0001370053false00013700532024-08-052024-08-05

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT PURSUANT TO

SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

Date of Report: August 5, 2024

(Date of earliest event reported)

ANAPTYSBIO, INC.

(Exact Name of Registrant as Specified in Charter)

| | | | | | | | |

| Delaware | 001-37985 | 20-3828755 |

| (State or Other Jurisdiction of Incorporation) | (Commission File Number) | (IRS Employer Identification No.) |

10770 Wateridge Circle, Suite 210,

San Diego, CA 92121

(Address of Principal Executive Offices, and Zip Code)

(858) 362-6295

(Registrant’s Telephone Number, Including Area Code)

Not Applicable

(Former name or former address, if changed since last report.)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

☐Written communication pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐Pre-commencement communication pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐Pre-commencement communication pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

Common Stock, par value $0.001 per share | ANAB | The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR §240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02 Results of Operations and Financial Condition.

On August 5, 2024, AnaptysBio, Inc. (“AnaptysBio”) issued a press release announcing its financial results for the three and six months ended June 30, 2024. A copy of the press release is attached as Exhibit 99.1 to this Current Report on Form 8-K.

The information in this Item 2.02, including Exhibit 99.1 to this Current Report on Form 8-K, shall not be deemed to be “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended, or otherwise subject to the liabilities of that section or Sections 11 and 12(a)(2) of the Securities Act of 1933, as amended. The information contained in this Item 2.02 and in the accompanying Exhibit 99.1 shall not be incorporated by reference into any registration statement or other document filed by AnaptysBio with the Securities and Exchange Commission, whether made before or after the date of this Current Report on Form 8-K, regardless of any general incorporation language in such filing (or any reference to this Current Report on Form 8-K generally), except as shall be expressly set forth by specific reference in such filing.

Item 9.01. Financial Statements and Exhibits

(d) Exhibits

| | | | | |

| Exhibit Number | Exhibit Title or Description |

| Press release issued by AnaptysBio, Inc. regarding its financial results for the three and six months ended June 30, 2024, dated August 5, 2024. |

| 104 | Cover Page Interactive Data File (the cover page XBRL tags are embedded within the inline XBRL document). |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

| | | | | | | | | | | |

| AnaptysBio, Inc. |

| Date: August 5, 2024 | By: | /s/Dennis Mulroy |

| | Name: Dennis Mulroy |

| | Title: Chief Financial Officer |

Anaptys Announces Second Quarter 2024 Financial Results and

Provides Business Update

•Top-line data expected in December 2024 after having completed enrollment for Phase 2b trial to treat atopic dermatitis (AD) with ANB032, our BTLA agonist

•Top-line data accelerated and now anticipated in Q1 2025 for Phase 2b trial to treat rheumatoid arthritis (RA) with rosnilimab, our PD-1 agonist

•Top-line data now anticipated in Q1 2026 for Phase 2 trial to treat ulcerative colitis (UC) with rosnilimab

•IND accepted by FDA for ANB033, our anti-CD122 antagonist; Phase 1 trial initiation anticipated in Q4 2024

SAN DIEGO, August 5, 2024 — AnaptysBio, Inc. (Nasdaq: ANAB), a clinical-stage biotechnology company focused on delivering innovative immunology therapeutics, today reported financial results for the second quarter ended June 30, 2024 and provided a business update.

“We’ve had an exceptional quarter as we approach multiple important value drivers for Anaptys including our first patient data for ANB032, our BTLA agonist. First, enrollment has completed in the Phase 2b trial of ANB032 in AD with strong demand leading to enrollment totaling approximately 200 patients. Importantly, we plan to share top-line Week 14 data in December of 2024,” said Daniel Faga, president and chief executive officer of Anaptys. “Second, strong demand in enrollment for the Phase 2b trial of rosnilimab in RA has accelerated anticipated top-line data from mid-2025 to Q1 2025. And finally, our IND for ANB033 was accepted by FDA in July and we look forward to initiating a Phase 1 trial in healthy volunteers soon. Looking to the end of the year, we still plan to have four immune cell modulators (ICMs) in clinical development.”

