Wolters Kluwer 2024 Nine-Month Trading Update

Alphen aan den Rijn, October 30, 2024 – Wolters Kluwer, a global

leader in professional information, software solutions and

services, today releases its scheduled 2024 nine-month trading

update.

Highlights

- Full-year 2024 guidance reiterated.

- Nine-month revenues up 6% in constant currencies and up 6%

organically.

- Recurring revenues (83% of total revenues) up 7% organically;

non-recurring revenues up 2%.

- Expert solutions revenues (59% of total revenues) grew 8%

organically.

- Cloud software revenues (18% of total revenues) grew 16%

organically.

- Nine-month adjusted operating profit up 8% in constant

currencies.

- Nine-month adjusted operating profit margin increased.

- Nine-month adjusted free cash flow up 9% in constant

currencies.

- Third quarter benefitted from favorable timing of vendor

payments.

- Net-debt-to-EBITDA ratio 1.8x as of September 30, 2024.

- Share buyback 2024: on track to reach €1 billion by

year-end.

- Share buyback 2025: mandate signed to repurchase up to €100

million in January and February 2025.

Nancy McKinstry, CEO and Chair of the Executive Board,

commented: “I am pleased to report 6% organic growth through the

first nine months, supported by continued growth in recurring

revenues, led by our expert solutions including cloud-based

software platforms. Investments in product innovation remained at

record levels as we continue to pursue opportunities to support our

customers in their drive for improved performance, outcomes, and

efficiencies. We are on track to meet our full-year guidance.”

Nine Months to September 30, 2024

Total revenues were up 6% in the first nine months of 2024,

despite a slightly weaker U.S. dollar in the third quarter.

Excluding the effect of currency, acquisitions, and divestments,

organic growth was 6% in the first nine months (9M 2023: 5%).

Recurring revenues (83% of total revenues) sustained 7% organic

growth (9M 2023: 7%; HY 2024: 7%). Within recurring revenues,

cloud software revenues grew 16% organically (9M 2023: 15%).

Non-recurring revenues (17% of total revenues) increased 2%

organically (9M 2023: 2% decline), benefitting from the improved

trend in Legal Services transactional fees in the Financial &

Corporate Compliance division compared to last year. Apart from

transactional fees, non-recurring revenues include print books,

on-premise software licenses, software implementation services, and

other non-subscription products and services.

Revenues from North America (64% of total) grew 6% organically

(9M 2023: 4%) while revenues from Europe (28% of total) grew 5%

(9M 2023: 7%). Asia Pacific & ROW (8% of total) grew 7%

organically (9M 2023: 8%).

Nine-month adjusted operating profit increased 8% in constant

currencies. The nine-month adjusted operating profit margin

improved, mainly driven by our Financial & Corporate Compliance

and Legal & Regulatory divisions. Restructuring expenses, which

are included in adjusted operating profit, increased. Product

development spend (CAPEX + OPEX) was maintained at 11% of revenues

(9M 2023: 11% of revenues).

Health: Nine-month revenues increased 6% in constant currencies

and 6% organically (9M 2023: 6%). Clinical Solutions recorded 8%

organic growth (9M 2023: 7%), led by clinical decision tool

UpToDate and our clinical drug databases (Medi-Span and UpToDate

Lexidrug). The UpToDate patient engagement solution delivered good

growth. Surveillance, compliance, and terminology software saw

improved organic growth, mainly reflecting the Invistics drug

diversion business acquired in June 2023. Health Learning, Research

& Practice recorded 3% organic growth (9M 2023: 4%), with good

organic growth in medical research against a challenging comparable

alongside improved growth in education and practice. In September

2024, we completed the previously announced divestment of Learner’s

Digest International (LDI).

Tax & Accounting: Nine-month revenues increased 5% in

constant currencies, reflecting the transfer of our Chinese legal

research solution (BOLD) from Tax & Accounting to Legal &

Regulatory at the start of the year. On an organic basis, revenues

grew 7% (9M 2023: 8%). The North American business recorded 7%

organic growth (9M 2023: 8%), driven by double-digit organic growth

in our cloud-based software suite, CCH Axcess. While outsourced

professional services continued to see strong growth, print books

and other non-recurring revenues recorded slower growth. Tax &

Accounting Europe sustained 7% organic growth

(9M 2023: 7%) and began integrating the cloud software

business acquired in September from the Isabel Group. Tax &

Accounting Asia Pacific & ROW organic revenues were stable.

