Dollar Loses Ground Against Major Counterparts Ahead Of Jobs Data

06 Juni 2024 - 6:54PM

RTTF2

The U.S. dollar stayed largely subdued on Thursday with traders

digesting the European Central Bank's rate cut decision, and

awaiting the crucial U.S. jobs data that could provide some clues

about the likely timing of an interest rate cut by the Federal

Reserve.

The European Central Bank (ECB) has cut interest rate for the

first time since September 2019. The ECB today cut key rates by 25

basis points but raised inflation forecasts for 2024 and 2025.

The ECB has raised the headline inflation outlook for 2024 to

2.5% from 2.3% previously and upped the forecast for 2025 to 2.2%

from 2%.

In U.S. economic news, the Labor Department released a report

this morning showing first-time claims for U.S. unemployment

benefits rose by more than expected in the week ended June 1st.

The Labor Department said initial jobless claims climbed to

229,000, an increase of 8,000 from the previous week's revised

level of 221,000.

Economists had expected jobless claims to inch up to 220,000

from the 219,000 originally reported for the previous week.

Meanwhile, the Commerce Department released a report showing the

U.S. trade deficit widened significantly in the month of April, as

the value of imports jumped by much more than the value of

exports.

The Commerce Department said the trade deficit surged to $74.6

billion in April from a downwardly revised $68.6 billion in

March.

Investors now look ahead to Friday's closely watched monthly

jobs report from the U.S., which could have a significant impact on

the outlook for interest rates.

The Labor Department report is expected to show employment

increased by 185,000 jobs in May after climbing by 175,000 jobs in

April, while the unemployment rate is expected to remain at

3.9%.

The dollar index, which advanced to 104.37 in early New York

session after remaining weak till then, drifted down gradually to

104.11, down 0.15% from the previous close.

Against the Euro, the dollar weakened to 1.0891 from 1.0871. The

dollar edged down marginally against Pound Sterling to 1.2790.

Against the Japanese currency, the dollar firmed to 155.63 yen.

The dollar weakened to 0.6667 against the Aussie, easing from

0.6647. Against Swiss franc, the dollar dropped to CHF 0.8898 a

unit. The dollar shed ground against the loonie as well, dropping

to C$ 1.3673.

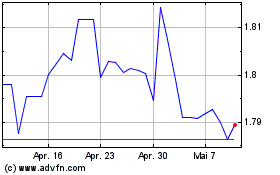

Euro vs NZD (FX:EURNZD)

Forex Chart

Von Mai 2024 bis Jun 2024

Euro vs NZD (FX:EURNZD)

Forex Chart

Von Jun 2023 bis Jun 2024