Filed by Akoya Biosciences, Inc.

pursuant to Rule 425 under the Securities Act of

1933

and deemed filed pursuant to Rule 14a-12

under the Securities Exchange Act of 1934

Filer: Akoya Biosciences, Inc.

Subject Company: Akoya Biosciences, Inc.

SEC File No.: 001-40344

Date: January 10, 2025

Dear Akoyans,

I hope this note finds all of you well and Happy New Year to each of

you.

We are kicking off 2025 with some exciting news. This morning, we announced

that we are combining forces with Quanterix Corporation in an all-stock transaction. Many of you are familiar with Quanterix, its

business and team based nearby in Billerica, MA. I would encourage you to read the enclosed press release from this morning.

Bringing Together Akoya and Quanterix

Here at Akoya, we have established ourselves as scientific and market

leaders in spatial biology providing solutions that enable profound expansion of our knowledge of disease progression and response to

therapy using high resolution spatial phenotyping of tissue. Quanterix brings equal leadership and scientific expertise with advanced

tools for the ultra-sensitive detection of biomarkers in blood, serum and plasma. The combination of the two organizations and technology

platforms provides the first fully integrated technology ecosystem to identify and measure biomarkers across tissue and blood.

Our 1,300 instruments have enabled Akoya to be a significant force

in cancer biomarker discovery and translational research with rapidly emerging clinical partnerships helping us achieve our goal of improving

patient care. Similarly, Quanterix with 1,000 instruments in the market has an established leadership position in the neurology

market also with significant opportunities for expansive market success in neurodegenerative disease diagnostics, especially Alzheimer’s.

By joining forces with Quanterix, we now have the opportunity to increase our commercial reach across the high growth markets in neurology,

oncology and immunology from discovery to diagnostics and from tissue to blood, a powerful combination.

This combination also creates a life sciences tools and emerging diagnostic

company at an impressive scale. We will have combined revenue of ~$220 million, a path to generating positive cash flow in 2026 with an

expected combined balance sheet of ~$175M in cash at the time of closing, likely the second quarter of this year. That is a robust and

solid financial profile.

Your hard work has made this milestone possible, and I hope you share

my excitement for this new chapter in Akoya’s story. This is a true catalyst for us as Akoyans, our customers and our shareholders.

Next Steps

During our All Hands scheduled for today at 11:30AM EST, we will discuss

the transaction in more detail, timing and what this means for all of us. As noted, we expect the transaction will close in the

second quarter of 2025, which will be followed by a thoughtful integration to bring our organizations together to realize our elevated

and combined vision.

Thank you all again and I look forward to catching up later this morning.

All the Best

Brian

IMPORTANT ADDITIONAL INFORMATION

In connection with the proposed transaction, Quanterix will file with

the U.S. Securities and Exchange Commission (the “SEC”) a registration statement on Form S-4 (the “registration statement”),

which will contain a joint proxy statement of Quanterix and Akoya and a prospectus of Quanterix (the “joint proxy statement/prospectus”),

and each of Quanterix and Akoya may file with the SEC other relevant documents regarding the proposed transaction. INVESTORS AND SECURITY

HOLDERS ARE URGED TO READ THE REGISTRATION STATEMENT AND THE JOINT PROXY STATEMENT/PROSPECTUS CAREFULLY AND IN THEIR ENTIRETY AND ANY

OTHER RELEVANT DOCUMENTS FILED WITH THE SEC BY QUANTERIX AND AKOYA, AS WELL AS ANY AMENDMENTS OR SUPPLEMENTS TO THOSE DOCUMENTS WHEN

THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT QUANTERIX, AKOYA AND THE PROPOSED TRANSACTION. A definitive

copy of the joint proxy statement/prospectus will be mailed to Quanterix and Akoya stockholders when that document is final. Investors

and security holders will be able to obtain the registration statement and the joint proxy statement/prospectus, as well as other filings

containing information about Quanterix and Akoya, free of charge from Quanterix or Akoya or from the SEC’s website when they are

filed. The documents filed by Quanterix with the SEC may be obtained free of charge at Quanterix’s website, at www.quanterix.com,

or by requesting them by mail at Quanterix Investor Relations, 900 Middlesex Turnpike, Billerica, MA 01821. The documents filed by Akoya

with the SEC may be obtained free of charge at Akoya’s website, at www.akoyabio.com, or by requesting them by mail at Akoya

Biosciences, 100 Campus Drive, 6th Floor, ATTN: Chief Legal Officer, Marlborough, MA 01752.

