TIDMIGP

RNS Number : 0632T

Intercede Group PLC

01 December 2011

1 DECEMBER 2011

INTERCEDE GROUP plc

('Intercede', 'the Company' or 'the Group')

Interim Results for the Six Months Ended 30 September 2011

Intercede (AIM: IGP.L) is a leading producer of Identity and

Credential Management software, called MyID, which manages the

secure registration, issuance and life cycle of digital identities

for a wide range of uses.

SUMMARY

- Sales of GBP3,528,000 (2010: GBP3,506,000);

- Underlying revenues have increased by 25%, excluding the

Boeing contract which was worth more than GBP1m in H1 2010;

- Operating profit of GBP617,000 (2010: GBP1,204,000);

- 23% increase in cost base reflects planned investment in

business expansion, principally sales and product development;

- Basic and fully diluted earnings per share of 1.4p (2010: 2.5p);

- Cash balances of GBP6,563,000 at 30 September 2011 (30 September 2010: GBP4,470,000);

- Significant endorsement of Intercede's proprietary MyID

Identity and Credential Management System as an industry

standard;

- Increasing collaboration with Microsoft in the US;

- New partnership agreement with Hewlett Packard in support of

the HP Assured Identity Product Suite;

- Winning new contracts to supply MyID to government ministries,

banks and business corporations around the world.

Richard Parris, Chairman & Chief Executive of Intercede,

said today:

"There have been a number of notable commercial successes during

the period demonstrating the fundamental strength and growth

trajectory of the business. Our financial position remains strong,

with no debt and cash balances up almost 50% year on year.

"We have also invested heavily in sales and product development

in order to pursue a greater number of opportunities. Our own sales

efforts are complemented by partnerships with some of the largest

IT industry players in the world, enabling us to punch above our

weight.

"We believe that this period's results provide further evidence

of our ability to execute to plan. The Board remains confident in

its long term growth strategy to create significant shareholder

value through continuing global market penetration and technology

excellence in the burgeoning cyber security industry."

ENQUIRIES

Intercede Group plc Tel. +44 (0)1455

558 111

Richard Parris, Chairman & Chief Executive

Andrew Walker, Finance Director

FinnCap Tel. +44 (0)20 7600

1658

Charles Cunningham, Corporate Finance

Rose Herbert, Corporate Finance

Joanna Weaving, Corporate Broking

Pelham Bell Pottinger Tel. +44 (0)20 7861

3112

Archie Berens

Clare Gilbey

About Intercede

Intercede is the producer of the MyID Identity and Credential

Management System (IDCMS).

Intercede MyID technology is being used around the world by

large corporations, governments and banks to manage millions of

identities for employees, citizens and customers. Notable

deployments in the US include 14 federal agencies, two million

smart cards in support of the US Transportation Worker Identity

Credential program (TWIC), four US financial institutions and

320,000 smart corporate identity badges for Boeing, Booz Allen

Hamilton and Lockheed Martin. In Europe, Australasia and the Middle

East, Intercede MyID is being deployed in support of government

identity, financial services, health and corporate employee ID

security projects.

Intercede MyID is the only IDCMS software product that enables

organizations to easily and securely manage the identities of

people and their associated identity credentials within a single,

integrated, workflow driven platform. This includes enabling and

managing secure registration, biometric capture, application

vetting and approval through to smart card personalization,

issuance and management.

Intercede MyID was the first electronic personalization product

to achieve compliance with the US FIPS-201 Personal Identity

Verification (PIV) standard and is widely deployed by federal

agencies, government contractors and other commercial entities. In

particular, it supports the latest standards applicable for all

PIV, PIV-Interoperable and PIV-Compatible deployments.

It can issue and manage a wide variety of IDs and credentials,

providing customers with a platform that can meet their needs now

and in the future. It is a fully supported commercial off-the-shelf

product that can be quickly deployed for thousands or millions of

users.

For more information visit www.intercede.com

INTERCEDE GROUP plc

('Intercede', 'the Company' or 'the Group')

Interim Results for the Six Months Ended 30 September 2011

Chairman's Statement

In the period ended 30 September 2011, revenues totalled

GBP3.53m compared to GBP3.51m in the previous year. However, it

should be noted that the previous period included a single contract

of more than GBP1m from Boeing, whereas there was no equivalent

contract in the first half of the current financial year. If

revenues from the Boeing contract are excluded from both periods,

there has been a 25% underlying increase in revenues year on year,

demonstrating the fundamental strength of the business and its

ongoing growth trajectory.