Financial & Corporate Compliance: Nine-month revenues

increased 5% in constant currencies. On an organic basis, revenues

rose 5% (9M 2023: 1%), with recurring revenues up 6%

organically (9M 2023: 5%) and non-recurring transactional revenues

up 3% (9M 2023: 7% decline). Legal Services grew 7% organically

(9M 2023: 1%), supported by services subscriptions and 6%

growth in Legal Services transactions. Subscriptions to our

Beneficial Ownership Information (BOI) platform continued to build,

in line with expectations. Financial Services recorded 3% organic

growth (9M 2023: 0%), reflecting growth in recurring revenues and a

stabilization in transactional revenues.

Legal & Regulatory: Nine-month revenues grew 8% in constant

currencies, partly reflecting the transfer of BOLD into the

division and bolt-on acquisitions. On an organic basis, revenues

grew 5% (9M 2023: 4%). Legal & Regulatory Information Solutions

grew 5% organically (9M 2023: 4%), supported by 7% growth in

digital information solutions. Legal & Regulatory Software

revenues grew 7% organically (9M 2023: 5%), led by double-digit

organic growth at Legisway and continued growth in ELM

transactional revenues.

Corporate Performance & ESG: Nine-month revenues increased

7% in constant currencies. On an organic basis, revenues increased

by 7% (9M 2023: 8%), as recurring cloud software revenues

sustained growth of 12%, but non-recurring on-premise license fees

and software implementation services declined 2% (9M 2023:

0%). Our EHS & ESG1 unit (Enablon) delivered 14% organic growth

(9M 2023: 15%), driven by 21% growth in cloud-based software

revenues, partly offset by a decline in on-premise software license

revenues. Within Corporate Performance Management, the CCH Tagetik

CPM platform delivered 9% organic growth (9M 2023: 14%),

driven by 17% organic growth in cloud software accompanied by a

decline in on-premise software licenses and modest growth in

services. Our Audit & Assurance (TeamMate) and Finance, Risk

& Reporting (OneSumX) units posted modest organic growth for

the nine-month period.

Corporate: Costs decreased in constant currencies as increased

personnel costs were more than offset by lower miscellaneous

expenses.

Cash Flow and Net Debt

Nine-month adjusted operating cash flow increased 7% in constant

currencies, reflecting fewer large vendor payments in the third

quarter. Nine-month adjusted free cash flow increased 9% in

constant currencies.

Total dividends paid to shareholders amounted to €491 million in

the first nine months, including the 2023 final dividend and the

2024 interim dividend (withholding tax to be paid in October).

Total acquisition spending, net of cash acquired and including

transaction costs, was €332 million in the first nine months,

primarily related to the acquisition of Isabel Group assets

completed in September 2024. Share repurchases amounted to €762

million in the first nine months.

As of September 30, 2024, net debt was €3,356 million

(year-end 2023: €2,612 million), reflecting acquisition spending

and cash returns to shareholders. Twelve months’ rolling

net-debt-to-EBITDA was 1.8x (compared to 1.5x at year-end

2023).

Sustainability Update

Throughout 2024, we have continued to invest in programs

designed to attract, engage, retain, and develop talent globally.

Our workforce turnover rate remained stable throughout the first

nine months at around 10%. Human resources programs currently

emphasize career development and manager enablement while

continuing initiatives to support an inclusive and engaging

workplace culture. In the third quarter, we rolled out our Annual

Compliance Training, which covers cybersecurity, data privacy, and

business ethics. As of the end of October, over 99% of employees

globally have completed the exercise.

Our global real estate team made better-than-expected progress

in further rationalizing our office footprint, having been able to

exit certain office leases earlier than planned. Through the first

nine months of 2024, we have achieved an 8% organic reduction in

office space (m2) compared to year-end 2023, thereby reducing our

Scope 1 and 2 greenhouse gas emissions.

We continued work to align our sustainability reporting with the

European Sustainability Reporting Standards (ESRS) set by the EU

Corporate Sustainability Reporting Directive (CSRD).

Share Cancellation 2024

On September 13, 2024, we cancelled 10.0 million shares that

were held in treasury, as approved by shareholders at the AGM in

May 2024. Following this cancellation, the number of issued

ordinary shares is now 238,516,153. As of September 30, 2024, 235.8

million shares were outstanding, and 2.7 million shares were held

in treasury.

Share Buyback Program 2024 and 2025

In February 2024, we announced a 2024 share buyback program of

up to €1 billion. In the year to date, through October 28, 2024, we

have completed approximately 85% of this buyback, having

repurchased €853 million in shares (5.8 million shares at an

average price of €147.64). A third-party mandate is in place to

complete the final tranche of €147 million in the period starting

October 31, 2024, up to and including December 27, 2024.

