APA Corporation (“APA”) (Nasdaq: APA) announced today the pricing

terms for the previously announced cash tender offers (the “Tender

Offers”) to purchase up to $1,000,000,000 aggregate principal

amount (the “Maximum Purchase Amount”) of validly tendered and

accepted notes issued by Apache Corporation, its wholly-owned

subsidiary (“Apache”), listed in the table below (collectively, the

“Apache Tender Notes”).

The applicable total consideration to be paid in

the Tender Offers for each series of Apache Tender Notes accepted

for purchase was determined by reference to a fixed spread

specified for such series of Apache Tender Notes over the yield

(the “Reference Yield”) based on the bid-side price of the

applicable U.S. Treasury Security, in each case as set forth in the

table below (the “Tender Total Consideration”). The Reference

Yields listed in the table below were determined pursuant to the

Offering Memorandum (as defined below) at 10:00 a.m., New York City

time, today, December 23, 2024, by the Lead Dealer Managers (as

defined below). The applicable Tender Total Consideration for each

series of Apache Tender Notes validly tendered as of the Extended

Early Consent Date (as defined below) includes an early

participation premium of $30 per $1,000 principal amount of Apache

Tender Notes (the “Early Participation Premium”) accepted for

purchase by APA.

In addition, all payments for tendered Apache

Tender Notes that are purchased by APA will also include accrued

and unpaid interest on the principal amount of Apache Tender Notes

tendered and accepted for purchase from the last interest payment

date applicable to the relevant series of Apache Tender Notes up

to, but not including, the settlement date, which is currently

expected to be January 10, 2025 (the “Settlement Date”).

The following table sets forth the aggregate

principal amounts of each series of Apache Tender Notes that were

tendered as of 5:00 p.m., New York City time, on December 20, 2024

(the “Extended Early Consent Date”) and the related pricing

information:

|

CUSIP No. |

Series ofnotes issuedby

Apache |

Aggregateprincipalamountoutstanding |

Reference U.S.Treasury Security |

ReferenceYield |

Fixed Spread(basis points)(1) |

Tender TotalConsideration (2) |

|

037411 AW5 |

5.100% Notes due2040 (the “2040 Notes”) |

$1,332,639,000 |

4.625% U.S. Treasury due November 15, 2044 |

4.834% |

155 |

$874.05 |

|

|

|

|

|

|

|

|

|

037411 AY1 |

5.250% Notes due2042 (the “2042 Notes”) |

$399,131,000 |

4.625% U.S. Treasury due November 15, 2044 |

4.834% |

155 |

$883.13 |

|

|

|

|

|

|

|

|

|

037411 BA2 |

4.750% Notes due2043 (the “2043 Notes”) |

$427,662,000 |

4.625% U.S. Treasury due November 15, 2044 |

4.834% |

160 |

$820.50 |

|

|

|

|

|

|

|

|

|

037411 BC8 |

4.250% Notes due2044 (the “2044 Notes”) |

$210,863,000 |

4.625% U.S. Treasury due November 15, 2044 |

4.834% |

175 |

$748.93 |

___________________(1) Includes the

Early Participation Premium of $30 per $1,000 principal amount of

Apache Tender Notes for each series.(2) Payable for each

$1,000 principal amount of applicable Apache Tender Notes validly

tendered at or prior to the Extended Early Consent Date and

accepted for purchase by APA and includes the Early Participation

Premium. In addition, holders whose Apache Tender Notes are

accepted will also receive interest on such notes accrued to the

Settlement Date.

As previously announced, APA has increased the

Series Cap for the 2043 Notes to $196,043,000 and the Series Cap

for the 2044 Notes to $110,002,000. The maximum amount of 2040

Notes that will be purchased in the Tender Offers is $700,000,000

aggregate principal amount. The maximum amount of 2042 Notes that

will be purchased in the Tender Offers is $125,000,000 aggregate

principal amount. The maximum amount of Apache’s 6.000% Notes due

2037 (the “2037 Notes”) that will be purchased in the Tender Offers

is equal to the Maximum Purchase Amount less the aggregate

principal amount of the 2040 Notes, the 2042 Notes, the 2043 Notes,

and the 2044 Notes accepted for purchase in the Tender Offers,

provided that the Series Cap for the 2037 Notes will not exceed

$50,000,000. We refer to these maximum amounts each as a “Series

Cap.” APA reserves the right, but is under no obligation, to

increase, decrease or eliminate the Series Cap and/or the Maximum

Purchase Amount at any time, subject to applicable law. Because the

aggregate principal amount of the 2040 Notes, the 2042 Notes, the

2043 Notes, and the 2044 Notes tendered as of the Extended Early

Consent Date exceeded the Maximum Purchase Amount, the Series Cap

for the 2037 Notes is equal to $0 and APA does not expect to accept

for purchase any 2037 Notes in the Tender Offers.