Profit for the period is GBP0.7m compared to GBP1.2m in the

prior year. This reduction reflects planned investment to

accelerate the growth of the business. As previously reported, the

goals for the current financial period are to increase sales and

marketing efforts in promoting MyID and to extend product

development in areas such as mobile devices and further

collaboration with Microsoft. The average number of employees and

contractors increased from 56 to 67 year on year in support of

these goals. Staff costs continue to represent the main area of

expense totalling 79% of the total operating costs during the

period (2010: 81%).

The Company continues to be cash generative. Through careful

cash management, the cash balance at the end of September was

GBP6.56m compared to GBP6.05m at the end of March 2011 and GBP4.47m

at the end of September 2010; a year on year increase of over

GBP2m.

There have been a number of commercial successes and industry

milestones achieved in the period, including the following:

-- Continuing implementation of large scale corporate identity card

projects in ANZ Bank, Booz Allen Hamilton, BASF, Boeing, HealthSmart

Australia, Lockheed Martin and Swedbank;

-- Delivery of services to support major MyID system upgrades in

US Federal Aviation Authority, Kuwait Public Authority for Civil

Information, Road Safety Authority Ireland;

-- Deployment of MyID to issue ID cards to members of the newly elected

Portuguese Parliament;

-- The securing of a large scale border security project with an

initial value in excess of GBP0.6m;

-- Increasing collaboration with Microsoft in the US and the first

confirmed sale to a corporate customer of the Intercede MyID connector

for Forefront Identity Manager;

-- Teaming with Atos, Verisec, the Post Office and Thales to win

the London Identity Provider framework contract;

-- Collaboration with major systems integrators on multiple tender

responses for large scale US Federal identity programs requiring

PIV and PIV-I solutions;

-- The development of a new technology to enable the over-the-air

(OTA) provisioning of digital certificates to mobile devices;

-- The development of a new technology to support the use of mobile

devices containing Near Field Communications (NFC) for personal

identity verification purposed;

-- The continuous improvement of the core MyID platform including

the release of MyID v8 Enterprise SP2 and MyID v9 PIV Service

Pack 1; and

-- The award of ISO9001 and TickIT certification to Intercede, as

announced on 14 September 2011.

We were also delighted to announce on 14 November 2011 that an

agreement has been entered into with Hewlett Packard ("HP"),

whereby the HP Global Identity Practice can now deliver MyID as a

component of their Assured Identity Plus solutions. Under the

agreement, Intercede and HP will target large scale Federal, state

and local government agencies and major enterprise customers.

The progress outlined above demonstrates the effectiveness of

Intercede's sales strategy. By focusing on major industry players

as channel partners, Intercede has continued to punch above its

weight in a way that would not be possible with a more conventional

direct sales structure. Intercede has significantly multiplied its

future revenue potential by accessing the sales teams and sales

infrastructure of partners such as Microsoft, HP, multiple US

systems integrators, Atos, Gemalto, Oberthur, Swisscom, Symantec

and Thales. Each channel will need continuing sales and technical

account management to maximise the return on investment.

This channel strategy has enabled Intercede to compete in new

territories during the period in a way we could not have reached

with a direct team.

Our commercial model continues to be market tested through

competition with industry rivals. To date, the evidence is that we

win most opportunities on technical merit, even though we are not

usually the lowest cost bidder. Customer feedback is that we

consistently represent the 'best value' supplier.

I am pleased that we continue to grow underlying new software

license revenues at a healthy rate. Annuity revenue from existing

customers as a percentage of total sales is also increasing towards

the long term goal of being able to support the cost of our

operations from recurring income. It is a characteristic of the

business that every GBP1 of new customer license revenue in a

period typically generates a further GBP2 from associated

maintenance plus additional fees from professional services and

development activities over future periods. This means that

Intercede has already locked in significant future value beyond

that disclosed in the current period's accounts.

