false

0001576873

0001576873

2023-12-21

2023-12-21

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

8-K

CURRENT

REPORT

PURSUANT

TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

Date

of Report (Date of earliest event reported): December 21, 2023

| AMERICAN

BATTERY TECHNOLOGY COMPANY |

| (Exact

name of registrant as specified in its charter) |

| Nevada

|

|

001-41811

|

|

33-1227980 |

| (State

or other jurisdiction of |

|

(Commission |

|

(IRS

Employer |

| incorporation

or organization) |

|

File

No.) |

|

Identification

Number) |

100

Washington Street, Suite 100

Reno,

NV |

|

89503

|

| (Address

of principal executive offices) |

|

(Zip

Code) |

(775)

473-4744

(Registrant’s

telephone number including area code)

N/A

(Former

name or former address, if changed since last report)

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under

any of the following provisions (see General Instruction A.2. below):

| ☐ |

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

| ☐ |

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities

registered pursuant to Section 12(b) of the Act:

| Title

of Each Class |

|

Trading

Symbol(s) |

|

Name

of Each Exchange on Which Registered |

| Common

stock, $0.001 par value |

|

ABAT |

|

The

Nasdaq Stock Market LLC |

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company ☐

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item

8.01 Other Events.

On

December 21, 2023, American Battery Technology Company (“the “Company”) issued a press release announcing results from

a third-party qualified person Initial Assessment technical and economic study of the economic potential of the Company’s lithium

deposit at its Tonopah Flats Lithium Project in Big Smoky Valley, Nevada.

A

copy of the press release is attached hereto as Exhibit 99.1 to this Current Report on Form 8-K.

Item

9.01 Financial Statements and Exhibits.

(d)

Exhibits:

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, as amended, the registrant has duly caused this report to be signed on its

behalf by the undersigned hereunto duly authorized.

| |

AMERICAN

BATTERY TECHNOLOGY COMPANY |

| |

|

|

| Date:

December 21, 2023 |

By: |

/s/

Ryan Melsert |

| |

|

Ryan

Melsert |

| |

|

Chief

Executive Officer |

Exhibit

99.1

American

Battery Technology Company Announces S-K 1300 Initial Assessment for its Tonopah Flats Lithium Project

Initial

Assessment, with engineering economic analysis supported by metallurgical and processing studies, has resulted in:

| |

● |

Updated

mineral resource estimate of 18.03 million tons lithium hydroxide monohydrate with an Inferred classification |

| |

● |

After-tax

cash flows: NPV of $4.41 billion @ 10% discount, IRR of 65.8%, and payback period of 2.4 years |

| |

● |

A

mine life of over 400 years with average annual production of 33,000 tons lithium hydroxide monohydrate |

Reno,

Nev., December 21, 2023 — American Battery Technology Company (ABTC) (NASDAQ:

ABAT), an integrated critical battery materials company that is commercializing its technologies for both primary battery minerals manufacturing

and secondary minerals lithium-ion battery recycling, is pleased to announce a positive Initial Assessment for its Tonopah Flats Lithium

Project (TFLP) located in Big Smoky Valley, near Tonopah, Nevada.

In

February 2023 ABTC published its Maiden Resource Report for the TFLP, which identified it as one of the largest known lithium resources

in the U.S., and now this U.S. SEC S-K 1300 Initial Assessment (similar to a Preliminary Economic Assessment under Canadian NI 43-101

standards) updates this resource report by also including:

| |

● |

Additional

data from the company’s Drill Program

II |

| |

|

|

| |

● |

Mineral processing

and metallurgical testing specifically with ABTC claystone material |

| |

|

|

| |

● |

Capital

and operating costs of a commercial-scale 33,000 ton/year lithium hydroxide monohydrate (LHM) facility |

| |

|

|

| |

● |

Economic

analysis for the lifetime of the project |

| |

|

|

| |

● |

Recommended

next steps for the TFLP project |

“We

are excited to have expanded upon our Maiden Resource Report from this past Spring with this Initial Assessment to further refine the

analysis of the magnitude and quality of this unconventional, domestic lithium resource, and also to detail the financial competitiveness

of bringing this resource and commercial-scale lithium hydroxide refinery to market,” stated ABTC CEO Ryan Melsert. “There

is extremely large demand for U.S.-based battery grade lithium products, especially in the hydroxide form that can enable the manufacturing

of high energy density cathode materials. Enhanced by the support of our U.S. Department of Energy grants, the economics of this project

are very compelling and result in a full project payback period of only 2.4 years.”