PARTICIPANTS IN THE SOLICITATION

Quanterix and Akoya and certain of their respective directors and executive

officers may be deemed to be participants in the solicitation of proxies from the stockholders of Quanterix or Akoya in respect of the

proposed transaction. Information about Quanterix’s directors and executive officers is available in Quanterix’s proxy statement

dated April 15, 2024, for its 2024 Annual Meeting of Stockholders, and other documents filed by Quanterix with the SEC. Information about

Akoya’s directors and executive officers is available in Akoya’s proxy statement dated April 23, 2024, for its 2024 Annual

Meeting of Stockholders, and other documents filed by Akoya with the SEC. Other information regarding the persons who may, under the rules

of the SEC, be deemed participants in the proxy solicitation and a description of their direct and indirect interests, by security holdings

or otherwise, will be contained in the joint proxy statement/prospectus and other relevant materials to be filed with the SEC regarding

the proposed transaction when they become available. Investors should read the joint proxy statement/prospectus carefully when it becomes

available before making any voting or investment decisions. You may obtain free copies of these documents from Quanterix or Akoya as indicated

above.

NO OFFER OR SOLICITATION

This communication shall not constitute an offer to sell or the solicitation

of an offer to buy any securities or a solicitation of any vote or approval with respect to the proposed merger of Quanterix and Akoya,

nor shall there be any sale of securities in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration

or qualification under the securities laws of any such jurisdiction. No offering of securities shall be made except by means of

a prospectus meeting the requirements of Section 10 of the U.S. Securities Act of 1933, as amended.

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING STATEMENTS

Statements included in this communication which are not historical

in nature or do not relate to current facts are intended to be, and are hereby identified as, forward-looking statements for purposes

of the safe harbor provided by Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act

of 1934, as amended. Forward-looking statements are based on, among other things, projections as to the anticipated benefits of

the proposed transaction as well as statements regarding the impact of the proposed transaction on Quanterix’s and Akoya’s

business and future financial and operating results, the amount and timing of synergies from the proposed transaction and the closing

date for the proposed transaction. Words and phrases such as “may,” “approximately,” “continue,”

“should,” “expects,” “projects,” “anticipates,” “is likely,” “look

ahead,” “look forward,” “believes,” “will,” “intends,” “estimates,”

“strategy,” “plan,” “could,” “potential,” “possible” and variations of such

words and similar expressions are intended to identify such forward-looking statements. Quanterix and Akoya caution readers that

forward-looking statements are subject to certain risks and uncertainties that are difficult to predict with regard to, among other things,

timing, extent, likelihood and degree of occurrence, which could cause actual results to differ materially from anticipated results.

Such risks and uncertainties include, among others, the following possibilities: the occurrence of any event, change or other circumstances

that could give rise to the right of one or both of the parties to terminate the definitive merger agreement entered into between Quanterix

and Akoya; the outcome of any legal proceedings that may be instituted against Quanterix or Akoya; the failure to obtain necessary regulatory

approvals (and the risk that such approvals may result in the imposition of conditions that could adversely affect the combined company

or the expected benefits of the proposed transaction) and stockholder approvals or to satisfy any of the other conditions to the proposed

transaction on a timely basis or at all; the possibility that the anticipated benefits and synergies of the proposed transaction are

not realized when expected or at all, including as a result of the impact of, or problems arising from, the integration of the two companies

or as a result of the strength of the economy and competitive factors in the areas where Quanterix and Akoya do business; the possibility

that the proposed transaction may be more expensive to complete than anticipated; diversion of management’s attention from ongoing

business operations and opportunities; potential adverse reactions or changes to business or employee relationships, including those

resulting from the announcement or completion of the proposed transaction; changes in Quanterix’s share price before the closing

of the proposed transaction; risks relating to the potential dilutive effect of shares of Quanterix common stock to be issued in the

proposed transaction; and other factors that may affect future results of Quanterix, Akoya and the combined company. Additional

factors that could cause results to differ materially from those described above can be found in Quanterix’s Annual Report on Form

10-K for the year ended December 31, 2023, as amended, Akoya’s Annual Report on Form 10-K for the year ended December 31, 2023,

and in other documents Quanterix and Akoya file with the SEC, which are available on the SEC’s website at www.sec.gov.

All forward-looking statements, expressed or implied, included in this

communication are expressly qualified in their entirety by the cautionary statements contained or referred to herein. If one or more events

related to these or other risks or uncertainties materialize, or if Quanterix’s or Akoya’s underlying assumptions prove to

be incorrect, actual results may differ materially from what Quanterix and Akoya anticipate. Quanterix and Akoya caution readers not to

place undue reliance on any such forward-looking statements, which speak only as of the date they are made and are based on information

available at that time. Neither Quanterix nor Akoya assumes any obligation to update or otherwise revise any forward-looking statements

to reflect circumstances or events that occur after the date the forward-looking statements were made or to reflect the occurrence of

unanticipated events except as required by federal securities laws.

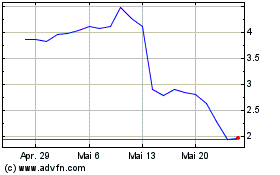

Akoya BioSciences (NASDAQ:AKYA)

Historical Stock Chart

Von Dez 2024 bis Jan 2025

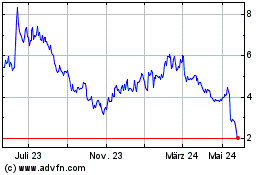

Akoya BioSciences (NASDAQ:AKYA)

Historical Stock Chart

Von Jan 2024 bis Jan 2025