false

0001173313

0001173313

2024-08-15

2024-08-15

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities

Exchange Act of 1934

Date of Report (Date of earliest event reported):

August 15, 2024

ABVC BIOPHARMA, INC.

(Exact name of registrant as specified in its charter)

| Nevada |

|

001-40700 |

|

26-0014658 |

(State or other jurisdiction

of incorporation) |

|

(Commission File Number) |

|

(IRS Employer

Identification No.) |

|

44370 Old Warm Springs Blvd.

Fremont, CA |

|

94538 |

| (Address of principal executive offices) |

|

(Zip Code) |

Registrant’s telephone number including area

code: (510) 668-0881

(Former name or former address, if changed since

last report)

Check the appropriate box below if the Form 8-K

filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title of Each Class |

|

Trading Symbol |

|

Name of each exchange on which registered |

| Common Stock, par value $0.001 per share |

|

ABVC |

|

The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant

is an emerging growth company as defined in as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule

12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check

mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting

standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02 Results of Operations and Financial

Condition.

On August 15, 2024, ABVC BioPharma, Inc. (the

“Company”) issued a press release announcing its financial results for the second quarter ended June 30, 2024, which

were disclosed in the Quarterly Report on Form 10-Q filed with the U.S. Securities and Exchange Commission on August 14, 2024. A copy

of the press release is furnished as Exhibit 99.1 to this Current Report on Form 8-K.

The information reported under this Item 2.02

of Form 8-K, including Exhibit 99.1, is being furnished and shall not be deemed to be “filed” for the purposes of Section

18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of

such section, nor shall such information be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended,

or the Exchange Act, except as shall be expressly set forth by specific reference in such filing.

Neither this Current Report on Form 8-K, nor any

exhibit attached hereto, is an offer to sell or the solicitation of an offer to buy the Securities described herein. Such disclosure does

not constitute an offer to sell, or the solicitation of an offer to buy nor shall there be any sales of the Company’s securities

in any state in which such an offer, solicitation or sale would be unlawful. The securities mentioned herein have not been registered

under the United States Securities Act of 1933, as amended, and may not be offered or sold in the United States absent registration or

an applicable exemption from the registration requirements under the Securities Act and applicable state securities laws.

Item 9.01 Exhibits

(d) Exhibits

| Exhibit No. |

|

Description |

| 99.1 |

|

Press Release |

| 104 |

|

Cover Page Interactive Data File, formatted in Inline XBRL |

SIGNATURE

Pursuant to the requirements

of the Securities and Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto

duly authorized.

| |

ABVC BioPharma, Inc. |

| |

|

|

| August 15, 2024 |

By: |

/s/ Uttam Patil |

| |

|

Uttam Patil |

| |

|

Chief Executive Officer |

Exhibit 99.1

ABVC BioPharma Inc. Reports Strong Q2 2024 Financial

Results

and Strategic Achievements

| ● | Executed Global Licensing Agreements that could provide up

to $292 million in income |

| ● | Received Cash Milestone Incomes of $116,000 |

| ● | Achieved Significant Improvements in Earnings |

| ● | Obtained Multiple Patents and FDA Approvals |

Fremont, CA (August 15, 2024) – ABVC BioPharma,

Inc. (NASDAQ: ABVC), a clinical-stage biopharmaceutical company developing therapeutic solutions in oncology/hematology, CNS, and ophthalmology,

is pleased to announce its financial results and key operational highlights for the second quarter ended June 30, 2024.

Key Financial and Operational Highlights:

1. Significant Global Licensing Agreements:

Vitargus® Licensing: Along with our subsidiary,

BioFirst Corporation, we secured licensing agreements with ForSeeCon Eye Corporation that have the potential to provide up to a total

of $187 million in income. The agreements include total upfront payments of $60 million that can be paid in cash or shares of ForSeeCon

stock, milestone cash payments of $7.0 million and potential royalties up to $120 million after the product launches, of which there can

be no guarantee; initial $116,000 milestone payment received in June 2024. This agreement underscores our commitment to advancing innovative

therapies and enhancing shareholder value.