The withdrawal rights for the Tender Offers

expired at 5:00 p.m., New York City time, on December 16, 2024 and

have not been extended; therefore, previously tendered Apache

Tender Notes may no longer be withdrawn. The Tender Offers will

expire at 5:00 p.m., New York City time, on January 7, 2025 (the

“Expiration Time”).

Apache Tender Notes that have been validly

tendered and not validly withdrawn at or before the Expiration Time

and are accepted in the Tender Offers will be purchased, retired

and cancelled by APA on the Settlement Date.

As previously announced, concurrently with the

Tender Offers, APA is offering to exchange (each, an “Exchange

Offer” and collectively, the “Exchange Offers”) any and all validly

tendered and accepted notes and debentures of certain series issued

by Apache, including the Apache Tender Notes (collectively, the

“Apache Notes”), for new notes and debentures to be issued by APA

(the “APA Notes”). Any validly tendered Apache Tender Notes not

accepted for purchase in the Tender Offers because the applicable

Series Cap or the Maximum Purchase Amount is exceeded will be

exchanged for APA Notes in the Exchange Offers, and holders of such

Apache Tender Notes will receive the Exchange Total Consideration

or the Exchange Consideration, as applicable, each as defined in

the Offering Memorandum. APA does not expect to accept for purchase

any 2037 Notes tendered in the Tender Offers and, as a result, any

2037 Notes validity tendered in the Tender Offers will be accepted

in the Exchange Offers and exchanged for APA Notes, and holders of

such Apache Tender Notes will receive the Exchange Total

Consideration or the Exchange Consideration, as applicable.

Also as previously announced, in connection with

the Tender Offers and the Exchange Offers (collectively, the

“Offers”) and upon the terms and conditions set forth in the

Offering Memorandum, Apache is soliciting consents from holders of

the Apache Notes to certain proposed amendments (the “Proposed

Amendments”) to the indentures under which the Apache Notes were

issued (the “Consent Solicitations”). Holders of Apache Notes that

tender such notes in a Tender Offer or an Exchange Offer will be

deemed to have consented to the Proposed Amendments to the

applicable indenture with respect to that specific series.

BofA Securities, Inc., HSBC Securities (USA)

Inc., Mizuho Securities USA LLC and RBC Capital Markets, LLC are

acting as Lead Dealer Managers, Barclays Capital Inc., Citigroup

Global Markets Inc., Goldman Sachs & Co. LLC, J.P. Morgan

Securities LLC, Morgan Stanley & Co. LLC, MUFG Securities

Americas Inc., PNC Capital Markets LLC, Scotia Capital (USA) Inc.,

TD Securities (USA) LLC, Truist Securities, Inc., Wells Fargo

Securities, LLC, Capital One Securities, Inc., Regions Securities

LLC, and Zions Direct, Inc. are acting as Dealer Managers and D.F.

King & Co., Inc. is acting as the Tender Agent and Information

Agent for the Offers and the Consent Solicitations. Requests for

documents may be directed to D.F. King & Co., Inc., for banks

and brokers, collect at (212) 269-5550, for all others, toll-free

at (866) 416-0576, at apache@dfking.com or may be downloaded at

www.dfking.com/apache. Questions regarding the Offers and the

Consent Solicitations may be directed to BofA Securities, Inc.

collect at (980) 387-3907 or toll-free at (888) 292-0070, HSBC

Securities (USA) Inc. collect at (212) 525-5552 or toll-free at

(888) 292-0070, Mizuho Securities USA LLC collect at (212) 205-7741

or toll-free at (866) 271-7403 or RBC Capital Markets, LLC collect

at (212) 618-7843 or toll-free at (877) 381-2099.

The Offers and the Consent Solicitations are

being made upon the terms and subject to the conditions set forth

in APA’s Offering Memorandum and Consent Solicitation Statement,

dated as of December 3, 2024 (the “Offering Memorandum”) as

modified by the press releases issued by APA on December 17, 2024

and December 23, 2024. APA may withdraw, amend, or, if a condition

to an Offer is not satisfied or, where permitted, waived, terminate

the Offers and the Consent Solicitations, subject to applicable

law.