Updates on Wholly Owned ICM Pipeline

ANB032 (BTLA agonist antibody)

•Completed enrollment for global Phase 2b trial in moderate-to-severe AD

◦Enrolled approximately 200 patients in a placebo-controlled trial assessing three dose levels of subcutaneously administered ANB032 (randomized 1:1:1:1) for a 14-week treatment duration and then followed for a six-month off-drug follow-up period on well-established endpoints, including EASI-75 and IGA 0/1

▪Enrollment included approximately 15% of patients with Dupixent/anti-IL-13 treatment experience

◦Top-line Week 14 data expected in December 2024

•Presented previously reported ANB032 preclinical graft vs. host disease (GvHD) data at the 2024 American Association of Immunology (AAI) Annual Meeting and Society of Investigative Dermatology (SID) Annual Meeting in May 2024 and ANB032 preclinical data supporting the modulation of dendritic cell (DC) maturation and function at the Federation of Clinical Immunology Societies (FOCIS) Annual Meeting in June 2024

◦Poster presentations are available at https://www.anaptysbio.com/technology/#anb032

Rosnilimab (PD-1 agonist antibody)

•Enrollment ongoing for global Phase 2b trial in moderate-to-severe RA

◦420-patient placebo-controlled trial assessing three dose levels of subcutaneously administered rosnilimab (randomized 1:1:1:1) for a 12-week treatment duration on well-established endpoints, including DAS28-CRP, CDAI and ACR20/50/70

▪At Week 14, rosnilimab-treated patients who achieve low disease activity, defined as CDAI<=10, are eligible to be dosed for an additional 16-week all-active treatment period and then followed for a three-month off-drug follow-up period

◦Top-line Week 12 data anticipated in Q1 2025

•Enrollment ongoing for global Phase 2 trial in moderate-to-severe UC

◦132-patient placebo-controlled trial assessing two dose levels of subcutaneously administered rosnilimab (randomized 1:1:1) for a 12-week treatment duration on well-established endpoints, including clinical response on modified Mayo score (mMS), clinical remission on mMS and endoscopic remission

▪Rosnilimab and placebo-treated patients who achieved clinical response on mMS are eligible to continue on their assigned treatment for an additional 12 weeks, while patients on placebo who are non-responders will be crossed over to the high-dose rosnilimab treatment arm, in an all-active treatment period and then followed for a three-month off-drug follow-up period

◦Top-line Week 12 data anticipated in Q1 2026

•Presented previously reported rosnilimab Phase 1 data and membrane proximal binding epitope to optimize PD-1 agonist signaling data at the 2024 Digestive Disease Week (DDW) Annual Meeting in May 2024 and at the Federation of Clinical Immunology Societies (FOCIS) Annual Meeting in June 2024

◦Poster presentations are available https://www.anaptysbio.com/technology/#anb030

ANB033 (anti-CD122 antagonist antibody)

•IND application accepted by the FDA in July 2024

•Phase 1 trial initiation in healthy volunteers anticipated in Q4 2024

ANB101 (BDCA2 modulator antibody)

•Plan to submit IND application in Q4 2024

Legacy Clinical-Stage Cytokine Antagonist Programs Available for Out-Licensing

•Comprehensive data from the Phase 3 GEMINI-1 and GEMINI-2 trials to be presented at a medical meeting in H2 2024

•Intend to out-license imsidolimab in 2024

GSK Immuno-Oncology Financial Collaboration

•GSK anticipates top-line data in H1 2025 from COSTAR Lung Phase 3 trial comparing cobolimab, a TIM-3 antagonist, plus dostarlimab, a PD-1 antagonist, plus docetaxel to dostarlimab plus docetaxel to docetaxel alone in patients with advanced NSCLC who have progressed on prior anti-PD-(L)1 therapy and chemotherapy