In

order to evaluate and standardize the performance of ABTCs claystone material, initially two conventional processing routes were employed

in empirical trials to manufacture battery grade LHM from bulk samples collected from the ABTC TFLP resource:

| |

● |

Low-Temperature,

Mineral Acid Process: The Initial Assessment

concluded that with ABTC’s claystone material utilizing a conventional low-temperature mineral acid processing route, very

high lithium recovery efficiencies can be achieved (>90%), however as is emblematic of this approach the selectivity of lithium

to other elements was low. This resulted in the need for complex and chemical reagent intensive purification and conversion

processes to produce battery grade LHM. |

| |

● |

Salt

Roasting Thermal Treatment: The Initial

Assessment concluded that with ABTC’s claystone material utilizing a salt roasting thermal treatment route, moderate lithium

recovery efficiencies can be achieved (>65%), however, the lithium selectivity was very high and battery grade LHM can

be manufactured with simple and low-cost purification and conversion processes. |

For

the purposes of this Initial Assessment, the economic analysis was performed utilizing the conventional salt roasting thermal treatment

route, as the combination of moderate lithium recovery, very high lithium selectivity, and simplified purification and conversion processes

resulted in the most attractive overall production costs.

Independent

from these commercially available conventional processes, ABTC has also developed its own processes for the extraction of lithium from

its claystone materials, the purification of these lithium intermediates, and their conversion to battery grade lithium hydroxide crystals.

While this Initial Assessment includes economics from commercially available processes applied to TFLP claystone material, ABTC

intends to utilize the data from its internally-developed processes in future reports.

ABTC

has recently completed a Drill Program III at TFLP consisting of 8 core drill holes with approximately 6,700 feet of drilling, and the

data from this drill program is not included in this Initial Assessment. This data will be integrated with data from earlier

drill phases and will be included in a future updated mineral resource estimate and economic analysis.

TFLP Initial Assessment Highlights:

Financial

Highlights:

| |

● |

LHM

production cost: |

$4,636/ton |

| |

● |

Lithium

refinery capital costs: |

$455

million |

| |

● |

Total

mine and refinery project capital costs: |

$1.06

billion |

| |

● |

After-tax

NPV, @10%: |

$4.41

billion |

| |

● |

After-tax

Initial Rate of Return: |

65.8% |

| |

● |

Project

payback period: |

2.4

years |

| |

● |

Total

50-year project revenue: |

$50.0

billion |

| |

● |

Total

50-year operating costs: |

$9.80

billion |

Project

and Resource Highlights:

| |

● |

Lithium

resource size, Inferred classification: |

18.03

million tons LHM |

| |

● |

Average

lithium hydroxide monohydrate grade: |

3,815

ppm |

| |

● |

Total

resource size: |

5.4

billion tons of claystone |

| |

● |

Average

annual production: |

33,000

tons LHM |

| |

● |

Project

lifetime: |

50

years |

| |

● |

Life

of Mine: The economic analysis presented in this report details a project with a life of approximately 50 years, however the estimated

lithium resources could support a mine life in excess of 400 years at the mining and processing rates of this Initial Assessment |

| |

● |

Mining

Method: Simple, near-surface open pit mining

method with concurrent reclamation planned to restore land in stages soon after an area is mined rather than waiting for all mining

to be completed |

| |

● |

Royalties:

ABTC owns 100% of the unpatented lode mining

claims comprising the TFLP property with no royalties |

Next

Steps for Project Commercialization:

| |

● |

Publication

of updated Initial Assessment, including data from Drill Program III, updated mineral resource assessment and economic analysis |

| |

● |

Completion

of Drill Program IV and publication of Pre-Feasibility Study (PFS) |

| |

● |

Hydrological

and Geotechnical Drill Programs of TFLP property |

| |

● |

Complete

Baseline Environmental Studies and National

Environmental Protection Act (NEPA) review process |

| |

● |

Complete

commissioning and begin operations of pilot refinery system that will process TFLP claystone materials, and utilize this

data from a continuously operating integrated refinery to further optimize the design of the commercial scale refinery |

| |

● |

Complete engineering design for ABTC’s commercial refinery with Black & Veatch |

The

information contained in this press release is qualified in its entirety by reference to the complete text of the Initial Assessment,

including but not limited to the mineral resource estimates and economic analysis. To read the full ABTC Tonopah Flats Lithium Project

