Schneider Electric Shares Fall After Flat 3Q Sales

26 Oktober 2023 - 10:16AM

Dow Jones News

By Pierre Bertrand

Schneider Electric sales fell on Thursday after the French

energy-management and automation group posted third-quarter revenue

that was largely flat on year, missing expectations.

At 0728 GMT, shares were down 2.5% at EUR136.48, having fallen

by as much as 4% earlier in the session.

The company said it made 8.79 billion euros ($9.29 billion) in

revenue for the quarter, a 0.1% reported on-year increase. Analysts

had expected revenue at EUR8.93 billion, according to a

company-provided consensus.

Schneider backed its 2023 outlook, which Berenberg analyst

Philip Buller said could be seen as a positive on one hand but

"leads to a wide range of outcomes" for the fourth quarter.

The company's scheduled capital markets day next month will

likely serve as an important catalyst for prospective buyers, the

analyst said.

Following the sales print, Citi sees limited changes ahead to

consensus for the year, analyst Martin Wilkie wrote in a research

note.

"With the sales mix shifting clearly to systems from products

and price carryover fading, there could be questions on margins in

H2 and sustainability in 2024," he said.

Write to Pierre Bertrand at pierre.bertrand@wsj.com

(END) Dow Jones Newswires

October 26, 2023 04:01 ET (08:01 GMT)

Copyright (c) 2023 Dow Jones & Company, Inc.

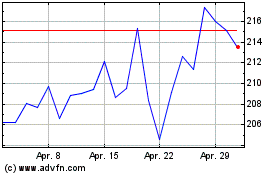

Schneider Electric (EU:SU)

Historical Stock Chart

Von Jun 2024 bis Jul 2024

Schneider Electric (EU:SU)

Historical Stock Chart

Von Jul 2023 bis Jul 2024