•GSK and iTEOS announced in June 2024 the initiation of the GALAXIES Lung-301 Phase 3 study, assessing belrestotug and dostarlimab in previously untreated, unresectable locally advanced/metastatic PD-L1 selected NSCLC

•GSK anticipates top-line data in H2 2024 from the FIRST Phase 3 trial for platinum-based therapy with dostarlimab and niraparib versus platinum-based therapy as first-line treatment of Stage III or IV nonmucinous epithelial ovarian cancer

Cash Runway

•Cash and investments of $393.5 million as of June 30, 2024 and reiterating cash runway through year-end 2026

Second Quarter Financial Results

•Cash, cash equivalents and investments totaled $393.5 million as of June 30, 2024, compared to $417.9 million as of December 31, 2023, for a decrease of $24.4 million due primarily to cash used for operating activities offset by $50.0 million received from the Sagard royalty monetization completed in May.

•Collaboration revenue was $11.0 million and $18.2 million for the three and six months ended June 30, 2024, compared to $3.5 million and $4.8 million for the three and six months ended June 30, 2023. The change is due primarily to increased royalties recognized for sales of Jemperli.

•Research and development expenses were $42.0 million and $79.0 million for the three and six months ended June 30, 2024, compared to $32.9 million and $67.9 million for the three and six months ended June 30, 2023. The increase was due primarily to development costs for rosnilimab, ANB032, ANB033 and ANB101 offset by a decrease in development costs for imsidolimab. The R&D non-cash, stock-based compensation expense was $3.5 million and $7.0 million for the three and six months ended June 30, 2024, compared to $2.7 million and $5.5 million in the same period in 2023.

•General and administrative expenses were $9.3 million and $21.6 million for the three and six months ended June 30, 2024, compared to $10.7 million and $21.5 million for the three and six months ended June 30, 2023. The G&A non-cash, stock-based compensation expense was $4.0 million and $10.7 million for the three and six months ended June 30, 2024, compared to $5.7 million and $11.8 million in the same period in 2023.

•Net loss was $46.7 million and $90.6 million for the three and six months ended June 30, 2024, or a net loss per share of $1.71 and $3.35, compared to a net loss of $39.8 million and $84.1 million for the three and six months ended June 30, 2023, or a net loss per share of $1.50 and $3.08.

About Anaptys

Anaptys is a clinical-stage biotechnology company focused on delivering innovative immunology therapeutics. It is developing immune cell modulators for autoimmune and inflammatory diseases, including two checkpoint agonists: ANB032, its BTLA agonist, in a Phase 2b trial for the treatment of atopic dermatitis and rosnilimab, its PD-1 agonist, in a Phase 2b trial for the treatment of rheumatoid arthritis and in a Phase 2 trial for the treatment of ulcerative colitis. It also has other immune cell modulator candidates in its portfolio, including ANB033, an anti-CD122 antagonist antibody, entering a Phase 1 trial and ANB101, a BDCA2 modulator antibody, in preclinical development. In addition, Anaptys has developed two cytokine antagonists available for out-licensing: imsidolimab, an anti-IL-36R antagonist, that has completed Phase 3 trials for the treatment of generalized pustular psoriasis, and etokimab, an anti-IL-33 antagonist that is Phase 2/3 ready. Anaptys has also discovered multiple therapeutic antibodies licensed to GSK in a financial collaboration for immuno-oncology, including an anti-PD-1 antagonist antibody (Jemperli (dostarlimab-gxly)) and an anti-TIM-3 antagonist antibody (cobolimab, GSK4069889). To learn more, visit www.AnaptysBio.com or follow us on LinkedIn and X.