Our research activities in the mobile communications sector have

spawned product line extensions that open new markets in the

telecommunications market with potential uses for identity

verification in the citizen and consumer spaces. This also serves

to protect our existing market position should mobile devices

overtake smart cards as the principal means of asserting strong

identity.

We believe that this period's results are evidence of our

ability to execute to plan. The Board remains confident in its long

term growth strategy to create significant shareholder value

through continuing global market penetration and technology

excellence in the burgeoning cyber security industry.

Richard Parris

Chairman & Chief Executive

1 December 2011

Consolidated Statement of Comprehensive Income

For the period ended 30 September 2011

6 months 6 months

ended ended Year ended

30 September 30 September 31 March

2011 2010 2011

GBP'000 GBP'000 GBP'000

Continuing operations

Revenue 3,528 3,506 6,872

Cost of sales (94) (8) (22)

__________ __________ __________

Gross profit 3,434 3,498 6,850

Administrative expenses (2,817) (2,294) (4,898)

__________ __________ __________

Operating profit 617 1,204 1,952

Finance income 36 21 53

__________ __________ __________

Profit before tax 653 1,225 2,005

Taxation 47 - (7)

__________ __________ __________

Profit for the period 700 1,225 1,998

__________ __________ __________

Total comprehensive income attributable

to owners of the company 700 1,225 1,998

__________ __________ __________

Earnings per share (pence)

- basic 1.4p 2.5p 4.1p

- diluted 1.4p 2.5p 4.1p

__________ __________ __________

Consolidated Balance Sheet

As at 30 September 2011

As at As at As at

30 September 30 September 31 March

2011 2010 2011

GBP'000 GBP'000 GBP'000

Non-current assets

Property, plant and equipment 162 152 167

Deferred tax 280 280 280

__________ __________ __________

442 432 447

__________ __________ __________

Current assets

Trade and other receivables 1,460 1,867 841

Cash and cash equivalents 6,563 4,470 6,046

__________ __________ __________

8,023 6,337 6,887

__________ __________ __________

Total assets 8,465 6,769 7,334

__________ __________ __________

Equity

Share capital 484 4,413 484

Share premium account 86 4,718 86

Other reserves 1,508 1,508 1,508

Retained earnings 3,833 (6,272) 3,113

__________ __________ __________

Total equity 5,911 4,367 5,191

__________ __________ __________

Current liabilities

Trade and other payables 772 773 790

Deferred revenue 1,782 1,629 1,353

__________ __________ __________

2,554 2,402 2,143

__________ __________ __________

Total equity and liabilities 8,465 6,769 7,334

__________ __________ __________

Consolidated Statement of Changes in Equity

As at 30 September 2011

Share Share Other Retained Total

capital premium reserves earnings

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

At 31 March 2011 484 86 1,508 3,113 5,191

Total comprehensive income - - - 700 700

Credit in respect of share

based payments - - - 20 20

________ ________ ________ ________ _______

At 30 September 2011 484 86 1,508 3,833 5,911

________ ________ ________ ________ ________

At 31 March 2010 4,413 4,718 1,508 (7,497) 3,142

Total comprehensive income - - - 1,225 1,225

________ ________ ________ ________ _______

At 30 September 2010 4,413 4,718 1,508 (6,272) 4,367

________ ________ ________ ________ ________

At 31 March 2010 4,413 4,718 1,508 (7,497) 3,142

Capital reduction (3,931) (4,718) - 8,649 -

Issue of shares, net of costs 2 86 - - 88

Purchase of treasury shares - - - (37) (37)

Total comprehensive income - - - 1,998 1,998

________ ________ ________ ________ _______

At 31 March 2011 484 86 1,508 3,113 5,191

________ ________ ________ ________ ________

Consolidated Cash Flow Statement

For the period ended 30 September 2011

6 months

ended 6 months ended Year ended

30 September 30 September 31 March

2011 2010 2011

GBP'000 GBP'000 GBP'000

Cash flows from operating activities

Operating profit 617 1,204 1,952

Depreciation 33 21 51

Credit in respect of share based payments 20 - -

(Increase)/decrease in trade and other

receivables (615) (904) 116

Increase/(decrease) in trade and other

payables 410 309 50

__________ __________ __________

Cash generated from operations before

exceptional item 465 630 2,169

Exceptional item - (747) (747)

Taxation 47 - (7)