- Oncology Products Licensing: Along with our

subsidiary and affiliate, BioLite, Inc. and Rgene Corporation, we entered into a total of 8 licensing agreements with OncoX BioPharma,

Inc., that have the potential to provide up to an aggregate of $105 million in income. The agreements include total upfront payments of

$55,000,000 that can be paid in cash or shares of OncoX stock and royalties up to a total of $50 million after the product launches, of

which there can be no guarantee. These potential payments and relationships will further solidify our financial foundation and strategic

partnerships.

2. Financial Performance:

- Earnings Per Share (EPS): Demonstrated a remarkable

year-over-year improvement of approximately 86.8%, with EPS improving to -$0.09 in Q2 2024 from -$0.68 in the same period last year. This

significant progress reflects our successful efforts in managing operational expenses and capitalizing on milestone payment revenue from

licensing agreements.

- Revenue Growth: Revenue increased to $117,142

in Q2 2024, a substantial rise from $6,109 in Q2 2023. This growth directly results from our strategic execution of licensing agreements,

which have begun generating meaningful cash inflows.

- Shareholders' Equity: As of June 30, 2024, shareholders'

equity stood at $7.8 million, maintaining a solid financial foundation despite challenging macroeconomic conditions.

3. Strategic Partnerships and Market Positioning:

- ABVC has strategically aligned itself with promising

partners that we believe will ultimately enhance the value of ABVC's equity holdings. These partnerships are pivotal in driving shareholder

value as we believe they will help market valuations grow.

- We believe the Company is poised for significant

market capitalization growth, leveraging its pipeline accomplishments and international partnerships to bring breakthrough therapies to

market.

4. Operational and Regulatory Milestones:

- Patent and FDA Approvals: Received multiple

patents and regulatory approvals across the US, Taiwan, and Australia for treatments targeting major depressive disorder, ADHD, and ophthalmology.

These achievements highlight our continued progress in expanding our intellectual property portfolio and advancing clinical trials.

- Neurology and Oncology Advancements: Completed

Phase II trials for MDD, initiated Phase IIb trials for ADHD, and received FDA approval for multiple IND applications, positioning us

for continued growth and innovation in these critical therapeutic areas.

Management Commentary:

Dr. Uttam Patil, ABVC Chief Executive Officer,

commented, "We are thrilled with the substantial progress we have made in Q2 2024. Our financial performance and strategic licensing

agreements have enhanced our cash reserves and strengthened our position in the biopharmaceutical industry. We remain focused on advancing

our pipeline, expanding our partnerships, and driving sustainable growth for the benefit of our shareholders."

Board of Directors Statement:

"We sincerely thank our shareholders for

their continued support and confidence in ABVC. Our focus remains on advancing our licensing agreements and maximizing the value they

bring. The execution of these agreements provides us with a solid foundation for future growth and stability. We are excited about these

partnerships' prospects and are committed to driving our strategic goals forward."

Outlook:

We believe ABVC BioPharma is on a promising trajectory,

focusing on sustainable growth, innovation, and value creation through strategic partnerships. Our improving financial strength and unwavering

commitment to advancing healthcare solutions prepare us for future success. We sincerely thank our shareholders, partners, and dedicated

team for their continued support and look forward to a prosperous future.

Recent Operational Highlights

Patents and FDA Approvals

The Company received a US patent (US 16/936,032),

valid until September 04, 2040, a Taiwanese (TW I821593) Patent, valid until July 22, 2040, and an Australian (AU2021314052B2) Patent,

valid until April 09, 2041, for Polygala extract for the treatment of major depressive disorder. The Company received a US (US17/120,965),

valid until December 20, 2040, and Taiwanese (TW 110106546), valid until February 24, 2041, Patent for Polygala Extract for treating Attention

Deficit Hyperactive Disorder. A Taiwanese Patent (TW I792427) for Storage Media for the Preservation of Corneal Tissue was obtained on

February 11, 2023, and is valid till July 19, 2041. As we work towards expanding our patent map into global coverage, we eagerly await

the results of patent applications in the European Union, China, Japan, and others.

