AppTech Payments Announces Commercial Launch of its Banking-as-a-Service (BaaS) Platform Following Successful Pilot Program

16 Mai 2024 - 1:30PM

AppTech Payments Corp. (Nasdaq: APCX), a pioneering Fintech company

powering frictionless commerce, announces today the successful

completion of the pilot program for its Banking-as-a-Service (BaaS)

platform. The Company will use this BaaS solution to commercially

launch InstaCash, which utilizes the BaaS for virtual accounts,

debit and credit cards, and high interest-yielding financial

products.

AppTech CEO Luke D’Angelo stated, “The success

of our BaaS pilot program signifies a significant milestone as we

continue our mission to democratize banking by providing small and

medium-sized enterprises access to products traditionally reserved

for Fortune 1000 companies. The availability of treasury products,

including T-bills and other high yielding financial products are

differentiators that we believe will help drive user growth as over

200 new Independent Sales Organizations are expected to utilize our

BaaS platform in the near-term. We look forward to continuing to

scale the use of our frictionless commerce products as we remain

committed to building long-term shareholder value.”

During the BaaS pilot program, clients were

issued a virtual account, a commercial purchase debit card, and

connected external accounts for funding of the new bank account.

Traditional features such as check issuance, wire and ACH set up

for bill pay were enhanced to include SMS invoicing for

Business-to-Business transactions. Pilot partners were encouraged

to invite other merchants who are in the supply chain to open bank

accounts to reduce friction in payments and create a Real Time

Payment network. In this account-to-account environment, each pilot

client received a unique handle to be put in invoices enabling

money transfers to be instant rather than involving multiple

financial institutions ultimately saving time and fees.

Positioned as a competitor to both Venmo and

Western Union, InstaCash aims to reshape the specialty

payments landscape by providing a seamless, account-to-account

transaction system that operates in real time, akin to FedNow.

Each bank and credit union maintains its own closed- loop

network, ensuring that customer relationships remain firmly between

the financial institution and the consumer. InstaCash acts as

the glue binding these networks together, enabling consumers

to transact instantly and securely over a unified ledger. With its

flexible, adaptable technology, it functions much like an

Intel chip, integrating seamlessly with any bank’s

existing infrastructure and providing powerful processing

capabilities that work both on-site and in the cloud.

InstaCash offers a Zelle-like experience for

every bank and credit union, not just the big players like Wells

Fargo, Chase, and Bank of America. By empowering financial

institutions of all sizes with the ability to offer instant

transactions to their customers, AppTech effectively levels the

playing field and makes cutting-edge Fintech accessible to smaller

banks and credit unions. This reinforces their mission to

democratize banking and payments, ensuring that all financial

institutions can provide the same advanced payment features their

customers expect in today’s digital economy. InstaCash is poised to

become a core feature in every bank’s technology stack, helping

them retain customer deposits while providing the seamless payment

solutions necessary to thrive in the rapidly evolving world of

Fintech. Building on its current framework, InstaCash plans to

extend its impact beyond merely facilitating transactions by

committing to enhancing financial literacy among the underbanked

and undereducated demographics. This initiative, set to roll out

across the United States before expanding to South America and

Canada, positions InstaCash not just as a financial tool but as a

vehicle for social empowerment. By integrating online financial

literacy courses directly into the InstaCash platform, AppTech aims

to equip its users with the knowledge and skills needed to navigate

the complexities of personal finance effectively.

About AppTech Payments

Corp.AppTech Payments Corp. (NASDAQ: APCX) provides

digital financial services for financial institutions,

corporations, small and midsized enterprises (“SMEs”), and

consumers through the Company’s scalable cloud-based platform

architecture and infrastructure, coupled with our Specialty

Payments development and delivery model. AppTech maintains

exclusive licensing and partnership agreements in addition to a

full suite of patented technology capabilities. For more

information, please visit apptechcorp.com.

Forward-Looking StatementsThis

press release contains forward-looking statements that are

inherently subject to risks and uncertainties. Any statements

contained in this document that are not historical facts are

forward-looking statements as defined in the U.S. Private

Securities Litigation Reform Act of 1995. Words such as

“anticipate, believe, estimate, expect, forecast, intend, may,

plan, project, predict, should, will” and similar expressions as

they relate to AppTech are intended to identify such

forward-looking statements. These risks and uncertainties include

but are not limited to, general economic and business conditions,

effects of continued geopolitical unrest and regional conflicts,

competition, changes in methods of marketing, delays in

manufacturing or distribution, changes in customer order patterns,

changes in customer offering mix, and various other factors beyond

the Company’s control. Actual events or results may differ

materially from those described in this press release due to any of

these factors. AppTech is under no obligation to update or alter

its forward-looking statements, whether as a result of new

information, future events, or otherwise.

Investor Relations ContactCORE

IRScott Arnoldscotta@coreir.com

AppTech Payments

Corp.760-707-5959info@apptechcorp.com

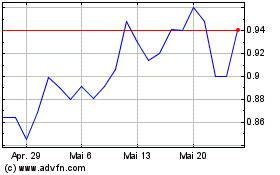

AppTech Payments (NASDAQ:APCX)

Historical Stock Chart

Von Dez 2024 bis Jan 2025

AppTech Payments (NASDAQ:APCX)

Historical Stock Chart

Von Jan 2024 bis Jan 2025