Forward-Looking Statements

This press release contains forward-looking statements within the meaning of the “safe harbor” provisions of the Private Securities Litigation Reform Act of 1995, including, but not limited to: the timing of the release of data from the Company’s clinical trials, including ANB032’s Phase 2b clinical trial in atopic dermatitis and rosnilimab’s Phase 2b clinical trial in rheumatoid arthritis and Phase 2 clinical trial in ulcerative colitis; the timing of IND filing for ANB101; the timing of initiation of ANB033’s Phase 1 clinical trial; the timing of a presentation of Phase 3 clinical data at a medical conference; the potential to receive any additional royalties from the GSK collaboration; the Company’s ability to find a licensing partner for imsidolimab or etokimab and the timing of any such

transaction; and the Company’s projected cash runway. Statements including words such as “plan,” “intend,” “continue,” “expect,” or “ongoing” and statements in the future tense are forward-looking statements. These forward-looking statements involve risks and uncertainties, as well as assumptions, which, if they do not fully materialize or prove incorrect, could cause its results to differ materially from those expressed or implied by such forward-looking statements. Forward-looking statements are subject to risks and uncertainties that may cause the company’s actual activities or results to differ significantly from those expressed in any forward-looking statement, including risks and uncertainties related to the company’s ability to advance its product candidates, obtain regulatory approval of and ultimately commercialize its product candidates, the timing and results of preclinical and clinical trials, the company’s ability to fund development activities and achieve development goals, the company’s ability to protect intellectual property and other risks and uncertainties described under the heading “Risk Factors” in documents the company files from time to time with the Securities and Exchange Commission. These forward-looking statements speak only as of the date of this press release, and the company undertakes no obligation to revise or update any forward-looking statements to reflect events or circumstances after the date hereof.

Contact:

Nick Montemarano

Senior Director, Investor Relations and Strategic Communications

858.732.0178

investors@anaptysbio.com

AnaptysBio, Inc.

Consolidated Balance Sheets

(in thousands, except par value data)

(unaudited)

| | | | | | | | | | | |

| June 30, 2024 | | December 31, 2023 |

| ASSETS |

| Current assets: | | | |

| Cash and cash equivalents | $ | 71,821 | | | $ | 35,965 | |

| Receivables from collaborative partners | 9,007 | | 6,851 |

| Short-term investments | 278,983 | | 354,939 |

| Prepaid expenses and other current assets | 7,539 | | 9,080 |

| Total current assets | 367,350 | | | 406,835 | |

| Property and equipment, net | 1,833 | | | 2,098 |

| Operating lease right-of-use assets | 15,291 | | | 16,174 |

| Long-term investments | 42,646 | | | 27,026 |

| Other long-term assets | 256 | | | 256 |

| | | |

| Total assets | $ | 427,376 | | | $ | 452,389 | |

| LIABILITIES AND STOCKHOLDERS’ EQUITY |

| Current liabilities: | | | |

| Accounts payable | $ | 4,890 | | | $ | 4,698 | |

| Accrued expenses | 33,680 | | | 30,967 | |

| Current portion of operating lease liability | 1,850 | | | 1,777 | |

| Total current liabilities | 40,420 | | | 37,442 | |

| Liability related to sale of future royalties | 361,981 | | | 310,807 | |

| Operating lease liability, net of current portion | 15,096 | | | 16,037 | |

| Stockholders’ equity: | | | |

Preferred stock, $0.001 par value, 10,000 shares authorized and no shares, issued or outstanding at June 30, 2024 and December 31, 2023, respectively | — | | | — | |

Common stock, $0.001 par value, 500,000 shares authorized, 27,434 shares and 26,597 shares issued and outstanding at June 30, 2024 and December 31, 2023, respectively | 27 | | | 27 | |

| Additional paid in capital | 714,959 | | | 702,969 | |

| Accumulated other comprehensive loss | (415) | | | (797) | |

| Accumulated deficit | (704,692) | | | (614,096) | |

| Total stockholders’ equity | 9,879 | | | 88,103 | |

| Total liabilities and stockholders’ equity | $ | 427,376 | | | $ | 452,389 | |

AnaptysBio, Inc.