On December 30, 2022, the Company received US

FDA approval for the IND ABV-1519 to proceed with the Combination therapy for treating Advanced Inoperable or Metastatic EGFR Wild-type

Non-Small Cell Lung Cancer was approved and the study can proceed. The IND was then submitted to the Taiwan FDA, and the approval was

received on January 04, 2024. The United States Food & Drug Administration (US FDA) has approved four INDs, ABV-1501 for Triple Negative

Breast Cancer (TNBC), ABV-1519 for Non-Small Cell Lung Cancer (NSCLC), ABV-1702 for Myelodysplastic Syndrome (MDS), and ABV-1703 for Pancreatic

Cancer Therapy.

Neurology

The MDD Phase II trials for ABV-1504 were completed

successfully with good tolerance to the drug, and no serious adverse effects were reported. The product is ready for an End-of-Phase 2

meeting with the FDA to finalize the protocol for Phase III trials. At the same time, we commenced the ADHD Phase IIb trials at the University

of California, San Francisco (UCSF) and five other sites in Taiwan. The trials are heading for the interim report, which we expect to

complete by the end of Q3 2024. ABV-1601 for MDD in cancer patients has completed Phase I study preparation, including the Site Initiation

Visit (SIV). The study is set to initiate by the end of 2024.

On July 31, 2023, ABVC signed a legally binding

term sheet with a Chinese pharmaceutical company, Xinnovation Therapeutics Co., Ltd, for the exclusive licensing of ABV-1504 for Major

Depressive Disorder (MDD) and ABV-1505 for Attention-Deficit Hyperactivity Disorder in mainland China. Under this agreement, Xinnovation

will hold exclusive rights to develop, manufacture, market, and distribute our innovative drugs for MDD and ADHD in the Chinese market

and shall bear the costs for clinical trials and product registration in China. We are negotiating definitive agreements with Xinnovation

and are excited that the licensing deal carries a possible aggregate income of $20 million for ABVC if all expected sales are made, of

which there can be no guarantee. This transaction remains subject to the negotiation of definitive documents and therefore there is no

guarantee that this transaction will occur.

In November 2023, each of ABVC and one of its

subsidiaries, BioLite, Inc. ("BioLite"), entered a multi-year, global licensing agreement with AIBL for the Company and BioLite's

CNS drugs with the indications of MDD (Major Depressive Disorder) and ADHD (Attention Deficit Hyperactivity Disorder) (the "Licensed

Products"). The potential license will cover the Licensed Products' clinical trial, registration, manufacturing, supply, and distribution

rights. The Licensed Products for MDD and ADHD, owned by ABVC and BioLite, were valued at $667M by a third-party evaluation. The parties

are determined to collaborate on the global development of Licensed Products. The parties are also working to strengthen new drug development

and business collaboration, including technology, interoperability, and standards development. As per each of the respective agreements,

each of ABVC and BioLite shall receive 23 million shares of AIBL stock that the parties value at $10 per share (not independently validated)

and if certain milestones are met, $3,500,000 and royalties equaling 5% of net sales, up to $100 million, which is not guaranteed.

Ophthalmology

Vitargus®, a vitreous substitute,

is a groundbreaking, advanced-staged R&D product that we believe will be the first biodegradable hydrogel used in retinal detachment

surgery. Vitargus® has completed the feasibility study in Australia and was approved by the Australian Therapeutic Goods

Administration (TGA) to initiate the next trial phase in two participating sites. This is vital to obtaining final regulatory approval

for Vitargus® in Australia.

The Science Park Administration in Taiwan approved

ABVC's plan to set up a pilot Good Manufacturing Practice (GMP) facility to produce Vitargus® and to pursue the process

development work for manufacturing optimization. We are undertaking this project, proposed by ABVC's Taiwan affiliate and co-development

partner, BioFirst Corporation, to upgrade the Vitargus® manufacturing processes so it can ultimately handle the global

market supply. ABVC and BioFirst Corporation expect to complete the facility's construction in Hsinchu Biomedical Science Park, Taiwan,

in 2024.