For the upcoming year 2025, we have this week signed a

third-party mandate to execute up to €100 million in share buybacks

for the period starting January 2, 2025, up to and including

February 24, 2025.

We continue to believe this level of share buybacks leaves us

with ample headroom to support our dividend plans, to sustain

organic investment, and to make selective acquisitions. The share

repurchases may be suspended, discontinued, or modified at any

time.

Third party mandates are governed by the limits of relevant laws

and regulations (in particular Regulation (EU) 596/2014) and

Wolters Kluwer’s Articles of Association. Repurchased shares are

added to and held as treasury shares and are either cancelled or

held to meet future obligations arising from share-based incentive

plans. We remain committed to our anti-dilution policy which aims

to offset the dilution caused by our annual incentive share

issuance with share repurchases.

Full-Year 2024 Outlook

Our group-level guidance for 2024 is unchanged. See table below.

We expect sustained good organic growth in 2024, in line with the

prior year, and an increase in the adjusted operating profit

margin.

|

Full-Year 2024 Outlook |

|

|

Performance indicators |

2024 Guidance |

2023 Actual |

|

Adjusted operating profit margin* |

26.4%-26.8% |

26.4% |

| Adjusted free

cash flow** |

€1,150-€1,200 million |

€1,164 million |

| ROIC* |

17%-18% |

16.8% |

|

Diluted adjusted EPS growth** |

Mid- to high single-digit |

12% |

|

*Guidance for adjusted operating profit margin and ROIC is in

reporting currency and assumes an average EUR/USD rate in 2024 of

€/$1.10. **Guidance for adjusted free cash flow and diluted

adjusted EPS is in constant currencies (€/$ 1.08). Guidance

reflects share repurchases of €1 billion in 2024. |

|

In 2023, Wolters Kluwer generated over 60% of its revenues and

adjusted operating profit in North America. As a rule of thumb,

based on our 2023 currency profile, each 1 U.S. cent move in the

average €/$ exchange rate for the year causes an opposite change of

approximately 3 euro cents in diluted adjusted EPS2.

We include restructuring costs in adjusted operating profit. We

now expect 2024 restructuring expenses to increase to approximately

€20-€25 million (FY 2023: €15 million). We expect adjusted net

financing costs3 in constant currencies to be approximately €55

million. We expect the benchmark tax rate on adjusted pre-tax

profits to be in the range of 23.0%-24.0% (FY 2023: 22.9%).

Capital expenditures are expected to be at the upper end of our

guidance range of 5.0%-6.0% of total revenues (FY 2023: 5.8%). We

continue to expect the full-year 2024 cash conversion ratio to be

around 95% (FY 2023: 100%) due to lower net working capital

inflows.

Our guidance assumes no additional significant change to the

scope of operations. We may make further acquisitions or disposals

which can be dilutive to margins, earnings, and ROIC in the near

term.

2024 outlook by division

Our guidance for full-year 2024 organic revenue growth by

divisions is summarized below. We expect the increase in full-year

adjusted operating profit margin to be driven by our Finance &

Corporate Compliance, Legal & Regulatory, and Corporate

Performance & ESG divisions.

Health: we expect full-year 2024 organic growth to be in line

with prior year (FY 2023: 6%). The division margin is expected to

decline slightly due to one-time write-offs to streamline the

portfolio.

Tax & Accounting: we expect full-year 2024 organic growth to

be slightly below prior year (FY 2023: 8%) due to slower growth in

non-recurring revenues and the absence of one-time favorable events

in Europe. The division margin is expected to decline slightly due

to increased product investment.

Financial & Corporate Compliance: we expect full-year 2024

organic growth to be higher than prior year (FY 2023: 2%) with

Legal Services transactions recovering and Financial Services

transactions stable.

Legal & Regulatory: we expect full-year 2024 organic growth

to be in line with or slightly better than prior year (FY 2023:

4%).

Corporate Performance & ESG: we expect full-year 2024

organic growth to be in line with or slightly higher than in the

prior year (FY 2023: 9%) as Finance, Risk & Reporting revenues

stabilize.

About Wolters Kluwer

Wolters Kluwer (EURONEXT: WKL) is a global leader in

information, software solutions and services for professionals in

healthcare; tax and accounting; financial and corporate compliance;

legal and regulatory; corporate performance and ESG. We help our

customers make critical decisions every day by providing expert

solutions that combine deep domain knowledge with technology and

services.