Consolidated Statements of Operations and Comprehensive Loss

(in thousands, except per share data)

(unaudited)

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended June 30, | | Six Months Ended

June 30, |

| 2024 | | 2023 | | 2024 | | 2023 |

| Collaboration revenue | $ | 10,971 | | | $ | 3,460 | | | $ | 18,150 | | | $ | 4,834 | |

| Operating expenses: | | | | | | | |

| Research and development | 41,997 | | | 32,923 | | | 79,039 | | | 67,880 | |

| General and administrative | 9,295 | | | 10,680 | | | 21,633 | | | 21,498 | |

| Total operating expenses | 51,292 | | | 43,603 | | | 100,672 | | | 89,378 | |

| Loss from operations | (40,321) | | | (40,143) | | | (82,522) | | | (84,544) | |

| Other (expense) income, net: | | | | | | | |

| Interest income | 4,623 | | | 4,653 | | | 9,207 | | | 9,139 | |

| Non-cash interest expense for the sale of future royalties | (10,953) | | | (4,358) | | | (17,270) | | | (8,694) | |

| Other (expense) income, net | — | | | 3 | | | (2) | | | (1) | |

| Total other (expense) income, net | (6,330) | | | 298 | | | (8,065) | | | 444 | |

| Loss before income taxes | (46,651) | | | (39,845) | | | (90,587) | | | (84,100) | |

| Provision for income taxes | (9) | | | — | | | (9) | | | — | |

| Net loss | (46,660) | | | (39,845) | | | (90,596) | | | (84,100) | |

| | | | | | | |

| Unrealized gain (loss) on available for sale securities | 209 | | | (344) | | | 382 | | | 1,635 | |

| Comprehensive loss | $ | (46,451) | | | $ | (40,189) | | | $ | (90,214) | | | $ | (82,465) | |

| Net loss per common share: | | | | | | | |

| Basic and diluted | $ | (1.71) | | | $ | (1.50) | | | $ | (3.35) | | | $ | (3.08) | |

| | | | | | | |

| Weighted-average number of shares outstanding: | | | | | | | |

| Basic and diluted | 27,356 | | | 26,629 | | | 27,079 | | | 27,288 | |

| | | | | | | |

v3.24.2.u1

Cover Page

|

Aug. 05, 2024 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Document Period End Date |

Aug. 05, 2024

|

| Entity Registrant Name |

ANAPTYSBIO, INC

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity File Number |

001-37985

|

| Entity Tax Identification Number |

20-3828755

|

| Entity Address, Address Line One |

10770 Wateridge Circle

|

| Entity Address, Address Line Two |

Suite 210,

|

| Entity Address, City or Town |

San Diego

|

| Entity Address, State or Province |

CA

|

| Entity Address, Postal Zip Code |

92121

|

| City Area Code |

858

|

| Local Phone Number |

362-6295

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock, par value $0.001 per share

|

| Trading Symbol |

ANAB

|

| Security Exchange Name |

NASDAQ

|

| Entity Emerging Growth Company |

false

|

| Entity Central Index Key |

0001370053

|

| Amendment Flag |

false

|

| Document Information [Line Items] |

|

| Document Type |

8-K

|

| Entity Addresses [Line Items] |

|

| Entity Address, Address Line One |

10770 Wateridge Circle

|

| Entity Address, Address Line Two |

Suite 210,

|

| Entity Address, City or Town |

San Diego

|

| Entity Address, State or Province |

CA

|

| Entity Address, Postal Zip Code |

92121

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLine items represent financial concepts included in a table. These concepts are used to disclose reportable information associated with domain members defined in one or many axes to the table.

| Name: |

dei_EntityAddressesLineItems |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:stringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

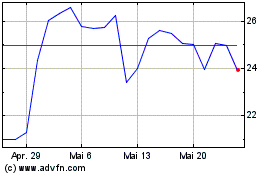

AnaptysBio (NASDAQ:ANAB)

Historical Stock Chart

Von Nov 2024 bis Dez 2024

AnaptysBio (NASDAQ:ANAB)

Historical Stock Chart

Von Dez 2023 bis Dez 2024