Oncology/Hematology

The United States Food & Drug Administration

(US FDA) approved the Investigational New Drug (IND) application for the proposed clinical investigation of BLEX 404, the primary active

ingredient in ABV-1519, for advanced inoperable or metastatic EGFR wild-type non-small cell lung cancer. This treatment is being co-developed

by BioKey, Inc. ("BioKey") and by the Rgene Corporation, Taiwan. The study received approval from the Taiwan FDA. This is the

fourth IND approved by the US FDA for BLEX 404. The previous three INDs are for the combination therapies of triple-negative breast cancer,

myelodysplastic syndromes (MDS), and pancreatic cancer.

CDMO

BioKey, a wholly-owned subsidiary of the Company

based in Fremont, California, produces dietary supplements derived from the maitake mushroom in tablet and liquid forms. BioKey has entered

the second year of the distribution agreement with Define Biotech Co. Ltd. BioKey is currently set to produce an additional $1 million

worth of products for the global market. We continue to work on distribution for the US and Canadian markets with Shogun Maitake.

On the regulatory services front for our clients,

we received two ANDA approvals from the US FDA. We have a three-year contract, worth up to $3 million, for clinical development services

between BioKey and Rgene Corporation. With this base, we are actively developing BioKey as a contract research, development, and manufacturing

organization (CRDMO) to become a one-stop solution for pharmaceutical services.

About ABVC BioPharma, Inc.

ABVC BioPharma, Inc. is a clinical-stage biopharmaceutical

company focused on utilizing its licensed technology to conduct proof-of-concept trials through Phase II of the clinical development process

at world-famous research institutions (such as Stanford University, University of California at San Francisco, and Cedars-Sinai Medical

Center) and then out-licensing the products to international pharmaceutical companies for pivotal Phase III studies and, eventually, generating

global sales. The Company has an active pipeline of six drugs and one medical device (ABV-1701/Vitargus®) under development.

Forward-looking Statements

This press release contains "forward-looking

statements." Such statements may be preceded by the words "intends," "may," "will," "plans,"

"expects," "anticipates," "projects," "predicts," "estimates," "aims," "believes,"

"hopes," "potential" or similar words. Forward-looking statements are not guarantees of future performance, are based

on certain assumptions and are subject to various known and unknown risks and uncertainties, many of which are beyond the Company's control,

and cannot be predicted or quantified and consequently, actual results may differ materially from those expressed or implied by such forward-looking

statements. Such risks and uncertainties include, without limitation, risks and uncertainties associated with (i) our inability to manufacture

our product candidates on a commercial scale on our own, or in collaboration with third parties; (ii) difficulties in obtaining financing

on commercially reasonable terms; (iii) changes in the size and nature of our competition; (iv) loss of one or more key executives or

scientists; and (v) difficulties in securing regulatory approval to proceed to the next level of the clinical trials or market our product

candidates. More detailed information about the Company and the risk factors that may affect the realization of forward-looking statements

is set forth in the Company's filings with the Securities and Exchange Commission (SEC), including the Company's Annual Report on Form

10-K and its Quarterly Reports on Form 10-Q. Investors are urged to read these documents free of charge on the SEC's website at http://www.sec.gov.

The Company assumes no obligation to publicly update or revise its forward-looking statements as a result of new information, future events

or otherwise.

This press release does not constitute an offer to sell or the solicitation

of an offer to buy these securities, nor shall there be any sale of these securities in any state or jurisdiction in which such offer,

solicitation or sale would be unlawful prior to registration or qualification under the securities laws of that state or jurisdiction.

Contact:

Uttam Patil

Email: uttam@ambrivis.com

v3.24.2.u1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

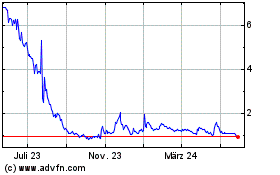

ABVC BioPharma (NASDAQ:ABVC)

Historical Stock Chart

Von Nov 2024 bis Dez 2024

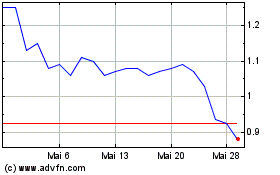

ABVC BioPharma (NASDAQ:ABVC)

Historical Stock Chart

Von Dez 2023 bis Dez 2024