES, INC.

ATTN: BETH JANTZEN

VIEW MATERIALS & VOTEw 50 HEALTH SCIENCES DRIVE

STONY BROOK, NY 11790 VOTE BY INTERNET

Before The Meeting - Go to www.proxyvote.com or scan the QR Barcode above

Use the Internet to transmit your voting instructions and for electronic delivery of information

up until 11:59 P.M. Eastern Time on January 22, 2025, the day before the meeting date. Have

your proxy card in hand when you access the web site and follow the instructions to obtain

your records and to create an electronic voting instruction form.

During The Meeting - Go to www.virtualshareholdermeeting.com/APDN2025SM

You may attend the meeting via the Internet and vote during the meeting. Have the information

that is printed in the box marked by the arrow available and follow the instructions.

VOTE BY PHONE - 1-800-690-6903

Use any touch-tone telephone to transmit your voting instructions up until

11:59 P.M. Eastern Time on January 22, 2025, the day before the meeting date. Have your

proxy card in hand when you call and then follow the instructions.

VOTE BY MAIL

Mark, sign and date your proxy card and return it in the postage-paid envelope we

have provided or return it to Vote Processing, c/o Broadridge, 51 Mercedes Way,

Edgewood, NY 11717. |

| V59783-S01990

Important Notice Regarding the Availability of Proxy Materials for the Special Meeting:

The Notice and Proxy Statement is available at www.proxyvote.com.

APPLIED DNA SCIENCES, INC.

Special Meeting of Stockholders

January 23, 2025 11:00 AM

This proxy is solicited by the Board of Directors

The stockholder executing and delivering this Proxy hereby appoints Ms. Judith Murrah and Ms. Beth Jantzen and each of them

as proxies (the "proxies"), with full power of substitution, and hereby authorizes them to represent and vote, as designated on

the reverse side, all shares of common stock, $0.001 par value per share, of Applied DNA Sciences, Inc. held of record by the

undersigned as of November 25, 2024, at the Special Meeting of Stockholders of Applied DNA Sciences, Inc., to be held virtually at

www.virtualshareholdermeeting.com/APDN2025SM on Thursday, January 23, 2025 at 11:00 AM Local Time, or at any

postponements or adjournments of the meeting.

This Proxy, when properly executed, will be voted in the manner directed herein by the undersigned stockholder. If no direction

is made, this Proxy will be voted in accordance with the recommendations of our Board of Directors and for such other matters

as may properly come before the meeting as said proxies deem advisable.

THIS PROXY SHOULD BE MARKED, DATED AND SIGNED BY THE STOCKHOLDER(S) EXACTLY AS SUCH STOCKHOLDER'S NAME

APPEARS HEREON AND RETURNED PROMPTLY IN THE ENCLOSED ENVELOPE. PERSONS SIGNING IN A FIDUCIARY CAPACITY

SHOULD SO INDICATE. IF SHARES ARE HELD BY JOINT TENANTS OR AS COMMUNITY PROPERTY, BOTH SHOULD SIGN.

Continued and to be signed on reverse side |

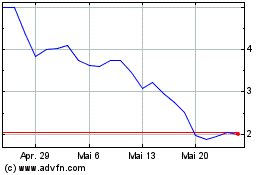

Applied DNA Sciences (NASDAQ:APDN)

Historical Stock Chart

Von Nov 2024 bis Dez 2024

Applied DNA Sciences (NASDAQ:APDN)

Historical Stock Chart

Von Dez 2023 bis Dez 2024