U.S. Dollar Advances As Weekly Jobless Claims Drop To Eight-month Low

02 Januar 2025 - 3:49PM

RTTF2

The U.S. dollar rose against its major counterparts in the New

York session on Thursday, as the nation's jobless claims came in

below economists' forecasts last week, supporting expectations that

the Federal Reserve will slow the pace of rate cuts going

forward.

Data from the Labor Department showed that initial jobless

claims slipped to 211,000, a decrease of 9,000 from the previous

week's revised level of 220,000.

The dip surprised economist, who had expected jobless claims to

inch up to 222,000 from the 219,000 originally reported for the

previous week.

Investors expect that the incoming Trump administration's

policies will boost economic growth and inflation, underpinning the

demand for the dollar.

The Fed is expected to adopt a cautious stance on further easing

this year.

The greenback climbed to more than a 2-year high of 1.0222

against the euro and more than an 8-month high of 1.2351 against

the pound, off its early lows of 1.0372 and 1.2535, respectively.

The currency is poised to challenge resistance around 0.99 against

the euro and 1.22 against the pound.

The greenback advanced to more than a 7-month high of 0.9137

against the franc and a 2-day high of 157.84 against the yen, from

its early lows of 0.9039 and 156.43, respectively. The next

possible resistance for the currency is seen around 0.93 against

the franc and 164.00 against the yen.

The greenback touched 1.4442 against the loonie, setting a 6-day

high. If the currency rises further, it is likely to find

resistance around the 1.47 region.

The greenback recovered to 0.6191 against the aussie and 0.5588

against the kiwi, reversing from its early lows of 0.6220 and

0.5624, respectively. The currency is seen finding resistance

around 0.59 against the aussie and 0.54 against the kiwi.

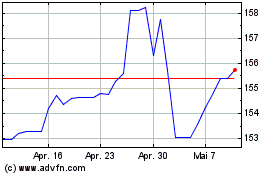

US Dollar vs Yen (FX:USDJPY)

Forex Chart

Von Dez 2024 bis Jan 2025

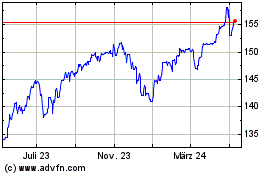

US Dollar vs Yen (FX:USDJPY)

Forex Chart

Von Jan 2024 bis Jan 2025