Initial Assessment, visit: https://americanbatterytechnology.com/wp-content/uploads/American-Battery-Technology_Initial-Assessment_December-21-2023.pdf

Qualified

Person

The

mineral resource estimates presented in the ABTC Tonopah Flats Initial Assessment were performed by third-party qualified person, RESPEC,

LLC, and were classified by geological and quantitative confidence in accordance with the Securities and Exchange Commission (SEC) Regulation

S-K 1300.

Initial

Assessment

An

Initial Assessment is a preliminary technical and economic study of the economic potential of all or parts of mineralization to

support the disclosure of mineral resources. The Initial Assessment must be prepared by a qualified person and must include appropriate

assessments of reasonably assumed technical and economic factors, together with any other relevant operational factors, that are necessary

to demonstrate at the time of reporting that there are reasonable prospects for economic extraction. An Initial Assessment

is required for disclosure of mineral resources but cannot be used as the basis for disclosure of mineral reserves.

Inferred

Resource

An

Inferred Resource is that part of a mineral resource for which quantity and grade or quality are estimated on the basis of limited

geological evidence and sampling. The level of geological uncertainty associated with an Inferred Resource is too high to apply

relevant technical and economic factors likely to influence the prospects of economic extraction in a manner useful for evaluation of

economic viability. Because an Inferred Resource has the lowest level of geological confidence of all mineral resources, which

prevents the application of the modifying factors in a manner useful for evaluation of economic viability, an Rnferred Resource

may not be considered when assessing the economic viability of a mining project and may not be converted to a mineral reserve..

About

American Battery Technology Company

American

Battery Technology Company (ABTC), headquartered in Reno, Nevada, has pioneered first-of-kind technologies to unlock domestically manufactured

and recycled battery metals critically needed to help meet the significant demand from the electric vehicle, stationary storage, and

consumer electronics industries. Committed to a circular supply chain for battery metals, ABTC works to continually innovate and master

new battery metals technologies that power a global transition to electrification and the future of sustainable energy.

Forward-Looking

Statements

This

press release contains “forward-looking statements” within the meaning of the safe harbor provisions of the U.S. Private

Securities Litigation Reform Act of 1995. All statements, other than statements of historical fact, are “forward-looking statements.”

Although the American Battery Technology Company’s (the “Company”) management believes that such forward-looking statements

are reasonable, it cannot guarantee that such expectations are, or will be, correct. These forward-looking statements involve a number

of risks and uncertainties, which could cause the Company’s future results to differ materially from those anticipated. Potential

risks and uncertainties include, among others, risks and uncertainties related to the Company’s ability to continue as a going

concern; interpretations or reinterpretations of geologic information, unfavorable exploration results, inability to obtain permits required

for future exploration, development or production, general economic conditions and conditions affecting the industries in which the Company

operates; the uncertainty of regulatory requirements and approvals; fluctuating mineral and commodity prices, final investment approval

and the ability to obtain necessary financing on acceptable terms or at all. Additional information regarding the factors that may cause

actual results to differ materially from these forward-looking statements is available in the Company’s filings with the Securities

and Exchange Commission, including the Annual Report on Form 10-K for the year ended June 30, 2023. The Company assumes no obligation

to update any of the information contained or referenced in this press release.

###

American

Battery Technology Company

Media

Contact:

Tiffiany

Moehring

tmoehring@batterymetals.com

720-254-1556

v3.23.4

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

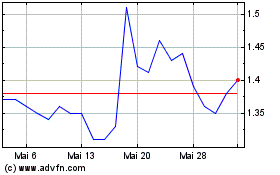

American Battery Technol... (NASDAQ:ABAT)

Historical Stock Chart

Von Nov 2024 bis Dez 2024

American Battery Technol... (NASDAQ:ABAT)

Historical Stock Chart

Von Dez 2023 bis Dez 2024