__________ __________ __________

Net cash generated from/(used by) operating

activities 512 (117) 1,415

__________ __________ __________

Investing activities

Interest received 33 12 50

Purchases of property, plant and equipment (28) (89) (134)

__________ __________ __________

Net cash generated from/(used by) investing

activities 5 (77) (84)

__________ __________ __________

Financing activities

Proceeds on issue of shares - - 88

Purchase of treasury shares - - (37)

__________ __________ __________

Net cash from financing activities - - 51

__________ __________ __________

Net increase/(decrease) in cash and

cash equivalents 517 (194) 1,382

Cash and cash equivalents at the beginning

of the period 6,046 4,664 4,664

__________ __________ __________

Cash and cash equivalents at the end

of the period 6,563 4,470 6,046

__________ __________ __________

Notes to the Accounts

For the period ended 30 September 2011

1 Preparation of the interim financial statements

These interim financial statements have been prepared under IFRS

as adopted by the European Union and on the basis of the accounting

policies set out in the Group's Annual Report for the year ended 31

March 2011.

The Group is not required to apply IAS 34 Interim Financial

Reporting at this time.

These interim financial statements have not been audited and do

not constitute statutory accounts as defined in Section 434 of the

Companies Act 2006. Statutory accounts for the year ended 31 March

2011 have been delivered to the Registrar of Companies. The

Auditors' Report on those accounts was unqualified and did not

contain any statement under Section 498 (2) or (3) of the Companies

Act 2006.

The Interim Report will be mailed to shareholders prior to the

end of December 2011 and copies will be available on the website

(www.intercede.com) and at the registered office: Intercede Group

plc, Lutterworth Hall, St Mary's Road, Lutterworth, Leicestershire,

LE17 4PS.

2 Revenue

All of the Group's revenue, operating profits and net assets

originate from operations in the UK. The Directors consider that

the activities of the Group constitute a single business

segment.

The split of revenue by geographical destination of the end

customer can be analysed as follows:

6 months ended 6 months ended Year ended

30 September 30 September 31 March

2011 2010 2011

GBP'000 GBP'000 GBP'000

UK 399 838 1,369

Rest of Europe 377 351 928

USA 1,801 2,032 3,965

Rest of World 951 285 610

__________ __________ __________

3,528 3,506 6,872

__________ __________ __________

3 Taxation

Taxation represents the net effect of amounts received from HMRC

in respect of research and development claims and US corporation

tax payable. There is no charge for UK corporation tax due to the

availability of losses brought forward from prior years.

4 Earnings per share

The calculations of earnings per ordinary share are based on the

profit for the period and the weighted average number of ordinary

shares in issue during each period.

6 months ended 6 months ended Year ended

30 September 30 September 31 March

2011 2010 2011

GBP'000 GBP'000 GBP'000

Profit for the period 700 1,225 1,998

__________ __________ __________

Number Number Number

Weighted average number

of shares - basic 48,365,005 48,178,005 48,239,997

- diluted 49,120,843 48,735,005 48,735,005

__________ __________ __________

Pence Pence Pence

Earnings per

share - basic 1.4p 2.5p 4.1p

- diluted 1.4p 2.5p 4.1p

__________ __________ __________

The increase in the weighted average number of shares used for

the calculation of diluted earnings per share reflects the grant of

share options to directors and senior managers during July and

August 2011. The total charge for the period relating to employee

share-based payments was GBP20,000 (2010: GBPnil).

5 Dividend

The Directors do not recommend the payment of a dividend.

6 Changes in equity

On 24 September 2010, shareholder approval was obtained at a

General Meeting of the company to cancel the share premium account

and to cancel and extinguish the deferred shares. This Capital

Reduction was registered by the Registrar of Companies on 30

October 2010.

This information is provided by RNS

The company news service from the London Stock Exchange

END

IR LLFELLELIVIL

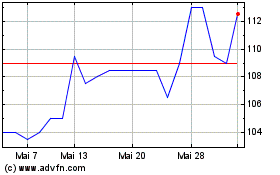

Intercede (LSE:IGP)

Historical Stock Chart

Von Jun 2024 bis Jul 2024

Intercede (LSE:IGP)

Historical Stock Chart

Von Jul 2023 bis Jul 2024