The consummation of the Offers and the Consent

Solicitations is subject to, and conditional upon, the satisfaction

or, where permitted, waiver of the conditions discussed in the

Offering Memorandum, including, among other things, with respect to

the Tender Offers, the Financing Condition (as defined in the

Offering Memorandum) and the operation of the Series Caps and the

Maximum Purchase Amount.

This press release shall not constitute an offer

to sell, or a solicitation of an offer to buy, any of the

securities described herein, including in connection with the

Financing Condition, and is also not a solicitation of the related

consents. The Offers and the Consent Solicitations are not being

made in any state or jurisdiction in which such Offers and Consent

Solicitations would be unlawful prior to registration or

qualification under the securities laws of any such state or

jurisdiction. None of APA, Apache, the Dealer Managers, or the

Tender Agent and Information Agent is making any recommendation as

to whether holders of any series of Apache Notes should exchange

their Apache Notes in the Exchange Offers, tender their Apache

Tender Notes in the Tender Offers or deliver consents to the

Proposed Amendments and the applicable series of Apache Notes in

the Consent Solicitations. Holders are urged to evaluate carefully

all information in the Offering Memorandum, including the documents

incorporated by reference therein, consult their investment,

accounting, legal and tax advisors and make their own decisions as

to whether to participate in the Offers and the Consent

Solicitations. The Offers and the Consent Solicitations may be made

only pursuant to the terms of the Offering Memorandum and the other

related materials.

About APA and Apache

APA Corporation owns consolidated subsidiaries

that explore for and produce oil and natural gas in the United

States, Egypt and the United Kingdom and that explore for oil and

natural gas offshore Suriname and elsewhere.

Forward-Looking Statements

This release contains forward-looking statements

within the meaning of Section 27A of the Securities Act of 1933 and

Section 21E of the Securities Exchange Act of 1934. Forward-looking

statements can be identified by words such as “anticipates,”

“intends,” “plans,” “seeks,” “believes,” “continues,” “could,”

“estimates,” “expects,” “goals,” “guidance,” “may,” “might,”

“outlook,” “possibly,” “potential,” “projects,” “prospects,”

“should,” “will,” “would,” and similar references to future

periods, but the absence of these words does not mean that a

statement is not forward-looking. These statements include, but are

not limited to, statements about future plans, expectations, and

objectives for operations, including statements about our capital

plans, drilling plans, production expectations, asset sales, and

monetizations. While forward-looking statements are based on

assumptions and analyses made by us that we believe to be

reasonable under the circumstances, whether actual results and

developments will meet our expectations and predictions depend on a

number of risks and uncertainties which could cause our actual

results, performance, and financial condition to differ materially

from our expectations. All of the forward-looking statements are

qualified in their entirety by reference to the factors discussed

under “Risk Factors” in the Offering Memorandum and under

“Forward-Looking Statements and Risk” and “Risk Factors” in APA’s

Annual Report on Form 10-K for the year ended December 31, 2023,

and in its Quarterly Reports on Form 10-Q for the quarterly periods

ended March 31, 2024, June 30, 2024, and September 30, 2024 (each

of which is incorporated by reference in the Offering Memorandum)

and similar sections in any subsequent filings, which describe

risks and factors that could cause results to differ materially

from those projected in those forward-looking statements. Any

forward-looking statement made in this news release speaks only as

of the date on which it is made. Factors or events that could cause

our actual results to differ may emerge from time to time, and it

is not possible for us to predict all of them. APA and its

subsidiaries undertake no obligation to publicly update any

forward-looking statement, whether as a result of new information,

future development or otherwise, except as may be required by

law.

|

Contacts |

|

|

|

|

|

|

|

|

|

|

|

Investor: |

|

(281) 302-2286 |

|

Gary Clark |

|

|

|

|

|

|

|

Media: |

|

(713) 296-7276 |

|

Alexandra Franceschi |

|

|

|

|

|

|

|

Website: www.apacorp.com |

|

|

|

|

|

|

APA-F

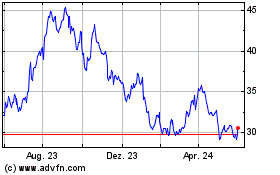

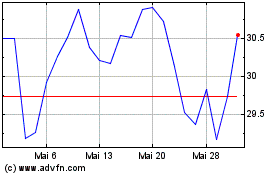

APA (NASDAQ:APA)

Historical Stock Chart

Von Dez 2024 bis Jan 2025

APA (NASDAQ:APA)

Historical Stock Chart

Von Jan 2024 bis Jan 2025