Interim Management Statement

09 Januar 2008 - 8:00AM

UK Regulatory

RNS Number:3526L

Record PLC

09 January 2008

9 JANUARY 2008

RECORD PLC

INTERIM MANAGEMENT STATEMENT

Record plc ("Record" or the "Company"), the specialist currency investment

manager, is pleased to make its first Interim Management Statement since its

admission to the official list of the Financial Services Authority and to

trading on the London Stock Exchange's main market.

Record announces today that as at 31st December 2007 its assets under management

equivalents ("AuME") totalled $54.8 billion (30th September 2007: $54.7

billion). This comprised $28.7 billion in respect of currency for absolute

return, $4.3 billion in respect of active hedging, $18.5 billion in respect of

passive hedging and $3.3 billion of client cash and futures positions managed by

Record to support currency management activity. Absolute return AuME comprised

$13.3 billion in segregated mandates and $15.3 billion in pooled funds. In

addition to these AuME, Record has since 31st December 2007 agreed and

implemented increases in segregated absolute return mandates with two existing

clients amounting to an additional $1.1 billion of absolute return AuME.

Record's development was strong in the period between 30th September 2007 and

31st December 2007, with continued growth in client numbers. Net client inflows

in the three months to 31st December 2007 by product were as follows:

($ million) Net AuME inflows (three months to 31st December 2007)

Absolute return - segregated mandates 744

Absolute return - pooled funds 1,571

Active hedging 83

Passive hedging (321)

Client cash and futures positions 245

Record had 127 clients as at 31st December 2007, compared to 115 at 30th

September 2007. Two of the new clients since 30th September 2007 are based in

North America.

Notwithstanding the growth in client numbers and the net AuME inflows set out

above, AuME in US dollar terms has remained broadly constant from 30th September

to 31st December. The offsetting amount is substantially a result of the

investment performance of the Company's currency for absolute return product,

which is compounded into the AuME in its pooled funds, but other contributing

factors were (i) changes in exchange rates over the period, which affect the

conversion of non-US dollar mandate sizes into US dollar AuME; and (ii) changes

in stock market levels, on which many of the sizes of the Company's mandates are

based.

Investment performance in the three months to 31st December 2007 was

challenging, as currency markets continued not to exhibit the patterns of

behaviour on which Record's systematic strategies are based. However, this

outcome is not unexpected, has occurred before, and Record's directors continue

to have confidence in the investment process. Record is not contemplating any

changes to the investment process, and the Company continues to keep its clients

and their investment consultants closely informed.

Given investment performance in the three months to 31st December 2007, Record

does not expect to earn significant performance fees in respect of this period.

Record continues to have a strong pipeline of new clients for its absolute

return products, with confirmation from a number of potential clients that they

have selected Record for currency management mandates, and are now engaged in

the documentation process, with an expectation that these mandates will be

initiated before 31st March 2008. These clients and AuME are not included in the

AuME and net inflows figures above.

Record expects to announce its preliminary results for the year to 31st March

2008 in June.

For further information, please contact:

Record plc Tel: +44 (0) 1753 852 222

Peter Wakefield

Mike Timmins

Hogarth Tel: +44 (0) 20 7357 9477

Nick Denton

Julian Walker

This announcement includes information with respect to Record's financial

condition, its results of operations and business, strategy, plans and

objectives. All statements in this document, other than statements of historical

fact, including words such as "anticipates", "expects", "intends", "plans",

"believes", "seeks", "estimates", "may", "will", "continue", "project" and

similar expressions, are forward-looking statements.

These forward-looking statements are not guarantees of the Company's future

performance and are subject to risks, uncertainties and assumptions that could

cause the actual future results, performance or achievements of the Company to

differ materially from those expressed in or implied by such forward-looking

statements.

The forward-looking statements contained in this document are based on numerous

assumptions regarding Record's present and future business and strategy and

speak only as at the date of this announcement.

The Company expressly disclaims any obligation or undertaking to disseminate any

updates or revisions to any forward-looking statements contained in this

announcement whether as a result of new information, future events or otherwise.

This information is provided by RNS

The company news service from the London Stock Exchange

EN

IMSUUUAUGUPRGMR

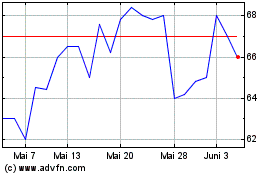

Record (LSE:REC)

Historical Stock Chart

Von Jun 2024 bis Jul 2024

Record (LSE:REC)

Historical Stock Chart

Von Jul 2023 bis Jul 2024