Wolters Kluwer reported 2023 annual revenues of €5.6 billion.

The group serves customers in over 180 countries, maintains

operations in over 40 countries, and employs approximately 21,400

people worldwide. The company is headquartered in Alphen aan den

Rijn, the Netherlands.

Wolters Kluwer shares are listed on Euronext Amsterdam (WKL) and

are included in the AEX, Euro Stoxx 50, and Euronext 100 indices.

Wolters Kluwer has a sponsored Level 1 American Depositary Receipt

(ADR) program. The ADRs are traded on the over-the-counter market

in the U.S. (WTKWY).

For more information, visit www.wolterskluwer.com, follow us on

LinkedIn, Facebook, YouTube, and Instagram.

Financial CalendarFebruary 26, 2025

Full-Year 2024

Results

March 12, 2025

Publication

of 2024 Annual Report

May 6,

2025 First-Quarter

2025 Trading Update

May 15,

2025 Annual

General Meeting of ShareholdersMay 19,

2025 Ex-dividend

date: 2024 final dividend ordinary shares

May 20,

2025 Record

date: 2024 final dividend

June 11,

2025 Payment

date: 2024 final dividend ordinary shares

June 18,

2025 Payment

date: 2024 final dividend ADRs

July 30,

2025 Half-Year

2025 Results

August 26,

2025 Ex-dividend

date: 2025 interim dividend ordinary shares

August 27,

2025 Record

date: 2025 interim dividend

September 18,

2025 Payment date:

2025 interim dividend

September 25,

2025 Payment date:

2025 interim dividend ADRs

November 5,

2025 Nine-Month 2025

Trading Update

| Media |

Investors/Analysts |

| Dave Guarino |

Meg Geldens |

| VP, Head of Global

Communications |

Investor

Relations |

| t +1-646 954

8215 |

t +31

(0)172-641-407 |

|

press@wolterskluwer.com |

ir@wolterskluwer.com |

| |

|

| Stefan Kloet |

|

| Associate Director,

Global Communications |

|

| m +31 (0)612 22 36

57 |

|

|

press@wolterskluwer.com |

|

Forward-looking Statements and Other Important Legal

InformationThis report contains forward-looking statements. These

statements may be identified by words such as “expect”, “should”,

“could”, “shall” and similar expressions. Wolters Kluwer cautions

that such forward-looking statements are qualified by certain risks

and uncertainties that could cause actual results and events to

differ materially from what is contemplated by the forward-looking

statements. Factors which could cause actual results to differ from

these forward-looking statements may include, without limitation,

general economic conditions; conditions in the markets in which

Wolters Kluwer is engaged; conditions created by global pandemics,

such as COVID-19; behavior of customers, suppliers, and

competitors; technological developments; the implementation and

execution of new ICT systems or outsourcing; and legal, tax, and

regulatory rules affecting Wolters Kluwer’s businesses, as well as

risks related to mergers, acquisitions, and divestments. In

addition, financial risks such as currency movements, interest rate

fluctuations, liquidity, and credit risks could influence future

results. The foregoing list of factors should not be construed as

exhaustive. Wolters Kluwer disclaims any intention or obligation to

publicly update or revise any forward-looking statements, whether

as a result of new information, future events or otherwise.

Elements of this press release contain or may contain inside

information about Wolters Kluwer within the meaning of Article 7(1)

of the Market Abuse Regulation (596/2014/EU). Trademarks referenced

are owned by Wolters Kluwer N.V. and its subsidiaries and may be

registered in various countries.

1 EHS & ESG (formerly EHS/ORM) = environmental, health, and

safety & environmental, social, and governance.2 This rule of

thumb excludes the impact of exchange rate movements on

intercompany balances, which is accounted for in adjusted net

financing costs in reported currencies and determined based on

period-end spot rates and balances.3 Adjusted net financing costs

include lease interest charges. Guidance for adjusted net financing

costs in constant currencies excludes the impact of exchange rate

movements on currency hedging and intercompany balances.

- 2024.10.30 Wolters Kluwer Nine-Month 2024 Trading Update

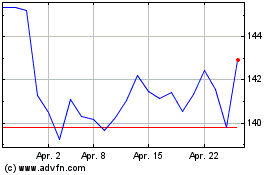

Wolters Kluwers NV (EU:WKL)

Historical Stock Chart

Von Mär 2025 bis Apr 2025

Wolters Kluwers NV (EU:WKL)

Historical Stock Chart

Von Apr 2024 bis Apr 2025